Appendix 4 Terminated UK PPP Projects

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

View Annual Report

Costain Group PLC PLC Costain Group Costain House Nicholsons Walk Being Number One Maidenhead Costain Group PLC Berkshire SL6 1LN Annual Report 2005 Telephone 01628 842444 www.costain.com Annual Report 2005 Costain is an international Financial calendar engineering and construction Half year results – Announced 31 August 2005 Full year results – Announced 15 March 2006 company, seen as an Report & Accounts – Sent to shareholders 28 March 2006 Annual General Meeting – To be held 27 April 2006 Half year results 2005 – To be announced 30 August 2006 automatic choice for projects Analysis of Shareholders Shares requiring innovation, initiative, Accounts (millions) % Institutions, companies, individuals and nominees: Shareholdings 100,000 and over 156 321.92 90.39 teamwork and high levels of Shareholdings 50,000 – 99,999 93 6.37 1.69 Shareholdings 25,000 – 49,999 186 6.01 1.79 Shareholdings 5,000 – 24,999 1,390 13.78 3.87 technical and managerial skills. Shareholdings 1 – 4,999 12,848 8.06 2.26 14,673 356.14 100.00 Secretary and Registered Office Secretary Registrar and Transfer Office Clive L Franks Lloyds TSB Registrars The Causeway Registered Office Worthing Costain Group PLC West Sussex Costain House BN99 6DA Nicholsons Walk Telephone 0870 600 3984 Maidenhead Berkshire SL6 1LN Telephone 01628 842444 www.costain.com [email protected] Company Number 1393773 Shareholder information The Company’s Registrar is Lloyds TSB Registrars, The Causeway, Worthing, West Sussex BN99 6DA. For enquiries regarding your shareholding, please telephone 0870 600 3984. You can also view up-to-date information abourt your holdings by visiting the shareholder web site at www.shareview.co.uk. -

BUILDING BLOCKS News from the HCD Group ISSUE 18

BUILDING BLOCKS News from the HCD Group ISSUE 18 IN THIS ISSUE EFFICIENT DESIGN FOR LONDON REGENERATION PIONEERING OXFORD FACILITY 60’S CENTRE UPGRADE FRAMEWORK AGREEMENT DELIVERS FOR SAINSBURY’S NATIONAL ‘BIOLOGICS’ CENTRE www.hcdgroup.co.uk EFFICIENT DESIGN FOR LONDON REGENERATION Acting as Approved Inspector to the scheme, HCD has incorporated complex fire engineering techniques which have allowed the reduction of costly fire resistance to structural steelwork. Following its successful involvement with the adjacent to Hammersmith tube station and Part L 2010. A further innovation will see a first phase of a prime office development in opposite Lyric Square. It will provide 15,330m2 window-wetting sprinkler system utilised to Hammersmith town centre, HCD Building of grade-A office space in an 11 storey building protect the external façades in case of fire. 2 Control is part of the team behind the second plus 560m of cafés, restaurants and additional As well as an efficient envelope, the use of phase of the scheme which is now underway. public spaces. highly effective M&E equipment and roof- Development Securities is pressing ahead with Acting as Approved Inspector to the scheme, mounted solar panels will also contribute to the the £92m project at 12 Hammersmith Grove. HCD has been involved in the evolution of the sustainable credentials of the scheme which is expected to achieve a BREEAM ‘Excellent’ This will complete the developer’s office-led building’s efficient design. Through its proactive rating. Additional features include ‘green’ regeneration in West London following the involvement and wide-ranging expertise sedum roofing to support biodiversity and 2013 completion of its neighbouring, 10,220m2 the company has incorporated complex fire sustainable employee travel will be encouraged development at 10 Hammersmith Grove. -

The Operator's Story Appendix

Railway and Transport Strategy Centre The Operator’s Story Appendix: London’s Story © World Bank / Imperial College London Property of the World Bank and the RTSC at Imperial College London Community of Metros CoMET The Operator’s Story: Notes from London Case Study Interviews February 2017 Purpose The purpose of this document is to provide a permanent record for the researchers of what was said by people interviewed for ‘The Operator’s Story’ in London. These notes are based upon 14 meetings between 6th-9th October 2015, plus one further meeting in January 2016. This document will ultimately form an appendix to the final report for ‘The Operator’s Story’ piece Although the findings have been arranged and structured by Imperial College London, they remain a collation of thoughts and statements from interviewees, and continue to be the opinions of those interviewed, rather than of Imperial College London. Prefacing the notes is a summary of Imperial College’s key findings based on comments made, which will be drawn out further in the final report for ‘The Operator’s Story’. Method This content is a collation in note form of views expressed in the interviews that were conducted for this study. Comments are not attributed to specific individuals, as agreed with the interviewees and TfL. However, in some cases it is noted that a comment was made by an individual external not employed by TfL (‘external commentator’), where it is appropriate to draw a distinction between views expressed by TfL themselves and those expressed about their organisation. -

London Underground Public Private Partnerships

House of Commons Committee of Public Accounts London Underground Public Private Partnerships Seventeenth Report of Session 2004–05 Report, together with formal minutes, oral and written evidence Ordered by The House of Commons to be printed 9 March 2005 HC 446 Incorporating HC 783-i, Session 2003–04 Published on 31 March 2005 by authority of the House of Commons London: The Stationery Office Limited £13.50 The Committee of Public Accounts The Committee of Public Accounts is appointed by the House of Commons to examine “the accounts showing the appropriation of the sums granted by Parliament to meet the public expenditure, and of such other accounts laid before Parliament as the committee may think fit” (Standing Order No 148). Current membership Mr Edward Leigh MP (Conservative, Gainsborough) (Chairman) Mr Richard Allan MP (Liberal Democrat, Sheffield Hallam) Mr Richard Bacon MP (Conservative, South Norfolk) Mrs Angela Browning MP (Conservative, Tiverton and Honiton) Jon Cruddas MP (Labour, Dagenham) Rt Hon David Curry MP (Conservative, Skipton and Ripon) Mr Ian Davidson MP (Labour, Glasgow Pollock) Rt Hon Frank Field MP (Labour, Birkenhead) Mr Brian Jenkins MP (Labour, Tamworth) Mr Nigel Jones MP (Liberal Democrat, Cheltenham) Jim Sheridan MP (Labour, West Renfrewshire) Mr Siôn Simon MP (Labour, Birmingham Erdington) Mr Gerry Steinberg MP (Labour, City of Durham) Mr Stephen Timms MP (Labour, East Ham) Jon Trickett MP (Labour, Hemsworth) Rt Hon Alan Williams MP (Labour, Swansea West) The following was also a member of the Committee during the period of this inquiry. Ms Ruth Kelly MP (Labour, Bolton West) Powers Powers of the Committee of Public Accounts are set out in House of Commons Standing Orders, principally in SO No 148. -

May CARG 2020.Pdf

ISSUE 30 – MAY 2020 ISSUE 30 – MAY ISSUE 29 – FEBRUARY 2020 Promoting positive mental health in teenagers and those who support them through the provision of mental health education, resilience strategies and early intervention What we offer Calm Harm is an Clear Fear is an app to Head Ed is a library stem4 offers mental stem4’s website is app to help young help children & young of mental health health conferences a comprehensive people manage the people manage the educational videos for students, parents, and clinically urge to self-harm symptoms of anxiety for use in schools education & health informed resource professionals www.stem4.org.uk Registered Charity No 1144506 Any individuals depicted in our images are models and used solely for illustrative purposes. We all know of young people, whether employees, family or friends, who are struggling in some way with mental health issues; at ARL, we are so very pleased to support the vital work of stem4: early intervention really can make a difference to young lives. Please help in any way that you can. ADVISER RANKINGS – CORPORATE ADVISERS RANKINGS GUIDE MAY 2020 | Q2 | ISSUE 30 All rights reserved. No part of this publication may be reproduced or transmitted The Corporate Advisers Rankings Guide is available to UK subscribers at £180 per in any form or by any means (including photocopying or recording) without the annum for four updated editions, including postage and packaging. A PDF version written permission of the copyright holder except in accordance with the provision is also available at £360 + VAT. of copyright Designs and Patents Act 1988 or under the terms of a licence issued by the Copyright Licensing Agency, Barnard’s Inn, 86 Fetter Lane, London, EC4A To appear in the Rankings Guide or for subscription details, please contact us 1EN. -

Taylor Woodrow Plc Report and Accounts 2006 Our Aim Is to Be the Homebuilder of Choice

Taylor Woodrow plc Report and Accounts 2006 Our aim is to be the homebuilder of choice. Our primary business is the development of sustainable communities of high-quality homes in selected markets in the UK, North America, Spain and Gibraltar. We seek to add shareholder value through the achievement of profitable growth and effective capital management. Contents 01 Group Financial Highlights 54 Consolidated Cash Flow 02 Chairman’s Statement Statement 05 Chief Executive’s Review 55 Notes to the Consolidated 28 Board of Directors Financial Statements 30 Report of the Directors 79 Independent Auditors’ Report 33 Corporate Governance Statement 80 Accounting Policies 37 Directors’ Remuneration Report 81 Company Balance Sheet 46 Directors’ Responsibilities 82 Notes to the Company Financial Statement Statements 47 Independent Auditors’ Report 87 Particulars of Principal Subsidiary 48 Accounting Policies Undertakings 51 Consolidated Income Statement 88 Five Year Review 52 Consolidated Statement of 90 Shareholder Facilities Recognised Income and Expense 92 Principal Taylor Woodrow Offices 53 Consolidated Balance Sheet Group Financial Highlights • Group revenues £3.68bn (2005: £3.56bn) • Housing profit from operations* £469m (2005: £456m) • Profit before tax £406m (2005: £411m) • Basic earnings per share 50.5 pence (2005: 50.6 pence) • Full year dividend 14.75 pence (2005: 13.4 pence) • Net gearing 18.6 per cent (2005: 23.7 per cent) • Equity shareholders’ funds per share 364.7 pence (2005: 338.4 pence) Profit before tax £m 2006 405.6 2005 411.0 2004 403.9 Full year dividend pence (Represents interim dividends declared and paid and final dividend for the year as declared by the Board) 2006 14.75 2005 13.4 2004 11.1 Equity shareholders’ funds per share pence 2006 364.7 2005 338.4 2004 303.8 * Profit from operations is before joint ventures’ interest and tax (see Note 3, page 56). -

Crr 412/2002

HSE Health & Safety Executive A survey of UK approaches to sharing good practice in health and safety risk management Prepared by Risk Solutions for the Health and Safety Executive CONTRACT RESEARCH REPORT 412/2002 HSE Health & Safety Executive A survey of UK approaches to sharing good practice in health and safety risk management E Baker Risk Solutions 1st floor, Central House 14 Upper Woburn Place London, WC1H 0JN United Kingdom The concept of good practice is central to HSE’s approach to regulation of health and safety management. There must therefore be a common understanding of what good practice is and where it can be found. A survey was conducted to explore how industry actually identifies good practice in health and safety management, decides how to adopt it, and how this is communicated with others. The findings are based primarily on a segmentation of the survey results by organisation size, due to homogeneity of the returns along other axes of analysis. A key finding is that there is no common understanding of the term good practice or how this is distinguished from best practice. Regulatory interpretation of good practice is perceived to be inconsistent. Three models were identified: A) Large organisations, primarily in privatised industries, have effective Trade Associations where good practice is developed and guidance disseminated industry-wide. B) Large and medium-sized organisations in competitive industries have ineffective trade associations. They develop good practices in-house and may only share these with their competitors when forced to do so. C) Small organisations have little contact with their competitors. -

![J Jarvis & Sons Ltd V Blue Circle Dartford Estates Ltd [2007]](https://docslib.b-cdn.net/cover/2296/j-jarvis-sons-ltd-v-blue-circle-dartford-estates-ltd-2007-322296.webp)

J Jarvis & Sons Ltd V Blue Circle Dartford Estates Ltd [2007]

J Jarvis & Sons Ltd v Blue Circle Dartford Estates Ltd [2007] APP.L.R. 05/14 JUDGMENT : MR JUSTICE JACKSON: TCC. 14th May 2007 1. This judgment is in seven parts, namely, Part 1 "Introduction"; Part 2 "The Facts"; Part 3 "The Present Proceedings"; Part 4 "The Law"; Part 5 "The Application for an Injunction"; Part 6 "Jarvis's Challenges to the Interim Award"; and Part 7 "Conclusion". Part 1: Introduction 2. This is an action brought by a main contractor in order to prevent the continuance of an arbitration. The contractor seeks to achieve that result either by means of an injunction or, alternatively, by challenging an Interim Award of the Arbitrator. This litigation has been infused with some urgency because it was launched just fifteen days before the date fixed for the start of arbitration hearing. 3. J Jarvis & Sons Limited is claimant in these proceedings and defendant in the arbitration. Prior to 18th February 1997, the name of this company was J Jarvis & Sons plc. I shall refer to the company as "Jarvis". Jarvis is the subsidiary company of Jarvis plc. Blue Circle Dartford Estates Limited is defendant in these proceedings and claimant in the arbitration. I shall refer to this party as "Blue Circle". Blue Circle is a subsidiary company of Blue Circle Industries plc. The solicitors for the parties will feature occasionally in the narrative. Squire & Co are solicitors for Jarvis. Howrey LLP are solicitors for Blue Circle. 4. I turn now to other companies which will feature in the narrative of events. GEFCO (UK) Limited are forwarding agents. -

Using the London Underground the London Underground

Using the London Underground The London Underground (also called the Tube) can be very daunting to anyone using the system for the first time – the crowds of people and bombardment of new sensory input can present a challenge in itself! To help you prepare for your journey, here’s some information on what to expect, as well as other tips and tricks to improve the experience. Entrance/Exit 2, Marble Arch Where do I need to go? The famous Tube map, available online and as a leaflet at Tube stations, shows which lines run through which stations across the entire network, allowing you to work out a route between your starting point and your destination. Stations where you can change lines are normally marked on the map with a white circle, although stations with step-free access will instead be marked with a white or blue circle including a wheelchair symbol. Part of the Tube map, showing central London Alternatively, various map websites and apps offer a journey planner tool – just type in two stations and you’ll be shown the quickest route and an approximate journey time. Transport for London’s own journey planner, which also includes other TfL-run transport such as buses, allows you to request step-free access, routes with fewest changes, and a host of other accessibility options. Always check for closures and delays on the day before you travel, for example on the TfL website – sometimes lines close at the weekend for maintenance, and this information will be available in advance. If you have Twitter, you can follow the accounts for TfL and the specific accounts for your most commonly used lines for up- to-date information. -

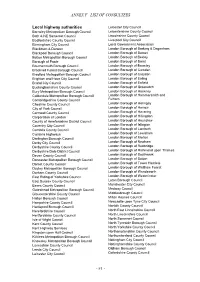

Annex F –List of Consultees

ANNEX F –LIST OF CONSULTEES Local highway authorities Leicester City Council Barnsley Metropolitan Borough Council Leicestershire County Council Bath & NE Somerset Council Lincolnshire County Council Bedfordshire County Council Liverpool City Council Birmingham City Council Local Government Association Blackburn & Darwen London Borough of Barking & Dagenham Blackpool Borough Council London Borough of Barnet Bolton Metropolitan Borough Council London Borough of Bexley Borough of Poole London Borough of Brent Bournemouth Borough Council London Borough of Bromley Bracknell Forest Borough Council London Borough of Camden Bradford Metropolitan Borough Council London Borough of Croydon Brighton and Hove City Council London Borough of Ealing Bristol City Council London Borough of Enfield Buckinghamshire County Council London Borough of Greenwich Bury Metropolitan Borough Council London Borough of Hackney Calderdale Metropolitan Borough Council London Borough of Hammersmith and Cambridgeshire County Council Fulham Cheshire County Council London Borough of Haringey City of York Council London Borough of Harrow Cornwall County Council London Borough of Havering Corporation of London London Borough of Hillingdon County of Herefordshire District Council London Borough of Hounslow Coventry City Council London Borough of Islington Cumbria County Council London Borough of Lambeth Cumbria Highways London Borough of Lewisham Darlington Borough Council London Borough of Merton Derby City Council London Borough of Newham Derbyshire County Council London -

Yorbuild2 East Area Framework – List of Unsuccessful Candidates at ITT Lot 1 0-£250K

YORbuild2 East Area Framework – list of unsuccessful candidates at ITT Lot 1 0-£250k Applicant T H Michaels (Construction) Ltd Evora Construction Limited Britcon Limited George Hurst & Sons Ltd FMe Property Solutions Ltd The Soper Group Ltd Transcore Limited J C Services & Son Ltd Strategic Team Maintenance Co Ltd Stubbs Brothers Building Services Limited Unico Construction Limited Woodhouse-Barry (Construction) Ltd Lot 2 over £250k-£1m Applicant S Voase Builders Limited F Parkinson Ltd Britcon Limited RN Wooler & Co Ltd Illingworth & Gregory Ltd George Hurst & Sons Ltd T H Michaels (Construction) Ltd Transcore Limited PBS Construction Elliott Group Northern Construction Solutions Ltd Woodhouse-Barry (Construction) Ltd Lot 3 over £1m-£4m Applicant Wildgoose Construction ltd Esh Construction Limited Morgan Sindall George Hurst & Sons Ltd Britcon Limited Hall Construction Group Caddick Construction Limited Strategic Team Maintenance Co Ltd F Parkinson Ltd Gentoo Tolent GMI Construction Group PLC United Living Lot 4 over £4m-£10m Applicant Conlon Construction Limited Bowmer & Kirkland Ltd Keepmoat Regeneration Limited Henry Boot Construction Limited Morgan Sindall Hobson and Porter Ltd Robertson Construction Group Ltd Eric Wright Group VINCI Construction UK Limited G F Tomlinson Group Limited Sewell Group Britcon Limited Lot 5 over £10m Applicant Henry Boot Construction Limited Bowmer & Kirkland Ltd John Graham Construction Ltd Morgan Sindall McLaughlin & Harvey (formally Barr Construction Ltd) Eric Wright Group VINCI Construction UK Limited Robertson Construction Group Ltd Caddick Construction Limited J F Finnegan Limited Shepherd Construction Lot 6 New housing up to 10 units Applicant GEDA Construction Lindum Group Limited Woodhouse-Barry (Construction) Ltd Lot 7 New housing over 10 units Applicant Gentoo Tolent Herbert T Forrest Ltd Lindum Group Limited Termrim Construction Strategic Team Maintenance Co Ltd GEDA Construction . -

Becoming Collaborative: Enhancing the Understanding of Intra-Organisational Relational Dynamics

BECOMING COLLABORATIVE: ENHANCING THE UNDERSTANDING OF INTRA-ORGANISATIONAL RELATIONAL DYNAMICS by Eloise Grove A Doctoral Thesis submitted in partial fulfilment of the requirements for the award of the Engineering Doctorate (EngD) degree, of Loughborough University July 2018 © by Eloise Grove (2018) Centre for Innovative and Collaborative Engineering (CICE) Department of Architecture, Civil & Building Engineering Loughborough University Loughborough Leics, LE11 3TU Acknowledgements ACKNOWLEDGMENTS I would first like to thank all the people at my Sponsoring organisation who have participated directly and indirectly in this research over the years. Not only have you provided me with the valuable material necessary but you have offered friendship that has made your place of work such an enjoyable place for me to be. Your candid contributions never cease to amaze me and for your trust I am truly grateful. Thanks to my supervisors at Loughborough University for their words of wisdom and encouragement. I’ve been connected to the School of Architecture, Building and Civil Engineering on and off since 2008. Whilst I’ve never been permanently based there I have always felt like I belong. I therefore extend this thanks to the wider team at ACBE – you make it a special place to learn. Thank you to all my industrial supervisors (there have been many) for their guidance, with special thanks to Lisa for, in her words, being the best industrial supervisor in the history of industrial supervisors. She’s kind of a big deal. For the hours upon hours of proof reading, not only throughout the years of this study but for all the homework, assignments, applications and papers that have got me to this stage in my life.