Chaos Theory in the Economic Forecasting

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

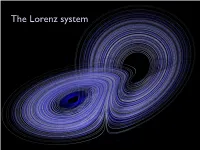

THE LORENZ SYSTEM Math118, O. Knill GLOBAL EXISTENCE

THE LORENZ SYSTEM Math118, O. Knill GLOBAL EXISTENCE. Remember that nonlinear differential equations do not necessarily have global solutions like d=dtx(t) = x2(t). If solutions do not exist for all times, there is a finite τ such that x(t) for t τ. j j ! 1 ! ABSTRACT. In this lecture, we have a closer look at the Lorenz system. LEMMA. The Lorenz system has a solution x(t) for all times. THE LORENZ SYSTEM. The differential equations Since we have a trapping region, the Lorenz differential equation exist for all times t > 0. If we run time _ 2 2 2 ct x_ = σ(y x) backwards, we have V = 2σ(rx + y + bz 2brz) cV for some constant c. Therefore V (t) V (0)e . − − ≤ ≤ y_ = rx y xz − − THE ATTRACTING SET. The set K = t> Tt(E) is invariant under the differential equation. It has zero z_ = xy bz : T 0 − volume and is called the attracting set of the Lorenz equations. It contains the unstable manifold of O. are called the Lorenz system. There are three parameters. For σ = 10; r = 28; b = 8=3, Lorenz discovered in 1963 an interesting long time behavior and an EQUILIBRIUM POINTS. Besides the origin O = (0; 0; 0, we have two other aperiodic "attractor". The picture to the right shows a numerical integration equilibrium points. C = ( b(r 1); b(r 1); r 1). For r < 1, all p − p − − of an orbit for t [0; 40]. solutions are attracted to the origin. At r = 1, the two equilibrium points 2 appear with a period doubling bifurcation. -

Tom W B Kibble Frank H Ber

Classical Mechanics 5th Edition Classical Mechanics 5th Edition Tom W.B. Kibble Frank H. Berkshire Imperial College London Imperial College Press ICP Published by Imperial College Press 57 Shelton Street Covent Garden London WC2H 9HE Distributed by World Scientific Publishing Co. Pte. Ltd. 5 Toh Tuck Link, Singapore 596224 USA office: Suite 202, 1060 Main Street, River Edge, NJ 07661 UK office: 57 Shelton Street, Covent Garden, London WC2H 9HE Library of Congress Cataloging-in-Publication Data Kibble, T. W. B. Classical mechanics / Tom W. B. Kibble, Frank H. Berkshire, -- 5th ed. p. cm. Includes bibliographical references and index. ISBN 1860944248 -- ISBN 1860944353 (pbk). 1. Mechanics, Analytic. I. Berkshire, F. H. (Frank H.). II. Title QA805 .K5 2004 531'.01'515--dc 22 2004044010 British Library Cataloguing-in-Publication Data A catalogue record for this book is available from the British Library. Copyright © 2004 by Imperial College Press All rights reserved. This book, or parts thereof, may not be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording or any information storage and retrieval system now known or to be invented, without written permission from the Publisher. For photocopying of material in this volume, please pay a copying fee through the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, USA. In this case permission to photocopy is not required from the publisher. Printed in Singapore. To Anne and Rosie vi Preface This book, based on courses given to physics and applied mathematics stu- dents at Imperial College, deals with the mechanics of particles and rigid bodies. -

Symmetric Encryption Algorithms Using Chaotic and Non-Chaotic Generators: a Review

Journal of Advanced Research (2016) 7, 193–208 Cairo University Journal of Advanced Research REVIEW Symmetric encryption algorithms using chaotic and non-chaotic generators: A review Ahmed G. Radwan a,b,*, Sherif H. AbdElHaleem a, Salwa K. Abd-El-Hafiz a a Engineering Mathematics Department, Faculty of Engineering, Cairo University, Giza 12613, Egypt b Nanoelectronics Integrated Systems Center (NISC), Nile University, Cairo, Egypt GRAPHICAL ABSTRACT ARTICLE INFO ABSTRACT Article history: This paper summarizes the symmetric image encryption results of 27 different algorithms, which Received 27 May 2015 include substitution-only, permutation-only or both phases. The cores of these algorithms are Received in revised form 24 July 2015 based on several discrete chaotic maps (Arnold’s cat map and a combination of three general- Accepted 27 July 2015 ized maps), one continuous chaotic system (Lorenz) and two non-chaotic generators (fractals Available online 1 August 2015 and chess-based algorithms). Each algorithm has been analyzed by the correlation coefficients * Corresponding author. Tel.: +20 1224647440; fax: +20 235723486. E-mail address: [email protected] (A.G. Radwan). Peer review under responsibility of Cairo University. Production and hosting by Elsevier http://dx.doi.org/10.1016/j.jare.2015.07.002 2090-1232 ª 2015 Production and hosting by Elsevier B.V. on behalf of Cairo University. 194 A.G. Radwan et al. between pixels (horizontal, vertical and diagonal), differential attack measures, Mean Square Keywords: Error (MSE), entropy, sensitivity analyses and the 15 standard tests of the National Institute Permutation matrix of Standards and Technology (NIST) SP-800-22 statistical suite. The analyzed algorithms Symmetric encryption include a set of new image encryption algorithms based on non-chaotic generators, either using Chess substitution only (using fractals) and permutation only (chess-based) or both. -

Chaos: the Mathematics Behind the Butterfly Effect

Chaos: The Mathematics Behind the Butterfly E↵ect James Manning Advisor: Jan Holly Colby College Mathematics Spring, 2017 1 1. Introduction A butterfly flaps its wings, and a hurricane hits somewhere many miles away. Can these two events possibly be related? This is an adage known to many but understood by few. That fact is based on the difficulty of the mathematics behind the adage. Now, it must be stated that, in fact, the flapping of a butterfly’s wings is not actually known to be the reason for any natural disasters, but the idea of it does get at the driving force of Chaos Theory. The common theme among the two is sensitive dependence on initial conditions. This is an idea that will be revisited later in the paper, because we must first cover the concepts necessary to frame chaos. This paper will explore one, two, and three dimensional systems, maps, bifurcations, limit cycles, attractors, and strange attractors before looking into the mechanics of chaos. Once chaos is introduced, we will look in depth at the Lorenz Equations. 2. One Dimensional Systems We begin our study by looking at nonlinear systems in one dimen- sion. One of the important features of these is the nonlinearity. Non- linearity in an equation evokes behavior that is not easily predicted due to the disproportionate nature of inputs and outputs. Also, the term “system”isoftenamisnomerbecauseitoftenevokestheideaof asystemofequations.Thiswillbethecaseaswemoveourfocuso↵ of one dimension, but for now we do not want to think of a system of equations. In this case, the type of system we want to consider is a first-order system of a single equation. -

The Lorenz System

The Lorenz system James Hateley Contents 1 Formulation 2 2 Fixed points 4 3 Attractors 4 4 Phase analysis 5 4.1 Local Stability at The Origin....................................5 4.2 Global Stability............................................6 4.2.1 0 < ρ < 1...........................................6 4.2.2 1 < ρ < ρh ..........................................6 4.3 Bifurcations..............................................6 4.3.1 Supercritical pitchfork bifurcation: ρ = 1.........................7 4.3.2 Subcritical Hopf-Bifurcation: ρ = ρh ............................8 4.4 Strange Attracting Sets.......................................8 4.4.1 Homoclinic Orbits......................................9 4.4.2 Poincar´eMap.........................................9 4.4.3 Dynamics at ρ∗ ........................................9 4.4.4 Asymptotic Behavior..................................... 10 4.4.5 A Few Remarks........................................ 10 5 Numerical Simulations and Figures 10 5.1 Globally stable , 0 < ρ < 1...................................... 10 5.2 Pitchfork Bifurcation, ρ = 1..................................... 12 5.3 Homoclinic orbit........................................... 12 5.4 Transient Chaos........................................... 12 5.5 Chaos................................................. 14 5.5.1 A plot for ρh ......................................... 14 5.6 Other Notable Orbits........................................ 16 5.6.1 Double Periodic Orbits................................... 16 5.6.2 Intermittent -

SPATIOTEMPORAL CHAOS in COUPLED MAP LATTICE Itishree

SPATIOTEMPORAL CHAOS IN COUPLED MAP LATTICE By Itishree Priyadarshini Under the Guidance of Prof. Biplab Ganguli Department of Physics National Institute of Technology, Rourkela CERTIFICATE This is to certify that the project thesis entitled ” Spatiotemporal chaos in Cou- pled Map Lattice ” being submitted by Itishree Priyadarshini in partial fulfilment to the requirement of the one year project course (PH 592) of MSc Degree in physics of National Institute of Technology, Rourkela has been carried out under my super- vision. The result incorporated in the thesis has been produced by developing her own computer codes. Prof. Biplab Ganguli Dept. of Physics National Institute of Technology Rourkela - 769008 1 ACKNOWLEDGEMENT I would like to acknowledge my guide Prof. Biplab Ganguli for his help and guidance in the completion of my one-year project and also for his enormous moti- vation and encouragement. I am also very much thankful to research scholars whose encouragement and support helped me to complete my project. 2 ABSTRACT The sensitive dependence on initial condition, which is the essential feature of chaos is demonstrated through simple Lorenz model. Period doubling route to chaos is shown by analysis of Logistic map and other different route to chaos is discussed. Coupled map lattices are investigated as a model for spatio-temporal chaos. Diffusively coupled logistic lattice is studied which shows different pattern in accordance with the coupling constant and the non-linear parameter i.e. frozen random pattern, pattern selection with suppression of chaos , Brownian motion of the space defect, intermittent collapse, soliton turbulence and travelling waves. 3 Contents 1 Introduction 3 2 Chaos 3 3 Lorenz System 4 4 Route to Chaos 6 4.1 PeriodDoubling............................. -

Unstable Dimension Variability Structure in the Parameter Space of Coupled Hénon Maps

Applied Mathematics and Computation 286 (2016) 23–28 Contents lists available at ScienceDirect Applied Mathematics and Computation journal homepage: www.elsevier.com/locate/amc Unstable dimension variability structure in the parameter space of coupled Hénon maps ∗ Vagner dos Santos a, José D. Szezech Jr. a,b, , Murilo S. Baptista c, Antonio M. Batista a,b,d, Iberê L. Caldas d a Pós-Graduação em Ciências, Universidade Estadual de Ponta Grossa, 84030-900 Ponta Grossa, PR, Brazil b Departamento de Matemática e Estatística, Universidade Estadual de Ponta Grossa, 84030-900 Ponta Grossa, PR, Brazil c Institute for Complex Systems and Mathematical Biology, SUPA, University of Aberdeen, AB24 3UE Aberdeen, UK d Instituto de Física, Universidade de São Paulo, 05508-090 São Paulo, SP, Brazil a r t i c l e i n f o a b s t r a c t Keywords: Coupled maps have been investigated to model the applications of periodic and chaotic UDV dynamics of spatially extended systems. We have studied the parameter space of coupled Shrimp Hénon maps and showed that attractors possessing unstable dimension variability (UDV) Hénon map appear for parameters neighbouring the so called shrimp domains, representing param- Parameter-space Lyapunov exponents eters leading to stable periodic behaviour. Therefore, the UDV should be very likely to be found in the same large class of natural and man-made systems that present shrimp domains. ©2016 Elsevier Inc. All rights reserved. 1. Introduction In the early 1960s, Lorenz proposed three coupled nonlinear differential equations to model atmospheric convection [1] . The Lorenz equations have attracted great attention due to their interesting dynamical solutions, for instance, a chaotic at- tractor [2,3] . -

THE BUTTERFLY EFFECT Étienne GHYS CNRS-UMPA ENS Lyon [email protected]

12th International Congress on Mathematical Education Program Name XX-YY-zz (pp. abcde-fghij) 8 July – 15 July, 2012, COEX, Seoul, Korea (This part is for LOC use only. Please do not change this part.) THE BUTTERFLY EFFECT Étienne GHYS CNRS-UMPA ENS Lyon [email protected] It is very unusual for a mathematical idea to disseminate into the society at large. An interesting example is chaos theory, popularized by Lorenz’s butterfly effect: “does the flap of a butterfly’s wings in Brazil set off a tornado in Texas?” A tiny cause can generate big consequences! Can one adequately summarize chaos theory in such a simple minded way? Are mathematicians responsible for the inadequate transmission of their theories outside of their own community? What is the precise message that Lorenz wanted to convey? Some of the main characters of the history of chaos were indeed concerned with the problem of communicating their ideas to other scientists or non-scientists. I’ll try to discuss their successes and failures. The education of future mathematicians should include specific training to teach them how to explain mathematics outside their community. This is more and more necessary due to the increasing complexity of mathematics. A necessity and a challenge! INTRODUCTION In 1972, the meteorologist Edward Lorenz gave a talk at the 139th meeting of the American Association for the Advancement of Science entitled “Does the flap of a butterfly’s wings in Brazil set off a tornado in Texas?”. Forty years later, a google search “butterfly effect” generates ten million answers. -

Exercises Week 8

M´etodosexp. ycomp. deBiof´ısica(ME) Exercisesweek8 Exercises week 8 December 14, 2017 Please submit your work after the Xmas break (name the script file as your name problems-week8.m) at the following e-mail address [email protected]. 1 Suggestions for a possible project The cycloidal pendulum (brachistochrone problem) A simple pendulum is not in general isochronous, i.e., the period of oscillations depends on their amplitude. However, if a simple pendulum is suspended from the cusp of an inverted cycloid, such that the “string” is constrained between the adjacent arcs of the cycloid, and the pendulum’s length is equal to that of half the arc length of the cycloid (i.e., twice the diameter of the generating circle), the bob of the pendulum also traces a cycloid path. Such a cycloidal pendulum is isochronous, regardless of amplitude. Study this problem and compare the numerical solutions of the equations of motion with the analytical ones. The double pendulum A double pendulum is a pendulum (point mass suspended from a string of negligible mass) with another pendulum attached to its end. Despite being a simple physical system, the dynamics of the double pendulum is rich and can exhibit chaotic behaviour and great sensitivity to initial conditions. The butterfly effect The butterfly effect in chaos theory refers to sensitive dependence on initial conditions that certain deterministic non-linear systems have. Here, a small change in one state of a deterministic non-linear system can result in large differences in a later state. In this project you can numerically simulate this effect by solving the Lorenz equations., i.e. -

Private Digital Communications Using Fully-Integrated Discrete-Time Synchronized Hyper Chaotic Maps

PRIVATE DIGITAL COMMUNICATIONS USING FULLY-INTEGRATED DISCRETE-TIME SYNCHRONIZED HYPER CHAOTIC MAPS by BOSHAN GU Submitted in partial fulfillment of the requirements For the degree of Master of Science Thesis Adviser: Dr. Soumyajit Mandal Department of Electrical, Computer, and Systems Engineering CASE WESTERN RESERVE UNIVERSITY May, 2020 Private Digital Communications Using Fully-Integrated Discrete-time Synchronized Hyper Chaotic Maps Case Western Reserve University Case School of Graduate Studies We hereby approve the thesis1 of BOSHAN GU for the degree of Master of Science Dr. Soumyajit Mandal 4/10/2020 Committee Chair, Adviser Date Dr. Christos Papachristou 4/10/2020 Committee Member Date Dr. Francis Merat 4/10/2020 Committee Member Date 1We certify that written approval has been obtained for any proprietary material contained therein. Table of Contents List of Tables v List of Figures vi Acknowledgements ix Acknowledgements ix Abstract x Abstract x Chapter 1. Introduction1 Nonlinear Dynamical Systems and Chaos1 Digital Generation of Chaotic Masking7 Motivation for This Project 11 Chapter 2. Mathematical Analysis 13 System Characteristic 13 Synchronization 16 Chapter 3. Circuit Design 19 Fully Differential Operational Amplifier 19 Expand and Folding function 27 Sample and Hold Circuits 31 Digital Signal Processing Block and Clock Generator 33 Bidirectional Hyperchaotic Encryption System 33 Chapter 4. Simulation Results 37 iii Chapter 5. Suggested Future Research 41 Current-Mode Chaotic Generators for Low-Power Applications 41 Appendix. Complete References 43 iv List of Tables 1.1 Different chaotic map and its system function.6 1.2 Similar factors between chaotic encryption and traditional cryptography.8 3.1 Op-amp performance simulated using different process parameter 23 3.2 Different gate voltage of transistor in corner case simulation 23 4.1 System performance comparison between previous work and this project. -

Complex Dynamic Behaviors of the Complex Lorenz System

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Elsevier - Publisher Connector Scientia Iranica D (2012) 19 (3), 733–738 Sharif University of Technology Scientia Iranica Transactions D: Computer Science & Engineering and Electrical Engineering www.sciencedirect.com Complex dynamic behaviors of the complex Lorenz system M. Moghtadaei, M.R. Hashemi Golpayegani ∗ Complex Systems and Cybernetic Control Lab., Faculty of Biomedical Engineering, Amirkabir University of Technology, Tehran, P.O. Box 1591634311, Iran Received 4 August 2010; revised 11 September 2010; accepted 29 November 2010 KEYWORDS Abstract This study compares the dynamic behaviors of the Lorenz system with complex variables to that Lorenz system; of the standard Lorenz system involving real variables. Different methodologies, including the Lyapunov Complex variables; Exponents spectrum, the bifurcation diagram, the first return map to the Poincaré section and topological Chaos; entropy, were used to investigate and compare the behaviors of these two systems. The results show that Hyper-chaos. expressing the Lorenz system in terms of complex variables leads to more distinguished behaviors, which could not be achieved in the Lorenz system with real variables, such as quasi-periodic and hyper-chaotic behaviors. ' 2012 Sharif University of Technology. Production and hosting by Elsevier B.V. Open access under CC BY-NC-ND license. 1. Introduction cannot be observed in 3-D systems. So, in order to achieve hyper-chaos, one should always add at least one extra variable In 1963, the concept of chaos was introduced by Edward to the three variable Lorenz equations [6,8,14–18]. Lorenz via his 3D autonomous system [1]. -

The Lorenz System Edward Lorenz

The Lorenz system Edward Lorenz • Professor of Meteorology at the Massachusetts Institute of Technology • In 1963 derived a three dimensional system in efforts to model long range predictions for the weather • The weather is complicated! A theoretical simplification was necessary The Lorenz system ▪ Le temperature delle due superfici sono fissate ▪ Assenza di flusso attraverso le 2 superfici • The Lorenz systems describes the motion of a fluid between two layers at different temperature. Specifically, the fluid is heated uniformly from below and cooled uniformly from above. • By rising the temperature difeerence between the two surfaces, we observe initially a linear temperature gradient, and then the formation of Rayleigh-Bernard convection cells. After convection, turbolent regime is also observed. D. Gulick, Encounters with Chaos, Mc-Graw Hill, Inc., New York, 1992. La Lorenz water wheel http://www.youtube.com/watch? v=zhOBibeW5J0 The equations • x proportional to the velocity field dx • y proportional to the difference of = σ y− x temperature T1-T2 ( ) • z proportional to the distortion of dt the vertical profile of temperature dy • σ depends on the type of fluid = −xz+ rx− y • b depends on the geometry dt • r depends on the Rayleigh, number which influences the dz change of behavior from = xy− bz conductive to convective dt σ, r, b are positive parameters σ=10, b=8/3, r varies in [0,30] Steady states S1 = (0, 0, 0) S2 = ( b(r −1), b(r −1),r −1) S3 = (− b(r −1), − b(r −1),r −1) Linear stability of S1 ⎡−σ σ 0 ⎤ Jacobian J 0, 0, 0 ⎢