Strategy, Conflict and Cooperation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Determinants of Efficient Behavior in Coordination Games

The Determinants of Efficient Behavior in Coordination Games Pedro Dal B´o Guillaume R. Fr´echette Jeongbin Kim* Brown University & NBER New York University Caltech May 20, 2020 Abstract We study the determinants of efficient behavior in stag hunt games (2x2 symmetric coordination games with Pareto ranked equilibria) using both data from eight previous experiments on stag hunt games and data from a new experiment which allows for a more systematic variation of parameters. In line with the previous experimental literature, we find that subjects do not necessarily play the efficient action (stag). While the rate of stag is greater when stag is risk dominant, we find that the equilibrium selection criterion of risk dominance is neither a necessary nor sufficient condition for a majority of subjects to choose the efficient action. We do find that an increase in the size of the basin of attraction of stag results in an increase in efficient behavior. We show that the results are robust to controlling for risk preferences. JEL codes: C9, D7. Keywords: Coordination games, strategic uncertainty, equilibrium selection. *We thank all the authors who made available the data that we use from previous articles, Hui Wen Ng for her assistance running experiments and Anna Aizer for useful comments. 1 1 Introduction The study of coordination games has a long history as many situations of interest present a coordination component: for example, the choice of technologies that require a threshold number of users to be sustainable, currency attacks, bank runs, asset price bubbles, cooper- ation in repeated games, etc. In such examples, agents may face strategic uncertainty; that is, they may be uncertain about how the other agents will respond to the multiplicity of equilibria, even when they have complete information about the environment. -

Lecture 4 Rationalizability & Nash Equilibrium Road

Lecture 4 Rationalizability & Nash Equilibrium 14.12 Game Theory Muhamet Yildiz Road Map 1. Strategies – completed 2. Quiz 3. Dominance 4. Dominant-strategy equilibrium 5. Rationalizability 6. Nash Equilibrium 1 Strategy A strategy of a player is a complete contingent-plan, determining which action he will take at each information set he is to move (including the information sets that will not be reached according to this strategy). Matching pennies with perfect information 2’s Strategies: HH = Head if 1 plays Head, 1 Head if 1 plays Tail; HT = Head if 1 plays Head, Head Tail Tail if 1 plays Tail; 2 TH = Tail if 1 plays Head, 2 Head if 1 plays Tail; head tail head tail TT = Tail if 1 plays Head, Tail if 1 plays Tail. (-1,1) (1,-1) (1,-1) (-1,1) 2 Matching pennies with perfect information 2 1 HH HT TH TT Head Tail Matching pennies with Imperfect information 1 2 1 Head Tail Head Tail 2 Head (-1,1) (1,-1) head tail head tail Tail (1,-1) (-1,1) (-1,1) (1,-1) (1,-1) (-1,1) 3 A game with nature Left (5, 0) 1 Head 1/2 Right (2, 2) Nature (3, 3) 1/2 Left Tail 2 Right (0, -5) Mixed Strategy Definition: A mixed strategy of a player is a probability distribution over the set of his strategies. Pure strategies: Si = {si1,si2,…,sik} σ → A mixed strategy: i: S [0,1] s.t. σ σ σ i(si1) + i(si2) + … + i(sik) = 1. If the other players play s-i =(s1,…, si-1,si+1,…,sn), then σ the expected utility of playing i is σ σ σ i(si1)ui(si1,s-i) + i(si2)ui(si2,s-i) + … + i(sik)ui(sik,s-i). -

Essays on Equilibrium Asset Pricing and Investments

Institute of Fisher Center for Business and Real Estate and Economic Research Urban Economics PROGRAM ON HOUSING AND URBAN POLICY DISSERTATION AND THESIS SERIES DISSERTATION NO. D07-001 ESSAYS ON EQUILIBRIUM ASSET PRICING AND INVESTMENTS By Jiro Yoshida Spring 2007 These papers are preliminary in nature: their purpose is to stimulate discussion and comment. Therefore, they are not to be cited or quoted in any publication without the express permission of the author. UNIVERSITY OF CALIFORNIA, BERKELEY Essays on Equilibrium Asset Pricing and Investments by Jiro Yoshida B.Eng. (The University of Tokyo) 1992 M.S. (Massachusetts Institute of Technology) 1999 M.S. (University of California, Berkeley) 2005 A dissertation submitted in partial satisfaction of the requirements for the degree of Doctor of Philosophy in Business Administration in the GRADUATE DIVISION of the UNIVERSITY OF CALIFORNIA, BERKELEY Committee in charge: Professor John Quigley, Chair Professor Dwight Ja¤ee Professor Richard Stanton Professor Adam Szeidl Spring 2007 The dissertation of Jiro Yoshida is approved: Chair Date Date Date Date University of California, Berkeley Spring 2007 Essays on Equilibrium Asset Pricing and Investments Copyright 2007 by Jiro Yoshida 1 Abstract Essays on Equilibrium Asset Pricing and Investments by Jiro Yoshida Doctor of Philosophy in Business Administration University of California, Berkeley Professor John Quigley, Chair Asset prices have tremendous impacts on economic decision-making. While substantial progress has been made in research on …nancial asset prices, we have a quite limited un- derstanding of the equilibrium prices of broader asset classes. This dissertation contributes to the understanding of properties of asset prices for broad asset classes, with particular attention on asset supply. -

Lecture Notes

GRADUATE GAME THEORY LECTURE NOTES BY OMER TAMUZ California Institute of Technology 2018 Acknowledgments These lecture notes are partially adapted from Osborne and Rubinstein [29], Maschler, Solan and Zamir [23], lecture notes by Federico Echenique, and slides by Daron Acemoglu and Asu Ozdaglar. I am indebted to Seo Young (Silvia) Kim and Zhuofang Li for their help in finding and correcting many errors. Any comments or suggestions are welcome. 2 Contents 1 Extensive form games with perfect information 7 1.1 Tic-Tac-Toe ........................................ 7 1.2 The Sweet Fifteen Game ................................ 7 1.3 Chess ............................................ 7 1.4 Definition of extensive form games with perfect information ........... 10 1.5 The ultimatum game .................................. 10 1.6 Equilibria ......................................... 11 1.7 The centipede game ................................... 11 1.8 Subgames and subgame perfect equilibria ...................... 13 1.9 The dollar auction .................................... 14 1.10 Backward induction, Kuhn’s Theorem and a proof of Zermelo’s Theorem ... 15 2 Strategic form games 17 2.1 Definition ......................................... 17 2.2 Nash equilibria ...................................... 17 2.3 Classical examples .................................... 17 2.4 Dominated strategies .................................. 22 2.5 Repeated elimination of dominated strategies ................... 22 2.6 Dominant strategies .................................. -

Experimental Game Theory and Its Application in Sociology and Political Science

Journal of Applied Mathematics Experimental Game Theory and Its Application in Sociology and Political Science Guest Editors: Arthur Schram, Vincent Buskens, Klarita Gërxhani, and Jens Großer Experimental Game Theory and Its Application in Sociology and Political Science Journal of Applied Mathematics Experimental Game Theory and Its Application in Sociology and Political Science Guest Editors: Arthur Schram, Vincent Buskens, Klarita Gërxhani, and Jens Großer Copyright © òýÔ Hindawi Publishing Corporation. All rights reserved. is is a special issue published in “Journal of Applied Mathematics.” All articles are open access articles distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. Editorial Board Saeid Abbasbandy, Iran Song Cen, China Urmila Diwekar, USA Mina B. Abd-El-Malek, Egypt Tai-Ping Chang, Taiwan Vit Dolejsi, Czech Republic Mohamed A. Abdou, Egypt Shih-sen Chang, China BoQing Dong, China Subhas Abel, India Wei-Der Chang, Taiwan Rodrigo W. dos Santos, Brazil Janos Abonyi, Hungary Shuenn-Yih Chang, Taiwan Wenbin Dou, China Sergei Alexandrov, Russia Kripasindhu Chaudhuri, India Rafael Escarela-Perez, Mexico M. Montaz Ali, South Africa Yuming Chen, Canada Magdy A. Ezzat, Egypt Mohammad R, Aliha, Iran Jianbing Chen, China Meng Fan, China Carlos J. S. Alves, Portugal Xinkai Chen, Japan Ya Ping Fang, China Mohamad Alwash, USA Rushan Chen, China István Faragó, Hungary Gholam R. Amin, Oman Ke Chen, UK Didier Felbacq, France Igor Andrianov, Germany Zhang Chen, China Ricardo Femat, Mexico Boris Andrievsky, Russia Zhi-Zhong Chen, Japan Antonio J. M. Ferreira, Portugal Whye-Teong Ang, Singapore Ru-Dong Chen, China George Fikioris, Greece Abul-Fazal M. -

Coalitional Stochastic Stability in Games, Networks and Markets

Coalitional stochastic stability in games, networks and markets Ryoji Sawa∗ Department of Economics, University of Wisconsin-Madison November 24, 2011 Abstract This paper examines a dynamic process of unilateral and joint deviations of agents and the resulting stochastic evolution of social conventions in a class of interactions that includes normal form games, network formation games, and simple exchange economies. Over time agents unilater- ally and jointly revise their strategies based on the improvements that the new strategy profile offers them. In addition to the optimization process, there are persistent random shocks on agents utility that potentially lead to switching to suboptimal strategies. Under a logit specification of choice prob- abilities, we characterize the set of states that will be observed in the long-run as noise vanishes. We apply these results to examples including certain potential games and network formation games, as well as to the formation of free trade agreements across countries. Keywords: Logit-response dynamics; Coalitions; Stochastic stability; Network formation. JEL Classification Numbers: C72, C73. ∗Address: 1180 Observatory Drive, Madison, WI 53706-1393, United States., telephone: 1-608-262-0200, e-mail: [email protected]. The author is grateful to William Sandholm, Marzena Rostek and Marek Weretka for their advice and sugges- tions. The author also thanks seminar participants at University of Wisconsin-Madison for their comments and suggestions. 1 1 Introduction Our economic and social life is often conducted within a group of agents, such as people, firms or countries. For example, firms may form an R & D alliances and found a joint research venture rather than independently conducting R & D. -

Introduction to Game Theory Lecture 1: Strategic Game and Nash Equilibrium

Game Theory and Rational Choice Strategic-form Games Nash Equilibrium Examples (Non-)Strict Nash Equilibrium . Introduction to Game Theory Lecture 1: Strategic Game and Nash Equilibrium . Haifeng Huang University of California, Merced Shanghai, Summer 2011 . • Rational choice: the action chosen by a decision maker is better or at least as good as every other available action, according to her preferences and given her constraints (e.g., resources, information, etc.). • Preferences (偏好) are rational if they satisfy . Completeness (完备性): between any x and y in a set, x ≻ y (x is preferred to y), y ≻ x, or x ∼ y (indifferent) . Transitivity(传递性): x ≽ y and y ≽ z )x ≽ z (≽ means ≻ or ∼) ) Say apple ≻ banana, and banana ≻ orange, then apple ≻ orange Game Theory and Rational Choice Strategic-form Games Nash Equilibrium Examples (Non-)Strict Nash Equilibrium Rational Choice and Preference Relations • Game theory studies rational players’ behavior when they engage in strategic interactions. • Preferences (偏好) are rational if they satisfy . Completeness (完备性): between any x and y in a set, x ≻ y (x is preferred to y), y ≻ x, or x ∼ y (indifferent) . Transitivity(传递性): x ≽ y and y ≽ z )x ≽ z (≽ means ≻ or ∼) ) Say apple ≻ banana, and banana ≻ orange, then apple ≻ orange Game Theory and Rational Choice Strategic-form Games Nash Equilibrium Examples (Non-)Strict Nash Equilibrium Rational Choice and Preference Relations • Game theory studies rational players’ behavior when they engage in strategic interactions. • Rational choice: the action chosen by a decision maker is better or at least as good as every other available action, according to her preferences and given her constraints (e.g., resources, information, etc.). -

Econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Stör, Lorenz Working Paper Conceptualizing power in the context of climate change: A multi-theoretical perspective on structure, agency & power relations VÖÖ Discussion Paper, No. 5/2017 Provided in Cooperation with: Vereinigung für Ökologische Ökonomie e.V. (VÖÖ), Heidelberg Suggested Citation: Stör, Lorenz (2017) : Conceptualizing power in the context of climate change: A multi-theoretical perspective on structure, agency & power relations, VÖÖ Discussion Paper, No. 5/2017, Vereinigung für Ökologische Ökonomie (VÖÖ), Heidelberg This Version is available at: http://hdl.handle.net/10419/150540 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. https://creativecommons.org/licenses/by-nc-nd/4.0/ www.econstor.eu VÖÖ Discussion Papers VÖÖ Discussion Papers · ISSN 2366-7753 No. -

The Conservation Game ⇑ Mark Colyvan A, , James Justus A,B, Helen M

Biological Conservation 144 (2011) 1246–1253 Contents lists available at ScienceDirect Biological Conservation journal homepage: www.elsevier.com/locate/biocon Special Issue Article: Adaptive management for biodiversity conservation in an uncertain world The conservation game ⇑ Mark Colyvan a, , James Justus a,b, Helen M. Regan c a Sydney Centre for the Foundations of Science, University of Sydney, Sydney, NSW 2006, Australia b Department of Philosophy, Florida State University, Tallahassee, FL 32306, USA c Department of Biology, University of California Riverside, Riverside, CA 92521, USA article info abstract Article history: Conservation problems typically involve groups with competing objectives and strategies. Taking effec- Received 16 December 2009 tive conservation action requires identifying dependencies between competing strategies and determin- Received in revised form 20 September 2010 ing which action optimally achieves the appropriate conservation goals given those dependencies. We Accepted 7 October 2010 show how several real-world conservation problems can be modeled game-theoretically. Three types Available online 26 February 2011 of problems drive our analysis: multi-national conservation cooperation, management of common-pool resources, and games against nature. By revealing the underlying structure of these and other problems, Keywords: game-theoretic models suggest potential solutions that are often invisible to the usual management pro- Game theory tocol: decision followed by monitoring, feedback and revised decisions. The kind of adaptive manage- Adaptive management Stag hunt ment provided by the game-theoretic approach therefore complements existing adaptive management Tragedy of the commons methodologies. Games against nature Ó 2010 Elsevier Ltd. All rights reserved. Common-pool resource management Multi-national cooperation Conservation management Resource management Prisoners’ dilemma 1. -

Transferable Strategic Meta-Reasoning Models

TRANSFERABLE STRATEGIC META-REASONING MODELS BY MICHAEL WUNDER Written under the direction of Matthew Stone New Brunswick, New Jersey October, 2013 ABSTRACT OF THE DISSERTATION TRANSFERABLE STRATEGIC META-REASONING MODELS by MICHAEL WUNDER Dissertation Director: Matthew Stone How do strategic agents make decisions? For the first time, a confluence of advances in agent design, formation of massive online data sets of social behavior, and computational techniques have allowed for researchers to con- struct and learn much richer models than before. My central thesis is that, when agents engaged in repeated strategic interaction undertake a reasoning or learning process, the behavior resulting from this process can be charac- terized by two factors: depth of reasoning over base rules and time-horizon of planning. Values for these factors can be learned effectively from interac- tion and are transferable to new games, producing highly effective strategic responses. The dissertation formally presents a framework for addressing the problem of predicting a population’s behavior using a meta-reasoning model containing these strategic components. To evaluate this model, I explore sev- eral experimental case studies that show how to use the framework to predict ii and respond to behavior using observed data, covering settings ranging from a small number of computer agents to a larger number of human participants. iii Preface Captain Amazing: I knew you couldn’t change. Casanova Frankenstein: I knew you’d know that. Captain Amazing: Oh, I know that. AND I knew you’d know I’d know you knew. Casanova Frankenstein: But I didn’t. I only knew that you’d know that I knew. -

Game Theory Model and Empirical Evidence

UC Irvine UC Irvine Electronic Theses and Dissertations Title Cheap Talk, Trust, and Cooperation in Networked Global Software Engineering: Game Theory Model and Empirical Evidence Permalink https://escholarship.org/uc/item/99z4314v Author Wang, Yi Publication Date 2015 License https://creativecommons.org/licenses/by/4.0/ 4.0 Peer reviewed|Thesis/dissertation eScholarship.org Powered by the California Digital Library University of California UNIVERSITY OF CALIFORNIA, IRVINE Cheap Talk, Trust, and Cooperation in Networked Global Software Engineering: Game Theory Model and Empirical Evidence DISSERTATION submitted in partial satisfaction of the requirements for the degree of DOCTOR OF PHILOSOPHY in Information and Computer Science by Yi Wang Dissertation Committee: Professor David F. Redmiles, Chair Professor Debra J. Richardson Professor Brian Skyrms 2015 Portion of Chapter 4 c 2013 IEEE. All other materials c 2015 Yi Wang DEDICATION To Natural & Intellectual Beauty ii TABLE OF CONTENTS Page LIST OF FIGURES vii LIST OF TABLES ix LIST OF ALGORITHMS x ACKNOWLEDGMENTS xi CURRICULUM VITAE xiii ABSTRACT OF THE DISSERTATION xvi 1 Introduction 1 1.1 Motivating Observations . 3 1.1.1 Empirical Observations . 3 1.1.2 Summary . 6 1.2 Dissertation Outline . 7 1.2.1 Overview of Each Chapter . 7 1.2.2 How to Read This Dissertation . 9 2 Research Overview and Approach 10 2.1 Overall Research Questions . 10 2.2 Research Approach . 11 2.3 Overview of Potential Contributions . 12 3 Backgrounds 14 3.1 Related Work . 14 3.1.1 Trust in Globally Distributed Collaboration . 14 3.1.2 Informal, Non-work-related Communication in SE and CSCW . -

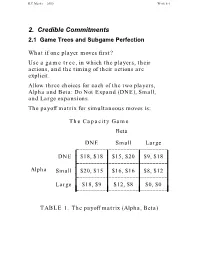

Credible Commitments 2.1 Game Trees and Subgame Perfection

R.E.Marks 2000 Week 8-1 2. Credible Commitments 2.1 Game Trees and Subgame Perfection What if one player moves first? Use a game tree, in which the players, their actions, and the timing of their actions are explicit. Allow three choices for each of the two players, Alpha and Beta: Do Not Expand (DNE), Small, and Large expansions. The payoff matrix for simultaneous moves is: The Capacity Game Beta ________________________________DNE Small Large L L L L DNE $18, $18 $15, $20 $9, $18 _L_______________________________L L L L L L L Alpha SmallL $20, $15L $16, $16L $8, $12 L L________________________________L L L L L L L Large_L_______________________________ $18, $9L $12, $8L $0, $0 L TABLE 1. The payoff matrix (Alpha, Beta) R.E.Marks 2000 Week 8-2 The game tree. If Alpha preempts Beta, by making its capacity decision before Beta does, then use the game tree: Alpha L S DNE Beta Beta Beta L S DNE L S DNE L S DNE 0 12 18 8 16 20 9 15 18 0 8 9 12 16 15 18 20 18 Figure 1. Game Tree, Payoffs: Alpha’s, Beta’s Use subgame perfect Nash equilibrium, in which each player chooses the best action for itself at each node it might reach, and assumes similar behaviour on the part of the other. R.E.Marks 2000 Week 8-3 2.1.1 Backward Induction With complete information (all know what each has done), we can solve this by backward induction: 1. From the end (final payoffs), go up the tree to the first parent decision nodes.