Royal Dutch Petroleum Company N.V

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Hess Corporation

New Hampshire Competitive Natural Gas Supplier Renewal Application Hess Corporation — DM — 07-112 PUC 3003.01 (d) Each CNGS applicant shall re-register with the commission every 2 years by filing with the commission an application for renewal. Each CNGS applicant shall file an application for renewal at least 60 days prior to the expiration oftheir registration. (e) The CNGS shall include on each renewal application an update, including any changes, to all information contained in the previous application. Pursuant to PUC 3003.01(e) the following provides any and all updates to responses contained within Hess Corporation’s original registration submitted November 25, 2003, and approved February 19, 2004 and Hess Corporation’s Renewal Application submitted October 16, 2007. For each item within the original registration that has not changed it is indicated as such below. PUC 3001.01 (b) (1) Be signed by the CNGS Please see certification in Exhibit 9. (2) Include the following: a. The legal name of the applicant as well as any trade name(s) under which it intends to operate in this state; (Updated) Hess Corporation f/k/a Arnerada Hess Corporation Please see Exhibit 8. b. The applicant’s business address, if any, principal place of business, telephone number, facsimile number and email address; (Unchanged) One Hess Plaza Woodbridge, NJ 07095 Phone: (732) 750-6000 Fax: (732 750-6670 www.hess. corn c. The applicant’s place of incorporation; (Unchanged) The State ofDelaware. d. The names, titles, business addresses, telephone numbers and facsimile numbers of the applicant’s principal officers; (Updated) Please See Exhibit 1. -

PDVSA US Litigation Trust: What Creditors Should Know About the Trust, Its Claims and Its Implications for Venezuela’S Restructuring

PDVSA US Litigation Trust: What Creditors Should Know About the Trust, Its Claims and Its Implications for Venezuela’s Restructuring Richard J. Cooper & Boaz S. Morag1 March 15, 2018 Last week, lawyers unsealed a complaint filed in the United States District Court for the Southern District of Florida on behalf of Venezuela’s state-owned oil company, Petróleos de Venezuela, S.A. (“PDVSA”), against a group of 44 oil trading companies, banks and individuals. The suit alleges that the defendants participated in a 14-year scheme to rig bids, underpay on purchases and overcharge on sales, allegedly resulting in billions of dollars of losses to PDVSA. According to published reports and the Amended Complaint (the “Complaint”) in the suit, an entity called the PDVSA US Litigation Trust (the “Trust”) was formed in New York on July 27, 2017 to investigate and pursue potential claims by PDVSA against third-parties.2 According to the Trust’s counsel, PDVSA irrevocably assigned to the Trust any claims PDVSA has for bribery, bid rigging, price fixing, and the like, which the Trust is now bringing on behalf of PDVSA itself. Counsel to the Trust maintains that the Trust, rather than PDVSA, controls the litigation, but that PDVSA will receive the benefits of any recovery, after deducting the contingency interest of the Trust’s counsel, once U.S. sanctions that currently block “dividend payments and other distributions of profits”3 to PDVSA are lifted. The decision by PDVSA to pursue these claims in the United States at this time via a litigation trust raises a number of interesting legal and strategic issues not just for the defendants named in the suit, but also for PDVSA’s bondholders and potentially other creditors, including Republic creditors. -

Creating a Sustainable Future Through Innovative Chemistry Sustainability Report 2020 ABOUT INFINEUM HIGHLIGHTS About This CEO MESSAGE

Creating a sustainable future through innovative chemistry Sustainability Report 2020 ABOUT INFINEUM HIGHLIGHTS About this CEO MESSAGE CREATING A Report SUSTAINABLE FUTURE THROUGH INNOVATIVE CHEMISTRY Welcome to the Infineum Group’s¹ first sustainability report. Content and scope of this report PROTECTING THE ENVIRONMENT As part of our corporate strategy, we are committed to This report covers all of Infineum’s owned and operated delivering a sustainable future through innovative chemistry locations, including our Manufacturing Plants and Business OUR PEOPLE and in doing so, we aim for the utmost transparency of our and Technology Centres. Data in the report covers the year environmental, social and governance performance. 2020, but as this is Infineum’s first sustainability report we OUR In the preparation of this report, we reviewed the also cover activity commenced during 2019. COMMUNITIES requirements of the Global Reporting Initiative (GRI), and To find out more about our business and our sustainability the United Nations Sustainable Development Goals (SDGs), work, please visit Infineum.com/sustainability. THE WAY WE DO and have started a process to align our work and progress BUSINESS If you have any questions or comments about this report, towards these frameworks. We have taken inspiration from please contact us at Infineum Sustainability. Thank you for the Global Reporting Initiative with regards to our data KEY FIGURES your interest in Infineum. and disclosures and will work towards more comprehensive compliance with the GRI standard in the future. 1The Infineum Group is comprised of various affiliated companies located around the world. The term “Infineum” in this report refers individually and collectively to these affiliated companies. -

Petrobras: the Unique Structure Behind Latin America's Best

University of New Mexico UNM Digital Repository Latin American Energy Dialogue, White Papers and Latin American Energy Policy, Regulation and Reports Dialogue 2011 Petrobras: The niqueU Structure behind Latin America's Best Performing Oil Company Genaro Arriagada Chris Cote Follow this and additional works at: https://digitalrepository.unm.edu/la_energy_dialog Recommended Citation Arriagada, Genaro and Chris Cote. "Petrobras: The niqueU Structure behind Latin America's Best Performing Oil Company." (2011). https://digitalrepository.unm.edu/la_energy_dialog/179 This Article is brought to you for free and open access by the Latin American Energy Policy, Regulation and Dialogue at UNM Digital Repository. It has been accepted for inclusion in Latin American Energy Dialogue, White Papers and Reports by an authorized administrator of UNM Digital Repository. For more information, please contact [email protected]. A MAGAZINE OF THE AMERICAS VOLUME 20 • SPRING 2011 • HTTP://LACC.FIU.EDU Energy Challenges in the Americas Hemisphere VOLUME 20 • SPRING 2011 • HTTP://LACC.FIU.EDU IN THIS ISSUE LETTER FROM THE EDITOR 3 LETTER FROM THE GUEST EDITORS 4 FEATURES Leading Energy Policy Issues in Latin America Genaro Arriagada 6 Energy Conflicts: A Growing Concern Patricia I. Vásquez 12 in Latin America Latin America’s Nuclear Future Jorge Zanelli Iglesias 16 REPORTS What Climate Change Means Paul Isbell 19 for Latin America Central America’s Energy Challenges Cristina Eguizábal 21 Why the United States and Cuba Jorge Piñón 24 Collaborate Challenges of Designing an Optimal Petroleum Roger Tissot 26 Fiscal Model in Latin America Petrobras: The Unique Structure behind Genaro Arriagada and Chris Cote 29 Latin America’s Best Performing Oil Company COMMENTARIES Argentina’s Energy Pricing Challenges Pablo Fernández-Lamela 32 Energy Consumption: Challenges and Heidi Jane Smith 33 Opportunities of Urbanization PetroCaribe: Welcome Relief for an Chris Cote 34 Energy-Poor Region SUGGESTED FURTHER READING 36 Hemisphere EDITORIAL STAFF Founding Editor Anthony P. -

2Q13 Dividend

600 North Dairy Ashford Road Houston, TX 77079-1175 Media Relations: 281-293-1149 www.conocophillips.com/media NEWS RELEASE Aug. 20, 2018 ConocoPhillips Signs $2 Billion Settlement Agreement with PDVSA on ICC Arbitration Award HOUSTON – ConocoPhillips (NYSE: COP) announced today that it has entered into a settlement agreement with Petróleos de Venezuela, S.A. (PDVSA), the Venezuelan state-owned oil company, to recover approximately $2 billion, the full amount awarded to ConocoPhillips by an arbitral tribunal constituted under the rules of the International Chamber of Commerce (ICC), plus interest through the payment period. PDVSA has agreed to recognize the ICC judgment and make initial payments totaling approximately $500 million within a period of 90 days from the time of signing. The balance of the settlement is to be paid quarterly over a period of 4.5 years. As a result of the settlement, ConocoPhillips has agreed to suspend its legal enforcement actions of the ICC award, including in the Dutch Caribbean. ConocoPhillips has ensured that the settlement meets all appropriate U.S. regulatory requirements, including any applicable sanctions imposed by the U.S. against Venezuela. Further details of the agreement are confidential. On April 25, 2018, the ICC tribunal awarded ConocoPhillips approximately $2 billion arising out of PDVSA’s failure to uphold its contractual commitments. The award relates to the unlawful expropriation of ConocoPhillips’ investments in the Hamaca and Petrozuata heavy crude oil projects in Venezuela in 2007 and other pre- expropriation fiscal measures. The ICC arbitration award is final and binding upon the parties. Additionally, ConocoPhillips has a separate and independent legal action pending against the government of Venezuela before a tribunal under the auspices of the World Bank's International Centre for Settlement of Investment Disputes (ICSID). -

Jiffy Lube 640 N Wayne St Angola, IN

NET LEASE INVESTMENT OFFERING Jiffy Lube NET640 LEASE N WayneINVESTMENT St OFFERING Angola, IN TABLE OF CONTENTS I. Executive Summary II. Location Overview III. Market & Tenant Overview Executive Summary Site Plan Tenant Profi le Investment Highlights Aerial Location Overview Property Overview Map Demographics Photos NET LEASE INVESTMENT OFFERING DISCLAIMER STATEMENT DISCLAIMER The information contained in the following Offering Memorandum is proprietary and strictly confi dential. It STATEMENT: is intended to be reviewed only by the party receiving it from The Boulder Group and should not be made available to any other person or entity without the written consent of The Boulder Group. This Offering Memorandum has been prepared to provide summary, unverifi ed information to prospective purchasers, and to establish only a preliminary level of interest in the subject property. The information contained herein is not a substitute for a thorough due diligence investigation. The Boulder Group has not made any investigation, and makes no warranty or representation. The information contained in this Offering Memorandum has been obtained from sources we believe to be reliable; however, The Boulder Group has not verifi ed, and will not verify, any of the information contained herein, nor has The Boulder Group conducted any investigation regarding these matters and makes no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. All potential buyers must take appropriate measures to verify all of the information set forth herein. NET LEASE INVESTMENT OFFERING EXECUTIVE SUMMARY EXECUTIVE The Boulder Group is pleased to exclusively market for sale a single tenant net leased Jiffy Lube property SUMMARY: located in Angola, Indiana. -

Royal Dutch Shell 2007 Annual Review

Delivery and growth Royal Dutch Shell plc Annual Review and Summary Financial Statements 2007 Delivery and growth are the basis for our success. We aim to SELECTED FINANCIAL DATA deliver major new energy projects, top-quality operational e selected financial data set out below is derived, in part, from performance and competitive returns while investing in new the Consolidated Financial Statements. e selected data should developments to secure the growth of our business . be read in conjunction with the Summary Consolidated Financial Delivery is doing what we say. Growth is our future . Statements and related Notes, as well as the Summary Operating and Financial Review in this Review. With effect from 2007, wind and solar activities, which were previously reported withi n Other industry segments, are reported within the Gas & Power segment and Oil Sands activities, which were previously reported within the Exploration & Production segment, are reported as a separate segment. During 2007, the hydrogen and CO 2 coordination activities were moved from Other industry segments to the Oil Products segment and all other activities within Other industry segments are now reported within the Corporate segment. CONSOLIDATED STATEMENT OF INCOME DATA $ million 2007 2006 2005 Revenue 355,782 318,845 306,731 Income from continuing operations 31,926 26,311 26,568 Income/(loss) from discontinued operations ––(307) Income for the period 31,926 26,311 26,261 Income attributable to minority interest 595 869 950 Income attributable to shareholders of Royal Dutch -

Invoicing Requirements

INVOICING REQUIREMENTS This Exhibit I sets forth several invoicing and payment methods for Goods or Services. Supplier with agreement from Purchaser shall use one of the methods below: 1. Electronic Invoice submission by Email 2. Einvoicing using the Ariba Supplier Network 3. OTHER INVOICING METHODS: • Evaluated Receipt Settlement (ERS) • Procurement Card Payments (Pcard) Purchaser may, at any time by notice to Supplier, offer additional methods for invoicing and payment or discontinue any of the methods shown in this Exhibit I. Invoice Payment Method Purchaser shall pay Supplier by Electronic Funds Transfer. 1. ELECTRONIC INVOICE SUBMISSION BY EMAIL 1. The following guidelines must be met to ensure Emailed invoices are handled promptly: • Infineum’s Affiliate name must be added to the subject of the email. • Send only one invoice with supporting documentation per attachment. • Send only one attachment per Email. • All invoices must be in the form of an attachment (i.e. no invoice data in the body of the Email). • Email size cannot be greater than 10MB • Do not include embedded links or pictures in the Email or attachment. • Do not include handwritten information on the invoices. • Invoices submitted via Hyperlink through tools like Accellion cannot be accepted and are rejected by automated workflow tools. Send invoices as a PDF readable attachment via Email to Infineum Payables via the correct Infineum affiliate email as listed below: Purchaser (Affiliate’s Name) Delivery of Invoice Infineum USA L.P. [email protected] Infineum -

U.S. Sanctions Venezuelan Oil Industry

ALERT MEMORANDUM U.S. Sanctions Venezuelan Oil Industry January 29, 2019 On January 28, 2019, the U.S. Department of the Treasury’s Office of Foreign Assets Control (“OFAC”), in consultation with the U.S. If you have any questions concerning Department of State, determined that persons operating in Venezuela’s oil this memorandum, please reach out to your regular firm contact or the sector are subject to sanctions under Executive Order (“E.O.”) 13850. As following authors a result, OFAC concurrently designated Petróleos de Venezuela, S.A. (“PdVSA”) as a specially designated national (“SDN”) pursuant to E.O. WASHINGTON 13850 for operating within this sector. Effective immediately, PdVSA is Paul Marquardt now included on OFAC’s list of SDNs (the “SDN List”) and all property +1 202 974 1648 and interests in property of PdVSA subject to U.S. jurisdiction are now [email protected] blocked. Nathanael Kurcab OFAC simultaneously amended previously-issued General License 3 by +1 202 974 1652 [email protected] issuing General License 3A (“GL 3A”) and issued eight (8) new general licenses related to the designation of PdVSA. Newly issued General Licenses 7, 8, 9, 10, 11, 12, 13, and 14—which are summarized further below—are intended to mitigate the impact of the designation of PdVSA outside of Venezuela by providing certain exemptions and time-limited authorizations for certain transactions and activities related to PdVSA and its subsidiaries. KEY TAKEAWAYS At a high level, as a result of OFAC’s designation of PdVSA and issuance of related general licenses: • all assets of PdVSA and its direct and indirect subsidiaries owned 50% or more by PdVSA or other SDNs (in the aggregate) within U.S. -

2005-2009 Financial and Operational Information

FIVE-YEAR FACT BOOK Royal Dutch Shell plc FINaNcIAL aND OPERATIoNAL INFoRMATIoN 2005–2009 ABBREVIATIONS WE help meet ThE world’S growing demand for energy in Currencies € euro economically, environmentally £ pound sterling and socially responsible wayS. $ US dollar Units of measurement acre approximately 0.4 hectares or 4 square kilometres About This report b(/d) barrels (per day) bcf/d billion cubic feet per day This five-year fact book enables the reader to see our boe(/d) barrel of oil equivalent (per day); natural gas has financial and operational performance over varying been converted to oil equivalent using a factor of timescales – from 2005 to 2009, with every year in 5,800 scf per barrel between. Wherever possible, the facts and figures have dwt deadweight tonnes kboe/d thousand barrels of oil equivalent per day been made comparable. The information in this publication km kilometres is best understood in combination with the narrative km2 square kilometres contained in our Annual Report and Form 20-F 2009. m metres MM million Information from this and our other reports is available for MMBtu million British thermal unit online reading and downloading at: mtpa million tonnes per annum www.shell.com/annualreports mscm million standard cubic metres MW megawatts The webpages contain interactive chart generators, per day volumes are converted to a daily basis using a downloadable tables in Excel format, hyperlinks to other calendar year webpages and an enhanced search tool. Sections of the scf standard cubic feet reports can also be downloaded separately or combined tcf trillion cubic feet into a custom-made PDF file. -

2005 Annual Report on Form 20-F

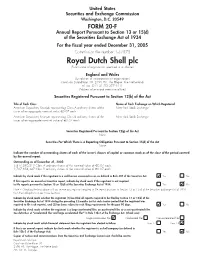

United States Securities and Exchange Commission Washington, D.C. 20549 FORM 20-F Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended December 31, 2005 Commission file number 1-32575 Royal Dutch Shell plc (Exact name of registrant as specified in its charter) England and Wales (Jurisdiction of incorporation or organisation) Carel van Bylandtlaan 30, 2596 HR, The Hague, The Netherlands tel. no: (011 31 70) 377 9111 (Address of principal executive offices) Securities Registered Pursuant to Section 12(b) of the Act Title of Each Class Name of Each Exchange on Which Registered American Depositary Receipts representing Class A ordinary shares of the New York Stock Exchange issuer of an aggregate nominal value €0.07 each American Depositary Receipts representing Class B ordinary shares of the New York Stock Exchange issuer of an aggregate nominal value of €0.07 each Securities Registered Pursuant to Section 12(g) of the Act None Securities For Which There is a Reporting Obligation Pursuant to Section 15(d) of the Act None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. Outstanding as of December 31, 2005: 3,817,240,213 Class A ordinary shares of the nominal value of €0.07 each. 2,707,858,347 Class B ordinary shares of the nominal value of €0.07 each. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

Daniel Suarez

DANIEL SUÁREZ Toyota Certified Used Vehicles Camry Team Report Round 17 of 36 – Quaker State 400 – Kentucky Car No.: 96 –Toyota Certified Used Vehicles Camry PR Contact: Laz Denes, True Speed Communication (704) 875-3388 ext. 806 or [email protected]) Primary Team Members: Driver: Daniel Suárez Crew Chief: Dave Winston Hometown: Monterrey, Mexico Hometown: Miami, Florida Technical Director: Nick Ollila Car Chief: Mark Hillman Hometown: Warren, Michigan Hometown: Lockport, New York Engine Builder: Toyota Racing Development Engine Specialist: Kirk Butterfield Headquarters: Costa Mesa, California Hometown: Carrollton, Ohio Spotter: Steve Barkdoll Hometown: Garrison, Iowa Over-The-Wall Crew Members: Gas Man: Cory White Front Tire Changer: Mike Mead Hometown: Vinson, Iowa Hometown: Sherrills Ford, North Carolina Jackman: Joel Bouagnon Rear Tire Changer: Brandon Traino Hometown: St. Charles, Illinois Hometown: Cherry Hill, New Jersey Windshield: Mark Hillman Tire Carrier: Mason Harris Hometown: Lockport, New York Hometown: Fort Oglethorpe, Georgia Kentucky Notes of Interest: After piloting the No. 19 NASCAR Cup Series Toyota for Joe Gibbs Racing in 2017 and 2018, then the No. 41 Cup Series entry for Stewart-Haas Racing in 2019, Suárez joined the single-car No. 96 Toyota Camry effort for Gaunt Brothers Racing (GBR) for the full 2020 season. Suárez will be making his 124th career NASCAR Cup Series start in Sunday’s Quaker State 400 at Kentucky Speedway in Sparta. He has career totals of eight top-five finishes, 32 top-10s and 242 laps led, with an average start of 17.5 and an average finish of 18.2. He also has qualified on the pole twice, most recently in this race last year in his Stewart-Haas entry.