Denver Capital Markets Report 1Q2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Downtown Denver Partnership, Inc

STATE OF DOWNTOWN DENVER SEPTEMBER 2012 Downtown Denver Partnership, Inc. With support from: STATE OF 1 DOWNTOWN DENVER INTRODUCTION TABLE OF CONTENTS Introduction Letter .................................................1 Dear Downtown Denver Stakeholder, Key Facts ...............................................................2 Thank you for picking up a copy of the Downtown Denver Partnership’s annual State of Downtown Denver report, a fact-driven report that provides timely, Denver’s Downtown Area Plan ..............................3 objective and accurate data about Downtown Denver. This year we are proud Notable Rankings ..................................................4 to collaborate with Newmark Knight Frank Frederick Ross to bring you the most complete statistics and analysis about Downtown Denver. Office Market .................................................... 6-7 Employers & Employees ..................................... 8-9 In his 2012 State of the City address, Mayor Michael B. Hancock remarked that a vibrant downtown core is essential to the health of the city. At the 2012 Retail & Restaurants .............................................11 Rocky Mountain Urban Leadership Symposium, Governor Hickenlooper and Downtown Residents ..................................... 12-13 other leaders in the Rocky Mountain West stressed the importance of urban centers in creating strong place-based economies that attract and retain top Transportation ............................................... 14-15 talent. Downtown Denver is one -

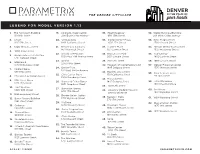

Denver Algorithmic Design in the Palm Of

DENVER ALGORITHMIC DESIGN IN THE PALM OF LEGEND FOR MODEL VERSIONS 1.11/1.12 1. 110 16th Street 20. Century Link 36. Independence Plaza 52. Wellington E. Webb 1801 California Street 1050 17th Street Municipal Office Building 2. 1125 17th Street 201 West Colfax Avenue 21. Denver City and County 37. Larimer Place 3. 1400 Wewatta Street Building, 1437 Bannock Street 1551 Larimer Street 53. Wells Fargo Center 4. 1600 Stout Street 1700 Lincoln Street 22. Denver Art Museum 38. One Lincoln Park 5. 1715 Tremont Street 100 West 14th Avenue 2001 Lincoln Street 54. Denver World Trade Center Parkway 1625 Broadway Street 6. 17th Street and 39. United Western Broadway Street 23. DaVita Financial Center 55. Xcel Energy 2000 16th Street 700 17th Street 1800 Larimer Street 7. 17th Street and Glenarm Street 24. Denver Post Building 40. Museum of Contemporary Art 56. 1660 Lincoln Street 101 West Colfax Avenue 1485 Delgany Street 8. 17th Street and Welton Street 57. Denver Financial Center 25. Civic Center Plaza 41. Denver Marriott City Center 1775 Sherman Street 9. 17th Street Plaza 1560 Broadway Street 1701 California Street 58. Four Seasons Hotel 10. First Western 26. Daniels & Fisher Tower 42. Monarch Mills 1111 14th Street 1900 16th Street 1601 Arapahoe Street 1475 Delgany Street 11. 1999 Broadway Street 27. Dominion Towers 43. 1761 Curtis Street 59. Xcel Energy Steam Plant and adjacent church 600 17th Street 19th Street & Wewatta Street 44. Regency Student Housing 12. Byron Rogers Federal 28. Denver Union Station 3900 Elati Street 60. Ice House Building, 1961 Stout Street 1701 Wynkoop Street 45. -

Case:12-24882-ABC Doc#:707 Filed:12/17/12 Entered:12/17/12 18:05:18 Page1 of 137

Case:12-24882-ABC Doc#:707 Filed:12/17/12 Entered:12/17/12 18:05:18 Page1 of 137 1ST MAIN CONDOMINIUM ASSOC 3E COMPANY CORP A GREAT TIME DJS INC 27 MAIN ST 3207 GREY HAWK CT STE 200 PO BOX 2202 C/O INN AT RIVERWALK PROP MGMT CARLSBAD, CA 92010-6664 AVON, CO 81620 EDWARDS, CO 81632 AAA STEAM SAUNA INC AARIF MOONIRA BARMA AARON JOHNSON 7301 BROADWAY APARTMENT 8B 8TH FLOOR 1956 SOUTH OGDEN ST DENVER, CO 80221 ROSE COURT BLOCK B 115 WONG NAI DENVER, CO 80210 CHUNG HONG KONG AARON SPEISMAN ABBY MILLER ABBY MILLER 5845 NW 23RD TERRACE 3811 TURTLE CREEK BLVD SUITE 250 4419 BUENA VISTA 11 BOCA RATON, FL 33496 DALLAS, TX 75219 DALLAS, TX 75205 ABUNDANCE WEALTH COUNSELORS ACCLIMATE HEATING COOLING ACCUPRODUCTS INTL 232 REGENT COURT STATE PO BOX 2011 PRECISION TOOL PRODUCTS CORP COLLEGE, PA 16801 EAGLE, CO 81631 7836 BETHEL CHURCH RD SALINE, MI 48176 ACTUAL TALENT ACUSHNET COMPANY ADAIR SMITH ANN PO BOX 24167 ATTN RYAN J BOUCHARD 78 WILDCAT STREET DENVER, CO 80224 PO BOX 965 EDWARDS, CO 81632 FAIRHAVEN, MA 02719 ADAM ELLEN BEREN ADAMS GOLF LTD ADDISON LAW FIRM 1739 N DUCKCROSS COVE MONICA 14901 QUORUM DRIVE WICHITA, KS 67206 PO BOX 951897 SUITE 650 DALLAS, TX 75395-1897 DALLAS, TX 75254 ADDISON PIPER ADOLF KIEFER ASSOC INC ADP Inc 2905 WILLOWOOD FARM RD 1700 KIEFER DRIVE PO Box 31001 1568 HAMEL, MN 55340-9518 ZION, IL 60099 Pasadena, CA 91110-1568 ADP INC ADP Inc ADP TIME ATTENDANCE PO Box 31001 1568 PO Box 842875 PO BOX 7247 0372 PASADENA, CA 91110-1568 Boston, MA 02284-2875 PHILADELPHIA, PA 19170-0372 ADP Total Source ADP Total Source ADP TOTAL -

The Judge William E

THE JUDGE WILLIAM E. DOYLE INN Pupilage Roster 2014-2015 JUDGE JACKSON’S GROUP Honorable R. Brooke Jackson US District court of Colorado 901 19th Street Denver, CO 80294 Tel: (303) 844-4694 Fax: (303) 355-2255 E-mail: [email protected] Adm: 1972 MASTERS Gregory Goldberg Craig May Holland & Hart Wheeler Trigg O’Donnell, LLP 555 17th Street, Suite 3200 370 17th Street, Suite 4500 Denver, CO 80202 Denver, CO 80202 Tel: (303)295-8099 Tel: (303) 294-1862 Fax: (303)727-5848 Fax: (303) 294-1879 E-mail: [email protected] E-mail: [email protected] Adm. 1995, Commerical Litigation, Adm: 2000; Commercial, Product Liability Compliance, White-Collar Eric M. Johnson Eric Johnson Law, Ltd. 200 S. Sheridan Boulevard, Suite 220 Denver, CO 80226 Tel: (303) 974-7758 Fax: (303) 484-2967 E-mail: [email protected] Adm: 1998; Immigration law BARRISTERS Chris Koupal Becky Bye Chalat Hatten Koupal & Banker PC 2630 Fenton Street 1900 Grant Street, Suite 1050 Wheat Ridge, CO 80214 Denver, CO 80203 Tel: (303)861-1042 Tel: (720) 272-2247 Fax: (303)861-0506 E-mail: [email protected] E-mail: [email protected] Adm: 2004; Civil litigation Adm: 2005 01/05/15 1 JUDGE JACKSON’S, cont’d BARRISTERS Jessica Kosares Anne Zellner Nolte Alderman Bernstein LLC Reilly Pozner LLP 450 E. 17th Street, Suite 400 1900 Sixteenth Street, Suite 1700 Denver, CO 80203 Denver, CO 80202 Tel: (720) 931-2098 Tel: (303) 893-6100 E-mail: [email protected] Fax: (303) 893-6100 Adm: 2008 E-mail: [email protected] Adm: 2006; Litigation David Belsheim Megan Rhodes The Fischer Law Firm, P.C. -

DEVELOPMENTS LARGE BLOCKS and Downtownwest RINO Whitney EAST RINO 303.407.1465Hake PLATTE ST/LOHI [email protected]

denver DEVELOPMENTS LARGE BLOCKS and downtownWEST RINO whitney EAST RINO 303.407.1465hake PLATTE ST/LOHI [email protected] LOWER DOWNTOWN MIDTOWN billy UPPER DOWNTOWN woodward303.952.5591 [email protected] centralCHERRY CREEK alison 720.388.6087utz southeastBELLEVIEW & I-25 [email protected] ARAPAHOE & I-25 DRY CREEK & I-25 3858 WALNUT STREET SUITE 164 LINCOLN & I-25 DENVER, CO 80205 downtownWEST RINO ACTIVE DEVELOPMENTS SUBLEASE LARGE BLOCKS UNION REV 360 JUNCTION 23 STATION 3600 BRIGHTON BOULEVARD 2323 DELGANY ST Developer Tributary Real Estate & Haselden Construction Developer EverWest Real Estate Investors & WHI RBA 171,000 RSF RBA 86,140 RSF COORS MAX Contiguous 65,000 RSF MAX Contiguous 86,140 RSF FIELD Rate $34.00/SF NNN Rate Est. $32.00/SF NNN OPEX $14.20/SF OPEX Est. $15.00/SF Delivery Date Q3 2020 Delivery Date N/A A Notes WeWork has signed a lease for 65,000 SF with a last-to- C Notes WeWork signed a full-building lease in late 2018. No TI close provision. Planned 4:1,000 parking ratio for Mission occurred, default is claimed by both parties. Site may Ballroom overflow. Leased by JLL (Roupp). sell to multifamily developer. C 2650 ARKINS COURT A N BROADWAY D 2650 ARKINS COURT DIRECT LARGE BLOCKS STALLED DEVELOPMENTS 3100 BRIGHTON BOULEVARD E NORTH WYNKOOP DENARGO MARKET LARIMER ST ST LARIMER LARIMER WALNUT ST ST WALNUT WALNUT BLAKE ST BLAKE BLAKE ST BLAKE 4180 WYNKOOP STREET 2650 ARKINS COURT Developer Westfield Developer Golub, Formativ & BlackRock RBA 88,925 RSF D RBA 11-13 Acres of Unimproved Land MAX Contiguous 64,995 RSF F 3555 BRIGHTON BOULEVARD Rate $32.00/SF NNN 3100 BRIGHTON OPEX $15.00/SF 3100, 3108 & 3120 BRIGHTON BOULEVARD Delivery Date N/A B Notes Completed AEG Live (38,000 SF) lease. -

Lobbyist by Client Directory Page 1

11/26/2019 Lobbyist by Client Directory Page 1 Lobbyist Name/Lobbyist Type/Lobbyist ID/Lobbyist Phone Lobbyist Client _____________________________________________________________________________________________ 5280 STRATEGIES 303 SOUTH BROADWAY, SUITE 200-321 DENVER CO 80209 Professional 20095007379 303-916-0579 5280 STRATEGIES, LLC. 303 S. BROADWAY, SUITE 200-321 DENVER CO 80209 303.916.0579 ACTION 22 PO Box 697 Suite 310 PUEBLO CO 81003 719-569-9897 AURORA ECONOMIC DEVELOPMENT COUNCIL 12510 E. Iliff Avenue, Suite 115 AURORA CO 80014 303-755-2223 BENSON, KERRANE, STORZ & NELSON, P.C. 110 Ruby Drive, Suite 200 GOLDEN CO 80403 720-898-9680 BURG SIMPSON ELDREDGE HERSH JARDINE PC 40 INVERNESS DRIVE ENGLEWOOD CO 8012 303-792-5595 CHERRY CREEK SCHOOL DISTRICT 4700 South Yosemite Street GREENWOOD VILLAGE CO 80111 720-554-4300 COLORADO CHIROPRATIC ASSOCIATION 8751 E. Hampden Avenue, #B-7 DENVER CO 80231 303-755-1010 COLORADO PROPANE GAS ASSOCIATION PO BOX 1425 LAMAR CO 80152 303-882-6161 COMPASSION & CHOICES 8156 S Wadsworth Blvd., E-162 LITTLETON CO 80128 703-684-1110 11/26/2019 Lobbyist by Client Directory Page 2 Lobbyist Name/Lobbyist Type/Lobbyist ID/Lobbyist Phone Lobbyist Client _____________________________________________________________________________________________ COUNTY SHERIFFS OF COLORADO 6001 Ron King Trail LITTLETON CO 80125 720-344-2762 DENVER URBAN RENEW AUTHORITY 1555 California Street, Suite 200 DENVER CO 80202 303-534-3872 ECONOMIC DEVELOPMET EDUCATION COMMITTEE 12510 E. Iliff Avenue, Suite 115 AURORA CO 80014 303-755-2224 -

The Denver Cityscape

THE DENVER CITYSCAPE Legend for Version 2.01.x Feb 2016 Scale: 1:5280 # Known As Address # Known As Address 1 621 17th Street 37 Glass House 1700 Bassett Street 2 633 17th Street 38 Granite Tower 1881 Curtis Street 3 700 17th Street 39 Grand Hyatt Denver 1750 Welton Street 4 1400 Wewatta Street 40 Hyatt Place 440 14th Street 5 1401 Lawrence Street 41 Hyatt Regency 650 15th Street 6 1600 Stout Street 42 Ice House 1801 Wynkoop Street 7 1601 Wewatta Street 43 Independence Plaza 1050 17th Street 8 1660 Lincoln Street 44 Larimer Place 1551 Larimer Street 9 1875 Lawrence Street 45 The Manhattan by Windsor 1801 Bassett Street 10 1899 Wynkoop Street 46 Mariott City Center 1701 California Street 11 1999 Broadway Street 47 MidFirst Bank 555 17th Street 12 17th Street Plaza 1225 17th Street 48 Monarch Mills 1475 Delgany Street 13 Alfred A. Arraj US Court- 901 19th Street 49 Mountain Bell 1001 17th Street house 50 Museum of Contemporary 1485 Delgany Street 14 Barclay Towers 1625 Larimer Street Art 15 Brooks Towers 1020 15th Street 51 One Lincoln Park 2001 Lincoln Street 16 Brown Palace Hotel & Spa 1715 Tremont Place 52 The Petroleum Building 110 16th Street 17 Byron Rogers Federal 1961 Stout Street 53 Pivot Union Station 17th & Wewatta Street Building 54 Platform 1650 Wewatta Street 18 Cadence 1920 17th Street 55 Republic Plaza 370 17th Street 19 CenturyLink 1801 California Street 56 Ritz-Carlton 1881 Curtis Street 20 Chase 1125 17th Street 57 Riverfront Tower 1590 Little Raven Street 21 Civic Center Plaza 1560 Broadway Street 58 Sheraton Denver 1550 -

Denver Algorithmic Design in the Palm Of

DENVER ALGORITHMIC DESIGN IN THE PALM OF LEGEND FOR MODEL VERSION 1.13 1. The Petroleum Building 19. Colorado State Capitol 35. Hyatt Regency 52. Webb Municipal Building 110 16th Street 200 East Colfax Avenue 650 15th Street 201 West Colfax Avenue 2. Chase 20. Century Link 36. Independence Plaza 53. Wells Fargo Center 1125 17th Street 1801 California Street 1050 17th Street 1700 Lincoln Street 3. 1400 Wewatta Street 21. Denver City & County 37. Larimer Place 54. Denver World Trade Center 1437 Bannock Street 1551 Larimer Street 1625 Broadway Street 4. 1600 Stout Street 22. Denver Art Museum 38. One Lincoln Park 55. Xcel Energy 5. Brown Palace Hotel & Spa 100 West 14th Avenue Pkwy 2001 Lincoln Street 1800 Larimer Street 1715 Tremont Street 23. DaVita 39. 700 17th Street 56. 1660 Lincoln Street 6. UMB Bank 2000 16th Street 1670 Broadway Street 40. Museum of Contemporary Art 57. Denver Financial Center 24. Denver Post 1485 Delgany Street 1775 Sherman Street 7. MidFirst Bank 101 West Colfax Avenue 555 17th Street 41. Marriott City Center 58. Four Seasons Hotel 25. Civic Center Plaza 1701 California Street 8. 17th Street & Welton Street 1111 14th Street 1560 Broadway Street 42. Monarch Mills 9. 17th Street Plaza 26. Daniels & Fisher Tower 1475 Delgany Street 59. Alta City House 1225 17th Street 1601 Arapahoe Street 1801 Chestnut Place 43. 1001 17th Street 10. First Western 27. Dominion Towers 1900 16th Street 44. Regency Student Housing 60. Ice House 600 17th Street 3900 Elati Street 1801 Wynkoop Street 11. 1999 Broadway Street 28. Denver Union Station 45. -

Chapter 11 Cordillera Golf Club, LLC Case No

Case:12-24882-ABC Doc#:784 Filed:01/21/13 Entered:01/21/13 17:43:04 Page1 of 8 UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF COLORADO In re: Chapter 11 Cordillera Golf Club, LLC1 Case No. 12-24882 (ABC) dba The Club at Cordillera Debtor. CERTIFICATE OF SERVICE STATE OF CALIFORNIA } } ss.: COUNTY OF LOS ANGELES } SCOTT M. EWING , being duly sworn, deposes and says: 1. I am employed by Rust Consulting/Omni Bankruptcy, located at 5955 DeSoto Avenue, Suite 100, Woodland Hills, CA 91367. I am over the age of eighteen years and am not a party to the above-captioned action. 2. On January 18, 2013, I caused to be served the: a. Debtor’s Motion to Assume and Assign Certain Executory Contracts and Unexpired Leases, with the Related Exhibit and Proposed Order [Docket No. 777], (the “Motion”), b. Notice Pursuant to Local Rule 9013-1.1 of Debtor’s Motion to Assume and Assign Certain Executory Contracts and Unexpired Leases [Docket No. 778], (the “Notice”). By causing true and correct copies to be served via first-class mail, enclosed securely in separate postage pre-paid envelopes to be delivered as follows: I. The Motion and the Notice to those parties listed on the annexed Exhibit A, /// 1 The Debtor in this Chapter 11 case, and the last four digits of its employer tax identification number, is: XX-XXX1317. The Corporate Headquarters address for the Debtor is 97 Main Street, Suite E202, Edwards, CO 81632. Case:12-24882-ABC Doc#:784 Filed:01/21/13 Entered:01/21/13 17:43:04 Page2 of 8 Case:12-24882-ABC Doc#:784 Filed:01/21/13 Entered:01/21/13 17:43:04 Page3 of 8 EXHIBIT A Case:12-24882-ABC Doc#:784 Filed:01/21/13 Entered:01/21/13 17:43:04 Page4 of 8 Cordillera Golf Club, LLC, dba The Club at Cordillera - U.S. -

Denver Office Spaces for Sublease March 2021

Denver Office Spaces For Sublease March 2021 Benchmark Commerical Real Estate | 303.395.0111 [email protected] | www.crebenchmark.com 1404 Larimer Street | Suite 200 | Denver, CO 80202 11750 W 2nd Pl - St Anthony Medical Plaza I - St. Anthony Medical West Campus Location: St Anthony Medical Plaza I Building Type: Class A Office/Medical AKA 11750 W 2nd Pl West Denver Cluster Status: Built 2012 West Denver Submarket Stories: 4 Jefferson County RBA: 90,579 SF Lakewood, CO 80228 Typical Floor: 23,000 SF Developer: - Total Avail: 38,662 SF % Leased: 96.2% Management: - Recorded Owner: United States Of America Expenses: 2016 Tax @ $4.07/sf; 2016 Ops @ $7.78/sf Parcel Number: 49-091-00-001 Parking: 150 free Surface Spaces are available; Ratio of 1.50/1,000 SF Floor SF Avail Floor Contig Bldg Contig Rent/SF/Yr + Svs Occupancy Term Type P 3rd / Suite A 6,428 11,453 35,195 $18.00/fs Vacant Thru Nov 2023 Sublet P 3rd / Suite B 2,000 - 5,025 11,453 35,195 $18.00/fs Vacant Thru Nov 2023 Sublet P 4th 23,742 23,742 35,195 $18.00/fs Vacant Thru Nov 2023 Sublet Copyrighted report licensed to Benchmark Commercial, LLC - 917549. Page 1 600-650 12th St - Clear Creek Square Location: Clear Creek Square Building Type: Class A Office AKA 600 12th Street 12th Ave & Jackson St. Status: Built 2002 West Denver Cluster Stories: 3 West Denver Submarket RBA: 79,705 SF Jefferson County Typical Floor: 25,500 SF Golden, CO 80401 Developer: McBroom Company, Inc. -

Denver Office Spaces for Sublease December 2020

Denver Office Spaces For Sublease December 2020 Benchmark Commerical Real Estate | 303.395.0111 [email protected] | www.crebenchmark.com 1404 Larimer Street | Suite 200 | Denver, CO 80202 1 110 16th St - The Petroleum Building Location: The Petroleum Building Building Type: Class B Office AKA 1550 Cleveland Pl Downtown Cluster Status: Built 1956, Renov 2007 CBD Submarket Stories: 14 Denver County RBA: 169,178 SF Denver, CO 80202 Typical Floor: 12,084 SF Developer: - Total Avail: 100,689 SF % Leased: 47.9% Management: Borst & Company Recorded Owner: DellaCava/Hartronft Development Co LLC Expenses: 2019 Tax @ $2.66/sf, 2011 Est Tax @ $1.26/sf; 2010 Ops @ $8.47/sf, 2011 Est Ops @ $8.47/sf Parcel Number: 2346-23-021 Parking: Ratio of 0.00/1,000 SF Amenities: Conferencing Facility, Controlled Access, Food Service, Property Manager on Site, Storage Space Floor SF Avail Floor Contig Bldg Contig Rent/SF/Yr + Svs Occupancy Term Type E 3rd 12,477 12,477 12,477 $22.50/fs 30 Days Thru Mar 2022 Sublet For more information contact: Benchmark Commercial llc 12/10/2020 www.crebenchmark.com 303.395.0112 [email protected] These are representative office subleases in the metro area. Copyrighted report licensed to Benchmark Commercial, LLC - 68672. Page 1 2 216 16th St - Columbine Place Location: Columbine Place Building Type: Class A Office Downtown Cluster CBD Submarket Status: Built 1983 Denver County Stories: 17 Denver, CO 80202 RBA: 154,304 SF Typical Floor: 12,560 SF Developer: Larkin Development Total Avail: 42,031 SF % Leased: 80.7% Management: -

Energize Denver Awards Supplement

Page 26 — Property Management Quarterly — January 2019 www.crej.com Energize Denver Awards Supplement January 2019 www.crej.com January 2019 — Property Management Quarterly — Page 27 Energize Denver Awards Letter from the executive director ear Denverites, we have more work show this much energy savings in such calls and answered more than 1,000 Denver Public Health & Envi- to do. a short time period underscores the emails. ronment’s Energize Denver The city and coun- significant potential of other existing We also offer in-person training, program is focused on improv- ty of Denver com- and forthcoming climate action proj- as well as a directory of benchmark- D ing building energy efficiency, mitted to the Paris ects. While some of those initiatives ing services providers so that owners which will help protect Denver’s qual- Climate Agreement will take longer than others to come to and operators have continual access ity of life and strengthen our economy. after President Don- fruition, our strategic and meaningful to assistance. To help each building Reducing energy costs and improving ald Trump withdrew advances with buildings bodes well for understand where they are in the pro- building energy efficiency comprise the United States. the city’s future. cess, we provide scorecards each fall to the single-most significant way build- We have a citywide The energy used in large buildings keep them apprised of year-to-year dif- ing owners and managers can contrib- Robert McDonald goal of reducing is equivalent to 57 percent of Denver’s ferences in their scores, and give them ute to solving climate change while all greenhouse greenhouse gas emissions.