Pennsylvania Real Estate Investment Trust ®

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

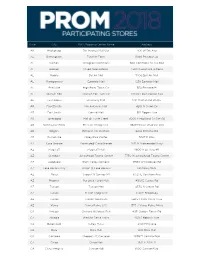

Prom 2018 Event Store List 1.17.18

State City Mall/Shopping Center Name Address AK Anchorage 5th Avenue Mall-Sur 406 W 5th Ave AL Birmingham Tutwiler Farm 5060 Pinnacle Sq AL Dothan Wiregrass Commons 900 Commons Dr Ste 900 AL Hoover Riverchase Galleria 2300 Riverchase Galleria AL Mobile Bel Air Mall 3400 Bell Air Mall AL Montgomery Eastdale Mall 1236 Eastdale Mall AL Prattville High Point Town Ctr 550 Pinnacle Pl AL Spanish Fort Spanish Fort Twn Ctr 22500 Town Center Ave AL Tuscaloosa University Mall 1701 Macfarland Blvd E AR Fayetteville Nw Arkansas Mall 4201 N Shiloh Dr AR Fort Smith Central Mall 5111 Rogers Ave AR Jonesboro Mall @ Turtle Creek 3000 E Highland Dr Ste 516 AR North Little Rock Mc Cain Shopg Cntr 3929 Mccain Blvd Ste 500 AR Rogers Pinnacle Hlls Promde 2202 Bellview Rd AR Russellville Valley Park Center 3057 E Main AZ Casa Grande Promnde@ Casa Grande 1041 N Promenade Pkwy AZ Flagstaff Flagstaff Mall 4600 N Us Hwy 89 AZ Glendale Arrowhead Towne Center 7750 W Arrowhead Towne Center AZ Goodyear Palm Valley Cornerst 13333 W Mcdowell Rd AZ Lake Havasu City Shops @ Lake Havasu 5651 Hwy 95 N AZ Mesa Superst'N Springs Ml 6525 E Southern Ave AZ Phoenix Paradise Valley Mall 4510 E Cactus Rd AZ Tucson Tucson Mall 4530 N Oracle Rd AZ Tucson El Con Shpg Cntr 3501 E Broadway AZ Tucson Tucson Spectrum 5265 S Calle Santa Cruz AZ Yuma Yuma Palms S/C 1375 S Yuma Palms Pkwy CA Antioch Orchard @Slatten Rch 4951 Slatten Ranch Rd CA Arcadia Westfld Santa Anita 400 S Baldwin Ave CA Bakersfield Valley Plaza 2501 Ming Ave CA Brea Brea Mall 400 Brea Mall CA Carlsbad Shoppes At Carlsbad -

Q413 Supplemental 021814.Xlsx

Pennsylvania Real Estate Investment Trust ® Supplemental Financial and Operating Information Quarter Ended December 31, 2013 www.preit.com NYSE: PEI NYSE: PEIPRA, PEIPRB Pennsylvania Real Estate Investment Trust Supplemental Financial and Operating Information December 31, 2013 Table of Contents Introduction Company Information 1 Market Capitalization and Capital Resources 2 Operating Results Statement of Operations - Proportionate Consolidation Method - Quarters Ended December 31, 2013 and December 31, 2012 3 Statement of Operations - Proportionate Consolidation Method - Years Ended December 31, 2013 and December 31, 2012 4 Statement of Net Operating Income - Quarters and Years Ended December 31, 2013 and December 31, 2012 5 Computation of Earnings Per Share 6 Funds From Operations and Funds Available for Distribution - Quarters Ended December 31, 2013 and December 31, 2012 7 Funds From Operations and Funds Available for Distribution - Years Ended December 31, 2013 and December 31, 2012 8 Operating Statistics Leasing Activity Summary 9 Summarized Sales and Rent Per Square Foot and Occupancy Percentages 10 Mall Occupancy Percentage and Sales Per Square Foot 11 Strip and Power Center Occupancy Percentages 12 Top Twenty Tenants 13 Lease Expirations 14 Property Information 15 Department Store Lease Expirations 17 Balance Sheet Condensed Balance Sheet - Proportionate Consolidation Method 19 Investment in Real Estate 20 Capital Expenditures 22 Debt Analysis 23 Debt Schedule 24 Selected Debt Ratios 25 Definitions 26 Forward Looking Statements 27 Pennsylvania Real Estate Investment Trust Company Information Background Pennsylvania Real Estate Investment Trust, founded in 1960 and one of the first equity REITs in the U.S., has a primary investment focus on retail shopping malls. As of December 31, 2013, the Company owned interests in 43 retail properties, 40 of which are operating retail properties and three are development properties. -

Land for Sale - North Whitehall, PA ROUTE 309 & LEVANS ROAD | LEHIGH COUNTY

Land For Sale - North Whitehall, PA ROUTE 309 & LEVANS ROAD | LEHIGH COUNTY 40.6 ACRES AVAILABLE PROPERTY INFO CCC Community Services Center + PROPERTY SIZE: 40.6 Acres + ZONING: The site is zoned to allow for a Planned Commercial Development as a Conditional Use + LOCATION: Site is located in the Northwest portion of the Lehigh Valley Metropolitan Area in the Village of Schnecksville, North Whitehall Township Schnecksville Fire Company Old Packhouse Rd Carbon Lehigh Intermediate Unit CONTACT US SITE Jeffrey Cohen Executive Vice President 484 567 2368 [email protected] 18,968 ADT Licensed: DE, MD, PA Licensed Salesperson: NJ 309 Levans Rd CBRE, Inc. 625 West Ridge Pike 3,645 ADT Building A; Suite 100 Conshohocken, PA 19428 T 610 834 8000 F 610 834 1793 Licensed Real Estate Broker Land For Sale - North Whitehall, PA ROUTE 309 & LEVANS ROAD | LEHIGH COUNTY 40.6 ACRES AVAILABLE Old Pachouse Rd SITE 3,645 ADT Leans Rd 476 30,454 ADT 18,68 ADT Heritage Baptist Church 309 © 2019 CBRE, Inc. All rights reserved. This information has been obtained from sources believed reliable, but has not been verified for accuracy or completeness. You should conduct a careful, independent investigation of the property and verify all information. Any reliance on this information is solely at your own risk. CBRE and the CBRE logo are service marks of CBRE, Inc. All other marks displayed on this document are the property of their respective owners. Land For Sale - North Whitehall, PA ROUTE 309 & LEVANS ROAD | LEHIGH COUNTY 40.6 ACRES AVAILABLE 476 DEMOGRAPHICS 3 Miles 5 Miles 7 Miles Agricultural/ 329 Residential Population (Est. -

Pennsylvania Real Estate Investment Trust

Pennsylvania Real Estate Investment Trust QUARTERLY SUPPLEMENTAL DISCLOSURE (March 31, 2005) www.preit.com Pennsylvania REIT QUARTERLY SUPPLEMENTAL DISCLOSURE (March 31, 2005) Table of Contents Company Information 1 Property Development/Redevelopment Summary 19 Timeline/Recent Developments 2 Top Twenty Tenants Schedule 20 Stock Information 3 Lease Expiration Schedule - Anchor Tenants 21 Market Capitalization and Capital Resources 4 Lease Expiration Schedule - Non-Anchor Tenants 22 Balance Sheet--Wholly Owned and Partnerships Detail 5 New Lease/Renewal Summary and Analysis 23 Balance Sheet--Property Type 6 Capital Expenditures-Quarterly 24 Income Statement--Wholly Owned and Partnerships Detail -Quarterly Comparison 7 Enclosed Mall-Summary and Occupancy 25 Income Statement--Property Type- Quarterly Comparison 8 Enclosed Mall-Rent Summary 26 Income Statement--Retail (Property Status) -Quarterly Comparison 9 Power Center- Summary and Occupancy 27 Income Statement--Retail (Property Subtype) -Quarterly Comparison 10 Strip Center- Summary and Occupancy 28 FFO and FAD 11 Retail Overall- Summary and Occupancy 29 Key Ratios 12 Summary of Portfolio Services 30 Property Debt Schedule--Wholly Owned 13 Flash Report-Quarterly 31 Property Debt Schedule--Partnerships 14 Debt Analysis 15 RECONCILIATION TO GAAP: Debt Ratios 16 Balance Sheet-Reconciliation to GAAP 32 Portfolio Summary--Retail 17 Income Statement-Reconciliation to GAAP -Quarterly 33 Property Acquisitions/Dispositions- Quarterly Summary 18 Flash Report-Reconciliation to GAAP- Quarterly 34 Definitions page 35 THIS QUARTERLY SUPPLEMENTAL DISCLOSURE CONTAINS CERTAIN “FORWARD-LOOKING STATEMENTS” THAT RELATE TO EXPECTATIONS, PROJECTIONS, ANTICIPATED EVENTS, TRENDS AND OTHER MATTERS THAT ARE NOT HISTORICAL FACTS. THESE FORWARD-LOOKING STATEMENTS REFLECT PREIT’S CURRENT VIEWS ABOUT FUTURE EVENTS AND ARE SUBJECT TO RISKS, UNCERTAINTIES AND ASSUMPTIONS THAT MAY CAUSE FUTURE EVENTS, ACHIEVEMENTS OR RESULTS TO DIFFER MATERIALLY FROM THOSE EXPRESSED BY THE FORWARD-LOOKING STATEMENTS. -

Q2 Investor Update

Q2 INVESTOR UPDATE PREIT Malls ABOUT PREIT Our community-centric retail and leisure real estate solutions maximize opportunities for the communities we serve, connecting people to jobs and businesses to customers. Our portfolio is located primarily in densely-populated, high businesses barrier-to-entry markets attractive to a wide array of uses. Recognizing the role we play, we optimize our real estate to create the most sustainable business model for each community, in turn MAXIMIZING THE VALUE OF OUR customers jobs PORTFOLIO FOR STAKEHOLDERS. PREIT has spent the last decade creating a stronger portfolio that meets the needs of the modern consumer through thriving disposition of 19 lower-productivity properties, repositioning communities 19 anchor boxes with over 3 dozen new tenants and securing a differentiated tenant base that is comprised of 30% “open air” tenancy. 2 Q2 FINANCIAL HIGHLIGHTS Same store NOI is up 62% Total liquidity of $104.9 million at end of Q2 FFO per share exceeding plan at $0.10, up 267% over the 2020 quarter Core Mall June sales +16% over June 3 Q2 OPERATING HIGHLIGHTS Core Mall Rolling 12 sales are est. to have reached a new high at $549 per sq Total Core Mall leased ft, an increase of space at 92.6% 1.3% over last reported comp sales in Feb. 2020 Construction is underway 500,000 sq ft of leases for Aldi to open its first signed for future openings, store in our portfolio at expected to contribute Dartmouth Mall in annual gross rent of $10.8 Dartmouth, MA in Q3 million 2021 4 RECENT ACTIVITY Phoenix Theatres signed a lease to replace former theater at Woodland Mall in Grand Rapids HomeGoods will replace the former Bed Bath & Beyond space at Cumberland Mall New retailer, Turn 7 signed to replace the former Lord & Taylor at Moorestown Mall Our properties welcomed 15 new tenants across the portfolio in Q2, accounting for over 120,000 square feet of leased space Retailers expanding in portfolio: Aerie/Offline, Rose & Remington, Windsor, Purple and more. -

Arkansas Colorado Florida Georgia Illinois Indiana

THE FOLLOWING STORES ARE CLOSED THANKSGIVING - RE-OPEN AT 5AM FRIDAY SHOP BLACK FRIDAY DOORBUSTERS ALL DAY THANKSGIVING AT SEARS.COM ALL OTHER SEARS STORES OPEN 6PM THANKSGIVING DAY ARKANSAS ILLINOIS NEW MEXICO HOT SPRINGS SEARS PERU SEARS BROADMOOR CENTER 4501 CENTRAL AVE STE 101 1607 36TH ST 1000 S MAIN ST HOT SPRINGS, AR PERU, IL, 61354-1232 ROSWELL, NM (501) 525-5197 M(815) 220-4700 (575) 622-1310 6P NORTH PLAINS MALL THANKSGIVINGCOLORADO INDIANA 2811 N PRINCE ST CLOVIS, NM FORT COLLINS SEARS MARQUETTE S/C (575) 769-4700 3400 S COLLEGE AVENUE 3901 FRANKLIN ST FT COLLINS, CO MICHIGAN CITY , IN 46360-7314 970-297-2770 (219) 878-6600 NEW YORK TOWN SQUARE SHOPPING CTR WILTON MALL FLORIDA 120 US HIGHWAY 41 3065 ROUTE 50 SCHERERVILLE, IN SARATOGA SPGS, NY GULF VIEW SQ (219) 864-8987 (518) 583-8500 9409 US HIGHWAY 19 N STE 101 PORT RICHEY, FL (727) 846-6255 MARYLAND NORTH CAROLINA OVIEDO MARKETPLACE EAST POINT MALL MONROE MALL 1360 OVIEDO MARKETPLACE BLVD 7885 EASTERN BLVD 2115 E ROOSEVELT BLVD STE 200 OVIEDO, FL BALTIMORE, MD MONROE, NC (407) 971-2600 (410) 288-7700 (704) 225-2100 SEMINOLE TOWNE CTR TOWNMALL OF WESTMINSTER RANDOLPH MALL 320 TOWNE CENTER CIR 400 N CENTER ST 200 RANDOLPH MALL SANFORD, FL WESTMINSTER, MD ASHEBORO, NC (407) 328-2600 (410) 386-6500 (336) 633-3200 SEARSTOWN MALL 3550 S WASHINGTON AVE MISSOURI NORTH DAKOTA TITUSVILLE, FL (321) 268-9255 EAST HILLS MALL COLUMBIA MALL 3702 FREDERICK AVE 2800 S COLUMBIA RD SAINT JOSEPH, MO GRAND FORKS, ND GEORGIA (816) 364-7000 (701) 787-9300 ALBANY MALL 2601 DAWSON RD BLDG G NEW -

Personal Rapid Transit (PRT) New Jersey

Personal Rapid Transit (PRT) for New Jersey By ORF 467 Transportation Systems Analysis, Fall 2004/05 Princeton University Prof. Alain L. Kornhauser Nkonye Okoh Mathe Y. Mosny Shawn Woodruff Rachel M. Blair Jeffery R Jones James H. Cong Jessica Blankshain Mike Daylamani Diana M. Zakem Darius A Craton Michael R Eber Matthew M Lauria Bradford Lyman M Martin-Easton Robert M Bauer Neset I Pirkul Megan L. Bernard Eugene Gokhvat Nike Lawrence Charles Wiggins Table of Contents: Executive Summary ....................................................................................................................... 2 Introduction to Personal Rapid Transit .......................................................................................... 3 New Jersey Coastline Summary .................................................................................................... 5 Burlington County (M. Mosney '06) ..............................................................................................6 Monmouth County (M. Bernard '06 & N. Pirkul '05) .....................................................................9 Hunterdon County (S. Woodruff GS .......................................................................................... 24 Mercer County (M. Martin-Easton '05) ........................................................................................31 Union County (B. Chu '05) ...........................................................................................................37 Cape May County (M. Eber '06) …...............................................................................................42 -

Philadelphia Premium Outlets® the Simon Experience — Where Brands & Communities Come Together

PHILADELPHIA PREMIUM OUTLETS® THE SIMON EXPERIENCE — WHERE BRANDS & COMMUNITIES COME TOGETHER More than real estate, we are a company of experiences. For our guests, we provide distinctive shopping, dining and entertainment. For our retailers, we offer the unique opportunity to thrive in the best retail real estate in the best markets. From new projects and redevelopments to acquisitions and mergers, we are continuously evaluating our portfolio to enhance the Simon experience - places where people choose to shop and retailers want to be. We deliver: SCALE Largest global owner of retail real estate including Malls, Simon Premium Outlets® and The Mills® QUALITY Iconic, irreplaceable properties in great locations INVESTMENT Active portfolio management increases productivity and returns GROWTH Core business and strategic acquisitions drive performance EXPERIENCE Decades of expertise in development, ownership, and management That’s the advantage of leasing with Simon. PROPERTY OVERVIEW PHILADELPHIA PREMIUM OUTLETS® LIMERICK TOWNSHIP, PA Easton MAJOR METROPOLITAN AREAS SELECT TENANTS Allentown Delaware 78 Water Gap Philadelphia: 35 miles southeast Neiman Marcus Last Call, adidas, Ann Taylor Factory Store, Asics, Banana Republic Factory Store, BCBGMAXAZRIA, Brooks Brothers 183 RETAIL Factory Store, Calvin Klein Company Store, Coach Factory Store, Reading 476 Cole Haan Outlet, Diesel, DKNY Company Store, Elie Tahari Outlet, 422 GLA (sq. ft.) 549,000; 150 stores Forever 21, Gap Factory Store, GUESS Factory Store, J.Crew Factory, 76 95 222 Sanatoga -

2019 Property Portfolio Simon Malls®

The Shops at Clearfork Denver Premium Outlets® The Colonnade Outlets at Sawgrass Mills® 2019 PROPERTY PORTFOLIO SIMON MALLS® LOCATION GLA IN SQ. FT. MAJOR RETAILERS CONTACTS PROPERTY NAME 2 THE SIMON EXPERIENCE WHERE BRANDS & COMMUNITIES COME TOGETHER SIMON MALLS® LOCATION GLA IN SQ. FT. MAJOR RETAILERS CONTACTS PROPERTY NAME 2 ABOUT SIMON Simon® is a global leader in retail real estate ownership, management, and development and an S&P 100 company (Simon Property Group, NYSE:SPG). Our industry-leading retail properties and investments across North America, Europe, and Asia provide shopping experiences for millions of consumers every day and generate billions in annual sales. For more information, visit simon.com. · Information as of 12/16/2019 3 SIMON MALLS® LOCATION GLA IN SQ. FT. MAJOR RETAILERS CONTACTS PROPERTY NAME More than real estate, we are a company of experiences. For our guests, we provide distinctive shopping, dining, and entertainment. For our retailers, we offer the unique opportunity to thrive in the best retail real estate in the best markets. From new projects and redevelopments to acquisitions and mergers, we are continuously evaluating our portfolio to enhance the Simon experience—places where people choose to shop and retailers want to be. 4 LOCATION GLA IN SQ. FT. MAJOR RETAILERS CONTACTS PROPERTY NAME WE DELIVER: SCALE A global leader in the ownership of premier shopping, dining, entertainment, and mixed-use destinations, including Simon Malls®, Simon Premium Outlets®, and The Mills® QUALITY Iconic, irreplaceable properties in great locations INVESTMENT Active portfolio management increases productivity and returns GROWTH Core business and strategic acquisitions drive performance EXPERIENCE Decades of expertise in development, ownership, and management That’s the advantage of leasing with Simon. -

Q207 Supplemental 073107 Final

Pennsylvania Real Estate Investment Trust Supplemental Financial and Operating Information Quarter Ended June 30, 2007 www.preit.com NYSE: (PEI) Pennsylvania Real Estate Investment Trust Supplemental Financial and Operating Information June 30, 2007 Table of Contents Introduction Company Information 1 Press Release Announcements 2 Market Capitalization and Capital Resources 3 Operating Results Income Statement-Proportionate Consolidation Method - Three Months Ended June 30, 2007 and 2006 4 Income Statement-Proportionate Consolidation Method - Six Months Ended June 30, 2007 and 2006 5 Net Operating Income - Three Months Ended June 30, 2007 and 2006 6 Net Operating Income - Six Months Ended June 30, 2007 and 2006 7 Computation of Earnings per Share 8 Funds From Operations and Funds Available for Distribution 9 Operating Statistics Leasing Activity Summary 10 Summarized Rent Per Square Foot and Occupancy Percentages 11 Mall Sales and Rents Per Square Foot 12 Mall Occupancy - Owned GLA 13 Power Center and Strip Center Rents Per Square Foot and Occupancy Percentages 14 Top Twenty Tenants 15 Lease Expirations 16 Gross Leasable Area Summary 17 Property Information 18 Balance Sheet Balance Sheet - Proportionate Consolidation Method 21 Balance Sheet - Property Type 22 Investment in Real Estate 23 Property Redevelopment and Repositioning Summary 25 Development Property Summary 26 Capital Expenditures 27 Debt Analysis 28 Debt Schedule 29 Shareholder Information 30 Definitions 31 FORWARD-LOOKING STATEMENTS This Quarterly Supplemental Financial and Operating Information contains certain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. -

November Feature Article Employment in New Jersey’S Labor Areas Annual Review and Outlook Series

November Feature Article Employment in New Jersey’s Labor Areas Annual Review and Outlook Series he national and state economic outlooks are both appreciably more positive than at this time last year. As 2009 ends, most experts believe that the economy bottomed out in theT third quarter and that a fragile recovery is underway. The most recent Gross Domestic Product (GDP) estimates support this view. In the third quarter, GDP grew at an annualized rate of 3.5 percent, a marked improvement over the huge losses suffered in the fourth quarter of 2008 and the first quarter of this year. Since then, GDP declined by 0.7 percent in the second quarter and had positive growth of 3.5 percent in the third quarter. Most experts believe that the economy will grow between 2.5 to 3.0 percent in 2010. Personal consumption expenditures in the third quarter were up 3.4 percent, after declin- ing in three of the previous four quarters. A challenge going forward will be to sustain con- sumer spending in the face of some serious obstacles, some of which are discussed below. The outlook for the labor market is far less optimistic. The labor market economy will es- sentially remain stagnant for a while longer. The national unemployment rate is now in double digits for the first time since the 1981-1982 recession. The New Jersey unemployment rate is at the highest level since early 1977. In October 2009, the national unemployment rate increased to 10.2 percent while the New Jersey unemployment rate rose to 9.7 percent. -

Phase 5: Thinkfang

Frank Edward Nora Thinkfang THINKFANG by Frank Edward Nora The First Edition was published in 2003 and was called Duskaway Parking . This Second Edition is being published on August 12, 2009 and was renamed Thinkfang . Published by Frank Edward Nora New Jersey, USA onsug.com • [email protected] Creative Commons Attribution-Noncommercial-No Derivative Works 3.0 United States http://creativecommons.org/licenses/by-nc-nd/3.0/us/ INTRODUCTION (FROM THE FIRST EDITION) Duskaway Parking is composed of 1,103 little numbered poems called “Superiors”. I wrote these over the course of 11 years, from late February 1992 to late February 2003. The Superiors originally appeared in my weekly ezine, “OsoaWeek”, which I published on my website. The Superiors began as poetry, but over time began to include other themes. Some of them are brief essays. Others are like diary entries. And some are like little science fiction stories. They are full of beauty and ugliness, focus and blur, just like life. The best of them still amaze me, and the worst make me cringe and shake my head. But all of them are here, in this book, in their original form. One aspect of Superior that has confused some people is all the made-up words and names and places. These are straight from my hyperactive creative mind, and in many instances I feel they convey ideas and images and atmospheres better than any real words. And keep in mind the science fiction aspect, with all sorts of mysterious characters, locales, and powers. And also keep in mind that there are references to real, but obscure, things as well, which does tend to muddle things a bit..