The First Real Estate Investment Trust Specialized in Business

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ANEXO 1 “Promoción Abril Reloj Inteligente Pospago”

ANEXO 1 “Promoción Abril Reloj Inteligente Pospago” Promoción que pone a disposición de sus consumidores Pegaso PCS, S.A DE C.V. (Movistar) bajo los siguientes términos y condiciones. I. INCENTIVO QUE SE OFRECE: 1. DESCRIPCIÓN DE BENEFICIO El incentivo de la presente promoción es Reloj Inteligente. Al cumplir con la mecánica y condiciones de esta promoción en la Contratación de un plan de Pospago, dentro de los Lugares Participantes, se otorgará como regalo un Reloj Inteligente color negro II. MECÁNICA, PROCEDIMIENTO Y LUGARES PARA REALIZAR EL CANJE DE LA PROMOCIÓN 1. VIGENCIA Y LUGARES PARTICIPANTES Vigente dentro de territorio nacional a partir del 17 de abril al 31 de mayo o hasta agotar existencias. a) Puntos de Venta Autorizados Movistar que vendan la modalidad de Pospago: Se tienen en existencia 10,757 piezas de los Relojes Inteligentes. Los cuáles serán entregados al momento de la Contratación o renovación de un plan Pospago según la dinámica para la obtención de regalo, durante el periodo promocional o hasta agotar existencias de las piezas, lo que ocurra primero. 2. PARTICIPANTES Y PROCEDIMIENTO DE OBTENCIÓN DEL REGALO Mecánica / Participantes: Para ser acreedor del regalo promocional, el consumidor deberá realizar cualquiera de las siguientes contrataciones o renovaciones: • Renovar con cualquier plan pospago con una renta mensual de servicio igual o mayor al Plan que el cliente tiene actualmente con cualquier equipo, a través de cualquiera de nuestros canales de renovación, tienda en línea tienda.movistar.com.mx o página web movistar.com.mx. • Contratar, portar, adicionar, migrar o cambiarse a cualquier Plan Movistar en la modalidad de Pospago con o sin equipo, a través de la tienda en línea tienda.movistar.com.mx o página web movistar.com.mx. -

Kick Off Meeting Private Equity with Afores and Other QIB's

Análisis Actinver Sector and Regional Studies May, 2015 Mexico’s Northwestern region economy CONFIDENCIAL Y DE USO INTERNO 1 Mexico’s Northwestern region Main points General features Page 3 Population Page 4 Working population Page 5 Importance of region economy in the macroeconomic context Page 6 Region’s economy Page 8 Sector participation in national economy Performance of agriculture sector Page 9 Performance of industrial sector Page 11 Performance of services sector Page 12 Foreign Direct Investment Page 13 Region infrastructure Page 14 Maritime ports Page 15 Railways Page 16 Highways and roads Page 17 Competitiveness index Page 18 Industrial Parks Page 19 Company generation Page 21 Commercial banking loans by State Page 23 State participation in NIP, investment projects Page 24 CONFIDENCIAL Y DE USO INTERNO 2 General features Mexico’s Northwestern region • Region concentrates 12.9% of country’s total population (119.71 million to 2014). • The fourth most important region of GDP value totaling MP 1,679,920 million during 2014, with a 12.8% participation. • Economic growth rhythm is above national GDP with a 3.1% rate between 2003 and 2013. • Sonora and Chihuahua are the highest added value economies of the six entities part of the region, together with BC, BCS, Durango and Sinaloa. • Services sector has the highest weight of the regional economy with a 59.30%, followed by the industrial sector with 34.22% and the agriculture sector with 6.49%. • Main activities of the region are focused on the industrial, mining and tourism activities. Although the agriculture sector represents 26.0% of national total. -

Programas Especiales

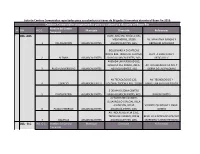

Lista de Centros Comerciales reportados para su cobertura a traves de Brigadas Itinerantes durante el Buen Fin 2016 Centros Comerciales programados para su cobertura durante el Buen Fin Nombre del Centro # UA # C.C. Municipio Dirección Referencias Comercial 1 DEL. AGS. BLVD. JOSÉ MA. CHÁVEZ S/N, MESONEROS, 20280 AV. MAHATMA GANDHI Y 1 VILLASUNCION AGUASCALIENTES AGUASCALIENTES, AGS. ABRAHAM GONZALEZ BOULEVARD A ZACATECAS NORTE 849, TROJES DE ALONSO, BLVD. A ZACATECAS Y 2 ALTARIA AGUASCALIENTES 20116 AGUASCALIENTES, AGS. ARTICULO 1° AVENIDA UNIVERSIDAD 935, BOSQUES DEL PRADO, 20127 AV. AGUASCALIENTES NTE Y 3 PLAZA UNIVERSIDAD AGUASCALIENTES AGUASCALIENTES, AGS SIERRA DE LAS PALOMAS AV TECNOLÓGICO 120, AV. TECNOLOGICO Y 4 ESPACIO AGUASCALIENTES COLONIA: OJOCALIENTE, 20198 CARRETERA SAN LUIS POTOSI 5 DE MAYO ZONA CENTRO 5 PLAZA PATRIA AGUASCALIENTES 20000 AGUASCALIENTES, AGS. RAYON Y NIETO AV MAHATMA GANDHI, DESARROLLO ESPECIAL VILLA ASUNCIÓN, 20230 VALENTE QUINTANA Y ANGEL 6 PLAZA CHEDRAUI AGUASCALIENTES AGUASCALIENTES, AGS. GOMEZ AV. INDEPENDENCIA 2351, TROJES DE ALONSO, 20116 BLVD. LUIS DONALDO COLOSIO 7 GALERIAS AGUASCALIENTES AGUASCALIENTES, AGS. MURRIETA Y JORGE REYNOSO 2 DEL - B.C. No. C.C. Nombre del Centro Municipio Dirección Referencias Comercial Lista de Centros Comerciales reportados para su cobertura a traves de Brigadas Itinerantes durante el Buen Fin 2016 Centros Comerciales programados para su cobertura durante el Buen Fin 2 DEL - B.C. Nombre del Centro # UA # C.C. Municipio Dirección Referencias Comercial CORREDOR TIJUANA-ROSARITO #26135, EJIDO FRANCISCO 1 PLAZA PASEO 2000 TIJUANA VILLA, CP 22235 TAMULTE Y BLVD CASA BLANCA CARRETERA LIBRE TIJUANA- PLAZA PABELLON ENSENADA #300, COL. PLAN SAN LUIS Y CARR. 2 ROSARITO PLAYAS DE ROSARITO REFORMA, CP 22710 ESCENICA AV NUEVO LEÓN S/N, COL. -

SCOTIABANK AGUASCALIENTES 1 Jose Maria Chavez No 1301, Col

Alianza ATM Intercam - BanBajío - Sco6abank Aguascalientes NOMBRE DIRECCIÓN AGUASCALIENTES CENTRO 1 Juan De Montoro Esq. Plaza Patria, col. Centro, c.p. 20000., Aguascalientes, Aguascalientes PLAZA SCOTIABANK AGUASCALIENTES 1 Jose Maria Chavez No 1301, col. Centro, c.p. 20270, Aguascalientes, Aguascalientes CLÍNICA IMSS AGS.HGZ2 Av. Los Conos No. 102 esq. Av. Aguascalientes, col. Ojo Caliente, c.p. 20190, Aguascalientes, Aguascalientes VERGELES Blvd. Miguel de la Madrid(Av. Universidad) No. 219, col. Fracc. Lomas Campestre 3er.SECC., c.p. 20119, Aguascalientes, Aguascalientes GALERIAS Av. Independencia No 2351 C.C. Galerias, Local 25 y 26, col. Trojes de Alonso , c.p 20120, Aguascalientes, Aguascalientes PLAZA SAN MARCOS Convencion Nte. No. 2301, col San Cayetano, c.p. 20010, Aguascalientes, Aguascalientes SORIANA AGS. Av. Universidad esq. Blvd. Aguascalientes Plaza Universidad, col. Bosques del Prado Sur, c.p. 20110, Aguascalientes, Aguascalientes EXPO - PLAZA AGUASCALIENTES Av. López Mateos S / No.Centro Com. Expo-Plaza, col. San Marcos, c.p. 20070, Aguascalientes, Aguascalientes SAN MARCOS Av. Convención de 1914 pte. No. 1405, col. Miravalle, c.p. 20040, Aguascalientes, Aguascalientes TELAS LAPROTEX Circuito Aguascalientes No. 119, col. Parque Industrial Valle de Ags., c.p. 20110, Aguascalientes, Aguascalientes HEXAGÓN POLYMERS Av. Japón No. 302, col. Parque Ind. San Fco. De los Pinos, c.p. 20304, Aguascalientes, Aguascalientes PLAZA SCOTIABANK AGUASCALIENTES 2 JOSE MARIA CHAVEZ NO 1301, COL. CENTRO, C.P. 20270, AGUASCALIENTES, AGUASCALIENTES AGUASCALIENTES CENTRO 2 JUAN DE MONTORO ESQ. PLAZA PATRIA, COL. CENTRO, C.P. 20000., AGUASCALIENTES, AGUASCALIENTES VELARIA MALL AGUASCALIENTES Avenida de los Maestros No. 2501, Isla "Q" esquina Avenida Aguscalientes, COL. Pirules, C.P. 20210, Aguascalientes , Aguascalientes CREACIONES MONSERRAT Díaz de León No.510 entre Abasolo y Mier y Pesado, COL. -

VIDA 10 OCTUBRE.Qxd 09/10/2008 08:14 P.M

VIDA 10 OCTUBRE.qxd 09/10/2008 08:14 p.m. Page 2 EL SIGLO DE DURANGO VIERNES 10 F2 MÉXICO DE OCTUBRE 2008 Sociales ESTILOS OPINIÓN Julio Sáenz 19 años ¿Quieres modelar “Modelar te sirve para la vida diaria, para aprender a ser más seguro de ti mismo y levantar tu en Paseo Durango? autoestima”. Hoy es el último día de casting para los chicos y chicas que quieren ser parte del desfile de modas del 30 de octubre. Humberto Morales 24 años “Te sirve mucho con tu autoafir- mación estética. Ayuda a proyec- tarte mejor frente a la sociedad y te da presencia con el público”. ¿Quién dice que modelar es fácil? Ayer y hoy en “Simplemente ahorita (4:30 de la tarde Paseo Durango, lo que hará más lucidor “Y, claro, contar con rasgos estéticos y ser Paseo Durango, por la entrada interior de de ayer), ya han venido cerca de 15 per- el suceso”. delgados”, dice entre risas. Suburbia, la agencia de modelos Garvam sonas. Yo creo que para mañana ya Finalmente, Martínez Garvalena invitó al realiza un casting para encontrar a parte habremos superado las 60 y de ahí se Aún es tiempo. Si quieres ser parte del even- público en general para que asista el Jesús Carrillo del cuerpo de modelos que formarán extraerá un determinado número para to, puedes ir todavía hoy en el horario de próximo 30 de octubre al desfile antes 19 años parte del desfile que se llevará a cabo el vestir las pasarelas que presentaremos el 16:00 a 18:00 horas para presentar tu citado para conocer las nuevas tenden- próximo 30 de octubre en las instala- 30 de octubre”. -

Acoxpa Americas Ecatepec Antara Polanco Artz

ACOXPA AMERICAS ECATEPEC ANTARA POLANCO AV. ACOXPA 430, LOC. L-75, COL. EX AV. CENTRAL CARLOS HANK GLZ S/N AV. EJERCITO NAL 843b, LOC C112/113 HACIENDA DE COAPA, CP 14340 MZ 4 LT 1, LOC. B44, FRAC. LAS AMERICAS COL. GRANADA, DEL. M. HIDALGO DEL. TLALPAN CP 55075 ECATEPEC DE MOR.,EDOMEX. C.P. 11520 MEX, DF. TEL. 5684 8109 TEL 2486 4174 TEL 5281 7836 ARTZ PEDREGAL PATIO CLAVERIA GAL. ATIZAPAN BLVD. ADOLFO RUIZ CORTINES 3720 EGIPTO 142 LOC. SA 03, COL. CLAVERIA AV. RUIZ CORTINEZ 255 MZ 2 LT 1 LOC 231 COL. JARDINES DEL PEDREGAL, CP 01900 DEL. AZCAPOTZALCO, CP 02080 COL. LAS MARGARITAS CP. 52977 DEL. A. OBREGÓN, LOC. L- 215 N2 MEXICO, DF. ATIZAPAN DE ZARAG, EDOMEX. TEL. 5929 32 00 TEL 5341 2695 TEL 1668 9134 PLAZA CARSO COAPLAZA GAL. COAPA LAGO ZURICH 245 LOC. B05 CANAL DE MIRAMONTES 3280 LOC. 26 CALZ. DEL HUESO 519 LOC. 133 P.B. COL. AMPLIACION GRANADA CP 11529 COL. VILLA COAPA, MEX DF CP. 14390 COL. RESIDENCIAL ACOXPA CP 14300 DEL. M. HIDALGO DELEG. TLALPAN TEL 5671 7736 DELEG. COYOACAN TEL 4976 0187 TEL 5671 7756 TEL 5627 8025 COYOACAN CUICUILCO PARQUE DELTA AV. COYOACAN 2000 LOC. 809 AV. SAN FERNANDO 649 LOC. 20 AV. CUAUHTEMOC 462, LOC. 12 COL.XOCO, DEL. B.JUAREZ CP 03300 COL. PEÑA POBRE, CP. 14060 COL. P. NARVARTE, DEL. B. JUAREZ MEXICO, D.F. DELEG. TLALPAN TEL 5666 1451 C.P. 03020, MEX, D.F. TEL 5605 7878 TEL 5666 3603 TEL 5440 1867 GRAN SUR INTERLOMAS INSURGENTES AV. -

Programas Especiales

Lista de Módulos de Atención reportados para su instalación durante el Buen Fin. Módulos programados para su instalación durante el Buen Fin # UA 1 DEL - Modulo Lugar Municipio Domicilio Referencias AGUASCALIENTES No. BLVD. JOSÉ MA. CHÁVEZ S/N, MESONEROS, 20280 AV. MAHATMA GANDHI Y 1 VILLASUNCION AGUASCALIENTES AGUASCALIENTES, AGS. ABRAHAM GONZALEZ BOULEVARD A ZACATECAS NORTE 849, TROJES DE ALONSO, 20116 BLVD. A ZACATECAS Y 2 ALTARIA AGUASCALIENTES AGUASCALIENTES, AGS. ARTICULO 1° AV. INDEPENDENCIA 2351, TROJES BLVD. LUIS DONALDO DE ALONSO, 20116 COLOSIO MURRIETA Y JORGE 3 GALERIAS AGUASCALIENTES AGUASCALIENTES, AGS. REYNOSO 5 DE MAYO ZONA CENTRO 20000 4 PLAZA PATRIA AGUASCALIENTES AGUASCALIENTES, AGS. RAYON Y NIETO AV MAHATMA GANDHI, DESARROLLO ESPECIAL VILLA ASUNCIÓN, 20230 VALENTE QUINTANA Y ANGEL 5 PLAZA CHEDRAUI AGUASCALIENTES AGUASCALIENTES, AGS. GOMEZ 2 DEL - BAJA Modulo Lugar Municipio Domicilio Referencias CALIFORNIA No. PASEO DE LOS HEROES NUM. 96 Y 1 PLAZA RIO TIJUANA TIJUANA 98, ZONA URBANA RIO 22320 ZONA URBANA RIO AVE. DE LOS INSURGENTES 18015, COL. RIO TIJUANA TERCERA ETAPA, A UN COSTADO DEL PARQUE 2 MACRO PLAZA INSURGENTES TIJUANA C.P.22226 MORELOS 3 DEL - BAJA Modulo Lugar Municipio Domicilio Referencias CALIFORNIA SUR No. 3 DEL - BAJA CALIFORNIA SUR BOULEVARD AGUSTIN OLACHEA AVILES S/N Y LIBRAMIENTO DANIEL ROLDAN, COLONIA EL ZACATAL,C.P PLAZA COMERCIAL "PASEO 23090, LA PAZ BAJA CALIFORNIA LIBRAMIENTO DANIEL 1 LA PAZ" LA PAZ SUR. ROLDAN BOULEVARD FORJADORES DE SUDCALIFORNIA Y BOULEVARD LUIS DONALDO COLOSIO, #4390, LUIS DONALDO COLOSIO 2 PLAZA COMERCIAL "LA PAZ" LA PAZ COLONIA EX BASE AEREA, C.P MURRIETA CARRETERA TRANSPENINSULAR #1080Y BOULEVARD PINO PAYAS,C.P 23088, COLONIA EL PLAZA COMERCIAL "THE ZACATAL, LA PAZ BAJA CALIFORNIA 3 SHOPPES" LA PAZ SUR. -

![[411000-AR] Datos Generales - Reporte Anual](https://docslib.b-cdn.net/cover/6719/411000-ar-datos-generales-reporte-anual-4746719.webp)

[411000-AR] Datos Generales - Reporte Anual

Clave de Cotización: AXO Fecha: 2020-12-31 [411000-AR] Datos generales - Reporte Anual Reporte Anual: Anexo N Oferta pública restringida: No Tipo de instrumento: Deuda LP,Deuda CP Emisora extranjera: No Mencionar si cuenta o no con aval u otra garantía, Garantía AXO 00120: Los Certificados Bursátiles no cuentan especificar la Razón o Denominación Social: con el Aval de ninguna sociedad. Garantía AXO 19-2: Los Certificados Bursátiles cuentan con el aval de las siguientes subsidiarias del emisor: Ledery México, S.A. de C.V.; I Nostri Fratelli, S. de R.L. de C.V.; Multibrand Outlet Stores S.A.P.I. de C.V., Servicios de Capital Humano Axo S.A. de C.V., Tennix, S.A. de C.V., Red Stripes, S.A. de C.V., East Coast Moda, S.A. de C.V. y cualquier otra subsidiaria presente o futura del Emisor que, durante la vigencia de la Emisión, (a) sea propiedad al 99% (noventa y nueve por ciento) (directa o indirectamente) del Emisor, y (b) represente al último trimestre del Emisor por lo menos el 5% de la UAFIDA o de los activos totales consolidados del Emisor; con excepción de las siguientes subsidiarias del Emisor que no podrán ser Avalistas durante la vigencia de la Emisión: Baseco, S.A.P.I. de C.V. Garantía AXO 19: Los Certificados Bursátiles cuentan con el aval de las siguientes subsidiarias del emisor: Ledery México, S.A. de C.V.; I Nostri Fratelli, S. de R.L. de C.V.; Multibrand Outlet Stores S.A.P.I. de C.V., Servicios de Capital Humano Axo S.A. -

Annual Report 2015 2015 Highlights

@FibraHotel Annual Report 2015 2015 Highlights 1.8 million hotel room nights 64.8% stabilized portfolio occupancy rate +7.1% stabilized portfolio RevPAR increase 62 operating hotels 18 hotels under development Sheraton Ambassador Monterrey 436 million distributed to holders 2,562 million pesos invested in hotels 852 million: financial debt as of December 31st, 2015 +117bps increase in hotel contribution margin for managed hotels (2014 comparable perimeter) Hotel’s list 2 Annual Report 2015 At the time of this Annual Report, the portfolio of hotels in operation was as follows: Hotel Page Hotel Page 1. One Acapulco 3 35. Fiesta Inn Perisur 27 2. One Aguascalientes 3 36. Fiesta Inn Puebla FINSA 27 3. One Coatzacoalcos 3 37. Fiesta Inn Querétaro 29 4. One Cuernavaca 3 38. Fiesta Inn Saltillo 29 5. One Culiacán 7 39. Fiesta Inn San Luis Potosí Oriente 29 6. One Durango 7 40. Fiesta Inn Tepic 29 7. One Guadalajara Tapatío 7 41. Fiesta Inn Tlalnepantla 31 8. One Monclova 7 42. Fiesta Inn Torreón Galerías 31 9. One Monterrey Aeropuerto 9 43. Fiesta Inn Toluca Tollocan 31 10. One Patriotismo 9 44. Fiesta Inn Xalapa 31 11. One Perisur 9 45. Fiesta Inn Villahermosa 35 12. One Puebla FINSA 9 46. Fiesta Inn Lofts Ciudad del Carmen 35 13. One Querétaro Plaza Galerías 11 47. Fiesta Inn Lofts Monclova 35 AC by Marriott 14. One Toluca 11 48. Fiesta Inn Lofts Querétaro 35 Antea Querétaro 15. One Xalapa 11 49. Gamma Ciudad Obregón 37 16. Fiesta Inn Aguascalientes 11 50. Gamma León 37 17. -

Annual Report 2013 Highlights 66Portfolio Occupancy Rate% 5.6Revenue Per Available Room Increase% 20

@FibraHotel 2013 Annual Report 2013 Highlights 66Portfolio occupancy rate% 5.6Revenue Per Available Room increase% 20 hotels acquired 2,924 million of Pesos invested in hotels 4,878 20 million of Pesos raised in May 2013 (follow-on) hotels: agreement with Marriott 338 million of Pesos: total distribution to holders 22.8% CBFI return from the IPO (November 2012) to December 2013 (including distributions) 2013 IBRA OTEL Annual Report F H 1 1. Fiesta Inn Aguascalientes This select-service, 125-room hotel is located in the city of Aguascalientes, in the State of Aguascalientes. Located just 20 minutes from the Aguascalientes international air- port and 10 minutes from downtown Aguascalientes, it has easy access to the city’s most important industrial corridor. This hotel is near the Villasunción Shopping Center, as well as various tourist attractions. As of Dec. 31, 2013, the number of employees was 61. 2 Content Page Hotel’s list 4 At the time of this Annual Report, the portfolio of Letter from the Director to Holders hotels in operation was as follows: Num. Hotel Introduction to FibraHotel 6 Page Introduction 6 8 1. Fiesta Inn Aguascalientes 2 The History of FibraHotel 3 8 2. Fiesta Inn Ciudad Juárez Portfolio Evolution 3. Fiesta Inn Ciudad Obregón 6 Structure 10 4. Fiesta Inn Chihuahua 7 8 Management Team 12 5. Fiesta Inn Culiacán 6. Fiesta Inn Cuautitlán 9 13 7. Fiesta Inn Durango 10 Industry overview 11 14 8. Fiesta Inn Ecatepec Hotel industry trends in Mexico 9. Fiesta Inn Guadalajara Expo 12 Market Opportunity 15 10. Fiesta Inn Hermosillo 13 11. -

Reporte Anual

Clave de Cotización: AXO Fecha: 2019-12-31 [411000-AR] Datos generales - Reporte Anual Reporte Anual: Anexo N Oferta pública restringida: No Tipo de instrumento: Deuda LP,Deuda CP Emisora extranjera: No Mencionar si cuenta o no con aval u otra garantía, Garantía AXO 19-2: Los Certificados Bursátiles cuentan con el especificar la Razón o Denominación Social: aval de las siguientes subsidiarias del emisor: Ledery México, S.A. de C.V.; I Nostri Fratelli, S. de R.L. de C.V.; Multibrand Outlet Stores S.A.P.I. de C.V., Servicios de Capital Humano Axo S.A. de C.V., Tennix, S.A. de C.V., Red Stripes, S.A. de C.V., East Coast Moda, S.A. de C.V. y cualquier otra subsidiaria presente o futura del Emisor que, durante la vigencia de la Emisión, (a) sea propiedad al 99% (noventa y nueve por ciento) (directa o indirectamente) del Emisor, y (b) represente al último trimestre del Emisor por lo menos el 5% de la UAFIDA o de los activos totales consolidados del Emisor; con excepción de las siguientes subsidiarias del Emisor que no podrán ser Avalistas durante la vigencia de la Emisión: Baseco, S.A.P.I. de C.V. Garantía AXO 19: Los Certificados Bursátiles cuentan con el aval de las siguientes subsidiarias del emisor: Ledery México, S.A. de C.V.; I Nostri Fratelli, S. de R.L. de C.V.; Multibrand Outlet Stores S.A.P.I. de C.V., Servicios de Capital Humano Axo S.A. de C.V., Tennix, S.A. -

Términos Y Condiciones

Términos y condiciones El obsequio del Adaptador Nikon FTZ y del battery grip MB-D18 es una promoción organizada por NIKON MÉXICO, S.A DE C.V. (en lo sucesivo “NIKON”) con domicilio en Avenida Paseo de la Reforma número 250, Torre Niza, Piso 12, Colonia Juárez, Delegación Cuauhtémoc, C.P. 06600 en la Ciudad de México, mismo que se llevará a cabo en las ciudades y estados pertenecientes al territorio Mexicano; con la finalidad de que los usuarios de la marca puedan experimentar los beneficios en fotografía y video de la serie de cámaras Nikon sin espejo (mirrorless) y del incremento del desempeño en el equipo DSLR D850 Cuerpo. I. DESCRIPCIÓN DE LA PROMOCIÓN: 1. Nikon México obsequiará un adaptador de montura Nikon FTZ a los clientes que adquieran una cámara Nikon Z7 y Z6 cuerpo así como Z7 y Z6 kit con lente Nikkor Z 24- 70mm f/4 S. 2. Nikon México obsequiará un battery grip modelo MB-D18 a los clientes que adquieran una cámara Nikon D850 Cuerpo. 3. Para hacer válida esta promoción, es necesario que la compra de los equipos Z7, Z6, D850 cuerpo así como los equipos Z7 y Z6 kit de un lente (Nikkor Z 24-70mm f/4 S) se realice en los canales autorizados por Nikon México, mismos que se anexan a continuación: Sanborns Tiendas Sanborns Madero Cuernavaca Centro Cuernavaca Plaza Xochimilco Chihuahua Pabellon Cuauhtémoc Xalapa Cuautitlán Centro Media Luna Nuevo Tlalnepantla Churubusco Monterrey Centro Interlomas Puebla Héroes Guadalajara Gran Plaza Zaragoza Coatzacoalcos Ciudad Jardín Neza La Raza Insurgentes Acapulco Centro Ermita Aeropuerto Veracruz