(2020) Benefits of Floating Offshore Wind to Wales and the South West

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Audit of Regional Working

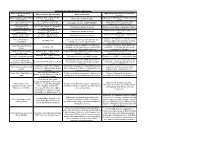

Audit of Regional Working - Place Directorate Name of Regional Group / What are the Benefits to CCoS of this Which Partners are involved? What is the remit? Working Group? Swansea Bay City Deal Officer Swansea, NPT, Carms, Pembs, Significant investment, job creation, economic Deliver the City Deal Projcets Working Group Ceredigion, Powys growth RDP South West & Central NPT, Swansea, Carmarthen, awareness of activity, delivery, risks, Information exchange of RDP LEADER Local Action Group Pembrokeshire, Ceredigion, Powys evaluation and expansion of RDP Workways + ESF NPT (lead), Swansea, Carmarthen, Management groups for project Management of major employability initiative employability project Pembs, Ceredigion Cynydd ESF young people Pembs (Lead), Swansea, Management of major youth engagement Management groups for project support project Carmarthen, NPT, Ceredigion project Cam Nesa ESF NEETs Pembs (Lead), Swansea, Management of major NEET engagement Management groups for project Employability Project Carmarthen, NPT, Ceredigion project Contibute to development of new WG Valleys Valleys Task Force - to develop each concept outlined in the “Our All Valleys LA's strategy; could be linked to future funding Landscapes Valleys, Our Future” high level plan opporutnities for north Swansea Meeting of officers engaged in securing and Exchange of information and good practice, Welsh European Funding All Wales LA's managing external funding sources such as EU constructive networking with other Local Group funding, HLF, WG capital funding etc authorities, -

Women in the Rural Society of South-West Wales, C.1780-1870

_________________________________________________________________________Swansea University E-Theses Women in the rural society of south-west Wales, c.1780-1870. Thomas, Wilma R How to cite: _________________________________________________________________________ Thomas, Wilma R (2003) Women in the rural society of south-west Wales, c.1780-1870.. thesis, Swansea University. http://cronfa.swan.ac.uk/Record/cronfa42585 Use policy: _________________________________________________________________________ This item is brought to you by Swansea University. Any person downloading material is agreeing to abide by the terms of the repository licence: copies of full text items may be used or reproduced in any format or medium, without prior permission for personal research or study, educational or non-commercial purposes only. The copyright for any work remains with the original author unless otherwise specified. The full-text must not be sold in any format or medium without the formal permission of the copyright holder. Permission for multiple reproductions should be obtained from the original author. Authors are personally responsible for adhering to copyright and publisher restrictions when uploading content to the repository. Please link to the metadata record in the Swansea University repository, Cronfa (link given in the citation reference above.) http://www.swansea.ac.uk/library/researchsupport/ris-support/ Women in the Rural Society of south-west Wales, c.1780-1870 Wilma R. Thomas Submitted to the University of Wales in fulfillment of the requirements for the Degree of Doctor of Philosophy of History University of Wales Swansea 2003 ProQuest Number: 10805343 All rights reserved INFORMATION TO ALL USERS The quality of this reproduction is dependent upon the quality of the copy submitted. In the unlikely event that the author did not send a com plete manuscript and there are missing pages, these will be noted. -

Directory of Cancer Support Services in South West Wales. 2010-2011

Directory of Cancer Support Services in South West Wales. 2010-2011 Self Help and Support Groups Voluntary Sector Hospice and Palliative Care Providers South West Wales Cancer Network 2010 Prepared by Helen Dorman, Macmillan Patient Involvement Facilitator SOUTH WEST WALES CANCER NETWORK SELF HELP / SUPPORT GROUPS NAME & ADDRESS INFORMATION TELEPHONE NUMBER The Beacon of Hope. A small team of professionals Aberystwyth. and volunteers working for 01970 615593 Cardigan a charity; providing immediate 01239 614989 comfort and on-going practical support to people with a life limiting or terminal illness in Ceredigion Pembrokeshire Meetings held on the2nd 01437 710376 Breast Cancer Friday of every month, 01437 720496 Support Group. between 10:30-12:30 The Community Providing support for those Centre, diagnosed with breast cancer Furzy Park, in Pembrokeshire Haverfordwest Tawe Valley Breast Support and Information. 01158 822554 Care Support Group. Secretary, Mair Griffith 01558 822588 Pembrokeshire Registered Charity. Barbara/ Jill Cancer Support. Provides Support &Information 01646 683078 for those who have or have had cancer together with their family and friends . Llanelli Breast Meet every 3 rd . Monday of the Jean 01554 Cancer Support month except in August. 810967 Group Provides support and Dilys (Welsh friendship. Speaker) 01554 758413 Breast Cancer Care. Support and advice Valerie Carmarthen Pearson 01559 384854 Stepping Stones A support group for women Angela Hamer Breast Support who meet in conjunction with 01686 624702 Group Macmillan Nurses, every Ist. Mary Newtown, Mid Wednesday of the month at 01938 558047 Powys 19:00 at The Hafan Day Unit, Newtown Hospital NAME & ADDRESS INFORMATION TELEPHONE NUMBER Breast of Friends Support and Information Janet Williams Breast Support 01686 412778 Group Llanidloes, Mid Powys Breast Cancer Information and advice Ffion Davies Group Community The Black Mountain Developmental Centre, Officer Cwmgarw Road, Brynaman 01269 823400 Carmarthenshire Llandeilo Breast Information and support Diane Rocca Cancer Group. -

NORTH WALES Expenditure £'S Scheme Local Authority Type Scheme Name 2011 to Date Future Total

NORTH WALES Expenditure £'s Scheme Local Authority Type Scheme Name 2011 to date Future Total Anglesey Local Llangefni Link Road 365,000 0 365,000 Trunk Britannia Bridge 300,000 0 300,000 Anglesey / Local Surface Access – Anglesey Airport 158,000 0 158,000 Gwynedd Trunk A55 Britannia Bridge 40,000 0 40,000 -A470 Pont yr Afanc, A5 Sth of Cerrigydrudion, A55 rainbow bridge, A5 W Hendre Arddwyfaen, E27A55 Conwy Trunk Tunnels safety improvement 18,845,000 32,500,000 51,345,000 Trunk A55 Junctions 15 and 16 Improvements 10,000 31,600,000 31,610,000 -A55 Talardy Para Refurb,A494 maesgarnedd Jctn, Denbighshire Trunk A5 Llangollen Golf Club, A494 Ruthin Vale 216,000 0 216,000 Trunk A5 Pont Melin Rug 165,000 0 165,000 Local Foryd Rd Junction Improvements 160,000 0 160,000 Flintshire Trunk A494/A550 Deeside Park to Drome Corner 90,000 206,270,000 206,360,000 Trunk -A55 J29 to 21, A55 Refuge/Crossovers 4,300,000 0 4,300,000 Local Shotton Corridor Signalisation B5129 450,000 0 450,000 Trunk A494 Drome Corner to Ewloe 44,000 0 44,000 Gwynedd Trunk A487 Caernarfon to Bontnewydd 921,000 103,927,000 104,847,000 Trunk A487 Dyfi Bridge 65,000 22,880,000 22,945,000 Trunk A487 Porthmadog, Minffordd and Tremadog 15,694,000 446,000 16,140,000 Trunk A470 Maes yr Helmau – Cross Foxes 10,123,000 472,000 10,595,000 Trunk A470 Gelligemlyn 9,185,000 176,000 9,361,000 - Pont Briwet, A493 Pontbren to Nant y Gwenlli, Local -A487Pont Dr Garndolbenmaen, Williams School, A494Dolgellau Golwg Hir, 3,757,000 0 3,757,000 Dolgellau, A487 Golan Junction, A55 Aber Tai’r Trunk -

South West Wales Regional Report

SOUTH WEST WALES REGIONAL COMMITTEE REPORT TO THE NATIONAL ASSEMBLY FOR WALES, 2003 - 2004 Introduction 1. The South West Wales Regional Committee is one of the Assembly's four regional committees constituted under s61 of the Government of Wales Act 1998 and Standing Order 10. 2. Standing Order 10.2 provides that “Regional committees shall advise the Assembly on matters affecting their regions, the affect of Assembly policies in those regions and the work of public bodies there.” The Committee is required to meet at least twice a year in the region. 3. There are 17 members: Peter Black South Wales West Liberal Democrats Nicholas Bourne Mid and West Wales Conservative Alun Cairns South Wales West Conservative Andrew Davies Swansea West Labour Glyn Davies Mid and West Wale Conservative Janet Davies South Wales West Plaid Cymru Tamsin Dunwoody Preseli Pembrokeshire Labour Kneafsey Lisa Francis Mid and West Wales Conservative Brian Gibbons Aberavon Labour Christine Gwyther Carmarthen West and Labour South Pembrokeshire Edwina Hart Gower Labour Helen Mary Jones Mid and West Wales Plaid Cymru Dai Lloyd South Wales West Plaid Cymru Val Lloyd Swansea East Labour Catherine Thomas Llanelli Labour Gwenda Thomas Neath Labour Rhodri Glyn Thomas Carmarthen East and Plaid Cymru Dinefwr 4. Peter Black was elected to chair the Committee from July 2003. Meetings 5. The Committee met five times between July 2003 and March 2004. Method of working 6. Generally, the Committee has focused on public discussion of policies being developed by the Welsh Assembly Government or reviews being carried out by subject committees. Members of the public have been able to raise questions and express their views on the topics discussed. -

Development of a Mid and South West Wales Regional Centre Of

Name of Meeting Board Date of Meeting 28 March 2019 Agenda item: 9.2.280319 Development of a Mid and South West Wales Regional Centre of Excellence Cellular Pathology Laboratory, Regional Diagnostic Immunology Laboratory & Regional Medical Microbiology Facility at Morriston Hospital, Swansea Executive lead: Dr Quentin Sandifer, Executive Director of Public Health Services and Medical Director Author: Ms Heather Edwards, Business Planning Manager, Abertawe Bro Morgannwg University Health Board, with amendment where necessary by Dr Quentin Sandifer, Executive Director of Public Health Services and Medical Director Approval/Scrutiny Business Executive Team, 18 March 2019 route: Purpose To seek Board approval on the Strategic Outline Case (SOC) prior to submission to Welsh Government. Nationally NHS Pathology services face a number of challenges. Within the Mid and South West Wales’ region, Hywel Dda University Health Board (HDUHB), Abertawe Bro Morgannwg University Health Board (ABMUHB) and Public Health Wales NHS Trust (PHW) are struggling to manage workforce and sustainability pressures, to maintain quality and safety issues and to meet clinically driven targets. Without investment in sustainable services we cannot deliver essential improvements and fit for purpose laboratories. Investment would allow us to co-locate and develop regionalised services and to support more innovative and sustainable service models which could be future-proofed, and be flexible enough, to respond to changing demand, new technologies and innovations. In 2017 a South West Wales Regional Pathology Reconfiguration Project Board was established to draft a Strategic Outline Business Case (SOC) to address these regional challenges in line with the national direction of travel for regional pathology services. -

City and County of Swansea Dinas a Sir Abertawe And

CITY AND COUNTY OF SWANSEA DINAS A SIR ABERTAWE AND NEATH PORT TALBOT COUNTY BOROUGH COUNCIL CYNGOR BWRDEISTREF SIROL CASTELL-NEDD PORT TALBOT Report of the County Archivist West Glamorgan Archives Committee 18 September 2015 The purpose of this report is to outline the work of the Archive Service during the period June to August 2015 1. South West Wales Partnership A further meeting took place on 20 th July between Swansea University and Swansea, Neath Port Talbot and Carmarthenshire Councils to explore the development together of shared archive provision for south west Wales. The outcome of the meeting was the statement which is attached at Appendix 1, drafted with the aid of archival consultant Elizabeth Oxborrow-Cowan. Each partner in the group is seeking approval for this statement from its governing committee and (in the case of West Glamorgan Archive Service) from each of its parent authorities. Members are requested to approve the use of Archive Service reserves to make the appropriate contribution towards consultancy fees to further investigate joint service options with Swansea University and Carmarthenshire County Council. It is anticipated that a one-third share will cost the Service approximately £5,000. 2. Use of the Service Statistics for June to August 2015 The number of members of public using the Service on-site, June to August 2015, was 1,927 and the total number reached by the Service on and off-site was 2,188 . Number of on-site visits at Swansea, Neath and Port Talbot 1,927 (1,907) (figures in brackets represent -

Conservation Team Report 2014-2015

Conservation Team Report 2014Wildlife Trust - of2015 South and West Wales 1 www.welshwildlife.org Conservation Team report 2014-2015 Contents 1. Introduction .................................................................................................................... 4 1.1 Members of the conservation team ......................................................................... 4 1.2 Our assets .............................................................................................................. 7 1.3 Our funders ............................................................................................................. 9 2. Nature Reserves .......................................................................................................... 10 2.1 Introduction to our work on our nature reserves .................................................... 10 2.2 Habitat management ............................................................................................. 14 2.3 Research .............................................................................................................. 19 2.4 Recording and monitoring ..................................................................................... 23 2.5 Volunteers ............................................................................................................ 26 2.6 Access management ............................................................................................ 30 2.7 Events on nature reserves ................................................................................... -

Post Medieval and Modern

A Research Framework for the Archaeology of Wales Select Bibliography, Southwest Wales Post Medieval and Modern A Research Framework for the Archaeology of Wales Southwest Wales – Post Medieval, bibliography 22/12/2003 This list is drawn from a number of sources : a small number derive from the original audit by Cambria Archaeology; more from a trawl through Ceredigion County Library, Aberystwyth; some from published bibliographies, but most from an incomplete search of current periodical literature. The compiler does not claim to have run all these to earth at first hand, so some page references, the names of publishers and some places of publication are missing. It should be noted that not all apparently authoritative published bibliographies - on the web and off it - are necessarily as complete as might be expected. Some may be biased by the interests or prejudices of their compilers. The Website on Mining Bilbiography is a good example. It excludes certain materials on processing and hydrology, and omits virtually everything the present writer has written on dating mines! The present writer regrets if his equally subjective selection inadvertently omits anything significant to the interests of its readers, but welcomes notification of it. Bibliographical Sources Dyfed 1990. Dyfed Llayfryddiaeth Ddethol: A Select Reading List, Adran Gwasanaethau Diwylliannol: Cultural Services Department. [This is a very useful document as far as it goes. However, it is carelessly edited and rather thin on archaeology]. Jones, G. Lewis, u. D. (c1968) A Bibliography of Cardiganshire, Cardiganshire Joint Library Committee. General BBC Wales Southwest website. Cadw 1998. Register of Landscapes of Outstanding Historic Interest in Wales, Cadw: Cardiff. -

Landscape, Seascape and Cultural Services the South-West Wales

Landscape, Seascape and Cultural The South-West Wales Landscape Distinctive landscapes and sense of place Services The Pembrokeshire Coast National Park includes the steep, rugged coastal cliffs and headlands, wide sandy The area includes the coast, Preseli Hills and Cleddau bays, small coves and remote rocky offshore islands of the coast; the open uplands of the Preseli Hills and upper Shaped by nature and people over time, landscapes are valleys of the Pembrokeshire Coast National Park, rolling reaches of the Cleddau rivers. There are spectacular sea views along the coast and a strong sense of place the settings in which we live, work and experience life. farmland of Pembrokeshire and Carmarthenshire, Tywi throughout. The whole area is important for tourism and includes the Heritage Coast and Wales Coast Path. All landscapes matter. They combine natural resources, Valley, extensive estuaries entering Carmarthen Bay, Historic St David’s, with its famous cathedral is a focal point for visitors. culture and economy. Many environmental resilience and upland moorlands and forests extending to the Cambrian place-based planning challenges that shape our future Mountains and the Brecon Beacons National Park. The Gower peninsula includes the AONB and lies to the wellbeing and prosperity are best addressed at a landscape-scale. south of the Swansea uplands. The City of Swansea enjoys the sweeping setting of the Bay. The historic Landscape characteristics and qualities combine to create industrial valleys are tranquil in places and the broad a distinct sense of place. Sense of place is key to Neath floodplain provides the setting for the town. Steep scarps form the backdrop to the narrow coastal strip at understanding how we derive cultural inspiration and well- being from landscape. -

The Cawdor Estates in South-West Wales in the Nineteenth Century

_________________________________________________________________________Swansea University E-Theses The Cawdor estates in south-west Wales in the nineteenth century. Davies, John Edward How to cite: _________________________________________________________________________ Davies, John Edward (2008) The Cawdor estates in south-west Wales in the nineteenth century.. thesis, Swansea University. http://cronfa.swan.ac.uk/Record/cronfa42270 Use policy: _________________________________________________________________________ This item is brought to you by Swansea University. Any person downloading material is agreeing to abide by the terms of the repository licence: copies of full text items may be used or reproduced in any format or medium, without prior permission for personal research or study, educational or non-commercial purposes only. The copyright for any work remains with the original author unless otherwise specified. The full-text must not be sold in any format or medium without the formal permission of the copyright holder. Permission for multiple reproductions should be obtained from the original author. Authors are personally responsible for adhering to copyright and publisher restrictions when uploading content to the repository. Please link to the metadata record in the Swansea University repository, Cronfa (link given in the citation reference above.) http://www.swansea.ac.uk/library/researchsupport/ris-support/ The Cawdor estates in south-west Wales in the nineteenth century. A thesis submitted to the University of Wales for the degree of Philosophiae Doctor by John Edward Davies B.A., D.A.A. December 2008. ProQuest Number: 10797978 All rights reserved INFORMATION TO ALL USERS The quality of this reproduction is dependent upon the quality of the copy submitted. In the unlikely event that the author did not send a com plete manuscript and there are missing pages, these will be noted. -

Visit Wales South West Wales Regional Forum Minutes From

Visit Wales South West Wales Regional Forum Minutes from Thursday, 23rd May 2019 National Botanic Garden, Carmarthenshire. Present George Reid (GR) Carmarthenshire Tourism Association Jacqui Davies (JDa) Clydey Cottages Zoe Wright (ZW) Head of Marketing, Folly Farm Nic Beggs (NB), Chair Area Manager, Freedom Leisure Paul Stone (PS) Oakwood Theme Park James Parkin (JP) Director of Delivery and Discovery, PCNPA Paula Ellis (PE) Group General Manager, Retreats Group Stephen Crocker (SC) Tourism Swansea Bay Andrew Campbell (AC) Chair, Wales Tourism Alliance Gina Gavigan (GG) WTSWW Neil Kedward (NK) The Grove, Narberth Adam Smith (AS) Village Hotel Club Paul Renfro (PR) WATO / POCG Sarah Owen (SO) Carmarthenshire County Council Karleigh Davies (KD) Neath Port Talbot County Borough Council Kate Clark (KC) Deputy Director Policy and Engagement, Culture Tourism & Sport Philip Abraham (PA) Regional Engagement Manager, VW Gerwyn Evans (GE) Head of Programme Development, VW Lucy Von Weber (LvW) Head of Marketing Jon Munro (JM) Digital Leadership Manager Apologies Mike Cavanagh Pembrokeshire Council Kevin Davies Gwesty’r Emlyn Hotel Huw Parsons Carmarthenshire County Council Frances Jenkins Swansea Council Tim Brace FBM Holidays and Pembrokeshire Tourism Emily Beaumont National Trust Clare Stowell Milford Waterfront 1 Chair Introduction Nic Beggs welcomed everyone to the Forum and gave an update on the current feel good factor in the industry as set out by a positive set of figures released by Visit Wales for the Easter Break. GR said this was not mirrored in Carmarthenshire from businesses he had spoken to while AS of the Village Hotel said their leisure market was not as strong as last year especially weekend leisure.