Anhui Conch Cement Company Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Platinum Asia Fund 6% 18% 29% 27% 34% Msci Ac Asia Ex Japan 10% 24% 28% 22% 24%

PLATINUM PERFORMANCE ASIA PERFORMANCE (compound pa, to 31 December 2006) FUND QUARTER 1 YR 2 YRS 3 YRS SINCE INCEPTION PLATINUM ASIA FUND 6% 18% 29% 27% 34% MSCI AC ASIA EX JAPAN 10% 24% 28% 22% 24% Source: Platinum and Factset. Refer to Note 1, page 46. It was an extraordinary quarter for Chinese stocks with the Shanghai "A" market up over 50% and the Hong Kong "H" market up 45%1. While the Chinese “A” shares have been steadily making ground over the last 18 months, having previously been one of the world's worst performing markets, this quarter's performance would suggest that the Andrew Clifford Portfolio Manager country's massive trade and capital account surplus have finally created liquidity conditions conducive to a good bull market. Efforts to hold back property prices, the major alternative asset class for domestic investors, have possibly helped funnel funds back towards stocks as well. Foreign investors have bought up the “H” share market in sympathy, particularly as it represents one of the few ways of playing the ongoing appreciation in the Chinese yuan. Other strong performers for the quarter were Indonesia, the Philippines, and Singapore, all up in excess of 16%. The major laggard was Thailand which was down 1% for the quarter after the Bank of Thailand imposed capital controls. 1 The “A” share market in China is primarily a domestic market only, although foreign investors now have some limited access, while the “H” share market in Hong Kong is open to foreign investors but not mainland investors. DISPOSITION OF ASSETS REGION DEC 2006 SEP 2006 CHINA (LISTED EX PRC) 5% 5% HONG KONG 8% 7% CHINA (LISTED PRC) 19% 22% VALUE OF $10,000 INVESTED SINCE INCEPTION TAIWAN 6% 4% 3 MARCH 2003 TO 31 DECEMBER 2006 GREATER CHINA TOTAL 38% 38% $35,000 KOREA 15% 18% Platinum Asia Fund $30,000 INDIA 15% 15% $25,000 MALAYSIA 7% 6% THAILAND 5% 5% $20,000 SINGAPORE 2% 2% $15,000 INDONESIA 3% 3% $10,000 MSCI All Country Asia ex Japan Index CASH 15% 13% $5,000 SHORTS 15% 9% 2003 2004 2005 2006 Source: Platinum and Factset. -

China Cement Sector

China / Hong Kong Industry Focus U740 China Cement Sector Refer to important disclosures at the end of this report DBS Group Research . Equity 2 Apr 2020 Sales to pick up from an exceptionally low season HSI: 23,086 • Recovering cement sales activities nationwide; shipment rate is up while inventory level is down U740 • Seasonal price correction signals stabilisation ANALYST Duncan CHAN +852 36684178 [email protected] • Resilient demand to drive cement consumption rebound in next few quarters • Top picks are China Resources Cement (1313 HK) and Recommendation & valuation Anhui Conch (914 HK) T arget Mk t PE Cement giants delivered good results. Three major cement Price Price Cap 21F companies’ net earnings uptrend continued in 2019. China Resources Cement (CR Cement) benefitted from resilient cement Local$ Local$ Recom US$m x China Resources Cement selling prices in Southern China market. Conch leveraged on its 9 11.00 BUY 8,107 7.36 (1313 HK) U740 low-cost advantage and higher margin aggregates business Anhui Conch Cmt. 'A' expansion. CNBM’s average capacity utilisation also improved 54.8 60.00 BUY 36,947 8.44 (600585 CH) post merger with SINOMA. Average unit cement gross margin U740 Anhui Conch Cement 'H' was RMB116 (CNBM) – RMB158 per tonne (Conch). Improved 54.05 58.00 BUY 36,947 7.62 U740 (914 HK) cash inflow on operation brought down net gearing to 104% for China National Building Mat CNBM and net cash for Conch and CR Cement. Conch 8.28 8.30 HOLD 8,890 5.69 'H' (3323 HK) outperformed in terms of asset turnover at 1.0x while CNBM ranked the last at 0.6x. -

Foreign Bonds

Quarterly Portfolio Disclosure |March 31, 2020 CI ICBCCS S&P China 500 Index ETF (CHNA.B) Summary of Investment Portfolio Sector Breakdown† as at 3/31/20 Top 25 Holdings* as at 3/31/20 Sector________________________________ ___________________________% of Net Asset Value Description________________________________ ___________________________% of Net Asset Value Financials 21.4 % Alibaba Group Holding Ltd. 9.7 % Consumer Discretionary 19.3 % Tencent Holdings Ltd. 9.1 % Communication Services 12.3 % Ping An Insurance Group Co. of China Ltd. 4.6 % Industrials 9.0 % China Construction Bank Corp. 2.8 % Information Technology 8.2 % China Merchants Bank Co., Ltd. 2.6 % Consumer Staples 7.7 % Kweichow Moutai Co., Ltd. 2.6 % Materials 5.8 % Industrial & Commercial Bank of China Ltd. 2.3 % Health Care 5.8 % China Mobile Ltd. 1.4 % Real Estate 5.1 % Meituan Dianping 1.4 % Utilities 2.5 % Bank of China Ltd. 1.3 % Energy 2.4 % JD.com, Inc. 1.2 % Other Assets less Liabilities‡ 0.5 % Jiangsu Hengrui Medicine Co., Ltd. 1.1 % Total 100.0 % Industrial Bank Co., Ltd. 1.1 % † The ETF’s sector breakdown is expressed as a percentage of net Midea Group Co., Ltd. 1.0 % asset value and may change over time. In addition, a sector may be Gree Electric Appliances, Inc. of Zhuhai 1.0 % comprised of several industries. It does not include derivatives (if CITIC Securities Co., Ltd. 1.0 % any). China Minsheng Banking Corp., Ltd. 1.0 % ‡ Other assets include investment of cash collateral for securities on Wuliangye Yibin Co., Ltd. 1.0 % loan (if any). Anhui Conch Cement Co., Ltd. -

Anhui Conch Cement Company Limited 2020

Anhui Conch Cement Company Limited Anhui Conch Cement Company Limited (H Share: 00914, A Share: 600585) 2020 ANNUAL REPORT Annual Report 2020 Important 1. The Board, Supervisory Committee and Directors, Supervisors and the senior management of the Company warrant that the information in this report, for which they jointly and severally accept legal liability, is truthful, accurate and complete, and does not contain any misrepresentation, misleading statement or material omission. 2. All Directors of the Company attended the sixth meeting of the eighth session of the Board. 3. KPMG and KPMG Huazhen LLP issued a standard unqualified audit report for the Company. 4. Mr. Gao Dengbang, Chairman, Mr. Wu Bin, officer-in-charge of the accounting function and Ms. Liu Yan, officer-in-charge of the accounting department, have declared that they warrant the financial statements contained herein are true, accurate and complete. 5. As considered by the sixth meeting of the eighth session of the Board of the Company, the annual profit distribution proposal for 2020 is a cash dividend of RMB2.12 per share (tax inclusive). No capitalization of common reserve fund was made. 6. Declaration of risks with respect to the forward-looking statements: the Company’s plans for 2021 concerning its capital expenditure, new production capacity and net sales objectives as disclosed Important herein do not constitute any substantive commitment to investors. Investors and the public are advised to be cautious of any investment risks. 7. There was no appropriation of the Company’s funds for non-operating purpose by the controlling shareholder of the Company and its related parties. -

Quarterly Holdings

American Century Investments® Quarterly Portfolio Holdings Emerging Markets Fund February 28, 2021 Emerging Markets - Schedule of Investments FEBRUARY 28, 2021 (UNAUDITED) Shares/ Principal Amount ($) Value ($) COMMON STOCKS — 99.0% Argentina — 1.1% Globant SA(1) 165,924 35,627,201 Brazil — 8.4% B3 SA - Brasil Bolsa Balcao 2,548,300 24,740,909 Banco BTG Pactual SA 1,100,700 20,082,541 Gerdau SA, Preference Shares 5,457,600 25,173,791 Locaweb Servicos de Internet SA 7,089,422 36,027,754 Magazine Luiza SA 6,528,672 28,308,542 Raia Drogasil SA 2,234,000 9,268,138 Randon SA Implementos e Participacoes, Preference Shares 4,833,500 11,246,715 Suzano SA(1) 756,100 9,896,138 TOTVS SA 3,500,400 19,531,335 Vale SA, ADR 3,342,195 56,483,095 WEG SA 2,530,800 35,246,590 276,005,548 China — 37.4% A-Living Smart City Services Co. Ltd. 3,194,500 13,378,203 Alibaba Group Holding Ltd., ADR(1) 753,185 179,077,266 Anhui Conch Cement Co. Ltd., H Shares 2,216,000 14,253,151 China Construction Bank Corp., H Shares 54,801,000 43,998,955 China Education Group Holdings Ltd. 9,550,000 17,703,980 China Gas Holdings Ltd. 4,976,000 20,026,059 China Tourism Group Duty Free Corp. Ltd., A Shares 1,000,917 47,507,859 CIFI Holdings Group Co. Ltd. 39,800,888 37,658,117 Contemporary Amperex Technology Co. Ltd., A Shares 334,100 16,589,095 Country Garden Services Holdings Co. -

Consolidated Statement of Investments (Unaudited), September 30, 2020

TEMPLETON DRAGON FUND, INC. Consolidated Statement of Investments (unaudited), September 30, 2020 a Country Shares a Value a Common Stocks 98.6% Air Freight & Logistics 1.3% aSF Holding Co. Ltd., A .................................. China 884,700 $10,644,988 Auto Components 0.7% Minth Group Ltd. ...................................... China 1,422,000 6,209,547 Banks 3.5% aChina Construction Bank Corp., A ......................... China 3,875,500 3,516,871 aChina Merchants Bank Co. Ltd., A ......................... China 1,935,246 10,301,832 China Merchants Bank Co. Ltd., H ......................... China 3,270,500 15,519,982 29,338,685 Beverages 2.6% China Resources Beer Holdings Co. Ltd. .................... China 1,082,000 6,645,564 aKweichow Moutai Co. Ltd., A ............................. China 46,445 11,456,278 aLuzhou Laojiao Co. Ltd., A ............................... China 202,956 4,310,078 22,411,920 Biotechnology 4.6% bBeiGene Ltd. ......................................... China 502,100 11,073,976 aHualan Biological Engineering, Inc., A ...................... China 538,188 4,530,141 bI-Mab, ADR .......................................... China 18,922 889,902 b,c,dInnoCare Pharma Ltd., 144A, Reg S ....................... China 2,028,400 2,657,048 b,dInnovent Biologics, Inc., 144A, Reg S ...................... China 2,133,900 15,913,012 aJinyu Bio-Technology Co. Ltd., A .......................... China 988,700 3,946,610 39,010,689 Capital Markets 0.5% aEast Money Information Co. Ltd., A ........................ China 1,268,800 4,515,968 Chemicals 1.6% aJiangsu Yangnong Chemical Co. Ltd., A .................... China 277,900 3,598,703 aShenzhen Capchem Technology Co. Ltd., A.................. China 1,218,410 10,309,913 13,908,616 Commercial Services & Supplies 2.4% dA-Living Services Co. -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

1/12/2021 Print Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT INVESTMENT COMPANIES Investment Company Act file number 811-08071 Lazard Retirement Series, Inc. (Exact name of Registrant as specified in charter) 30 Rockefeller Plaza New York, New York 10112 (Address of principal executive offices) (Zip code) Mark R. Anderson, Esq. Lazard Asset Management LLC 30 Rockefeller Plaza New York, New York 10112 (Name and address of agent for service) Registrant’s telephone number, including area code: (212) 632-6000 Date of fiscal year end: 12/31 Date of reporting period: 9/30/2020 https://prospectus-express.broadridge.com/print.asp?doctype=phq3&clientid=lazardll&fundid=521071803 1/22 1/12/2021 Print Document Item 1. Schedule of Investments. https://prospectus-express.broadridge.com/print.asp?doctype=phq3&clientid=lazardll&fundid=521071803 2/22 1/12/2021 Print Document Fair Fair Description Shares Value Description Shares Value Lazard Retirement Emerging Markets Equity Portfolio Indonesia | 4.0% Common Stocks | 96.5% PT Astra International Tbk 11,421,504 $ 3,436,239 Brazil | 4.1% PT Bank Mandiri (Persero) Tbk 21,526,030 7,223,354 Banco do Brasil SA 1,411,602 $ 7,445,227 PT Telekomunikasi Indonesia (Persero) BB Seguridade Participacoes SA 1,178,100 5,091,346 Tbk Sponsored ADR 322,481 5,601,495 CCR SA 1,926,050 4,345,350 16,261,088 16,881,923 Luxembourg | 0.8% China | 21.4% Ternium SA Sponsored ADR (*) 181,880 3,424,800 AAC Technologies Holdings, Inc. -

Stake in WCC Likely to Cement Leadership in Northwest China

June 19, 2015 COMPANY UPDATE Anhui Conch Cement (H) (0914.HK) Buy Equity Research Stake in WCC likely to cement leadership in Northwest China What's changed Investment Profile Anhui Conch Cement announced that its wholly-owned subsidiary Conch Low High International will acquire 16.7% of the enlarged equity of West China Growth Growth Returns * Returns * Cement (2233 HK, Not Covered) for a consideration of HK$1,527mn. The Multiple Multiple implied EV/t is Rmb355/t, compared with Conch’s 2015E EV/t of Rmb492/t. Volatility Volatility Percentile 20th 40th 60th 80th 100th Implications Anhui Conch Cement (H) (0914.HK) We see strategic merit for both West China Cement and Anhui Conch. Asia Pacific Metals & Mining Peer Group Average * Returns = Return on Capital For a complete description of the investment West China Cement is Shaanxi’s biggest cement producer, with dominant profile measures please refer to the market position in South Shaanxi (75% market share), while Conch is its disclosure section of this document. major competitor in Central Shaanxi. After the acquisition, Conch and Key data Current West China Cement could control 46% of Central and South Shaanxi Price (HK$) 29.10 12 month price target (HK$) 35.80 capacity, and we note that better market cooperation should enhance 600585.SS Price (Rmb) 24.88 600585.SS 12 month price target (Rmb) 28.00 profitability in the region. Market cap (HK$ mn / US$ mn) 154,209.7 / 19,891.4 Foreign ownership (%) -- Ytd Shaanxi cement price is down 5% due to weak demand. We think any 12/14 12/15E 12/16E 12/17E EPS (Rmb) 2.07 2.11 2.44 2.54 potential improvement in the market structure post the proposed deal could EPS growth (%) 17.0 1.9 15.8 4.0 EPS (diluted) (Rmb) 2.07 2.11 2.44 2.54 help stabilize pricing in the region, and note that WCC and Conch’s Shaanxi EPS (basic pre-ex) (Rmb) 2.07 2.11 2.44 2.54 plants are well positioned to benefit from any demand uptick. -

安徽海螺水泥股份有限公司 ANHUI CONCH CEMENT COMPANY LIMITED (A Joint Stock Limited Company Incorporated in the People’S Republic of China) (Stock Code: 00914)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. 安徽海螺水泥股份有限公司 ANHUI CONCH CEMENT COMPANY LIMITED (a joint stock limited company incorporated in the People’s Republic of China) (Stock Code: 00914) Results for the year ended 31 December 2020 Revenue of the Company for the year 2020 amounted to approximately RMB176,242.68 million (in accordance with the International Financial Reporting Standards (“IFRSs”)), representing an increase of 12.23% over that of 2019. Net profit attributable to equity shareholders of the Company for the year 2020 amounted to approximately RMB35,163.54 million (in accordance with the IFRSs), representing an increase of 4.56% over that of 2019. Earnings per share for the year 2020 were RMB6.64 (in accordance with the IFRSs), representing an increase of 4.56% over that of 2019. Unless otherwise stated, the currency unit in this announcement is Renminbi (“RMB”), the lawful currency of the People’s Republic of China (“PRC”). Unless otherwise stated, the financial information in this announcement is prepared in accordance with the China Accounting Standards for Business Enterprises (2006) (“PRC Accounting Standards”). I. Basic Corporate Information of the Company 1. Basic information Company Name Anhui Conch Cement Company Limited (“the Company”, together with its subsidiaries , the “Group”) A Shares stock abbreviation Conch Cement A Shares stock code 600585 Exchange on which A shares (“A Shares”) are listed The Shanghai Stock Exchange (“SSE”) H Shares stock abbreviation Conch Cement H Shares stock code 00914 Exchange on which H shares (“H Shares”) are listed The Stock Exchange of Hong Kong Limited (“Stock Exchange”) 1 2. -

Anhui Conch Cement Company Limited ANNUAL REPORT

Anhui Conch Cement Company Limited Anhui Conch Cement Company Limited (H Share: 00914, A Share: 600585) 2019 ANNUAL REPORT Annual Report 2019 Annual Important 1. The Board, Supervisory Committee and Directors, Supervisors and the senior management of the Company warrant that the information in this report, for which they jointly and severally accept legal liability, is truthful, accurate and complete, and does not contain any misrepresentation, misleading statement or material omission. 2. All Directors of the Company attended the third meeting of the eighth session of the Board. 3. KPMG and KPMG Huazhen LLP issued a standard unqualified audit report for the Company. 4. Mr. Gao Dengbang, Chairman, Mr. Wu Bin, officer-in-charge of the accounting function and Ms. Liu Yan, officer-in-charge of the accounting department, have declared that they warrant the financial statements contained herein are true, accurate and complete. 5. As considered by the third meeting of the eighth session of the Board of the Company, the annual profit distribution proposal for 2019 is a cash dividend of RMB2.0 per share (tax inclusive). No capitalization of common reserve fund was made. 6. Declaration of risks with respect to the forward-looking statements: the Company’s plans for 2020 concerning its capital expenditure, new production capacity and net sales objectives as disclosed Important herein do not constitute any substantive commitment to investors. Investors and the public are advised to be cautious of any investment risks. 7. There was no appropriation of the Company’s funds for non-operating purpose by the controlling shareholder of the Company and its related parties. -

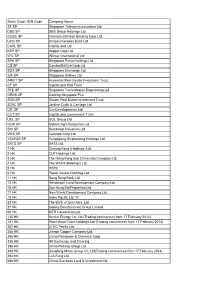

Stock Code/ ISIN Code Company Name ST SP Singapore

Stock Code/ ISIN Code Company Name ST SP Singapore Telecommunications Ltd DBS SP DBS Group Holdings Ltd OCBC SP Oversea-Chinese Banking Corp Ltd UOB SP United Overseas Bank Ltd CAPL SP CapitaLand Ltd KEP SP Keppel Corp Ltd WIL SP Wilmar International Ltd SPH SP Singapore Press Holdings Ltd CD SP ComfortDelGro Corp Ltd SGX SP Singapore Exchange Ltd SIA SP Singapore Airlines Ltd AREIT SP Ascendas Real Estate Investment Trust CT SP CapitaLand Mall Trust STE SP Singapore Technologies Engineering Ltd GENS SP Genting Singapore PLC SUN SP Suntec Real Estate Investment Trust JCNC SP Jardine Cycle & Carriage Ltd CIT SP City Developments Ltd CCT SP CapitaLand Commercial Trust UOL SP UOL Group Ltd GGR SP Golden Agri-Resources Ltd SCI SP Sembcorp Industries Ltd VMS SP Ventrure Corp Ltd YZJSGD SP Yangzijiang Shipbuilding Holdings Ltd SATS SP SATS Ltd 1 HK Cheung Kong (Holdings) Ltd. 2 HK CLP Holdings Ltd. 3 HK The Hong Kong and China Gas Company Ltd. 4 HK The Wharf (Holdings) Ltd. 5 HK HSBC 6 HK Power Assets Holdinsg Ltd 11 HK Hang Seng Bank Ltd. 12 HK Henderson Land Development Company Ltd. 16 HK Sun Hung Kai Properties Ltd. 17 HK New World Development Company Ltd. 19 HK Swire Pacific Ltd. 'A' 23 HK The Bank of East Asia, Ltd. 27 HK Galaxy Entertainment Group Limited 66 HK MTR Corporation Ltd. 135 HK Kunlun Energy Co. Ltd (Trading commences from 17 February 2014) 151 HK Want Want China Holdings Ltd (Trading commences from 17 February 2014) 267 HK CITIC Pacific Ltd. -

Fact Book 2013

Fact Book 2013 Contents Shanghai Securities Market.......................................................1 Historical Review .........................................................................................................................................1 Securities Products ......................................................................................................................................1 2012 Market Review....................................................................5 Overview ....................................................................................................................................................5 Securities Issuance and Listing ......................................................................................................................5 Major Events in the Securities Market 2012 ....................................................................................................6 Market Highlights .........................................................................................................................................9 Transactions ................................................................................................................................................9 Stock Indices .............................................................................................................................................10 Ratios .......................................................................................................................................................10