Sigma 1/2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Significant Loss Report

NATIONAL FLOOD INSURANCE PROGRAM Bureau and Statistical Agent W-01049 3019-01 MEMORANDUM TO: Write Your Own (WYO) Principal Coordinators and NFIP Servicing Agent FROM: WYO Clearinghouse DATE: July 18, 2001 SUBJECT: Significant Loss Report Enclosed is a listing of significant flooding events that occurred between February 1978 and October 2000. Only those events that had more than 1500 losses are included on the list. These data were compiled for WYO Companies and others to use to remind their customers of the impact of past flooding events. Please use this information in your marketing efforts as you feel it is appropriate. If you have any questions, please contact your WYO Program Coordinator. Enclosure cc: Vendors, IBHS, FIPNC, WYO Standards Committee, WYO Marketing Committee, ARCHIVEDGovernment Technical Representative APRIL 2018 Suggested Routing: Claims, Marketing, Underwriting 7700 HUBBLE DRIVE • LANHAM, MD 20706 • (301) 731-5300 COMPUTER SCIENCES CORPORATION, under contract to the FEDERAL EMERGENCY MANAGEMENT AGENCY, is the Bureau and Statistical Agent for the National Flood Insurance Program NATIONAL FLOOD INSURANCE PROGRAM SIGNIFICANT FLOOD EVENTS REPORT EVENT YEAR # PD LOSSES AMOUNT PD ($) AVG PD LOSS Massachusetts Flood Feb. 1978 Feb-78 2,195 $20,081,479 $9,149 Louisiana Flood May 1978 May-78 7,284 $43,288,709 $5,943 WV, IN, KY, OH Floods Dec 1978 Dec-78 1,879 $11,934,512 $6,352 PA, CT, MA, NJ, NY, RI Floods Jan-79 8,826 $31,487,015 $3,568 Texas Flood April 1979 Apr-79 1,897 $19,817,668 $10,447 Florida Flood April 1979 Apr-79 -

Revised Based on Discussions with Inter Ministerial Central Team

Revised based on discussions with Inter Ministerial Central Team Submitted by Additional Chief Secretary, Disaster Management (State Relief Commissioner) Government of Kerala 17 January 2018 1 Contents 1. Situation Assessment ................................................................................................................................ 3 1.1. Introduction ....................................................................................................................................... 3 1.2. Timeline of the incident as per IMD and INCOIS bulletin .................................................................. 3 1.3. Action taken by the State Government on 29-11-2017 to 30-11-2017 ............................................ 3 2. Losses ......................................................................................................................................................... 7 2.1. Human Fatalities ................................................................................................................................ 7 2.2. Search and Rescue Operations .......................................................................................................... 8 2.3. Relief Assistance ................................................................................................................................ 8 2.4. Clearance of Affected Areas .............................................................................................................. 9 2.5. House damages ................................................................................................................................ -

Texas Hurricane History

Texas Hurricane History David Roth National Weather Service Camp Springs, MD Table of Contents Preface 3 Climatology of Texas Tropical Cyclones 4 List of Texas Hurricanes 8 Tropical Cyclone Records in Texas 11 Hurricanes of the Sixteenth and Seventeenth Centuries 12 Hurricanes of the Eighteenth and Early Nineteenth Centuries 13 Hurricanes of the Late Nineteenth Century 16 The First Indianola Hurricane - 1875 21 Last Indianola Hurricane (1886)- The Storm That Doomed Texas’ Major Port 24 The Great Galveston Hurricane (1900) 29 Hurricanes of the Early Twentieth Century 31 Corpus Christi’s Devastating Hurricane (1919) 38 San Antonio’s Great Flood – 1921 39 Hurricanes of the Late Twentieth Century 48 Hurricanes of the Early Twenty-First Century 68 Acknowledgments 74 Bibliography 75 Preface Every year, about one hundred tropical disturbances roam the open Atlantic Ocean, Caribbean Sea, and Gulf of Mexico. About fifteen of these become tropical depressions, areas of low pressure with closed wind patterns. Of the fifteen, ten become tropical storms, and six become hurricanes. Every five years, one of the hurricanes will become reach category five status, normally in the western Atlantic or western Caribbean. About every fifty years, one of these extremely intense hurricanes will strike the United States, with disastrous consequences. Texas has seen its share of hurricane activity over the many years it has been inhabited. Nearly five hundred years ago, unlucky Spanish explorers learned firsthand what storms along the coast of the Lone Star State were capable of. Despite these setbacks, Spaniards set down roots across Mexico and Texas and started colonies. Galleons filled with gold and other treasures sank to the bottom of the Gulf, off such locations as Padre and Galveston Islands. -

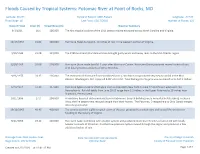

Floods Caused by Tropical Systems: Potomac River at Point of Rocks, MD

Floods Caused by Tropical Systems: Potomac River at Point of Rocks, MD Latitude: 39.274 Period of Record: 1889-Present Longitude: -77.543 Flood Stage: 16 Last Flood: 12/17/2018 Number of Floods: 121 Date of Flood Crest (ft) Streamflow (cfs) Weather Summary 9/1/1911 16.1 106,000 The first tropical cyclone of the 1911 season moved eastward across North Carolina and Virginia. 10/17/1954 21.02 130,000 Hurricane Hazel dumped 6- 10 inches of rain in the western portion of Virginia. 9/20/1945 21.98 139,000 The 1945 Southeast Florida Hurricane brought gusty winds and heavy rains to the Mid-Atlantic region. 8/20/1955 29.08 214,000 Hurricane Diane made landfall 5 days after Hurricane Connie. Hurricane Diane produced several inches of rain with locally heavier amounts of 10 to 20 inches. 9/26/1975 24.35 126,000 The remnants of Hurricane Eloise combined with a cold front and produced very heavy rainfall in the Mid- Atlantic. Washington, D.C. reported 9.08" of rainfall. Total damage for Virginia was estimated to be $17.2 million. 6/23/1972 37.43 347,000 Hurricane Agnes made landfall again over southeastern New York on June 22 and moved westward into Pennsylvania. Rainfall totals from June 20-25 range from 2-3 inches in the Upper Potomac to 18 inches near Shamokin, Pennsylvania. 10/1/1896 27.2 204,000 A hurricane knocked out communication in Richmond. Several buildings were unroofed in Petersburg. In Buena Vista, the fire department rescued people from their homes. -

FEMA FOIA Log – 2018

Mirandra Abrams, Monique any and all records concerning clients. Kindly provide our office with 10/4/2017 Sambursky a complete copy of clients entire file as it pertains as it pertains to Slone Sklarin Inquiry Number (b) (6) ; Voucher Number (b) (6) ; Payee Verveniotis Reference Number (b) (6) in your possession. 2017-FEFO-02138 - Masters, Mark all contract documents related to temporary staffing services 10/5/2017 contracts for emergency call center support for FEMA in the last five 2017-FEFO-02177 (5) years 2017-FEFO-02187 - (b) (6) all files, correspondence, or other records concerning yourself 10/6/2017 Dallas News Benning, Tom 1) All active FEMA contracts for manufactured housing units. 2) All 10/13/2017 active FEMA individual assistance/technical assistance contracts (IATACs). 3) All pre-event contracts for debris removal that are overseen by FEMA Region 6. 4) All pre-event contracts for housing assistance that are overseen by FEMA Region 6. 5) All noncompetitive disaster relief contracts approved by FEMA since August 14, 2017. 6) All non-local disaster relief contracts approved by FEMA since August 14, 2017, including the written justification 2017-FEFO-02214 for choosing a non-local vendor. FCI Keys, Clay a copy of any and all records related to [FEMA's] response to 10/23/2017 SEAGOVILLE hurricane Katrina, including all memoranda, communications and records of any kind and from any source from August 29, 2005 to 2012. (Date Range for Record Search: From 8/29/2005 To 2017-FEFO-02239 12/1/2012) - (b) (6) Any files related to yourself (Date Range for Record Search: From 10/24/2017 2017-FEFO-02240 1/1/2000 To 9/11/2017) - McClain, Don every individual who has requested assistance by FEMA from both 10/31/2017 Hurricane Irma and Harvey. -

Intense Hurricane Activity Over the Past 1500 Years at South Andros

RESEARCH ARTICLE Intense Hurricane Activity Over the Past 1500 Years 10.1029/2019PA003665 at South Andros Island, The Bahamas Key Points: E. J. Wallace1 , J. P. Donnelly2 , P. J. van Hengstum3,4, C. Wiman5, R. M. Sullivan4,2, • Sediment cores from blue holes on 4 2 6 7 Andros Island record intense T. S. Winkler , N. E. d'Entremont , M. Toomey , and N. Albury hurricane activity over the past 1 millennium and a half Massachusetts Institute of Technology/Woods Hole Oceanographic Institution Joint Program in Oceanography, Woods • Multi‐decadal shifts in Intertropical Hole, Massachusetts, USA, 2Department of Geology and Geophysics, Woods Hole Oceanographic Institution, Woods Convergence Zone position and Hole, Massachusetts, USA, 3Department of Marine Sciences, Texas A&M University at Galveston, Galveston, Texas, USA, volcanic activity modulate the 4Department of Oceanography, Texas A&M University, College Station, Texas, USA, 5School of Earth and Sustainability, hurricane patterns observed on 6 Andros Northern Arizona University, Flagstaff, Arizona, USA, U.S. Geological Survey, Florence Bascom Geoscience Center, • Hurricane patterns on Andros Reston, Virginia, USA, 7National Museum of The Bahamas, Nassau, The Bahamas match patterns from the northeastern Gulf of Mexico but are anti‐phased with patterns from New Abstract Hurricanes cause substantial loss of life and resources in coastal areas. Unfortunately, England historical hurricane records are too short and incomplete to capture hurricane‐climate interactions on ‐ ‐ ‐ Supporting Information: multi decadal and longer timescales. Coarse grained, hurricane induced deposits preserved in blue holes • Supporting Information S1 in the Caribbean can provide records of past hurricane activity extending back thousands of years. Here we present a high resolution record of intense hurricane events over the past 1500 years from a blue hole on South Andros Island on the Great Bahama Bank. -

Perspectives on Emergency Preparedness in South-East Asia

Perspective Turning commitments into actions: perspectives on emergency preparedness in South-East Asia Roderico H Ofrin, Anil K Bhola, Nilesh Buddha World Health Organization Health Emergencies Programme, World Health Organization Regional Office for South-East Asia, New Delhi, India Correspondence to: Dr Roderico H Ofrin ([email protected]) Abstract Emergency preparedness is a continuous process in which risk and vulnerability assessments, planning and implementation, funding, partnerships and political commitment at all levels must be sustained and acted upon. It relates to health systems strengthening, disaster risk reduction and operational readiness to respond to emergencies. Strategic interventions to strengthen the capacities of countries in the World Health Organization (WHO) South-East Asia Region for emergency preparedness and response began in 2005. Efforts accelerated from 2014 when emergency risk management was identified as one of the regional flagship priority programmes following the pragmatic approach “sustain, accelerate and innovate”. Despite increased attention and some progress on risk management, the existing capacities to respond to health emergencies are inadequate in the face of prevailing and increasing threats posed by multiple hazards, including climate change and emerging and re-emerging diseases. The setting up of a “preparedness stream” under the South-East Asia Regional Health Emergency Fund in July 2016 was an important milestone. The endorsement of the Five-year regional strategic plan to strengthen public health preparedness and response – 2019–2023 by Member States was another step forward. Furthermore, ministerial-level commitment, in the form of the Delhi Declaration on Emergency Preparedness, adopted in September 2019 in the 72nd session of the WHO Regional Committee for South-East Asia, is in place to facilitate Member States to invest resources in the protection and safety of people and systems and in overall emergency risk management through national action plans for health security. -

2021 Rio Grande Valley/Deep S. Texas Hurricane Guide

The Official Rio Grande Valley/Deep South Texas HURRICANE GUIDE 2021 IT ONLY TAKES ONE STORM! weather.gov/rgv A Letter to Residents After more than a decade of near-misses, 2020 reminded the Rio Grande Valley and Deep South Texas that hurricanes are still a force to be reckoned with. Hurricane Hanna cut a swath from Padre Island National Seashore in Kenedy County through much of the Rio Grande Valley in late July, leaving nearly $1 billion in agricultural and property damage it its wake. While many may now think that we’ve paid our dues, that sentiment couldn’t be further from the truth! The combination of atmospheric and oceanic patterns favorable for a landfalling hurricane in the Rio Grande Valley/Deep South Texas region can occur in any season, including this one. Residents can use the experience of Hurricane Hanna in 2020 as a great reminder to be prepared in 2021. Hurricanes bring a multitude of hazards including flooding rain, damaging winds, deadly storm surge, and tornadoes. These destructive forces can displace you from your home for months or years, and there are many recent cases in the United States and territories where this has occurred. Hurricane Harvey (2017), Michael (2018, Florida Panhandle), and Laura (2020, southwest Louisiana) are just three such devastating events. This guide can help you and your family get prepared. Learn what to do before, during and after a storm. Your plan should include preparations for your home or business, gathering supplies, ensuring your insurance is up to date, and planning with your family for an evacuation. -

Climatology, Variability, and Return Periods of Tropical Cyclone Strikes in the Northeastern and Central Pacific Ab Sins Nicholas S

Louisiana State University LSU Digital Commons LSU Master's Theses Graduate School March 2019 Climatology, Variability, and Return Periods of Tropical Cyclone Strikes in the Northeastern and Central Pacific aB sins Nicholas S. Grondin Louisiana State University, [email protected] Follow this and additional works at: https://digitalcommons.lsu.edu/gradschool_theses Part of the Climate Commons, Meteorology Commons, and the Physical and Environmental Geography Commons Recommended Citation Grondin, Nicholas S., "Climatology, Variability, and Return Periods of Tropical Cyclone Strikes in the Northeastern and Central Pacific asinB s" (2019). LSU Master's Theses. 4864. https://digitalcommons.lsu.edu/gradschool_theses/4864 This Thesis is brought to you for free and open access by the Graduate School at LSU Digital Commons. It has been accepted for inclusion in LSU Master's Theses by an authorized graduate school editor of LSU Digital Commons. For more information, please contact [email protected]. CLIMATOLOGY, VARIABILITY, AND RETURN PERIODS OF TROPICAL CYCLONE STRIKES IN THE NORTHEASTERN AND CENTRAL PACIFIC BASINS A Thesis Submitted to the Graduate Faculty of the Louisiana State University and Agricultural and Mechanical College in partial fulfillment of the requirements for the degree of Master of Science in The Department of Geography and Anthropology by Nicholas S. Grondin B.S. Meteorology, University of South Alabama, 2016 May 2019 Dedication This thesis is dedicated to my family, especially mom, Mim and Pop, for their love and encouragement every step of the way. This thesis is dedicated to my friends and fraternity brothers, especially Dillon, Sarah, Clay, and Courtney, for their friendship and support. This thesis is dedicated to all of my teachers and college professors, especially Mrs. -

American Post-Conflict Educational Reform This Page Intentionally Left Blank American Post-Conflict Educational Reform from the Spanish-American War to Iraq

American Post-Conflict Educational Reform This page intentionally left blank American Post-Conflict Educational Reform From the Spanish-American War to Iraq Edited by Noah W. Sobe AMERICAN POST-CONFLICT EDUCATIONAL REFORM Copyright © Noah W. Sobe, 2009. Softcover reprint of the hardcover 1st edition 2009 978-0-230-61592-2 All rights reserved. First published in 2009 by PALGRAVE MACMILLAN® in the United States—a division of St. Martin’s Press LLC, 175 Fifth Avenue, New York, NY 10010. Where this book is distributed in the UK, Europe and the rest of the world, this is by Palgrave Macmillan, a division of Macmillan Publishers Limited, registered in England, company number 785998, of Houndmills, Basingstoke, Hampshire RG21 6XS. Palgrave Macmillan is the global academic imprint of the above companies and has companies and representatives throughout the world. Palgrave® and Macmillan® are registered trademarks in the United States, the United Kingdom, Europe and other countries. ISBN 978-1-349-37951-4 ISBN 978-0-230-10145-6 (eBook) DOI. 10.1057/9780230101456 Library of Congress Cataloging-in-Publication Data American post-conflict educational reform : from the Spanish- American War to Iraq / edited by Noah W. Sobe. p. cm. Includes bibliographical references and index. 1. Educational assistance, American. 2. Educational change. 3. Conflict management. I. Sobe, Noah W., 1971– LB2283.A47 2009 379.1Ј290973—dc22 2009014130 A catalogue record of the book is available from the British Library. Design by Newgen Imaging Systems (P) Ltd., Chennai, India. First edition: December 2009 10 9 8 7 6 5 4 3 2 1 CONTENTS Part I Introduction One American Imperatives, Educational Reconstruction and the Post-Conflict Promise 3 Noah W. -

AFTER the STORM: WHY ART STILL MATTERS Amanda Coulson Executive Director, NAGB

Refuge. Contents An open call exhibition of Bahamian art following Hurricane Dorian. Publication Design: Ivanna Gaitor Photography: Jackson Petit Copyright: The National Art Gallery of The Bahamas (NAGB) 8. Director’s Foreword by Amanda Coulson © 2020 The National Art Gallery of The Bahamas 16. Curator’s Note by Holly Bynoe West and West Hill Streets Nassau, N.P. 23. Writers: Essays/Poems The Bahamas Tel: (242) 328-5800 75. Artists: Works/Plates Email: [email protected] Website: nagb.org.bs 216. Acknowledgements ISBN: 978-976-8221-16-2 All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording or any information storage and retrieval system, without prior permission in writing from the publisher. The views and opinions expressed in this publication are those of the authors and do not necessarily reflect the official policy or position of the National Art Gallery of The Bahamas. Cover: Mystery in da Mangroves, 2019 (New Providence) Lemero Wright Acrylic on canvas 48” x 60” Collection of the artist Pages 6–7: Visitor viewing the artwork “Specimen” by Cydne Coleby. 6 7 AFTER THE STORM: WHY ART STILL MATTERS Amanda Coulson Executive Director, NAGB Like everybody on New Providence and across the other islands of our archipelago, all of the there, who watched and imagined their own future within these new climatic landscapes. team members at the National Art Gallery of The Bahamas (NAGB) watched and waited with a rock in their bellies and their hearts already broken, as the storm ground slowly past the islands In addition to conceiving this particular show “Refuge,” in order to create space for artists to of Abaco and Grand Bahama. -

Report of the Governor's Commission to Rebuild Texas

EYE OF THE STORM Report of the Governor’s Commission to Rebuild Texas John Sharp, Commissioner BOARD OF REGENTS Charles W. Schwartz, Chairman Elaine Mendoza, Vice Chairman Phil Adams Robert Albritton Anthony G. Buzbee Morris E. Foster Tim Leach William “Bill” Mahomes Cliff Thomas Ervin Bryant, Student Regent John Sharp, Chancellor NOVEMBER 2018 FOREWORD On September 1 of last year, as Hurricane Harvey began to break up, I traveled from College Station to Austin at the request of Governor Greg Abbott. The Governor asked me to become Commissioner of something he called the Governor’s Commission to Rebuild Texas. The Governor was direct about what he wanted from me and the new commission: “I want you to advocate for our communities, and make sure things get done without delay,” he said. I agreed to undertake this important assignment and set to work immediately. On September 7, the Governor issued a proclamation formally creating the commission, and soon after, the Governor and I began traveling throughout the affected areas seeing for ourselves the incredible destruction the storm inflicted Before the difficulties our communities faced on a swath of Texas larger than New Jersey. because of Harvey fade from memory, it is critical that Since then, my staff and I have worked alongside we examine what happened and how our preparation other state agencies, federal agencies and local for and response to future disasters can be improved. communities across the counties affected by Hurricane In this report, we try to create as clear a picture of Harvey to carry out the difficult process of recovery and Hurricane Harvey as possible.