Print 007-8205•RECORD

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

LEGISLATIVE RESOLUTION Honoring Patricia M. Cloherty Upon the Occasion of Her Designation for Special Recognition at the Hudson Valley Shakes- Peare Festival

LEGISLATIVE RESOLUTION honoring Patricia M. Cloherty upon the occasion of her designation for special recognition at the Hudson Valley Shakes- peare Festival WHEREAS, It is incumbent upon the people of the State of New York to recognize and acknowledge those within our midst who have made signif- icant contributions to the quality of life therein; and WHEREAS, Attendant to such concern, and in full accord with its long- standing traditions, this Legislative Body is justly proud to commend Patricia Cloherty upon the occasion of her designation for special recognition at the Hudson Valley Shakespeare Festival; and WHEREAS, Patricia M. Cloherty is Chairman and CEO Emeritus of Delta Private Equity Partners, LLC, manager of The U.S. Russia Investment Fund and Delta Russia Fund, L.P., two venture capital funds invested in 55 Russian companies, and is also Senior Advisor to UFG Private Equity, partner firm to Delta Private Equity; and WHEREAS, Patricia Cloherty is former Co-Chairman, President and Gener- al Partner of Apax Partners, Inc. (formerly Patricof & Co. Ventures, Inc.), a private equity company she joined in 1970, and from which she withdrew in 2000, and is a past President and Chairman of the National Venture Capital Association of the United States; and WHEREAS, She holds a Bachelor of Arts degree from the San Francisco College for Women, a Masters of Arts degree and a Masters of Interna- tional Affairs degree from Columbia University; from 1963 through 1965, she served in the Peace Corps in Brazil; and WHEREAS, In 1991, President George H. Bush appointed her chairman of an Investment Advisory Council to revamp the Small Business Investment Company program of the U.S. -

Oral History with Alan Patricof

2UDO+LVWRU\ZLWK$ODQPatricof NVCA Oral History Collection This oral history is part of National Venture Capital Association (NVCA) Oral History Collectionat the Computer History Museum and was recporded under the auspieces of the NVCA. In November 2018, the NVCA transferred the copyright of this oral history to the Computer History Museum to ensure that it is freely accessible to the public and preserved for future generations. CHM Reference number: X8628.208 © 201 Computer History Museum National Venture Capital Association Venture Capital Oral History Project Alan J. Patricof Interview Conducted by Carole Kolker, PhD September 24 and October 26, 2010 ___________________________________________________________________________ This collection of interviews, Venture Capital Greats, recognizes the contributions of individuals who have followed in the footsteps of early venture capital pioneers such as Andrew Mellon and Laurance Rockefeller, J. H. Whitney and Georges Doriot, and the mid-century associations of Draper, Gaither & Anderson and Davis & Rock — families and firms who financed advanced technologies and built iconic U.S. companies. Each interviewee was asked to reflect on his formative years, his career path, and the subsequent challenges faced as a venture capitalist. Their stories reveal passion and judgment, risk and rewards, and suggest in a variety of ways what the small venture capital industry has contributed to the American economy. As the venture capital industry prepares for a new market reality in the early years of the 21st century, the National Venture Capital Association reports (2008) that venture capital investments represented 21 percent of U.S. GDP and was responsible for 12.1 million American jobs and $2.9 trillion in sales. -

Multi Asset Class Investing Workshop

KN2129new cover06 31/5/06 12:08 pm Page 1 SAVE UP TO BOOK BEFORE£600 4 August 06 The 6th Annual Just Some Of The 130 Industry Figureheads That You Will Meet At SuperInvestor: • Jon Moulton, ALCHEMY PARTNERS • Steven Costabile, AIG • George Anson, HARBOURVEST GLOBAL INVESTMENT GROUP PARTNERS (UK) • Hans Albrecht, NORDWIND • Guy Hands, TERRA FIRMA CAPITAL CAPITAL PARTNERS • Billy Gilmore, SCOTTISH • Peter Gale, GARTMORE PRIVATE EQUITY WIDOWS INVESTMENT • Sandra Robertson, THE WELLCOME TRUST PARTNERSHIP • Jonathan Colby, THE CARLYLE GROUP • Arlett Tygesen, ILPA • Wim Borgdorff, ALPINVEST PARTNERS • Martin Day, OMERS CAPITAL • Jonny Maxwell, STANDARD LIFE INVESTMENTS PARTNERS Anders Strömblad, SECOND • Rick Hayes, OAK HILL INVESTMENT • SWEDISH NATIONAL PENSION FUND MANAGEMENT • Hanspeter Bader, UNIGESTION • Derek Murphy, PSP INVESTMENTS • Wayne Harber, HAMILTON LANE • Ivan Vercoutére, LGT CAPITAL PARTNERS • Bruno Raschle, ADVEQ • Carol Kennedy, PANTHEON • Charlie van Horne, ABBOTT CAPITAL Jos van Gisbergen, MN SERVICES • • Gordon Hargraves, • Hanneke Smits, ADAMS STREET PARTNERS Rho FUND INVESTORS • Ray Maxwell, PRIV-ITY LIMITED • Graham O' Keefe, ATLAS VENTURE • Veronica Eng, PERMIRA • Andrew Joy, CINVEN • Nikos Stathopoulos, BC PARTNERS • Ronan Cunningham, IRISH NATIONAL • Ian Armitage, Hg CAPITAL PENSIONS RESERVE FUNDS • Johannes Huth, KKR • Jonathan Russell, 3i • Kevin Albert, ELEVATION PARTNERS • Pat Cloherty, • Chris Kojima, GOLDMAN SACHS ASSET DELTA PRIVATE EQUITY PARTNERS MANAGEMENT • Mark Weston, ELECTRA PARTNERS EUROPE • Chris Masterson, -

Analysing How Turkey's Growing Gas Market Will Be

Day 1 – Tuesday 22nd February 2005 Main Conference 0730 Registration & Coffee 0800 Chairman’s Opening Address: Derek Zissman, Partner, KPMG’s Private Equity Group, KPMG LLP (UK) 0810 LP Perspectives: Does Being In A Top Quartile Fund Limit An LP's Ability To Maintain An Alignment Of Interests? David Larsen, Partner, KPMG's Private Equity Group, KPMG LLP (USA) 0830 INSIGHTS FROM A PRIVATE EQUITY GURU Three Decades of Leveraged Buyout Investing – Thoughts On The Progression Of The Private Equity Industry Henry Kravis, Founding Partner, KOHLBERG KRAVIS ROBERTS & CO. 0900 HEAD-TO-HEAD WITH THE INDUSTRY EXPERTS: Middle Aged Spread In Private Equity: Which Evolution Routes Should The Industry Take Now? Moderator: HAMILTON LANE Panellists: Nigel Doughty, CEO, DOUGHTY HANSON & CO Philip Yea, CEO, 3I GROUP PLC Douglas Karp, Managing Partner, TAILWIND CAPITAL 0945 SPECIAL GUEST PRESENTATION Lessons Of Leadership: Examining The Strengths & Weaknesses Of Different Styles Of Leadership & Predicting The Future As It Will Affect Both Business & Society William Hague LEADER OF THE BRITISH CONSERVATIVE PARTY 1997 – 2001 1045 Morning Coffee 1115 The Transformation of the Private Equity Industry: Successions & Spin-outs 1135 Examining The Private Equity Investment Cycle 1967-2004: Where Are We In The Current Cycle, And What Lessons Have We Learned That Can Be Applied To Future Investment Strategies? Brooks Zug, Senior Managing Director, HARBOURVEST PARTNERS 1200 Lessons From Israel Boaz Dinte & Erez Shachar, Co-Managing Partners, EVERGREEN VENTURE PARTNERS -

Read Full Article (PDF)

june 2007 private equity international page 1 global movers Global movers Our selection of the most influential people operating in private equity today brings together diverse strategies, geographies and personalities. The common denominator is their ability to shape events around them, adding their own sizeable footprints to the forward march of the asset class. Turn to the following pages and “Those included are the additions and subtractions you will uncover the identities of before we finally arrived at a list those private equity professionals helping to shape the that we felt best reflected what we who we have defined collectively evolution of the asset class were attempting to achieve. as “global movers”. This marks It could be argued, quite reason- the first occasion in which the at an absolutely crucial ably, that practitioners operating editorial team at PEI, following time in its history – when in North America and Western many discussions with those of Europe are over-represented in the you on the frontline, has drawn public scrutiny has never pages that follow. Certainly, it is up a global list of this nature. been higher and, too easy to assume that the world Which brings us immediately revolves around the more mature to a point of clarification: what consequently, so much markets when the reality is that follows is an alphabetical list, is at stake.” the profile (and, dare we say it, not a ranking. We have quite influence) of private equity’s deliberately assembled an eclectic emerging markets is increasing all mix, sprinkled with representatives from all corners of the time. -

Postseason Revenues Loom Large

nb40p01.qxp 9/28/2007 8:42 PM Page 1 SPECIAL No easy SECTION fix for 100 MOST local INFLUENTIAL news —Valerie Block WOMEN IN NYC on WNBC’s BUSINESS 7 p.m. ® newscast PAGES W1-W32 Page 13 VOL. XXIII, NO. 40 WWW.NEWYORKBUSINESS.COM OCTOBER 1-7, 2007 PRICE: $3.00 Postseason revenues TOP STORIES Bank believes its union ties are key loom large to future growth PAGE 2 of Mr. Steinbrenner and the Mets’ Yankees need them Fred Wilpon, it looms as a chance Bollywood grows in to turn a profit, to make big money in just a few games. Owners mint cash as ticket NY as Indian media while benefit to prices soar higher with each round firms multiply Mets is long-term and fans rush to show their loyalty by forking over hefty sums to buy PAGE 3 their official playoff and World Se- BY AARON ELSTEIN ries caps and jackets. Café Gray kills For big-city teams like the Yan- catering biz after let the profits roll.In squeak- kees and Mets, the added revenue ing into the playoffs last week, the collected on the postseason road to only seven months Yankees did more than add anoth- the World Series can easily top $40 NEW YORK, NEW YORK, P. 6 er hard-won entry to their long list million, Mr. McDonnell says. of accomplishments. They saved Though ticket receipts and Hotel execs may owner George Steinbrenner’s ba- merchandise revenues must be abandon Javits con. Sadly, perhaps, the Mets have shared with players and other never faced that kind of pressure. -

KN2153 SUPINV07 in 9/8/07 13:44 Page 2

KN2153new cover 9/8/07 11:32 Page 1 attendees in 2006 Private Equity, Venture Capital & including 650+ Institutional Investment Summit 130+ Building And Maintaining Robust LPs And Loyal LP/GP Relationships The 7th Annual Join The Most Incisive & Authoritative Chairmen: Ray Maxwell Jonny Maxwell Jon Moulton Founder and CEO formerly Managing Partner PRIV-ITY STANDARD LIFE ALCHEMY PARTNERS Hear From 70 LPs Including: INVESTMENTS v • Caisse de Dépot et Placement de Québec • Nordea • Adams Street • Teachers Private Capital • New York Life Capital Partners • Alpinvest • Hear From Outstanding Performance Equity Management • 747 Capital • William & Flora Hewlett Foundation • Cambridge Associates • Capital Dynamics • Irish National Pension Guest Speakers: Reserve Fund • Scottish Widows Investment Partnership • JP Morgan Asset Management • Altius • F&C • AIG Investments • Hamilton Lane • Keyhaven Capital Partners • Bregal Investments • Portfolio Advisors • Gartmore Private Equity • Harbourvest • Caisses des Dépots et Consignations • ATP PEP • Abbott Capital Partners • PSP Investments • BA Pensions • Northwestern Mutual Life Insurance • Allianz Alternative Assets Holding • Access Capital Partners • Second Swedish National Pension Fund AP2 • Altium Capital Gestion • European Investment Fund • Adveq Capital • OMERS Capital Partners • Standard Life • MN Services • Adams Capital Partners • Unigestion • SVB Capital • GE Asset Management • Hermes Private Dan Pink Mike Harris Equity • Jade Advisors • CAM Newmarkets International Finance Corporation • Author -

Conference Program

CONFERENCE PROGRAM OCTOBER 1, 2009 STOCKHOLM About The Swedish-American Chamber of Commerce, Inc. The Swedish-American Chamber of Commerce, Inc. is a private membership organization, founded in New York 1906. As the fi rst and leading Swedish-American Chamber, SACC New York has a mission to promote and increase trade and investments between the U.S. and Sweden by providing member companies and clients with a wide range of transatlantic business contacts, services, and information. One of the most important features of the Chamber is the strength derived from its unique network of members. Industry leaders, business executives, lawyers, bankers, as well as an impressive number of entrepreneurs are actively engaged in the organization. The focus is to give members a promotional platform with high visibility and to provide expert consulting services. For more than a century, the Chamber’s meetings and events have served an important role in the Swedish-American business community. Each year, SACC New York hosts a number of exclusive conferences, informal seminars, speaker luncheons, week-long delegations, traditional Swedish events, and black-tie galas. The SACC New York Business Services consultants manage everything from a company’s most challenging and complex business decisions to the most basic inquiries. Services include advice when opening a new business, fi nding potential partners, or simply investigating foreign business practices. For more information regarding SACC New York’s different types of membership, how to become a member, or to view our calendar of upcoming events, please visit us at www.saccny.org. It is my distinct pleasure to welcome you to the Eighth An- nual Swedish-American Executive Women’s Conference. -

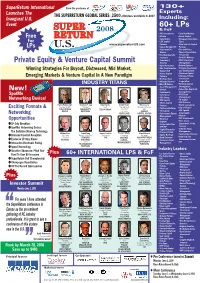

Super Return

KN2190SRA08 A3 COVER 30/1/08 14:22 Page 1 SuperReturn International From the producers of 130+ Launches The Experts THE SUPERRETURN GLOBAL SERIES: 3500 attendees worldwide in 2007 Inaugural U.S. Including: Event 60+ LPs SUPERSUPER 2008 & FoF • AIG Investments • Cam NewMarkets RETURNRETURN • Allstate • Parish Capital Free Investments • European Investment For • LGT Capital Fund www.superreturnUS.com Partners • New York Life Capital LPs • Caisse De Dépôt Et Partners Placement Du • Fire and Police Québec Pension Association • The Guardian Life of Colorado Insurance • Portfolio Advisors Private Equity & Venture Capital Summit Company of • MLC Investment America Management • Alpha Associates • Private Advisors • Rho Fund Investors • Emirates Investment Winning Strategies For Buyout, Distressed, Mid Market, • Siguler Guff and Development • Access Capital • Northsea Capital Emerging Markets & Venture Capital In A New Paradigm Partners • Overseas Private • Northern Trust Investment • Alchemy Partners Corporation INDUSTRY TITANS • WestLB Mellon • Pathway Capital Asset Management Management New! • Kendall • Caisse Des Dépôts Et Investments Consignations SpotMe • Jade Invest • PCG Asset • CDC Group Management Networking Device! • SVB Capital • TD Capital • Adams Capital • RCP Advisors David Rubenstein Thomas H. Lee Guy Hands David Roux Marc Lasry Partners • North Sea Capital Founder & MD President Founder and Founder & Senior Exciting Formats & CEO • Pantheon Ventures • City of Boston THE CARLYLE LEE EQUITY TERRA FIRMA Co-Chief MD GROUP PARTNERS