Vision 2040 for the Civil Aviation Industry in India

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1 K P and Company 2 Dignity Enterprises Private Limited 3 Dorupo Financial Services Private Limited 4 Ram Bonde & Co 5 Argus

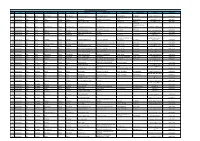

Active list of Outsourcing Vendors as on 30 June 2021: S NO. NAME OF VENDOR 1 K P AND COMPANY 2 DIGNITY ENTERPRISES PRIVATE LIMITED 3 DORUPO FINANCIAL SERVICES PRIVATE LIMITED 4 RAM BONDE & CO 5 ARGUS INC 6 VEGA CORPORATE SERVICES PVT LTD 7 EAGLE EYE ASSOCIATES 8 V D DADINATH & ASSOCIATES 9 AKEBONO CREDIT SERVICES PRIVATE LIMITED 10 N S ADVISORY SERVICES PRIVATE LIMITED 11 LOGIC ENTERPRISES 12 ALPHA RISK CONTROL SERVICES 13 HI - TEK SYNDICATE 14 KATIYAL AND ASSOCIATES 15 DEEPAK BATRA AND ASSOCIATES 16 COGENT 17 COMPETENT SYNERGIES PRIVATE LIMITED 18 CROSS CHECK ASSOCIATES - AAKFC1867B 19 MAHESHWARI MANTRY AND CO 20 FINMARC CORPORATE SOLUTION 21 NORTHERN CREDIT AND COLLECTION BUSI 22 3G FIELD BASE MANAGEMENT 23 GKC MANAGEMENT SERVICES PRIVATE LIMITED 24 HIRANANDANI AND ASSOCIATES 25 MANOJ KUMAR ROUT 26 KAPIL KAJLA ASSOCIATES 27 MAYAS CORPORATE MANAGEMENT 28 GLOBAL RISK MANAGEMENT SERVICES 29 SYMBIOSIS ENTERPRISE 30 RATNADEEP SETHI AND ASSOCIATES 31 JRSCA CONSULTING AND ADVISORY PRIVA 32 GOPALAIYER AND SUBRAMANIAN 33 CREDIT ALLIANCE SERVICES PRIVATE LIMITED 34 LANDMARK CREDIT 35 SUNNY JOSEPH AND ASSOCIATES 36 WRANGLER ENTERPRISE - GAXPS0212K 37 J MITTAL AND ASSOCIATES 38 AGARWAL PODDAR AND ASSOCIATES 39 ARTHOR SERVICES PRIVATE LIMITED 40 AKR AND ASSOCIATES 41 SARVOTTAM CONSULTANT 42 NEERAJ MEHAN AND ASSOCIATES 43 SHAILENDRA AGARWAL 44 PERFECT INVESTIGATION 45 CHHAJED ENTERPRISES PRIVATE LIMITED 46 S MALHOTRA & CO PRIVATE LIMITED 47 INDEPTH SCREENING SOLUTIONS 48 PRECISE SERVICES 49 AIRAN AND COMPANY 50 MOHIT BAID AND ASSOCIATES 51 RAJESH -

The 'Make in India' Initiative

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Nam, Chang Woon; Steinhoff, Peter Article The ‘Make in India’ Initiative CESifo Forum Provided in Cooperation with: Ifo Institute – Leibniz Institute for Economic Research at the University of Munich Suggested Citation: Nam, Chang Woon; Steinhoff, Peter (2018) : The ‘Make in India’ Initiative, CESifo Forum, ISSN 2190-717X, ifo Institut – Leibniz-Institut für Wirtschaftsforschung an der Universität München, München, Vol. 19, Iss. 3, pp. 44-45 This Version is available at: http://hdl.handle.net/10419/186086 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially -

Make in India Campaign: a Boost to Young Entrepreneurs

MAKE IN INDIA CAMPAIGN: A BOOST TO YOUNG ENTREPRENEURS HEENA MUSHTAQUE SAYYED Assistant Professor Poona College of Arts Science & Commerce Camp, Pune. (MS) INDIA Make in India Campaign is a major initiative undertaken by the government of India to promote companies an invest in manufacturing sector. The campaign was launched by Prime Minister Narendra Modi on 25th September 2014. This campaign is an attempt to keep India’s money in India. Startups in India have never got the opportunity to pick the smoother route. It was difficult to gather funds and convince investors and leaders to get engaged. Make in India Campaign ignites a hope to these Issues. The role of government is remarkable towards youth entrepreneurs of India. The incentives introduced by government of India motivate and boost the youth to get into entrepreneurship and do their own business in India. Key words – Make in India Campaign, Government, Youth Entrepreneurs, and Entrepreneurship. INTRODUCTION Entrepreneurship plays vital role in economic development. Youth entrepreneurship is one of the way that can be the answer to problems of youth unemployment and underemployment. Entrepreneurs create workplaces for themselves and their employees, increase innovation and quickly adapt and create market trends using available opportunities. It is important not to waste youth energy and potentials for innovation as traits are necessary for creating breakthrough in business . taking into account the positive effects of entrepreneurship. The incentives introduced by government of India acts as an boost entrepreneurship. A young entrepreneur’s focus should necessarily be on the long term. Making money is often easy, sustaining a regular cash flow is much more difficult. -

4. Make in India Advantages, Disadvantages and Impact On

Mukt Shabd Journal ISSN NO : 2347-3150 MAKE IN INDIA ADVANTAGES, DISADVANTAGES AND IMPACT ON INDIAN ECONOMY. *Dr. Bulla Thirumalesh **B. Bhagyalakshmamma ABSTRACT: This Government of India initiative was launched by Prime Minister Narendra Modi on September 25th, 2014. Make in India is a Lion’s Step. So, pledged the prime minister of India, Narendra Modi, during the inauguration of the prominent ‘Make in India’ campaign. The program was introduced to bring the global investment from large production houses around the world in terms of electronics equipment manufacturing. ‘Make in India’ is an initiative of government of India to boost domestic manufacturing industry and attract foreign investors to invest into the Indian economy. Manufacturing sector in India currently contributes just over 15% to the national GDP. The Indian government through this initiative aims to put to use its rapidly increasing workforce to productive use, realizing that service sector though contributing about 55-60% of the GDP cannot be the sole driver of the economy. In this research paper `Make in India’ an attempt has been made to review the advantages and disadvantages of this concept and to understand the impact of it on the Indian Economy. Key Words: Make In India, Manufacturing, Technology, Growth, Entrepreneur Etc. *Dr. Bulla Thirumalesh, Assistant Professor in Economics, SML GDC, Yemmiganur, Kurnool (Dist). E-mail Id: [email protected]. ** B. Bhagyalakshmamma, Post Graduate Teacher in Economics, A.P.Model school,, Kalyanadurg, Ananthapuramu(Dist). E-mail Id: [email protected]. Volume IX, Issue IX, SEPTEMBER/2020 Page No : 25 Mukt Shabd Journal ISSN NO : 2347-3150 INTRODUCTION: Make in India is an initiative launched by the Government of India to encourage multinational, as well as national companies to manufacture their products in India. -

Transforming India Through Make in India, Skill India and Digital India

through Make in India, Sk⬆⬆⬆ India & 1 through Make in India, Sk⬆⬆⬆ India & 2 through Make in India, Sk⬆⬆⬆ India & 3 through Make in India, Sk⬆⬆⬆ India & From President’s Desk We envisage a transformed India where the economy is in double digit growth trajectory, manufacturing sector is globally competitive, the agriculture sector is sufficient to sustain the rising population and millions of jobs are created for socio-economic development of the Dr. Mahesh Gupta nation. This transformation will take place through the dynamic policy environment announced by our esteemed Government. The policies like Make in India, Skill India and Digital India have the potential to “India has emerged as the boost not only economic growth but overall socio-economic development of the country to the next level. The inclusive one of the fastest moving development of the country would pave the way for peace, progress economies and a leading and prosperity. investment destination. The fact is that ever since India I believe, the economic activity is expected to regain its momentum in has launched dynamic the coming months with circulation of new currency in the system that reforms there has been no would lead to reduction in interest rates and higher aggregate demand. looking back. ” The theme of our 111th AGM is “Transforming India through Make in India, Skill India & Digital India’. The transformed India provide housing for all, education for all, easy access to medical and health facilities as well as safe and better standards of living to the population of India. Transformed India would promise every citizen to realize his or her potential and contribute towards self, family and the country. -

UDAN-Regional Connectivity Scheme

MEMBERS REFERENCE SERVICE LARRDIS LOK SABHA SECRETARIAT NEW DELHI REFERENCE NOTE For the use of Members of Parliament NOT FOR PUBLICATION No.11/RN/Ref/March/2018 REGIONAL CONNECTIVITY SCHEME – UDAN Prepared by, Shri Naushad Alam, Additional Director (23034299) and Smt. Shalima Sharma, RO of Lok Sabha Secretariat under the supervision of Smt. Kalpana Sharma, Joint Secretary and Smt. Anita Khanna, Director. The Reference Note is for personal use of the Members in the discharge of their Parliamentary duties, and is not for publication. This Service is not to be quoted as the source of information as it is based on the sources indicated at the end/in the context. REGIONAL CONNECTIVITY SCHEME – UDAN Introduction The Ministry of Civil Aviation launched the 'Regional Connectivity Scheme (RCS) UDAN---- Ude Desh Ka Aam Naagrik' on 21 October 2016 with the twin objectives of1: i. Promoting Balanced Regional Growth; and ii. Making Flying Affordable For Masses The scheme is a major step towards making flying a reality for the small town common man. With the launch of UDAN, the Aviation Sector is set to get a big boost and tap huge market of middle class flyers living in Tier-2 and Tier-3 cities2. Highlights of the Scheme3 Pay only Rs. 2500 per seat for One Hour of flight by an aeroplane or a journey covered in 30 minutes by the helicopter. In a Century of Civil Aviation, only 76 airports connected by scheduled commercial flights but now in 16 months of UDAN, 56 unreserved airports and 30 unreserved helipads awarded for connectivity. -

India: Airport Security Screening for Passengers Departing on International Flights Research Directorate, Immigration and Refugee Board of Canada, Ottawa

Home > Research > Responses to Information Requests RESPONSES TO INFORMATION REQUESTS (RIRs) New Search | About RIR's | Help 14 April 2009 IND103120.E India: Airport security screening for passengers departing on international flights Research Directorate, Immigration and Refugee Board of Canada, Ottawa In 27 April 2009 correspondence, the Security Manager of Air India in Toronto stated the following in regard to airport security screening for passengers departing on international flights: … when the passenger approaches the check-in counter, his/her travel documents, such as passport, visa, ticket, etc. are checked by an airline check-in agent to verify the genuineness of the [documents] prior to the issuance of a boarding card. After obtaining the boarding card, the passenger goes through immigration checks where his/her passport/visa is thoroughly screened and their biographical data are stored into the computer by the government immigration officials. And, at this stage the passenger's data is matched with the suspected criminal databank. The Security Manager also stated that these screening procedures are generally similar at all airports (27 April 2009). The Bengaluru International Airport [Bangalore] website has a "security and passport control" section for international flight passengers that states that passengers, after acquiring their boarding pass, must proceed to the emigration check area where they are to complete "Visa formalities," after which they can proceed to the "international security control area," and then to the departure area (n.d.). Specific information on the security screening procedures within the emigration check area or the international security control area is not available on this airport website. -

2020121470.Pdf

INDEX 1. Ministry of Agriculture and Farmers Welfare ................................................... 1 to 12 2. Ministry of Commerce and Industry .................................................................... 13 to 16 3. Ministry of communication ................................................................................... 17 to 18 4. Ministry of Finance ................................................................................................. 19 to 24 5. Ministry of Heavy Industries & Public Enterprises ...................................................... 25 6. Ministry of Human Resource and Development ................................................... 26 to 32 7. Ministry of Jal Shakti. ............................................................................................ 33 to 36 8. Ministry of Minority Affairs .................................................................................. 37 to 39 9. Minority of Personnel, Public Grievances and Pensions .............................................. 40 10. Ministry of Panchayat Raj .............................................................................................. 41 11. Ministry of Road Transport and Highways: .................................................................. 42 12. Ministry of Rural Development ............................................................................ 43 to 47 13. Ministry of Shipping ....................................................................................................... 48 14. Ministry -

PHD Aviation Summit 2019

APR 2019 SKILLING FOR TOMORROW IN CIVIL AVIATION 5th PHD Aviation Summit - 2019 Presented to: Mr. Pradeep Singh Kharola | Hon’ble Secretary, Ministry of Civil Aviation TITLE Skilling for tomorrow in Civil Aviation YEAR 2019 AUTHOR AUCTUS ADVISORS No part of this publication may be reproduced in any form by photo, photo print, microfilm or any other COPYRIGHT means without the written permission of AUCTUS ADVISORS Pvt. Ltd. This report is the publication of AUCTUS ADVISORS Private Limited (“AUCTUS ADVISORS”) and so AUCTUS ADVISORS has editorial control over the content, including opinions, advice, statements, services, offers etc. that is represented in this report. However, AUCTUS ADVISORS will not be liable for any loss or damage caused by the reader’s reliance on information obtained through this report. This report may contain third-party contents and third-party resources. AUCTUS ADVISORS takes no responsibility for third part content, advertisements or third-party applications that are printed on or through this report, nor does it take any responsibility for the goods or services provided by its advertisers or for any error, omission, deletion, defect, theft or destruction or unauthorized access to, or alteration of, any user communication. Further, AUCTUS ADVISORS does not assume any responsibility or liability for any loss or damage, including personal injury or death, resulting from use of this report or from any content for communications or materials available on this report. The contents are provided for your reference only. The reader/ buyer understands that except for the information, products and services clearly identified as being supplied by AUCTUS ADVISORS, it does not operate, control or endorse any information, products, or services appearing in the report in any way. -

Common Service Center List

CSC Profile Details Report as on 15-07-2015 SNo CSC ID District Name Block Name Village/CSC name Pincode Location VLE Name Address Line 1 Address Line 2 Address Line 3 E-mail Id Contact No 1 CG010100101 Durg Balod Karahibhadar 491227 Karahibhadar LALIT KUMAR SAHU vill post Karahibhadar block dist balod chhattisgarh [email protected] 8827309989 VILL & POST : NIPANI ,TAH : 2 CG010100102 Durg Balod Nipani 491227 Nipani MURLIDHAR C/O RAHUL COMUNICATION BALOD DISTRICT BALOD [email protected] 9424137413 3 CG010100103 Durg Balod Baghmara 491226 Baghmara KESHAL KUMAR SAHU Baghmara BLOCK-BALOD DURG C.G. [email protected] 9406116499 VILL & POST : JAGANNATHPUR ,TAH : 4 CG010100105 Durg Balod JAGANNATHPUR 491226 JAGANNATHPUR HEMANT KUMAR THAKUR JAGANNATHPUR C/O NIKHIL COMPUTER BALOD [email protected] 9479051538 5 CG010100106 Durg Balod Jhalmala 491226 Jhalmala SMT PRITI DESHMUKH VILL & POST : JHALMALA TAH : BALOD DIST:BALOD [email protected] 9406208255 6 CG010100107 Durg Balod LATABOD LATABOD DEKESHWAR PRASAD SAHU LATABOD [email protected] 9301172853 7 CG010100108 Durg Balod Piparchhedi 491226 PIPERCHEDI REKHA SAO Piparchhedi Block: Balod District:Balod [email protected] 9907125793 VILL & POST : JAGANNATHPUR JAGANNATHPUR.CSC@AISEC 8 CG010100109 Durg Balod SANKARAJ 491226 SANKARAJ HEMANT KUMAR THAKUR C/O NIKHIL COMPUTER ,TAH : BALOD DIST: BALOD TCSC.COM 9893483408 9 CG010100110 Durg Balod Bhediya Nawagaon 491226 Bhediya Nawagaon HULSI SAHU VILL & POST : BHEDIYA NAWAGAON BLOCK : BALOD DIST:BALOD [email protected] 9179037807 10 CG010100111 -

Vayu Issue V Sep Oct 2018

V/2018 Aerospace & Defence Review The IAF at 86 In Defence of the Rafale Interview with the CAS Air Combat Enablers Indian Women (Air) Power Out of Africa SAF-AP LEAP-INDIA-210x297-GB-V3.indd 1 18/08/2017 15:50 V/2018 V/2018 Aerospace & Defence Review 32 Interview 98 Out of Africa with the CAS The IAF at 86 In Defence of the Rafale Interview with the CAS Air Combat Enablers Indian Women (Air) Power Out of Africa Marshal BS Dhanoa gave a special address on the rationale behind the Cover : Pair of Dassault Rafales fully loaded Rafale acquisition programme as also with long range tanks and weaponry on the IAF’s modernisation roadmap. (photo : Rafale International) Air Combat Enablers This evocative article looks back to 42 the early 1960s when the Indian Air EDITORIAL PANEL Force deployed a flight of Canberra MANAGING EDITOR interdictor bombers to central Africa, in support of the United Nations in Vikramjit Singh Chopra In Vayu’s interview with Air Chief the Congo. As part of the motley ‘UN EDITORIAL ADVISOR Marshal BS Dhanoa, the CAS Air Force’, the IAF turned the tables, emphasised that the case for 114 new Admiral Arun Prakash providing the UN with their real ‘force fighters will be progressed through the multipliers’. The article includes some EDITORIAL PANEL Strategic Partnership route and as per very rare images then taken by Air Chapter VII of the DPP-16. The Chief Pushpindar Singh Marshal (retd) SC Lal. also refered to the FRA and AEW&C Air Marshal Brijesh Jayal requirement and importantly, on the Air Vice Marshal Manmohan Bahadur Raptors on a roll Dr. -

We Want to Continue Innovating, Finding Newer Ways to Delight Our Customers and Redefine Air Travel.” — LESLIE THNG, CHIEF EXECUTIVE OFFICER, VISTARA

FIRST BIOFUEL CIVIL AIRCRAFT SHOW POWERED FLIGHT MANUFACTURING REPORT: IN INDIA IN INDIA FIA 2018 P 11 P 16 P 22 AUGUST-SEPTEMBER 2018 `100.00 (INDIA-BASED BUYER ONLY) VOLUME 11 • ISSUE 4 WWW.SPSAIRBUZ.COM ANAIRBUZ EXCLUSIVE MAGAZINE ON CIVIL AVIATION FROM INDIA EXCLUSIVE PAGE 8 “we wANT TO CONTINUE INNOVATING, FINDING NEWER WAYS TO DELIGHT OUR CUSTOMERS AND REDEFINE AIR TRAvel.” — LESLIE THNG, CHIEF EXECUTIVE OFFICER, VISTARA AN SP GUIDE PUBLICATION RNI NUMBER: DELENG/2008/24198 TABLE OF CONTENTS EXCLUSIVE COVER STORY / INTERVIEW P8 “we’re not chasing the COMPETITION, BUT CREATING A Cover: FIRST BIOFUEL CIVIL AIRCRAFT SHOW “Vistara has naturally inherited POWERED FLIGHT MANUFACTURING REPORT: IN INDIA IN INDIA FIA 2018 UNIQUE SPACE FOR OURSELVES IN P 11 P 16 P 22 very strong values and stands the market” AUGUST-SEPTEMBER 2018 `100.00 (INDIA-BASED BUYER ONLY) VOLUME 11 • ISSUE 4 committed to delivering WWW.SPSAIRBUZ.COM ANAIRBUZ EXCLUSIVE MAGAZINE ON CIVIL AVIATION FROM INDIA EXCLUSIVE In an exclusive interview with Jayant customer-centricity at every PAGE 8 “WE WANT touchpoint,”says Leslie Thng, TO CONTINUE Baranwal, Editor-in-Chief of SP’s INNOVATING, FINDING CEO, Vistara, in an exclusive NEWER WAYS AirBuz, Leslie Thng, Chief Executive TO DELIGHT OUR CUSTOMERS with SP’s AirBuz. AND REDEFINE AIR TRAVEL.” Officer of Vistara shares his optimism — LESLIE THNG, CHIEF EXECUTIVE OFFICER, Cover Photograph: VISTARA AN SP GUIDE PUBLICATION and outlines his vision and plans for Vistara RNI NUMBER: DELENG/2008/24198 the future growth of the airlines. SP's AirBuz Cover 4-2018.indd 1 18/09/18 4:43 PM POLICY / AIR INDIA P14 AIR INDIA DISINVESTMENT Debate on Air India disinvestment though, has been on for over two decades and the failed attempt at disinvestment earlier this year, was an anticlimactic episode in the ongoing saga.