The Global Challenge in Services Trade

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

0 0 0 0 Acasa Program Final For

PROGRAM ABSTRACTS FOR THE 15TH TRIENNIAL SYMPOSIUM ON AFRICAN ART Africa and Its Diasporas in the Market Place: Cultural Resources and the Global Economy The core theme of the 2011 ACASA symposium, proposed by Pamela Allara, examines the current status of Africa’s cultural resources and the influence—for good or ill—of market forces both inside and outside the continent. As nation states decline in influence and power, and corporations, private patrons and foundations increasingly determine the kinds of cultural production that will be supported, how is African art being reinterpreted and by whom? Are artists and scholars able to successfully articulate their own intellectual and cultural values in this climate? Is there anything we can do to address the situation? WEDNESDAY, MARCH 23, 2O11, MUSEUM PROGRAM All Museum Program panels are in the Lenart Auditorium, Fowler Museum at UCLA Welcoming Remarks (8:30). Jean Borgatti, Steven Nelson, and Marla C. Berns PANEL I (8:45–10:45) Contemporary Art Sans Frontières. Chairs: Barbara Thompson, Stanford University, and Gemma Rodrigues, Fowler Museum at UCLA Contemporary African art is a phenomenon that transcends and complicates traditional curatorial categories and disciplinary boundaries. These overlaps have at times excluded contemporary African art from exhibitions and collections and, at other times, transformed its research and display into a contested terrain. At a moment when many museums with so‐called ethnographic collections are expanding their chronological reach by teasing out connections between traditional and contemporary artistic production, many museums of Euro‐American contemporary art are extending their geographic reach by globalizing their curatorial vision. -

September 2020 Issue

Volume XXXVIII No. 9 September 2020 Montreal, QC www.filipinostar.org Second COVID-19 wave has already stOaTTAWrA,tSepetembder 23:, PM in address to natesttedipoositiven for the virus. 2020 -- Prime Minister Justin Trudeau "This is the time for all of us as says that in some parts of the country Canadians, to do our part for our the COVID-19 second wave has country, as government does its part already begun, but Canadians have for you," he said. the power to flatten the curve again, in Responding to Trudeau’s his evening address to the nation declaration of a second wave, CTV from his West Block office. Infectious Disease Specialist Dr. Abdu "In our four biggest provinces, Sharkawy said that he thinks we’re the second wave isn’t just starting, it’s “very much there.” already underway," said Trudeau, of “We have seen that the the current outbreaks in British numbers are rising disproportionate to Columbia, Alberta, Ontario and the number of tests that are being Quebec. "We’re on the brink of a fall done, and we've seen a consistent that could be much worse than the trend of community transmission that spring." has been uncontrolled now for some COVID-19 cases have jumped time. And it's evidenced by people in nationally, from about 300 cases per my emergency room and in my ICU,” day in mid-August to 1,248 on Prime Minister Justin Trudeau delivers his address to the nation Dr. Sharkawy said, adding that Tuesday, prompting Chief Public in the evening after the speech from the throne from his West addressing the current testing Health Officer Dr. -

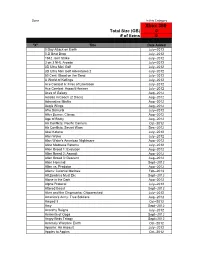

Xbox 360 Total Size (GB) 0 # of Items 0

Done In this Category Xbox 360 Total Size (GB) 0 # of items 0 "X" Title Date Added 0 Day Attack on Earth July--2012 0-D Beat Drop July--2012 1942 Joint Strike July--2012 3 on 3 NHL Arcade July--2012 3D Ultra Mini Golf July--2012 3D Ultra Mini Golf Adventures 2 July--2012 50 Cent: Blood on the Sand July--2012 A World of Keflings July--2012 Ace Combat 6: Fires of Liberation July--2012 Ace Combat: Assault Horizon July--2012 Aces of Galaxy Aug--2012 Adidas miCoach (2 Discs) Aug--2012 Adrenaline Misfits Aug--2012 Aegis Wings Aug--2012 Afro Samurai July--2012 After Burner: Climax Aug--2012 Age of Booty Aug--2012 Air Conflicts: Pacific Carriers Oct--2012 Air Conflicts: Secret Wars Dec--2012 Akai Katana July--2012 Alan Wake July--2012 Alan Wake's American Nightmare Aug--2012 Alice Madness Returns July--2012 Alien Breed 1: Evolution Aug--2012 Alien Breed 2: Assault Aug--2012 Alien Breed 3: Descent Aug--2012 Alien Hominid Sept--2012 Alien vs. Predator Aug--2012 Aliens: Colonial Marines Feb--2013 All Zombies Must Die Sept--2012 Alone in the Dark Aug--2012 Alpha Protocol July--2012 Altered Beast Sept--2012 Alvin and the Chipmunks: Chipwrecked July--2012 America's Army: True Soldiers Aug--2012 Amped 3 Oct--2012 Amy Sept--2012 Anarchy Reigns July--2012 Ancients of Ooga Sept--2012 Angry Birds Trilogy Sept--2012 Anomaly Warzone Earth Oct--2012 Apache: Air Assault July--2012 Apples to Apples Oct--2012 Aqua Oct--2012 Arcana Heart 3 July--2012 Arcania Gothica July--2012 Are You Smarter that a 5th Grader July--2012 Arkadian Warriors Oct--2012 Arkanoid Live -

Seameo Retrac

Welcome Remarks Welcome Remarks by Dr. Ho Thanh My Phuong, Director SEAMEO Regional Training Center (SEAMEO RETRAC) Distinguished Guests, Ladies and Gentlemen, It is my great pleasure, on behalf of SEAMEO RETRAC, to welcome all of you to this International Conference on “Impacts of Globalization on Quality in Higher Education”. I am really delighted with the attendance of more than 150 educational leaders, administrators, professors, educational experts, researchers and practitioners from both Vietnamese and international universities, colleges and other educational organizations. You are here to share your expertise, experience, research findings and best practices on three emerging issues (1) Management and Leadership in Higher Education; (2) Teaching and Learning in Higher Education; and (3) Institutional Research Capacity and Application. In view of the major challenges in the era of globalization in the 21st century and the lessons learned during the educational reforms taking place in many countries, these topics are indeed important ones. It is without a doubt that education quality, particularly of higher education, plays a crucial role in the development of the human resources of a nation. Higher Education provides a strong foundation to uplift the prospects of our people to participate and take full advantage of the opportunities in Southeast Asia and beyond. Along this line, the impact of the globalization in the development of a quality educational system has to be emphasized. It is becoming increasingly important for global educational experts to get together to identify what should be done to enhance and strengthen the higher education quality, especially in the globalized context. It has become more imperative than ever for higher education to prepare students to meet the dynamic challenges of the globalized world. -

PIDS Annual Report 2002

Philippine Institute for Development Studies Surian sa mga Pag-aaral Pangkaunlaran ng Pilipinas 2002 Annual Report Table of contents The Institute ○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○ ii ○○○○○○○○○○○○○○○○○○○○○○○○○ The President’s message ○○○○○○○○○○○○○ iii Proclamation No. 247 declaring the month of September of every year as Development Policy Research Month ○○○○○○○○○○○○○○○○○○○○○○○○○○○○ v Looking back ○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○ vi ○○○○○○○ Research and research-related activities ○○○○○○○○○○○○○○○○○○○○○○ 1 Research dissemination and utilization ○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○ 9 Management information ○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○ 17 ○○○○○○○○○ Investment and financial operations ○○○○○○○○○○○○○○○○○○○○○○○ 19 ○○○○○○○○○○○○○○○○○○○○○○○ PIDS Provident Fund ○○○○○○○○○○○○○○○○○○ 20 ○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○ PIDS Employees Association ○○○○ 22 Annexes ○○○○○○○○○○○○○○○○○○○○○○○○○○ A Completed studies/projects ○○○○○○○ 23 B Ongoing studies and projects ○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○ 25 ○○○○○○○○○○○○○○ C Project proposals developed ○○○○○○○○○○○○○○○○○○○ 27 ○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○ D Public affairs ○○○○○○○○○○○○ 28 ○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○ E Media exposure ○○○○○○○ 34 ○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○ F Publications ○○○○○○○○○○ 36 ○○○○○○○○○○○○○○○○○○○○○○○○○○○○ G Audit certificate ○○○○○○○○○○○○ 39 H Balance sheet ○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○ 40 I Income statement ○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○ 41 ○○○○○○○○○○○○○○○○○○○○○○○○○○○○○ J Statement of cash flows ○○○○○○○ 42 ○○○○○○○○○○○○○ K Notes to PIDS -

Harnessing Rural Radio for Climate Change Mitigation and Adaptation in the Philippines

Harnessing Rural Radio for Climate Change Mitigation and Adaptation in the Philippines Working Paper No. 275 CGIAR Research Program on Climate Change, Agriculture and Food Security (CCAFS) Rex L. Navarro Renz Louie V. Celeridad Rogelio P. Matalang Hector U. Tabbun Leocadio S. Sebastian 1 Harnessing Rural Radio for Climate Change Mitigation and Adaptation in the Philippines Working Paper No. 275 CGIAR Research Program on Climate Change, Agriculture and Food Security (CCAFS) Rex L. Navarro Renz Louie V. Celeridad Rogelio P. Matalang Hector U. Tabbun Leocadio S. Sebastian 2 Correct citation: Navarro RL, Celeridad RLV, Matalang RP, Tabbun HU, Sebastian LS. 2019. Harnessing Rural Radio for Climate Change Mitigation and Adaptation in the Philippines. CCAFS Working Paper no. 275. Wageningen, the Netherlands: CGIAR Research Program on Climate Change, Agriculture and Food Security (CCAFS). Available online at: www.ccafs.cgiar.org Titles in this Working Paper series aim to disseminate interim climate change, agriculture and food security research and practices and stimulate feedback from the scientific community. The CGIAR Research Program on Climate Change, Agriculture and Food Security (CCAFS) is a strategic partnership of CGIAR and Future Earth, led by the International Center for Tropical Agriculture (CIAT). The Program is carried out with funding by CGIAR Fund Donors, Australia (ACIAR), Ireland (Irish Aid), Netherlands (Ministry of Foreign Affairs), New Zealand Ministry of Foreign Affairs & Trade; Switzerland (SDC); Thailand; The UK Government (UK Aid); USA (USAID); The European Union (EU); and with technical support from The International Fund for Agricultural Development (IFAD). For more information, please visit https://ccafs.cgiar.org/donors. Contact: CCAFS Program Management Unit, Wageningen University & Research, Lumen building, Droevendaalsesteeg 3a, 6708 PB Wageningen, the Netherlands. -

Philippine Humanities Review, Vol. 13, No

The Politics of Naming a Movement: Independent Cinema According to the Cinemalaya Congress (2005-2010) PATRICK F. CAMPOS Philippine Humanities Review, Vol. 13, No. 2, December 2011, pp. 76- 110 ISSN 0031-7802 © 2011 University of the Philippines 76 THE POLITICS OF NAMING A MOVEMENT: INDEPENDENT CINEMA ACCORDING TO THE CINEMALAYA CONGRESS (2005-2010) PATRICK F. CAMPOS Much has been said and written about contemporary “indie” cinema in the Philippines. But what/who is “indie”? The catchphrase has been so frequently used to mean many and sometimes disparate ideas that it has become a confusing and, arguably, useless term. The paper attempts to problematize how the term “indie” has been used and defined by critics and commentators in the context of the Cinemalaya Film Congress, which is one of the important venues for articulating and evaluating the notion of “independence” in Philippine cinema. The congress is one of the components of the Cinemalaya Independent Film Festival, whose founding coincides with and is partly responsible for the increase in production of full-length digital films since 2005. This paper examines the politics of naming the contemporary indie movement which I will discuss based on the transcripts of the congress proceedings and my firsthand experience as a rapporteur (2007- 2009) and panelist (2010) in the congress. Panel reports and final recommendations from 2005 to 2010 will be assessed vis-a-vis the indie films selected for the Cinemalaya competition and exhibition during the same period and the different critical frameworks which panelists have espoused and written about outside the congress proper. Ultimately, by following a number PHILIPPINE HUMANITIES REVIEW 77 of key and recurring ideas, the paper looks at the key conceptions of independent cinema proffered by panelists and participants. -

Labor Policy Analysis for Jobs Expansion and Development

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Orbeta, Aniceto Jr. C.; Paqueo, Vicente B.; Lanzona, Leonardo Jr. A.; Dulay, Dean Gerard C. Working Paper Labor Policy Analysis for Jobs Expansion and Development PIDS Discussion Paper Series, No. 2014-34 Provided in Cooperation with: Philippine Institute for Development Studies (PIDS), Philippines Suggested Citation: Orbeta, Aniceto Jr. C.; Paqueo, Vicente B.; Lanzona, Leonardo Jr. A.; Dulay, Dean Gerard C. (2014) : Labor Policy Analysis for Jobs Expansion and Development, PIDS Discussion Paper Series, No. 2014-34, Philippine Institute for Development Studies (PIDS), Makati City This Version is available at: http://hdl.handle.net/10419/127011 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. www.econstor.eu Philippine Institute for Development Studies Surian sa mga Pag-aaral Pangkaunlaran ng Pilipinas Labor Policy Analysis for Jobs Expansion and Development Vicente B. -

Philippine Studies Fifteen-Year Index 1993–2007

Philippine Studies Fifteen-Year Index 1993–2007 Ateneo de Manila University Loyola Heights, Quezon City Philippines Contents Index to authors 1 Index to titles of articles, commentaries, and related materials 35 Index to titles of works in special literary issues 51 Index to books reviewed and noted 58 ii Index to authors Abacahin, Danilo. Aso. 43(1995): 453–54. Abad, Gémino H. Care of light. 53(2005): 353–54. ———. Going to America. 43(1995): 455–58. ———. An imaginary letter to my twin sons. 43(1995): 458–59. ———. Rime of the spirit’s quest. 53(2005): 351. ———. Word without end. 53(2005): 352. Abad, Ricardo G. Attitudes towards welfare and inequality. 45(1997): 447–76. ———. Filipino religiosity: Some international comparisons. 43(1995): 195–212. ———. Religion in the Philippines. 49(2001): 337–67. Abais, Rogel Anecito L., S.J. Review of Rizal and Republican Spain and other Rizalist Essays, by Manuel Sarkisyanz. 46(1998): 122–23. Abalahin, Andrew J. Review of Church Lands and Peasant Unrest in the Philippines: Agrarian Conflict in 20th-Century Luzon, by Michael J. Connolly, S.J. 45(1997): 292–93. ———. Review of Philippine Localities and Global Perspectives: Essays on Society and Culture, by Raul Pertierra. 45(1997): 295–97. Abiad, Virginia G., Romel del Mundo, Napoleon Y. Navarro, Victor S. Venida, and Arleen Ramirez-Villoria. The sustainability of the Botika-Binhi program. 49(2001): 176–202. Abinales, Patricio N. The good imperialists? American military presence in the southern Philippines in historical perspective. 52(2004): 179–207. ———. Review of Empire of Care: Nursing and Migration in Filipino American History, by Catherine Ceniza-Choy. -

Credit Exclusions, Repeatability, Concentration Exclusions

Credit Exclusions, Repeatability, Concentration Exclusions 311 CAAS 311 CAAS 103. First Year Social Science Seminar. 247(448) / Hist. 247. Africa Since 1850. (Cross-Area Courses). May not be included in a concentration plan. (African Studies). 311 CAAS 311 CAAS 104. First Year Humanities Seminar. 274 / Engl. 274. Introduction to Afro-American Literature. (Cross-Area Courses). May not be included in a concentration plan. (African-American Studies). 311 CAAS 311 CAAS 108 / Hist. of Art 108. Introduction to African Art. 303 / Soc. 303. Race and Ethnic Relations. (African Studies). May not be included in a concentration plan. (African-American Studies). 311 CAAS 311 CAAS 111. Introduction to Africa and Its Diaspora. 321 / Soc. 323. African American Social Thought. May not be included in a concentration plan. (African-American Studies). 311 CAAS 311 CAAS 200(105). Introduction to African Studies. 322 / NR&E 335. Introduction to Environmental Politics: Race, Class, and Gender. (African Studies). (Cross-Area Courses). 311 CAAS 311 CAAS 201(100). Introduction to Afro-American Studies. 325. Afro-American Social Institutions. (African-American Studies). (African-American Studies). 311 CAAS 311 CAAS 202(200). Introduction to Afro-Caribbean Studies. 326. The Black American Family. (Afro-Caribbean Studies). (African-American Studies). 311 CAAS 311 CAAS 203. Issues in Afro-American Development. 327 / Psych. 315. Psychological Aspects of the Black Experience. (African-American Studies). (African-American Studies). 311 CAAS 311 CAAS 204. Cultural History of Afro-America. 329. African American Leadership. (African-American Studies). (African-American Studies). 311 CAAS 311 CAAS 205. Introduction to Black Cultural Arts and Performance. 330. African Leaders. May be elected for credit twice. -

Industry Guide Focus Asia & Ttb / April 29Th - May 3Rd Ideazione E Realizzazione Organization

INDUSTRY GUIDE FOCUS ASIA & TTB / APRIL 29TH - MAY 3RD IDEAZIONE E REALIZZAZIONE ORGANIZATION CON / WITH CON IL CONTRIBUTO DI / WITH THE SUPPORT OF IN COLLABORAZIONE CON / IN COLLABORATION WITH CON LA PARTECIPAZIONE DI / WITH THE PARTICIPATION OF CON IL PATROCINIO DI / UNDER THE PATRONAGE OF FOCUS ASIA CON IL SUPPORTO DI/WITH THE SUPPORT OF IN COLLABORAZIONE CON/WITH COLLABORATION WITH INTERNATIONAL PARTNERS PROJECT MARKET PARTNERS TIES THAT BIND CON IL SUPPORTO DI/WITH THE SUPPORT OF CAMPUS CON LA PARTECIPAZIONE DI/WITH THE PARTICIPATION OF MAIN SPONSORS OFFICIAL SPONSORS FESTIVAL PARTNERS TECHNICAL PARTNERS ® MAIN MEDIA PARTNERS MEDIA PARTNERS CON / WITH FOCUS ASIA April 30/May 2, 2019 – Udine After the big success of the last edition, the Far East Film Festival is thrilled to welcome to Udine more than 200 international industry professionals taking part in FOCUS ASIA 2019! This year again, the programme will include a large number of events meant to foster professional and artistic exchanges between Asia and Europe. The All Genres Project Market will present 15 exciting projects in development coming from 10 different countries. The final line up will feature a large variety of genres and a great diversity of profiles of directors and producers, proving one of the main goals of the platform: to explore both the present and future generation of filmmakers from both continents. For the first time the market will include a Chinese focus, exposing 6 titles coming from China, Hong Kong and Taiwan. Thanks to the partnership with Trieste Science+Fiction Festival and European Film Promotion, Focus Asia 2019 will host the section Get Ready for Cannes offering to 12 international sales agents the chance to introduce their most recent line up to more than 40 buyers from Asia, Europe and North America. -

Curriculum Vitae 1 Joseph Y

Curriculum Vitae 1 Joseph Y. Lim ------------------------------------------------------------------------------------------------------ Curriculum Vitae Name JOSEPH ANTHONY Y. LIM Date of Birth September 4, 1952 Nationality Filipino Home Address 3-D 12th St., New Manila, Quezon City, Philippines 1100 Office Address Economics Department, Ateneo de Manila University, Loyola, Quezon City, Philippines Contact Information 415 6684 and 09192269793, [email protected] and [email protected] Education B.S. Management Engineering : Ateneo de Manila University, 1974 (Magna Cum Laude) M.S. Operation Research : Massachusetts Institute of Technology,1976 Ph.D. Economics : University of Pennsylvania, 1985 Post-doctoral Studies : University of Cambridge, 1989 Present Position Professor Economics Department Ateneo de Manila University, Loyola, Quezon City, Philippines June 2005 to present Past Position Policy Adviser on Debt and External Finance for Developing Countries Bureau for Development Policy United Nations Development Programme (UNDP), New York 2002-2004 Curriculum Vitae 2 Joseph Y. Lim ------------------------------------------------------------------------------------------------------ Professor School of Economics University of the Philippines, Diliman, Quezon City 1978 to May 2005 Published and Other Papers 1985 - "The Monetarist Models of Inflation: The Case of the Philippines," Philippine Review of Economics and Business, Vol. 22, Nos. 3-4, September-December 1985. - (co-author with Florian Alburo, Dante Canlas, Emmanuel de Dios,