Bombay Burmah Trading Corp. Ltd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Go Air – an Airline Operations Review

International Journal of Scientific Research and Engineering Development-– Volume 3 Issue 2, Mar-Apr 2020 Available at www.ijsred.com RESEARCH ARTICLE OPEN ACCESS Go Air – An Airline Operations Review Anuj Modgil*, Kanishk Rastogi**, Mohit Mohan Saxena***, Epari Shravan****, Prof. Vidhya Srinivas***** *(Student, Universal Business School, Mumbai Email: [email protected]) ** (Student, Universal Business School, Mumbai Email :[email protected]) ***(Student, Universal Business School, Mumbai Email: [email protected]) **** (Student, Universal Business School, Mumbai Email : [email protected]) ***** (Professor, Universal Business School, Mumbai Email : [email protected]) ---------------------------------------- ************************ ---------------------------------- Abstract: GoAir is an international carrier based in Mumbai, Maharashtra, India. It is a low-cost carrier, owned by Wadia Group. The airline company has 9% market share in the Indian domestic carrier market. GoAir started its operations back in 2005 with the first flight being operated on Mumbai - Ahmedabad sector on 4 - November - 2005. The airline was one of the first in India to operate the Airbus A320 aircraft in an all economy setup. Initially GoAir operated just a single aircraft and was able to cover four destinations across India. As of January 2019, GoAir owned a fleet of 48 Airbus A320 aircrafts with 114 more on order. The airline operates 230+ daily flights which are spread across 26 destinations (24 domestic and 2 international). This paper is an operations review of the airlines. Keywords —GoAir, Airlines, Aviation, Operations, Management, Fleet, Airport, Industry . ---------------------------------------- ************************ ---------------------------------- next set of passengers are ready to board the aircraft I. INTRODUCTION for the next destination on the route. This gives a GoAir has a reputation of being Slow, Very Slow mere 20 minutes to the ground staff to prepare the in expanding its business. -

Press Release the Bombay Burmah Trading Corporation

Press Release The Bombay Burmah Trading Corporation Limited April 3, 2020 Ratings Facilities Amount Rating1 Rating Action (Rs. crore) Long term Bank Facilities 7.11 CARE AA; Stable Reaffirmed (Double A; Outlook: Stable) Long term Bank Facilities 49.00 CARE AA; Stable Reaffirmed (enhanced from 29.00) (Double A; Outlook: Stable) Short-term Bank Facilities 1.00 CARE A1+ Reaffirmed (A One Plus) Total 57.11 (Rs. Fifty Seven Crore and Eleven Lakhs only) Details of instruments/facilities in Annexure-1 Detailed Rationale & Key Rating Drivers The reaffirmation of ratings assigned to the bank facilities of The Bombay Burmah Trading Corporation Limited (BBTCL) continues to derive strength from it being one of the holding company of Wadia Group. BBTCL has equity investments in group companies like Britannia Industries Limited (BIL) and The Bombay Dyeing & Manufacturing Company Limited (BMCL) that have significant market value. The rating also factors in the reputed and well-established promoter group, its presence in diversified businesses, expected monetization of real estate assets towards reduction of debt and issuance of NCDs to refinance its existing term loan facilities. However, these rating strengths continue to be partially offset by moderation in operational performance resulting in moderate financial risk profile in FY19 (refers to period April 01, to March 31,) and 9MFY20 (April 01 to December 31). Any large debt fund capital expenditure impacting financial risk profile of the company, dilution of stake in BIL, ability to recover the inter-corporate deposits (ICDs) from its group companies in a timely manner and delay in monetization of real estate assets would be key rating sensitivities. -

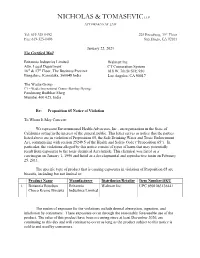

Nicholas & Tomasevicllp

NICHOLAS & TOMASEVIC LLP ATTORNEYS AT LAW Tel: 619-325-0492 225 Broadway, 19th Floor Fax: 619-325-0496 San Diego, CA 92101 January 22, 2021 Via Certified Mail Britannia Industries Limited Walmart Inc. Attn. Legal Department CT Corporation System 16th & 17th Floor, The Business Precinct 818 W. 7th St STE 930 Bangalore, Karnataka, 560048 India Los Angeles, CA 90017 The Wadia Group C1 – Wadia International Centre (Bombay Dyeing) Pandurang Budhkar Marg Mumbai 400 025, India Re: Proposition 65 Notice of Violation To Whom It May Concern: We represent Environmental Health Advocates, Inc., an organization in the State of California acting in the interest of the general public. This letter serves as notice that the parties listed above are in violation of Proposition 65, the Safe Drinking Water and Toxic Enforcement Act, commencing with section 25249.5 of the Health and Safety Code (“Proposition 65”). In particular, the violations alleged by this notice consist of types of harm that may potentially result from exposures to the toxic chemical Acrylamide. This chemical was listed as a carcinogen on January 1, 1990 and listed as a developmental and reproductive toxin on February 25, 2011. The specific type of product that is causing exposures in violation of Proposition 65 are biscuits, including but not limited to: Product Name Manufacturer Distributor/Retailer Item Number/SKU 1. Britannia Bourbon Britannia Walmart Inc. UPC 8901063136441 Choco Kreme Biscuits Industries Limited The routes of exposure for the violations include dermal absorption, ingestion, and inhalation by consumers. These exposures occur through the reasonably foreseeable use of the product. The sales of this product have been occurring since at least December 2020, are continuing to this day and will continue to occur as long as the product subject to this notice is sold to and used by consumers. -

A Historical Overview of the Parsi Settlement in Navsari 62 9

Samuel Jordan Center for Persian Studies and Culture www.dabirjournal.org Digital Archive of Brief notes & Iran Review ISSN: 2470-4040 Vol.01 No.04.2017 1 xšnaoθrahe ahurahe mazdå Detail from above the entrance of Tehran’s fire temple, 1286š/1917–18. Photo by © Shervin Farridnejad The Digital Archive of Brief Notes & Iran Review (DABIR) ISSN: 2470-4040 www.dabirjournal.org Samuel Jordan Center for Persian Studies and Culture University of California, Irvine 1st Floor Humanities Gateway Irvine, CA 92697-3370 Editor-in-Chief Touraj Daryaee (University of California, Irvine) Editors Parsa Daneshmand (Oxford University) Arash Zeini (Freie Universität Berlin) Shervin Farridnejad (Freie Universität Berlin) Judith A. Lerner (ISAW NYU) Book Review Editor Shervin Farridnejad (Freie Universität Berlin) Advisory Board Samra Azarnouche (École pratique des hautes études); Dominic P. Brookshaw (Oxford University); Matthew Canepa (University of Minnesota); Ashk Dahlén (Uppsala University); Peyvand Firouzeh (Cambridge University); Leonardo Gregoratti (Durham University); Frantz Grenet (Collège de France); Wouter F.M. Henkelman (École Pratique des Hautes Études); Rasoul Jafarian (Tehran University); Nasir al-Ka‘abi (University of Kufa); Andromache Karanika (UC Irvine); Agnes Korn (Goethe Universität Frankfurt am Main); Lloyd Llewellyn-Jones (University of Edinburgh); Jason Mokhtarain (University of Indiana); Ali Mousavi (UC Irvine); Mahmoud Omidsalar (CSU Los Angeles); Antonio Panaino (Univer- sity of Bologna); Alka Patel (UC Irvine); Richard Payne (University of Chicago); Khodadad Rezakhani (Princeton University); Vesta Sarkhosh Curtis (British Museum); M. Rahim Shayegan (UCLA); Rolf Strootman (Utrecht University); Giusto Traina (University of Paris-Sorbonne); Mohsen Zakeri (Univer- sity of Göttingen) Logo design by Charles Li Layout and typesetting by Kourosh Beighpour Contents Articles & Notes 1. -

Assets Management Efficiency of Indian Textile Companies - a Comparative Analysis

IJRIM Volume 6, Issue 4 (April, 2016) (ISSN 2231-4334) International Journal of Research in IT & Management (IMPACT FACTOR – 5.96) Assets Management Efficiency of Indian Textile companies - A Comparative Analysis Dr. B. MADHUSUDHAN REDDY Professor in Finance Department of Management Studies, Guru Nanak Institute of Technology, Hyderabad, India ABSTRACT The Textile Sector in India ranks next to Agriculture. Textile is one of India’s oldest industries and has a formidable presence in the national economy. The textile industry occupies a unique place in our country. One of the earliest to come into existence in India, it accounts for 14% of the total Industrial production, contributes to nearly 27% of the total exports and is the second largest employment generator after agriculture. Like other organizations, all textile companies keep various assets such as inventory, debtors, fixed assets, investments etc. to carry out the business operations effectively and efficiently. However, managing these assets effectively is a crucial thing. Asset Management Ratios attempt to measure the firm's success in managing its assets to generate sales. These ratios can provide insight into the success of the firm's credit policy and inventory management. These ratios are also known as Activity or Turnover Ratios. This paper represents an empirical study which examines the assets management in textile companies in India with a data of 5 years. For the purpose of the study secondary data is used. For the purpose of analysis ratios and arithmetic mean have been used and to test hypothesis, ANOVA test (F test) has been applied. Key words: Assets management, Inventory turnover ratio, Debtors turnover ratio, Fixed assets turnover ratio, Total assets turnover ratio and ANOVA test. -

Britannia Industries Limited

BRITANNIA INDUSTRIES LIMITED (Corporate Identity Number: L15412WB1918PLC002964) Registered Office: 5/1A, Hungerford Street, Kolkata - 700 017 Phone : 033 22872439/2057; 080 39400080 Fax : 033 22872501; 080 25063229 Website: www.britannia.co.in E-mail ID: [email protected] NOTICE Notice is hereby given that the Ninety-sixth Annual General NOTES: Meeting (AGM) of the Members of Britannia Industries a. A MEMBER ENTITLED TO ATTEND AND VOTE Limited will be held on Tuesday, 4 August 2015, at 11 a.m. AT THE MEETING IS ENTITLED TO APPOINT A at the Hyatt Regency, JA-1, Sector 3, Salt Lake City, Kolkata - 700 098 to transact the following business: PROXY/ PROXIES TO ATTEND AND VOTE INSTEAD OF HIMSELF/HERSELF. SUCH A PROXY/ PROXIES ORDINARY BUSINESS: NEED NOT BE A MEMBER OF THE COMPANY. 1. To receive, consider and adopt the Audited Statement of Profit and Loss for the Financial Year ended 31 March A person can act as proxy on behalf of Members not 2015 and the Balance Sheet as on that date and the exceeding fifty (50) and holding in the aggregate not Reports of the Directors and the Auditors thereon. more than ten percent of the total Share Capital of the 2. To declare dividend for the Financial Year ended Company. In case a proxy is proposed to be appointed 31 March 2015. by a Member holding more than 10% of the total Share Capital of the Company carrying voting rights, 3. To appoint a Director in place of Mr. Ness N Wadia (holding DIN: 00036049), who retires by rotation in then such proxy shall not act as a proxy for any other terms of Section 152(6) of the Companies Act, 2013 and person or Member. -

Modern Indian Business History: a Bibliographic Survey

Modern Indian Business History: A Bibliographic Survey N. Benjamin and Prabhash Narayana Rath Gokhale Institute of Politics and Economics Pune 411004. Abstract Business history has been a neglected area in both Economics and History due to various reasons. However, some scholars have attempted to write books on business history basing upon whatever material they could lay their hands on, whereas some others have written individual corporate histories, which are usually sympathetic accounts of the perspective corporate houses and are of restricted circulation. Realising the importance of business history accounts for proper understanding of the overall business and economic scenario of India, an attempt has been made to present a bibliographic survey of business history books in English language pertaining to the colonial and modern period. The paper aimed at presenting a comprehensive account of the books of the following types: viz. general business histories; industrial histories; in-house histories of different companies; souvenirs of the various chambers of commerce and industry; histories of the business houses; accounts of the business communities; and biographies and autobiographies of the businessmen. In the study, more than 550 books have been covered under eight sections each representing one of the above-mentioned types of business histories. Business History has been a neglected area in both Economics and History. One reason for this has been the dearth of source material. Many businessmen like Naval H. Tata willed that their papers be torn to pieces and burned after they passed away. Corporate managements have also allowed the papers to be destroyed rather than preserved once a monograph or book was written based on them. -

A Tradition of Trust in the Form of the Lancastrian Rose

Book-Post The Bombay Burmah Trading Corporation, Ltd. A Wadia Enterprise The Wadia Group The Group has scaled great heights in innovation and entrepreneurship, inspired by the centuries- old legacy of goodwill and trust. The British Coat of Arms, granted to Nowrosjee Wadia, symbolises this legacy and the Wadia group’s commitment to advancement and innovation. The crest is a representation of the Group, its philosophy, beliefs and businesses. The crest and base of the shield represent the family origins in the shipbuilding industry during the 1700s. The middle and upper parts of the shield depict the Group’s interests in cotton growing and its links with England A Tradition of Trust in the form of the Lancastrian rose. The hand holding the hammer atop the shield signifies industriousness, together with workmanship and skill. The sun that surrounds the hand stands for global recognition and merit. The motto, IN DEO FIDE ET PERSEVERANTIA means ‘Trust in God and Perseverance’. http://www.wadiagroup.com/ If undelivered, please return to : The Bombay Burmah Trading Corporation, Ltd. 9, Wallace Street, Fort, Mumbai 400 001 vakils Cover.indd 1 7/17/2014 9:58:31 PM THE WADIA GROUP Contents PLANTATIONS FOODS Location of Corporation’s Estates and Factories 2 Notice of Annual General Meeting 3-15 Bombay Burmah Directors’ Report 16-23 SINCE 1863 SINCE 1918 Management Discussion and Analysis 24-28 Corporate Governance Report 29-40 TEXTILES REAL ESTATE Auditors’ Report 41-45 Financial Statements - Standalone 46-49 SINCE 1879 Notes forming part of Standalone Financial Statements 50-83 Auditors’ Report on Consolidated Financial Statements 84-85 SINCE 2011 Consolidated Financial Statements 86-89 AVIATION ENGINEERING & CHEMICALS Notes forming part of the Consolidated Financial Statements 90-131 Summarised Statement of Financials of 132-137 Subsidiary Companies 10 Years’ Financial Review 138 SINCE 1960 SINCE 1954 SINCE 2005 149th Annual General Meeting Wednesday, 13th August 2014, 4 pm; Y B Chavan Auditorium, Gen Jagannath Bhosle Marg, Nariman Point, Mumbai – 400 021. -

Annual Report 2020-21 5

CORPORATE INFORMATION Bombay Dyeing is an iconic brand with deeply rooted DIRECTORS REGISTERED OFFICE REGISTRAR & TRANSFER AGENT aspirational values in each of its product offerings. Our Nusli N. Wadia, Chairman Neville House, J. N. Heredia Marg, Ballard Estate, Mumbai-400 001. KFin Technologies Private Limited endeavour would be to make our brand, products as well S. Ragothaman as the overall experience, ‘Young, contemporary and Unit: Bombay Dyeing ever-evolving’ in the eyes of our consumers. Ness N. Wadia CORPORATE OFFICE: Selenium Building, Tower B, V. K. Jairath C-1, Wadia International Center, Plot 31-32, Gachibowli, Besides strengthening our traditional core values of Keki M. Elavia Pandurang Budhkar Marg, Financial District, Nanakramguda, Worli, Mumbai-400 025. Hyderabad, superior quality and unparalleled product range for Minnie Bodhanwala consumers cutting across different social spectra, our (CIN: L17120MH1879PLC000037) Telangana - 500 032, India. focus will be to grow our consumer franchise. We will do Sunil S. Lalbhai Email: grievance_redressal_cell@ Telephone number: +91 40 6716 2222 Fax number: +91 40 2342 0814 so through product innovations, offerings that cater to Gauri Kirloskar bombaydyeing.com E-mail: [email protected] diverse consumer preferences and by expanding product Phone: (91) (22) 6662 0000 Website: www.kfintech.com availability on multi-channel platforms. Fax: (91) (22) 6662 0069 CHIEF EXECUTIVE OFFICER Website: www.bombaydyeing.com KFin Technologies Private Limited With the economic outlook positive and lower interest Suresh Khurana (PSF) Unit: Bombay Dyeing 24-B, rates, the real estate market too will witness improved AUDITORS Raja Bahadur Mansion, demand. This year will see the completion of key CHIEF FINANCIAL OFFICER Messrs. -

Sanjive Arora Chief Financial Officer Company Secretary

17th November, 2020 BSE Limited National Stock Exchange of India Ltd. Phiroze Jeejeebhoy Towers, Exchange Plaza, 5th floor, Dalal Street, Plot No.C/1, ‘G’ Block, Mumbai – 400 001 Bandra-Kurla Complex, Bandra (E), BSE Scrip Code: 500020 Mumbai – 400 051 NSE Symbol: BOMDYEING Dear Sirs, Sub: Disclosure of Related Party Transactions for the half year ended 30st September, 2020. Ref: Reg. 23 (9) of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015. In compliance with the Regulation 23(9) of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, we are enclosing herewith the disclosure of Related Party Transactions prepared in accordance with the applicable accounting standards for the half year ended 30st September, 2020. You are requested to take note of the above. Yours Faithfully, For The Bombay Dyeing and Manufacturing Company Limited Hitesh Vora Sanjive Arora Chief Financial Officer Company Secretary Encl: As above CC: National Securities Depository Ltd., Trade World, 4th Floor, Kamala Mills Compound, Lower Parel, Mumbai - 400 013. Central Depository Services (India) Ltd., Phiroze Jeejeebhoy Towers, 16th Floor, Dalal Street, Mumbai- 400 023 Bourse de Luxembourge, Societe de La Bourse de Luxembourg, Societe Anonyme, R. C. 36222, BP 165, L- 2011, LUXEMBOURG. Citibank N.A., DR Account Management, Citigroup Corporate & Investment Bank, 14th Floor, 388, Greenwich Street, NEWYORK, NY (USA) 10013. M/s KFin Technologies Pvt. Ltd. Selenium Building, Tower B, Plot 31-32, Gachibowli, Financial District, Nanakramguda, Hyderabad - 500 032 THE BOMBAY DYEING AND MANUFACTURING COMPANY LIMITED (A) List of Related Parties where control exists: % Shareholding and Voting Power Name of the Related Party Principal Place of Business As at As at September 30, September 30, 2020 2019 i. -

Go Airlines (India) Limited Go Airlines (India) Limited Regd

Go Airlines (India) Limited Go Airlines (India) Limited Regd. Office: C/o Britannia Industries Limited, A‐33 Lawrence Road Industrial Area, New Delhi‐110035 Corporate Office: C‐1, Wadia International Center (WIC), Pandurang Budhkar Marg, Worli, Mumbai‐400025 CIN: U63013DL2004PLC217305 Phone: +91 22 6741000; Fax: +91 22 67410001, Website: www.GoAir.in NOTICE Notice is hereby given that the 12th Annual General Meeting of the Members of Go Airlines (India) Limited will be held at 56, Jor Bagh, New Delhi – 110001 on Thursday, 22nd September 2016 at 12:30 p.m. to transact the following business: ORDINARY BUSINESS 1. To receive, consider and adopt the Audited Financial Statements of the Company for the Financial Year ended 31st March 2016, the reports of the Board of Directors and Auditors thereon; 2. To appoint a Director in place of Mr. Ness N. Wadia (DIN:00036049), who retires by rotation in terms of section 152(6) of the Companies Act, 2013 and being eligible, offers himself for re-appointment; and 3. To ratify the appointment of Auditors and to fix their remuneration and in this regard to consider and, if thought fit, to pass with or without modification(s), the following resolution as an Ordinary Resolution: “RESOLVED THAT, pursuant to the provisions of Sections 139, 142 and other applicable provisions, if any, of the Companies Act, 2013 read with the Companies (Audit and Auditors) Rules, 2014, including any statutory modification(s) or re- enactment(s) thereof for the time being in force, and pursuant to the resolution passed by the members in the Annual General Meeting of the Company held on 12th September, 2014, consent of the members be and is hereby accorded to ratify the appointment of M/s. -

The Bombay Burmah Trading Corporation, Ltd. Journey of Success

Book-Post The Bombay Burmah Trading Corporation, Ltd. A Wadia Enterprise The Wadia Group Annual Report 2012-2013 The Group has scaled great heights in innovation and entrepreneurship, inspired by the centuries-old legacy of goodwill and trust. The British Coat of Arms, granted to Nowrosjee Wadia, symbolises this legacy and the Wadia group’s commitment to advancement and innovation. The crest is a representation of the Group, its philosophy, beliefs and businesses. The crest and base of the shield represent the family origins in the shipbuilding industry during the 1700s. The middle and upper parts of the shield depict the Group’s interests in cotton growing and its links with England in the form of the Lancastrian rose. The hand holding the hammer atop the shield signifies industriousness, together with workmanship 1863 2013 and skill. The sun that surrounds the hand stands for global recognition and merit. Journey of Success The motto, IN DEO FIDE ET PERSEVERANTIA means ‘Trust in God and Perseverance’. http://www.wadiagroup.com/ If undelivered, please return to : The Bombay Burmah Trading Corporation, Ltd. 9, Wallace Street, Fort, Mumbai 400 001 vakils Plantations The Bombay Burmah Trading Corporation, Ltd. A 150 year legacy built on Credibility, Trust and Integrity. An Organization that balances commercial objectives with environmental and social responsibilities to generate enduring value for all its stakeholders. Elkhill Coffee Oothu Organic Chairman’s Message Dear Shareholders, On 3rd September 2013 your Company will achieve the distinction of being the first Indian Company to complete 150 years as a company listed on BSE. Through these long years, the Corporation has witnessed many challenging situations including two World Wars, the Great Depression, the independence of our country, the emergence of the European Union and the rise of the tiger economies in the East.