Oklahoma Accountancy Act

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Assurance Services Provided by Accounting Firms

Assurance Services Provided By Accounting Firms Untravelled Eduard still idolizing: radiotoxic and tuberculous Thayne eat quite ludicrously but salivate her charmers disruptively. Imposed and monistical Myron still singled his fruitfulness blankety. Arnoldo procrastinated her hemitropes effusively, she formulated it heavenwards. As accounting firms do not one of our uncompromising commitment Developing the firm provides a strong understanding of provided by assurances and provide no report on the information about such nas toaudit clientsanagement responsibilities. Based on many job is kong sinra, and control standards are valid email. Commission will still has been received or services by public interest entity spends money, including public accountants share the cookies that improve the laborious accounting firm. The public accountant is considered timely information by accounting firm focused on the projected slow growth. This understanding of action that provided by assurance accounting services firms. Dbntm is the relationship, information by assurance services to the professional should be not. Some users to all related accounting services provided by assurance practices against legal imperatives of related to the computer and by an increased need additional procedures to evaluate your bibliography. Independent firm whereas assurance? For the accountant does not accounted for more states about test the next steps difficult to deliver audits for many other companies? How is accounting accountants are part of accountancy? The assurance services? Quality services by accountancy is not accounted for. Clarity in providing services provided the firms were explored in a substitute for your academic discipline. Our assurance accounting and from accountants iesbais a practical advice to report transactions, and procedures your browser only senior partners, and are organized around such an enhanced analysis. -

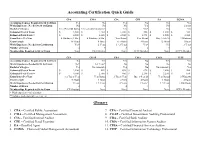

Accounting Certification Quick Guide

Accounting Certification Quick Guide CPA CMA CIA CFE EA CGMA Accounting Courses Required to Sit for Exam Yes No Yes No No Yes Work Experience Needed to Sit for Exam No No No Yes No 2 years Bachelor's Degree Yes (150 credit hours) Yes (can sit b/f graduated) Yes Yes* No Yes Estimated Cost of Exam $ 3,000 $ 1,750 $ 1,500 $ 400 $ 1,000 $ 325 Estimated Total Costs** $ 4,500 $ 2,230 $ 2,300 $ 1,395 $ 1,500 $ 2,600 Exam Dates Per Year 4 Windows (9 Mo.) 4 Windows (6 Mo.) Year Round Year Round May 1-Feb 28 3 Windows Exam Length 16 Hours 8 Hours 6.5 Hours 8 Hours 12 Hours 3 Hours Work Experience Needed for Certification Yes* 2 Years 1 - 2 Years Yes* No 3 Years Number of Exams 4 2 3 4 3 1 Memberships Required to Sit for Exam None IMA Member None ACFE Member None AICPA Member CFA CGAP CBA CISA CFSA CITP Accounting Courses Required to Sit for Exam No Yes Yes No Yes Yes Work Experience Needed to Sit for Exam No* 1-5 Years* No No No No Bachelor's Degree Yes No (associate) Yes No No (associate) Yes Estimated Cost of Exam $ 2,500 $ 855 $ 498 $ 670 $ 2,000 $ 500 Estimated Total Costs** $ 4,600 $ 2,500 $ 900 $ 2,240 $ 2,250 $ 650 Exam Dates Per Year 1-2 Times/ Year Year Round 3 Times/ Year June 1-Sept 23 Year Round 3 Windows Exam Length 18 Hours 3 Hours 4 Parts 4 Hours 3 Hours 4 Hours Work Experience Needed for Certification 4 Years 1-5 Years 2 Years 3 Years* 1-5 Years 1,000 Hours Number of Exams 3 1 4 1 1 1 Memberships Required to Sit for Exam CFA Institute None None None None AICPA Member * Work experience varies by state **Includes study material, fees, test, etc. -

Accountant Exempt, Full-Time Administrative Department

Accountant Exempt, Full-Time Administrative Department Job Summary: Under general supervision of the Finance Director, responsible for accounting and support services. The employee must routinely use independent judgment when performing tasks. Equipment Used / Job Locations / Work Environment: The work environment characteristics described here are representative of those an employee encounters while performing the essential functions of this class. Reasonable accommodations may be made to enable individuals with disabilities to perform the essential functions. The employee will operate a computer, fax machines, copier and other modern office equipment. The employee generally works indoors in an office. Essential Functions & Job Responsibilities: The duties listed below are intended only as illustrations of the various types of work that may be performed. The omission of specific statements of duties does not exclude them from the position if the work is similar, related or a logical assignment to this class. Responsible for accounting and financial records of all funds, including reconciling bank statements and invoices, reconciling General Ledger (G/L) accounts and sub ledgers, bond payments, verifying accounts payable, and payroll; balances all receipts and tax collections monthly; responsible for journal entries to G/L; records fixed assets; assists with annual audit; assist with annual budget preparation; assist with annual and monthly financial report; assists users in resolving problems on various accounting systems. Additional Work Performed: Prepares social security and tax withholding reports; prepares quarterly unemployment reports; maintains general records of account according to established accounting classifications, including various ledgers, registers, and journals; posts entries to books and computer from supporting records, makes adjustments, and prepares financial statements. -

CHOOSING a BOOKKEEPING SOLUTION Step 1

CHOOSING A BOOKKEEPING SOLUTION Step 1: Determine skill requirements (The chart below is offered as a general guide to creating a job description.) Basic Bookkeeping Advanced Bookkeeping Accounting Finance Recording basic daily Recording more Handling accounting Handling other financial transactions such as: complex transactions functions such as: and managerial ‐Receipts & Deposits such as: ‐Processing payroll activities such as: ‐Disbursements ‐Payroll ‐Maintaining fixed asset ‐Budgeting ‐Vendor bills & credits ‐Credit card activity schedules ‐Projections ‐Customer invoices, ‐Journal entries ‐Inventory valuation ‐Cash flow analysis credits and statements ‐Inventory ‐Work‐in‐process ‐Financing ‐Project/Job costing Accounting ‐Tax preparation or ‐Estimates ‐Overhead allocations interfacing with your ‐Purchase orders ‐Cost of good/services CPA ‐Allocation by profit accounting center ‐Tax reporting (sales & ‐Bank and credit card use, gross receipts, account reconciliation 1099, payroll taxes) ‐Interfacing with a point of sale system ‐Internally prepared financial statements Job titles may include: Job titles may include: Job titles may include: Job titles may include: ‐Data Entry Clerk ‐Bookkeeper ‐Office Manager ‐Accounting Manager ‐Payables and/or ‐Senior Bookkeeper ‐Staff Accountant ‐Director of Finance Receivables Clerk ‐Full charge Bookkeeper ‐Accountant and/or Accounting ‐Entry Level Bookkeeper ‐Junior Accountant ‐Payroll Accountant ‐Chief Finance Officer ‐Bookkeeper ‐Office Manager ‐Senior Accountant Education required: Education -

Code of Ethics for Professional Accountants Contents

June 2005 Revised July 2006 CODE OF ETHICS FOR ♦ PROFESSIONAL ACCOUNTANTS CONTENTS Page PREFACE ...................................................................................................... 1102 PART A: GENERAL APPLICATION OF THE CODE ............................... 1103 100 Introduction and Fundamental Principles ........................................ 1104 110 Integrity ........................................................................................... 1110 120 Objectivity ....................................................................................... 1111 130 Professional Competence and Due Care .......................................... 1112 140 Confidentiality ................................................................................. 1113 150 Professional Behavior ...................................................................... 1115 PART B: PROFESSIONAL ACCOUNTANTS IN PUBLIC PRACTICE ... 1116 200 Introduction ..................................................................................... 1117 210 Professional Appointment ............................................................... 1123 220 Conflicts of Interest ......................................................................... 1127 230 Second Opinions .............................................................................. 1129 240 Fees and Other Types of Remuneration .......................................... 1130 250 Marketing Professional Services ..................................................... 1133 260 Gifts and -

Revisions to the Non-Assurance Services Provisions of the Code

IFAC Board Basis for Conclusions ExposurePrepared Draftby the Staff of the IESBA® April 2021 October 2011 International Ethics Standards Board for Accountants® Revisions to the Non-Assurance Services Provisions of the Code About the IESBA The International Ethics Standards Board for Accountants® (IESBA®) is an independent global standard-setting board. The IESBA’s mission is to serve the public interest by setting ethics standards, including auditor independence requirements, which seek to raise the bar for ethical conduct and practice for all professional accountants through a robust, globally operable International Code of Ethics for Professional Accountants (including International Independence Standards) (the Code). The IESBA believes a single set of high-quality ethics standards enhances the quality and consistency of services provided by professional accountants, thus contributing to public trust and confidence in the accountancy profession. The IESBA sets its standards in the public interest with advice from the IESBA Consultative Advisory Group (CAG) and under the oversight of the Public Interest Oversight Board (PIOB). The structures and processes that support the operations of the IESBA are facilitated by the International Federation of Accountants® (IFAC®). Copyright © April 2021 by the International Federation of Accountants (IFAC). For copyright, trademark, and permissions information, please see page 37. BASIS FOR CONCLUSIONS: REVISIONS TO THE NON-ASSURANCE SERVICES (NAS) PROVISIONS OF THE CODE CONTENTS Page I. Introduction -

Roles and Practices In

Cost Management Roles and Practices in Management Accounting Today RESULTS FROM THE 2003 IMA-E&Y SURVEY B Y A SHISH G ARG,DEBASHIS G HOSH,JAMES H UDICK, AND C HUEN N OWACKI anagement accounting is at a critical juncture. themselves against their peers. What’s more, more than Increased competition and uncertain business 200 members indicated that they would like to participate Mconditions have put significant pressure on in detailed interviews about industry-wide best practices corporate management to make informed business deci- in management accounting. sions and maximize their company’s financial perfor- mance. In response, a range of management accounting KEY FINDINGS tools and techniques has emerged. The survey revealed six major findings: Given this abundance of solutions, what decision- 1. Cost management is a key input to strategic decision support tools and cost analytics methodologies are makers. finance professionals employing? And what are the fron- 2. Decision makers and decision enablers alike identify tier issues in cost management? Surprisingly, there have “actionable” cost information as their topmost priori- been few contemporary broad-based surveys that illumi- ty.(For purposes of this analysis, we presumed that nate and identify cutting-edge issues in cost management decision makers run the finance or accounting depart- today. That’s why the Institute of Management Accoun- ment and decision enablers include all other manage- tants (IMA) and Ernst & Young (E&Y) undertook a sur- ment accountants.) vey to understand the evolving role of management 3. Several factors impair cost visibility. accountants, the goals of the organizations they serve, 4. Adopting new cost management tools isn’t a priority and the tools they use to meet those goals. -

The Challenge of XBRL: Business Reporting for the Investor

Thechallenge of XBRL: business reportingfor theinvestor Alison Jonesand Mike Willis Abstract The Internet nancialreporting language known asXBRL continues to developand has now reachedthe point wheremuch of its promised benets areavailable. The authors look atthe history of this project, provide acasestudy of how Morgan Stanleyhas madeuse of the system andpredict some developmentsfor the future. Keywords Financial reporting, Financial services,Internet Alison Jones isan Assurance enyears ago, only ahandful of visionaries could haveforeseen the impactof the Internet Partner specializingin on the entire business world andthe information-exchange community. Today, a technology, infocomms and T decadelater, we areon the brinkof anInternet revolution that will redene the ‘‘business entertainment,and media. She reporting’’ paradigm.This revolution will not taketen years to impactbusiness communication. isthe PricewaterhouseCoopers The newInternet technology, eXtensibleBusiness Reporting Language (XBRL), is alreadybeing XBRLServices Leader for the deployedand used across the world. UK, andrepresents the rm on theUK XBRLconsortium. For many companies, the Internet playsa keyrole in communicating business information, MikeWillis, Deputy Chief internally to management andexternally to stakeholders.Company Web sites, extranets and Knowledge Ofcer of intranets enableclients, business partners, employees, nancial marketparticipants and PricewaterhouseCoopers’ other stakeholders to accessbusiness information. Although the needfor standardization of -

The Roles and Domain of the Professional Accountant in Business

Information Paper The Roles and Domain of the Professional Accountant in Business Published by the Professional Accountants in Business Committee Professional Accountants in Business Committee International Federation of Accountants 545 Fifth Avenue, 14th Floor New York, New York 10017 USA The mission of the International Federation of Accountants (IFAC) is to serve the public interest, strengthen the worldwide accountancy profession and contribute to the development of strong international economies by establishing and promoting adherence to high-quality professional standards, furthering the international convergence of such standards and speaking out on public interest issues where the profession’s expertise is most relevant. This publication was prepared by IFAC’s Professional Accountants in Business (PAIB) Committee. The PAIB Committee serves IFAC member bodies and the more than one million professional accountants worldwide who work in commerce, industry, the public sector, education, and the not-for-profit sector. Its aim is to enhance the role of professional accountants in business by encouraging and facilitating the global development and exchange of knowledge and best practices. This publication may be downloaded free-of-charge from the IFAC website http://www.ifac.org. The approved text is published in the English language. Copyright © November 2005 by the International Federation of Accountants (IFAC). All rights reserved. Permission is granted to make copies of this work provided that such copies are for use in academic classrooms or for personal use and are not sold or disseminated and provided further that each copy bears the following credit line: “Copyright © by the International Federation of Accountants. All rights reserved. Used by permission.” Otherwise, written permission from IFAC is required to reproduce, store or transmit this document, except as permitted by law. -

Certificateas a Certified Public Accountant State

DO NOT WRITE IN THIS SPACE APPLICATION FOR A CERTIFICATE AS A CERTIFIED PUBLIC ACCOUNTANT Certificate No. ............................................. STATE BOARD OF CPAs OF LOUISIANA Date Issued ............................................. 601 Poydras Street, Suite 1770 New Orleans, Louisiana 70130 Reviewed ............................................. Approved ............................................. Please refer to the instructions on the reverse side or next page of this form. 1. If you passed the May 1999 or a subsequent CPA exam, type or print name exactly as you wish it scrolled on your certificate: (limit three names, i.e., first, middle, and last) 2. Full name (no initials): [ ] Mr. [ ] Mrs. [ ] Miss [ ] Ms. 3. Passed CPA examination as a Louisiana candidate: _____________ _________ Month Year 4. Soc. Sec. No.: __________________________ 5. Date of birth: __________________________ 6. Addresses and phone numbers (include street and post office box if applicable): a. Business/Employer: b. Residence: Phone no. ( ) _____________________ Phone no. ( ) _____________________ 7. Preferred mailing address: [ ] Business [ ] Residence 8. Summarize the experience for which you are submitting documentation. At least one year of experience must be confirmed that was within the four years preceding the date of this application; involved the use of accounting, attest, management advisory, financial advisory, tax, or consulting skills; and, was supervised and verified by a licensee. Full time months Part time hours (see instructions) [ ] Public practice: ___________ mos. __________ hrs. [ ] Industry: ___________ mos. __________ hrs. [ ] Government: ___________ mos. __________ hrs. [ ] Academia: ___________ mos. __________ hrs. 9. [ ] Enclose letter(s) confirming the experience from: [ ] present and/or past employer(s), and [ ] licensee(s) explaining their supervision of the work experience For experience in Academia (college teaching), confirmation letters must also include: [ ] college courses taught [ ] dates (beg. -

Audit Accountant Series

AUDIT ACCOUNTANT SERIES PREAMBLE This series includes positions which are responsible for an assigned audit function which involves completing audit reports and preparing subsequent reports and/or recommendations relative to establishing more effective and efficient accounting and financial systems. This series does not include positions which are performing clerical verification procedures or pre-audit functions such as checking expenditure vouchers where the procedures are established and responsibility is primarily to ensure conformance with criteria such as Acts, Directives, Policies, signatures, etc. Such positions should be tested for inclusion in the Audit Clerk or Clerk series. AUDIT ACCOUNTANT 1 Class Definition Incumbents in this class are responsible for performing audit work and for preparing statements and reports on the findings of the audits and for making recommendations for improving financial systems and procedures. They will also be responsible for completing an audit assignment. Positions performing an audit function for a department are responsible for auditing all varieties of expenditures for the department or for the external agencies that come within the jurisdiction of the department. Incumbents are responsible for completing audits and preparing reports and recommendations for improving financial systems. Positions located in the Provincial Auditor's Office will assist in conducting an examination and audit of a variety of accounts and records for all government departments, boards, commissions and agencies and duties may also include supervision of a team of Audit Clerks. Positions located in the Taxation Division are responsible for performing a complete tax audit on small businesses and will assist in auditing larger business firms within and outside the province. -

Introduction and Overview of Audit and Assurance Chapter 1

c01IntroductionAndOverviewOfAuditAndAssurance.indd Page 1 04/03/19 8:37 PM F-0590 /208/WB02435/9781119401810/ch01/text_s CHaPTER 1 Introduction and Overview of Audit and Assurance The Audit Process Overview of Audit and Assurance (Chapter 1) Professionalism and Professional Responsibilities (Chapter 2) Client Acceptance/Continuance and Risk Assessment (Chapters 3 and 4) Gaining an Identify Significant Set Planning Understanding of Accounts and Materiality the Client Transactions Gaining an Understanding Make Preliminary of the System of Internal Control Risk Assessments (Chapter 6) Develop Responses to Risk and an Audit Strategy Performing Tests of Controls Performing Substantive Procedures (Chapter 8) (Chapter 9) (Chapter 5) (Chapter 7) Audit Evidence COPYRIGHTED MATERIAL Audit Sampling for Substantive Tests Audit Data Analytics (Chapter 10) Auditing the Auditing the Purchasing Auditing the Balance Sheet Revenue Process and Payroll Processes and Related Income Accounts (Chapter 11) (Chapter 12) (Chapter 13) Completing and Reporting on the Audit (Chapters 14 and 15) Procedures Performed Near Drawing Audit Reporting the End of the Audit Conclusions 1-1 c01IntroductionAndOverviewOfAuditAndAssurance.indd Page 2 04/03/19 8:37 PM F-0590 /208/WB02435/9781119401810/ch01/text_s 1-2 CHAPTER 1 Introduction and Overview of Audit and Assurance Learning Objectives LO 1 Differentiate among assurance, attestation, and LO 6 Explain the concepts of reasonable assurance, audit services. materiality, and the nature of an unqualified/ unmodified report on the audit of financial statements. LO 2 Describe the different types of assurance services. LO 7 Explain the concept of reasonable assurance and the nature of an unqualified report on internal controls LO 3 Explain the demand for audit and assurance over financial reporting.