Canalys Global Cybersecurity Leadership Matrix 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Hostscan 4.8.01064 Antimalware and Firewall Support Charts

HostScan 4.8.01064 Antimalware and Firewall Support Charts 10/1/19 © 2019 Cisco and/or its affiliates. All rights reserved. This document is Cisco public. Page 1 of 76 Contents HostScan Version 4.8.01064 Antimalware and Firewall Support Charts ............................................................................... 3 Antimalware and Firewall Attributes Supported by HostScan .................................................................................................. 3 OPSWAT Version Information ................................................................................................................................................. 5 Cisco AnyConnect HostScan Antimalware Compliance Module v4.3.890.0 for Windows .................................................. 5 Cisco AnyConnect HostScan Firewall Compliance Module v4.3.890.0 for Windows ........................................................ 44 Cisco AnyConnect HostScan Antimalware Compliance Module v4.3.824.0 for macos .................................................... 65 Cisco AnyConnect HostScan Firewall Compliance Module v4.3.824.0 for macOS ........................................................... 71 Cisco AnyConnect HostScan Antimalware Compliance Module v4.3.730.0 for Linux ...................................................... 73 Cisco AnyConnect HostScan Firewall Compliance Module v4.3.730.0 for Linux .............................................................. 76 ©201 9 Cisco and/or its affiliates. All rights reserved. This document is Cisco Public. -

Consumer Security Products Performance Benchmarks (Edition 2) Antivirus & Internet Security Windows 10

Consumer Security Products Performance Benchmarks (Edition 2) Antivirus & Internet Security Windows 10 January 2020 Document: Consumer Security Products Performance Benchmarks (Edition 2) Authors: J. Han, D. Wren Company: PassMark Software Date: 13 January 2020 Edition: 2 File: Consumer_Security_Products_Performance_Benchmarks_2020_Ed_2.docx Consumer Security Performance Benchmarks 2019 PassMark Software Table of Contents TABLE OF CONTENTS ......................................................................................................................................... 2 REVISION HISTORY ............................................................................................................................................ 3 REFERENCES ...................................................................................................................................................... 3 EXECUTIVE SUMMARY ...................................................................................................................................... 4 OVERALL SCORE ................................................................................................................................................ 5 PRODUCTS AND VERSIONS ............................................................................................................................... 6 PERFORMANCE METRICS SUMMARY ................................................................................................................ 7 TEST RESULTS ................................................................................................................................................ -

Nessus and Antivirus

Nessus and Antivirus January 31, 2014 (Revision 4) Table of Contents Introduction ......................................................................................................................................... 3 Standards and Conventions........................................................................................................................... 3 Overview .............................................................................................................................................. 3 A Note on SCAP Audits ................................................................................................................................. 4 Microsoft Windows Defender ............................................................................................................. 4 Kaspersky Internet Security 2012 ...................................................................................................... 4 AVG 2012 ............................................................................................................................................. 7 Norton Internet Security 2012 .......................................................................................................... 10 Norton 360 ......................................................................................................................................... 14 Panda Internet Security 2012 ........................................................................................................... 18 Trend Micro Titanium -

VPN Report 2020

VPN Report 2020 www.av-comparatives.org Independent Tests of Anti-Virus Software VPN - Virtual Private Network 35 VPN services put to test LANGUAGE : ENGLISH LAST REVISION : 20 TH MAY 2020 WWW.AV-COMPARATIVES.ORG 1 VPN Report 2020 www.av-comparatives.org Contents Introduction 4 What is a VPN? 4 Why use a VPN? 4 Vague Privacy 5 Potential Risks 5 The Relevance of No-Logs Policies 6 Using VPNs to Spoof Geolocation 6 Test Procedure 7 Lab Setup 7 Test Methodology 7 Leak Test 7 Kill-Switch Test 8 Performance Test 8 Tested Products 9 Additional Product Information 10 Consolidations & Collaborations 10 Supported Protocols 11 Logging 12 Payment Information 14 Test Results 17 Leak & Kill-Switch Tests 17 Performance Test 19 Download speed 20 Upload speed 21 Latency 22 Performance Overview 24 Discussion 25 General Security Observations 25 Test Results 25 Logging & Privacy Policies 26 Further Recommendations 27 2 VPN Report 2020 www.av-comparatives.org Individual VPN Product Reviews 28 Avast SecureLine VPN 29 AVG Secure VPN 31 Avira Phantom VPN 33 Bitdefender VPN 35 BullGuard VPN 37 CyberGhost VPN 39 ExpressVPN 41 F-Secure Freedome 43 hide.me VPN 45 HMA VPN 47 Hotspot Shield 49 IPVanish 51 Ivacy 53 Kaspersky Secure Connection 55 McAfee Safe Connect 57 mySteganos Online Shield VPN 59 Norton Secure VPN 63 Panda Dome VPN 65 Private Internet Access 67 Private Tunnel 69 PrivateVPN 71 ProtonVPN 73 PureVPN 75 SaferVPN 77 StrongVPN 79 Surfshark 81 TorGuard 83 Trust.Zone VPN 85 TunnelBear 87 VPNSecure 89 VPN Unlimited 91 VyprVPN 93 Windscribe 95 ZenMate VPN 97 Copyright and Disclaimer 99 3 VPN Report 2020 www.av-comparatives.org Introduction The aim of this test is to compare VPN services for consumers in a real-world environment by assessing their security and privacy features, along with download speed, upload speed, and latency. -

2012 Consumer Security Products Performance Benchmarks (Edition 2) Antivirus and Internet Security Windows 7

2012 Consumer Security Products Performance Benchmarks (Edition 2) Antivirus and Internet Security Windows 7 November 2011 Document: 2012 Consumer Security Products Performance Benchmarks (Edition 2) Authors: M. Baquiran, D. Wren Company: PassMark Software Date: 14 November 2011 Edition: 2 File: antivirus_12-performance-testing-ed2.docx Consumer Internet Security and Antivirus Solutions PassMark Software Table of Contents TABLE OF CONTENTS ......................................................................................................................................... 2 REVISION HISTORY ............................................................................................................................................ 4 REFERENCES ...................................................................................................................................................... 4 EXECUTIVE SUMMARY ...................................................................................................................................... 5 OVERALL SCORE ................................................................................................................................................ 6 PRODUCTS AND VERSIONS ............................................................................................................................... 8 INTERNET SECURITY SOFTWARE .................................................................................................................................. 8 ANTIVIRUS SOFTWARE ............................................................................................................................................. -

Guía Para Administradores De

Guide for Network Administrators Adaptive Defense 360 Guide for Network Administrators 1 Guide for Network Administrators Table of contents PREFACE .......................................................................................................................... 9 INTRODUCTION ...............................................................................................................10 WHO IS THE GUIDE AIMED AT? ...........................................................................................10 ICONS ...........................................................................................................................10 INTRODUCTION ..............................................................................................................11 INTRODUCTION ...............................................................................................................12 KEY FEATURES OF ADAPTIVE DEFENSE 360 ............................................................................12 ADAPTIVE DEFENSE 360 USER PROFILE .................................................................................13 ADAPTIVE DEFENSE 360 ARCHITECTURE: KEY COMPONENTS .....................................................13 ADAPTIVE DEFENSE 360 CLOUD SERVER FARM ........................................................................... 14 MANAGEMENT CONSOLE WEB SERVER ..................................................................................... 15 COMPUTERS PROTECTED WITH ADAPTIVE DEFENSE 360 ............................................................. -

Cybersecurity

Cybersecurity Sector Update – April 2020 SPECIALIST INDEPENDENT M&A AND FUNDRAISING ADVISER TO FAST-GROWING TECHNOLOGY BUSINESSES April 2020 - CONFIDENTIAL 1 CYBERSECURITY SECTOR UPDATE – APRIL 2020 1 Cybersecurity experienced another record year in 2019 followed by a strong Q1 2020 ▪ Consolidation continued across all subsectors including data security, network security, app security, IAM, endpoint, sec ops, etc. ▪ Record private investment activity: $8.05bn in VC money raised across 626 deals in 2019, $1.74bn through 118 deals in Q1 2020(1) ▪ Exceptionally strong M&A activity: 209 deals with a total value of $43.75bn in 2019, 32 deals with a total value of $13.78bn in Q1 2020(1) 2 High-profile European transactions keep making the global headlines ▪ Orange acquiring MSSPs SecureData for $157m in Jan 2019 followed by the acquisition of SecureLink for $577m in May 2019 ▪ Sophos $3.9bn take-private by Thoma Bravo in Oct 2019 after a recent stint of four years as a UK plc ▪ Immersive Labs’ £40m Series B fundraise by Summit Partners and Goldman Sachs in Nov 2019 ▪ Privitar’s $80m Series C led by Warburg Pincus, Accel, Partech, IQ Capital, Salesforce Ventures and ABN AMRO Ventures in Apr 2020 ▪ Onfido’s $100m fundraise led by TPG Growth ▪ Investcorps’s $180m acquisition of consumer focused cybersecurity provider Avira in Apr 2020 3 Cybersecurity in times of Covid-19 ▪ Covid-19 has thrown the global economy into unchartered territory. With many sectors in slowdown, cybersecurity has proven to remain virus-resistant and continues to be a necessary investment for every organisation ▪ The widely adapted working-from-home policy has vastly enlarged the attack surface and placed major strain on enterprise IT to protect against an increased level of malicious activity 4 New cycle of cybersecurity investment leading to sustained financing and M&A activity ▪ Cybersecurity remains a top corporate IT priority (see also our previous report), now representing approximately 12.8% of companies’ total IT budgets(2). -

Advanced Administration Guide – Endpoint Protection

Advanced Administration Guide – Endpoint Protection Advanced administration guide 1 Advanced Administration Guide – Endpoint Protection Tabla de contenidos 1. INTRODUCTION ..............................................................................................................12 1.1. WHAT'S NEW IN THIS VERSION ...........................................................................................13 1.2. WHAT IS ENDPOINT PROTECTION? ......................................................................................14 THE PROTECTION .................................................................................................................. 14 WHICH PROTECTIONS ARE AVAILABLE? ..................................................................................... 14 INSTALLATION ....................................................................................................................... 14 1.3. PROTECTION TECHNOLOGIES ..............................................................................................15 ANTI-EXPLOIT TECHNOLOGY .................................................................................................... 15 SECURITY FROM THE CLOUD AND COLLECTIVE INTELLIGENCE ......................................................... 15 1.4. INFORMATION, QUERIES AND SERVICES .................................................................................16 USEFUL LINKS ....................................................................................................................... 16 ENDPOINT -

Magic Quadrant for Endpoint Protection Platforms

Licensed for Distribution Magic Quadrant for Endpoint Protection By Peter Firstbrook, Dionisio Zumerle, Prateek Bhajanka, Lawrence Pingree, Paul Webber Platforms Published 20 August 2019 - ID G00352135 - 63 min read The endpoint protection market is transforming as new approaches challenge the status quo. We evaluated solutions with an emphasis on hardening, detection of advanced and fileless attacks, and response capabilities, favoring cloud-delivered solutions that provide a fusion of products and services. Strategic Planning Assumption By 2025, cloud-delivered EPP solutions will grow from 20% of new deals to 95%. Market Definition/Description This document was revised on 23 August 2019. The document you are viewing is the corrected version. For more information, see the Corrections page on gartner.com. An endpoint protection platform (EPP) is a solution deployed on endpoint devices to harden endpoints, to prevent malware and malicious attacks, and to provide the investigation and remediation capabilities needed to dynamically respond to security incidents when they evade protection controls. Traditional EPP solutions have been delivered via a client agent managed by an on-premises management server. More modern solutions utilize a cloud-native architecture that shifts the management, and some of the analysis and detection workload, to the cloud. Security and risk management leaders responsible for endpoint protection are placing a premium on detection capabilities for advanced fileless threats and investigation and remediation capabilities. Data protection solutions such as data loss prevention (DLP) and encryption are also frequently part of EPP solutions, but are considered by buyers in a different buying cycle. Protection for Linux and Mac is increasingly common, while protection for mobile devices and Chromebooks is increasing but is not typically considered a must-have capability. -

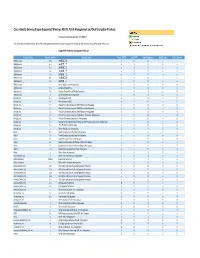

Cisco Identity Services Engine Supported Windows AV/AS/PM/DE

Cisco Identity Services Engine Supported Windows AS/AV, Patch Management and Disk Encryption Products Compliance Module Version 3.6.10363.2 This document provides Windows AS/AV, Patch Management and Disk Encryption support information on the the Cisco AnyConnect Agent Version 4.2. Supported Windows Antispyware Products Vendor_Name Product_Version Product_Name Check_FSRTP Set_FSRTP VirDef_Signature VirDef_Time VirDef_Version 360Safe.com 10.x 360安全卫士 vX X v v 360Safe.com 4.x 360安全卫士 vX X v v 360Safe.com 5.x 360安全卫士 vX X v v 360Safe.com 6.x 360安全卫士 vX X v v 360Safe.com 7.x 360安全卫士 vX X v v 360Safe.com 8.x 360安全卫士 vX X v v 360Safe.com 9.x 360安全卫士 vX X v v 360Safe.com x Other 360Safe.com Antispyware Z X X Z X Agnitum Ltd. 7.x Outpost Firewall Pro vX X X O Agnitum Ltd. 6.x Outpost Firewall Pro 2008 [AntiSpyware] v X X v O Agnitum Ltd. x Other Agnitum Ltd. Antispyware Z X X Z X AhnLab, Inc. 2.x AhnLab SpyZero 2.0 vv O v O AhnLab, Inc. 3.x AhnLab SpyZero 2007 X X O v O AhnLab, Inc. 7.x AhnLab V3 Internet Security 2007 Platinum AntiSpyware v X O v O AhnLab, Inc. 7.x AhnLab V3 Internet Security 2008 Platinum AntiSpyware v X O v O AhnLab, Inc. 7.x AhnLab V3 Internet Security 2009 Platinum AntiSpyware v v O v O AhnLab, Inc. 7.x AhnLab V3 Internet Security 7.0 Platinum Enterprise AntiSpyware v X O v O AhnLab, Inc. 8.x AhnLab V3 Internet Security 8.0 AntiSpyware v v O v O AhnLab, Inc. -

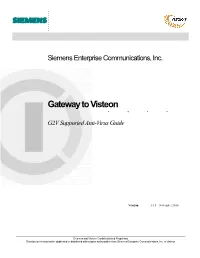

Gateway to Visteon G2V Supported Anti-Virus Guide

. Siemens Enterprise Communications, Inc. ........Gateway to Visteon G2V Supported Anti-Virus Guide Version: 1.6.5 – November 2010 Siemens and Visteon Confidential and Proprietary This document may not be duplicated or distributed without prior authorization from Siemens Enterprise Communications, Inc. or Visteon . Supported Anti-Virus Software The following Anti-Virus applications are fully supported. It is highly recommended that one of the following applications be used for accessing G2V. Please note that this list will change as new versions are released by their vendors. Normally, the current and previous release of these applications will remain on the supported list. Newer versions released may not be immediately supported or compatible, please consult this list before updating to a newer version. Vendor Product Version Windows XP Windows Vista Windows 7 McAfee, Inc. VirusScan Enterprise 8.7.x ✔ ✔ ✔ VirusScan 2009 13.x ✔ ✔ ‐‐ VirusScan 2010 14.x ✔ ✔ ✔ Symantec Corp. Norton Anti-Virus 2010 17.x ✔ ✔ ‐‐ Norton Anti-Virus 2011 18.x ✔ ✔ ✔ Symantec Endpoint Protection 11.x ✔ ✔ ✔ Symantec Endpoint Protection 12.x ✔ ✔ ✔ Trend Micro, Inc. Anti‐Virus 17.x ✔ ✔ ‐‐ Anti‐Virus 17.5 ✔ ✔ ✔ OfficeScan 8.x ✔ ✔ ‐‐ OfficeScan 10.x ✔ ✔ ✔ Notes: Please see the notes at the end of this guide for special instructions for Vista users with Norton Anti-Virus 2009. The products highlighted in yellow will be removed from the supported list in the next update. If you are using one of these products, you should consider upgrading to a newer version. Compatible Anti-Virus Software The applications below have been specified as compatible by the Anti-Virus Host Check vendor. Support for these applications may be removed at any time, especially in the case of older versions that may be at or near end-of-life status. -

Cisco Identity Services Engine Release 1.2 Supported Windows

Cisco Identity Services Engine Supported Windows AV/AS Products Compliance Module Version 3.5.6317.2 This document provides Windows 8/7/Vista/XP AV/AS support information on the Cisco NAC Agent version 4.9.0.x and later. For other support information and complete release updates, refer to the Release Notes for Cisco Identity Services Engine corresponding to your Cisco Identity Services Engine release version. Supported Windows AV/AS Product Summary Added New AV Definition Support: COMODO Antivirus 5.x COMODO Internet Security 3.5.x COMODO Internet Security 3.x COMODO Internet Security 4.x Kingsoft Internet Security 2013.x Added New AV Products Support: V3 Click 1.x avast! Internet Security 8.x avast! Premier 8.x avast! Pro Antivirus 8.x Gen-X Total Security 1.x K7UltimateSecurity 13.x Kaspersky Endpoint Security 10.x Kaspersky PURE 13.x Norman Security Suite 10.x Supported Windows AntiVirus Products Product Name Product Version Installation Virus Definition Live Update 360Safe.com 360 Antivirus 1.x 4.9.0.28 / 3.4.21.1 4.9.0.28 / 3.4.21.1 yes 360 Antivirus 3.x 4.9.0.29 / 3.5.5767.2 4.9.0.29 / 3.5.5767.2 - 360杀毒 1.x 4.9.0.28 / 3.4.21.1 4.9.0.28 / 3.4.21.1 - 360杀毒 2.x 4.9.0.29 / 3.4.25.1 4.9.0.29 / 3.4.25.1 - 360杀毒 3.x 4.9.0.29 / 3.5.2101.2 - Other 360Safe.com Antivirus x 4.9.0.29 / 3.5.2101.2 - AEC, spol.