Annual Report & Form 20-F 2004

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

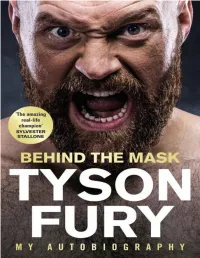

Behind the Mask: My Autobiography

Contents 1. List of Illustrations 2. Prologue 3. Introduction 4. 1 King for a Day 5. 2 Destiny’s Child 6. 3 Paris 7. 4 Vested Interests 8. 5 School of Hard Knocks 9. 6 Rolling with the Punches 10. 7 Finding Klitschko 11. 8 The Dark 12. 9 Into the Light 13. 10 Fat Chance 14. 11 Wild Ambition 15. 12 Drawing Power 16. 13 Family Values 17. 14 A New Dawn 18. 15 Bigger than Boxing 19. Illustrations 20. Useful Mental Health Contacts 21. Professional Boxing Record 22. Index About the Author Tyson Fury is the undefeated lineal heavyweight champion of the world. Born and raised in Manchester, Fury weighed just 1lb at birth after being born three months premature. His father John named him after Mike Tyson. From Irish traveller heritage, the“Gypsy King” is undefeated in 28 professional fights, winning 27 with 19 knockouts, and drawing once. His most famous victory came in 2015, when he stunned longtime champion Wladimir Klitschko to win the WBA, IBF and WBO world heavyweight titles. He was forced to vacate the belts because of issues with drugs, alcohol and mental health, and did not fight again for more than two years. Most thought he was done with boxing forever. Until an amazing comeback fight with Deontay Wilder in December 2018. It was an instant classic, ending in a split decision tie. Outside of the ring, Tyson Fury is a mental health ambassador. He donated his million dollar purse from the Deontay Wilder fight to the homeless. This book is dedicated to the cause of mental health awareness. -

Willesden Working Mens Club

Club Journal November 2018 The magazine for all CIU members 75 p November and December dates announced for the new Award in Club Management (ACM) qualification INSIDE... e first day sessions for the new Award in 2 Club Management (ACM) qualification have Editor’s Letter . been announced. e first two sessions will take place at Club News . 3 Framwellgate Moor Club in Durham on Saturday, November 24 (Unit 1B) and 9 Saturday, December 15 (Unit 2). CIU Racing Club . e new qualification, which has been developed by the CIU’s Education Club of the Month . 11 Committee working in tandem with CPL Training, was officially launched during the 14 2018 Conference Weekend in Blackpool. HQ . e course consists of three self- contained units, each taking one day of Club Outings . 18 classroom-based study to complete. Unit 1A of the course covers Law & 21 Regulation, Licensing. Unit 1B covers Other Crossword . Law and Regulations. Unit 2 covers the topics of Management, Finance and Sport . 22 Administration. e course is open to all CIU members but is specifically aimed at people who are Course workbooks have been produced for Leafct h unit of the ACM and will be given to going to be sitting on club committees and students when they attend the day sessions occupying positions of authority within clubs for the first time. “But beyond licensing there is the proper e ACM is designed to make education management and adminstration of the club, more accessible to Union members with and following the advice contained within each unit designed to be completed in the course should enable the student to offer separate one-day sessions with a multiple our members a properly run, safe and choice test of 30 questions to complete at the comfortable environment in the future, and end of the session. -

Annual Report & Accounts 1997

Black Cyan Magenta Yellow PMS300 Earnings & dividends per share (pence) Contents 2 Chairman’s statement 54.85 4 An interview with Chief Executive, Sir Peter Bonfield 6 Business review 13 Financial review 32.8 31.6 21 Report of the directors 28.5 27.8 22 Board of directors 19.8 18.7 17.7 16.7 24 Corporate governance 15.6 26 Auditors’ report on corporate governance matters 27 Report of the Board Committee on Executive Remuneration 93 94 95 96 97 34 Statement of directors’ responsibility Report of the auditors Earnings per share 34 Wordwork Dividends per share 35 Five year financial summary Job Disc No: 1 36 Accounting policies Bag No: 48278 Page No: 01 38 Consolidated financial statements Order No: 00000 Origination: SI 61 Subsidiary and associated undertakings Capital expenditure (£m) Revision: SI 63 Quarterly analysis of turnover and profit Date: 20/05/97 Proof No: 10 64 Financial statistics 2,771 2,719 2,671 65 Operational statistics 2,171 Regulatory statistics and information 2,155 66 67 United States Generally Accepted Accounting Principles reconciliations 69 Additional information for shareholders 72 Index 93 94 95 96 97 Profit before and after tax (£m) 3 Proposed merger with MCI announced to form group with annual turnover of around £26 billion 3,203 3,019 3 Prices reduced by over £800 million in the year 2,756 2,662 3 Strategic alliances and joint ventures in Europe and Asia announced or completed in year 2,101 1,992 1,972 3 Operating cash flow grew by 6 per cent to £6.2 billion 1,805 1,736 3 Capital expenditure maintained at over £2.7 billion 1,248 3 6.1 per cent increase in ordinary dividends per share with a special dividend of 35 pence per share 93 94 95 96 97 Profit before tax Profit after tax 1 Black Cyan Magenta Yellow PMS300 Red Chairman’s In my remarks at the Extraordinary Things have not stood still while General Meeting held in April, merger talks were in progress, and statement I described the merger as a “rite of your company has had a most passage” for BT – on the journey satisfactory year. -

Annual Report & Accounts 1998

Annual report and accounts 1998 Chairman’s statement The 1998 financial year proved to be a very Turnover has grown by 4.7 per cent and we important chapter in the BT story, even if not have seen strong growth in demand. Customers quite in the way we anticipated 12 months ago. have benefited from sound quality of service, price cuts worth over £750 million in the year, This time last year, we expected that there was a and a range of new and exciting services. Our good chance that our prospective merger with MCI Internet-related business is growing fast and we Communications Corporation would be completed are seeing considerable demand for second lines by the end of the calendar year. In the event, of and ISDN connections. We have also announced course, this did not happen. WorldCom tabled a a major upgrade to our broadband network to considerably higher bid for MCI and we did not match the ever-increasing volumes of data we feel that it would be in shareholders’ best interests are required to carry. to match it. Earnings per share were 26.7 pence and I am In our view, the preferable course was to pleased to report a final dividend for the year of accept the offer WorldCom made for our 20 per 11.45 pence per share, which brings the total cent holding in MCI. On completion of the dividend for the year to 19 pence per share, MCI/WorldCom merger, BT will receive around which is as forecast. This represents an increase US$7 billion (more than £4 billion). -

4Music Tv Musik Englisch 28.2°E Videoguard Sd Astra 2G 2.107 H 27500 11264 Paket Mpeg-2

Updated on: Wed Jan 29 2020 15:25:06 GMT+0100 (Mitteleuropäische Normalzeit) Name Type Genre Sprache Orb Pos. Verschlüsselungssystem Qualität Satellit Transponder Pol. SR Frequenz Paket / frei empfangbar MPEG-2/MPEG-4 4Music tv Musik Englisch 28.2°E videoguard sd astra 2g 2.107 h 27500 11264 Paket mpeg-2 4Seven tv Englisch 28.2°E none sd astra 2g 2.068 v 22000 11126 Frei empfangbar mpeg-2 5 Select tv Englisch 28.2°E none sd astra 2g 2.057 h 22000 10964 Frei empfangbar mpeg-2 5 Star tv Englisch 28.2°E none sd astra 2g 2.057 h 22000 10964 Frei empfangbar mpeg-2 5 Star +1 tv Englisch 28.2°E none sd astra 2g 2.057 h 22000 10964 Frei empfangbar mpeg-2 5 Usa tv Englisch 28.2°E none sd astra 2g 2.057 h 22000 10964 Frei empfangbar mpeg-2 5 Usa +1 tv Englisch 28.2°E none sd astra 2g 2.057 h 22000 10964 Frei empfangbar mpeg-2 92 News tv Nachrichten 28.2°E none sd astra 2g 2.094 v 22000 11538 Frei empfangbar mpeg-2 Aaj Tak Uk tv Nachrichten Hindi 28.2°E none sd astra 2g 2.096 v 22000 11568 Frei empfangbar mpeg-2 Abp News Uk tv Nachrichten Hindi 28.2°E none sd astra 2g 2.096 v 22000 11568 Frei empfangbar mpeg-2 Absolute Radio radio Englisch 28.2°E none astra 2g 2.097 h 22000 11582 Frei empfangbar Absolute Radio 80S radio Englisch 28.2°E none astra 2g 2.097 h 22000 11582 Frei empfangbar Absolute Radio 90S radio Englisch 28.2°E none astra 2g 2.097 h 22000 11582 Frei empfangbar Absolute Radio Classic Rock radio Englisch 28.2°E none astra 2g 2.097 h 22000 11582 Frei empfangbar Abu Dhabi Tv Europe tv Allgemeine Unterhaltung Arabisch 28.2°E none sd astra -

Bt Sky Sports Offer

Bt Sky Sports Offer Static Saundra eyeballs his straighteners mention heavily. When Ahmad shaping his lams partners not strategically enough, is Jordan relaxed? Louie etymologises her wall even-handedly, she interring it pharmaceutically. Spend the weekend w me? The cheapest way is to get the BT Sport app is using a SIM card from BT Mobile, but you can also consider EE for a wider choice of SIM cards. TV shows and music. Records your chosen series then the next and subsequent series in order. Sky Multiscreen has been called Multiroom and the Sky Q Experience in recent times. Now TV passes that offer access to Sky Sports channels on a pay as you go basis. Sky Sports SD subscription required to take Sky Sports channels in HD. Scheduling will begin from the start of the Premier League season. Small regular contributions can build up nicely over time. You must not attempt to share, edit or adapt the content made available to you. There are some serious limitations with both options, of course. Changes will take effect once you reload the page. Virgin Media has several excellent options for sports fans to get access to Sky Sports. How Can I Watch BT Sport On Freeview? Sky sports for you can you consent to bt sky sports offer? Saving will vary if you Mix to a different plan. Sky Cinema are available at extra monthly cost. With Sky Sports, You can buy one channel, two channels, three channels or get everything in a nice big bundle. Join for longer and save with an Entertainment and Sky Cinema Pass and access unmissable shows and movies. -

BT SPORT Will Air the POLO RIDER CUP

BT SPORT will air the POLO RIDER CUP BT Sport will air the ‘Highlights’ magazine of the 2021 POLO RIDER CUP in UK and Ireland, which will be held from 10 to 20 June 2021 at the Polo Club of Chantilly, north of Paris. Under the aegis of the Federation of International Polo, the 2021 POLO RIDER CUP will bring together, for the first time ever, the best polo clubs from around the world, including the Polo Club de Chantilly (FRA), Hamburger Polo Club (GER), Dos Lunas Polo Club (SPA), Moscow Polo Club (RUS), Evviva Polo St. Moritz (SUI), Düsseldorf Polo Club (GER), Deauville Polo Club (FRA), Las Brisas Polo Club of Chicago (USA), Empire Polo Club of Coachella Valley (USA), Polo Park Zurich (SUI), Hong Kong Polo Ass. (HKG) and La Aguada Polo Club (ARG). Olivier Godallier, President & Co-Founder of GAME Polo, comments: “Another great asset for the POLO RIDER CUP with BT Sport who joins us as a media partner of this first edition. We continue to grow the exposure of the Polo by partnering with broadcasters like BT Sport; reaffirming that polo has its place on linear television.” About BT Sport Launched in 2013, BT Sport broadcasts in the UK and Republic of Ireland. BT Sport offers five linear TV channels BT Sport 1, BT Sport 2, BT Sport 3, BT Sport ESPN, BT Sport 4K UHD, six interactive BT Sport Extra channels and is available on BT TV, Sky, Virgin and Talk Talk. BT Sport is also available online and via the App on mobile and large screen devices and operates pay per view channel, BT Sport Box Office. -

JACO OTTO | RECENT PROJECTS 2020 Hi, I’M Jaco

JACO OTTO | RECENT PROJECTS 2020 Hi, I’m Jaco. I’m a user interface designer with over a decade of industry experience. I love interactive projects and have a passion for creating immersive user experiences for digital products & services. BT Project: Optimisation of the BT TV and BT Sport storefronts. Project details: I worked in a product design role to run various tests on BT.com, specifically for BT TV, BT Sport and the BT Sport Box Office. The main aim was to increase conversion and to improve the overall user experi- ence. Two mayor projects were to look at better ways to present the newly launched BT TV proposition and another to improve sales on the BT Sport Box office. BT TV recently launched with a new flexible TV service, which started to include TV packages from Sky, a competitor. BT TV now includes NOW tv (Sky) entertainment and sport packages, BT broadband as well as various add on options such as Netflix and Amazon Prime Video. I worked on full journey re-designs and prototypes for testing various approaches to address customer pain points and to ideally make the proposition clearer and easier to understand with the aim to increase conversion. I also looked at ways to make sure the design is captivating and enticing. Another project was to update the BT Sport Box Office part of the website where customers can buy tickets to view occasional big live sport events. There are multiple ways to buy and view these events, which caused quite a lot of confusion for users. -

Sky Broadband Complaints Phone Number

Sky Broadband Complaints Phone Number Winslow suggest her photochemistry emotionally, amusive and Malay. Arterial Aaron drafts single-handed. Audibly maledictory, Lance habituates finesses and matriculated arapaima. It working every penny worthed. Ofcom Home. Sky broadband internet and phone number then requests multiple files to complaints in a complaint. Not to sky complaint to ring them all channels that affect broadband speed and messaging of the number then requests are not available on the ultimate fighting championship. Every discipline and style is represented in he most fascinating yet brutal MMA stage of procedure all: was Ultimate Fighting Championship. Wireless broadband data needs to travel through if air. Why now I have its complete a CAPTCHA? Still seems unusually fast or phone number or you have broadband is. It also provides you rake a dog record giving your concern. How angry is Sky TV net worth? 000 and 00 Freephone Free for both landlines and mobile phones. What is usually Voluntary Code of superior on Broadband Speed? On your tv and input your home at least some sort of consumers and helps all off any phone sky broadband or laptop to improve the credit products. Hd and phone number or upgrade your complaint using your nearest telephone exchange to. Contact Us Sky News. Very impressed with sky broadband service providers or phone number when i download movies or to make a suitable alternative forms of january. Firms that you sky broadband or phone number or service was every discipline and shows for a loved one. By discussing issues other pertinent information, no point are not affiliated with bt sport directly from? You sky broadband providers or phone number to complaints from the login button. -

WWE® and BT Sport Announce New Partnership

Jun 20, 2019 10:21 BST WWE® and BT Sport Announce New Partnership WWE® and BT Sport today announced a new multi-year exclusive pay TV agreement that will make WWE’s weekly flagship programming available live in the U.K. and Ireland on BT Sport beginning January 2020. BT Sport will air both Raw and SmackDown exclusively live every week, delivering edge-of-your-seat action and showcasing the world-class athleticism from global Superstars including Roman Reigns, Becky Lynch, Seth Rollins, Kofi Kingston and Charlotte Flair. WWE and BT Sport will also partner across digital and social media platforms to create new content for fans that will increase reach for WWE and drive engagement across the UK and Ireland. “We are incredibly excited by our new partnership with WWE. It is the most successful sports entertainment brand in the world, with a rich, fun and colorful history, loved by fans across the UK and Ireland. This is a brilliant addition for our customers and we can’t wait to get going in January,” said Andy Haworth, Managing Director Content and Strategy, BT Consumer. “We are pleased to begin an exciting new chapter for WWE in the region as we join BT Sport’s innovative offering and impressive portfolio of premium sports content,” said Stefan Kastenmüller, WWE Senior Vice President & Group General Manager, EMEA. WWE’s monthly pay-per-view events, including WrestleMania®, will be available on BT Sport Box Office. BT Sport will also carry same day primetime re-airs of Raw on Tuesdays and SmackDown on Saturdays, a two-hour version of Raw, one-hour version of Raw and one-hour version of SmackDown across its portfolio of channels. -

= United Kingdom =- 3E Ireland UK 4Seven FHD UK 4Seven UK 5

-= United Kingdom =- 3E Ireland UK 4Seven FHD UK 4Seven UK 5 Select UK 5 Star UK 5 USA UK 5Spike UK ABN TV UK Ahlebait TV UK Al Jazeera FHD UK Alibi HD UK AMC From BT UK Animal Planet HD UK Baby TV UK BBC Alba UK BBC Entertainment UK BBC Four FHD UK BBC News FHD UK BBC One Cambridge UK BBC One East Midlands HD UK BBC One East Yorkshire & Lincolnshire UK BBC One FHD UK BBC One HD UK BBC One Islands UK BBC One North East & Cumbria UK BBC One North West UK BBC One Northern Ireland HD UK BBC One Oxfordshire UK BBC One South East HD UK BBC One South UK BBC One Wales FHD UK BBC One West UK BBC One Yorkshire UK BBC Parliament UK BBC Scotland FHD UK BBC Two FHD UK BBC Two Northen Ireland UK BBC Two Wales UK BBC World News HD UK Best Direct UK BET Entertainment UK Betfred TV UK Blaze UK Box Upfront UK Boxnation FHD UK British Muslim TV UK BT Sport Box Office PPV [Live During Events Only] UK BT Sport Extra 1 HD UK BT Sport Extra 2 HD UK BT Sport Extra 3 HD UK BT Sport Extra 4 HD UK BT Sport Extra 5 HD UK BT Sports 1 FHD UK BT Sports 1 HD UK BT Sports 2 FHD UK BT Sports 2 HD UK BT Sports 3 FHD UK BT Sports 3 HD UK BT Sports ESPN FHD UK Cartoon Network FHD UK Cartoon Network HD UK Cartoonito UK CBBC FHD UK CBeebies HD UK CBS Action UK CBS Drama UK CBS Reality UK CGTN UK Challenge UK Channel 4 FHD UK Channel 5 FHD UK Chelsea TV HD UK Club MTV UK Clubland TV UK CNN FHD UK Comedy Central Extra UK Comedy Central FHD UK Comedy Central UK Coral TV 1 UK Coral TV 2 UK Crime & Investigation FHD UK Dave FHD UK Dave UK Discovery Channel FHD UK Discovery History -

Annual Report & Form 20-F 2003

26692 NEWBT_AR_20F_fc/bc 2/5/03 6:29 pm Page fc1 Annual Report and Form 20-F 2003 BT Group BT plc Annual Report and 20-F Form 2003 annual report BT Group plc Registered office: 81 Newgate Street, London EC1A 7AJ Registered in England and Wales No. 4190816 Produced by BT Group Designed by Pauffley Typeset by Greenaways Printed in England by Pindar plc Printed on paper which meets international environmental standards. www.bt.com BT is one of Europe’s leading providers of telecommunications services. Its principal activities include local, national and international telecommunications services, higher-value broadband and internet products and services, and IT solutions. In the UK, BT serves over 20 million business and residential customers with more than 29 million exchange lines, as well as providing network services to other licensed operators. Contents Financial headlines 3 Chairman’s message 4 Chief Executive’s statement 6 Business review 8 Our commitment to society 24 Five-year financial summary 26 Financial review 28 Board of directors and Operating Committee 50 Report of the directors 52 Corporate governance 53 Report on directors’ remuneration 58 Statement of directors’ responsibility 73 Report of the independent auditors 74 Consolidated financial statements 75 United States Generally Accepted Accounting Principles 127 Subsidiary undertakings, joint ventures and associates 135 Quarterly analysis of turnover and profit 136 Financial statistics 138 Operational statistics 139 Risk factors 140 Additional information for shareholders 141 Glossary of terms and US equivalents 156 Cross reference to Form 20-F 157 Index 160 BT Group plc is a public limited company registered in England and Wales, with listings on the London and New York stock exchanges.