Social Sciences

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nigerian Breweries Plc

2015 Corporate Rating Report – Nigerian Breweries Plc Nigerian Breweries Plc Rating Assigned: This is a company that possesses very strong financial condition and very strong capacity to meet local currency obligations as and Aa when they fall due. Outlook: Stable ATING ATIONALE Issue Date: September 2015 R R Expiry Date: 30 June 2016 Nigerian Breweries Plc (“Nigerian Breweries”, “NB” or “the Company”) is Previous Rating: None the premier and largest brewing company in Nigeria. NB’s rating is underlined by the Company’s dominant position in the Industry; highly experienced and stable Board of Directors; and competent management Industry: team. The rating is also supported by NB’s strong financial condition Breweries which is validated by good profitability, low leverage, good cash flow and adequate working capital. Outline Page Rationale 1 Nigerian Breweries is a subsidiary of Heineken, the third largest global Company Profile 3 player in the Brewery Industry with international ratings of Baa1 by Financial Condition 5 Moody’s and Bbb+ by Standard and Poor’s. Ownership, Mgt & Staff 8 Outlook 10 Financial Summary 11 During the year ended 31 December 2014, NB’s turnover decreased slightly by 1% to ₦266 billion but its profit before tax margin remained strong, while its three-year weighted average return on equity of 46% Analysts: and three-year average profit before tax as a percentage of sales ratio of Olusegun Owadokun 23% are well above our benchmarks. In the same vein, cash flow [email protected] indicators such as operating cash flow as a percentage of sales (35%) Isaac Babatunde and operating profit margin (25%) surpass our expectations. -

Sustainability Report 2014 Brewing a Better World Introduction the Big Picture Our Focus Areas Values and Behaviours Appendices

Sustainability Report 2014 Brewing a Better World Introduction The big picture Our focus areas Values and behaviours Appendices Our Sustainability Report 2014 HEINEKEN is the world’s most international brewer with its brands available in 178 countries around the world. Sustainability is one of our core business priorities, and Brewing a Better World is our strategic focus. About this report The big picture This report summarises HEINEKEN’s progress on Brewing a Better World in 2014. CEO Foreword 3 We continue to focus on the topics that are most relevant for our stakeholders Brewing a Better World 4 and our business. For the first time, the report follows version 4.0 of the Global What we said and what we’ve done 6 Reporting Initiative Guidelines (G4). We believe the data and statements in this Our value chain 8 report should be externally assured. To confirm the information is reliable and Benchmarks and achievements 10 accurate, we have asked KPMG to provide us with independent, limited assurance Stakeholder dialogue 11 on the entire report. KPMG summarises its activities and conclusions in Appendix 1. Our focus areas This year, in response to stakeholder feedback, we have created a more focused Protecting water resources 15 and simplified report, while still maintaining the same level of transparency. To Reducing CO2 emissions 20 achieve this, we have made a clear separation between information about our Sourcing sustainably 28 actions and progress, and more in-depth contextual information. Advocating responsible consumption 33 Promoting health and safety 37 This PDF document summarises our main progress and activities in 2014. -

Referenze Dryer

RREEFFEERREENNCCEESS LLIISSTT DRYING SYSTEMS More than 6.000 modules in the world. ––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––– Europool s.r.l. Via G.Ferraris, 13 – 43036 Fidenza – Parma (Italy) Tel. +39 0524 528616 – Fax +39 0524 520125 e-mail: [email protected] - website: www.europool.biz P.IVA 01840800344 CCUUSSTTOOMMEERR YYEEAARR CCOOUUNNTTRRYY TTYYPPEE RRAANNGGEE /// SSIIIZZEE /// PPRROODDUUCCTT SSCCOOPPEE OOFF BBRRAANNDD HHOOUURR LLTT SSUUPPPPLLYY KHS GmbH RIF. TEMUCO 2016 CHILE PET 26.500 0.5 SOFT DRINK N° 3 FINAL DRYER S 20.000 1.5 16.500 2.0 12.600 3.0 E&J GALLO WINERY 201 6 USA GLASS 21.000 0,75 WINE N. 7 FINAL DRYER S KHS GmbH RIF. HANGZHOU 2016 CHINA CAN 70.000 0.3 BEER N° 12 FINAL DRYERS 53.000 0.5 KHS GmbH RIF. ZHENGZHOU 2016 CHINA CAN 70.000 0.3 BEER N°12 FINAL DRYERS 53.000 0.5 KH S GmbH RIF. CHENGDU 2016 CHINA CAN 90.000 0.3 BEER N°12 FINAL DRYERS 0.5 KHS GmbH RIF. QIANNAN 2016 CHINA CAN 70.000 0.3 BEER N°12 FINAL DRYERS 53.000 0.5 Pag. 2 di 89 KOSME SRL – LORINA 2016 FRANCIA PET 16.000 0.33 BEER N°3 FINAL DRYERS 0.75 1.0 PERNOD 2016 FRANCIA GLASS 12.000 0.75 WINE N°3 FINAL DRYERS 1.5 SAN BERNARDO 2016 ITALIA GLASS 18.000 0.5 WATER N°3 FINAL DRYERS 0.1 KHS GmbH RIF. CHANDIGARH 2016 INDIA CANS 60.000 0.3 SOFT N°6 FINAL DRYERS 35.000 0.5 DRINKS KHS GmbH RIF. -

CEO Foreword

Sustainability Report 2012 Overview Improve Empower Impact Appendices Brewing a better future for our Improving the environmental Empowering our people and Positively impacting the role of Additional information, tables, stakeholders and communities impact of our business communities beer in society and backgrounds Overview CEO Foreword Jean-François van Boxmeer, Chairman of the Executive Board/CEO ‘Embracing Change’ Every day consumers in 178 countries around the world choose to enjoy one of our more than 250 beer, cider and soft drink brands. In each glass or bottle is a refreshing product of the highest quality. Beer is at the heart of our business and the art of brewing beer is similar today to when Gerard Adriaan Heineken started this great company 149 years ago. He was driven by the desire to create a successful, sustainable business that wasn’t just financially successful but which also made a positive contribution to society as a whole. The simple blueprint he established was to hire passionate people, use the freshest ingredients, constantly innovate, never compromise on quality and then to reinvest in society and the communities where we operate. In the last 149 years, this approach has served us well. It continues to do so today and it will remain our approach into the future. However, what is changing is the world in which we operate. Mega-trends The world is facing significant environmental and sustainability related challenges. Mega-trends such as climate change, population growth, increasing demand for energy, food security and water scarcity are real issues that are forcing society as a whole to think and act differently. -

Presentation 2020 Disclaimer

Facts Behind the Figures PRESENTATION 2020 DISCLAIMER This presentation contains forward-looking statements with regard to the financial position and results of Nigerian Breweries activities. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements. Many of these risks and uncertainties relate to factors that are beyond Nigerian Breweries ability to control or estimate precisely, such as future market and economic conditions, the behaviour of other market participants, changes in consumer preferences, costs of raw materials, interest rate and foreign exchange fluctuations, change in tax rates, changes in law, changes in pension costs, the actions of government regulators and weather conditions. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Nigerian Breweries does not undertake any obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date of these materials. Market share estimates contained in this presentation are based on outside sources in combination with management estimates. CONTENT 1. Nigerian Breweries Plc 2. Market Overview 3. Our strategy to win 4. Financial Results 5. 2021 Outlook Nigerian Breweries Plc. at a glance NGN 234.0bn NGN 162.2bn Net revenue Net assets NGN 22.6bn 1.6x c. 3,100 Operating profit Net debt/EBITDA Employees Figures as of 30th September 2020 ...listed on The Nigerian Stock Exchange, with a strong Board and Corporate governance Key Numbers Market Capitalisation (Naira) Shareholders N391bn Market Capitalisation Audit Committee (US Dollar) $1bn Board of Directors Number of Shareholders 111,600 Independent Non- Heineken N.V. -

Annheineken HOLDING N.V. ANNUAL REPORT 2014

(1,1) -1- HH_ENG_JV2014_cover_rug10mm.indd 17-02-15 08:52 Annual Report 2014 Report Annual 2014 Heineken Holding N.V. Holding Heineken Established in Amsterdam HEINEKEN HOLDING N.V. AnANNUAL REPORT 2014 n HH_ENG_JV2014_cover_rug10mm.indd 1 117-02-157-02-15 08:5208:52 Established in Amsterdam HEINEKEN HOLDING N.V. 2014ANNUAL REPORT 2014 PROFILE Heineken Holding N.V., which holds 50.005 per cent of the issued share capital of Heineken N.V., heads the HEINEKEN group. The object of Heineken Holding N.V. pursuant to its Articles of Association is to manage or supervise the management of the HEINEKEN group and to provide services for Heineken N.V. It seeks to promote the continuity, independence and stability of the HEINEKEN group, thereby enabling Heineken N.V. to grow in a controlled and steady manner and to pursue its long-term policy in the interest of all stakeholders. Heineken Holding N.V. does not engage in operational activities itself. These have been assigned within the HEINEKEN group to Heineken N.V. and its subsidiaries and associated companies. Heineken Holding N.V.’s income consists almost exclusively of dividends received on its interest in Heineken N.V. Every Heineken N.V. share held by Heineken Holding N.V. is matched by one share issued by Heineken Holding N.V. The dividend payable on the two shares is identical. Heineken Holding N.V. ordinary shares are listed on NYSE Euronext Amsterdam. An abbreviated version of this report Both the English and Dutch versions can be is available in the Dutch language. -

Nigerian Breweries Plc Aa

2016 Corporate Rating Review Report Nigerian Breweries Plc Issuer Rating This is a company that possesses very strong financial condition and very strong capacity to meet local currency obligations as and when Aa they fall due. Outlook: Stable ATING ATIONALE Issue Date: July 2016 R R Expiry Date: 30 June 2017 Agusto & Co. hereby affirms the “Aa“ rating assigned to Nigerian Breweries Previous Rating: Aa Plc (“Nigerian Breweries”, “NB” or “the Company”). The rating is based on Nigerian Breweries’ good profitability, strong cash flow and low leverage position. The rating is also supported by the Company’s dominant Industry Industry: Brewery position as well its stable, experienced & highly qualified management team. However, the Company’s rating is moderated by inadequate working capital. Outline Page Rationale 1 Nigeria Breweries is Nigeria’s leading alcoholic and non-alcoholic beverage Company Profile 3 manufacturer with dominant position in various segments of the alcoholic and Financial Condition 6 non-alcoholic market in the country. The Company accounts for over two-third Ownership, Mgt & Staff 10 of the Nigerian Brewery Industry’s market share. Outlook 11 Financial Summary 13 During the financial year ended 31 December 2015, the Company’ turnover Rating Definition 17 grew by 10% on the back of enlarged product offerings underpinned by the merger with Consolidated Breweries. Although NB’s operating profit and profit Analysts: before tax margins declined slightly to 21% and 18.5% respectively during the Olusegun Owadokun period due to higher operating costs, the Company’s profit margins are still [email protected] higher than our benchmarks. In addition, Nigerian Breweries recorded an impressive pre-tax return on equity (ROE) of 31.7% (2014: 43.2%), which is Isaac Babatunde [email protected] significantly higher than the average yield on treasury certificate in the same period. -

Sustainability Report 2015 Brewing a Better World Contents the Big Picture Our Focus Areas Values and Behaviours Appendices

Sustainability Report 2015 Brewing a Better World Contents The big picture Our focus areas Values and behaviours Appendices Our Sustainability Report 2015 About this report This report summarises HEINEKEN’s progress on Brewing a Better World (BaBW) in 2015. We continue to focus on the topics of the greatest material importance to our stakeholders and our business. Following stakeholder feedback and the formal inclusion of BaBW as a dedicated pillar within our Company strategy, we are taking the first steps towards an Integrated Reporting <IR> approach, communicating the value we create from the resources we use. We produce our report in accordance with version 4.0 of the Global Reporting Initiative Guidelines (G4) – Core. We believe it is important to provide independent confirmation that the information in this report is reliable and accurate. This year, in line with the change in our financial auditors, we have asked Deloitte to provide us with limited assurance on the entire report. Deloitte summarises its procedures and conclusions in Appendix 1. We invited Kevin ‘Blaxtar’ de Randamie to transform this Sustainability Report into his own artistic expression. Click here to see the result. Contents The big picture Values and behaviours Further information online: CEO foreword 3 Employee engagement 42 We have again made a clear separation Brewing a Better World 4 Diversity 42 between information about our actions and What we said and what we’ve done 6 Code of Business Conduct 42 progress, and more in-depth contextual From Barley to Bar 8 Employees’ and Human Rights 43 information that can be found in the Benchmarks and achievements 9 sustainability section of our Company Stakeholder dialogue 10 Appendices website. -

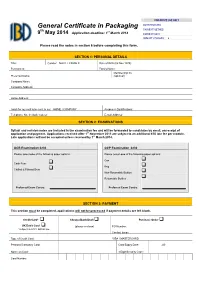

General Certificate in Packaging DATE RECEIVED: PAYMENT METHOD: Th St 9 May 2014 Application Deadline: 1 March 2014 PAYMENT DATE: AMOUNT CHARGED: £

FOR OFFICE USE ONLY General Certificate in Packaging DATE RECEIVED: PAYMENT METHOD: th st 9 May 2014 Application deadline: 1 March 2014 PAYMENT DATE: AMOUNT CHARGED: £ . Please read the notes in section 6 before completing this form. SECTION 1: PERSONAL DETAILS Title: Gender: MALE / FEMALE Date of Birth (06 Nov 1975): Forenames: Family Name: Membership no: Preferred Name: (optional) Company Name: Company Address: Home Address: I wish for my mail to be sent to my: HOME / COMPANY Academic Qualifications: Telephone No. (Include codes): E-mail Address: SECTION 2: EXAMINATIONS Syllabi and revision notes are included in the examination fee and will be forwarded to candidates by email, on receipt of application and payment. Applications received after 1 st November 2013 are subject to an additional £50 late fee per module. st Late applications will not be accepted unless received by 1 March 2014. GCB Examination £230 GCP Examination £230 Please select one of the following paper options: Please select one of the following paper options: Can Cask Beer Keg Chilled & Filtered Beer Non-Returnable Bottles Returnable Bottles Preferred Exam Centre: Preferred Exam Centre: SECTION 3: PAYMENT This section must be completed, applications will not be processed if payment details are left blank. Credit Card* Cheque/Bank Draft Purchase Order UK Debit Card (please enclose) PO Number: *subject to a 5% admin fee Contact Email: Type of Credit Card: VISA / MASTERCARD Personal/Company Card: Card Expiry Date: /20 Name on Card: 3 Digit Security Code: Card Number: SECTION 4: SPONSORS STATEMENT Every application should be supported by a mentor/sponsor. The mentor/sponsor must verify the qualifications and experience of the candidate and confirm that support will be provided. -

Nigerian Breweries Plc

Nigerian Breweries Plc 2020 Final Corporate Rating Review Report 2019 Corporate Rating Review Report Nigerian Breweries Plc Rating Assigned: This is a company that possesses very strong financial condition and very strong Aa- capacity to meet local currency obligations as and when they fall due. Outlook: Stable RATING RATIONALE Issue Date: 19 August 2020 • Agusto & Co. hereby affirms the “Aa-“ rating assigned to Nigerian Breweries Plc Expiry Date: 30 June 2021 (“Nigerian Breweries”, “NB Plc” or “the Company”). The assigned rating reflects Previous Rating: Aa- our opinion on the Company’s very strong financial condition evidenced by good cash flow, low leverage, adequate working capital, satisfactory profitability, stable and experienced management team as well as strong support from the parent Industry: Brewery company – Heineken N.V Group. However, growing competition in the Nigerian Brewery Industry, unfavourable regulatory stance, weak consumer purchasing power and uncertainty of the economic impact of COVID-19 pandemic remains a Outline Page Rationale 1 challenge for key operators in the Brewery Industry in the short to medium term. Company Profile 4 Financial Condition 7 • Nigerian Breweries Plc is a subsidiary of Heineken N.V of Netherlands Ownership, Mgt & Staff 12 Outlook 14 (“Heineken” or “the Group”) – one of the world’s leading manufacturers of beers Financial Summary 15 and ciders. Heineken operates in over 190 countries and has a rich portfolio of Rating Definition 19 over 300 global brands across alcoholic and non-alcoholic beverage categories with consolidated beer volume sales of 241.4 million hectolitres in the financial year ended 31 December 2019. Heineken N.V Group has credit ratings from two Analysts: international rating agencies - Moody’s (“Baa1”) and S&P (“BBB+”). -

General Certificate in Brewing& General Certificate in Packaging

FOR OFFICE USE ONLY DATE RECEIVED: General Certificate in Brewing& PAYMENT METHOD: General Certificate in Packaging PAYMENT DATE: th AMOUNT CHARGED: £ 14 November 2014 Final application deadline: 1 st September 2014. Please read the notes in Section 6 before completing this for SECTION 1: PERSONAL DETAILS Title: Gender: MALE / FEMALE Date of Birth (06 Nov 1975): Forenames: Family Name: Membership no: Preferred Name: (optional) Company Name: Company Address: Home Address: I wish for my mail to be sent to my: HOME / COMPANY Academic Qualifications: Telephone No. (Include codes): E-mail Address: SECTION 2: EXAMINATIONS Syllabi and revision notes are included in the examination fee and will be forwarded to candidates by email, on receipt of application and payment. Late applications will not be accepted unless received by 1 st September 2014. GCB Examination £230 GCP Examination £230 Please select one of the following paper options: Please select one of the following paper options: Can Mainstream Brewery Keg Craft Brewery Non-Returnable Bottles Returnable Bottles Preferred Exam Centre: Preferred Exam Centre: You can purchase a hard copy of the revision notes at our online bookshop: http://www.lulu.com/spotlight/IBD SECTION 3: PAYMENT This section must be completed, applications will not be processed if payment details are left blank. Credit Card* Cheque/Bank Draft Purchase Order UK Debit Card (please enclose) PO Number: *subject to a 5% admin fee Contact Email: Type of Credit Card: VISA / MASTERCARD Personal/Company Card: Card Expiry Date: /20 Name on Card: 3 Digit Security Code: Card Number: SECTION 4: SPONSORS STATEMENT Every application should be supported by a mentor/sponsor. -

Our Sustainability Report 2014

Sustainability Report 2014 Brewing a Better World Introduction The big picture Our focus areas Values and behaviours Other information Our Sustainability Report 2014 Nigerian Breweries Plc is the leading brewing company in Nigeria and our brands are enjoyed across the nation and exported to 15 countries in Africa, Asia, Europe and America. We are committed to satisfying our customers and consumers in a socially and environmentally responsible manner. Sustainability is one of our core priorities; our way of doing business and creating value; and Brewing a Better World is our long-term strategic agenda. We are Contents A proud, longstanding market leader, committed to 01 About this Sustainability Report 4,280 02 MD/CEO Foreword meeting and exceeding Employees consumer expectations. The Big Picture We value 03 Brewing a Better World A passion for quality, 04 HEINEKEN’s 2020 Commitments enjoyment of life, respect for 05 From Barley to Bar 19 07 What we said and what we’ve done people and our planet as well Brands as encouraging performance. 09 Stakeholder Dialogue We want Our Focus Areas To consistently win with Nigeria 1 0 P r o t ec t i n g W at e r R es o u r c e s 12 Reducing CO emissions in line with our core business 2 11 14 Sourcing Sustainably philosophy. Brewery Locations 16 Advocating Responsible Consumption 18 Promoting Health and Safety 20 Growing with Communities Our Brewery Locations: Our Ways of Working Awo-Omamma Aba Ama Ibadan 22 Values and Behaviours Ijebu Ode Kaduna-Kakuri Kaduna-Kudenda Lagos Makurdi Onitsha Ota Other Information