Full Year Results to 31 December 2015

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sensory Santa – Queensland Sunday 8Th November 2015

Sensory Santa – Queensland Sunday 8th November 2015 Westfield Brookside 9am-11am CLOSED 0422416509 Sunday 15th November 2015 Westfield Chermside 8am-10am BOOKED OUT 0422416509 Strathpine Shopping 8am-9.45am BOOKED OUT 38179601 Centre Westfield Brookside 9am-11am Bookings open 0422416509 Westfield Garden CIty 8am-10am Bookings open 0422416509 Helensvale 9am-10am Book Online at http://www.westfield.com.au/helensvale/ events/sensory-santa/21835 Saturday 21st November 2015 Toombul 8am-10am Bookings open 0422416509 Sunday 22nd November 2015 Stockland Townsville 9am-11am BOOKED OUT 0422416509 Smithfield Shopping Centre 8am–10am Bookings open 0422416509 Orion Springfield Free Photo 8am-10am Bookings open 0422416509 Runaway Bay Shopping Village 4pm-6pm Bookings open 07 5537 2566 Stockland Rockhampton 8am-10am Bookings open 0422416509 Toombul 8am-10am Bookings open 0422416509 Helensvale 9am-10am Book Online at http://www.westfield.com.au/helensvale/events/sensory- santa/21835 Sunday 29th November 2015 Stockland Townsville 9am-11am Bookings open 0422416509 Kawana Shoppingworld Free photo 8am-10am Bookings open 0422416509 Taigum 8am-10am Bookings open 0422416509 Noosa Civic 8am-10am Bookings open 5440 7900 Stockland Cairns 8am-10am Bookings Open 4054 3066 Smithfield Shopping Centre 8am-10am Bookings open 0422416509 Bundaberg Hinkler Central 9am-10am Bookings Open 4152 9888 Riverlink Ipswich 10am-2pm Booking open 32945500 Morayfield Shopping Centre 9am-11am BOOKED OUT 0422416509 Runaway Bay Shopping Village 8am-10am Bookings open 07 5537 2566 Robina -

ACT Belconnen Shop 76 Westfield Benjamin Way Belconnen ACT

ACT Belconnen Shop 76 Westfield Benjamin Way Belconnen ACT Canberra city 148 Bunda St Canberra ACT NSW Bankstown Shop T068 Centro Bankstown 1 North Terrace Bankstown NSW Blacktown Shop 1058 Westpoint S/C Patrick Street Blacktown NSW Bondi junction Shop 1031a Westfield 500 Oxford St Bondi junction NSW Burwood Shop 1- 130A G Level Westfield 100 - 110 Burwood Road Burwood NSW Castle hill Shop 241 Castle Towers S/C 1 Castle Street Castle hill NSW Charlestown Shop 202 Lvel 2 Charlestown SQ Pearson Street Charlestown NSW Chatswood Shop 447 Westfield 1 Anderson Street Chatswood NSW Chatswood chase Tenancy B/048 Chatswood Chase S/ 345 Victoria Avenue Chatswood NSW Eastgardens Shop 171, Westfield Eastgardens 152 Bunnerong Road Eastgardens NSW Gosford Shop 227/228 Level 2 171 Mann Street Gosford NSW Hurstville Shop 351 Westfield S/Town Cross Street Hurstville NSW Kotara Shop 1035 Westfield S/Town Cnr Northcott Dve & Park Ave Kotara NSW Lismore TLS 25 Woodlark Street, Lismore NSW Liverpool Shop 186 - 189 Level 1 Westfield Macquarie Street Liverpool NSW Macquarie centre Shop 437 Lvl 4 MACQUARIE Centre Cnr Waterloo & Herring Rds North ryde NSW Miranda 1094 Westfield S/C Wandella Road North Miranda NSW Mosman Shop 1 732 Miltary Road Mosman NSW Mt Druitt Shop 159 Westfield S/C Cnr Luxford & Carlise Rd Mount druitt NSW Narellan Shop 63 Narellan Town Centre Camden Valley Way Narellan NSW Orange 227-237 Summer St Orange NSW Parramatta Level 5 Shop 5012 Westfield 159-175 Church Street Parramatta NSW Penrith Shop 45, Westfield Penrith 585 High Street Penrith -

RTI #1062/20 – Approved Pharmacies

RTI #1062/20 – Approved Pharmacies Contextual Information Queensland Health does not approve pharmacies. The Department of Health has statewide responsibility for pharmacy ownership under the Pharmacy Business Ownership Act 2001 (PBOA). We require documentary evidence that any proposed ownership complies with the requirements of the legislation by completion and return of a Pharmacy Ownership Notification. Queensland does not record or monitor PBS or non-PBS approved pharmacies as this is a Commonwealth matter. The field for non-PBS approved is not a reliable record that other pharmacies are PBS approved. Data source The attached information has been extracted from the Queensland Hospital Monitoring of Drugs of Dependence System (MODDS) database based on records from our Health (Drugs & Poisons) Regulation, 1996 and Pharmacy Business Ownership Act, 2001 notifications. The data was extracted on 4 August 2020 and is subject to change. DOH-DL 20/21-002 Extract of Pharmacy Businesses in Queensland RTI 1062/20 PHARMACY BUSINESS NAME PHARMACY BUSINESS ADDRESS SUBURB POST CODE POST OFFICE SQUARE DISCOUNT PHARMACY POST OFFICE SQUARE SHOP 17 / 280 QUEEN ST BRISBANE QLD 4000 BRISBANE 4000 THE MILL PHARMACY WATKINS MEDICAL CENTRE 225 WICKHAM TCE BRISBANE QLD 4000 BRISBANE 4000 QUEEN STREET MALL PHARMACY 141 QUEEN ST BRISBANE QLD 4000 BRISBANE 4000 SPRING HILL PRICELINE PHARMACY SPRING HILL MARKET PLACE SHOP 3 / 375 TURBOT ST SPRING HILL QLD 4000 SPRING HILL 4000 SPRING HILL PHARMACY 135 WICKHAM TCE SPRING HILL QLD 4000 SPRING HILL 4000 CHEMIST WAREHOUSE -

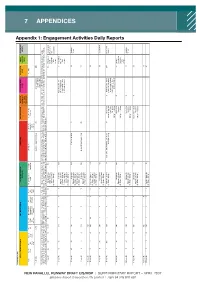

7 Appendices

Appendix 1:EngagementActivitiesDailyReports NOVEMBER 2006 CALL CENTRE REPORTS ON LINE REPORTS SHOPPING CENTRE BRIEFINGS INFO SESSIONS NO. KITS DATABASE MAIL TOTAL KITS EMAIL ADVERTISE REPORTS GIVEN OUT OUTS SENT ALERTS MENTS 7 APPENDICES NEW PARALLEL RUNWAY DRAFT EIS/MDP RUNWAY NEW PARALLEL AT INFO SENT SESSIONS Date No. of No. of Visits to Web No. of No. of Formal No. of No. of Shopping Centres Info Packs Briefings Held No. of Info Location of Info ALL KITS Calls Info Info Hits Online Submissions Comments Info Visited Handed Out Packs Given Sessions Packs Centre Info (on-line and & Queries Packs Out at Sent Requests postal) Sent briefings 31-Oct-06 2,708 Canberra (refer list below) 40 Information kits 845 posted to 805 stakeholders. The Hon. Martin Ferguson, Shadow Minister for Primary Industries, Resources, Forestry and Tourism, Peta Lane, Adviser to Senator Campbell, Minister for Environment & Heritage, Paul Neville, Chair - Transport & Regional Services, The Hon. Arch Bevis, MP Shadow Minister for Homeland Security, Shadow Minister for Aviation and Transport Security, Wayne Swan, MP, Shadow Treasurer, Brad Williams and Diana Stainlay - Minister Vaile's office, Christine Hoystead and Susan Rymer - Prime Minister and Cabinet, Kevin Rudd MP, Suzanne Combes, Adviser to the Hon. Ian Macfarlane, Minister for Industry, Tourism and Resources, David Gazard - Treasurer's Office, Senator Kerry O'Brien, Shadow Minister for Transport, Anthony Albanese MP, Shadow Minister for Environment & Heritage. Media Representatives in Brisbane. 1-Nov-06 43 35 0 2,519 50 1 11 65 Wynnum Plaza 104 204 Release of Courier Mail Brisbane Airport Corporation Pty Limited |ABN 54076 870650 (8am - 5.45pm), Draft Quest (16) Buranda Plaza EIS/MDP The (8.00am - 5.30pm) 1,056 Australian emails 2-Nov-06 16 15 1 818 1 1 1 1 Carindale 155 Fact Sheet No. -

2020 Property Compendium

2020 Property Compendium Creating extraordinary places, connecting 31 December 2020 and enriching communities Scentre Group Limited ABN 66 001 671 496 Creating extraordinary places, connecting and enriching communities Contents Portfolio Overview __________________________ 1 Westfield Knox, VIC _________________________ 28 Operating Performance _______________________ 3 Westfield Kotara, NSW _______________________ 29 Retailers and Lease Expiry Profile _______________ 4 Westfield Liverpool, NSW _____________________ 30 Portfolio Details _____________________________ 6 Westfield Manukau, NZ _______________________ 31 Scentre Group Property Profiles _______________ 7 Westfield Marion, SA ________________________ 32 Westfield Airport West, VIC ____________________ 8 Westfield Miranda, NSW ______________________ 33 Westfield Albany, NZ _________________________ 9 Westfield Mt Druitt, NSW _____________________ 34 Westfield Belconnen, ACT ____________________ 10 Westfield Newmarket, NZ _____________________ 35 Westfield Bondi Junction, NSW ________________ 11 Westfield North Lakes, QLD ___________________ 36 Westfield Booragoon, WA ____________________ 12 Westfield Parramatta, NSW ____________________ 37 Westfield Burwood, NSW _____________________ 13 Westfield Penrith, NSW _______________________ 38 Westfield Carindale, QLD _____________________ 14 Westfield Plenty Valley, VIC ___________________ 39 Westfield Carousel, WA ______________________ 15 Westfield Riccarton, NZ ______________________ 40 Westfield Chatswood, NSW ___________________ -

The Myer Centre Brisbane

The Myer Centre Brisbane 91 Queen Street, Brisbane QLD 4000 Telephone +61 7 3223 6900, Facsimile +61 7 3003 1217 myercentreshopping.com.au The Myer Centre is a six-level shopping centre located in the heart of Brisbane’s CBD on Queen Street Mall. The centre is located above an underground bus interchange, which is Brisbane's busiest transport hub. The centre is anchored by the largest Myer store in Queensland plus Target, Event Cinemas, Coles Central and over 150 specialty stores. The Myer Centre is an iconic CBD retail destination and convenient go-to centre for city workers and families, offering a selection of well-known brands and major retailers under the one roof. North Lakes PENINSULA FAIR NN BrisbaneBrisbane CBD CBD WESTFIELD NORTH LAKES FORTITIUDE VALLEY Joyner THE MYER CENTRE STRATHPINE CENTRE BRISBANE Cashmere SOUTH BRISBANE EAST BRISBANE Carseldine TAIGUM SQUARE ASPLEY HYPERMARKET SC WESTFIELD CHERMSIDE Wavell ARANA HILLS KMART PLAZA Heights Ferny Hills BROOKSIDE SC TOOMBUL SC STAFFORD Brisbane Mitchelton CITY SC Airport Lutwyche Hendra The Gap Eagle Farm Bowen Red Hills Hill Balmoral WYNNUM PLAZA QUEENSPLAZA CANNON HILL KMART PLAZA THE MYER CENTRE BRISBANE Seven TOOWONG VILLAGE East Hills Brookfield Brisbane INDOOROOPILLY SC BURANDA WESTFIELD CARINDALE Indooroopilly VILLAGE Pullenvale CAPALABA CENTRAL CAPALABA PARK SC Pinjarra Hills Mount Gravatt Mackenzie MT OMMANEY CENTRE Bellbowrie WESTFIELD GARDEN CITY SUNNYBANK PLAZA Sunnybank Inala UNDERWOOD REDBANK PLAZA Algester MARKETPLACE SC CALAMVALE CENTRAL SC SUNNYBANK SPRINGWOOD -

Doh-Dl 18/19-002

RTI #4502 – Approved Pharmacies Contextual Information Queensland Health does not approve or license pharmacies. The Department of Health has state wide responsibility for pharmacy ownership under the Pharmacy Business Ownership Act 2001 (PBOA). The Department requires documentary evidence that any proposed ownership arrangement complies with the requirements of the legislation by completion and return of a Pharmacy Business Ownership Notification. Queensland Health does not record or monitor PBS or non-PBS approved pharmacies as this is a Commonwealth Government matter. The field for non-PBS approved is not a reliable record that other pharmacies are PBS approved. Data source The attached information has been extracted from the Queensland Monitoring of Drugs of Dependence System (MODDS) database based on records collected under provisions of the PBOA. The data was extracted on 13 July 2018 and is subject to change. RTI Release DOH-DL 18/19-002 PHARMACY NAME ADDRESS 23RD AVENUE PHARMACY PALM GARDENS SHOPPING CENTRE SHOP 7 CNR TOWNSON AVENUE & MAWARRA ST PALM BEACH QLD 4221 7-DAY PHARMACY 359 QUEEN ST BRISBANE QLD 4000 A.F.S. DISPENSARY SHOP 3 / 378 DEAN ST FRENCHVILLE QLD 4701 ACACIA RIDGE DISCOUNT PHARMACY ACACIA MARKETPLACE SHOPPING CENTRE SHOP 2 / 1150 BEAUDESERT RD ACACIA RIDGE QLD 4110 ACPHARM QUEENSLAND 1 / 24 SURFERS AV MERMAID WATERS QLD 4218 ACTON HEALTH PHARMACY CHINCHILLA MEDICAL CENTRE SUITE 1 / 58 MIDDLE ST CHINCHILLA QLD 4413 ACTON HEALTH PHARMACY MILES 63 MURILLA ST MILES QLD 4415 AFS DISPENSARIES ELPHINSTONE ST 117 ELPHINSTONE -

23 February 2016 the Manager Company Announcements Office

23 February 2016 The Manager Company Announcements Office ASX Limited Level 4, Exchange Centre 20 Bridge Street SYDNEY NSW 2000 Dear Sir/Madam SCENTRE GROUP (ASX:SCG / ADR:SCTRY) MEDIA RELEASE AND RESULTS PRESENTATION Attached are the Media Release and Results Presentation for Scentre Group’s full year results for the year ended 31 December 2015. Yours faithfully SCENTRE GROUP Maureen McGrath Company Secretary Encl. SCENTRE GROUP LIMITED ABN 66 001 671 496 SCENTRE MANAGEMENT LIMITED ABN 41 001 670 579 AFS Licence No: 230329 as responsible entity of Scentre Group Trust 1 ABN 55 191 750 378 ARSN 090 849 746 RE1 LIMITED ABN 80 145 743 862 AFS Licence No: 380202 as responsible entity of Scentre Group Trust 2 ABN 66 744 282 872 ARSN 146 934 536 RE2 LIMITED ABN 41 145 744 065 AFS Licence No: 380203 as responsible entity of Scentre Group Trust 3 ABN 11 517 229 138 ARSN 146 934 652 Level 30, 85 Castlereagh Street, Sydney NSW 2000 Australia · GPO Box 4004 Sydney NSW 2001 Australia · T +61 (02) 9358 7000 · scentregroup.com MEDIA RELEASE 23 February 2016 SCENTRE GROUP REPORTS FULL YEAR 2015 RESULTS ABOVE FORECAST WITH 3.8% GROWTH IN FFO EARNINGS Scentre Group (ASX:SCG) today announced results for the 12 months to 31 December 2015, with Funds From Operations (“FFO”) of $1.199 billion or 22.58 cents per security and distribution of 20.9 cents per security. The strong underlying operating performance has meant that above forecast FFO growth of 3.8% was achieved, notwithstanding the dilution from asset sales effected by the Group in 2015. -

International Student Handbook ACTB

International Student Handbook ACTB Australian College of Technology & Business P/L CRICOS # 03164M Australian College of Technology and Business Pty Ltd Telephone: +61 7- 3852 6967 Email: [email protected] Website: www.actb.com.au Street Address: 100 Brunswick Street, Fortitude Valley, Brisbane, Queensland, Australia Postal Address: PO Box 1133, Kenmore, Queensland 4069, Australia INTERNATIONAL STUDENT HANDBOOK Australian College of Technology and Business Pty Ltd Page 2 of 69 International Students’ Handbook CRICOS Code: 03164M Last updated June 2014 National Provider Code (NTIS): 32017 Australian College of Technology and Business Pty Ltd Telephone: +61 7- 3852 6967 Email: [email protected] Website: www.actb.com.au Street Address: 100 Brunswick Street, Fortitude Valley, Brisbane, Queensland, Australia Postal Address: PO Box 1133, Kenmore, Queensland 4069, Australia CONTENTS 1. WELCOME 1.1. Welcome from the CEO 1.2. Key Contacts 2. ACTB STAFF 2.1. The Management and Administration team 2.2. The teaching team 3. CODE OF PRACTICE 4. LOCAL ENVIRONMENT AND CULTURE 4.1. Australia 4.2. Queensland 4.3. Brisbane 4.4. Fortitude Valley 4.5. Australian Culture 4.6. Culture Shock 5. ACTB: Location, Facilities and Student Resources 5.1. Location 5.2. Facilities 5.3. Classrooms 5.4. Equipment 5.5. Library Resources 5.6. Computers and Internet 5.7. Photocopying 5.8. ID Cards 5.9. Car parks 5.10. Student activities 6. COURSE INFORMATION 6.1. Courses 6.1.1. Refer to the website for details 6.2. Course Dates 6.3. Public Holidays 6.4. Class Timetables 7. YOUR RIGHTS AND RESPONSIBILITIES 7.1. -

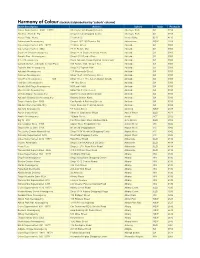

Alphabetical by 'Suburb' Column

Harmony of Colour stockists (alphabetical by 'suburb' column) Outlet Description Address Suburb State Postcode Coles Supermarket 4942 19771 Aberfoyle Hub Shopping Centre Aberfoyle Park SA 5159 Aberfoyle Park & LPO Shop 51 Hub Shopping Centre Aberfoyle Park SA 5159 Acacia Ridge News Elizabeth St. Acacia Ridge QLD 4110 Adamstown Newsagency Shop 4 267-269 Brunker Rd Adamstown NSW 2289 Coles Supermarket 435 19771 21 Grote Street Adelaide SA 5000 Coles Supermarket 4964 77-81 Rundle Mall Adelaide SA 5000 Southern Cross Newsagency Shop 24-28 Southern Cross Arcade Adelaide SA 5000 Rundle Place Newsagency Shop LG12 Rundle Place Adelaide SA 5000 R A H Newsagency Royal Adelaide Hosp (Cynthia Henderson) Adelaide SA 5000 Campbells N/A - Adelaide Central Plaza 100 Rundle Mall / Shop L G 4 Adelaide SA 5000 Topham Mall Newsagency Shop 3-5 Topham Mall Adelaide SA 5000 Adelaide Newsagency 115 Waymouth Street Adelaide SA 5000 Citinews Newsagency Shop 19-20 / 49 Pulteney Street Adelaide SA 5000 City West Newsagency 826 Shop 16 Lvl 1 The Atrium Station Arcade Adelaide SA 5000 Hutt Street Newsagency 184 Hutt Street Adelaide SA 5000 Rundle Mall Plaza Newsagency 50 Rundle Mall Adelaide SA 5000 Myer Centre Newsagency Shop T26 Terrace Level Adelaide SA 5000 Victoria Square Newsagency Stall 51 Central Market Arcade Adelaide SA 5000 Adelaide Railway Stn Newsagency Railway Station Kiosk Adelaide SA 5000 Target Variety Store 5009 Cnr Rundle & Pulteney Streets Adelaide SA 5000 Nlk-Ade Dom Cut (ADL101) Virgin Domestic Terminal-Airside Adelaide SA 5950 Adelong Newsagency -

2,205,227 $86,725

QueensPlaza 226 Queen Street, Brisbane QLD 4000 Telephone +61 7 3234 3900, Facsimile +61 7 3229 2644 queensplazashopping.com.au QueensPlaza is the leading luxury fashion shopping destination in Brisbane’s CBD. Strategically located on the Queen Street Mall, Queens Plaza offers a designer experience for customers over three levels. Anchored by David Jones, its unique mix of more than 50 international and local retailers including luxury brands Chanel, Louis Vuitton and Tiffany & Co., as well as Coles supermarket to capture all consumer needs. QueensPlaza is currently undergoing a major remix to reinforce the centre as Queensland's leading CBD premium and luxury destination. NN BrisbaneBrisbane CBD CBD SPRING HILL QUEENSPLAZA BRISBANE SOUTH BRISBANE Moreton Island Deception Bay PENINSULA FAIR Armstrong WESTFIELD NORTH LAKES Creek STRATHPINE CENTRE Sandgate TAIGUM SQUARE ASPLEY HYPERMARKET SC WESTFIELD CHERMSIDE ARANA HILLS KMART PLAZA STAFFORD CITY SC BROOKSIDE SC TOOMBUL SC DFO BRISBANE Ashgrove WYNNUM PLAZA QUEENSPLAZA THE MYER CENTRE BRISBANE CANNON HILL KMART PLAZA TOOWONG VILLAGE INDOOROOPILLY SC BURANDA WESTFIELD CARINDALE VILLAGE CAPALABA PARK SC CAPALABA CENTRAL MT OMMANEY CENTRE Darra WESTFIELD GARDEN CITY SUNNYBANK PLAZA Ipswich SUNNYBANK HILLS REDBANK PLAZA SHOPPING TOWN UNDERWOOD MARKETPLACE SC SPRINGWOOD SHOPPING MALL CALAMVALE CENTRAL SC LOGAN CENTRAL PLAZA GRAND PLAZA HYPERDOME ORION SPRINGFIELD CENTRAL Beenleigh Lyons ● CITY CENTRE ● REGIONAL CENTRE PRIMARY SECONDARY TERTIARY ● SUPER REGIONALCITY CENTRE CENTRE ● SUB REGIONAL CENTRE CENTRAL ● MAJOR REGIONAL CENTRE ● OUTLET CENTRE INNER SUPER REGIONAL CENTRE MAJOR REGIONAL CENTRE Centre statistics MID REGIONAL CENTRE OUTER SUB REGIONAL CENTRE Centre type City Centre Annual traffic (million) 12.5 Key statistics Total GLA (sqm) 39,066 Total tenants 59 2,205,227 Majors1 Coles, David Jones Residents in TTA Mini Majors2 Louis Vuitton Number of specialty retailers3 51 Number of car spaces 600 $86,725 Average household income Moving annual turnover (MAT) ($m)4 n.a. -

Full Store List

FULL STORE LIST • NEW SOUTH WALES • VICTORIA • QUEENSLAND • SOUTH AUSTRALIA • A.C.T. • WESTERN AUSTRALIA 1/8 NEW SOUTH WALES ASHFIELD CABRAMATTA EASTGARDENS 25 Hercules Street, Ashfield NSW 2131 Shop 2-3, 90 John Street, Cabramatta Shop 171, Westfield Eastgardens, 152 TEL: (02) 9799 2969 NSW 2166 Bunnerong Road, Eastgardens NSW 2036 Mon - Sun 7:00-19:00 TEL: (02) 9723 8879 TEL: (02) 9349 8848 Mon - Sun 7:00-19:30 Mon - Wed, Fri - Sun 7:30 - 19:30 BANKSTOWN Thu 7:30 - 21:00 66 Bankstown City Plaza, Bankstown CAMPSIE NSW 2200 Shop 19, Campsie Centre, 14-28 Amy EASTWOOD TEL: (02) 9708 1261 Street, Campsie NSW 2194 Shop 3, 163 Rowe Street, Eastwood Mon - Sun 7:00 -18:00 TEL: (02) 9789 6522 NSW 2122 Mon - Wed and Fri - Sun 7:30 - 18:00 TEL: (02) 9804 6188 BROADWAY Thur 7:30-21:00 Mon - Fri 7:00-20:00 Shop 2, 173-179 Broadway, Sat 7:00-20:30 Ultimo NSW 2007 CARLINGFORD Sun 8:00-20:30 TEL: (02) 9280 3430 Shop No L01 E105 Carlingford Crt, Mon - Fri 7:30-20:30 Corner Carlingford Rd and Pennant ERINA FAIR Sat 8:30-19:30 Hills Road, Carlingford NSW 2118 Shop T346, Erina Fair Shopping Sun Closed TEL: (02) 9872 1128 Centre, 620-654 Terrigal Dr, Erina NSW Mon - Wed and Fri - Sun 7:30-20:30 2250 BURWOOD Thurs 7:30-21:00 TEL: (02) 4365 6584 158 Burwood Road, Burwood NSW 2134 Mon - Wed, Fri - Sun 7:30 - 19:30 TEL: (02) 9745 5682 CHATSWOOD Thu 7:30 - 21:00 Mon - Fri 7:00-20:30 334 Victoria Avenue, Chatswood, NSW 2067 Sat - Sun 8:00-20:30 TEL: (02) 9413 9686 HORNSBY Mon - Sun 7:30-20:00 Shop 1018, Hornsby Westfield, 236 BURWOOD WESTFIELD Pacific HWY, Hornsby