View Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2020 Mvca Service Provider Membership

2020 MVCA SERVICE PROVIDER MEMBERSHIP THANK YOU for your interest in joining the Michigan Venture Capital Association (MVCA) as one of our exclusive Service Provider Members. Each year, the MVCA Membership Committee extends a limited number of invitations to law firms, accounting firms, banks, independent consultants, etc.; these are top tier service providers who have been identified by MVCA members as being a valuable partner within the entrepreneurial and investment landscape. ABOUT YOUR EXCLUSIVE MEMBERSHIP OPPORTUNITY MVCA caps the number of service providers accepted into the membership at 25% of the overall membership to ensure that service provider members have superior relationship building opportunities. Your exclusive membership also assures you that MVCA will only promote events, marketing materials or news from MVCA service provider members. In addition, only MVCA Service Provider Members are given the opportunity to contribute to MVCA panels, blog posts or newsletters. WHO DO YOU HAVE ACCESS TO? Nowhere else will you find it easier to access early-stage investors who do business in Michigan. MVCA represents: All active venture firms All active angel Corporate Venture Fund-of-Funds, Economic in Michigan, as well as groups in Michigan Funds Foundations, and Development out-of-state venture firms and one in Canada, other Institutional Organizations and who do business in Michigan, representing over Investors University Partners representing over 150 300 angel investment venture capital investment professionals professionals HERE’S WHAT YOU GET As a valued service provider in the industry, you are eligible to have up to four employees registered as part of your MVCA Service Provider Membership. -

THE WONDERFUL APPEARANCE of an Angel, Devil & Ghost, to a GENTLEMAN in the Town of Boston, in the Nights of the 14Th, 15Th, and 16Th of October, 1774" (Boston, 1774)

National Humanities Center My Neighbor, My Enemy: How American Colonists Became Patriots and Loyalists "THE WONDERFUL APPEARANCE of an Angel, Devil & Ghost, to a GENTLEMAN in the Town of Boston, In the Nights of the 14th, 15th, and 16th of October, 1774" (Boston, 1774) A little known political document, "The Wonderful Appearance" is sort of a colonial American version of A Christmas Carol in which three apparitions try to convert a sinner. It was published in Boston in the summer of 1774, the moment of greatest popular rage against royal officials in Massachusetts. It asked the ordinary reader to consider carefully what might happen to someone who tried to remain neutral—or worse, gave comfort to the enemy—during a revolutionary crisis. Although the story contains marvelous humor, it reminds us of the pressure a community could bring to bear on enemies and skeptics. The narrator, who sympathizes with the British, returns to his room after a supper with some jovial companions and is struck by terror when he hears an awful sound nearby. The noise continues until a "violent wrap against" his window signals the entrance of an angel, who pulls up a chair and delivers two messages. First, the angel says, if the narrator does not cease to oppress his countrymen, he will end up in hell. Second, the Devil is going to drop by tomorrow night to tell him so in person. Like Scrooge, the narrator tries to convince himself that his first nocturnal visitor was merely a delusion, but he never quite succeeds. The next night, as predicted, the Devil—a rational, cool- headed gentleman—appears and asks the narrator how he became such an enemy to his country. -

The Angel on Your Shoulder: Prompting Employees to Do the Right Thing Through the Use of Wearables Timothy L

Northwestern Journal of Technology and Intellectual Property Volume 14 | Issue 2 Article 1 2016 The Angel on Your Shoulder: Prompting Employees to Do the Right Thing Through the Use of Wearables Timothy L. Fort Indiana University Anjanette H. Raymond Indiana University Scott .J Shackelford Indiana University Recommended Citation Timothy L. Fort, Anjanette H. Raymond, and Scott .J Shackelford, The Angel on Your Shoulder: Prompting Employees to Do the Right Thing Through the Use of Wearables, 14 Nw. J. Tech. & Intell. Prop. 139 (2016). https://scholarlycommons.law.northwestern.edu/njtip/vol14/iss2/1 This Article is brought to you for free and open access by Northwestern Pritzker School of Law Scholarly Commons. It has been accepted for inclusion in Northwestern Journal of Technology and Intellectual Property by an authorized editor of Northwestern Pritzker School of Law Scholarly Commons. Copyright 2016 by Northwestern University Pritzker School of Law Volume 14, Number 2 (2016) Northwestern Journal of Technology and Intellectual Property The Angel on Your Shoulder: Prompting Employees to Do the Right Thing Through the Use of Wearables By Timothy L. Fort,* Anjanette H. Raymond ** & Scott J. Shackelford *** ABSTRACT The wearable revolution is upon us. Bulky chest straps and large wristbands are going the way of flip cellphones and floppy disks. In the near future, for example, it may be commonplace for athletes to wear Biostamps or smart T-shirts with embedded sensors during practices, games, and even sleep. And while athletic competitors may have been one of the first movers in the area, health care, the military, and the industrial sector have all begun to use wearables to harness vast treasure troves of information destined to provide highly individualized feedback. -

Slayage, Number 16

Roz Kaveney A Sense of the Ending: Schrödinger's Angel This essay will be included in Stacey Abbott's Reading Angel: The TV Spinoff with a Soul, to be published by I. B. Tauris and appears here with the permission of the author, the editor, and the publisher. Go here to order the book from Amazon. (1) Joss Whedon has often stated that each year of Buffy the Vampire Slayer was planned to end in such a way that, were the show not renewed, the finale would act as an apt summation of the series so far. This was obviously truer of some years than others – generally speaking, the odd-numbered years were far more clearly possible endings than the even ones, offering definitive closure of a phase in Buffy’s career rather than a slingshot into another phase. Both Season Five and Season Seven were particularly planned as artistically satisfying conclusions, albeit with very different messages – Season Five arguing that Buffy’s situation can only be relieved by her heroic death, Season Seven allowing her to share, and thus entirely alleviate, slayerhood. Being the Chosen One is a fatal burden; being one of the Chosen Several Thousand is something a young woman might live with. (2) It has never been the case that endings in Angel were so clear-cut and each year culminated in a slingshot ending, an attention-grabber that kept viewers interested by allowing them to speculate on where things were going. Season One ended with the revelation that Angel might, at some stage, expect redemption and rehumanization – the Shanshu of the souled vampire – as the reward for his labours, and with the resurrection of his vampiric sire and lover, Darla, by the law firm of Wolfram & Hart and its demonic masters (‘To Shanshu in LA’, 1022). -

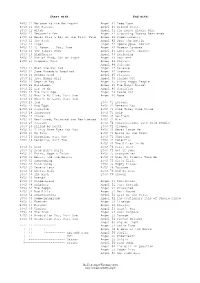

Buffy & Angel Watching Order

Start with: End with: BtVS 11 Welcome to the Hellmouth Angel 41 Deep Down BtVS 11 The Harvest Angel 41 Ground State BtVS 11 Witch Angel 41 The House Always Wins BtVS 11 Teacher's Pet Angel 41 Slouching Toward Bethlehem BtVS 12 Never Kill a Boy on the First Date Angel 42 Supersymmetry BtVS 12 The Pack Angel 42 Spin the Bottle BtVS 12 Angel Angel 42 Apocalypse, Nowish BtVS 12 I, Robot... You, Jane Angel 42 Habeas Corpses BtVS 13 The Puppet Show Angel 43 Long Day's Journey BtVS 13 Nightmares Angel 43 Awakening BtVS 13 Out of Mind, Out of Sight Angel 43 Soulless BtVS 13 Prophecy Girl Angel 44 Calvary Angel 44 Salvage BtVS 21 When She Was Bad Angel 44 Release BtVS 21 Some Assembly Required Angel 44 Orpheus BtVS 21 School Hard Angel 45 Players BtVS 21 Inca Mummy Girl Angel 45 Inside Out BtVS 22 Reptile Boy Angel 45 Shiny Happy People BtVS 22 Halloween Angel 45 The Magic Bullet BtVS 22 Lie to Me Angel 46 Sacrifice BtVS 22 The Dark Age Angel 46 Peace Out BtVS 23 What's My Line, Part One Angel 46 Home BtVS 23 What's My Line, Part Two BtVS 23 Ted BtVS 71 Lessons BtVS 23 Bad Eggs BtVS 71 Beneath You BtVS 24 Surprise BtVS 71 Same Time, Same Place BtVS 24 Innocence BtVS 71 Help BtVS 24 Phases BtVS 72 Selfless BtVS 24 Bewitched, Bothered and Bewildered BtVS 72 Him BtVS 25 Passion BtVS 72 Conversations with Dead People BtVS 25 Killed by Death BtVS 72 Sleeper BtVS 25 I Only Have Eyes for You BtVS 73 Never Leave Me BtVS 25 Go Fish BtVS 73 Bring on the Night BtVS 26 Becoming, Part One BtVS 73 Showtime BtVS 26 Becoming, Part Two BtVS 74 Potential BtVS 74 -

The Angels Loyalty

Hermetic Angel Messages PDF version 24 degrees Libra The Angels of Loyalty Also known as The Angels of Istaroth Beloved, Opening the heart to the purity of loyalty is one of the greatest blessings possible on earth. Sacred loyalty opens ways to serve peace on earth. Loyalty is essentially a commitment, or meditation, upon loving impeccability. Those who hold this concentration upon loyalty have made a commitment to someone or some worthy quality. A vow is made never to fall below a lofty, inspired standard of ethical behavior and commitment on every level of awareness. A loyal person is purified and uplifted by the very act of staying true to the commitment to uphold the high standard, and never forsake it. One of the special gifts bestowed by loyalty upon the person who has taken on its mantle is inner peace, a paradoxical gift: by giving it away toward another, you receive the solace yourself of always dwelling where there is no betrayal. By being completely loyal to the true spiritual essence of those you are committed to, and staying true to your commitment, you embark upon an exquisite journey of transformation to a special Garden of Eden, wherein the paths of mastery and sainthood unite. Although loyalty appears to limit ones options and restrict freedom, on the contrary, committing to be loyal opens a beautiful, inner world of refined emotions and peace of mind which is not accessible by any other means. In any relationship, we inspire each person so that they will never be disloyal. We help you discover anything that would cause infidelity, as you go along, so that you prevent it before it even starts. -

Angels in the Nursery: the Intergenerational Transmission of Benevolent Parental Influences

IMHJ (Wiley) LEFT BATCH top of AH ARTICLE ANGELS IN THE NURSERY: THE INTERGENERATIONAL TRANSMISSION OF BENEVOLENT PARENTAL INFLUENCES ALICIA F. LIEBERMAN, ELENA PADRO´ N, PATRICIA VAN HORN, AND WILLIAM W. HARRIS San Francisco General Hospital and University of California, San Francisco ABSTRACT: Fraiberg and her colleagues (1975) introduced the metaphor “ghosts in the nursery” to de- scribe the ways in which parents, by reenacting with their small children scenes from the parents’ own unremembered early relational experiences of helplessness and fear, transmit child maltreatment from one generation to the next. In this article we propose that angels in the nursery—care-receiving experi- ences characterized by intense shared affect between parent and child in which the child feels nearly perfectly understood, accepted, and loved—provide the child with a core sense of security and self-worth that can be drawn upon when the child becomes a parent to interrupt the cycle of maltreatment. We argue that uncovering angels as growth-promoting forces in the lives of traumatized parents is as vital to the work of psychotherapy as is the interpretation and exorcizing of ghosts. Using clinical case material, we demonstrate the ways in which early benevolent experiences with caregivers can protect against even overwhelming trauma, and examine the reemergence of these benevolent figures in consciousness as an instrument of therapeutic change. Finally, we examine implications of the concept of “angels in the nursery” for research and clinical intervention. RESUMEN: Fraiberg y sus colegas (1975) introdujeron la meta´fora “fantasmas en la habitacio´n” para describir las maneras en que los padres transmiten el maltratamiento infantil de una generacio´n a la otra, por medio de poner en escena, con sus nin˜os pequen˜os, situaciones de sus propias -si bien no recordadas- experiencias de miedo y falta de ayuda en sus tempranas relaciones en sus tempranas relaciones. -

Ever Faithful

Ever Faithful Ever Faithful Race, Loyalty, and the Ends of Empire in Spanish Cuba David Sartorius Duke University Press • Durham and London • 2013 © 2013 Duke University Press. All rights reserved Printed in the United States of America on acid-free paper ∞ Tyeset in Minion Pro by Westchester Publishing Services. Library of Congress Cataloging- in- Publication Data Sartorius, David A. Ever faithful : race, loyalty, and the ends of empire in Spanish Cuba / David Sartorius. pages cm Includes bibliographical references and index. ISBN 978- 0- 8223- 5579- 3 (cloth : alk. paper) ISBN 978- 0- 8223- 5593- 9 (pbk. : alk. paper) 1. Blacks— Race identity— Cuba—History—19th century. 2. Cuba— Race relations— History—19th century. 3. Spain— Colonies—America— Administration—History—19th century. I. Title. F1789.N3S27 2013 305.80097291—dc23 2013025534 contents Preface • vii A c k n o w l e d g m e n t s • xv Introduction A Faithful Account of Colonial Racial Politics • 1 one Belonging to an Empire • 21 Race and Rights two Suspicious Affi nities • 52 Loyal Subjectivity and the Paternalist Public three Th e Will to Freedom • 94 Spanish Allegiances in the Ten Years’ War four Publicizing Loyalty • 128 Race and the Post- Zanjón Public Sphere five “Long Live Spain! Death to Autonomy!” • 158 Liberalism and Slave Emancipation six Th e Price of Integrity • 187 Limited Loyalties in Revolution Conclusion Subject Citizens and the Tragedy of Loyalty • 217 Notes • 227 Bibliography • 271 Index • 305 preface To visit the Palace of the Captain General on Havana’s Plaza de Armas today is to witness the most prominent stone- and mortar monument to the endur- ing history of Spanish colonial rule in Cuba. -

Beatitudes of a Dad

BEATITUDES OF A DAD FATHER’S DAY 2007 Written by Fr. Richard J. Bartoszek IN HONOR OF MY DAD, STEP-DAD AND GRANDDADS Blessed be the man who God choose to be a parent, a teacher, a protector, a provider, a role model and a motivator, He shall be called Dad. Blessed be DAD as he holds each of his children for the first time and realizes the gift that God has entrusted to him. Blessed be DAD as he changes his first diaper which leaks, is home for the first time with a baby and is scarred but with all his pride never shows it. Instead he prays someone comes home soon. Blessed be DAD as he checks the babies in the night, checks on them before leaving for work and can’t wait to get home from work to hold the gift of life he would do anything for. Blessed be DAD for the bad dreams he woke us up from, the boogie men and monsters he chased away and the many times he told us, “Don’t worry, I’m here and will always be.” Blessed be DAD for the Christmas Eves he stayed up all night putting toys together, the Halloweens he took us trick or treating, and the parades he let us sit on his shoulders so we could see. Blessed be DAD for ice cream cones on hot summer days, hugs on cold winter nights kisses at bedtime and a shoulder to cry on when his child’s heart was broken. Blessed be DAD for the puppies and kitties he let us have as long as we took care of them and then as they grew up from being cute and cuddly they became his pets. -

Virtual Communities in the Buffyerse

Buffy, Angel, and the Creation of Virtual Communities By Mary Kirby Diaz Professor, Sociology-Anthropology Department Farmingdale State University of New York Abstract The Internet has provided a powerful medium for the creation of virtual communities. In the case of Buffy the Vampire Slayer and Angel: the Series, the community is comprised of fans whose commonality is their love of the universe created by the producers, writers, cast and crew of these two television series. This paper will explore the current status of the major ongoing communities of Buffy and Angel fans, and the support that binds them into a “real” virtual community. “The Internet, you know... The bitch goddess that I love and worship and hate. You know, we found out we have a fan base on the Internet. They came together as a family on the Internet, a huge, goddamn deal. It's so important to everything the show has been and everything the show has done – I can't say enough about it.' (http://filmforce.ign.com/articles/425/425492p10.html: IGGN. Introduction [1]This is the first of a projected series of short sociological studies dealing with the general subject of the Buffyverse fandom. Subsequent project topics include (1) canonical and non-canonical love in the Buffyverse (Bangels, Spuffies, Spangels, etc.), (2) fanfiction (writers and readers), (3) unpopular canonical decisions, (4) a review of the relevant literature on fandom, (5) the delineation of character loyalty, (6) the fancon, (7) the Buffyverse as entrepreneur, and (8) predictions about the Buffista and Angelista fandom over the next five years. -

Angel's First Loyalty Card Goes Live!

Angel’s first loyalty 33/ card goes live! In response to huge business demand we’re proud to present.... 15 Swipii, the Angel’s first loyalty card. We’ve signed up everyone’s favourite independent shops and eateries offering coffee, lunch, drinks and dinner, plus flowers, cosmetics, electricals and toys, with rewards you actually like! To get started, just pick up a card from one of these 20 businesses Pizzeria Oregano, Cuppacha bubble tea, After Noah, Angel Deli, Angel NEWS Flowers, L’Erbolario Italian natural beauty products, Tenshi Japanese, Snappy Snaps, Colibri fashion boutique, Angel Inn cafe, The Old Red Lion, Rayshack electrical, 5 Star dry cleaners, Chilango, Amorino Italian The newsletter from gelataria, Chana chemist, Diverse boutique, Radicals & Victuallers, Angel Business Tatami Health and Kimantra Spa. Improvement District Swipii works with one swipe of a card or a phone app on an iPad as you pay at the counter. Each business designs their own reward scheme but you only need one card for everything at the Angel - and it works across London too. “We’ve had requests for a loyalty scheme from businesses, and people working and living here, and we’re delighted to have found Swipii which is quick and easy to use,” says angel.london Chief Executive Christine Lovett. “It’s all about rewarding customer loyalty to everyone’s favourite brands and keeping the quirky independent flavour of businesses at the Angel, which brings people back time and again.” Don’t miss out - contact us for cards or to sign up your business 020 7288 4377 or [email protected] www.swipiicard Has your business Leap into dance – it’s a won an award? Tell us and we’ll tell stone’s throw away everyone else. -

The Third Angel's Message, and Proclaimed It in the Power of the Holy Spirit, the Lord Would Have Wrought Mightily with Their Efforts

The Third Angel’s Message (1897) February 9, 1897 The Spirit of Prophecy. - No. 1. A. T. Jones (Tuesday Forenoon, Feb. 9, 1897.) I SUPPOSE there is no one in this room who does not think but that he truly believes in the Spirit of Prophecy; that is, that the Spirit of Prophecy belongs to the church,-to this message as is manifested through Sister White, and that these things are believed, professedly believed at least, so far as the idea and the Scriptures that prove that such things are a part of this work. But that is not where the trouble lies, for we are in trouble now. If we do not know it, we are much worse off than if we were in trouble and did know it. And more than that, the cause of God, as well as you and I, are in such trouble that we are in danger day by day of incurring the wrath of God because we are where we are. The Lord tells us that more than once, and he tells us how we got there, and he tells us how to get out of it. And the only thing I know how to tell you here, is to study the Spirit of Prophecy, and get out of it what you need. That is only one of the statements that is made. In knowing these statements, and having known them for some time, I would have been glad to stay at home and go on with the work there, because there is so much to be done and so many involved.