FINANCIAL STATEMENTS 2019 Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2019 June Edition Angela Qu, SVP Head of Procurement

2019 June Edition Angela Qu, SVP Head of Procurement Company: Lufthansa Group 1. How and when did procurement & supply become your passion and career choice? A government job I had in China facilitated working with a Siemens joint venture. I supported the related General Manager (helping to open the factory, hiring people, etc.) and was asked which function I’d like to join - purchasing was my first selection for a personal and career choice. The 9 years at Siemens gave me lot of opportunities working from operational tasks, to category managers and later on as Senior consultants optimizing Supply Chains for Siemens factories and suppliers. 2. How did that lead to your recent roles, and what has occupied most of your time? After being headhunted to set-up the global sourcing department for Leybold Optics, I then moved to ABB firstly in Germany. Later I moved to Switzerland and remained for a total of 13.5 years. I had a lot of focus on harmonizing the sourcing and category management processes across the different fractionated ABB organizations. People development was also significant: career paths, job profiles, high potential programs and knowledge management (in 2014 we won an Award from the Procurement Leaders organization). Recently I was leading the largest business division in ABB, with about 7 Billion purchasing volume and 850 people. 3. What makes you proud of your team? Changing the mind-set of the purchasing community has been a key milestone. From local traditional tactical methods to becoming one of global sourcing excellence. Staying the course over multiple years. -

PRESS RELEASE Frankfurt, May, 20, 2021

PRESS RELEASE Frankfurt, May, 20, 2021 Summer 2022: Seven additional long-haul tourist connections from Frankfurt and Munich − Directly from Munich to Punta Cana, Cancún and Las Vegas − Four additional destinations from Frankfurt: Fort Myers, Panama City, Salt Lake City and Kilimanjaro − All destinations for summer 2022 bookable as of May 26 The Lufthansa Group now already offers exciting vacation destinations on long- haul tourist routes for summer 2022. In addition to four more routes from Frankfurt, the Munich hub will again be integrated more strongly into the Lufthansa Group's long-haul tourist offering. From March 2022, flights will once again depart from Munich to the sunny destinations of Punta Cana in the Dominican Republic and Cancún in Mexico. Each destination will be served twice a week. Moreover, there will be two flights per week from the Bavarian capital to Las Vegas in the United States. Departing from Frankfurt, travelers can look forward to four dream destinations. Back on the flight schedule: Starting in March 2022, the Lufthansa Group will offer three flights a week to Fort Myers in the sunny state of Florida as well as to Panama City in Central America. In addition, Salt Lake City in the western United States will be on the flight schedule for the first time starting in May 2022 - with three flights per week. The Lufthansa Group is also expanding its services to East Africa and will be flying from Frankfurt to Kilimanjaro twice a week for the first time from June 2022. This summer, the flight schedule already includes Mombasa (Kenya) with onward flights to the dream island of Zanzibar (Tanzania). -

Conference & Roadshow Presentation

Conference & Roadshow Presentation June / July 2019 Disclaimer The information herein is based on publicly available information. It This presentation contains statements that express the Company‘s has been prepared by the Company solely for use in this opinions, expectations, beliefs, plans, objectives, assumptions or presentation and has not been verified by independent third parties. projections regarding future events or future results, in contrast with No representation, warranty or undertaking, express or implied, is statements that reflect historical facts. While the Company always made as to, and no reliance should be placed on, the fairness, intends to express its best knowledge when it makes statements accuracy, completeness or correctness of the information or the about what it believes will occur in the future, and although it bases opinions contained herein. The information contained in this these statements on assumptions that it believes to be reasonable presentation should be considered in the context of the when made, these forward-looking statements are not a guarantee circumstances prevailing at that time and will not be updated to of performance, and no undue reliance should be placed on such reflect material developments which may occur after the date of the statements. Forward-looking statements are subject to many risks, presentation. uncertainties and other variable circumstances that may cause the statements to be inaccurate. Many of these risks are outside of the Company‘s control and could cause its actual results (positively or The information does not constitute any offer or invitation to sell, negatively) to differ materially from those it thought would occur. purchase or subscribe any securities of the Company. -

Liberalization, Hysteresis, and Labor Relations in Western European Commercial Aviation

MPIfG Discussion Paper 17/16 Liberalization, Hysteresis, and Labor Relations in Western European Commercial Aviation Filippo Reale MPIfG Discussion Paper MPIfG Discussion Paper Filippo Reale Liberalization, Hysteresis, and Labor Relations in Western European Commercial Aviation MPIfG Discussion Paper 17/16 Max-Planck-Institut für Gesellschaftsforschung, Köln Max Planck Institute for the Study of Societies, Cologne September 2017 MPIfG Discussion Paper ISSN 0944-2073 (Print) ISSN 1864-4325 (Internet) © 2017 by the author(s) About the author Filippo Reale is a postdoctoral researcher at the Institute of Sociology at Goethe University Frankfurt. He was a doctoral researcher at the International Max Planck Research School on the Social and Political Constitution of the Economy (IMPRS-SPCE), Cologne, from 2012 to 2016. Email: [email protected] MPIfG Discussion Papers are refereed scholarly papers of the kind that are publishable in a peer-reviewed disciplinary journal. Their objective is to contribute to the cumulative improvement of theoretical knowl- edge. The papers can be ordered from the institute for a small fee (hard copies) or downloaded free of charge (PDF). Downloads www.mpifg.de Go to Publications / Discussion Papers Max-Planck-Institut für Gesellschaftsforschung Max Planck Institute for the Study of Societies Paulstr. 3 | 50676 Cologne | Germany Tel. +49 221 2767-0 Fax +49 221 2767-555 www.mpifg.de [email protected] Reale: Liberalization, Hysteresis, and Labor Relations iii Abstract Airlines have reacted in many ways to the liberalization and privatization of commercial aviation in Western Europe, one of them being outsourcing. The labor unions, for their part, have reacted in unexpected ways to these developments, not cooperating as anticipated by various political theories and, conversely, collaborating surprisingly under other conditions. -

Brussels Airlines Introduces Year Round Service to Washington D.C

Brussels Airlines introduces year round service to Washington D.C. Year round service begins February 20, 2020 Capacity increases to daily service in the summer 2020 schedule February 20, 2020, New York, NY – Today, Brussels Airlines launched year-round flights to and from Washington, DC to Brussels, Belgium. The new service increases the air carrier’s capacity on this important route from a seasonal flight to year-round service. Traveling four times per week, Brussels Airlines flight SN515 will depart from Brussels at 10:15 am with an A330-200 aircraft. It will arrive in DC at 01:00 pm. The return flight, SN516, will depart from Dulles International Airport at 06:10 pm and arrive in Brussels at 07:45 am on the following day. All times are local. Beginning March 29, 2020, Belgium’s home air carrier will increase the frequency of its Washington, DC route to a daily operation. The daily service will also be operated with an Airbus 330-200 aircraft that consists of a seat configuration of 22 Business Class seats, 21 Premium Economy Class seats and 212 Economy Class seats. "North America continues to be one of our most important global regions and Brussels Airlines’ increased flight capacity clearly reflects the Lufthansa Group's strong commitment to the U.S. market," said Frank Naeve, Vice President of Sales, The Americas, Lufthansa Group, "We are pleased to offer our customers an enhanced connectivity between Europe’s capital city and the capital of the United States. Furthermore, with Brussels Airlines’ unique offering of 84 weekly flights and service to 17 destinations in Sub-Saharan Africa – a continent the airline considers its second home – Washingtonians will now be able to visit this spectacular region with great ease, all while experiencing Brussels Airlines premium product and personalized customer service.” “Brussels Airlines strives to provide our customers with top-of-the-line service and on board product. -

B COMMISSION REGULATION (EC) No 748/2009 Of

02009R0748 — EN — 16.03.2018 — 011.001 — 1 This text is meant purely as a documentation tool and has no legal effect. The Union's institutions do not assume any liability for its contents. The authentic versions of the relevant acts, including their preambles, are those published in the Official Journal of the European Union and available in EUR-Lex. Those official texts are directly accessible through the links embedded in this document ►B COMMISSION REGULATION (EC) No 748/2009 of 5 August 2009 on the list of aircraft operators which performed an aviation activity listed in Annex I to Directive 2003/87/EC on or after 1 January 2006 specifying the administering Member State for each aircraft operator (Text with EEA relevance) (OJ L 219, 22.8.2009, p. 1) Amended by: Official Journal No page date ►M1 Commission Regulation (EU) No 82/2010 of 28 January 2010 L 25 12 29.1.2010 ►M2 Commission Regulation (EU) No 115/2011 of 2 February 2011 L 39 1 12.2.2011 ►M3 Commission Regulation (EU) No 394/2011 of 20 April 2011 L 107 1 27.4.2011 ►M4 Commission Regulation (EU) No 100/2012 of 3 February 2012 L 39 1 11.2.2012 ►M5 Commission Regulation (EU) No 109/2013 of 29 January 2013 L 40 1 9.2.2013 ►M6 Commission Regulation (EU) No 815/2013 of 27 August 2013 L 236 1 4.9.2013 ►M7 Commission Regulation (EU) No 100/2014 of 5 February 2014 L 37 1 6.2.2014 ►M8 Commission Regulation (EU) 2015/180 of 9 February 2015 L 34 1 10.2.2015 ►M9 Commission Regulation (EU) 2016/282 of 26 February 2016 L 56 1 2.3.2016 ►M10 Commission Regulation (EU) 2017/294 of 20 February -

EASA NPA 2016-12 EFB EFB Admin Remarks

EASA NPA 2016-12 EFB 1/3 EFB Admin Remarks From: Hans-Conrad Stamm (SWISS / OFI) in coordination with Lufthansa EFB Hamonisation Group representing EFB Administrators from AUA Austian Airlines, Brussels Airline, Eurowings/Germanwings, Lufthansa Passage, Lufthansa Cityline, Lufthansa Cargo, SWISS) Date: Dez 2016 Feedback from LH EFB Hamonisation Group & SWISS regarding proposed “EASA NPA 2016-12 Transposition of provisions on electronic flight bags from ICAO Annex 6” (RMT.0601 — 4.10.2016) Executive Summary of the NPA 2016-12 EFB The NPA is published to maintain a high level of safety with regard to the use of EFBs by ensuring a harmonised implementation of the current provisions of AMC 20-25. It includes a proposal for an operational approval for the use of EFB applications by commercial air transport (CAT) operators. General Remarks LX The proposed NPA 2016-12 has the goal to harmonize the implementation of the AMC 20-25 and to give EFB system providers, application developers, operators and regulators guidance how to implement an EFB solution. The 138 page NPA is very detailed and covers all relevant areas. It supports the basic principle that an EFB system should support the pilots and should support a safe operation. Nevertheless in some parts the guidance is very specific, restrictive and complex. This could lead to: - It will increase complexity, manpower needed and time to implement an EFB solution for system suppliers, operators and regulators. - It is questionable if a regulation this complex and specific can cope in all cases with technology innovations especially in the IT- and EFB-Area. -

Signatory Visa Waiver Program (VWP) Carriers

Visa Waiver Program (VWP) Signatory Carriers As of May 1, 2019 Carriers that are highlighted in yellow hold expired Visa Waiver Program Agreements and therefore are no longer authorized to transport VWP eligible passengers to the United States pursuant to the Visa Waiver Program Agreement Paragraph 14. When encountered, please remind them of the need to re-apply. # 21st Century Fox America, Inc. (04/07/2015) 245 Pilot Services Company, Inc. (01/14/2015) 258131 Aviation LLC (09/18/2013) 26 North Aviation Inc. 4770RR, LLC (12/06/2016) 51 CL Corp. (06/23/2017) 51 LJ Corporation (02/01/2016) 620, Inc. 650534 Alberta, Inc. d/b/a Latitude Air Ambulance (01/09/2017) 711 CODY, Inc. (02/09/2018) A A OK Jets A&M Global Solutions, Inc. (09/03/2014) A.J. Walter Aviation, Inc. (01/17/2014) A.R. Aviation, Corp. (12/30/2015) Abbott Laboratories Inc. (09/26/2012) ABC Aerolineas, S.A. de C.V. (d/b/a Interjet) (08/24/2011) Abelag Aviation NV d/b/a Luxaviation Belgium (02/27/2019) ABS Jets A.S. (05/07/2018) ACASS Canada Ltd. (02/27/2019) Accent Airways LLC (01/12/2015) Ace Aviation Services Corporation (08/24/2011) Ace Flight Center Inc. (07/30/2012) ACE Flight Operations a/k/a ACE Group (09/20/2015) Ace Flight Support ACG Air Cargo Germany GmbH (03/28/2011) ACG Logistics LLC (02/25/2019) ACL ACM Air Charter Luftfahrtgesellschaft GmbH (02/22/2018) ACM Aviation, Inc. (09/16/2011) ACP Jet Charter, Inc. (09/12/2013) Acromas Shipping Ltd. -

Sustainability 2019 2 INTRO

FACT SHEET ONLINE lufthansagroup.com/en/responsibility FACT SHEET FACT Sustainability 2019 Sustainability 2 INTRO The responsible and sustainable treatment of resources, the environment and society is a prerequisite for the long-term financial stability and attractiveness of the Lufthansa Group for its customers, employees, investors and partners. With its measures and concepts, the Lufthansa Group aims to strengthen the positive effects of its business activities and further reduce the negative impacts in order to consolidate its position as a leading player in the airline industry, including in the area of corporate responsibility. You will find further information, the strategic direction and targets in the non-financial declaration of the annual report 2019. ↗ investor-relations.lufthansagroup.com The Executive Board has been extended to include a position responsible for Customer & Corporate Responsibility since 1 January 2020. This will establish responsibility for environment, climate and society directly at the Executive Board level. The Company has applied the principles of the UN Global Compact for sustainable and responsible corporate governance since 2002. A Supplier Code of Conduct has supplemented the Code of Conduct, which has been binding for all corporate bodies, managers and employees since 2017. The Lufthansa Group supports the Sustainable Development Goals (SDGs) of the Agenda 2030, as adopted by the UN member states in 2015 and is concentrating on the seven SDGs 4, 5, 8, 9, 12, 13 and 17 due to the impacts of its business -

1St Interim Report 2021

1ST INTERIM REPORT January – March 2021 The Lufthansa Group KEY FIGURES Jan - Mar Jan - Mar Change 2021 2020 in % Revenue and result Total revenue €m 2,560 6,441 -60 of which traffic revenue €m 1,542 4,539 -66 Operating expenses €m 3,980 8,162 -51 Adjusted EBITDA 1) €m -577 -540 -7 Adjusted EBIT 1) €m -1,143 -1,220 6 EBIT €m -1,135 -1,622 30 Net profit/loss €m -1,049 -2,124 51 Key balance sheet and cash flow statement figures Total assets €m 38,453 43,352 -11 Equity €m 2,052 7,497 -73 Equity ratio % 5.3 17.3 -12.0 pts Net indebtedness €m 10,924 6,354 72 Pension provision €m 7,821 6,989 12 Cash flow from operating activities €m -766 1,367 Capital expenditures (gross) 3) €m 153 770 -80 Adjusted free cash flow 1) €m -947 620 Key profitability and value creation figures Adjusted EBITDA margin 1) % -22.5 -8.4 -14.1 pts Adjusted EBIT margin 1) % -44.6 -18.9 -25.7 pts EBIT margin % -44.3 -25.2 -19.1 pts Lufthansa share Share price as of 31 March € 11.31 8.56 32 Earnings per share € -1.75 -4.44 61 Traffic figures 2) Flights number 41,011 209,094 -80 Passengers thousands 3,043 21,756 -86 Available seat-kilometres millions 16,843 64,297 -74 Revenue seat-kilometres millions 7,584 47,099 -84 Passenger load factor % 45.0 73.3 -28.3 pts Available cargo tonne-kilometres millions 2,528 3,428 -26 Revenue cargo tonne-kilometres millions 1,940 2,159 -10 Cargo load factor % 76.7 63.0 13.7 pts Employees Employees as of 31 March number 111,262 136,966 -19 1) Derivation -> Financial performance, p. -

(VWP) Carriers

Visa Waiver Program (VWP) Signatory Carriers February 1, 2020 In order to facilitate the arrival of Visa Waiver Program (VWP) passengers, carriers need to be signatory to a current agreement with U.S. Customs and Border Protection (CBP). A carrier is required to be signatory to an agreement in order to transport aliens seeking admission as nonimmigrant visitors under the VWP (Title 8, U.S.C. § 1187(a)(5). The carriers listed below are currently signatory to the VWP and can transport passengers under the program. The date indicates the expiration of the current signed agreement. Agreements are valid for 7 years. If you transport VWP passengers and are not a signatory carrier, fines will be levied. Use the following link to apply to CBP to become a Signatory Carrier: https://www.cbp.gov/travel/international-visitors/business-pleasure/vwp/signatory-status # 21st Century Fox America, Inc. (04/07/2022) 245 Pilot Services Company, Inc. (01/14/2022) 258131 Aviation LLC (09/18/2020) 4770RR, LLC (12/06/2023) 51 CL Corp. (06/23/2024) 51 LJ Corporation (02/01/2023) 650534 Alberta, Inc. d/b/a Latitude Air Ambulance (01/09/2024) 711 CODY, Inc. (02/09/2025) A A&M Global Solutions, Inc. (09/03/2021) A.J. Walter Aviation, Inc. (01/17/2021) A.R. Aviation, Corp. (12/30/2022) Abbott Laboratories Inc. (08/26/2026) AbbVie US LLC (10/15/2026) Abelag Aviation NV d/b/a Luxaviation Belgium (02/27/2026) ABS Jets A.S. (05/07/2025) ACASS Canada Ltd. (02/27/2026) Accent Airways LLC (01/12/2022) Ace Flight Center Inc. -

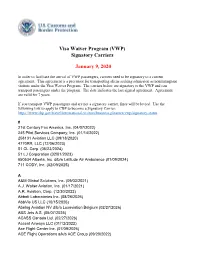

Signatory Visa Waiver Program (VWP) Carriers

Visa Waiver Program (VWP) Signatory Carriers January 9, 2020 In order to facilitate the arrival of VWP passengers, carriers need to be signatory to a current agreement. This agreement is a precursor for transporting aliens seeking admission as nonimmigrant visitors under the Visa Waiver Program. The carriers below are signatory to the VWP and can transport passengers under the program. The date indicates the last signed agreement. Agreement are valid for 7 years. If you transport VWP passengers and are not a signatory carrier, fines will be levied. Use the following link to apply to CBP to become a Signatory Carrier: https://www.cbp.gov/travel/international-visitors/business-pleasure/vwp/signatory-status # 21st Century Fox America, Inc. (04/07/2022) 245 Pilot Services Company, Inc. (01/14/2022) 258131 Aviation LLC (09/18/2020) 4770RR, LLC (12/06/2023) 51 CL Corp. (06/23/2024) 51 LJ Corporation (02/01/2023) 650534 Alberta, Inc. d/b/a Latitude Air Ambulance (01/09/2024) 711 CODY, Inc. (02/09/2025) A A&M Global Solutions, Inc. (09/03/2021) A.J. Walter Aviation, Inc. (01/17/2021) A.R. Aviation, Corp. (12/30/2022) Abbott Laboratories Inc. (08/26/2026) AbbVie US LLC (10/15/2026) Abelag Aviation NV d/b/a Luxaviation Belgium (02/27/2026) ABS Jets A.S. (05/07/2025) ACASS Canada Ltd. (02/27/2026) Accent Airways LLC (01/12/2022) Ace Flight Center Inc. (07/09/2026) ACE Flight Operations a/k/a ACE Group (09/20/2022) ACG Logistics LLC (02/25/2026) ACM Air Charter Luftfahrtgesellschaft GmbH (02/22/2025) ACP Jet Charter, Inc.