Nava Bharat Ventures Featured in Fortune

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Merger of Tech Mahindra and Satyam Computer Services Ltd. with Special Reference to HR Issues

IOSR Journal of Business and Management (IOSR-JBM) e-ISSN: 2278-487X, p-ISSN: 2319-7668 PP 03-06 www.iosrjournals.org Merger of Tech Mahindra and Satyam Computer Services Ltd. with special reference to HR Issues Rangana Maitra1, M. Phil (Management), M.B.A (NMIMS), M.A. (English Literature), P.G. Diploma in Personnel Management & Ms. Mayuri Asamwar 2, 1Associate Professor,IES’ Management College and Research Centre, Mumbai 2MMS, IES’ Management College and Research Centre, Mumbai Abstract: Satyam Computer Services Ltd is an Indian IT services company based in Hyderabad, India. Tech Mahindra which was ranked #5 in India's software services firms and overall #161 in Fortune India 500 list for 2011, is a is a part of Mahindra Group conglomerate with headquartered at Pune, India. Tech Mahindra Limited is a leading global systems integrator and business transformation consulting organization, focused primarily on the telecommunications industry. Satyam unveiled its new brand identity Mahindra Satyam subsequent to its takeover by the Mahindra Group's IT arm on 13 April 2009. On June 24, 2013 Tech Mahindra and Mahindra Satyam merging process completed and the name of the parent company was retained for the merged entity with a new Logo and motto. Merger was delayed due to various disputes both in India and abroad. There were quite many problems in the areas of legal and judicial issues, diverse expertise of the merged entities and also the culture between two companies. All these problems were successfully handled by the companies even while working is virtually integrated companies before the High court clearance for the merger. -

Trent Hypermarket Ties up with Future Consumer Enterprise Ltd to Retail a Wide Range of Products ~A First of Its Kind Tie-Up

Trent Hypermarket ties up with Future Consumer Enterprise Ltd to retail a wide range of products ~A first of its kind tie-up that aims to bring customers of Star Bazaar, a unique product-price proposition~ Mumbai, 3rd March, 2016: Star, a TATA & TESCO enterprise, has tied up with Future Consumer Enterprise Ltd. (FCEL), to launch a wide range of food and non-food products across Star Bazaar stores. Star Bazaar aims to launch close to 148 SKUs across 10 FCEL brands with a view to provide their customers a unique product price proposition. FCEL’s portfolio includes popular consumer brands in the food category like ‘Sunkist’, ‘Tasty Treat’, “Karmiq” “Desi Atta” and ‘Fresh & Pure’; while “Think Skin”, ‘Clean Mate’ and ‘Care Mate’ constitute the non-food category. The FCEL range will be made available across large format hypermarkets of Star Bazaar in its initial phase. While this alliance offers customers a unique advantage of accessing everyday products at a great price, the launch will also see exclusive offers and promotions for Star’s Club card loyalty members. This association aims to serve the customers an unmatched array of products and introduce services that will see the store as a one stop destination for all daily household needs. Speaking on the launch, Mr. Jamshed Daboo, Managing Director, Trent Hypermarket Ltd. said, “We are excited about our collaboration with Future Consumer Enterprise to retail their flagship brands. With this tie- up, we will be bringing our customers an extensive range of high quality food products and non-food merchandise. Our objective is to enhance our existing range and ensure we address the growing needs of customers to access unique products at affordable price points” Mr. -

Presentation Title ( Arial, Font Size 28 )

PresentationThe Tata Power Title (Company Arial, Font size Ltd. 28 ) Date, Venue, etc ..( Arial, January Font size 18 2013 ) …Message Box ( Arial, Font size 18 Bold) Disclaimer •Certain statements made in this presentation may not be based on historical information or facts and may be “forward looking statements”, including those relating to The Tata Power Company Limited’s general business plans and strategy, its future outlook and growth prospects, and future developments in its industry and its competitive and regulatory environment. Actual results may differ materially from these forward-looking statements due to a number of factors, including future changes or developments in The Tata Power Company Limited’s business, its competitive environment, its ability to implement its strategies and initiatives and respond to technological changes and political, economic, regulatory and social conditions in India. •This presentation does not constitute a prospectus, offering circular or offering memorandum or an offer to acquire any Shares and should not be considered as a recommendation that any investor should subscribe for or purchase any of The Tata Power Company Limited’s Shares. Neither this presentation nor any other documentation or information (or any part thereof) delivered or supplied under or in relation to the Shares shall be deemed to constitute an offer of or an invitation by or on behalf of The Tata Power Company Limited. •The Company, as such, makes no representation or warranty, express or implied, as to, and do not accept any responsibility or liability with respect to, the fairness, accuracy, completeness or correctness of any information or opinions contained herein. -

Titan Company Limited Jewellery Business Back on Track

Titan Company Limited Jewellery business back on track Powered by the Sharekhan 3R Research Philosophy Consumer Discretionary Sharekhan code: TITAN Result Update Update Stock 3R MATRIX + = - Summary Right Sector (RS) ü Titan’s standalone business recovered to 89% (consolidated recovered to 98%) with the jewellery business growing by 9% in Q2FY2021; watches and eyewear Right Quality (RQ) ü business recoveredto 56% and 61%, respectively. Consolidated OPM declined 433 bps to 6.9%, affected by hedging loss and lower operating leverge. Operating profit was down 40% to Rs. 313 crore. Right Valuation (RV) ü Higher demand during the festive season and improving wedding demand will help Titan post sustained recovery in the jewellery business going ahead. + Positive = Neutral - Negative We have fine-tuned our estimates for FY2021 to factor in lower-than-expected OPM. We have maintained them for FY2022/FY2023E. We maintain Buy with a Reco/View Change revised PT of Rs. 1,350. Reco: Buy Titan Company’s (Titan) consolidated revenue decreased by 2.3% to Rs. 4,553 crore as against our expectation of Rs. 4175.7 crore. This is including the gold-ingots sale of CMP: Rs. 1,218 Rs. 391 crore. Revenue of the jewellery business grew by 9%, while watches and eye wear businesses recovered to 56% and 61%, respectively, in Q2 (both the businesses Price Target: Rs. 1,350 á recovered to 70% each in September 2020). Operating profit margin (OPM) decreased by 433 bps to 6.9% as against our expectation of 7.5%. During the quarter, the company á Upgrade Maintain â Downgrade has recognised loss of Rs. -

Profitability Analysis of Mahindra & Mahindra Ltd

OPEN ACCESS Int. Res. J. of Science & Engineering, 2016; Vol. 4 (1): 36-38 ISSN: 2322-0015 RESEARCH ARTICLE Profitability Analysis of Mahindra & Mahindra ltd. Ltd Rakhi Sharma Assistant Professor, Tirpude Institute of Management Education, Nagpur Manuscript Details ABSTRACT Received : 27.02.2016 The study examines the profitability position of Mahindra & Mahindra Accepted: 16.03.2016 ltd. for the past ten years. It involves in-depth analysis of profitability of Published: 10.05.2016 the company having regard to important aspects concerning the same. Comparative study of annual increase in sales and profitability is made to understand the growth of the company ISSN: 2322-0015 Keywords: Net profit, EBIDT, PBT, PAT, Return on Net worth. Editor: Dr. Arvind Chavhan INTRODUCTION Cite this article as: Sharma Rakhi. Profitability Wealth creation is ultimate objective of any business & the same is not Analysis of Mahindra & Mahindra possible without earning profits. Without earning profits, a business ltd. Ltd. Int. Res. Journal of Science may not survive in the long run. A business needs profit not only for its & Engineering, 4(1): 36-38. existence but also for expansion and diversification. Copyright: © Author(s), This is A business enterprise can discharge its obligations to the various an open access article under the segments of the society only through earning of profits. Profit is a useful terms of the Creative Commons measure of overall efficiency of a business. Profits to the management Attribution Non-Commercial No are the test of efficiency and a measurement of control; to owners, a Derivs License, which permits use measure of worth of their investment; to the creditors, the margin of and distribution in any medium, safety; to employees, a source of fringe benefits; to Government, a provided the original work is measure of taxpaying capacity and a basis of legislative action; to properly cited, the use is non- customers, a hint to demand for better quality and price cuts; to an commercial and no modifications enterprise, for growth and existence. -

Fundamental Analysis: Tata Consultancy Services Limited (TCS)

Fundamental Analysis: Tata Consultancy Services Limited (TCS) May 15, 2020 ─ Ayan Banerjee Roll No. 16EC8020 Stock Market and Investment Management (MS842) Assignment Part-I Company Background and Product/Services Tata Consultancy Services Limited (TCS) is the largest Indian multinational information technology (IT) service and consulting company, and is headquartered in Mumbai, Maharashtra, India. It is a subsidiary of Tata Group and operates in 149 locations across 46 countries. TCS is the largest Indian company by market capitalization. Tata consultancy services is now placed among the most valuable IT services brands worldwide. It is the world's largest IT services provider. In 2018, it is ranked 11th on the Fortune India 500 list. In April 2018, TCS became the first Indian IT company to reach $100 billion market capitalization (this makes it a large cap company), and second Indian company ever (after Reliance Industries achieved it in 2007) after its market capitalization stood at ₹6,79,332.81 crores ($102.6 billion) on the BSE (formerly Bombay Stock Exchange). Sales Break up Net sales breakdown by activity – IT services (98.7%): consulting and engineering services, solutions and systems integration, management applications development, outsourcing services, etc.; Sale of IT equipment and software licenses (1.3%) Net sales break down by market – Sales Breakdown by Activity Bank-financial services insurance (BFSI) (30.5%) Retail and consumer packaged goods (15.2%) Communication and media (7.0%) Sales of IT Equipme Manufacturing industry (9.9%) nt & Life sciences and healthcare (8.3%) Software Licenses Technology and services (8.6%) and, 1% Others (20.5%). Net sales are distributed geographically as follows – India (5.7%), Americas (52.3%), Europe (30.6%) and, Others (11.4%). -

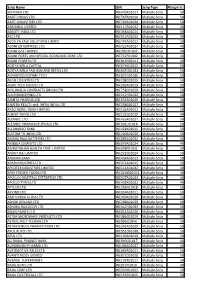

Scrip Name ISIN Scrip Type Margin % 3M INDIA LTD INE470A01017

Scrip Name ISIN Scrip Type Margin % 3M INDIA LTD INE470A01017 Multiple Scrip 50 AARTI DRUGS LTD INE767A01016 Multiple Scrip 50 AARTI INDUSTRIES LTD INE769A01020 Multiple Scrip 50 ABB INDIA LIMITED INE117A01022 Multiple Scrip 40 ABBOTT INDIA LTD INE358A01014 Multiple Scrip 50 ACC LTD INE012A01025 Multiple Scrip 40 ACCELYA KALE SOLUTIONS LIMITD INE793A01012 Multiple Scrip 50 ADANI ENTERPRISES LTD INE423A01024 Multiple Scrip 40 ADANI GAS LIMITED INE399L01023 Multiple Scrip 40 ADANI PORTS AND SPECIAL ECONOMIC ZONE LTD INE742F01042 Multiple Scrip 40 ADANI POWER LTD INE814H01011 Multiple Scrip 40 ADITYA BIRLA CAPITAL INE674K01013 Multiple Scrip 50 ADITYA BIRLA FASHION AND RETAIL LTD INE647O01011 Multiple Scrip 50 ADVANCED ENZYME TECH INE837H01020 Multiple Scrip 50 AEGIS LOGISTICS LTD INE208C01025 Multiple Scrip 50 AGRO TECH FOODS LTD INE209A01019 Multiple Scrip 50 AHLUWALIA CONTRACTS (INDIA) LTD INE758C01029 Multiple Scrip 50 AIA ENGINEERING LTD INE212H01026 Multiple Scrip 50 AJANTA PHARMA LTD INE031B01049 Multiple Scrip 50 AJMERA REALTY and INFRA INDIA LTD INE298G01027 Multiple Scrip 50 AKZO NOBEL INDIA LIMITED INE133A01011 Multiple Scrip 50 ALBERT DAVID LTD INE155C01010 Multiple Scrip 40 ALEMBIC LTD INE426A01027 Multiple Scrip 50 ALEMBIC PHARMACEUTICALS LTD INE901L01018 Multiple Scrip 50 ALLAHABAD BANK INE428A01015 Multiple Scrip 50 ALSTOM TD INDIA LTD INE200A01026 Multiple Scrip 50 AMARA RAJA BATTERIES LTD INE885A01032 Multiple Scrip 50 AMBUJA CEMENTS LTD INE079A01024 Multiple Scrip 40 AMRUTANJAN HEALTH CARE LIMITED INE098F01031 Multiple -

Presentation Title ( Arial, Font Size 28 )

PresentationThe Tata Power Title (Company Arial, Font size Ltd. 28 ) Date, Venue, etc ..( Arial, September Font size 18 ) 2013 …Message Box ( Arial, Font size 18 Bold) Disclaimer •Certain statements made in this presentation may not be based on historical information or facts and may be “forward looking statements”, including those relating to The Tata Power Company Limited‟s general business plans and strategy, its future outlook and growth prospects, and future developments in its industry and its competitive and regulatory environment. Actual results may differ materially from these forward-looking statements due to a number of factors, including future changes or developments in The Tata Power Company Limited‟s business, its competitive environment, its ability to implement its strategies and initiatives and respond to technological changes and political, economic, regulatory and social conditions in India. •This presentation does not constitute a prospectus, offering circular or offering memorandum or an offer to acquire any Shares and should not be considered as a recommendation that any investor should subscribe for or purchase any of The Tata Power Company Limited‟s Shares. Neither this presentation nor any other documentation or information (or any part thereof) delivered or supplied under or in relation to the Shares shall be deemed to constitute an offer of or an invitation by or on behalf of The Tata Power Company Limited. •The Company, as such, makes no representation or warranty, express or implied, as to, and do not accept any responsibility or liability with respect to, the fairness, accuracy, completeness or correctness of any information or opinions contained herein. -

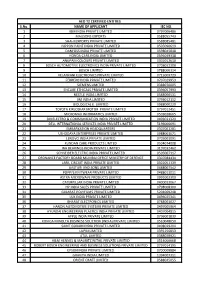

S.No. NAME of APPLICANT IEC NO. 1 IBM INDIA PRIVATE LIMITED 0797006486 2 MAGSONS EXPORTS 0588055743 3 SHAHI EXPORTS PRIVATE LIMI

AEO T2 CERTIFIED ENTITIES S.No. NAME OF APPLICANT IEC NO. 1 IBM INDIA PRIVATE LIMITED 0797006486 2 MAGSONS EXPORTS 0588055743 3 SHAHI EXPORTS PRIVATE LIMITED 0588085481 4 NIPPON PAINT INDIA PRIVATE LIMITED 0505090619 5 DANFOSS INDIA PRIVATE LIMITED 0598045848 6 HONDA CARS INDIA LIMITED 0595049338 7 ANUPAM COLOURS PRIVATE LIMITED 0301012610 8 BOSCH AUTOMOTIVE ELECTRONICS INDIA PRIVATE LIMITED 0708022308 9 BOSCH LIMITED 0788000314 10 VELANKANI ELECTRONICS PRIVATE LIMITED 0715009729 11 FERRERO INDIA PRIVATE LIMITED 0707029953 12 SIEMENS LIMITED 0388070005 13 ENCUBE ETHICALS PRIVATE LIMITED 0396057993 14 NESTLE INDIA LIMITED 0588000531 15 3M INDIA LIMITED 0793012112 16 BIOLOGICAL E. LIMITED 0988000229 17 TOYOTA KIRLOSKAR MOTOR PRIVATE LIMITED 0797012451 18 MICROMAX INFORMATICS LIMITED 0503028665 19 3M ELECTRO & COMMUNICATION INDIA PRIVATE LIMITED 0493021329 20 DELL INTERNATIONAL SERVICES INDIA PRIVATE LIMITED 5196000691 21 EMBARKATION HEADQUARTERS 0307061281 22 USHODAYA ENTERPRISES PRIVATE LIMITED 0988001071 23 LENOVO INDIA PRIVATE LIMITED 0705001091 24 KUNDAN CARE PRODUCTS LIMTED 0504074008 25 INA BEARINGS INDIA PRIVATE LIMITED 3197032462 26 SCHNEIDER ELECTRIC INDIA PRIVATE LIMITED 0595007317 27 ORDNANCE FACTORY BOARD MUMBAI OFFICE MINISTRY OF DEFENCE 0307084434 28 JABIL CIRCUIT INDIA PRIVATE LIMITED 0302051139 29 KASTURI AND SONS LIMITED 0488007542 30 POPPYS KNITWEAR PRIVATE LIMITED 0488013011 31 ASTRA MICROWAVE PRODUCTS LIMITED 0991002300 32 CATERPILLAR INDIA PRIVATE LIMITED 0400023067 33 HP INDIA SALES PRIVATE LIMITED 0798008300 34 GUJARAT -

Program Committee 6:30 Pm – 9:30 Pm Shoes

2862_AM_fin_prog_cover_v1.qxd 2/7/08 4:28 PM Page 1 Advanced Aromatics, LP Afton Chemicals Corporation Air Products and Chemicals, Inc. Albemarle Corporation Alon USA, LP American Ref Group, Inc. Arkema Ashland, Inc. Baker Petrolite Corporation Basell North America BASF Corporation BAYER BOC GROUP Border Refinin pany BP Chemicals BP p.l.c. Cabot Corporation Calcasieu Refining Company Calumet Lubricants Celanese Ltd. Chevron Corporation Chev Phillips Chemical Company LP CHS Inc. CITGO Petroleum Corporation Coffeyville Resources LLC ConocoPhillips Countrymark Co-op Ass Criterion Catalysts & Technologies Cross Oil Refining & Marketing, Inc. Cytec Industries Delek Inc.San Deltech Diego, Corporation CA The Dow Chemical pany E.I. DuPont de Nemours & Co. Eastman Chemical Company Enterprise Products Ergon, Inc. Exxon Mobil Corporation ExxonMobil Ch Co. Flying J Inc. Formosa Plastics Corporation, USA Frontier Oil Corporation Gary-Williams Energy Corporation GE Plastics GE Water & Pr Technologies Georgia Gulf Giant Industries, Inc. Grace Davison Hess Corporation Holly Corporation Honeywell Inc. HOVENSA LLC Hunt R Company Huntsman Company LLC INEOS Kinder Morgan Koch Industries Lion Oil Company Lubrizol Corporation Lyondell Chemical Com LYONDELL-CITGO Refining, LP Marathon Petroleum Company LLC Merichem Company Montana Refining Company Motiva Enterprises L Murphy Oil USA, Inc. Nalco Company National Cooperative Refinery Assoc. NOVA Chemicals Corporation Occidental Chemical Corporation Chlor Alkali Products Pasadena Refining System, Inc. Placid Refining Company PPG Industries, Inc. Rohm and Haas Company Safety-Klee Corporation Sasol North America Shell Chemical Company Sinclair Oil Corporation Solutia Inc. Sonneborn, Inc. South Hampton Resources Chemicals Suncor Energy Inc. Sunoco Inc. Tesoro Corporation Texas Petrochemicals LP TOTAL Trigeant, Ltd. U.S. -

Mahindra Ei Ileal Lint

Tech 7 Mahindra ei ilealL i n t Pune 411004, Maharashtra, India Tel. +91 206601 8100 Fax. +91 20 2542 4466 techmahindra.com [email protected] Registered Office: th ¥ Gateway Building, Apoilo Bunder 26% April, 2021 Mumbai 400 001, India CIN L64200MH1 S86PLC041370 To, BSE Limited National Stock Exchange of India Limited Phiroze Jeejeebhoy Towers, Exchange Plaza, 5" floor, Dalal Street, Plot No. - C/1, G Block, Mumbai - 400 001. Bandra-Kurla Complex, Bandra (E), Scrip Code: 532755 Mumbai - 400 051. NSE Symbol: TECHM Sub: Outcome of Board Meeting held on 26" April, 2021 Dear Sir(s) Pursuant to Regulation 33 read with Regulation 30 of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, (“Listing Regulations”), we wish to inform that the Board of Directors of the Company in its meeting held today approved the following: 1. Audited financial results and consolidated financial results of the Company for the fourth quarter and year ended 31% March, 2021. A copy of Audit Report with unmodified opinion under Regulation 33 of Listing Regulations on the annual Audited Financial Results of the Company for the year ended on 31* March, 2021 is enclosed. In this regard, please find enclosed: a.) Audited financial results and consolidated financial results of the Company for the fourth quarter and year ended 31*' March, 2021 together with Auditors Report thereon. b.) Press Release on the financial results. c.) Fact Sheet giving certain financial and operational parameters which will be put up on the Company website. 2. The Board of Directors have recommended a Final dividend of Rs.30/- per share (including Special Dividend of Rs.15/- per share) on par value of Rs.5/- (600%) for the financial year ended 31 March, 2021, subject to approval by the members of the Company at the forthcoming Annual General Meeting. -

Titan Company Limited Recovery in Jewellery Business to Drive Earnings Growth

Titan Company Limited Recovery in jewellery business to drive earnings growth Powered by the Sharekhan 3R Research Philosophy Consumer Discretionary Sharekhan code: TITAN Company Update Update Stock 3R MATRIX + = - Summary Right Sector (RS) ü We maintain our Buy recommendation on Titan with a revised PT of Rs. 1,910. It Right Quality (RQ) ü remains one of our top picks in the discretionary space due to a strong balance sheet and dominance in the branded jewellery space. Right Valuation (RV) ü The company expects strong recovery in pent-up demand especially in the jewellery + Positive = Neutral - Negative segment in H2FY2022; Ticket size is also expected to go up due to higher wedding spends shifted towards jewellery buying. What has changed in 3R MATRIX Titan has a market share of 5-6% in the jewellery market. Sustained new customer addition, strong safety standards followed by the company, omni channel platform, Old New and new product launches would help market share to improve ahead. RS Balance sheet strength will help it to compete well with strong regional and large players in the domestic market. RQ Titan Company Limited’s (Titan) market share in the jewellery market improved to 6% RV from 4% in the last four years. Improvement in market share is largely due to strong addition of new customers every year. Around 45% of sales of the jewellery business is Reco/View Change contributed by new customers. Uncertainty in business led by frequent lockdowns had huge impact on small jewellers cash flows. This led to large shift of customers to top Reco: Buy brands such as Tanishq (by Titan) in recent times.