San Francisco Bay Area Rapid Transit District

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Warm Springs Extension Title VI Equity Analysis and Public Participation Report

Warm Springs Extension Title VI Equity Analysis and Public Participation Report May 7, 2015 Prepared jointly by CDM Smith and the San Francisco Bay Area Rapid Transit District, Office of Civil Rights 1 Table of Contents Executive Summary 3 Section 1: Introduction 6 Section 2: Project Description 7 Section 3: Methodology 14 Section 4: Service Analysis Findings 23 Section 5: Fare Analysis Findings 27 Appendix A: 2011 Warm Springs Survey 33 Appendix B: Proposed Service Options Description 36 Public Participation Report 4 1 2 Warm Springs Extension Title VI Equity Analysis and Public Participation Report Executive Summary In June 2011, staff completed a Title VI Analysis for the Warm Springs Extension Project (Project). Per the Federal Transit Administration (FTA) Title VI Circular (Circular) 4702.1B, Title VI Requirements and Guidelines for Federal Transit Administration Recipients (October 1, 2012), the District is required to conduct a Title VI Service and Fare Equity Analysis (Title VI Equity Analysis) for the Project's proposed service and fare plan six months prior to revenue service. Accordingly, staff completed an updated Title VI Equity Analysis for the Project’s service and fare plan, which evaluates whether the Project’s proposed service and fare will have a disparate impact on minority populations or a disproportionate burden on low-income populations based on the District’s Disparate Impact and Disproportionate Burden Policy (DI/DB Policy) adopted by the Board on July 11, 2013 and FTA approved Title VI service and fare methodologies. Discussion: The Warm Springs Extension will add 5.4-miles of new track from the existing Fremont Station south to a new station in the Warm Springs district of the City of Fremont, extending BART’s service in southern Alameda County. -

EMMA Official Statement

NEW ISSUE – BOOK ENTRY ONLY RATINGS: Moody’s (2020 Bonds): Aaa Long Term Standard & Poor’s (2020C-1 Bonds): AAA Short Term Standard & Poor’s (2020C-2 Bonds): A-1+ See “Ratings” herein. In the opinion of Orrick, Herrington & Sutcliffe LLP, Bond Counsel to the District, based upon an analysis of existing laws, regulations, rulings and court decisions, and assuming, among other matters, the accuracy of certain representations and compliance with certain covenants, interest on the 2020C-1 Bonds is excluded from gross income for federal income tax purposes under Section 103 of the Internal Revenue Code of 1986. In the further opinion of Bond Counsel, interest on the 2020C-1 Bonds is not a specific preference item for purposes of the federal alternative minimum tax. Bond Counsel is also of the opinion that interest on the 2020 Bonds is exempt from State of California personal income taxes. Bond Counsel further observes that interest on the 2020C-2 Bonds is not excluded from gross income for federal income tax purposes under Section 103 of the Code. Bond Counsel expresses no opinion regarding any other tax consequences related to the ownership or disposition of, or the amount, accrual or receipt of interest on, the 2020 Bonds. See “TAX MATTERS.” $700,000,000 SAN FRANCISCO BAY AREA RAPID TRANSIT DISTRICT GENERAL OBLIGATION BONDS $625,005,000 $74,995,000 (ELECTION OF 2016), (ELECTION OF 2016), 2020 SERIES C-1 2020 SERIES C-2 (FEDERALLY TAXABLE) (GREEN BONDS) (GREEN BONDS) Dated: Date of Delivery Due: As shown on inside cover The San Francisco Bay Area Rapid Transit District General Obligation Bonds (Election of 2016), 2020 Series C-1 (Green Bonds) (the “2020C-1 Bonds”) and 2020 Series C-2 (Federally Taxable) (Green Bonds) (the “2020C-2 Bonds” and, together with the 2020C-1 Bonds, the “2020 Bonds”) are being issued to finance specific acquisition, construction and improvement projects for District facilities approved by the voters and to pay the costs of issuance of the 2020 Bonds. -

Semi-Annual Report June 2017

2000 Measure A Program Semi-Annual Report June 2017 2000 Measure A Program Semi-Annual Report – June 2017 Table of Contents TABLE OF CONTENTS Section Title Page 1 EXECUTIVE SUMMARY AND PROJECT COSTS A. Executive Summary .............................................................................1-2 B. Project Costs .........................................................................................1-5 C. Measure A Fund Exchange ................................................................1..-8 D. Funding................................................................................................1-.9 2 PROJECT SUMMARY REPORTS 1 Silicon Valley Rapid Transit 1. BART SV Program Development Implementation & 2-1-1 Warm Springs 2. BART SV Corridor Establishment and Maintenance ..........................2-1-2 3. Berryessa Extension Project SVBX - Phase 1 ................................2-1-3.... 4 Future Extension to Santa Clara – Phase II and NMF .........................2-1-4 5. BART Core Systems Modifications (BCS) ................................2-........1-5 6. Other Supporting Project ………………………………….. 2-1-6 2. Mineta San Jose Airport People Mover ..............................................2-2 3. Capitol Expressway Light Rail to Eastridge .......................................2-3 4. Low Floor Light Rail Vehicles.............................................................2-4 5. Caltrain – Capacity Improvements & Electrification ...........................2-5 6. Caltrain Service Upgrades ................................................................2...-6 -

2009 Draft EIS Chapter 5.14: Visual Quality and Aesthetics

Silicon Valley Rapid Transit Corridor EIS 5.14 VISUAL QUALITY AND AESTHETICS This section assesses the visual affects of the alternatives and associated facilities and alignment features. Viewpoints along the corridor where the project alternatives and options could affect existing visual quality are identified and evaluated with and without a project. These include corridor locations possessing sensitive viewer groups or offering scenic views. 5.14.1 INTRODUCTION Adverse effects to visual and aesthetic resources would include substantial degradation of the existing visual character or quality of the SVRTC and its surroundings, substantial contrast with the scale or visual context of the surrounding landscape, creation of a substantial new source of light or glare that would adversely affect day or nighttime views in the area, and substantially altering a scenic vista. Visual resource change is analyzed in terms of visual dominance and other specific visual effects of facilities that would be constructed under the BEP and SVRTP alternatives, together with the change in visual quality. Viewer responses to these changes are interpreted based on the sensitivity of the viewer types identified and the duration of views. Three terms are used to describe effects on visual quality, including: ■ Vividness – Refers to the visual power of memorability of landscape components as they combine in striking and distinctive visual patterns. Effects would be evaluated based on the degree to which they affect the visual power or memorability of the landscape components. ■ Intactness – Refers to the visual integrity of the natural and man-made landscapes. Effects would be evaluated based on the degree to which they encroach into the visual integrity of the landscape. -

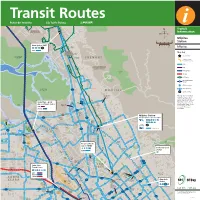

Milpitas Transit Routes

W Y P K A L L O M A U T Arroyo Agua Caliente Park 239 P L V D A B O S C E L L R D R B S 212 M E 239 E 239 R I M O S G P 215 680 Transit W A C U R I E S T 215 D PACIFIC A R E R COMMONS M Information 880 S 239 P R C I U N S N G H O S I N R B G T L P H V K P D Milpitas W 215 O Y R T 217 0 1mi Station FREMONT BLVD Warm Springs BART 215 E WARREN AVE 239 Warm B E N I C I A S T Springs 0 1km 215 217 239 Milpitas 217 Park BART 215 WARM Map Key SPRINGS Booster BAYSIDE PKWY DISTRICT Park WARM SPRINGS BLVD San Francisco Bay You Are Here National Wildlife Lone Tree Refuge Creek Park FREMONT 3-Minute Walk 880 500ft/150m Radius 680 BART PAGE M I K A T O RL D L M 239 IRVINGTON D O R ACE K N EE 217 CR DISTRICT T TT CO D S R R Amtrak Train K ATO RD Ed R. Levin 239 Park Caltrain D I X O NARIZONA R D 217 AC Transit 66 E S C U Amtrak Thruway E 17 L A Motorcoach WASHINGTON D 217 R 86 Monterey-Salinas Transit N J A C K L I N R D P San Francisco Bay 66 A R National Wildlife K 23 VTA Bus Service Refuge V MILPITAS I N C T M O VTA Light Rail R B I L P I I T A A D Alan B. -

Downtown-Diridon CWG Presentation 9-10-19

VTA’s BART Silicon Valley Phase II Extension Project Downtown-Diridon Community Working Group November 12, 2019 Agenda • Follow-Up Items & 2020 Work Plan • CWG Member Report Back • Government Affairs • Phase I Update • Phase II Update • Related Planning Efforts • Construction Education & Outreach Plan • Design Development Framework • Next Steps 2 Role of the CWG • Be project liaisons • Receive briefings on technical areas • Receive project updates • Build an understanding of the project • Collaborate with VTA • Contribute to the successful delivery of the project 3 Your Role as a CWG Member • Attend CWG meetings – Bring your own binder • Be honest • Report back and provide feedback • Get informed • Disseminate accurate information • Act as conduits for information to community at large 4 Role of the CWG Team CWG Team Member Role Eileen Goodwin Facilitator Gretchen Baisa Primary Outreach Contact Jill Gibson Phase II Planning Manager Kate Christopherson CWG Coordinator 5 Upcoming Meetings • CWG Dates – February 11, 2020, 4:00-6:00 PM – May 12, 2020, 4:00-6:00 PM – September 15, 2020, 4:00-6:00 PM – November 17, 2020, 4:00-6:00 PM • VTA Board of Directors (https://www.vta.org/about/board-and-committees) – December 5, 2019, 5:30 PM – January 9, 2020, 5:30 PM – February 6, 2020, 5:30 PM • Joint Policy Advisory Board (JPAB) (http://santaclaravta.iqm2.com/Citizens/Board/1074-Diridon-Station-Joint-Policy-Advisory- Board) – November 15, 2019, 3:00 PM 6 Follow-Up Items & 2020 Work Plan 7 Follow-Up Items • Links to the Downtown San José development tools were included in the September meeting summary. -

Vta's Bart Silicon Valley— Phase Ii Extension Project

VTA’S BART SILICON VALLEY— PHASE II EXTENSION PROJECT LOCATION HYDRAULIC STUDY P REPARED FOR : Santa Clara Valley Transportation Authority U.S. Department of Transportation Federal Transit Administration P R E P A R E D B Y : WRECO 1000 Broadway, Suite 415 Oakland, CA 94607 November 2017 WRECO. 2017. VTA’s BART Silicon Valley—Phase II Extension Project Location Hydraulic Study. November. San Jose, CA. Prepared for the Santa Clara Valley Transportation Authority, San Jose, CA, and the Federal Transit Administration, Washington, D.C. Errata E.1 Introduction This Errata reflects the modifications to the Phase II Extension Project – Location Hydraulic Study that may have resulted from comments received during the public review of the Supplemental Environmental Impact Statement (SEIS) and Subsequent Environmental Impact Report (SEIR) for the BART Silicon Valley Phase II Extension (Phase II) Project or that were required for purposes of clarifications. Changes to the Location Hydraulic Study shown in strikeout text for deletions and in underline text for additions. These modifications do not alter the conclusions of the environmental analysis such that new significant environmental impacts have been identified, nor do they constitute significant new information. The modifications are provided by chapter and indicated with the page number from the Location Hydraulic Study that they would replace. This Errata is intended to be used in conjunction with the Location Hydraulic Study. E.2 Chapter/Section Changes E.2.1 Global Changes to the Study Two station names from the Phase I Extension have been renamed: Berryessa Station (or Berryessa BART Station) is now Berryessa/North San Jose Station. -

River Oaks Pkwy

MONTAGUE OAKS FOR LEASE 19,985 SF 625 RIVER OAKS PARKWAY SAN JOSE "GOLDEN TRIANGLE" | CALIFORNIA MICHAEL ROSENDIN, sior, ccim CRAIG FORDYCE, sior, ccim SHANE MINNIS, leed ap +1 408 282 3900 +1 408 282 3911 +1 408 282 3901 [email protected] [email protected] [email protected] CA License No. 00826095 CA License No. 00872812 CA License No. 01708656 COLLIERS INTERNATIONAL | 225 West Santa Clara St, 10th Floor, Suite 1000, San Jose, CA 95113 | +1 408 282 3800 Main | +1 408 292 3855 Fax | www.colliers.com SHANE MINNIS, leed ap +1 408 282 3901 [email protected] CA License No. 01708656 MONTAGUE OAKS 611-697 River Oaks Parkway, San Jose, CA Montague Expy Seely Ave 625 A2 A1 River Oaks Pkwy Montague Expy Business Park Highlights • 8 building office/R&D business park • 3.3/1,000 parking ratio • Expansion opportunities • Prominent “Golden Triangle” location at intersection of • Walk to restaurants and amenities Montague Expressway and River Oaks Parkway • Walk to Light Rail (connects to Milpitas Station) • Broadband service providers include Comcast, AT&T, Verizon, • Central access to Highways 101, 880, 680 & 237 Covad, and others. ±15,178 Square Feet MONTAGUE OAKS 611-697 River Oaks Parkway, San Jose, CA Availability Address Size Available Date 625 River Oaks Pkwy 19,985 SF 4/1/2020 New common outdoor amenity areas S E E L Y A V E 631 611 625 RIVER OAKS PKWY 633 617 627 641 AMENITY AREA - A1 A2 645 695 683 685 A1 651 679 677 655 MONTAGUE EXPY AMENITY AREA - A2 MONTAGUE OAKS 625 River Oaks Parkway, San Jose, CA EXISTING -

The Downtown San Jose BART Station Area Playbook

BART VTA’s BART Phase II San Francisco Bay Transit Oriented Communities Caltrain VTA’s BART Strategy Study Phase I The Downtown San José BART Station Area Playbook For more information: See the Project Website at: www.vta.org/bart/tocs A recommended series of actions for the City of San Jose, VTA, and other implementation partners to get a once-in-a-generation opportunity right VTA’sPhase BART II Contact Us: [email protected] 408-321-7575 FINAL - JULY 2020 INTRODUCTION The Call To Action Content This Playbook presents a starting point for a long-term partnership between the City of San José and Santa Clara Valley Transportation Authority (VTA) to capitalize on the new Downtown San José BART Station. Downtown San José is undergoing a renaissance. The arrival of BART can help to Executive Summary further reposition downtown to a new place of prominence in the Bay Area. There is much to do to Page 1 ensure that the arrival of the station leads directly to realizing a vital, healthy, connected, prosperous, walkable, and equitable 24/7 downtown. The Big Moves We must begin working now. Page 18 The real estate market is already showing interest in the station area. Elevating Downtown San José to a long envisioned thriving, transit- anchored core requires implementing Transit Oriented Communities (TOC) principles well before BART arrives. The recommended actions in this “Playbook” provide a well-traveled, tried-and-true pathway to capitalize on this multi-billion dollar transit investment. Appendices Getting to the finish line requires a long-term, concerted partnership between the City of San José and VTA to take critical actions, like new policies, strategies, and investments essential to a TOC. -

Hsp Milp-Routes.Pdf

W Y P K A L L O M A U T Arroyo Agua Caliente Park 239 P L V D A B O S C E L L R D R B S 212 M E 239 E 239 R I M O S G P 215 680 Transit W A C U R I E S T 215 D PACIFIC A R E R COMMONS M Information 880 S 239 P R C I U N S N G H O S I N R B G T L V P H K P D Milpitas W 215 O Y R T 217 0 1mi Station FREMONT BLVD Warm Springs BART 215 E WARREN AVE 239 Warm B E N I C I A S T Springs 0 1km 215 217 239 Milpitas 181 217 Park BART 215 WARM Map Key SPRINGS Booster DISTRICT Park WARM SPRINGS BLVD San Francisco Bay You Are Here National Wildlife Lone Tree Refuge Creek Park FREMONT 3-Minute Walk 880 500ft/150m Radius 680 BART PAGE M I K A T O RL D L M 239 IRVINGTON D O R ACE K N EE 217 CR DISTRICT T TT CO D S R Amtrak Train K ATO RD Ed R. Levin 239 Park Caltrain D I X O NARIZONA R D 217 AC Transit 66 E S C U Monterey-Salinas E L 86 A Transit WASHINGTON D R 217 70 VTA Bus Service N J A C K L I N R D P San Francisco Bay 66 A B VTA Light Rail 181 R National Wildlife K Refuge V MILPITAS I N C 60 Route Terminus T M O I L R P I I T A A D Alan B. -

New BART Service to Milpitas and Berryessa/North San José Stations

New BART Service to Milpitas and Berryessa/North San José Stations Comments and Feedback Please answer the questions below. Your answers will help us evaluate how well we’re reaching the communities we serve. BART values your input. Information will be treated confidentially. USAGE OF BART (Optional) Do you have any comments on any of the options listed in questions 7-8? 1. Which BART station do you usually enter when making a trip from __________________________________________________________ your home (i.e., your “home” station)? __________________________________________________________ ____________________________________________________ __________________________________________________________ __________________________________________________________ 2. At which BART station do you usually exit the system (i.e., your __________________________________________________________ “destination” station)? ____________________________________________________ PROPOSED BART FARES FOR MILPITAS AND BERRYESSA/NORTH SAN 3. What time of day do you typically use BART? Select all that apply. JOSÉ STATIONS Morning Afternoon Evening Late night 9. BART plans to extend its distance-based fare structure for 4. Do you plan to use the Milpitas and/or Berryessa/North San José Milpitas and Berryessa/North San José Stations. For example, in Station? Select all that apply. 2018, a one-way trip to Embarcadero Station from Warm Yes, Milpitas Station Springs/South Fremont Station will cost $6.75, while a trip to Yes, Berryessa/North San José Station Embarcadero Station from Milpitas Station is estimated to cost Neither, I plan to use: ___________________ $7.50 ($0.75 more), and from Berryessa/North San José Station, $7.75 ($1.00 more). Do you have any general comments about 5. How will you access the Milpitas and/or Berryessa/North San José BART’s proposed fares for Milpitas and Berryessa/North San José Station? Select all that apply. -

River Oaks Pkwy

MONTAGUE OAKS FOR LEASE 21,172 SF 695 RIVER OAKS PARKWAY SAN JOSE "GOLDEN TRIANGLE" | CALIFORNIA MICHAEL ROSENDIN, sior, ccim CRAIG FORDYCE, sior, ccim SHANE MINNIS, leed ap +1 408 282 3900 +1 408 282 3911 +1 408 282 3901 [email protected] [email protected] [email protected] CA License No. 00826095 CA License No. 00872812 CA License No. 01708656 COLLIERS INTERNATIONAL | 225 West Santa Clara St, 10th Floor, Suite 1000, San Jose, CA 95113 | +1 408 282 3800 Main | +1 408 292 3855 Fax | www.colliers.com MONTAGUE OAKS 611-697 River Oaks Parkway, San Jose, CA Montague Expy Seely Ave A2 695 A1 River Oaks Pkwy Montague Expy Business Park Highlights • 8 building office/R&D business park • 3.3/1,000 parking ratio • Expansion opportunities • Prominent “Golden Triangle” location at intersection of • Walk to restaurants and amenities Montague Expressway and River Oaks Parkway • Walk to Light Rail (connects to Milpitas Station) • Broadband service providers include Comcast, AT&T, Verizon, • Central access to Highways 101, 880, 680 & 237 Covad, and others. ±15,178 Square Feet MONTAGUE OAKS 611-697 River Oaks Parkway, San Jose, CA Availability Address Size Available Date 695 River Oaks Pkwy 21,172 SF 7/1/2020 New common outdoor amenity areas S E E L Y A V E 631 611 625 RIVER OAKS PKWY 633 617 627 641 AMENITY AREA - A1 A2 645 695 683 685 A1 651 679 677 655 MONTAGUE EXPY AMENITY AREA - A2 MONTAGUE OAKS 695 River Oaks Parkway, San Jose, CA EXISTING FLOOR PLAN Space Highlights Exterior Exterior • 21,172 SF Fenced Fenced Dock Storage Storage Area High • Available July 1, 2020 Area Lift GL GL GL • Signage: Over door, monument & directory • Power: 1,200 amps at 277/480 volts Inventory Proj.