The Story of Ercot the Grid Operator, Power Market & Prices Under Texas Electric Deregulation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Policy Report Texas Fact Book 2010

Texas Fact Book 2010 Legislative Budget Board LEGISLATIVE BUDGET BOARD EIGHTY-FIRST TEXAS LEGISLATURE 2009 – 2010 DAVID DEWHURST, JOINT CHAIR Lieutenant Governor JOE STRAUS, JOINT CHAIR Representative District 121, San Antonio Speaker of the House of Representatives STEVE OGDEN Senatorial District 5, Bryan Chair, Senate Committee on Finance ROBERT DUNCAN Senatorial District 28, Lubbock JOHN WHITMIRE Senatorial District 15, Houston JUDITH ZAFFIRINI Senatorial District 21, Laredo JIM PITTS Representative District 10, Waxahachie Chair, House Committee on Appropriations RENE OLIVEIRA Representative District 37, Brownsville Chair, House Committee on Ways and Means DAN BRANCH Representative District 108, Dallas SYLVESTER TURNER Representative District 139, Houston JOHN O’Brien, Director COVER PHOTO COURTESY OF HOUSE PHOTOGRAPHY CONTENTS STATE GOVERNMENT STATEWIDE ELECTED OFFICIALS . 1 MEMBERS OF THE EIGHTY-FIRST TEXAS LEGISLATURE . 3 The Senate . 3 The House of Representatives . 4 SENATE STANDING COMMITTEES . 8 HOUSE OF REPRESENTATIVES STANDING COMMITTEES . 10 BASIC STEPS IN THE TEXAS LEGISLATIVE PROCESS . 14 TEXAS AT A GLANCE GOVERNORS OF TEXAS . 15 HOW TEXAS RANKS Agriculture . 17 Crime and Law Enforcement . 17 Defense . 18 Economy . 18 Education . 18 Employment and Labor . 19 Environment and Energy . 19 Federal Government Finance . 20 Geography . 20 Health . 20 Housing . 21 Population . 21 Science and Technology . 22 Social Welfare . 22 State and Local Government Finance . 22 Transportation . 23 Border Facts . 24 STATE HOLIDAYS, 2010 . 25 STATE SYMBOLS . 25 POPULATION Texas Population Compared with the U .s . 26 Texas and the U .s . Annual Population Growth Rates . 27 Resident Population, 15 Most Populous States . 28 Percentage Change in Population, 15 Most Populous States . 28 Texas Resident Population, by Age Group . -

The Unlikely Demise of Texas' Biggest Corporate Tax Break

The Unlikely Demise of Texas’ Biggest Corporate Tax Break After 20 years, the state’s most lucrative corporate welfare program comes to an end. Justin Miller Jun 9, 2021, 6:00 am CST In 2001, state lawmakers and business leaders warned that the state’s high property tax rates were discouraging corporations from locating big projects in Texas. At the time, Site Selection magazine—a trade publication about economic development—showed Texas’ national ranking on new manufacturing plants had plummeted to 37th in the nation, and without a state income tax, the Lone Star State had no choice but to lean on sales and local property tax revenue to fund basic services like public education. In order to attract large manufacturing projects, lawmakers proposed allowing school districts to offer generous property tax abatement deals—with the state picking up the tab—as a way to lure companies to Texas. Proponents promised that good-paying jobs and long-term investment that came with those projects would more than make up for the cost of the tax breaks. The bill, dubbed the Texas Economic Development Act, passed quickly, championed by then-state Representative Kim Brimer, a Fort Worth Republican, and backed by powerful business groups. Colloquially known as Chapter 313 due to its place in the state’s tax code, the program is immensely popular for both industry and school districts. For the last two decades, it’s been the state’s largest corporate welfare program. But data reveals that 313 projects routinely lose more value than originally estimated when they return to the tax rolls, at a total cost of nearly $10 billion to Texas since the program’s beginning, raising questions about whether the projects ever actually pay off. -

82Nd Leg Members

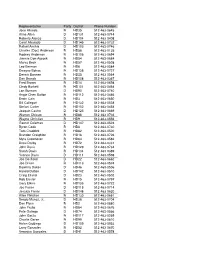

Representative Party District Phone Number Jose Aliseda R HD35 512-463-0645 Alma Allen D HD131 512-463-0744 Roberto Alonzo D HD104 512-463-0408 Carol Alvarado D HD145 512-463-0732 Rafael Anchia D HD103 512-463-0746 Charles (Doc) Anderson R HD56 512-463-0135 Rodney Anderson R HD106 512-463-0694 Jimmie Don Aycock R HD54 512-463-0684 Marva Beck R HD57 512-463-0508 Leo Berman R HD6 512-463-0584 Dwayne Bohac R HD138 512-463-0727 Dennis Bonnen R HD25 512-463-0564 Dan Branch R HD108 512-463-0367 Fred Brown R HD14 512-463-0698 Cindy Burkett R HD101 512-463-0464 Lon Burnam D HD90 512-463-0740 Angie Chen Button R HD112 512-463-0486 Erwin Cain R HD3 512-463-0650 Bill Callegari R HD132 512-463-0528 Stefani Carter R HD102 512-463-0454 Joaquin Castro D HD125 512-463-0669 Warren Chisum R HD88 512-463-0736 Wayne Christian R HD9 512-463-0556 Garnet Coleman D HD147 512-463-0524 Byron Cook R HD8 512-463-0730 Tom Craddick R HD82 512-463-0500 Brandon Creighton R HD16 512-463-0726 Myra Crownover R HD64 512-463-0582 Drew Darby R HD72 512-463-0331 John Davis R HD129 512-463-0734 Sarah Davis R HD134 512-463-0389 Yvonne Davis D HD111 512-463-0598 Joe Deshotel D HD22 512-463-0662 Joe Driver R HD113 512-463-0574 Dawnna Dukes D HD46 512-463-0506 Harold Dutton D HD142 512-463-0510 Craig Eiland D HD23 512-463-0502 Rob Eissler R HD15 512-463-0797 Gary Elkins R HD135 512-463-0722 Joe Farias D HD118 512-463-0714 Jessica Farrar D HD148 512-463-0620 Allen Fletcher R HD130 512-463-0661 Sergio Munoz, Jr. -

Select Committee on Judicial Interpretation Of

TEXAS HOUSE OF REPRESENTATIVES SELECT COMMITTEE ON JUDICIAL INTERPRETATIONS OF LAW INTERIM REPORT TO THE 77TH TEXAS LEGISLATURE FRED M. BOSSE Chairman Committee Clerk CRAIG P. CHICK Committee On Select Committee on Judicial Interpretations of Law December 5, 2000 Fred M. Bosse P.O. Box 2910 Chairman Austin, Texas 78768-2910 The Honorable James E. "Pete" Laney Speaker, Texas House of Representatives Members of the Texas House of Representatives Texas State Capitol, Rm. 2W.13 Austin, Texas 78701 Dear Mr. Speaker and Fellow Members: The Select Committee on Judicial Interpretations of Law of the Seventy-Sixth Legislature hereby submits its interim report including recommendations for consideration by the Seventy-Seventh Legislature. Respectfully submitted, Fred M. Bosse, Chairman Jim Dunnam Toby Goodman Patricia Gray Peggy Hamric Juan Hinojosa Todd Smith Members: Jim Dunnam; Toby Goodman; Patricia Gray; Peggy Hamric; Juan Hinojosa; Todd Smith; and Burt Solomons Burt Solomons TABLE OF CONTENTS Introduction ...................................................................ii Review of Identified Appellate Court Decisions .........................................2 I. Decisions Clearly Failing to Properly Implement Legislative Purposed ..........3 II. Decisions Finding Two or More Statutes to be in Conflict ..................5 III. Decisions Holding a Statute Unconstitutional ..........................15 IV. Decisions Expressly Finding a Statute to be Ambiguous ..................19 V. Decisions Expressly Suggesting Legislative Action .......................34 -

Evaluation of Sb 16 Mu Center for Business & Economic Research

EVALUATION OF SB 16 MU CENTER FOR BUSINESS & ECONOMIC RESEARCH October 2017 Evaluation of SB 16 i EVALUATION OF SB 16 MU CENTER FOR BUSINESS & ECONOMIC RESEARCH Evaluation of SB 16 FINAL REPORT October 19, 2017 Christine Risch, MS Director of Resource & Energy Economics Calvin Kent, PhD Professor Emeritus Center for Business & Economic Research Marshall University Contact: [email protected] OR (304-696-5754) ii EVALUATION OF SB 16 MU CENTER FOR BUSINESS & ECONOMIC RESEARCH Executive Summary West Virginia Senate Bill 16, introduced in the 2017 regular legislative session would repeal 11-6A-5a of the West Virginia Code related to wind power projects. The current Code grants pollution control property tax treatment to wind turbines and towers. For property taxation, assessment of the covered facilities is based on salvage value which the statute defines as five percent (5%) of original cost. Senate Bill 16 would repeal this status for existing and future wind facilities without a grandfathering provision for either operating wind projects, or those currently under development. • Passage of SB 16 would amount to an increase in the property taxes levied on wind facilities from $2.7 million to $11.9 million, a factor of 4.4. To the industry, this would be an average increase in operating costs of 34 percent. • While it is uncertain what the impact of this policy change would be on future wind development in the State or on the probability that other industries will choose to invest here, one wind developer stopped development on two early-stage projects in West Virginia because of SB 16. -

Who Uses the Land?

National Park Service Bering Land Bridge US Department of the Interior Lesson Plan Who Uses the Land? The Seward Peninsula has been used for over 10,000 years. The earliest evidence of usage harkens back to Grade Level: Sixth Grade- the Bering Land Bridge, when the earliest inhabitants Eleventh Grade of this continent crossed over from Asia. This land Grade Subjects: American Indian use continues up to today, with many different groups History and Culture, Community, competing for rights to use the land. The various Government, Historic Preservation, types of usage have not always been beneficial. History, Planning/Development, Public Policy, Regional Studies, Objective Westward Expansion The students will engage in research to learn how the local environment has been used throughout history. Duration: 30-60 minutes Background Group Size: Up to 24 For background information on land use history in Alaska, visit Standards: (8) SA3.1, AH. PPE3, the following websites: AH. CC6 • Alaska history: http://www.akhistorycourse.org/articles/ Vocabulary article.php?artID=138 Land use • Native Alaskan History wiki: http://wiki.bssd.org/index. ANCSA php/Native_Alaskan_history Native corporations • ANCSA info for Elementary School age: http://www. alaskool.org/projects/ancsa/elem_ed/elem_ancsa.htm • Inuit History in Alaska: http://www.everyculture.com/multi/Ha-La/Inuit.html • History of Northwest Alaska: http://www.akhistorycourse.org/articles/article.php?artID=75 Introduction: • Point to a couple of places on a map of the United States. Picking Texas or Florida may prove to be good starting points. • Ask the students how those lands are used today? Some potential answers may include fishing, tourism and orchards for Florida. -

Interim Report to the 82Nd Texas Legislature

InterIm report to the 82nd texas LegisLature House Committee on State affairS December 2010 ______________________________________________________________________________ HOUSE COMMITTEE ON STATE AFFAIRS TEXAS HOUSE OF REPRESENTATIVES INTERIM REPORT 2010 BURT R. SOLOMONS CHAIRMAN LESLEY FRENCH COMMITTEE CLERK/GENERAL COUNSEL ROBERT ORR DEPUTY COMMITTEE CLERK/POLICY ANALYST ALFRED BINGHAM LEGAL INTERN ______________________________________________________________________________ ______________________________________________________________________________ COMMITTEE ON STATE AFFAIRS TEXAS HOUSE OF REPRESENTATIVES P.O. BOX 2910 • AUSTIN, TEXAS 78768-2910 CAPITOL EXTENSION E2.108 • (512) 463-0814 September 27th, 2010 The Honorable Joe Straus Speaker, Texas House of Representatives Texas State Capitol, Rm. 2W.13 Austin, Texas 78701 Dear Mr. Speaker and Fellow Members: The Committee on State Affairs of the Eighty-First Legislature hereby submits its interim report for consideration by the Eighty-Second Legislature. Respectfully submitted, _______________________ Burt Solomons, Chair _______________________ _______________________ Rep. José Menéndez, Vice-Chair Rep. Byron Cook _______________________ _______________________ Rep. Tom Craddick Rep. David Farabee _______________________ _______________________ Rep. Pete Gallego Rep. Charlie Geren ______________________ _______________________ Rep. Patricia Harless Rep. Harvey Hilderbran ______________________ _______________________ Rep. Delwin Jones Rep. Eddie Lucio III _______________________ -

November 1998 Election Day Only (WITH 534 of 534 PRECINCTS COUNTED) JOHN CORNYN (REP)

OFFICIAL SUMMARY REPORT TARRANT COUNTY ELECTION DAY ONLY GENERAL ELECTION NOVEMBER 3, 1998 VOTES PERCENT PRECINCTS COUNTED (OF 534) . 534 100.00 REGISTERED VOTERS - TOTAL . 814,547 BALLOTS CAST - TOTAL. 193,021 VOTER TURNOUT - TOTAL . 23.70 STRAIGHT PARTY OFFICE (WITH 534 OF 534 PRECINCTS COUNTED) REPUBLICAN PARTY (REP) . 63,216 60.40 DEMOCRATIC PARTY (DEM) . 40,882 39.06 LIBERTARIAN PARTY (LIB) . 562 .54 UNITED STATES REPRESENTATIVE DISTRICT 6 (WITH 224 OF 224 PRECINCTS COUNTED) JOE BARTON (REP) . 71,209 72.39 BEN B. BOOTHE (DEM) . 25,943 26.37 RICHARD A. BANDLOW (LIB) . 1,214 1.23 UNITED STATES REPRESENTATIVE DISTRICT 12 (WITH 221 OF 221 PRECINCTS COUNTED) KAY GRANGER (REP) . 37,234 61.82 TOM HALL (DEM) . 21,913 36.39 PAUL BARTHEL (LIB) . 1,078 1.79 UNITED STATES REPRESENTATIVE DISTRICT 24 (WITH 77 OF 77 PRECINCTS COUNTED) SHAWN TERRY (REP) . 7,613 32.72 MARTIN FROST (DEM) . 15,170 65.19 DAVID A. STOVER (LIB) . 202 .87 GEORGE ARIAS (IND) . 284 1.22 UNITED STATES REPRESENTATIVE DISTRICT 26 (WITH 12 OF 12 PRECINCTS COUNTED) DICK ARMEY (REP) . 6,153 88.72 JOE TURNER (LIB) . 782 11.28 GOVERNOR (WITH 534 OF 534 PRECINCTS COUNTED) GEORGE W. BUSH (REP) . 136,907 71.10 GARRY MAURO (DEM) . 54,482 28.29 LESTER R.(LES) TURLINGTON JR (LIB) . 1,100 .57 WRITE-IN . 72 .04 LIEUTENANT GOVERNOR (WITH 534 OF 534 PRECINCTS COUNTED) RICK PERRY (REP) . 107,555 56.04 JOHN SHARP (DEM) . 81,108 42.26 ANTHONY GARCIA (LIB) . 3,249 1.69 ATTORNEY GENERAL Page 1 November 1998 Election Day Only (WITH 534 OF 534 PRECINCTS COUNTED) JOHN CORNYN (REP) . -

The Role of Natural Gas in a Low-Carbon Energy Economy

Briefing Paper The Role of Natural Gas in a Low-Carbon Energy Economy Christopher Flavin Saya Kitasei April 2010 Natural Gas and Sustainable Energy Initiative The Role of Natural Gas in a Low-Carbon Energy Economy* Christopher Flavin and Saya Kitasei Executive Summary Growing estimates of natural gas resources, including a new category of ―unconventional‖ gas, suggest that accessible supplies of this least carbon-intensive of the fossil fuels may be far more abundant than previously assumed. This unexpected development creates opportunities for deploying natural gas in a variety of sectors—including power generation, industry, and transportation—to help displace oil and coal, thereby reducing greenhouse gas emissions and improving air quality. Beyond providing a cleaner, market-ready alternative to oil and coal, natural gas can facilitate the systemic changes that will underpin the development of a more energy-efficient and renewable energy-based economy. For example, smaller, distributed generators, many producing usable heat as well as electricity, could generate economical, low-emission replacements for a large fraction of currently operating conventional power plants, providing flexible back-up to the variable output of the solar and wind generators that will comprise a growing share of the electric power system. All of these gains are contingent on the development of sound public policy to incentivize and guide the transition. Critical policy decisions that are now pending include: electric power regulation at the local, state, and federal levels; effective federal and state oversight of the natural gas exploration and extraction process; future Environmental Protection Agency (EPA) regulatory decisions under the U.S. -

On the Record Reporting (512) 450-0342 Texas

TEXAS DEPARTMENT OF HOUSING AND COMMUNITY AFFAIRS BOARD MEETING Capitol Extension Room E1.026 1100 Congress Avenue Austin, Texas 11:00 a.m. Monday, March 20, 2006 BOARD MEMBERS: ELIZABETH ANDERSON, Chairman C. Kent Conine, Vice-Chairman (Not Present) VIDAL GONZALEZ, Member SHADRICK BOGANY, Member NORBERTO SALINAS, Member STAFF: BILL DALLY, Acting Executive Director ON THE RECORD REPORTING (512) 450-0342 2 I N D E X AGENDA ITEM PAGE CALL TO ORDER, ROLL CALL 6 CERTIFICATION OF QUORUM PUBLIC COMMENT 11 ACTION ITEMS Item 1 Presentation, Discussion and Possible 54 Approval of Minutes of the Board Meeting of February 15, 2006 Item 2 Presentation and Discussion of the Findings 54 of the Recently Completed Market Study of the Houston Metropolitan Statistical Area (MSA)by Vogt Williams & Bowen Item 3 Presentation, Discussion and Possible Approval of Housing Tax Credit Items: a) Housing Tax Credit Amendments 03254 Bayou Bend, Waller, Waller 76 County 05243 Villas of Hubbard, Hill County 77 b) Housing Tax Credit Extensions for Commencement of Substantial Construction 04200 Alvin Manor Estates, Alvin, 77 Brazoria County 04203 Alvin Manor, Alvin, Brazoria 77 County 04224 Commons of Grace Apartments, 78 Harris County c) Adoption of Amendments to Title 10, 81 Part 1, Chapter 50, 2006 Housing Tax Credit Program Qualified Allocation Plan and Rules, §50.9(I)(6), regarding the Level of Community Support from State Elected Officials d) Issuance of Determination on Tax- Exempt Bond Transactions with Other Issuers: 05452 Lindberg Parc Senior Apartments, 82 -

Wind Energy Institute 2008

UTCLE THE UNIVERSITY OF TEXAS SCHOOL OF LAW WIND ENERGY INSTITUTE 2008 THE PREMIER GATHERING OF KEY PARTICIPANTS IN TEXAS WIND DEVELOPMENT Tuesday, February 19 – Wednesday, February 20, 2008 Austin Convention Center • Austin, Texas PLATINUM SPONSORS FPL Energy, LLC Invenergy LLC RES Americas GOLD SPONSORS AES Wind Generation • Airtricity Inc. • Siemens Power Generation • Stoel Rives LLP SILVER SPONSORS Baker Botts L.L.P. • Chadbourne & Parke LLP • Clipper Windpower, Inc. • Gexa Energy, LLC • Horizon Wind Energy Locke Lord Bissell & Liddell LLP • Lone Star Transmission, LLC • Stahl, Bernal & Davies, L.L.P. Steakley, Wetsel & Carmichael, L.L.P. • Suzlon Wind Energy Corporation • Vinson & Elkins LLP PRESENTED BY THE UNIVERSITY OF TEXAS SCHOOL OF LAW AND THE OIL, GAS AND ENERGY RESOURCES LAW SECTION OF THE STATE BAR OF TEXAS 2008 WIND ENERGY INSTITUTE Presented by The University of Texas School of Law and The Oil, Gas and Energy Resources Law Section of the State Bar of Texas February 19-20, 2008 • Austin Convention Center • Austin, Texas Earn up to 14.50 Hours of MCLE Credit Specialization Credit Expected for Oil, Gas & Mineral Law TUESDAY, FEBRUARY 19, 2008 10:45 a.m. .50 hr Presiding Officer: Power Markets and Nodal Pricing: How the New Andy Bowman, Airtricity, Inc., Austin, TX Rules will Change the Economics and Location of Wind Developments This session provides a snapshot of common methods by 7:30 a.m. Registration Opens which power is currently bought and sold in Texas, and continues with non-technical highlights of the new nodal Includes continental breakfast. pricing system, using illustrative and practical examples Edward W. -

Renewable Energy: Wind and Solar

Renewable Energy: Chapter | 19 Wind and Solar ❖ Can Texans harness the wind and sun and even the jobs that go with these energy sources? 600-turbine development across 336,000 Introduction acres of West Texas. Financed by Chinese In late 2009, German utility giant E.ON banks, the development will feature new constructed the world’s largest wind farm in turbines made in China and will bring the tiny West Texas town of Roscoe. The 300 temporary construction jobs and 30 Roscoe wind farm has the capacity to produce permanent jobs to the area. Renewable 781.5 megawatts — enough electricity for energy in Texas is new — and it has already every home in Plano, McKinney and the been globalized. rest of the 265,000 households in Collin These giant wind projects illustrate County. The $1 billion project in Roscoe two key trends: Texas is emerging as took 21 months to complete and employed the capital of renewable energy, and 500 construction workers, who built 627 wind foreign companies are moving fast to take turbines on the fields of 300 property owners advantage. “People in Texas think it has — land that once pumped oil. got to be conventional energy or renewable The wind turbines of West Texas spin at energy. It’s not. It’s both,” said Michael 7 miles per hour. And one turbine produces Webber, an engineering professor at the about as much electricity as 350 households University of Texas at Austin and associate consume in a year. These economics are director of the Center for International attracting more wind turbines to the state, Energy and Environmental Policy.