Shell Pension Benefit Is Funded

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Shell" Transport and Trading Company, Ltd

THE ECONOMIC WEEKLY May 21, 1955 The "Shell" Transport and Trading Company, Ltd. Greater Operational Activity Results in Increased Sales Volume Heavy Capital Expenditure Inescapable Substantially Enlarged World Consumption Sir Frederick Godber's views on Oil Prices HE Annual General Meeting of through the capitalization of part of ber, was widely appreciated and T The " Shell " Transport and the company's share premiums re favourably commented upon, as Trading Company, Limited, will be serve. affording an opportunity of following held on June 1 at The Chartered In more closely the current trading When commenting on this issue surance Institute, 20, Aldermanbury, results of the group. I am glad to in my statement last year, I said that say that this year we propose to London, E.C. one of its objects was to broaden the publish similar results on a quarterly The following is the statement by basis of the ownership of the com basis, and that figures for the first the Chairman, Sir Frederick Godber, pany. You may, therefore, be inter quarter will be available within a few which has been circulated with the ested to learn that during 1954 re weeks. report and accounts for the year end gistered Ordinary stockholders in ed December 31, 1954: — creased by approximately 10,000, and I will now proceed to the report in December numbered over 142,000. on the group financial results for The Board of Directors You will appreciate, of course, that 1954. Little more than a year after his the number of individuals who own THE ROYAL DUTCH/SHELL resignation from the board owing to the equity of the company must ill health, Sir Andrew Agnew, our exceed this figure by a substantial GROUP REPORT ON THE colleague for so many years, has margin, there being no record of those YEAR 1934 passed away. -

7-Eleven & Shell

MARCUS & MILLICHAP OFFERING MEMORANDUM Activity#Z0380619 7 - ELEVEN & SHELL 8541 WEST FREEWAY FORT WORTH, TEXAS 76116 OFFERING MEMORANDUM | 7 - ELEVEN & SHELL 8541 WEST FREEWAY, FORT WORTH, TEXAS 76116 INVESTMENT OVERVIEW INVESTMENT HIGHLIGHTS • Irreplaceable Off-Ramp Location • Absolute NNN Lease with Zero Landlord Responsibilities • Income Tax Free State • Corner Location with Dedicated Turn Lane • Large Pylon Sign with Freeway Visibility • 80,523 People in Three Mile Radius • 106,194 Vehicles Per Day on Interstate 30 • 7-Eleven is the World’s Largest Operator, Franchisor & Licensor of INVESTMENT SUMMARY Convenient Stores The Conway Group at Marcus & Millichap is pleased to present th • Fort Worth is the 4 Most Populous Metropolitan Area in the the sale of this 3,042 square foot 7-Eleven and Shell property in United States Fort Worth, Texas. The subject property operates as a NNN Lease, with zero landlord responsibilities. This convenient store sits on 0.74 acres of and, with filling stations present. Situated on a signalized OFFERING SUMMARY corner, with a dedicated turn lane and pylon signage, the subject property sees over 106,194 Vehicles Per Day on Interstate PRICE $1,974,000 30. Located in a Tax Free State, this 7-Eleven offers great visibility and easy access. NOI $101,640 th C A P R A T E 5.15 % Fort Worth is the 15 -Largest City in the United States, with a population of 875,000 people. Population growth is up 8.50 PRICE/SF $648.92 percent in a one mile radius from the property. RENT/SF $33.41 7-Eleven was founded in 1927 and has now grown and evolved L E A S E T Y P E NNN into an international chain of convenience stores, operating nearly 7,800 company-owned and franchised stores in North GROSS LEASABLE AREA 3,042 SF America. -

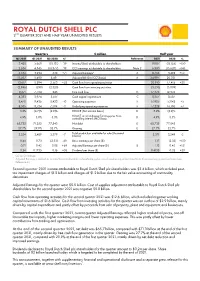

Shell QRA Q2 2021

ROYAL DUTCH SHELL PLC 2ND QUARTER 2021 AND HALF YEAR UNAUDITED RESULTS SUMMARY OF UNAUDITED RESULTS Quarters $ million Half year Q2 2021 Q1 2021 Q2 2020 %¹ Reference 2021 2020 % 3,428 5,660 (18,131) -39 Income/(loss) attributable to shareholders 9,087 (18,155) +150 2,634 4,345 (18,377) -39 CCS earnings attributable to shareholders Note 2 6,980 (15,620) +145 5,534 3,234 638 +71 Adjusted Earnings² A 8,768 3,498 +151 13,507 11,490 8,491 Adjusted EBITDA (CCS basis) A 24,997 20,031 12,617 8,294 2,563 +52 Cash flow from operating activities 20,910 17,415 +20 (2,946) (590) (2,320) Cash flow from investing activities (3,535) (5,039) 9,671 7,704 243 Free cash flow G 17,375 12,376 4,383 3,974 3,617 Cash capital expenditure C 8,357 8,587 8,470 9,436 8,423 -10 Operating expenses F 17,905 17,042 +5 8,505 8,724 7,504 -3 Underlying operating expenses F 17,228 16,105 +7 3.2% (4.7)% (2.9)% ROACE (Net income basis) D 3.2% (2.9)% ROACE on an Adjusted Earnings plus Non- 4.9% 3.0% 5.3% controlling interest (NCI) basis D 4.9% 5.3% 65,735 71,252 77,843 Net debt E 65,735 77,843 27.7% 29.9% 32.7% Gearing E 27.7% 32.7% Total production available for sale (thousand 3,254 3,489 3,379 -7 boe/d) 3,371 3,549 -5 0.44 0.73 (2.33) -40 Basic earnings per share ($) 1.17 (2.33) +150 0.71 0.42 0.08 +69 Adjusted Earnings per share ($) B 1.13 0.45 +151 0.24 0.1735 0.16 +38 Dividend per share ($) 0.4135 0.32 +29 1. -

Royal Dutch Shell Report on Payments to Governments for the Year 2018

ROYAL DUTCH SHELL REPORT ON PAYMENTS TO GOVERNMENTS FOR THE YEAR 2018 This Report provides a consolidated overview of the payments to governments made by Royal Dutch Shell plc and its subsidiary undertakings (hereinafter refer to as “Shell”) for the year 2018 as required under the UK’s Report on Payments to Governments Regulations 2014 (as amended in December 2015). These UK Regulations enact domestic rules in line with Directive 2013/34/EU (the EU Accounting Directive (2013)) and apply to large UK incorporated companies like Shell that are involved in the exploration, prospection, discovery, development and extraction of minerals, oil, natural gas deposits or other materials. This Report is also filed with the National Storage Mechanism (http://www.morningstar.co.uk/uk/nsm) intended to satisfy the requirements of the Disclosure Guidance and Transparency Rules of the Financial Conduct Authority in the United Kingdom This Report is available for download from www.shell.com/payments BASIS FOR PREPARATION - REPORT ON PAYMENTS TO GOVERNMENTS FOR THE YEAR 2018 Legislation This Report is prepared in accordance with The Reports on Payments to Governments Regulations 2014 as enacted in the UK in December 2014 and as amended in December 2015. Reporting entities This Report includes payments to governments made by Royal Dutch Shell plc and its subsidiary undertakings (Shell). Payments made by entities over which Shell has joint control are excluded from this Report. Activities Payments made by Shell to governments arising from activities involving the exploration, prospection, discovery, development and extraction of minerals, oil and natural gas deposits or other materials (extractive activities) are disclosed in this Report. -

Quest Opens Page 4 2 Shell News

ALUMNIPUBLISHED FOR SHELL ALUMNI IN THE AMERICAS | WWW.SHELL.US/ALUMNINEWSMARCH 2016 ULTIMATE JOURNEY TO THE DEEP WATER MAKES ENERGY LAST FRONTIER HEADLINES IN EFFICIENCY MARS-URSA BASIN Shell alumnus takes the trip Shell Eco-marathon of a lifetime. Shell announces Americas returns 100 million boe discovery to Detroit. at Kaikias field. QUEST OPENS PAGE 4 2 SHELL NEWS ALUMNINEWS AlumniNews is published for Shell US and Canada. Editors: Design: Heather Pray Russell and Jackie Panera Production Centre of Excellence Shell Communications Calgary Writer/copy editor: Shell Human Resources: Susan Diemont-Conwell Annette Chavez Torma Communications and Alicia Gomez A WORD FROM OUR EDITORS GO GREEN! A company that is simpler, more focused and U.S. AlumniNews moving to a digital more competitive. That’s the aim of a recent version starting December 2016 global structure change introduced by CEO Beginning with our December 2016 issue, Ben van Beurden and implemented at the AlumniNews will be delivered in an start of 2016. Along with the evolved global electronic format and will no longer be structure come projects that exemplify Shell’s offered as a printed and mailed publication. continued innovation and willingness to lead CONTENTS We invite our U.S. subscribers to sign up the industry. online at www.shell.us/alumni or by email This issue of AlumniNews features articles on at [email protected]. We will notify the company’s support of Alberta’s climate you directly when the latest version of change proposal and the historic opening of AlumniNews is posted online each quarter. Quest, a carbon capture and storage project designed to capture more than 1 million tons of carbon dioxide (CO²) each year. -

The Evolution of the Royal Dutch Shell: a Conversation with Marvin Odum, President of Shell Oil Company

Penn Sustainability Review Volume 1 Issue 8 Environmental Politics Article 2 5-5-2016 The Evolution of the Royal Dutch Shell: A Conversation with Marvin Odum, President of Shell Oil Company Follow this and additional works at: https://repository.upenn.edu/psr Part of the Environmental Studies Commons Recommended Citation (2016) "The Evolution of the Royal Dutch Shell: A Conversation with Marvin Odum, President of Shell Oil Company," Penn Sustainability Review: Vol. 1 : Iss. 8 , Article 2. Available at: https://repository.upenn.edu/psr/vol1/iss8/2 This paper is posted at ScholarlyCommons. https://repository.upenn.edu/psr/vol1/iss8/2 For more information, please contact [email protected]. The Evolution of the Royal Dutch Shell: A Conversation with Marvin Odum, President of Shell Oil Company This journal article is available in Penn Sustainability Review: https://repository.upenn.edu/psr/vol1/iss8/2 THE EVOLUTION OF ROYAL DUTCH SHELL A CONVERSATION WITH MARVIN ODUM PRESIDENT OF SHELL OIL COMPANY 6 THE EVOLUTION OF ROYAL DUTCH SHELL A CONVERSATION WITH MARVIN ODUM PRESIDENT OF SHELL OIL COMPANY 7 The following are excerpts from our interview. OIL IN THE ENERGY Note: Shortly following this interview, Odum TRANSITION: THE retired from Royal Dutch Shell. EVOLUTION OF Sasha Klebnikov: Shell is a company that has ROYAL DUTCH SHELL a lot of different aspects to it. How would you describe it? Is it an energy company? An oil Penn Sustainability Review’s editor-in-chief, company? A gas company? An engineering Sasha Klebnikov, recently had the honor of company? sitting down with the former president of Shell Oil Company, Marvin Odum, to talk about the Marvin Odum: Shell is an energy company, but future of energy, the push for a price on car- also a company that’s always looking forward. -

In the Matter of Shell Oil Corporation, Et

UNITED STATES OF AMERICA BEFORE FEDERAL TRADE COMMISSION In the Matter of ) ) Shell Oil Company, ) a corporation, ) ) File No. 971-0026 and ) ) Texaco Inc., ) a corporation. ) AGREEMENT CONTAINING CONSENT ORDER The Federal Trade Commission ("Commission"), having initiated an investigation of proposed joint ventures between Shell Oil Company ("Shell"), and Texaco Inc. ("Texaco"), and it now appearing that Shell and Texaco, hereinafter sometimes referred to as "proposed respondents," are willing to enter into an agreement containing an order to divest certain assets and providing for other relief: IT IS HEREBY AGREED by and between proposed respondents, by their duly authorized officers and attorneys, and counsel for the Commission that: 1. Proposed respondent Shell Oil Company is a corporation organized, existing and doing business under and by virtue of the laws of the State of Delaware, with its office and principal place of business located at One Shell Plaza, Houston, Texas 77002. 2. Proposed respondent Texaco Inc. is a corporation organized, existing and doing business under and by virtue of the laws of the State of Delaware, with its office and principal place of business located at 2000 Westchester Ave., White Plains, New York 10650. 3. Proposed respondents admit all the jurisdictional facts set forth in the draft of Complaint here attached. 4. Proposed respondents waive: a. any further procedural steps; b. the requirement that the Commission's decision contain a statement of findings of fact and conclusions of law; c. all rights to seek judicial review or otherwise to challenge or contest the validity of the order entered pursuant to this agreement; Page 2 of 20 and d. -

Win at Daytona Page 3

ALUMNIPUBLISHED FOR SHELL ALUMNI IN THE AMERICAS | WWW.SHELL.US/ALUMNINEWSJUNE 2015 UNLOCKING SHELL MAKES HISTORY SHELL IN THE ARCTIC ENERGY ON NEW YORK STOCK IN ULTRA- EXCHANGE Answers to commonly DEEPWATER asked questions. Shell Midstream Partners 3D printing saves goes public. months of work. WIN AT DAYTONA PAGE 3 20154305 ComPgs.indd 1 5/13/15 5:20 AM 2 SHELL NEWS ALUMNINEWS AlumniNews is published for Shell US and Canada. Editors: Design: Natalie Mazey and Jackie Panera Production Centre of Excellence Shell Communications The Hague Writer/copy editor: Shell Human Resources: Susan Diemont-Conwell Annette Chavez Torma Communications and Alicia Gomez A WORD FROM OUR EDITORS We know that many of you as former Shell GO GREEN employees field questions from time to time Sign up to receive the newsletter electronically by on Shell projects and the direction of the visiting www.shell.us/alumni. While you’re there, read industry. While our goal is to provide you the latest news and information about Shell. Thank you to those who have already chosen to go green! with news about the business, some alumni expressed a need for messaging documents that would help explain Shell’s stance on CONTENTS particular hot-button issues. This issue, we’ve sought to answer commonly asked questions about our role in the Arctic. We hope this information will prove helpful when HIGHLIGHTS discussing the project with friends and family. Shell technology under the hood 03 Joey Logano wins his first-ever Daytona 500. Also in this issue, we’ve shared a major success at the Daytona 500—a big win for Unlocking energy in ultra-deepwater driver Joey Logano and for Shell as 04 3D printing saves months of work. -

Climbing Hubbert's Peak: the Looming World Oil Crisis

03TQEM_17_3_eccleston.qxd 3/7/08 12:19 PM Page 25 Climbing Hubbert’s Peak: The Looming World Oil Crisis When the American Peak Oil Theory Petroleum Institute Hubbert argued met for a conference Declines in global oil production that petroleum pro- in March 1956, duction would fol- most of the partici- are inevitable low a standard sta- pants probably ex- tistical “bell-shaped pected to hear up- curve.” He noted beat news. After all, that the quantity of back in the 1950s, oil available for production in any given region the U.S. petroleum industry was humming and must necessarily be finite, and therefore subject vibrant. The petroleum companies were produc- to depletion at some point. ing more U.S.-generated crude oil than ever be- Whenever a new oil field is discovered, the fore—in excess of 7 million barrels per day.1 The petroleum yield from that location tends to in- sky was the limit. Or so it appeared. crease rapidly for a period of years, as drilling in- Then M. King Hubbert delivered his paper. frastructure is put in place and extraction activi- ties are ramped up. Hubbert’s Prediction Once half of the oil field’s reserves are Dr. Hubbert, then age 52, was a geologist with pumped out, however, the oil source reaches its Shell Oil Company. Officials at his company had peak rate of production. Then decline sets in, received advance word about Hubbert’s speech, with the rate of production decrease ultimately and they were worried. They pleaded with him to approximating a “mirror image” of the produc- downplay some of the paper’s more controversial tion increase rate seen in the oil field’s early years. -

ELIGIBLE FACILITIES for ONLINE PERMITTING SYSTEM Page 1

ELIGIBLE FACILITIES FOR ONLINE PERMITTING SYSTEM Facility Number Facility Name 289 Broadway Cleaners 292 Willard's Cleaners 297 Vogue Cleaners, Inc 298 Poly Clean Center 299 Killarney Cleaners 311 LP's Town and Country Cleaners 318 Crystal Cleaning Center 345 Roy's Cleaners 353 AJ's Quick Clean Center 378 Ideal Cleaners 387 R&J Quick Clean Center 495 Annabelle's French Cleaner 614 Don's Body Shop 673 Mike's One Hour Cleaners 800 Pinecrest Cleaners 863 Paul's Sparkle Cleaners 867 Locust Cleaners 892 One Hour Martinizing 906 St Francis Cleaners 916 London Pride Cleaners 966 Blossom Hill Cleaners 972 NJ United, INC. dba Fred's Cleaners 973 Crystal Cleaners 1003 Anthony Cleaners 1010 One Hour Martinizing by Lee 1016 Courtesy Cleaners 1031 Brite-N-Clean Cleaners 1140 Crown Cleaners 1148 Coit Drapery & Carpet Cleaners, Inc 1148 Coit Drapery & Carpet Cleaners, Inc 1168 Walnut Cleaners 1180 Perfection Cleaners 1295 West Cleaners 1356 Glen Park Cleaners 1390 Norge Cleaners & Laundry 1436 Pacheco Plaza Cleaners 1499 Redwood Shores Cleaners 1518 Quito Park Dry Cleaners 1592 Four Mile Cleaners 1693 Lombard Dry Cleaners 1703 Inter-City Cleaners 1729 Wardrobe Cleaners Page 1 ELIGIBLE FACILITIES FOR ONLINE PERMITTING SYSTEM 1816 L & M One Hour Cleaners 1838 Hoot N' Toot Cleaners 1846 Mark Hopkins Hotel 1846 Mark Hopkins Hotel 1869 Blue Bird Cleaners 1890 Aristocrat Cleaners 2019 U S Cleaners 2028 Rockridge Royal Cleaners 2067 Orchid French Cleaners 2075 Veteran's DeLuxe Cleaners 2140 Price Rite Cleaners, Inc 2141 El Portal One Hour Cleaners And Laundry -

FTC Testimony: on Exxon/Mobil Merger

Statement of The Federal Trade Commission Presented by William J. Baer Director, Bureau of Competition(1) before the Committee on Commerce, Subcommittee on Energy and Power, U.S. House of Representatives March 10, 1999 Mr. Chairman, our thanks to you and the Committee for the opportunity to discuss the Federal Trade Commission's role in enforcing the antitrust laws to protect consumers in the petroleum industry. The Commission shares the view that a viable and competitive energy sector is vitally important to the economic health of the United States and the world. The Commission has an extensive history of carefully examining mergers in the petroleum industry, and has used its authority to enforce the antitrust laws to assure that mergers in this industry do not lead to lessened competition or its consequence - higher prices for gasoline and other fuels, and the consequent harm to the economy of the nation or of any region. As has been publicly observed, the combination of Exxon and Mobil is the largest industrial merger ever, and will create the largest private oil company worldwide and the largest US- based company of any type (by revenues). Today, Exxon and Mobil face each other at just about every level of the industry - exploration for and production of crude oil, refining of crude oil into petroleum products, manufacture of petrochemicals and lubricants, and the marketing of gasoline and other fuels in many parts of the United States (in particular the northeast, the Gulf Coast, and California). Exxon/Mobil is likely to be the largest or one of the largest players in each of these market sectors. -

2015 Shell Annual Report and Form 20-F

ANNUAL REPORT Royal Dutch Shell plc Annual Report and Form 20-F for the year ended December 31, 2015 01 106 CONTENTS INTRODUCTION FINANCIAL STATEMENTS 01 Form 20-F AND SUPPLEMENTS 02 Cross reference to Form 20-F 106 Consolidated Financial Statements 04 Terms and abbreviations 153 Supplementary information – oil and 05 About this Report gas (unaudited) 173 Parent Company Financial Statements 06 185 Royal Dutch Shell Dividend Access Trust STRATEGIC REPORT Financial Statements 06 Chairman’s message 07 Chief Executive Officer’s review 190 08 Risk factors ADDITIONAL 13 Business overview INFORMATION 15 Strategy and outlook 190 Shareholder information 16 Market overview 197 Section 13(r) of the US Securities 18 Summary of results Exchange Act of 1934 disclosure 20 Performance indicators 198 Non-GAAP measures reconciliations 22 Selected financial data and other definitions 23 Upstream 200 Exhibits 41 Downstream 48 Corporate 49 Liquidity and capital resources Cover images 53 Environment and society 60 Our people The cover shows some of the ways that Shell helps to meet the world’s diverse energy needs – from supplying gas for cooking, heating, 62 and generating electricity for GOVERNANCE homes and businesses, to liquefied natural gas (LNG) to fuel trucks 62 The Board of Royal Dutch Shell plc and ships. Pearl, the world’s largest 65 Senior Management gas-to-liquids (GTL) plant, makes 66 Directors’ Report lubricants, fuels and products for 69 Corporate governance plastics. Prelude, the world’s largest floating LNG facility, will produce 83 Audit Committee Report LNG off the coast of Australia. 86 Directors’ Remuneration Report Designed by Conran Design Group carbon neutral natureOffice.com | NL-215-168617 Typeset by RR Donnelley print production Printed by Tuijtel under ISO 14001 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C.