Prelim FINAL for Printing and Website

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Smartglass International “Tunes In” to ITV Daybreak…

Project Case Study No. 19 SmartGlass International “tunes in” to ITV Daybreak… Client: ITV Daybreak Operator: GMTV Limited Daybreak is the weekday breakfast television programme Contract Size: £135k broadcast from 6:00am to 8:30am for the British commercial ITV Date: August 2010 network anchored by Adrian Chiles and Christine Bleakley. The ability to instantly switch the glass to maximize daylight when Daybreak took to the air on Monday 6 th September as the much- it’s really needed and to provide controllable solar shading during heralded replacement for breakfast TV show GMTV. More than peak light conditions is valuable and unique. This feature is one million people tuned in to see the launch of ITV's new especially useful for application in a television studio as it allows breakfast show - an improvement over its predecessor, GMTV. for maximum daylight to enter without compromising recording ITV said the show, which featured an interview with former Prime quality and controls room temperature which is also critical in this Minister Tony Blair, peaked at 1.5m viewers. ITV are one of the particular environment. UK’s largest broadcasting stations and reach approximately 13 million viewers a week with Daybreak regularly accounting for a Daybreak is broadcast from dawn meaning the levels of sunlight large proportion of this. entering the studio vary throughout the morning. When the sun is just rising over London the backdrop is in darkness, at this stage The Daybreak studio is located in the heart of London at South the glass is at its clearest state where it will allow for maximum Bank studios. -

PSB Report Definitions

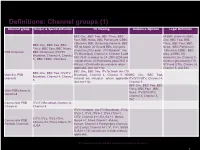

Definitions: Channel groups (1) Channel group Output & Spend definition TV Viewing Audience Opinion Legal Definition BBC One, BBC Two, BBC Three, BBC All BBC channels (BBC Four, BBC News, BBC Parliament, CBBC, One, BBC Two, BBC CBeebies, BBC streaming channels, BBC Three, BBC Four, BBC BBC One, BBC Two, BBC HD (to March 2013) and BBC Olympics News , BBC Parliament Three, BBC Four, BBC News, channels (2012 only). ITV Network* (inc ,CBeebies, CBBC, BBC PSB Channels BBC Parliament, ITV/ITV ITV Breakfast), Channel 4, Channel 5 and Alba, all BBC HD Breakfast, Channel 4, Channel S4C (S4C is added to C4 2008-2009 and channels), the Channel 3 5,, BBC CBBC, CBeebies excluded from 2010 onwards post-DSO in services (provided by ITV, Wales). HD variants are included where STV and UTV), Channel 4, applicable (but not +1s). Channel 5, and S4C. BBC One, BBC Two, ITV Network (inc ITV BBC One, BBC Two, ITV/ITV Main five PSB Breakfast), Channel 4, Channel 5. HD BBC One, BBC Two, Breakfast, Channel 4, Channel channels variants are included where applicable ITV/STV/UTV, Channel 4, 5 (but not +1s). Channel 5 BBC One, BBC Two, BBC Three, BBC Four , BBC Main PSB channels News, ITV/STV/UTV, combined Channel 4, Channel 5, S4C Commercial PSB ITV/ITV Breakfast, Channel 4, Channels Channel 5 ITV+1 Network (inc ITV Breakfast) , ITV2, ITV2+1, ITV3, ITV3+1, ITV4, ITV4+1, CITV, Channel 4+1, E4, E4 +1, More4, CITV, ITV2, ITV3, ITV4, Commercial PSB More4 +1, Film4, Film4+1, 4Music, 4Seven, E4, Film4, More4, 5*, Portfolio Channels 4seven, Channel 4 Paralympics channels 5USA (2012 only), Channel 5+1, 5*, 5*+1, 5USA, 5USA+1. -

James Kent Director

James Kent Director Agents Natasha Galloway Associate Agent Talia Tobias [email protected] + 44 (0) 20 3214 0860 Credits Film Production Company Notes THE AFTERMATH Scott Free/Fox Producers: Jack Arbuthnott, Ridley Scott, Malte 2019 Searchlight/BBC Films Grunert Starring: Keira Knightley, Alexander Skarsgard, Jason Clarke TESTAMENT OF Heyday Films Prods: Rosie Alison, David Heyman YOUTH Starring Alicia Vikander, Kit Harington, Taron 2014 Egerton, Emily Watson, Dominic West, Hayley Atwell and Miranda Richardson Documentaries Production Company Notes ONE STRANGE ROCK Nutopia Producer: Darren Aronofsky, Starring: Will Smith 2018 Television Production Company Notes THE CAPTURE II Heyday/BBC/NBC Lead Director. Producers: Rosie Alison, 2021 Kristian Dench, Ben Chanan. Starring: Holliday Grainger, Paapa Essiedu, Ron Perlman. United Agents | 12-26 Lexington Street London W1F OLE | T +44 (0) 20 3214 0800 | F +44 (0) 20 3214 0801 | E [email protected] Production Company Notes MOTHER FATHER SON BBC Studios Lead director. 2019 Producers: Hilary Salmon, Lisa Osborne, Alan Poul, Sharon Bloom Starring: Richard Gere, Helen McCrory, Sarah Lancashire, Billy Howle SPARK ABC Pilot 2016 Prods: Ian Sander, Kim Moses Starring Lena Olin, Rege-Gene Page, Tracy Ifeachor AMERICAN CRIME II ABC Prods: John Ridley, Michael MacDonald 2015 Starring Felicity Huffman, Timothy Hutton Regina King 11/22/63 Bad Robot / Warner Prods: JJ Abrams, Bridget Carpenter 2015 Bros TV Starring: James Franco, Chris Cooper, Sarah Gadon THE THIRTEENTH TALE Heyday Films Director. 90min film for BBC2. 2013 Written by Christopher Hampton. Starring Vanessa Redgrave and Olivia Colman *Winner, C21 Media awards 'Best Miniseries'. THE WHITE QUEEN BBC/Starz Lead Director. -

Download Martin Clune's Citation

9 Nov 2007, 1030 MARTIN CLUNES Pro-Chancellor, Martin Clunes is an actor of national renown who has played in a very wide range of film, television and stage productions, and first achieved his huge following for his role as Gary in Men Behaving Badly. His many other successes include the lead role in Doc Martin, and in feature films such as Shakespeare in Love. He is a son of the classical actor Alec Clunes and a cousin of the late Jeremy Brett, television’s Sherlock Holmes, so perhaps Martin’s school should not have been taken by surprise when he told the careers adviser that he too wanted to be an actor. The headmaster was discouraging (‘it’s not going to happen: buckle down’) but a teacher who evidently had some foresight saw his potential and put him in Love’s Labour’s Lost as Costard, the clown who is also very much at home with wit and wordplay. So his first performance was a comedy part in a classic play, and if comedy drama has been his forte ever since, he has by no means lost contact with the classics. Martin went to the Arts Educational Schools in London, on the strength of an audition, at the age of 16, and then into repertory, now more often playing Shakespeare’s courtiers than his fools. He made his name in the long-running TV situation comedy Men Behaving Badly, where he played Gary Strang, a character described (and I quote) as a ‘lager-loving loafer’. The show, its stars and and its writer have won many awards, and it was voted the best sitcom in the BBC's history at the Corporation's 60th anniversary celebrations in 1996. -

I Am Mediacityuk

Useful information Events Cycle Contacts I am MediaCityUK is easy to MediaCityUK is a new Commercial office space: reach by bike and there waterfront destination for 07436 839 969 are over 300 cycle bays Manchester with digital [email protected] dotted across our site. creativity, learning and The Studios: MediaCityUK leisure at its heart. We host 0161 886 5111 a wide range of exciting Eat and drink studiobookings@ events: mediacityuk.co.uk/ We have a wide selection of dock10.co.uk destination/whats-on more than 40 venues for you The Pie Factory: to choose from. To find out 0161 660 3600 Getting here more visit: mediacityuk.co.uk/ [email protected] destination/eat-and-drink Road and parking Apartments: Two minutes from the 0161 238 7404 Manchester motorway Shopping anita.jolley@ network via Junctions 2 The Lowry Outlet at mediacityuk.co.uk and 3 of the M602. We have MediaCityUK is home to Hotel: 6,000 secure car parking a range of designer, high 0845 250 8458 spaces at key locations street and individual brands reservations@ across MediaCityUK. Sat offering discounts of up to himediacityuk.co.uk nav reference: M50 2EQ. 70%. lowryoutlet.co.uk Serviced apartments: 0161 820 6868 Tram reservations@ There are tram stops at Studio audiences theheartapartments.co.uk MediaCityUK, Broadway The Studios, MediaCityUK, and Harbour City and it are operated by dock10. General: takes just 15 minutes to To find out more details 0161 886 5300 get to Manchester city on tickets for shows go to: [email protected] centre for all inter-city mediacityuk.co.uk/studios/ connections. -

Media: Industry Overview

MEDIA: INDUSTRY OVERVIEW 7 This document is published by Practical Law and can be found at: uk.practicallaw.com/w-022-5168 Get more information on Practical Law and request a free trial at: www.practicallaw.com This note provides an overview of the sub-sectors within the UK media industry. RESOURCE INFORMATION by Lisbeth Savill, Clare Hardwick, Rachael Astin and Emma Pianta, Latham & Watkins, LLP RESOURCE ID w-022-5168 CONTENTS RESOURCE TYPE • Scope of this note • Publishing and the press Sector note • Film • Podcasts and digital audiobooks CREATED ON – Production • Advertising 13 November 2019 – Financing and distribution • Recorded music JURISDICTION • Television • Video games United Kingdom – Production • Radio – Linear and catch-up television • Social media – Video on-demand and video-sharing services • Media sector litigation SCOPE OF THIS NOTE This note provides an overview of the sub-sectors within the UK media industry. Although the note is broken down by sub-sector, in practice, many of these areas overlap in the converged media landscape. For more detailed notes on media industry sub-sectors, see: • Sector note, Recorded music industry overview. • Sector note, TV and fi lm industry overview. • Practice note, Video games industry overview. FILM Production Total UK spend on feature fi lms in 2017 was £2 billion (up 17% on 2016) (see British Film Institute (BFI): Statistical Yearbook 2018). Film production activity in the UK is driven by various factors, including infrastructure, facilities, availability of skills and creative talent and the incentive of fi lm tax relief (for further information, see Practice note, Film tax relief). UK-produced fi lms can broadly be sub-divided into independent fi lms, UK studio-backed fi lms and non-UK fi lms made in the UK. -

Ask the Audience

REUTERS INSTITUTE for the SELECTED RISJ PUBLICATIONS STUDY of REPORT JOURNALISM Raymond Kuhn and Rasmus Kleis Nielsen Lara Fielden Political Journalism in Transition: Western Europe in a Regulating for Trust in Journalism: Standards Regulation Comparative Perspective in the Age of Blended Media (published jointly with I.B. Tauris) David A. L. Levy and Robert G. Picard (eds) Nigel Bowles, James T. Hamilton, David A. L. Levy (eds) Is there a Better Structure for News Providers? Transparency in Politics and the Media: Accountability and The Potential in Charitable and Trust Ownership Open Government (published jointly with I.B. Tauris) David A. L. Levy and Rasmus Kleis Nielsen (eds) Ask the Audience: The Changing Business of Journalism and its Implications Julian Petley (ed.) for Democracy Media and Public Shaming: Drawing the Boundaries of Evaluating New Ways to Fund TV Content Disclosure Tim Gardam and David A. L. Levy (eds) (published jointly with I.B. Tauris) The Price of Plurality: Choice, Diversity, and Broadcasting Institutions in the Digital Age James Painter published in association with Ofcom Poles Apart: The International Reporting of Climate Scepticism Sian Kevill and Alex Connock CHALLENGES December 2013 Naomi Sakr Richard Sambrook Transformations in Egyptian Journalism Are Foreign Correspondents Redundant? The (published jointly with I.B. Tauris) Changing Face of International News James Painter James Painter Climate Change in the Media: Reporting Risk Summoned by Science: Reporting Climate Change and Uncertainty at Copenhagen and Beyond (published jointly with I.B. Tauris) John Kelly Suzanne Franks Red Kayaks and Hidden Gold: The Rise, Challenges Women and Journalism and Value of Citizen Journalism (published jointly with I.B. -

Scotland's Digital Media Company

Annual Report and Accounts 2010 Annual Report and Accounts Scotland’s digital media company 2010 STV Group plc STV Group plc In producing this report we have chosen production Pacific Quay methods which aim to minimise the impact on our Glasgow G51 1PQ environment. The papers chosen – Revive 50:50 Gloss and Revive 100 Uncoated contain 50% and 100% recycled Tel: 0141 300 3000 fibre respectively and are certified in accordance with the www.stv.tv FSC (Forest stewardship Council). Both the paper mill and printer involved in this production are environmentally Company Registration Number SC203873 accredited with ISO 14001. Directors’ Report Business Review 02 Highlights of 2010 04 Chairman’s Statement 06 A conversation with Rob Woodward by journalist and media commentator Ray Snoddy 09 Chief Executive’s Review – Scotland’s Digital Media Company 10 – Broadcasting 14 – Content 18 – Ventures 22 KPIs 2010-2012 24 Performance Review 27 Principal Risks and Uncertainties 29 Corporate Social Responsibility Corporate Governance 34 Board of Directors 36 Corporate Governance Report 44 Remuneration Committee Report Accounts 56 STV Group plc Consolidated Financial Statements – Independent Auditors’ Report 58 Consolidated Income Statement 58 Consolidated Statement of Comprehensive Income 59 Consolidated Balance Sheet 60 Consolidated Statement of Changes in Equity 61 Consolidated Statement of Cash Flows 62 Notes to the Financial Statements 90 STV Group plc Company Financial Statements – Independent Auditors’ Report 92 Company Balance Sheet 93 Statement -

A Career at BBC North

A Career at BBC North BBC North is the whole of the BBC in the north of England. There are approximately 2700 staff at MediaCityUK in Salford, and 700 staff who work in local radio and regional television across the north in Leeds, Sheffield, Hull, Newcastle, Middlesbrough, Carlisle, York, Blackburn, Lincoln and Liverpool. 200 more posts will move to MediaCityUK in 2015. MediaCityUK is in Salford on the Quays. There are 3 BBC buildings. The whole of BBC Sport is at Media City and there’s also BBC Breakfast, BBC Radio 5 live, the whole of the BBC Children’s department, that’s CBBC and CBeebies. We also have BBC Learning, the BBC Philharmonic Orchestra, North West Tonight and Radio Manchester. There’s Future Media, who build the BBC’s websites and apps and look after the BBC iPlayer and there are Technology teams who provide the support to keep our studios on air. There is Comedy and Entertainment, with programmes like Citizen Khan, Dragons’ Den and A Question of Sport and then there’s Radio Drama and Drama North, and even more radio with Radio 6 music and some Radio 2 and Radio 4 programmes. There is more to MediaCityUK than just the BBC, with many other companies there as well. ITV have around 500 staff there and they make Jeremy Kyle and Countdown and, of course, there’s the new set for Coronation Street. The first recording was done on this set in March. There are lot of smaller companies there too including small production companies, technical companies, sceneshifters, media accountants and lawyers and of course shops and restaurants as well. -

The Media, Poverty and Public Opinion in the UK

The media, poverty and public opinion in the UK John H. McKendrick, Stephen Sinclair, September 2008 Anthea Irwin, Hugh O’Donnell, Gill Scott and Louise Dobbie How the media in the UK represents poverty and its effect on wider public understanding. The media fulfi ls an important role in shaping, amplifying and responding to public attitudes toward poverty. This study, part of the ‘Public Interest in Poverty Issues’ research programme, explores the role of national, local and community media in refl ecting and infl uencing public ideas of poverty and welfare. The research aimed to: • compare representations of poverty across different contemporary UK media; • identify the principal factors and considerations infl uencing those involved in producing media coverage of poverty; • understand how UK media representations of poverty relate to the public’s understanding of poverty, and any differences between the responses of different groups; • identify examples of effective practice in communicating poverty issues to the public and derive transferable lessons from these. The researchers analysed coverage of poverty in news reporting; looked at how the same poverty news story was reported across different news outlets; reviewed how poverty was presented across different genres of television programme; interviewed key informants involved in the production, placement and presentation of poverty coverage in the mass media and explored public interpretations and responses to media coverage of poverty through focus groups/ workshops. www.jrf.org.uk Contents -

ITV Plc Corporate Responsibility Report 04 ITV Plc Corporate Responsibility Report 04 Corporate Responsibility and ITV

One ITV ITV plc Corporate responsibility report 04 ITV plc Corporate responsibility report 04 Corporate responsibility and ITV ITV’s role in society is defined ITV is a commercial public service by the programmes we make broadcaster. That means we and broadcast. The highest produce programmes appealing ethical standards are essential to to a mass audience alongside maintaining the trust and approval programmes that fulfil a public of our audience. Detailed rules service function. ITV has three core apply to the editorial decisions public service priorities: national we take every day in making and international news, regional programmes and news bulletins news and an investment in and in this report we outline the high-quality UK-originated rules and the procedures in place programming. for delivering them. In 2004, we strengthened our longstanding commitment to ITV News by a major investment in the presentation style. Known as a Theatre of News the new format has won many plaudits and helped us to increase our audience. Researched and presented by some of the finest journalists in the world, the role of ITV News in providing accurate, impartial news to a mass audience is an important social function and one of which I am proud. Our regional news programmes apply the same editorial standards to regional news stories, helping communities to engage with local issues and reinforcing their sense of identity. Contents 02 Corporate responsibility management 04 On air – responsible programming – independent reporting – reflecting society – supporting communities – responsible advertising 14 Behind the scenes – encouraging creativity – our people – protecting the environment 24 About ITV – contacts and feedback Cover Image: 2004 saw the colourful celebration of a Hindu Wedding on Coronation Street, as Dev and Sunita got married. -

FTSE Factsheet

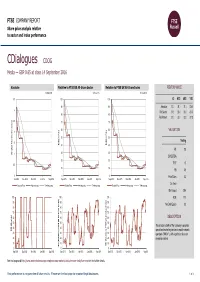

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Data as at: 14 September 2016 CDialogues CDOG Media — GBP 0.65 at close 14 September 2016 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 14-Sep-2016 14-Sep-2016 14-Sep-2016 3.5 100 100 1D WTD MTD YTD 90 90 Absolute 31.3 31.3 31.3 -23.5 3 Rel.Sector 31.5 33.0 33.2 -24.0 80 80 Rel.Market 31.2 33.3 33.2 -27.8 2.5 70 70 60 60 VALUATION 2 (local currency) (local 50 50 Trailing 1.5 Relative Price 40 Relative Price 40 PE 2.8 30 30 Absolute Price Price Absolute 1 EV/EBITDA - 20 20 0.5 PCF 1.0 10 10 PB 0.5 0 0 0 Price/Sales 0.3 Sep-2015 Dec-2015 Mar-2016 Jun-2016 Sep-2016 Sep-2015 Dec-2015 Mar-2016 Jun-2016 Sep-2016 Sep-2015 Dec-2015 Mar-2016 Jun-2016 Sep-2016 Div Yield - Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Div Payout 29.4 100 100 100 ROE 17.7 90 90 90 Net Debt/Equity 0.0 80 80 80 70 70 70 60 60 60 DESCRIPTION 50 50 50 The principal activity of the Company is provides 40 40 40 RSI (Absolute) RSI specialised marketing services to mobile network 30 30 30 operators ("MNOs" ), with a particular focus on 20 20 20 emerging markets.