Executive Summary

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Official Site, Telegram, Facebook, Instagram, Instamojo

Page 1 Follow us: Official Site, Telegram, Facebook, Instagram, Instamojo All SUPER Current Affairs Product Worth Rs 1200 @ 399/- ( DEAL Of The Year ) Page 2 Follow us: Official Site, Telegram, Facebook, Instagram, Instamojo SUPER Current Affairs MCQ PDF 3rd August 2021 By Dream Big Institution: (SUPER Current Affairs) © Copyright 2021 Q.World Sanskrit Day 2021 was celebrated on ___________. A) 3 August C) 5 August B) 4 August D) 6 August Answer - A Sanskrit Day is celebrated every year on Shraavana Poornima, which is the full moon day in the month of Shraavana in the Hindu calendar. In 2020, Sanskrit Day was celebrated on August 3, while in 2019 it was celebrated on 15 August. Sanskrit language is believed to be originated in India around 3,500 years ago. Q.Nikol Pashinyan has been re-appointed as the Prime Minister of which country? A) Ukraine C) Turkey B) Armenia D) Lebanon Answer - B Nikol Pashinyan has been re-appointed as Armenia’s Prime Minister by President Armen Sarkissian. Pashinyan was first appointed as the prime minister in 2018. About Armenia: Capital: Yerevan Currency: Armenian dram President: Armen Sargsyan Page 3 Follow us: Official Site, Telegram, Facebook, Instagram, Instamojo Q.Min Aung Hlaing has taken charge as the Prime Minister of which country? A) Bangladesh C) Thailand B) Laos D) Myanmar Answer - D The Chief of the Myanmar military, Senior General Min Aung Hlaing has taken over as the interim prime minister of the country on August 01, 2021. About Myanmar Capital: Naypyitaw; Currency: Kyat. NEWLY Elected -

The State Bank of Sikkim (Acquisition of Shares) and Miscellaneous Provisions Act, 1982 Act No

THE STATE BANK OF SIKKIM (ACQUISITION OF SHARES) AND MISCELLANEOUS PROVISIONS ACT, 1982 ACT NO. 62 OF 1982 [6th November, 1982.] An Act to provide, in the public interest, for the acquisition of certain shares of the State Bank of Sikkim for the purpose of better consolidation and extension of banking facilities in the State of Sikkim and for matters connected therewith or incidental thereto. WHEREAS for the purpose of better consolidation and extension of banking facilities in the State of Sikkim, it is expedient to provide for a single apex banking institution in that State, and for that purpose to provide for the acquisition of certain shares of the State Bank of Sikkim and for matters connected therewith or incidental thereto; BE it enacted by Parliament in the Thirty-third Year of the Republic of India as follows:— CHAPTER I PRELIMINARY 1. Short title and commencement.—(1) This Act may be called the State Bank of Sikkim (Acquisition of Shares) and Miscellaneous Provisions Act, 1982. (2) It shall come into force on such date as the Central Government may, by notification in the Official Gazette, appoint. 2. Definitions.—In this Act, unless the context otherwise requires,— (a) “appointed day” means the date on which this Act comes into force; (b) “co-operative bank” means the Sikkim State Co-operative Bank Limited, a society registered under the Sikkim Co-operative Societies Act, 1978 (Sikkim Act No. 12 of 1978); (c) “notification” means a notification published in the Official Gazette; (d) “prescribed” means prescribed by rules made -

Booklet on Measurement of Digital Payments

BOOKLET ON MEASUREMENT OF DIGITAL PAYMENTS Trends, Issues and Challenges Revised and Updated as on 9thMay 2017 Foreword A Committee on Digital Payments was constituted by the Ministry of Finance, Department of Economic Affairs under my Chairmanship to inter-alia recommend measures of promotion of Digital Payments Ecosystem in the country. The committee submitted its final report to Hon’ble Finance Minister in December 2016. One of the key recommendations of this committee is related to the development of a metric for Digital Payments. As a follow-up to this recommendation I constituted a group of Stakeholders under my chairmanship to prepare a document on the measurement issues of Digital Payments. Based on the inputs received from RBI and Office of CAG, a booklet was prepared by the group on this subject which was presented to Secretary, MeitY and Secretary, Department of Economic Affairs in the review meeting on the aforesaid Committee’s report held on 11th April 2017 at Ministry of Finance. The review meeting was chaired by Secretary, Department of Economic Affairs. This booklet has now been revised and updated with inputs received from RBI and CAG. The revised and updated booklet inter-alia provides valuable information on the trends in Digital Payments in 2016-17. This has captured the impact of demonetization on the growth of Digital Payments across various segments. Shri, B.N. Satpathy, Senior Consultant, NISG, MeitY and Shri. Suneet Mohan, Young Professional, NITI Aayog have played a key role in assisting me in revising and updating this booklet. This updated booklet will provide policy makers with suitable inputs for appropriate intervention for promoting Digital Payments. -

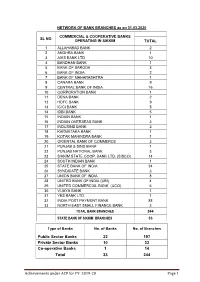

Achievements Under ACP for FY: 2019-20 Page 1 Public Sector Banks 22

NETWORK OF BANK BRANCHES as on 31.03.2020 COMMERCIAL & COOPERATIVE BANKS SL NO. OPERATING IN SIKKIM TOTAL 1 ALLAHABAD BANK 2 2 ANDHRA BANK 1 3 AXIS BANK LTD 10 4 BANDHAN BANK 1 5 BANK OF BARODA 3 6 BANK OF INDIA 2 7 BANK OF MAHARASHTRA 1 8 CANARA BANK 9 9 CENTRAL BANK OF INDIA 16 10 CORPORATION BANK 1 11 DENA BANK 2 12 HDFC BANK 9 13 ICICI BANK 5 14 IDBI BANK 5 15 INDIAN BANK 1 16 INDIAN OVERSEAS BANK 3 17 INDUSIND BANK 2 18 KARNATAKA BANK 1 19 KOTAK MAHINDRA BANK 1 20 ORIENTAL BANK OF COMMERCE 3 21 PUNJAB & SIND BANK 1 22 PUNJAB NATIONAL BANK 3 23 SIKKIM STATE COOP. BANK LTD. (SISCO) 14 24 SOUTH INDIAN BANK 1 25 STATE BANK OF INDIA 34 26 SYNDICATE BANK 3 27 UNION BANK OF INDIA 8 28 UNITED BANK OF INDIA (UBI) 4 29 UNITED COMMERCIAL BANK (UCO) 6 30 VIJAYA BANK 1 31 YES BANK LTD. 1 32 INDIA POST PAYMENT BANK 88 33 NORTH EAST SMALL FINANCE BANK 2 TOTAL BANK BRANCHES 244 STATE BANK OF SIKKIM BRANCHES 53 Type of Banks No. of Banks No. of Branches Public Sector Banks 22 197 Private Sector Banks 10 33 Co-operative Banks 1 14 Total 33 244 Achievements under ACP for FY: 2019-20 Page 1 DISTRICT-WISE BANK BRANCH as on 31.03.2020 NO. OF BRANCHES DISTRICT-WISE BANKS IN SIKKIM NORTH EAST SOUTH WEST TOTAL 1 ALLAHABAD BANK 0 2 0 0 2 2 ANDHRA BANK 0 1 0 0 1 3 AXIS BANK LTD 1 6 1 2 10 4 BANDHAN BANK 0 1 0 0 1 5 BANK OF BARODA 0 3 0 0 3 6 BANK OF INDIA 0 2 0 0 2 7 BANK OF MAHARASHTRA 0 1 0 0 1 8 CANARA BANK 1 5 2 1 9 9 CENTRAL BANK OF INDIA 1 8 1 6 16 10 CORPORATION BANK 0 1 0 0 1 11 DENA BANK 0 1 1 0 2 12 HDFC BANK LTD 0 6 3 0 9 13 ICICI BANK LTD 0 2 2 -

List of Appellate Authority, S.P.I.O's & A.P.I.O

1 STATEMENT OF TRANSPARENCY OFFICER/APPELLATE AUTHORITY/SPIO/ASPIO RECEIVED FROM DEPARTMENTS/PSUs. Sl.No. Name of Department Appellate Authority SPIO ASPIO Phone No. & Fax No. & website 1. Animal Husbandry LF & 1. Dr. Sangay D.Bhutia, Addl. 1. Dr. P.K. Pradhan, l 1. Dr. N.M.Cintury, Jt. sikkim- VS Department Director (East) 9434127258 Direcor, (E&T) Director (West) ahvs.gov.in 2. Dr. S.K.Subba, Addl. 9434179031 9733047890 Director (North) 2. Dr. Puspa Kala Rai, 2. Dr. D.P.Pradhan, Jt. 9434241634 Director, (VS) Director (East) 3. Dr.Sanjay Pradhan, Jt. 9932706073 9609833698 Director (West) 9733051860 3. Dr. K.T. Bhutia, Jt. 4. Dr. Tilotama Bajgai, Jt. Director (North) Director (South) 9434179407 9434033008 4. Dr.Arthalal Rai, Dy. 5. Dr. N.T.Bhutia, Director Director (South) (VS) 9800815776 (a) Directorate of Fisheries Shri. Sunil Pradhan, Additional Shri C.S Rai, Jt. Director-II (i) Shri. Man Kumar Rai, sikkim- Director U.S/Gangtok/East ahvs.gov.in Mobile No: 9434109803 (ii) Shri Devi Bdr. Rai Jt. Director/East (iii) Shri Chuman Singh Rai, Jt.Director/South Dist. (iv) Shri Nagendra Dhakal , Dy. Director/North Dist. 2 2. Buildings & Housing Shri Kuldip Chettri, C.S 1. Shri M.N Dhakal, Spl. 1. Shri. Sonam Pinsto Bhutia, Department Secretary, (Adm.) DE (South) Gangtok 7319565234 9733017987 2. Shri Bidlat Rai, D.E (N/E) 2. Smt. Yogita Rai, Jt. Gnagtok 9647859299 3. Shri. Saurav T.Lepcha Chief Architect, Gangtok (HQ) - 9434408980 9434110063 4. Shri. Karma Yangtey, DE (Project I) Gangtok 3. Shri S.S Timsina D.E 9474529106 (N/E) 5. -

Chronological List of Central Acts ------Page: 1

CHRONOLOGICAL LIST OF CENTRAL ACTS -------- PAGE: 1 Name of the Act Year Act No -------------------------------------------------- ---------- -------------------------------------------------------------------- Bengal Indigo Contracts Act 1836 10 Bengal Districts Act 1836 21 Madras Public Property Malversation Act 1837 36 Bengal Bonded Warehouse Association Act 1838 5 Coasting Vessels Act 1838 19 Madras Rent and Revenue Sales Act 1839 7 Bengal Land Revenue Sales Act 1841 12 Revenue, Bombay 1842 13 Revenue Commissioners, Bombay 1842 17 Sales of Land for Revenue Arrears 1845 1 Boundary-marks, Bombay 1846 3 Boundaries 1847 1 Bengal Alluvion and Diluvion Act 1847 9 Bengal Land Holders' Attendance Act 1848 20 Madras Revenue Commissioner Act 1849 10 Judicial Officers Protection Act 1850 18 Calcutta Land-revenue Act 1850 23 Forfeited Deposits Act 1850 25 Improvements in Towns 1850 26 Indian Tolls Act 1851 8 Madras City Land Revenue Act 1851 12 Bombay Rent-free Estates Act 1852 11 Rent Recovery Act 1853 6 Shore Nuisances (Bombay and Kolaba) Act 1853 11 Bengal Bonded Warehouse Association Act 1854 5 Police, Agra 1854 16 Legal Representatives' Suits Act 1855 12 Fatal Accidents Act 1855 13 Usury Laws Repeal Act 1855 28 Bengal Embankment Act 1855 32 Sonthal Parganas Act 1855 37 Indian Bills of Lading Act 1856 9 Calcutta Land-revenue Act 1856 18 Bengal Chaukidari Act 1856 20 Tobacco Duty (Town of Bombay) Act 1857 4 Oriental Gas Company 1857 5 Madras Compulsory Labour Act 1858 1 Bengal Ghatwali Lands Act 1859 5 Bengal Rent Act 1859 10 Bengal Land Revenue -

Government of Sikkim

GOVERNMENT OF SIKKIM MEMORANDUM TO THE FOURTEENTH FINANCE COMMISSION VOLUME – III SUBSIDIARY POINTS (NOTES ON TOPICS-STATE) FINANCE, REVENUE & EXPENDITURE DEPARTMENT Contents I. BASE AND RATES OF STATE TAXES, DUTIES ETC .............................................. 1 1. Land Revenue ............................................................................................................ 1 (a) Base and existing rates of land ............................................................................... 1 (b) In some States in addition to irrigation,. .................................................................. 1 (c) The size of holdings – un-irrigated and irrigated ...................................................... 2 (d) Any cess on land revenue whether land revenue .................................................... 2 2. Agricultural Income Tax .............................................................................................. 2 (a) Base and existing rates. .......................................................................................... 2 (b) Changes made in the base/rates during each of the last three years ...................... 2 3. Tax on Urban Land ..................................................................................................... 2 (a) Base and prevailing rates of tax from 2010-11 onward (year-wise). ........................ 2 (b) Rate of premium for conversion of agricultural land to non-agricultural uses. .......... 2 (c) The base and tax rate of (a) & (b) above in 2010-11. -

Minutes of the 60Th SLBC Meeting, Sikkim Held on 19Th March 2019 at the Conference Hall of Tashiling, Secretariat, Gangtok

Minutes of the 60th SLBC Meeting, Sikkim held on 19th March 2019 At The Conference Hall of Tashiling, Secretariat, Gangtok The 60th Meeting of State Level Bankers’ Committee (SLBC) for the State of Sikkim was held at The Conference Hall of Tashiling, Secretariat, Gangtok on 19th March 2019. The meeting was chaired by Shri A.K. Srivastava, IAS, Chief Secretary, Govt. of Sikkim Shri Thomas Chandy, IFS, Principal Secretary, Commerce and Industries Dept, Govt. of Sikkim, Shri C S Rao, IFS, Principal Secretary, Rural Management and Development Department, Govt. of Sikkim, Dr. P Senthil Kumar, IAS, Commissioner, Rural Management and Development Department, Govt. of Sikkim, Shri Naresh Yadav, GM, State Bank of India, LHO, Kolkata, Shri Olden Nongpluh , GM, RBI, Gangtok, Smt R Tshering, GM, NABARD Gangtok & Shri Satish Rao, DGM, State Bank of India, Zonal Office, Siliguri, were the other dignitaries on the dais. Shri Surender Singh, Deputy Secretary, Department of Financial Services, Govt of India was also present in the meeting. State Bank of Sikkim and India Post Payment Bank were the special invitees in the meeting, represented by Shri. P Wangdi Bhutia, Chief General Manager State Bank of Sikkim and Shri Mridul Das, Senior Manager, India Post Payment Banks,respectively. Representatives from member Banks and Government Departments also attended the meeting. Shri Aftab Ahmad Mallick, Regional Manager, State Bank of India and SLBC Convenor , welcomed the dignitaries on the dais as well as all the stakeholders present in the meeting. He also introduced and welcomed to the house, Shri P Wangdi Bhutia, Chief General Manager, State Bank of Sikkim as a special guest . -

Maruthi Schoo Maruthi School of Banking (Msb) (Msb)

MARUTHI SCHOOL OF BANKING (MSB) GENERAL AND FINANCIAL AWARENESS (VIIIof X) 1. What is the base color of Rs 2,000 note? Red Fort-an image of Indian heritage site with 1.Pink 2.Magenta 3. Violet Indian flag on the reverse 4.Fuchsia The base colour of the note is magenta. 10. How many angular bleed lines are present on Rs 500 bank note? 2.Rs 2,000 bank note has a motif of ______ . 1.5 2.6 3.7 4. 8 1.Red Fort 2.Taj Mahal 3.Mangalyaan 4.India Gate 11. Payment of coupons on PDI from the revenue The new denomination has Motif of Mangalyaan on reserves is subject to the issuing bank meeting the reverse, depicting the country’s first venture into minimum regulatory requirements for CETA What the interplanetary space. does P stands for in PDI? 1.Portfolio 2.Paid up 3.Perpetual 3. How many angular bleed lines are present on Rs 4.Participatory 2,000 bank note? PDI- Perpetual Debt Instruments 1.5 2.6 3.7 4.8 Seven angular bleed lines on left and right side in 12. What does R stands for in CFR with respect to raised print. (For visually impaired) Fraud Management? 1.Reporting 2.Registry 3.Relevance 4. How many languages are used for writing the 4.Response denomination of Rs 2,000 bank note? Central Fraud Registry 1.17 2.14 3.15 4.16 17 languages in Rs 500 new bank note also 13. Restructuring of loan accounts with exposure of On the obverse, the denomination is written in above Rs.25 crore will continue t o be governed by English and Hindi. -

JAIIB | CAIIB | RRB NTPC | SSC and State Government 1 Jobs Ambitiousbaba.Com Online Test Series

ambitiousbaba.com Online Test Series Best Online Test Series Site for Bank | JAIIB | CAIIB | RRB NTPC | SSC and State Government 1 Jobs ambitiousbaba.com Online Test Series Banking and Financial News PDF 2021 Index No. of Topic Topic Name Topic 1 List of Banks who has been imposed penalty by RBI in 2021 Topic 2 List of Banks whose licence has been canceled by RBI in 2021 Topic 3 Important Committee (Feb to July) Topic 4 List of Merger and Acquisition (Covered Feb to July) Topic 5 List of Partnership/Agreement (Covered Feb to July) Topic 6 List of loan agreement for India from different organizations 2021 Topic 7 Union Budget 2021-22: Highlights Topic 8 RBI Annual Report 2021 Topic 9 Banking & Financial News (Feb to July) Topic 10 India’s GDP Growth Forecast FY 21 and 22 by various Financial Organizations (last Update 10 August 2021) Topic 1: List of Banks who has been imposed penalty by RBI in 2021 (Covered January to July) RBI slaps penalty of Rs 2 crore on Standard The Reserve Bank of India (RBI) has imposed Chartered Bank a monetary penalty of Rs 2 crore on Standard Chartered Bank–India for delays in reporting of frauds. The penalty has been imposed on the bank for non-compliance with certain directions issued by it contained in the ‘Reserve Bank of India" Directions 2016’. RBI fines Bajaj Finance Rs 2.5 crore for The Reserve Bank of India (RBI) has imposed recovery agent harassment Rs 2.50 crore monetary penalty on Bajaj Finance for violating RBI’s directions on fair practices code (FPC) and outsourcing of financial services by a non-banking financial company. -

Official Site, Telegram, Facebook, Instagram, Instamojo

Page 1 Follow us: Official Site, Telegram, Facebook, Instagram, Instamojo Page 2 Follow us: Official Site, Telegram, Facebook, Instagram, Instamojo SUPER Current Affairs MCQ PDF 24th May 2021 By Dream Big Institution: (SUPER Current Affairs) © Q.Which Bank has issued India’s first foreign portfolio investor (FPI) licence to the GIFT IFSC alternative investment fund (AIF) of True Beacon Global? A)HDFC Bank C)Yes Bank B)Kotak Mahindra Bank D)ICICI Bank Answer – B Kotak Mahindra Bank In NEWS Kotak Mahindra Bank Issues India’s First FPI Licence To GIFT AIF Kotak Mahindra Bank To Extend Online Payments To Farmers & Traders Tie-Up With Indian Army To Handle Salary Accounts ‘Kona Kona Umeed’ Campaign 1st Bank In India To Allow Video KYC First Lender To Charge For UPI Use About Kotak Mahindra Bank: MD & CEO: Uday Kotak Headquarters: Mumbai, Maharashtra Tagline: Let’s Make Money Simple, Ab Kona Kona Kotak Q.Who has been appointed as the CEO of Reserve Bank Innovation Hub (RBIH)? A)Rajesh Bansal C)Jose J Kattoor B)Kris Gopalakrishnan D)Vijay Goel Answer - A RBI IN NEWS 2021 . RBI Increases The Limit For Full-KYC PPIs To Rs 2 Lakh From Rs 1 Lakh Page 3 Follow us: Official Site, Telegram, Facebook, Instagram, Instamojo . RBI To Transfer Rs. 99,122 Crore Surplus To Central Government For FY21 . RBI Announces Term Liquidity Facility of Rs. 50,000 Crore For Healthcare . RBI imposes Rs 3 crore penalty on ICICI Bank for Violating Specific Directions Issued by RBI . T Rabi Sankar appointed fourth Deputy Governor of RBI, succeeding BP Kanungo . -

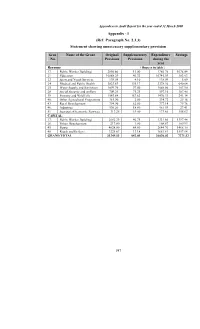

197 Appendix

Appendices to Audit Report for the year ended 31 March 2000 Appendix - I (Ref: Paragraph No. 2.3.3) Statement showing unnecessary supplementary provision Grant Name of the Grant Original Supplementary Expenditure Savings No. Provision Provision during the year Revenue ( Rupees in lakh ) 17. Public Works (Building) 2850.60 15.00 1786.76 1078.84 21 Education 10888.29 40.33 10745.59 183.03 22 Sport and Youth Services 139.98 4.10 138.99 5.09 24 Medical and Public Health 3823.83 195.17 3378.36 640.64 25 Water Supply and Sanitation 1099.70 97.00 1088.80 107.90 28 Social Security and welfare 709.25 75.25 597.10 187.40 39 Forestry and Wild Life 1543.84 167.63 1470.33 241.14 40. Other Agricultural Programme 361.90 2.00 334.72 29.18 43 Rural Development 794.90 62.00 777.14 79.76 46. Industries 570.20 18.80 561.59 27.41 51 Secretariat Economic Services 313.28 19.00 173.66 158.62 CAPITAL 17. Public Works (Building) 2682.29 46.75 1331.60 1397.44 26. Urban Development 217.80 1.00 108.87 109.93 45 Power 4028.00 84.80 2644.70 1468.10 48. Roads and Bridges 3225.67 13.18 1681.81 1557.04 GRAND TOTAL 33249.53 842.01 26820.02 7271.52 197 Appendices to Audit Report for the year ended 31 March 2000 Appendix - II (Ref: Paragraph No.2.3.6) Statement showing surrender less than actual savings Sl.No.