Logistics Business Segment

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Frequently Asked Questions (Faqs)

Frequently asked questions (FAQs). 020 bookings on ANA Joint Venture routings. (Status: November 2014) General information. These FAQs are applicable for joint venture flights on LH and ANA and contain general information as well as specific eBooking information. What benefits do I have as a customer? Increased frequencies on routings from Japan to Europe and a wider range of choices. In addition, you can now book direct flights from Tokyo Haneda (HND)/Tokyo Narita (NRT) to London Heathrow (LHR), Paris Charles de Gaulle (CDG) and Düsseldorf (DUS). What routings are bookable on ANA flights? Bookings are possible on flights from Japan to Europe, including feeders and de-feeders within Japan and Europe. Which stations will be offered? Within Japan: Tokyo Haneda (HND), Tokyo Narita (NRT), Nagoya (NGO) and Osaka (KIX). Within Europe: all transit/import stations currently open for cargo. Which products and services can be booked on ANA flights? Standard cargo (td.Services) with td.Pro and td.Flash priority can be booked on ANA flights. Specials such as dangerous goods, animals or temperature-sensitive goods are excluded in a first step. Are my rates also valid for ANA flights? LH Cargo TACT, SRS and SRA rates can be booked on ANA flights. The shipment will receive access to an ANA flight if the booked revenue rate meets the access criteria defined by ANA. Additionally, ad hoc rates (spot quotations) can be requested for both LH Cargo and ANA flights. Is it possible to book 205(NH)-AWBs via Lufthansa Cargo? No, only 020(LH)-AWB bookings are possible in Lufthansa Cargo systems, e.g. -

2019 June Edition Angela Qu, SVP Head of Procurement

2019 June Edition Angela Qu, SVP Head of Procurement Company: Lufthansa Group 1. How and when did procurement & supply become your passion and career choice? A government job I had in China facilitated working with a Siemens joint venture. I supported the related General Manager (helping to open the factory, hiring people, etc.) and was asked which function I’d like to join - purchasing was my first selection for a personal and career choice. The 9 years at Siemens gave me lot of opportunities working from operational tasks, to category managers and later on as Senior consultants optimizing Supply Chains for Siemens factories and suppliers. 2. How did that lead to your recent roles, and what has occupied most of your time? After being headhunted to set-up the global sourcing department for Leybold Optics, I then moved to ABB firstly in Germany. Later I moved to Switzerland and remained for a total of 13.5 years. I had a lot of focus on harmonizing the sourcing and category management processes across the different fractionated ABB organizations. People development was also significant: career paths, job profiles, high potential programs and knowledge management (in 2014 we won an Award from the Procurement Leaders organization). Recently I was leading the largest business division in ABB, with about 7 Billion purchasing volume and 850 people. 3. What makes you proud of your team? Changing the mind-set of the purchasing community has been a key milestone. From local traditional tactical methods to becoming one of global sourcing excellence. Staying the course over multiple years. -

Lufthansa German Airlines Announcement

Lufthansa German Airlines Announcement Message to all interested in a flight on Friday, July 10, 2020 from Dammam to Frankfurt Main (Germany) with possible connections to Europe, Canada, the USA, Mexico and Brazil. GENERAL INFO Lufthansa German Airlines is planning a commercial special flight on Friday, July 10, 2020 at 01:55 AM in order to provide further travel possibilities within the given restrictions due to the ongoing Corona-crisis. Announcements about this flight will be shared via the respective embassies and business councils. Lufthansa German Airlines is bookable for regular, scheduled flights to/from Dammam as of August 2020. This however continues to depend on the lifting of the air travel restrictions to/from Saudi Arabia. DISCLAIMER As much as Lufthansa wants to support in connecting people around the world with their beloved friends and relatives, we can only operate this flight once sufficient demand is given and all the regulatory approvals are granted. We kindly ask you to check all the travel rules and regulations with regards to your travel plans with the respective embassies/consulates. It is each passenger's responsibility to comply with all visa, quarantine and transit regulations, other forced travel regulations and current enforced travel restrictions. DESTINATIONS Departing King Fahd International Airport in Dammam (DMM) to Frankfurt Main (FRA) with connection possibilities to Europe, Canada, the USA, Mexico and Brazil. Destinations in Europe From Frankfurt Main (FRA) there are connecting flights to following -

PRESS RELEASE Frankfurt, May, 20, 2021

PRESS RELEASE Frankfurt, May, 20, 2021 Summer 2022: Seven additional long-haul tourist connections from Frankfurt and Munich − Directly from Munich to Punta Cana, Cancún and Las Vegas − Four additional destinations from Frankfurt: Fort Myers, Panama City, Salt Lake City and Kilimanjaro − All destinations for summer 2022 bookable as of May 26 The Lufthansa Group now already offers exciting vacation destinations on long- haul tourist routes for summer 2022. In addition to four more routes from Frankfurt, the Munich hub will again be integrated more strongly into the Lufthansa Group's long-haul tourist offering. From March 2022, flights will once again depart from Munich to the sunny destinations of Punta Cana in the Dominican Republic and Cancún in Mexico. Each destination will be served twice a week. Moreover, there will be two flights per week from the Bavarian capital to Las Vegas in the United States. Departing from Frankfurt, travelers can look forward to four dream destinations. Back on the flight schedule: Starting in March 2022, the Lufthansa Group will offer three flights a week to Fort Myers in the sunny state of Florida as well as to Panama City in Central America. In addition, Salt Lake City in the western United States will be on the flight schedule for the first time starting in May 2022 - with three flights per week. The Lufthansa Group is also expanding its services to East Africa and will be flying from Frankfurt to Kilimanjaro twice a week for the first time from June 2022. This summer, the flight schedule already includes Mombasa (Kenya) with onward flights to the dream island of Zanzibar (Tanzania). -

Key Data on Sustainability Within the Lufthansa Group Issue 2012 Www

Issue 2012 Balance Key data on sustainability within the Lufthansa Group www.lufthansa.com/responsibility You will fi nd further information on sustainability within the Lufthansa Group at: www.lufthansa.com/responsibility Order your copy of our Annual Report 2011 at: www.lufthansa.com/investor-relations The new Boeing 747-8 Intercontinental The new Boeing 747-8 Intercontinental is the advanced version of one of the world’s most successful commercial aircraft. In close cooperation with Lufthansa, Boeing has developed an aircraft that is optimized not only in terms of com- fort but also in all dimensions of climate and environmental responsibility. The fully redesigned wings, extensive use of weight-reducing materials and innova- tive engine technology ensure that this aircraft’s eco-effi ciency has again been improved signifi cantly in comparison with its predecessor: greater fuel effi - ciency, lower emissions and signifi cant noise reductions (also see page 27). The “Queen of the Skies,” as many Jumbo enthusiasts call the “Dash Eight,” offers an exceptional travel experience in all classes of service, especially in the exclusive First Class and the entirely new Business Class. In this way, environmental effi ciency and the highest levels of travel comfort are brought into harmony. Lufthansa has ordered 20 aircraft of this type. Editorial information Published by Deutsche Lufthansa AG Lufthansa Group Communications, FRA CI Senior Vice President: Klaus Walther Concept, text and editors Media Relations Lufthansa Group, FRA CI/G Director: Christoph Meier Bernhard Jung Claudia Walther in cooperation with various departments and Petra Menke Redaktionsbüro Design and production organic Marken-Kommunikation GmbH Copy deadline 18 May 2012 Photo credits Jens Görlich/MO CGI (cover, page 5, 7, 35, 85) SWISS (page 12) Brussels Airlines (page 13) Reto Hoffmann (page 24) AeroLogic (page 29) Fraport AG/Stefan Rebscher (page 43) Werner Hennies (page 44) Ulf Büschleb (page 68 top) Dr. -

Conference & Roadshow Presentation

Conference & Roadshow Presentation June / July 2019 Disclaimer The information herein is based on publicly available information. It This presentation contains statements that express the Company‘s has been prepared by the Company solely for use in this opinions, expectations, beliefs, plans, objectives, assumptions or presentation and has not been verified by independent third parties. projections regarding future events or future results, in contrast with No representation, warranty or undertaking, express or implied, is statements that reflect historical facts. While the Company always made as to, and no reliance should be placed on, the fairness, intends to express its best knowledge when it makes statements accuracy, completeness or correctness of the information or the about what it believes will occur in the future, and although it bases opinions contained herein. The information contained in this these statements on assumptions that it believes to be reasonable presentation should be considered in the context of the when made, these forward-looking statements are not a guarantee circumstances prevailing at that time and will not be updated to of performance, and no undue reliance should be placed on such reflect material developments which may occur after the date of the statements. Forward-looking statements are subject to many risks, presentation. uncertainties and other variable circumstances that may cause the statements to be inaccurate. Many of these risks are outside of the Company‘s control and could cause its actual results (positively or The information does not constitute any offer or invitation to sell, negatively) to differ materially from those it thought would occur. purchase or subscribe any securities of the Company. -

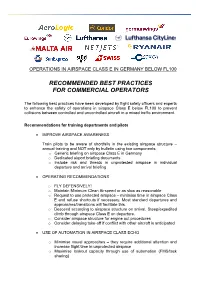

Recommended Best Practices for Commercial Operators

OPERATIONS IN AIRSPACE CLASS E IN GERMANY BELOW FL100 RECOMMENDED BEST PRACTICES FOR COMMERCIAL OPERATORS The following best practices have been developed by flight safety officers and experts to enhance the safety of operations in airspace Class E below FL100 to prevent collisions between controlled and uncontrolled aircraft in a mixed traffic environment. Recommendations for training departments and pilots • IMPROVE AIRSPACE AWARENESS Train pilots to be aware of shortfalls in the existing airspace structure – annual training and NOT only by bulletin using two components: o Generic briefing on airspace Class E in Germany o Dedicated airport briefing documents o Include risk and threats in unprotected airspace in individual departure and arrival briefing • OPERATING RECOMMENDATIONS o FLY DEFENSIVELY! o Maintain Minimum Clean Airspeed or as slow as reasonable o Request to use protected airspace – minimise time in airspace Class E and refuse shortcuts if necessary. Most standard departures and approaches/transitions will facilitate this. o Descend according to airspace structure on arrival. Steep/expedited climb through airspace Class E on departure. o Consider airspace structure for engine out procedures o Consider delaying take-off if conflict with other aircraft is anticipated • USE OF AUTOMATION IN AIRSPACE CLASS ECHO o Minimise visual approaches – they require additional attention and increase flight time in unprotected airspace o Maximise lookout capacity through use of automation (FMS/task sharing) • SEE AND AVOID o Maximise lookout -

September, 2008

WWW.AIRCARGOWORLD.COM SEPTEMBER 2008 International Trends & Analysis INTERNATIONAL EDITION The World’s Top Cargo Airlines50 Cargo Security • India • Anti-Trust 2008 SUPPLY CHAIN INNOVATION AWARD FINALIST 6H>6 IDD J#H# EDGII"ID "9DDG# 96NN"9:;>C>I::# ,% A:HH I=6C6>G# As fuel prices send airfreight costs soaring, only OceanGuaranteed ® provides day-definite delivery from Asia to the U.S. that’s just as reliable, but at a fraction of the cost.With the combined resources and expertise of APL Logistics and Con-way Freight, OceanGuaranteed provides a unique single-source LCL/LTL solution with proven 99% on-time performance. In fact, your shipment is guaranteed to arrive on schedule, or we’ll pay 20% of the invoice.* Call 866-896-2005 or visit www.oceanguaranteed.com/22 for more information or to book a shipment today. *Conditions and restrictions apply. See website for full details. Service also available to Canada and Mexico. International Edition September 2008 CONTENTS Volume 11, Number 7 COLUMNS Top Cargo 12 North America Airlines With all the turmoil in Ohio, 22 The annual ranking of the growth at Toledo Express the world’s top 50 cargo air- Airport as a freight center is lines by traffic, with aircraft noteworthy orders and cargo revenue. 14 Pacific Yields on freighters may be down, but handling cargo in China remains a feast • JAL Slimmer 17 Europe Despite its bad timing of entering the market, Cargo 30 India B could be a survivor among India could become a plenty of airline failures key growth market for air 30 cargo, but overcapacity could spoil the party for freight operators. -

551 236 33,43% 3 172 095 29,48% 872 040 52,89% 5 927 313 55,09

Domestic and international scheduled operations - passenger traffic by carriers in the fourth quarter of 2019 and 2020 2020 2019 market market Carrier number passengers share number passengers share LOT Polish Airlines 1 514 194 31,18% 1 3 018 259 28,05% Ryanair 2 490 672 29,76% 2 2 960 873 27,52% Wizz Air 3 351 334 21,31% 3 2 342 228 21,77% KLM Royal Dutch Airlines 4 74 096 4,49% 7 167 647 1,56% Lufthansa 5 62 945 3,82% 4 533 641 4,96% Enter Air 6 36 871 2,24% 8 153 836 1,43% EasyJet 7 12 439 0,75% 5 243 676 2,26% Norwegian Air Shuttle 8 11 388 0,69% 6 201 750 1,88% British Airways 9 11 210 0,68% 12 79 209 0,74% Air France 10 10 186 0,62% 11 84 697 0,79% Belavia 11 10 026 0,61% 30 17 273 0,16% Emirates 12 10 022 0,61% 14 61 242 0,57% SAS 13 9 676 0,59% 9 114 174 1,06% Swiss International Air Lines 14 8 601 0,52% 13 63 360 0,59% Turkish Airlines (THY) 15 8 581 0,52% 26 24 692 0,23% TAP Portugal 16 3 986 0,24% 22 28 676 0,27% Austrian Airlines 17 3 791 0,23% 18 49 944 0,46% Aegean Airlines 18 3 107 0,19% 24 25 665 0,24% Eurowings (Germanwings) 19 2 675 0,16% 21 44 874 0,42% Finnair 20 2 621 0,16% 15 58 297 0,54% Transavia Airlines 21 2 493 0,15% 23 27 163 0,25% Air China 22 2 486 0,15% 33 15 270 0,14% SunExpress 23 1 749 0,11% 37 2 471 0,02% Jet2.com 24 929 0,06% 20 46 394 0,43% Qatar Airways 25 922 0,06% 10 86 279 0,80% Other carriers 1 890 0,11% 307 289 2,86% Polish carriers* 551 236 33,43% 3 172 095 29,48% LCC** 872 040 52,89% 5 927 313 55,09% Total passengers 1 648 890 10 758 879 Source: Civil Aviation Authority of Republic of Poland, data obtained from Polish airports, Warsaw, May 2021 *Polish carriers: LOT Polish Airlines, Enter Air, Smartwings (d. -

Attachment F – Participants in the Agreement

Revenue Accounting Manual B16 ATTACHMENT F – PARTICIPANTS IN THE AGREEMENT 1. TABULATION OF PARTICIPANTS 0B 475 BLUE AIR AIRLINE MANAGEMENT SOLUTIONS S.R.L. 1A A79 AMADEUS IT GROUP SA 1B A76 SABRE ASIA PACIFIC PTE. LTD. 1G A73 Travelport International Operations Limited 1S A01 SABRE INC. 2D 54 EASTERN AIRLINES, LLC 2I 156 STAR UP S.A. 2I 681 21 AIR LLC 2J 226 AIR BURKINA 2K 547 AEROLINEAS GALAPAGOS S.A. AEROGAL 2T 212 TIMBIS AIR SERVICES 2V 554 AMTRAK 3B 383 Transportes Interilhas de Cabo Verde, Sociedade Unipessoal, SA 3E 122 MULTI-AERO, INC. DBA AIR CHOICE ONE 3J 535 Jubba Airways Limited 3K 375 JETSTAR ASIA AIRWAYS PTE LTD 3L 049 AIR ARABIA ABDU DHABI 3M 449 SILVER AIRWAYS CORP. 3S 875 CAIRE DBA AIR ANTILLES EXPRESS 3U 876 SICHUAN AIRLINES CO. LTD. 3V 756 TNT AIRWAYS S.A. 3X 435 PREMIER TRANS AIRE INC. 4B 184 BOUTIQUE AIR, INC. 4C 035 AEROVIAS DE INTEGRACION REGIONAL 4L 174 LINEAS AEREAS SURAMERICANAS S.A. 4M 469 LAN ARGENTINA S.A. 4N 287 AIR NORTH CHARTER AND TRAINING LTD. 4O 837 ABC AEROLINEAS S.A. DE C.V. 4S 644 SOLAR CARGO, C.A. 4U 051 GERMANWINGS GMBH 4X 805 MERCURY AIR CARGO, INC. 4Z 749 SA AIRLINK 5C 700 C.A.L. CARGO AIRLINES LTD. 5J 203 CEBU PACIFIC AIR 5N 316 JOINT-STOCK COMPANY NORDAVIA - REGIONAL AIRLINES 5O 558 ASL AIRLINES FRANCE 5T 518 CANADIAN NORTH INC. 5U 911 TRANSPORTES AEREOS GUATEMALTECOS S.A. 5X 406 UPS 5Y 369 ATLAS AIR, INC. 50 Standard Agreement For SIS Participation – B16 5Z 225 CEMAIR (PTY) LTD. -

Brussels Airlines Introduces Year Round Service to Washington D.C

Brussels Airlines introduces year round service to Washington D.C. Year round service begins February 20, 2020 Capacity increases to daily service in the summer 2020 schedule February 20, 2020, New York, NY – Today, Brussels Airlines launched year-round flights to and from Washington, DC to Brussels, Belgium. The new service increases the air carrier’s capacity on this important route from a seasonal flight to year-round service. Traveling four times per week, Brussels Airlines flight SN515 will depart from Brussels at 10:15 am with an A330-200 aircraft. It will arrive in DC at 01:00 pm. The return flight, SN516, will depart from Dulles International Airport at 06:10 pm and arrive in Brussels at 07:45 am on the following day. All times are local. Beginning March 29, 2020, Belgium’s home air carrier will increase the frequency of its Washington, DC route to a daily operation. The daily service will also be operated with an Airbus 330-200 aircraft that consists of a seat configuration of 22 Business Class seats, 21 Premium Economy Class seats and 212 Economy Class seats. "North America continues to be one of our most important global regions and Brussels Airlines’ increased flight capacity clearly reflects the Lufthansa Group's strong commitment to the U.S. market," said Frank Naeve, Vice President of Sales, The Americas, Lufthansa Group, "We are pleased to offer our customers an enhanced connectivity between Europe’s capital city and the capital of the United States. Furthermore, with Brussels Airlines’ unique offering of 84 weekly flights and service to 17 destinations in Sub-Saharan Africa – a continent the airline considers its second home – Washingtonians will now be able to visit this spectacular region with great ease, all while experiencing Brussels Airlines premium product and personalized customer service.” “Brussels Airlines strives to provide our customers with top-of-the-line service and on board product. -

Lufthansa Decommissions Aircraft, Predicts Recovery Will Take Years Airline Also Deploys Passenger Aircraft on Large Scale for Dedicated Cargo Transport

Lufthansa decommissions aircraft, predicts recovery will take years Airline also deploys passenger aircraft on large scale for dedicated cargo transport Eric Kulisch, Air Cargo Editor Tuesday, April 7, 2020 0 1,943 2 minutes read Lufthansa is retiring Airbus super-jumbo jets and other aircraft to right-size operations with demand. (Image: Flickr/Aero Icarus) Speculation that the demand destruction from the coronavirus will be long-lasting and result in a smaller airline industry after the pandemic is starting to become a reality. On Tuesday, Deutsche Lufthansa AG (CXE: LHA) announced a significant restructuring that includes a permanent reduction in capacity and the consolidation of several flight operations within the airline group. The company said the board of directors made the decisions because it expects global travel restrictions won’t be completely lifted for months and that it will take years until worldwide demand for air travel returns to levels before the coronavirus crisis. Vasu Raja, American Airlines’ senior vice president for network strategy, said in The Wall Street Journal that few people are making plans to travel in the next three to five months. The Lufthansa Group has already cut capacity by more than 90% and parked about 700 aircraft. Based on the estimate of a slow recovery, Lufthansa Airlines is decommissioning six Airbus A380 double-decker planes, seven A340-600s and five Boeing 747-400s. The carrier is also withdrawing 11 A320 single-aisle planes from short-haul operations. The six A380 aircraft were already scheduled to be sold back to Airbus in 2022. The decision to phase out the A340s and B747s was made because they burn more fuel and pollute more than more modern aircraft, Deutsche Lufthansa said.