Read Full Article (PDF)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

LEGISLATIVE RESOLUTION Honoring Patricia M. Cloherty Upon the Occasion of Her Designation for Special Recognition at the Hudson Valley Shakes- Peare Festival

LEGISLATIVE RESOLUTION honoring Patricia M. Cloherty upon the occasion of her designation for special recognition at the Hudson Valley Shakes- peare Festival WHEREAS, It is incumbent upon the people of the State of New York to recognize and acknowledge those within our midst who have made signif- icant contributions to the quality of life therein; and WHEREAS, Attendant to such concern, and in full accord with its long- standing traditions, this Legislative Body is justly proud to commend Patricia Cloherty upon the occasion of her designation for special recognition at the Hudson Valley Shakespeare Festival; and WHEREAS, Patricia M. Cloherty is Chairman and CEO Emeritus of Delta Private Equity Partners, LLC, manager of The U.S. Russia Investment Fund and Delta Russia Fund, L.P., two venture capital funds invested in 55 Russian companies, and is also Senior Advisor to UFG Private Equity, partner firm to Delta Private Equity; and WHEREAS, Patricia Cloherty is former Co-Chairman, President and Gener- al Partner of Apax Partners, Inc. (formerly Patricof & Co. Ventures, Inc.), a private equity company she joined in 1970, and from which she withdrew in 2000, and is a past President and Chairman of the National Venture Capital Association of the United States; and WHEREAS, She holds a Bachelor of Arts degree from the San Francisco College for Women, a Masters of Arts degree and a Masters of Interna- tional Affairs degree from Columbia University; from 1963 through 1965, she served in the Peace Corps in Brazil; and WHEREAS, In 1991, President George H. Bush appointed her chairman of an Investment Advisory Council to revamp the Small Business Investment Company program of the U.S. -

Shareholder 02 Behind the fi Gures Quarterly Magazine ING Group November 2006

Shareholder 02 Behind the fi gures Quarterly Magazine ING Group November 2006 Philippe Damas: Why knowledge matters Q3: Balancing growth and returns Private equity: blessing or curse? ING Shareholder 02 – November 2006 1 153187_Share02EN_025-048.indd 1 10-11-2006 17:11:31 Dear reader, The theme of the second issue of ING Shareholder Our feature stories in this edition continue the This magazine is a quarterly publication is dialogue. Alongside our website, this magazine dialogue theme. The article on private equity by ING Group for shareholders and others is itself one of the ways by which we try to keep highlights the importance of good dialogue interested in ING. you informed on activities within ING and the between management and shareholders, and Subscribe to ING Shareholder strategy and thinking that lies behind those indeed between investors and the wider world. Fax (+31) 411 65 21 25 activities. And if the piece on private banking tells us any- Mail P.O. Box 258, 5280 AG Boxtel thing, it is that the banks that will succeed in this The Netherlands But communication can hardly be called dialogue sector in the future are the ones that can enter a Internet: www.ing.com if it is all one-way. Which is why we would genuine dialogue with their highly-demanding encourage you to email us (address below). With clientele, one that goes deeper than just market- Editorial offi ce your views and comments on ING Shareholder, ing and good intentions. ING Group, Corporate Communications with topics you would like to see covered in Investor Relations Department future issues, with any wider questions you may It has been said that the highest form of dialogue P.O. -

The People Who Matter Your Vote on European Private Equity’S Most Influential

olympic opportunitiEs > vEndor financing > partEch’s parting RealDeals 14 august 2008 For Europe’s private equity professional » E u r o p E The people who matter Your vote on European private equity’s most influential www.rEaldEals.Eu.com 20 MOST influential A tumultuous 12 months on from the onset of the credit crunch, we asked 500 of the industry’s biggest hitters to name the most powerful people in European private equity. 1: GUY HANDS (8) Guy Hands, chief executive of Terra Firma, The man who holds the future of embattled is embroiled in the most highly publicised music business EMI in his hands has shot to the private equity deal of recent times. But while top of the 20 most influential list this year as he all about him appear to doubt, he has remained attempts to drag the company’s creative prima committed to bringing uncompromising donnas into economic reality in the full glare of leveraged buyout efficiency to the extravagant the public spotlight. muso world. Despite frequent spats with pop idols – Robbie Williams’ manager accused Hands of running the business like a plantation owner – and a string of celebrity departures, including the Rolling Stones and Radiohead, as well as the painful fall-out of 2,000 job losses and the impact of the credit crunch on the deal itself, this unlikely rock and roll legend has managed to swing a company, hitherto spouting losses, into profit over recent months. There is still a long way to go before Hands can be declared a hit, of course, but what is clear is that the impact of the £3.2bn (¤4bn) deal will spread way beyond EMI’s walls. -

Alpinvest Annual Review 2013 02

1 AlpInvest Annual Review 2013 02 04 Our business 29 Remuneration policy 08 Chairman’s statement 30 Risk management 10 Strategic review 32 Financial performance and investment overview 14 Fund Investments 34 Fund Investments overview 16 Secondary Investments 37 Secondary Investments overview 18 Co-Investments 38 Equity Co-Investments overview 23 Governance 40 Mezzanine Co-Investments overview 24 Firm leadership 41 Private equity 27 Responsible investment 42 Important information 28 Human resources AlpInvest Annual Review 2013 Throughout this document, ‘AlpInvest’ or ‘AlpInvest Partners’ refers to AlpInvest Partners B.V. and its subsidiaries. In considering the past, targeted or projected performance and other financial information contained herein, readers should bear in mind that past, targeted or projected performance is not necessarily indicative of future results and there can be no assurance that targeted or projected returns will be achieved, that any AlpInvest fund or other investment will achieve comparable results or that the returns generated by an AlpInvest fund or other investment will equal or exceed those of other investment activities of AlpInvest. 033 AlpInvest is one of the largest We aim to offer clients a private equity investors in the customized approach to their world, with a 14-year track record investment needs, underpinned of consistent success. by a disciplined and discerning investment strategy. We invest in primary funds, secondaries and co-investments Our 72 investment professionals for investors across the globe. are dedicated to applying their collective skills, insights and Through our on-the-ground knowledge to maximize value presence in three continents, we for our investors. have built a deep understanding of the market and developed an extensive network of relationships that spans the world. -

Kn2212sra08br:GAIM Asia 14/5/09 16:15 Page 3

KN2212SRACOVER09:0 14/5/09 16:17 Page 1 Endowmentsfor Pension FREE& Foundations Funds, Private Equity & Venture Capital Investing In (subject to verification) China, India, Japan, Korea, SE Asia, Australia & Vietnam In Challenging Times What Makes SuperReturn Asia 4th Annual The “Must-Attend” 220 LPs SuperReturn Asia “ attended brings together the who’s Asian Private Equity in 2008 “ who of Asia & Venture Capital private equity Rebecca Xu, Asia Alternatives Event? Management LLC 50+ www.superreturnasia.com 220+ LPs – The Largest LP Speakers LP Perspectives From Around The World Gathering In Asia 800+ Attendees – The Industry All In One Place New – LP/GP Structured Speed Networking Jim Pittman Saguna Malhotra Erol Uzumeri John Mark Wiseman Volkert Doeksen Philip Bilden New – Knowledge & Vice President, Managing Senior Vice Schumacher Senior Vice CEO & Managing Managing Private Equity Director, Private President CEO President, Private Partner Director Networking Exchange For PSP Equity TEACHERS’ NEW YORK Investments ALPINVEST HARBOURVEST INVESTMENTS STANFORD PRIVATE LIFE CAPITAL CPP PARTNERS PARTNERS More Focused Discussions MANAGEMENT CAPITAL PARTNERS INVESTMENT (ASIA) COMPANY BOARD New – 3 Esteemed Renowned Industry Leaders Economists 2 Portfolio Companies Interviewed 150 Influential LP & GP Speakers – Only The Top Industry Titans & Influential Tim Draper Tim Sims Joe Skrzynski KY Tang Wu Shang Zhi Ajay Relan Michael B. Kim Founder & Managing Partner Founding Chairman & Chairman & Co-Founder Partner LPs Managing PACIFIC EQUITY Partner Managing Partner Managing Partner CX PARTNERS MBK Director PARTNERS CHAMP AFFINITY CDH PARTNERS DRAPER FISHER GROUP EQUITY INVESTMENTS More Structured JURVETSON PARTNERS Networking – SpotMe Meeting Planner For Every China Summit LP/GP Relations Summit Attendee Plus Hear from: Hear from: 2 Hardtalk LP Interviews – Capital Today, Hony Capital, SAIF Partners, CNEI Stanford Management, And many more…. -

Print 007-8205•RECORD

2 TheRecord OCTOBER 14, 2005 Columbians Taking Initiative Students Design Practical Plans to Implement Student to Assist New Environmental Legislation with Innovative There are no easy solutions to tation for developing countries a Solutions to NYC’s longstanding environmental policy U.S.policy objective in foreign assis- Transportation issues such as the need to balance tance programs. economic growth with environ- According to team member Problems mental concerns, and the debate Lauren Bome, studying the pro- David Dayu Zhang, over the causes of global warming. posed legislation in detail had GSAPP’06 and a native But a group of Columbia gradu- demonstrated “how complex and Chinese graduate of ate students, refusing to be daunted sometimes difficult” it can be to Beihang University in by these hurdles, spent the summer break down a problem in order to Beijing, will soon be using evaluating the merits of proposed understand it. “We have to under- his unique international environmental legislation and mak- stand what it is that needs to be experiences to bring New ing concrete recommendations for fixed, what is the root cause of the York’s commuting trou- implementation. problem.” bles to a halt. Over the past few months, a Bome says she also learned Zhang is one of three group of 58 candidates from “how important it is for a policy- recipients of the first Columbia’s Master of Public maker to understand the science annual September 11th Administration Program in behind a problem before imple- Memorial Program Award Environmental Science and Policy menting or even proposing solu- for Transportation Plan- participated in a series of work- tions to solve it.” ning. -

Oral History with Alan Patricof

2UDO+LVWRU\ZLWK$ODQPatricof NVCA Oral History Collection This oral history is part of National Venture Capital Association (NVCA) Oral History Collectionat the Computer History Museum and was recporded under the auspieces of the NVCA. In November 2018, the NVCA transferred the copyright of this oral history to the Computer History Museum to ensure that it is freely accessible to the public and preserved for future generations. CHM Reference number: X8628.208 © 201 Computer History Museum National Venture Capital Association Venture Capital Oral History Project Alan J. Patricof Interview Conducted by Carole Kolker, PhD September 24 and October 26, 2010 ___________________________________________________________________________ This collection of interviews, Venture Capital Greats, recognizes the contributions of individuals who have followed in the footsteps of early venture capital pioneers such as Andrew Mellon and Laurance Rockefeller, J. H. Whitney and Georges Doriot, and the mid-century associations of Draper, Gaither & Anderson and Davis & Rock — families and firms who financed advanced technologies and built iconic U.S. companies. Each interviewee was asked to reflect on his formative years, his career path, and the subsequent challenges faced as a venture capitalist. Their stories reveal passion and judgment, risk and rewards, and suggest in a variety of ways what the small venture capital industry has contributed to the American economy. As the venture capital industry prepares for a new market reality in the early years of the 21st century, the National Venture Capital Association reports (2008) that venture capital investments represented 21 percent of U.S. GDP and was responsible for 12.1 million American jobs and $2.9 trillion in sales. -

Multi Asset Class Investing Workshop

KN2129new cover06 31/5/06 12:08 pm Page 1 SAVE UP TO BOOK BEFORE£600 4 August 06 The 6th Annual Just Some Of The 130 Industry Figureheads That You Will Meet At SuperInvestor: • Jon Moulton, ALCHEMY PARTNERS • Steven Costabile, AIG • George Anson, HARBOURVEST GLOBAL INVESTMENT GROUP PARTNERS (UK) • Hans Albrecht, NORDWIND • Guy Hands, TERRA FIRMA CAPITAL CAPITAL PARTNERS • Billy Gilmore, SCOTTISH • Peter Gale, GARTMORE PRIVATE EQUITY WIDOWS INVESTMENT • Sandra Robertson, THE WELLCOME TRUST PARTNERSHIP • Jonathan Colby, THE CARLYLE GROUP • Arlett Tygesen, ILPA • Wim Borgdorff, ALPINVEST PARTNERS • Martin Day, OMERS CAPITAL • Jonny Maxwell, STANDARD LIFE INVESTMENTS PARTNERS Anders Strömblad, SECOND • Rick Hayes, OAK HILL INVESTMENT • SWEDISH NATIONAL PENSION FUND MANAGEMENT • Hanspeter Bader, UNIGESTION • Derek Murphy, PSP INVESTMENTS • Wayne Harber, HAMILTON LANE • Ivan Vercoutére, LGT CAPITAL PARTNERS • Bruno Raschle, ADVEQ • Carol Kennedy, PANTHEON • Charlie van Horne, ABBOTT CAPITAL Jos van Gisbergen, MN SERVICES • • Gordon Hargraves, • Hanneke Smits, ADAMS STREET PARTNERS Rho FUND INVESTORS • Ray Maxwell, PRIV-ITY LIMITED • Graham O' Keefe, ATLAS VENTURE • Veronica Eng, PERMIRA • Andrew Joy, CINVEN • Nikos Stathopoulos, BC PARTNERS • Ronan Cunningham, IRISH NATIONAL • Ian Armitage, Hg CAPITAL PENSIONS RESERVE FUNDS • Johannes Huth, KKR • Jonathan Russell, 3i • Kevin Albert, ELEVATION PARTNERS • Pat Cloherty, • Chris Kojima, GOLDMAN SACHS ASSET DELTA PRIVATE EQUITY PARTNERS MANAGEMENT • Mark Weston, ELECTRA PARTNERS EUROPE • Chris Masterson, -

Analysing How Turkey's Growing Gas Market Will Be

Day 1 – Tuesday 22nd February 2005 Main Conference 0730 Registration & Coffee 0800 Chairman’s Opening Address: Derek Zissman, Partner, KPMG’s Private Equity Group, KPMG LLP (UK) 0810 LP Perspectives: Does Being In A Top Quartile Fund Limit An LP's Ability To Maintain An Alignment Of Interests? David Larsen, Partner, KPMG's Private Equity Group, KPMG LLP (USA) 0830 INSIGHTS FROM A PRIVATE EQUITY GURU Three Decades of Leveraged Buyout Investing – Thoughts On The Progression Of The Private Equity Industry Henry Kravis, Founding Partner, KOHLBERG KRAVIS ROBERTS & CO. 0900 HEAD-TO-HEAD WITH THE INDUSTRY EXPERTS: Middle Aged Spread In Private Equity: Which Evolution Routes Should The Industry Take Now? Moderator: HAMILTON LANE Panellists: Nigel Doughty, CEO, DOUGHTY HANSON & CO Philip Yea, CEO, 3I GROUP PLC Douglas Karp, Managing Partner, TAILWIND CAPITAL 0945 SPECIAL GUEST PRESENTATION Lessons Of Leadership: Examining The Strengths & Weaknesses Of Different Styles Of Leadership & Predicting The Future As It Will Affect Both Business & Society William Hague LEADER OF THE BRITISH CONSERVATIVE PARTY 1997 – 2001 1045 Morning Coffee 1115 The Transformation of the Private Equity Industry: Successions & Spin-outs 1135 Examining The Private Equity Investment Cycle 1967-2004: Where Are We In The Current Cycle, And What Lessons Have We Learned That Can Be Applied To Future Investment Strategies? Brooks Zug, Senior Managing Director, HARBOURVEST PARTNERS 1200 Lessons From Israel Boaz Dinte & Erez Shachar, Co-Managing Partners, EVERGREEN VENTURE PARTNERS -

Postseason Revenues Loom Large

nb40p01.qxp 9/28/2007 8:42 PM Page 1 SPECIAL No easy SECTION fix for 100 MOST local INFLUENTIAL news —Valerie Block WOMEN IN NYC on WNBC’s BUSINESS 7 p.m. ® newscast PAGES W1-W32 Page 13 VOL. XXIII, NO. 40 WWW.NEWYORKBUSINESS.COM OCTOBER 1-7, 2007 PRICE: $3.00 Postseason revenues TOP STORIES Bank believes its union ties are key loom large to future growth PAGE 2 of Mr. Steinbrenner and the Mets’ Yankees need them Fred Wilpon, it looms as a chance Bollywood grows in to turn a profit, to make big money in just a few games. Owners mint cash as ticket NY as Indian media while benefit to prices soar higher with each round firms multiply Mets is long-term and fans rush to show their loyalty by forking over hefty sums to buy PAGE 3 their official playoff and World Se- BY AARON ELSTEIN ries caps and jackets. Café Gray kills For big-city teams like the Yan- catering biz after let the profits roll.In squeak- kees and Mets, the added revenue ing into the playoffs last week, the collected on the postseason road to only seven months Yankees did more than add anoth- the World Series can easily top $40 NEW YORK, NEW YORK, P. 6 er hard-won entry to their long list million, Mr. McDonnell says. of accomplishments. They saved Though ticket receipts and Hotel execs may owner George Steinbrenner’s ba- merchandise revenues must be abandon Javits con. Sadly, perhaps, the Mets have shared with players and other never faced that kind of pressure. -

Superreturn B 2011:Superreturn A3 10 15/11/10 10:32 Page 2

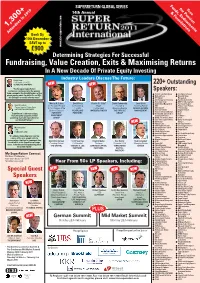

SR INTER COVER 2011:Layout 1 15/11/10 14:22 Page 1 SUPERRETURN GLOBAL SERIES Funds, Endowments for PensionFree 14th Annual & Foundations 1,300+ Attendees In 2010Book By 10th December SAVE up to £900 www.icbi-superreturn.com Determining Strategies For Successful Fundraising, Value Creation, Exits & Maximising Returns In A New Decade Of Private Equity Investing Industry Leaders Discuss The Future: David Roux Co-Founder & Co-CEO SILVERLAKE PARTNERS NEW NEW 220+ Outstanding "The European SuperReturn conference continues to be the premier Speakers: forum convening the thought leaders of the ● Fortress Investment Group ● Jira Capital & Consult private equity world. For both LPs and GPs, ● Warburg Pincus ● Brookfield Asset it is Europe's essential industry event" ● TPG Capital Management ● UNC Management Company ● New Mountain Capital ● The Carlyle Group ● MHR Fund Management Wesley R. Edens David Roux Charles R. “Chip” David Rubenstein Leon Black ● Apollo Global Management ● Park Square Capital Ivan Vercoutere Co-Founder, Principal Co-Founder & Kaye Founder & Founding Partner ● KKR ● Thomas H. Lee Partners Partner, Head of Private Equity & Co-Chairman of the Co-CEO Co-President Managing Director APOLLO GLOBAL ● Better Capital ● FTI Consulting LGT CAPITAL PARTNERS ● ● Board of Directors SILVERLAKE WARBURG PINCUS THE CARLYLE MANAGEMENT Silverlake Partners Tangent Advisors ● Advent International Europe ● Triago “SuperReturn is the most unique, FORTRESS PARTNERS GROUP ● The Guardian Life Insurance ● Onex interesting and enjoyable annual INVESTMENT -

Making Disruption Work

1 A Decade of Making Disruption Work disruption � � noun disturbance or problems which interrupt an event, activity, or process. what happens when companies harness new digital technologies and serve customers better, thereby breaking open markets and shattering existing orders. Published by SparkOptimus Copyright © Alexandra Jankovich & Tom Voskes, 2020 Concept and production support by Marieke Berendsen, Claire Broeders, Britt Fellinger, Sophie Heijenberg, Maurice van Heijningen, Sonja Pfleghaar, Wendy Rudder, Vivianne Vluggen and Sébastien Volker Copywriting and design by Falcon Windsor All rights reserved. No part of this publication may be reproduced, stored or introduced into a retrieval system, or transmitted, in any form or by any means (electronic, mechanical, photocopying, recording or otherwise) without the prior written permission of the copyright owner, except in the case of brief quotations in a critical review or other non-commercial use permitted under copyright law. Disclaimer All information in this publication has been written and put together with care, especially when it comes to intellectual property rights and privacy. SparkOptimus cannot, however, accept any liability with respect to accuracy of the information and no rights may be derived from the information provided. In case of any questions or queries please contact SparkOptimus (via [email protected] or +31 20 305 9000). No part of this publication may be reproduced, transmitted, or stored electronically, in any form, without the prior permission in writing of the publisher, nor otherwise be circulated in any form other than that in which it is published. Please note that any sign and/or trademark shown in this publication is depicted for informative purposes only and does not concern trademark use as such.