Conference & Roadshow Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2019 June Edition Angela Qu, SVP Head of Procurement

2019 June Edition Angela Qu, SVP Head of Procurement Company: Lufthansa Group 1. How and when did procurement & supply become your passion and career choice? A government job I had in China facilitated working with a Siemens joint venture. I supported the related General Manager (helping to open the factory, hiring people, etc.) and was asked which function I’d like to join - purchasing was my first selection for a personal and career choice. The 9 years at Siemens gave me lot of opportunities working from operational tasks, to category managers and later on as Senior consultants optimizing Supply Chains for Siemens factories and suppliers. 2. How did that lead to your recent roles, and what has occupied most of your time? After being headhunted to set-up the global sourcing department for Leybold Optics, I then moved to ABB firstly in Germany. Later I moved to Switzerland and remained for a total of 13.5 years. I had a lot of focus on harmonizing the sourcing and category management processes across the different fractionated ABB organizations. People development was also significant: career paths, job profiles, high potential programs and knowledge management (in 2014 we won an Award from the Procurement Leaders organization). Recently I was leading the largest business division in ABB, with about 7 Billion purchasing volume and 850 people. 3. What makes you proud of your team? Changing the mind-set of the purchasing community has been a key milestone. From local traditional tactical methods to becoming one of global sourcing excellence. Staying the course over multiple years. -

PRESS RELEASE Frankfurt, May, 20, 2021

PRESS RELEASE Frankfurt, May, 20, 2021 Summer 2022: Seven additional long-haul tourist connections from Frankfurt and Munich − Directly from Munich to Punta Cana, Cancún and Las Vegas − Four additional destinations from Frankfurt: Fort Myers, Panama City, Salt Lake City and Kilimanjaro − All destinations for summer 2022 bookable as of May 26 The Lufthansa Group now already offers exciting vacation destinations on long- haul tourist routes for summer 2022. In addition to four more routes from Frankfurt, the Munich hub will again be integrated more strongly into the Lufthansa Group's long-haul tourist offering. From March 2022, flights will once again depart from Munich to the sunny destinations of Punta Cana in the Dominican Republic and Cancún in Mexico. Each destination will be served twice a week. Moreover, there will be two flights per week from the Bavarian capital to Las Vegas in the United States. Departing from Frankfurt, travelers can look forward to four dream destinations. Back on the flight schedule: Starting in March 2022, the Lufthansa Group will offer three flights a week to Fort Myers in the sunny state of Florida as well as to Panama City in Central America. In addition, Salt Lake City in the western United States will be on the flight schedule for the first time starting in May 2022 - with three flights per week. The Lufthansa Group is also expanding its services to East Africa and will be flying from Frankfurt to Kilimanjaro twice a week for the first time from June 2022. This summer, the flight schedule already includes Mombasa (Kenya) with onward flights to the dream island of Zanzibar (Tanzania). -

Brussels Airlines Introduces Year Round Service to Washington D.C

Brussels Airlines introduces year round service to Washington D.C. Year round service begins February 20, 2020 Capacity increases to daily service in the summer 2020 schedule February 20, 2020, New York, NY – Today, Brussels Airlines launched year-round flights to and from Washington, DC to Brussels, Belgium. The new service increases the air carrier’s capacity on this important route from a seasonal flight to year-round service. Traveling four times per week, Brussels Airlines flight SN515 will depart from Brussels at 10:15 am with an A330-200 aircraft. It will arrive in DC at 01:00 pm. The return flight, SN516, will depart from Dulles International Airport at 06:10 pm and arrive in Brussels at 07:45 am on the following day. All times are local. Beginning March 29, 2020, Belgium’s home air carrier will increase the frequency of its Washington, DC route to a daily operation. The daily service will also be operated with an Airbus 330-200 aircraft that consists of a seat configuration of 22 Business Class seats, 21 Premium Economy Class seats and 212 Economy Class seats. "North America continues to be one of our most important global regions and Brussels Airlines’ increased flight capacity clearly reflects the Lufthansa Group's strong commitment to the U.S. market," said Frank Naeve, Vice President of Sales, The Americas, Lufthansa Group, "We are pleased to offer our customers an enhanced connectivity between Europe’s capital city and the capital of the United States. Furthermore, with Brussels Airlines’ unique offering of 84 weekly flights and service to 17 destinations in Sub-Saharan Africa – a continent the airline considers its second home – Washingtonians will now be able to visit this spectacular region with great ease, all while experiencing Brussels Airlines premium product and personalized customer service.” “Brussels Airlines strives to provide our customers with top-of-the-line service and on board product. -

Sustainability 2019 2 INTRO

FACT SHEET ONLINE lufthansagroup.com/en/responsibility FACT SHEET FACT Sustainability 2019 Sustainability 2 INTRO The responsible and sustainable treatment of resources, the environment and society is a prerequisite for the long-term financial stability and attractiveness of the Lufthansa Group for its customers, employees, investors and partners. With its measures and concepts, the Lufthansa Group aims to strengthen the positive effects of its business activities and further reduce the negative impacts in order to consolidate its position as a leading player in the airline industry, including in the area of corporate responsibility. You will find further information, the strategic direction and targets in the non-financial declaration of the annual report 2019. ↗ investor-relations.lufthansagroup.com The Executive Board has been extended to include a position responsible for Customer & Corporate Responsibility since 1 January 2020. This will establish responsibility for environment, climate and society directly at the Executive Board level. The Company has applied the principles of the UN Global Compact for sustainable and responsible corporate governance since 2002. A Supplier Code of Conduct has supplemented the Code of Conduct, which has been binding for all corporate bodies, managers and employees since 2017. The Lufthansa Group supports the Sustainable Development Goals (SDGs) of the Agenda 2030, as adopted by the UN member states in 2015 and is concentrating on the seven SDGs 4, 5, 8, 9, 12, 13 and 17 due to the impacts of its business -

1St Interim Report 2021

1ST INTERIM REPORT January – March 2021 The Lufthansa Group KEY FIGURES Jan - Mar Jan - Mar Change 2021 2020 in % Revenue and result Total revenue €m 2,560 6,441 -60 of which traffic revenue €m 1,542 4,539 -66 Operating expenses €m 3,980 8,162 -51 Adjusted EBITDA 1) €m -577 -540 -7 Adjusted EBIT 1) €m -1,143 -1,220 6 EBIT €m -1,135 -1,622 30 Net profit/loss €m -1,049 -2,124 51 Key balance sheet and cash flow statement figures Total assets €m 38,453 43,352 -11 Equity €m 2,052 7,497 -73 Equity ratio % 5.3 17.3 -12.0 pts Net indebtedness €m 10,924 6,354 72 Pension provision €m 7,821 6,989 12 Cash flow from operating activities €m -766 1,367 Capital expenditures (gross) 3) €m 153 770 -80 Adjusted free cash flow 1) €m -947 620 Key profitability and value creation figures Adjusted EBITDA margin 1) % -22.5 -8.4 -14.1 pts Adjusted EBIT margin 1) % -44.6 -18.9 -25.7 pts EBIT margin % -44.3 -25.2 -19.1 pts Lufthansa share Share price as of 31 March € 11.31 8.56 32 Earnings per share € -1.75 -4.44 61 Traffic figures 2) Flights number 41,011 209,094 -80 Passengers thousands 3,043 21,756 -86 Available seat-kilometres millions 16,843 64,297 -74 Revenue seat-kilometres millions 7,584 47,099 -84 Passenger load factor % 45.0 73.3 -28.3 pts Available cargo tonne-kilometres millions 2,528 3,428 -26 Revenue cargo tonne-kilometres millions 1,940 2,159 -10 Cargo load factor % 76.7 63.0 13.7 pts Employees Employees as of 31 March number 111,262 136,966 -19 1) Derivation -> Financial performance, p. -

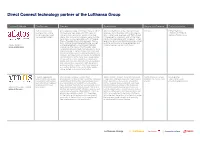

Direct Connect Technology Partner of the Lufthansa Group

Direct Connect technology partner of the Lufthansa Group Company & Website Core Services Overview Target Markets Geographical Presence Contact Information Platform for booking As a system provider of business travel solutions Atlatos‘s clients are on the one hand travel Europa Esther Stehning business trips, online for travel agencies, Atlatos GmbH offers an agencies doing business with corporate cli- +49 6431-212498-10 booking engine, travel online booking engine for serving corporate ents, online travel agencies and TMCs (travel [email protected] management system. clients. Our company‘s business areas include management companies), and on the other the solution components Atlatos Profi Traveller, hand corporate clients with a medium to high Atlatos Traveller, Atlatos Online Agent, Atlatos level of travel activity. Booking business travel Sync and the Atlatos Expense Engine, as well and the optimization of travel expenses and Atlatos GmbH as the development of customized individu- travel processes are our main focus. www.atlatos.com al solutions. The Atlatos Profi Traveller offers companies efficient travel management for easy online booking of flights, hotels, rental cars and train travel while taking company guidelines into account. The relevant travel agency is integrated into the process at the same time. Travel expen- se accounting is also available, in addition to profile management, interactive travel guidelines and authorisation processes. With the Atlatos Expense Engine, a web-based travel expense accounting system, trips can be billed easily online, based on booking information. Content Aggregator - Atriis provides a single, unified Travel Target markets include: Travel Management North America, Europe, David Bishop GDS Content and Direct Management system to TMC‘s and their corporate Companies and Multi-National Corporations. -

Titel Der Präsentation

Lufthansa Group Conference & Roadshow Presentation March / April 2016 Disclaimer in respect of forward-looking statements Information published in this presentation concerning the future development of the Lufthansa Group and its subsidiaries consists purely of forecasts and assessments and not of definitive historical facts. These forward-looking statements are based on all discernible information, facts and expectations available at the time. They can, therefore, only claim validity up to the date of their publication. Since forward-looking statements are by their nature subject to uncertainties and imponderable risk factors – such as changes in underlying economic conditions – and rest on assumptions that may not occur, or may occur differently, it is possible that the Group’s actual results and development may differ materially from the forecasts. Lufthansa makes a point of checking and updating the information it publishes. However, the Company is under no obligation to update forward-looking statements or adapt them to subsequent events or developments. Accordingly, it neither explicitly nor implicitly accepts liability, nor gives any guarantee for the actuality, accuracy or completeness of this data and information. Page 2 The Lufthansa Group is based on three strong pillars - Synergetic portfolio of premium hub airlines, profitably growing P2P airlines and high margin aviation services - New organizational structure to create efficiencies and to help implementing seven fields of action The Lufthansa Group benefits from a sound financial setup - Strong balance sheet, investment grade rating, sustainable free cash flow generation - Clear and consistent dividend policy with industry leading pay-out ratio The Lufthansa Group has good FY15 results - Passenger airlines drive results improvement; improvements at MRO and Catering; Logistics below PY - Adj. -

Annual Report 2016 Lufthansa Group

Annual Report 2016 Lufthansa Group The Lufthansa Group is the world’s leading aviation group. Its portfolio of companies consists of network airlines, point-to-point airlines and aviation service companies. Its combination of business segments makes the Lufthansa Group a globally unique aviation group. T001 Key figures Lufthansa Group 2016 2015 Change in % Revenue and result Total revenue €m 31,660 32,056 – 1.2 of which traffic revenue 1) €m 24,661 25,506 – 3.3 EBIT €m 2,275 1,676 35.7 Adjusted EBIT €m 1,752 1,817 – 3.6 EBITDA €m 4,065 3,395 19.7 Net profit / loss €m 1,776 1,698 4.6 Key balance sheet and cash flow statement figures Total assets €m 34,697 32,462 6.9 Equity ratio % 20.6 18.0 2.6 pts Net indebtedness €m 2,701 3,347 – 19.3 Cash flow from operating activities €m 3,246 3,393 – 4.3 Capital expenditure (gross) €m 2,236 2,569 – 13.0 Key profitability and value creation figures EBIT margin % 7.2 5.2 2.0 pts Adjusted EBIT margin % 5.5 5.7 – 0.2 pts EBITDA margin % 12.8 10.6 2.2 pts EACC €m 817 323 152.9 ROCE % 9.0 7.7 1.3 pts Lufthansa share Share price at year-end € 12.27 14.57 – 15.8 Earnings per share € 3.81 3.67 3.8 Proposed dividend per share € 0.50 0.50 0.0 Traffic figures 2) Passengers thousands 109,670 107,679 1.8 Available seat-kilometres millions 286,555 273,975 4.6 Revenue seat-kilometres millions 226,633 220,396 2.8 Passenger load factor % 79.1 80.4 – 1.4 pts Available cargo tonne-kilometres millions 15,117 14,971 1.0 Revenue cargo tonne-kilometres millions 10,071 9,930 1.4 Cargo load factor % 66.6 66.3 0.3 pts Total available tonne-kilometres millions 43,607 40,421 7.9 Total revenue tonne-kilometres millions 32,300 29,928 7.9 Overall load factor % 74.1 74.0 0.1 pts Flights number 1,021,919 1,003,660 1.8 Employees Average number of employees number 123,287 119,559 3.1 Employees as of 31.12. -

Investor Info December 2015

Investor Info December 2015 New record: airlines of the Lufthansa Group Traffic figures Passenger Airline Group (month change yoy in %) transport 108 million passengers in 2015 In December, the airlines of the Lufthansa Group carried out 3.2 per cent more flights. Capacity was 5.3 per cent above previous year and sales were up 3.8 per cent. The seat load factor decreased by 1.1 percentage points. The trading performance was affected by 3 days of strike at Lufthansa Passenger Airlines and Lufthansa Cargo in the previous year. Adjusted for currency effects, the pricing environment was clearly negative. Lufthansa Passenger Airlines (incl. Eurowings) saw a capacity increase of 7.5 per cent. The load factor decreased slightly (-0.4pts.). Capacity at SWISS increased by 0.8 per cent. Sales declined by 2.2 per cent and the seat load factor fell by 2.4 percentage points. Austrian Airlines also recorded a lower load factor (-3.6pts.), as sales Traffic figures by region decreased by 6.4 per cent on a capacity reduction of 1.8 per cent. (month change yoy in %) The development in the traffic regions shows a differentiated picture. In both Europe and the Americas the seat load factors decreased by 1.7 percentage points on capacity growth of 2.8 per cent and 9.4 per cent, respectively. In Asia/Pacific capacity increased by 4.9 per cent and the seat load factor fell by 0.6 percentage points. On routes to Middle East/Africa, sales increased by 1.4 per cent on a slight capacity increase (+0.4%). -

The General Court Confirms That the Aid Granted by Austria to Austrian

General Court of the European Union PRESS RELEASE No 125/21 Luxembourg, 14 July 2021 Judgment in Case T-677/20 Press and Information Ryanair and Laudamotion v Commission (Austrian Airlines - Covid-19) The General Court confirms that the aid granted by Austria to Austrian Airlines in order to compensate it for the damage resulting from the cancellation or rescheduling of its flights due to the COVID-19 pandemic is compatible with the internal market That aid, having been deducted from the subsidies granted, in the same context, by Germany to the Lufthansa group, which also includes Austrian Airlines, does not constitute overcompensation in favour of that group In June 2020, the Republic of Austria notified the European Commission of an individual aid measure in favour of the company Austrian Airlines AG (‘AUA’). The aid notified, in the form of a subordinated loan convertible into a subsidy for €150 million (‘the measure at issue’), was intended to compensate AUA for the damage resulting from the cancellation or rescheduling of its flights due to the imposition of travel restrictions and other containment measures amid the COVID-19 pandemic. AUA is part of the Lufthansa group, headed by the parent company Deutsche Lufthansa AG (‘DLH’). Between March and June 2020, the Commission had already approved various aid measures in favour of undertakings in the Lufthansa group, in particular (1) a State guarantee from the Federal Republic of Germany of 80% on a loan of €3 billion in favour of DLH, granted under a German aid scheme designed to support undertakings in all economic sectors in need of liquidity for their activities in Germany (‘the German loan’), 1 (2) a State guarantee from the Republic of Austria of 90% on a loan of €300 million granted by a consortium of commercial banks in favour of AUA granted under an Austrian aid scheme intended to support the economy during the current COVID-19 pandemic (‘the Austrian loan’), 2 and (3) individual aid of €6 billion granted by the Federal Republic of Germany in favour of DLH. -

PRESS RELEASE Munich, 12

PRESS RELEASE Munich, 12. Oktober 2018 Lufthansa CityLine to fly the Airbus A319 Future-proof cockpit collective agreement opens door for A320 family at Lufthansa CityLine for the first time First Airbus A319 to take off from Munich in spring 2019 Lufthansa CityLine and pilots’ union Vereinigung Cockpit have agreed on new em- ployment conditions for their approx. 650 pilots. The collective bargaining agree- ment sets the stage for the introduction of a new, future-proof aircraft type at Lufthansa CityLine. Come 2019, Lufthansa CityLine will start operating A320 family planes taken over from Lufthansa. The first A319-100 aircraft will depart from the Munich hub next spring. Another 5 aircraft will follow by the end of 2020. "Lufthansa CityLine has been handling an important part of our feeder traffic at the hubs in Munich and Frankfurt for many years," says Wilken Bormann, Chairman of the Supervisory Board of Lufthansa CityLine and CEO of Lufthansa Hub Mu- nich. "Entering the A320 segment is a logical next step. With the new collective agreement, both negotiating partners have illustrated their will to jointly develop Lufthansa CityLine as a key component of the Lufthansa Group." The parties have agreed on an extensive package. It includes, among other things, a moderate salary increase for the next three years and a growth-related increase for 2021. Essential points of the structure of the company pension plan will be adapted to the regulations for Lufthansa’s mainline staff. Another key aspect is the optimization of the training roadmap for its pilots. The package thus opens up im- portant new growth prospects. -

Logistics Business Segment

COMBINED MANAGEMENT REPORT LUFTHANSA GROUP ANNUAL REPORT 2019 55 Business segments → Logistics business segment Logistics business segment Lufthansa Cargo is one of Europe’s leading freight airlines. | Service improvements and global partnerships strengthen market position. | Customers benefit from increasing digitalisation. | Difficult market environment burdens revenue and earnings. The focus of Lufthansa Cargo’s operations lies in the airport-to-airport airfreight business. Its product portfolio 2.5 1 encompasses standard and express freight as well as highly specialised products. These include the transport of living €bn Revenue €m Adjusted EBIT animals, valuable cargo, post and dangerous goods, as well as meeting growing market demand for the carriage of temperature-sensitive goods. The company has specialised infrastructure at Frankfurt Airport to handle these sensitive T!"# KEY FIGURES LOGISTICS goods, including the Animal Lounge and the Lufthansa Cargo Cool Center. 1!23 !"#$ Change in % Revenue 0m !,34$ !,4#5 – 7 The Lufthansa Cargo freighter fleet consisted of seven of which Boeing 777F and eight Boeing MD-11F aircraft as of the end traffic revenue 0m !,5#$ !,>>" – 7 of 2019. Around half its freight volumes are also carried in the Adjusted EBITDA 0m #H# 54! – >4 belly capacities of passenger aircraft operated by Lufthansa Adjusted EBIT 0m # !H$ – #"" German Airlines, Brussels Airlines, Austrian Airlines, Eurowings EBIT 0m – 55 !H5 long-haul and SunExpress. Altogether, Lufthansa Cargo Adjusted offers connections to more than 300 destinations in around EBIT margin % "." 7.7 – 7.7 pts 100 countries. Adjusted ROCE % "." #3.H – #3.H pts EACC 0m – #"! #57 AeroLogic is a joint venture based in Leipzig and operates Segment capital its 14 B777 freighters to 28 destinations around the world expenditure 0m !$H 543 – !3 on behalf of its two shareholders, Lufthansa Cargo and Employees as of 5# Dec number 3,>57 3,>"> # DHL Express.