TIO Quarter One 2020 Complaints Report.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2021 NBN Plan Awards Methodology Report

Mozo Experts Choice Awards NBN Plans 2021 This is the third year running that we’ve gathered together countless pieces of information and applied our methodology to find the leading NBN broadband plans in Australia. Product providers don’t pay to be in the running with our awards, and we don’t play favourites. Our judges base their decision on hard-nosed calculations of value to the consumer, using Mozo’s extensive product database and research capacity. We identify the most important features of each product, group each product into like-for-like comparisons, and then calculate which are better value than most or offer market-leading features. This report lists the winners and explains the judging methodology for our 2021 NBN awards. 1 NBN Plans - 2021 Winners Fast (NBN 100) This category assessed Premium plans offering the NBN’s top speeds and no data limits. Accord with Officeworks Super Fast Dodo nbn100 Exetel Premium nbn100 iPrimus Premium Kogan Gold Mate Soul Mates Spintel Premium 100 Tangerine Telecom XXL Speed Boost TPG NBN100 Unlimited Standard Plus (NBN 50) For this category, the judges looked at plans for the middle tier NBN speed, with no limit on data usage. Belong Standard Plus Exetel Standard Plus nbn50 iPrimus Standard Plus Kogan Silver Spintel Plus 50 Tangerine Telecom XL Speed Boost 2 Standard (NBN 25) People looking for a more entry level internet service may not need to high speeds of other tiers, and have lower data usage. In this category, plans with a data limit of at least 500GB could qualify, as long as there was a meaningful price benefit. -

ASX/Media Release

ASX/Media Release 29 March 2017 Sale of Investment in Macquarie Telecom Group Vocus Group Limited (ASX: VOC, ‘Vocus’) today announces that it has disposed of 3,358,511 shares representing ~16% relevant interest in the ordinary shares of Macquarie Telecom Group Limited (ASX: MAQ). The shares were held via a total return swap as described in the FY16 Vocus financial statements. Attached is the Form 605 Notice of ceasing to be a substantial holder. ENDS For further information please contact: Kelly Hibbins Investor Relations Debra Mansfield Corporate Communications P: +61 2 8316 9856 P: +61 3 9674 6569 M: +61 414 609 192 E: [email protected] E: [email protected] About Vocus: Vocus Group (ASX: VOC) is a vertically integrated telecommunications provider, operating in the Australian and New Zealand markets. The Company owns an extensive national infrastructure network of metro and back haul fibre connecting all capital cities and most regional centres across Australia and New Zealand. Vocus infrastructure now connects directly to more than 5,500 buildings. Vocus owns a portfolio of brands catering to corporate, small business, government and residential customers across Australia and New Zealand. Vocus also operates in the wholesale market providing high performance, high availability and highly scalable communications solutions which allow service providers to quickly and easily deploy new services for their own customer base. For more information please go to our website www.vocusgroup.com.au. VOCUSGROUP.COM.AU 605 page 1/2 15 July 2001 Form 605 Corporations Act 2001 Section 671B Notice of ceasing to be a substantial holder To Company Name/Scheme ACN/ARSN 1. -

Vocus Retail New Zealand

Vocus Group Vocus AUSTRALIAʼS SPECIALIST FIBRE | Annual Report 2019 AND NETWORK SOLUTIONS PROVIDER Annual Report 2019 For personal use only VOCUS GROUP Annual Report 2019 ABOUT THIS REPORT The Annual Report 2019 is a summary of Vocus operations, activities and financial position for the 12 month period to 30 June 2019. Vocus Group Limited is the parent company of the Vocus group of companies. In this report, unless otherwise stated, references to “Vocus”, “the Group”, “the Company”, “we”, “our” and “us” refer to Vocus Group Limited and its controlled entities. In this report, references to the financial year refer to the period 1 July to 30 June unless otherwise stated. All dollar figures are expressed in Australian dollars, unless otherwise stated. Our Corporate Governance Statement, detailing our compliance with the ASX Corporate Governance Council’s “Corporate Governance Principles & Recommendations – 3rd Edition” can be found online at our website via http://vocusgroup.com.au/ about-us/corporate-governance/. REPORT OBJECTIVES This report meets our governance and compliance requirements and has been written to provide shareholders and interested parties with clear, easy to understand information on the Company and its performance in FY19. ADDITIONAL INFORMATION This report can also be found online via http://vocusgroup.com.au/investors/ company-performance/annual-reports/ A full copy of our Sustainability Report, reviewing our environmental, social and economic impact, can be found online via http://vocusgroup.com.au/sustainability/ sustainability-report/. KEY DATES Financial Year End – 30 June 2019 Annual General Meeting – 29 October 2019 The 2019 Annual General Meeting will be held at the Warrane Theatre at the Museum of Sydney. -

Australiaʼs Specialist Fibre and Network Solutions Provider

Vocus Group Vocus AUSTRALIAʼS SPECIALIST FIBRE | Annual Report 2019 AND NETWORK SOLUTIONS PROVIDER Annual Report 2019 VOCUS GROUP Annual Report 2019 ABOUT THIS REPORT The Annual Report 2019 is a summary of Vocus operations, activities and financial position for the 12 month period to 30 June 2019. Vocus Group Limited is the parent company of the Vocus group of companies. In this report, unless otherwise stated, references to “Vocus”, “the Group”, “the Company”, “we”, “our” and “us” refer to Vocus Group Limited and its controlled entities. In this report, references to the financial year refer to the period 1 July to 30 June unless otherwise stated. All dollar figures are expressed in Australian dollars, unless otherwise stated. Our Corporate Governance Statement, detailing our compliance with the ASX Corporate Governance Council’s “Corporate Governance Principles & Recommendations – 3rd Edition” can be found online at our website via http://vocusgroup.com.au/ about-us/corporate-governance/. REPORT OBJECTIVES This report meets our governance and compliance requirements and has been written to provide shareholders and interested parties with clear, easy to understand information on the Company and its performance in FY19. ADDITIONAL INFORMATION This report can also be found online via http://vocusgroup.com.au/investors/ company-performance/annual-reports/ A full copy of our Sustainability Report, reviewing our environmental, social and economic impact, can be found online via http://vocusgroup.com.au/sustainability/ sustainability-report/. KEY DATES Financial Year End – 30 June 2019 Annual General Meeting – 29 October 2019 The 2019 Annual General Meeting will be held at the Warrane Theatre at the Museum of Sydney. -

2012 Annual Report

Telecommunications Industry Ombudsman TELECOMMUNICATIONS INDUSTRY OMBUDSMAN 2012 ANNUAL REPORT PREPARING FOR THE FUTURE CONTENTS ABOUT US 1 COMPLAINT STATISTICS 16 ENGAGEMENT 32 About the TIO 1 Dashboard 16 Awareness of TIO services 32 Ombudsman’s message 2 New Complaints by quarter 16 Resilient Consumers 32 New Complaints v. concilations TIO Talks 32 Board Chairman’s message 3 and investigations 16 First online annual report 32 Council Chairman’s message 4 New complaints by consumer type 16 Accessibility 32 New complaints by service type 17 A new website 32 Board and Council in 2011-12 5 Conciliations and Investigations Community engagement 33 Board members in 2011-12 5 by service type 17 Council members in 2011-12 8 Top 7 issues in new complaints 17 Industry engagement 34 Trends overview 18 Account management model 34 Ombudsman roadshow 34 PERFORMANCE 11 Complaints about the “big three” service providers 18 MNews 34 Conciliation 11 Complaints about mobile phone Our membership 34 services 18 Live transfers 11 Government and regulation 34 Small business complaints 19 Conciliation snapshot 11 Highlights 34 Increase in enquiries 19 List of submissions 35 Timeliness 12 Geographical trends 20 Consumer satisfaction Australia wide 20 ORGANISATION 36 with TIO services 12 Victoria 21 Feedback about the TIO 12 South Australia 21 Staff overview 36 Amendments to the Australian Capital Territory 22 New teams 36 TIO Constitution 13 New South Wales 22 TIO organisational structure 36 Queensland 23 Wellness program 36 Monetary limits 13 Western Australia -

Federal Court of Australia District Registry: New South Wales Division: General No: NSD239/2016

Federal Court of Australia District Registry: New South Wales Division: General No: NSD239/2016 ROADSHOW FILMS PTY LTD (ACN 100 746 870) and others named in the schedule First Applicant TELSTRA CORPORATION LTD (ACN 051 775 556) and others named in the schedule First Respondent ORDER JUDGE: JUSTICE NICHOLAS DATE OF ORDER: 15 November 2019 WHERE MADE: Sydney THE COURT ORDERS THAT: 1. The operation of orders 2 to 17 of the Court’s orders of 15 December be extended for 3 years from the date of these orders. 2. There be no order as to costs. Date that entry is stamped: 15 November 2019 Prepared in the New South Wales District Registry, Federal Court of Australia Level 17, Law Courts Building, Queens Square, Telephone 02 9230 8567 - 2 - Schedule No: NSD239/2016 Federal Court of Australia District Registry:New South Wales Division:General Second Applicant VILLAGE ROADSHOW FILMS (BVI) LTD Third Applicant DISNEY ENTERPRISES, INC Fourth Applicant TWENTIETH CENTURY FOX FILM CORPORATION Fifth Applicant PARAMOUNT PICTURES CORPORATION Sixth Applicant COLUMBIA PICTURES INDUSTRIES, INC. Seventh Applicant UNIVERSAL CITY STUDIOS LLC. Eighth Applicant WARNER BROS. ENTERTAINMENT INC. Second Respondent PACNET INTERNET (A) PTY LTD ACN 085 213 690 Third Respondent PACNET SERVICES (A) PTY LTD ACN 056 783 852 Fourth Respondent OPTUS MOBILE PTY LIMITED ACN 054 365 696 Fifth Respondent OPTUS NETWORKS PTY LIMITED ACN 008 570 330 Sixth Respondent UECOMM PTY LIMITED ACN 079 083 195 Seventh Respondent OPTUS FIXED INFRASTRUCTURE PTY LIMITED (FORMERLY XYZED PTY LIMITED) -

Customer Financial Hardship in the Telco Industry State of Play Report 2018–19

Customer financial hardship in the telco industry State of play report 2018–19 MARCH 2020 Canberra Red Building Benjamin Offices Chan Street Belconnen ACT PO Box 78 Belconnen ACT 2616 T +61 2 6219 5555 F +61 2 6219 5353 Melbourne Level 32 Melbourne Central Tower 360 Elizabeth Street Melbourne VIC PO Box 13112 Law Courts Melbourne VIC 8010 T +61 3 9963 6800 F +61 3 9963 6899 Sydney Level 5 The Bay Centre 65 Pirrama Road Pyrmont NSW PO Box Q500 Queen Victoria Building NSW 1230 T +61 2 9334 7700 or 1800 226 667 F +61 2 9334 7799 Copyright notice https://creativecommons.org/licenses/by/4.0/ With the exception of coats of arms, logos, emblems, images, other third-party material or devices protected by a trademark, this content is made available under the terms of the Creative Commons Attribution 4.0 International (CC BY 4.0) licence. We request attribution as © Commonwealth of Australia (Australian Communications and Media Authority) 2020. All other rights are reserved. The Australian Communications and Media Authority has undertaken reasonable enquiries to identify material owned by third parties and secure permission for its reproduction. Permission may need to be obtained from third parties to re-use their material. Written enquiries may be sent to: Manager, Editorial Services PO Box 13112 Law Courts Melbourne VIC 8010 Email: [email protected] Contents Snapshot 1 Introduction 2 Financial hardship and telco assistance 2 Key findings 5 Customers experiencing financial hardship 5 Financial hardship debt 6 Financial hardship payment plans 7 Financial hardship arrangements 8 Financial hardship disconnections 9 Detailed information 10 Customers experiencing financial hardship 10 Financial hardship debt 12 Financial hardship payment plans 15 Exiting financial hardship arrangements 17 Financial hardship disconnections 19 Notes 21 acma | iii Snapshot acma | 1 Introduction Telco products and services are essential to the needs of Australians who rely on them to stay connected, communicate and do business. -

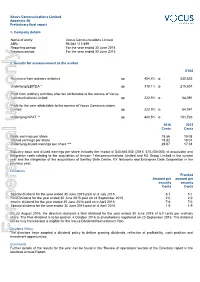

Vocus Communications Limited Appendix 4E Preliminary Final Report

Vocus Communications Limited Appendix 4E Preliminary final report 1. Company details Name of entity: Vocus Communications Limited ABN: 96 084 115 499 Reporting period: For the year ended 30 June 2016 Previous period: For the year ended 30 June 2015 2. Results for announcement to the market $'000 Revenues from ordinary activities up 454.6% to 830,825 Underlying EBITDA * up 318.1% to 215,607 Profit from ordinary activities after tax attributable to the owners of Vocus Communications Limited up 222.9% to 64,091 Profit for the year attributable to the owners of Vocus Communications Limited up 222.9% to 64,091 Underlying NPAT ** up 460.5% to 101,726 2016 2015 Cents Cents Basic earnings per share 18.86 19.08 Diluted earnings per share 18.82 19.01 Underlying diluted earnings per share *** 29.87 17.38 Statutory basic and diluted earnings per share includes the impact of $40,660,000 (2015: $10,400,000) of acquisition and integration costs relating to the acquisition of Amcom Telecommunications Limited and M2 Group Limited in the current year and the integration of the acquisitions of Bentley Data Centre, FX Networks and Enterprise Data Corporation in the previous year. Dividends Franked Amount per amount per security security Cents Cents Special dividend for the year ended 30 June 2015 paid on 8 July 2015 5.1 5.1 Final dividend for the year ended 30 June 2015 paid on 24 September 2015 2.0 2.0 Interim dividend for the year ended 30 June 2016 paid on 6 April 2016 7.6 7.6 Special dividend for the year ended 30 June 2016 paid on 6 April 2016 1.9 1.9 On 23 August 2016, the directors declared a final dividend for the year ended 30 June 2016 of 8.0 cents per ordinary share. -

For Personal Use Only Use Personal For

ASX/Media Release 29 March 2017 Sale of Investment in Macquarie Telecom Group Vocus Group Limited (ASX: VOC, ‘Vocus’) today announces that it has disposed of 3,358,511 shares representing ~16% relevant interest in the ordinary shares of Macquarie Telecom Group Limited (ASX: MAQ). The shares were held via a total return swap as described in the FY16 Vocus financial statements. Attached is the Form 605 Notice of ceasing to be a substantial holder. ENDS For further information please contact: Kelly Hibbins Investor Relations Debra Mansfield Corporate Communications P: +61 2 8316 9856 P: +61 3 9674 6569 M: +61 414 609 192 E: [email protected] E: [email protected] About Vocus: Vocus Group (ASX: VOC) is a vertically integrated telecommunications provider, operating in the Australian and New Zealand markets. The Company owns an extensive national infrastructure network of metro and back haul fibre connecting all capital cities and most regional centres across Australia and New Zealand. Vocus infrastructure now connects directly to more than 5,500 buildings. Vocus owns a portfolio of brands catering to corporate, small business, government and residential customers across Australia and New Zealand. Vocus also operates in the wholesale market providing high performance, high availability and highly scalable communications solutions which allow service providers to quickly and easily deploy new services for their own customer base. For more information please go to our website www.vocusgroup.com.au. For personal use only VOCUSGROUP.COM.AU 605 page 1/2 15 July 2001 Form 605 Corporations Act 2001 Section 671B Notice of ceasing to be a substantial holder To Company Name/Scheme ACN/ARSN 1. -

Annual Report 2018 Contents

ANNUAL REPORT 2017-2018 WELCOME The Telecommunications Industry Ombudsman acknowledges the traditional owners of country throughout Australia and their continuing connection to land, culture and community. We pay our respects to elders past, present and future. 2 TELECOMMUNICATIONS INDUSTRY OMBUDSMAN ANNUAL REPORT 2018 CONTENTS Contents Chair’s Message 4 Ombudsman’s Message 6 The Telecommunications Industry Ombudsman Board of Directors 8 The Telecommunications Industry Ombudsman 9 How To Make a Complaint 11 STRATEGY AND STRATEGIC GOALS 12 Our Purpose 13 Our Goals 13 COMPLAINTS 31 How Complaints Are Recorded 32 Complaints to the Telecommunications Industry Ombudsman 34 Establishing a Connection, Changing Provider and Service Quality 37 Case Outcomes 39 Systemic Issues 40 Land Access Objections 42 Complaints from Residential Consumers 43 Complaints from Small Businesses 45 Complaints from the Australian Capital Territory 47 Complaints from New South Wales 49 Complaints from the Northern Territory 51 Complaints from Queensland 53 Complaints from South Australia 55 Complaints from Tasmania 57 Complaints from Victoria 59 Complaints from Western Australia 61 Complaints about Phone and Internet Providers 63 FINANCIAL REPORT Financial Report for the year ended 30 June 2018 85 3 TELECOMMUNICATIONS INDUSTRY OMBUDSMAN ANNUAL REPORT 2018 CHAIR’S MESSAGE Chair’s message I am pleased to report the Telecommunications Industry Ombudsman has continued to deliver fair, independent, and accessible dispute resolution for Australian consumers and the telecommunications -

Australian Communications and Media Authority Annual

Annual report 2014 –15 Annual report 2014–15 Copyright notice http://creativecommons.org/licenses/by/3.0/au/ With the exception of coats of arms, logos, emblems, images, other third-party material or devices protected by a trademark, this content is licensed under the Creative Commons Australia Attribution 3.0 Licence. We request attribution as: © Commonwealth of Australia (Australian Communications and Media Authority) 2015. All other rights are reserved. The Australian Communications and Media Authority has undertaken reasonable enquiries to identify material owned by third parties and secure permission for its reproduction. Permission may need to be obtained from third parties to re-use their material. Written enquiries may be sent to: Manager, Editorial Services PO Box 13112 Law Courts Melbourne VIC 8010 E: [email protected] ISSN 1834-0776 This report is available on the ACMA website at www.acma.gov.au/annualreport. ACMA Annual report 2014–15 | 3 Contents 12 Part 1—The year in review 14 Chairman’s foreword 18 At a glance—significant issues and developments 20 Part 2—Agency overview 22 Chapter 1: About the ACMA 23 Functions and responsibilities 24 Strategic work program 25 Structure 25 The Authority 28 Corporate structure 30 Chapter 2: Revenue and fees 31 Revenue collection 31 Revenue and fees 32 Telecommunications services funding 33 Eligible revenue assessment 33 Annual carrier licence charges 33 Do Not Call Register access fees 33 Numbering charges 33 Number auctions 34 Apparatus licence taxes 34 Spectrum licence tax 34 Broadcasting -

25 September 2020 the Manager Market Announcements Office

Date: 25 September 2020 The Manager Market Announcements Office Australian Securities Exchange Limited 20 Bridge St Sydney NSW 2000 ELECTRONIC LODGEMENT Dear Sir or Madam, Annual Report Please find attached the Vocus 2020 Annual Report Notice for release to the market. Authorised for release by: Simon Lewin Company Secretary Level 10, 452 Flinders Street, Melbourne VIC 3000 Australia 1300 88 99 88 [email protected] vocus.com.au 2020 Report Annual Brilliant Made Simple. Vocus | Annual Report 2020 Our refreshed brand is About more representative of the Vocus business today and its strategic direction this report for the future. The Annual Report 2020 is a summary of Vocus operations, activities and financial position for the 12 month period to 30 June 2020. Vocus Group Limited is the parent company of the Vocus group of companies. In this report, unless otherwise stated, references to “Vocus”, “the Group”, “the Company”, “we”, “our” and “us” refer to Vocus Group Limited and its controlled entities. In this report, references to the financial year refer to the period 1 July to 30 June unless otherwise stated. All dollar figures are expressed in Australian dollars, unless otherwise stated. Our Corporate Governance Statement, detailing our compliance with the ASX Corporate Governance Council’s “Corporate Governance Principles & Recommendations – 4th edition” can be found online at our website via www.vocus.com.au/legal/corporate-governance. Report objectives Our new brand colours are taken directly from the colour This report meets our governance and coding of fibre optic cables. compliance requirements and has been written to provide shareholders and interested parties with clear, easy to understand information on the Company and its performance in FY20.