Plant-Based Diets Are Here to Stay!

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Winter Lunch Menu} February 2021 Monday Tuesday Wednesday Thursday Friday December 1St, 2020 December 2Nd, 2020 December 3Rd, 2020 December 4Th, 2020

december 2020 january 2021 winter lunch menu} february 2021 monday tuesday wednesday thursday friday December 1st, 2020 December 2nd, 2020 December 3rd, 2020 December 4th, 2020 Chicken Nuggets Asian Meatballs Turkey Taco Tomato Cream Pasta Veggie Nuggets Veggie Meatballs Boca Taco Mozzarella Cheese WG Roll Asian BBQ Sauce Flour Tortilla Cauliflower Steamed Carrots Quinoa Peppers & Onions Apple Slices Melon Broccoli Melon Pineapple December 7th, 2020 December 8th, 2020 December 9th, 2020 December 10th, 2020 December 11th, 2020 Pizza Muffins Tandoori Chicken Ravioli Turkey Sloppy Joe Three Bean Chili Marinara Sauce Tandoori Tofu Marinara Sauce Boca Sloppy Joe Shredded Cheddar Cheese Steamed Peas Brown Rice Green Beans WG Hamburger Bun Saltines Melon Steamed Carrots Pineapple Collard Greens Roasted Sweet Potato Melon Pear Slices Apple Slices December 14th, 2020 December 15th, 2020 December 16th, 2020 December 17th, 2020 December 18 th, 2020 Sweet & Sour Chicken Tortellini Fajita Chicken Mac N Cheese Chicken Nuggets Sweet & Sour Tofu Marinara Sauce Fajita Tofu Steamed Carrots Veggie Nuggets Brown Rice Broccoli Flour Tortilla Melon WG Bread Roasted Zucchini Melon Peppers & Onions Roasted Butternut Squash Orange Slices Pineapple Fruit Salad December 21st, 2020 December 22nd, 2020 December 23rd, 2020 December 24th, 2020 Decemb er 25th, 2020 Roasted Turkey w/Gravy Adobo Chicken Beef Burger Penne Pasta w/Marinara Veggie Tamale Tofurkey w/Gravy Adobo Tofu Veggie Burger Mozzarella Cheese Green Beans WG Roll Brown Rice WG Hamburger Bun Broccoli Applesauce -

Great Food, Great Stories from Korea

GREAT FOOD, GREAT STORIE FOOD, GREAT GREAT A Tableau of a Diamond Wedding Anniversary GOVERNMENT PUBLICATIONS This is a picture of an older couple from the 18th century repeating their wedding ceremony in celebration of their 60th anniversary. REGISTRATION NUMBER This painting vividly depicts a tableau in which their children offer up 11-1541000-001295-01 a cup of drink, wishing them health and longevity. The authorship of the painting is unknown, and the painting is currently housed in the National Museum of Korea. Designed to help foreigners understand Korean cuisine more easily and with greater accuracy, our <Korean Menu Guide> contains information on 154 Korean dishes in 10 languages. S <Korean Restaurant Guide 2011-Tokyo> introduces 34 excellent F Korean restaurants in the Greater Tokyo Area. ROM KOREA GREAT FOOD, GREAT STORIES FROM KOREA The Korean Food Foundation is a specialized GREAT FOOD, GREAT STORIES private organization that searches for new This book tells the many stories of Korean food, the rich flavors that have evolved generation dishes and conducts research on Korean cuisine after generation, meal after meal, for over several millennia on the Korean peninsula. in order to introduce Korean food and culinary A single dish usually leads to the creation of another through the expansion of time and space, FROM KOREA culture to the world, and support related making it impossible to count the exact number of dishes in the Korean cuisine. So, for this content development and marketing. <Korean Restaurant Guide 2011-Western Europe> (5 volumes in total) book, we have only included a selection of a hundred or so of the most representative. -

September 2021 K-8 Menu

LANCER CATERING 651-646-2197 X32 SEPTEMBER 2021 K-8 MENU Menu Subject to Change Monday Tuesday Wednesday Thursday Friday 1-Sep 2-Sep 3-Sep Beef Cheeseburger on WG Bun Chicken Marinara w/ Mozzarella Cheese Buffalo Chicken on WG Bun Lancer Dining Services does not use peanuts, pork, Veg Baked Beans WG Teabiscuit Fresh Carrots tree nut or shellfish ingredients. All items are baked Applesauce Cup Brown Rice Fresh Celery Sticks or steamed, mindfully made with fresh or frozen Ketchup PC Fresh Broccoli Fruit Chef's Choice vegetables (never canned!),100% whole grains and Fresh Orange a variety of lean meats using heart-healthy oils and low-salt seasonings. 0 VEGETARIAN: Gardenburger VEGETARIAN: Cheesebread w/ Marinara VEGETARIAN: Cheese Quesadilla ALTERNATE: Chicken Buffalo Wrap ALTERNATE: SW Chicken Wrap ALTERNATE: Pizza or Turkey Club Sub 6-Sep 7-Sep 8-Sep 9-Sep 10-Sep BBQ Drumstick w/ Veg. Brown Rice Turkey w/Gravy Softshell Beef Taco Teriyaki Chicken Over Brown Rice WG Teabiscuit WG Teabiscuit Black Beans Fresh Broccoli Fresh Carrots Mashed Potatoes WG 8" Tortilla Fresh Orange Fresh Banana Fresh Celery Shredded Cheese & Lettuce Fruit Chef's Choice Salsa Fresh Apple 0 0 CLOSED VEGETARIAN: Tofu w/ Sweet & Sour VEGETARIAN: Gardenburger w/ Veg Gravy VEGETARIAN: Vegetarian Taco Meat VEGETARIAN: Teriyaki Tofu ALTERNATE: Chicken Cheddar Wrap ALTERNATE: Chicken Buffalo Wrap ALTERNATE: SW Chicken Wrap ALTERNATE: Pizza or Turkey Club Sub 13-Sep 14-Sep 15-Sep 16-Sep 17-Sep Beef Hot Dog on WG Hot Dog Bun Chicken Parmesan Sandwich Sweet & Sour Chicken BBQ Chicken Bosco Sticks 6" w/ Marinara Veg. -

ON PLANT-BASED “MEAT” by Andy Amakihe1

BURGERS, CHOPS, & VEGETABLE CROPS: CONSTITUTIONAL RIGHTS AND THE “WAR” ON PLANT-BASED “MEAT” By Andy Amakihe1 1 J.D. Candidate 2021, Rutgers Law School 120 RUTGERS LAW RECORD ABSTRACT The Arkansas State Legislature has passed a new law called Act 501 (hereinafter referred to as “the Act”), “The Arkansas Truth in Labeling Law.”2 The Act prohibits labeling any food products as “meat” or similarly descriptive words if the product is not derived from livestock or poultry.3 Some “similarly descriptive” words include, without limitation, “burger,” “sausage,” and “deli slice.”4 The Act also applies to dairy products such as milk, butter, and cheese.5 Additionally, the Act applies to vegetable products that serve as alternatives to grains and dairy, such as cauliflower rice and nut “milks.”6 Every violation of the Act is met with a $1,000 civil fine for each plant-based product packaged and labeled as meat.7 Many other states such as Mississippi, Louisiana, and South Dakota have passed substantially similar laws that affect the way food products are marketed and sold within their states.8 Act 501 was passed after heavy lobbying of the Arkansas State Legislature by the animal agriculture industry.9 After a subsequent action by the American Civil Liberties Union, the Good Food Institute, the Animal Legal Defense Fund, and the Tofurky Company, the District Court granted a preliminary injunction temporarily halting the enforcement of the law.10 The plaintiffs ultimately seek a permanent injunction banning Act 501.11 The purpose of this note is to explore the constitutionality of Act 501 as it pertains to the challenges on the First and Fourteenth Amendment’s freedom of speech (specifically commercial speech), freedom from vague statutes, and violations of the Dormant Commerce Clause. -

Going for the Plant-Based (Legen)Dairy Alternative?

Going for the plant-based (legen)dairy alternative? An exploratory study on consumer attitudes and purchase intentions towards plant-based dairy alternatives Master thesis within: Business Administration - Marketing Number of credits: 30 ECTS Program of study: Civilekonom Authors: Emma Rosenlöw & Tommie Hansson Tutor: Adele Berndt Jönköping May 2020 Master Thesis in Business Administration - Marketing Title: Going for the plant-based (legen)dairy alternative? An exploratory study on consumer attitudes and purchase intentions towards plant-based dairy alternatives Authors: Emma Rosenlöw & Tommie Hansson Tutor: Adele Berndt Date: May 18, 2020 Key terms: Attitude, Environmental concern, Greenhouse gas, Health consciousness, Perceived behavioral control, Plant-based dairy substitutes, Purchase intention, Subjective norms Abstract Global food production, and consequently consumption, contributes significantly to total greenhouse gas emissions. Hence, there is a need for a shift towards more environmentally friendly consumption patterns. This includes moving away from current levels of dairy consumption, where plant-based alternatives can serve as more environmentally friendly options. This research sheds light on an emerging product category, namely plant-based dairy alternatives, which can serve as options or substitutes for traditional dairy products. The purpose of this thesis is to explore consumer attitudes and purchase intentions towards plant- based dairy alternatives, as well as the factors that influence attitudes and intentions respectively. To achieve an in-depth understanding of the topic, this study is of qualitative nature, using an abductive approach and interpretive philosophy. The primary data is collected through interviews with 16 consumers in the selected target group. Further, this research has developed a modified theory of planned behavior (TPB), to add to current consumer behavior research. -

Winter Menu } February Fruit & Veg/ 1/2 Cup Total Milk 6Oz Cup

tm local & organic food for kids december Protein =2oz total january Grain>2oz winter menu } february Fruit & Veg/ 1/2 cup total Milk 6oz cup monday tuesday wednesday thursday friday Dec 31, Jan 28 January 1, 29 January 2, 30 January 3, 31 January 4 Roast Turkey w/ Gravy Three Cheese Baked Chicken Nuggets Beefy Sloppy Joe Three Bean Chili Lasagna Veggie “Chicken” Tenders Veggie Sloppy Joe Tofurkey Fresh Cucumbers Steamed Carrots Mixed Veggies Whipped Potatoes Fresh Broccoli Fruit Salad Fresh Pineapple Fresh Bananas Appleberry Sauce Pear Slices Elbow Pasta Whole Grain Bread Whole Grain Bread Whole Grain Bun January 7 January 8 January 9 January 10 January 11 Orange Chicken Farfalle w/ Tomato Beef Kabab Bites Creamy Three Cheese Orange Vegetarian Chicken Cream Sauce Falafel Mac n’ Cheese Pizza w/ Yogurt Dip Asian Veggies Steamed Carrots Sweet Local Peas Fresh Broccoli Honeydew Melon Fresh Cucumbers Fresh Pineapple Apple Slices Orange Slices Fruit Salad Brown Rice Whole Grain Pita January 14 January 15 January 16 January 17 January 18 Turkey Pot Pie Juicy Beef Burger Cheesy Quesadillas Cheesey Ravioli Sweet Apple Chicken Curry Veggie Pot Pie Veggie Burger w/ Sour Cream w/ Marinara Vegetarian Chicken Local Green Beans Fresh Steamed Broccoli Butternut Squash Sweet Local Peas Cauliflower & Carrots Orange Slices Appleberry Sauce Fresh Pineapple Fresh Melon Fruit Salad Fresh Baked Biscuit Whole Grain Bun Naan Bread January 21 January 22 January 23 January 24 January 25 Pasta w/ Alfredo Chicken w/ Plum Sauce Swedish Meatballs Fish Tenders Adobo -

Chef Catherine Blake Presented “Cooking for Brain Power”

The Island Vegetarian Vegetarian Society of Hawaii Quarterly Newsletter Inside This Issue Time to Celebrate! VSH Pre-Thanksgiving Dinner 1,3 VSH’s Pre-Thanksgiving Mahalo to Our VSH Volunteers 2 Top Cardiologist Eats Vegan 3 Dinner on Novembef 21 Animal Protein & Osteoporosis 4 Tasty & Meatless at ShareFest 5 Vegan Foodies Club-Sushi Rolls 6-7 Nutrition News 7 If the Oceans Die, We Die 8 Oahu and Maui VSH Events 8,9 Kauai VSH Events 10 Cowspiracy 11 by Karl Seff, PhD Fermentation 12 VSH Board member Heart Healthy Recipe 13 Our Daily Food Choices Matter 14 Upcoming Events 15-18 Membership Benefits 19 Our year-end holidays begin each year with VSH’s annual vegan Pre- Thanksgiving Dinner! This year it will be at McCoy Pavilion at Ala Moana Beach Park, 1201 Ala Moana Boulevard, in Honolulu, and, like last year, it will be on the Friday before Thanksgiving, November 21, 2014. Free Public Lectures As in recent years, Madana Sundari will be preparing a full Thanksgiving vegan buffet for us. Wherever possible, it will be organic and free of GMOs, T. Colin Campbell, PhD hydrogenated oils, MSG, preservatives, and artificial colors and flavors. Open “Nutrition Is Far More Effective to VSH members and non-members, from vegans to non-vegetarians, a record Than Generally Known” high of about 340 people attended last year’s dinner, held at Govinda’s. Tuesday, October 14, 2014 The fare will be very traditional (see the menu on page 3), and entirely home- Ala Wai Golf Course Clubhouse made. Expect a comfortable, quiet Thanksgiving experience. -

Y Ou R Ca Fe Te Ri A

VeganizeVeganize YOURYOUR CAFETERIA CAFETERIA © Steve Lee Studios Dear Student, Thanks for your interest in getting more vegan options offered in your cafeteria. With the addition of plant-based entrées, you can spare thousands of animals a life of misery. As more high school students stop eating animals, cafeteria managers are working to accommodate students’ dietary choices. So what kind of legacy do you want to leave at your school? By dedicating a few hours to meetings, you can help create monumental changes for animals and expose students to vegan options that they otherwise would never have had the opportunity to try. PETA is here to provide support and guidance throughout the process. In this guide, we’ve laid out the steps necessary for your school to earn an “A” on the PETA Vegan Report Card. Feel free to contact our team, which helps students increase the number of vegan options at their schools. E-mail us at [email protected]. Students across the country are working with PETA and winning victories for animals. The more praise and demand for plant-based foods that cafeterias receive, the greater the number of vegan dining options they will offer. So let’s get started! Sincerely, PETA Alptraum | Chick: © Dreamstime.com THE Five-StepPROCESS FOR MORE VEGAN OPTIONS STEP 1: INVESTIGATIVE PROCESS Survey the Options Already Available Find out which vegan options already exist and how often they’re served—the more thorough your assessment, the more prepared and knowledgeable you’ll be when you meet with the cafeteria manager. Know who your school’s food-service provider is. -

Cheese Sandwiches Will Be Given As a Substitute Lunch If Your Child Dislikes Lunch of the Day

THE CHILDREN’S CENTER OF BRIGHTON, INC. Menu Milk served with AM Snack & Lunch (Milk Substitute: Silk Soy Milk) Date: Monday Tuesday Wednesday Thursday Friday Name: Name: Name: Name: Name: 5/3 -5/7 • No Nut Butter • Bagels • Strawberry Jelly • Grits with Cinnamon • Apple Bread AM Snack • No Salt Saltines • Cream Cheese • Tortillas • Blueberries • Cheese Sticks • Berries • Oranges • Cantaloupe Dairy Sub. (DF) Cream Cheese (DF) Cheese Soy Sub. Gluten Sub. (GF) (GF) Crackers (GF) Bagel (GF) Apple Bread (GF) Tortilla Vegetarian Sub. Vegan Sub. (V) (V) Cream Cheese (V) Cheese Infant Sub. Oyster Crackers • Spaghetti and Ground • Turkey and Cheddar • Tuna Melt Turkey Meat Sauce • Raisin French Toast • Veggie Nuggets Pinwheel • Broccoli and • Italian Bread and Butter • Cottage Cheese Lunch • Beets • Sliced Tomatoes Cauliflower • Green Beans • Mixed Veggies • Mandarin Oranges • Corn • Peaches • Fruit Salad • Applesauce • Plums Dairy Sub. (DF) Cheese (DF) Butter (DF) Cheese (DF) Cottage Cheese Soy Sub. Gluten Sub. (GF) (GF) Bread (GF) Bread, Pasta (GF) Veggie Nuggets (GF) Tortilla (GF) Bread Vegetarian Sub. (V) Grilled Cheese (V) Tofu Crumble (V) Tofurkey Vegan Sub. (V) (V) Grilled Cheese (V) Tofu Crumble (V) Tofurkey, Cheese (V) Cottage Cheese Infant Sub. • Baked Chick Peas • Peppers • Vegan Vanilla Wafer Bar • Vegan Peach Crisp • Banana Chips PM Snack • Pretzels • Dill Dip • Fruit Cocktail • Carrots • Fruit Salad • Sliced Apples • Watermelon Dairy Sub. (DF) Dill Dip Soy Sub. Gluten Sub. (GF) (GF) Pretzels Vegetarian Sub. Vegan Sub. (V) (V) Dill Dip Infant Sub. Baked Sliced Apples Cooked Carrots Cooked Veggies Cheese Sandwiches will be given as a substitute lunch if your child dislikes lunch of the day. -

DECA Lunch Menu

Date | January 4 Price | All you can eat buffet $10.00 Mongolian Grill Taco Bar Garbage Plates Chicken, Beef & Vegetarian Taco on Corn, Hamburgers, Cheeseburgers, Hot Dogs, Macaroni Salad, White or Wholegrain Tortilla Homefries, Baked Beans, Hot Sauce Spanish Beans, Cilantro Rice, Romaine, Tomatoes, Olives, Jalapeños, Sour Cream, Guacamole, Pepper Jack Ched- Pizza dar Cheese Blend, Ranch Taco Sauce, Homemade Pico de Gallo & Chipotle Picante Sauce Sheet Pizzas Pepperoni / Cheese / Sausage & Mushroom Grill Angus Beef or Halal Burgers Pasta Bar Grilled Chicken Barilla Regular & Wholegrain Pasta Toppings: Italian Chicken, Italian Tofu, Steamed Broccoli, Zwiegel’s Hot Dog Seasonal Vegetable, Meatballs Chicken Fingers Tomato Sauce & Alfredo Sauce Grilled Cheese Deli Fried Fish Fillet Sandwiches Boca Burger (vegan) White or Wheat Sub Roll, Wraps, Variety of Breads Black Bean Burger (vegan) Turkey, Ham, Roast Beef, Regular & Lite Tuna Salad, Gardenburger Original (vegetarian) Chicken, Hummus Toppings: Bacon, American Cheese, Lettuce, Tomato, Bacon, Tomato, Lettuce, Onion, Banana Peppers, Onions, Onion, Relish & Tartar Sauce Pickles, Cucumbers Sides: French Fries, Cheese Sauce American, Swiss, Cheddar, Provolone, Mozzarella Cheeses Condiments: Mayonnaise, Reduced Fat Mayonnaise, Caesar, Yellow Mustard, Spicy Brown Mustard, Honey Salad Bar Mustard, Italian Dressing Romaine Salad Mix Baby Spinach Toppings Toppings: Chopped Egg, Edamame, Chicken, Tuna, Olives, Broccoli, Baby Carrots, Cucumbers, Grape Tomatoes, Peppers, Cottage Cheese, Pepper Jack Cheddar Cheese, Asiago Cheese, Greek Yogurt, Cut Fruit, Canned Fruit, Assorted Dressings, Croutons, Bacon Bits, & Sunower Seeds Assorted Desserts, Ice Cream & Beverages. -

A Pocket Guide to Veganism

A Pocket Guide to Veganism What is veganism? Veganism is a way of living that seeks to exclude, as far as is possible and practicable, cruelty to and exploitation of animals. In dietary terms, this means avoiding eating animal products like meat, dairy, eggs and honey. Why Vegan? It’s better for animals! The majority of animals who are bred for consumption spend their short lives on a factory farm, before facing a terrifying death. Chickens like Bramble here spend their lives in tiny, windowless sheds. She had no access to natural light, fresh air, or even grass. Thankfully she was saved from slaughter. But many others aren’t as lucky. It helps the planet! Animal farming is responsible for more greenhouse gas emissions than all motorised transport combined. In addition, it is responsible for vast amounts of deforestation and water pollution around the world. The carbon footprint of a vegan diet is as much as 60% smaller than a meat-based one and 24% smaller than a vegetarian one. It’s healthy! You can obtain all of the nutrients your body needs from a vegan diet. As such, the British Dietetics Association and American Academy of Nutrition and Dietetics (along with many other similar organisations around the world) all support a well-planned vegan diet as being healthy and suitable for all age groups. Shopping It has never been easier to be vegan, with plant-based foods now available in every single supermarket. Thanks to Animal Aid’s #MarkItVegan campaign, the vast majority of supermarkets now clearly label their own-brand vegan products! Brands to look out for.. -

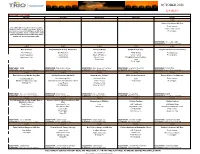

October 2021

LANCER CATERING 651-646-2197 X32 OCTOBER 2021 K-8 MENU Menu Subject to Change Monday Tuesday Wednesday Thursday Friday 1-Oct Buffalo Chicken on WG Bun Fresh Carrots Lancer Dining Services does not use peanuts, pork, tree nut or shellfish ingredients. All items Fresh Celery Sticks are baked or steamed, mindfully made with fresh Fresh Apple or frozen vegetables (never canned!),100% whole grains and a variety of lean meats using heart- healthy oils and low-salt seasonings. VEGETARIAN: Cheese Quesadilla ALTERNATE: Pizza or Turkey Club Sub 4-Oct 5-Oct 6-Oct 7-Oct 8-Oct Mac & Cheese BBQ Drumstick w/ Veg. Brown Rice Turkey w/Gravy Softshell Beef Taco Teriyaki Chicken Over Brown Rice WG Teabiscuit WG Teabiscuit WG Teabiscuit Black Beans Fresh Broccoli Mixed Vegetables Fresh Carrots Mashed Potatoes WG 8" Tortilla Fresh Orange Applesauce Cup Fresh Banana Fresh Celery Shredded Cheese & Lettuce Peach Cup Salsa Fresh Apple 0 0 0 VEGETARIAN: NONE VEGETARIAN: Tofu w/ Sweet & Sour VEGETARIAN: Gardenburger w/ Veg Gravy VEGETARIAN: Vegetarian Taco Meat VEGETARIAN: Teriyaki Tofu ALTERNATE: Roast Turkey & Cheese Sandwich ALTERNATE: Chicken Cheddar Wrap ALTERNATE: Chicken Buffalo Wrap ALTERNATE: SW Chicken Wrap ALTERNATE: Pizza or Turkey Club Sub 11-Oct 12-Oct 13-Oct 14-Oct 15-Oct Beef Hot Dog on WG Hot Dog Bun Chicken Parmesan Sandwich Sweet & Sour Chicken BBQ Chicken Sandwich Bosco Sticks 6" w/ Marinara Veg. Baked Beans WG Hamburger Bun Veg Brown Rice Corn Fresh Carrots Strawberry Applesauce Cup Marinara Sauce & Shredded Mozzarella Fresh Broccoli Fresh Orange