Euronext Options and Futures Traded at the Amsterdam Derivatives Markets

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Stop & Shop Reaches Tentative Withdrawal

Stop & Shop Reaches Tentative Withdrawal Agreement with Local Unions on UFCW International Union - Industry Pension Fund Zaandam, the Netherlands, July 21, 2020 – Ahold Delhaize announces today that its U.S. brand Stop & Shop, reached a tentative agreement to terminate its participation in the United Food & Commercial Workers International Union (UFCW) – Industry Pension Fund (the “National Plan”), through a transaction that the National Plan’s trustees determined to be in the best interests of the National Plan’s participants and beneficiaries. While the plan is not in critical status, the tentative agreement does importantly improve the security of pension benefits for associates as well as reduces financial risk for the company. If ratified by the UFCW Locals, the transaction will be treated as an extraordinary item and will therefore not impact the underlying operating results outlook for 2020. This statement should not be interpreted as an update to any component of the previously issued 2020 outlook. As is customary, the 2020 outlook will be updated on August 5th, when the company reports Q2 2020 results. Pending ratification of this agreement, Stop & Shop expects to pay the National Plan withdrawal liability of $649 million (€567 million), on a pre-tax basis, to fulfill Stop & Shop’s obligations for past service for associates and retirees in the National Plan. Stop & Shop will also make an $18 million (€16 million) contribution to a transition reserve for a new variable annuity pension plan, described in further detail below. On an after-tax basis, the withdrawal liability and contribution to the transition reserve total approximately $500 million (€437 million). -

Euro Stoxx® International Exposure Index

EURO STOXX® INTERNATIONAL EXPOSURE INDEX Components1 Company Supersector Country Weight (%) ASML HLDG Technology Netherlands 6.02 LVMH MOET HENNESSY Consumer Products & Services France 4.99 LINDE Chemicals Germany 3.79 SAP Technology Germany 3.62 SANOFI Health Care France 3.20 IBERDROLA Utilities Spain 3.04 SIEMENS Industrial Goods & Services Germany 2.63 AIR LIQUIDE Chemicals France 2.17 SCHNEIDER ELECTRIC Industrial Goods & Services France 2.10 L'OREAL Consumer Products & Services France 2.05 ANHEUSER-BUSCH INBEV Food, Beverage & Tobacco Belgium 1.99 BASF Chemicals Germany 1.89 ADIDAS Consumer Products & Services Germany 1.76 AIRBUS Industrial Goods & Services France 1.68 DAIMLER Automobiles & Parts Germany 1.65 BAYER Health Care Germany 1.61 PHILIPS Health Care Netherlands 1.51 ADYEN Industrial Goods & Services Netherlands 1.49 ESSILORLUXOTTICA Health Care France 1.40 DEUTSCHE TELEKOM Telecommunications Germany 1.36 INFINEON TECHNOLOGIES Technology Germany 1.35 Kering Retail France 1.35 BCO SANTANDER Banks Spain 1.29 SAFRAN Industrial Goods & Services France 1.26 HERMES INTERNATIONAL Consumer Products & Services France 1.10 PERNOD RICARD Food, Beverage & Tobacco France 1.09 CRH Construction & Materials Ireland 1.09 DEUTSCHE POST Industrial Goods & Services Germany 1.05 BCO BILBAO VIZCAYA ARGENTARIA Banks Spain 1.03 FLUTTER ENTERTAINMENT Travel & Leisure Ireland 1.02 DANONE Food, Beverage & Tobacco France 1.00 MUENCHENER RUECK Insurance Germany 0.99 VOLKSWAGEN PREF Automobiles & Parts Germany 0.82 BMW Automobiles & Parts Germany 0.80 -

Remuneration Policies for the Management Board and Supervisory Board Were Consistency Prepared in Accordance with the Dutch Corporate Governance Code

Strategic report Governance Performance Appendix Governance Governance 106 Our Management Board and Executive Committee 108 Our Supervisory Board 110 Corporate governance 115 Letter from the Chair of the Supervisory Board 116 Supervisory Board report 122 How we manage risk 125 Declarations Remuneration 126 Letter from the Remuneration Committee Chair 127 Remuneration policy 132 2020 Remuneration at a glance 133 2020 Remuneration Ahold Delhaize Annual Report 2020 105 Strategic report Governance Performance Appendix Governance Our Management Board and Executive Committee Frans Muller Natalie Knight Kevin Holt Wouter Kolk President and Chief Executive Officer; Chief Financial Officer; Member Chief Executive Officer Ahold Delhaize Chief Executive Officer Europe and Chair and member of the Management Management Board and Executive USA; Member Management Board and Indonesia; Member Management Board and Executive Committee; Committee Executive Committee Board and Executive Committee interim Chief Human Resources Officer Natalie Knight was appointed Chief Financial Officer and a Kevin Holt has served as Chief Executive Officer of Ahold Wouter Kolk started as Chief Executive Officer Europe and member of the Management Board on April 8, 2020. She Delhaize USA and a member of the Ahold Delhaize Indonesia on October 1, 2018. He had been Chief Frans Muller started as President and Chief Executive started at Ahold Delhaize as Executive Vice President Management Board since January 1, 2018. Prior to that, Operating Officer the Netherlands and Belgium and Officer of Ahold Delhaize on July 1, 2018. Before that, he Finance and Member of the Executive Committee on Kevin was Chief Operating Officer of Ahold USA since member of the Executive Committee of Ahold Delhaize served as Deputy Chief Executive Officer and Chief March 1, 2020. -

Historyeurex14e 08-03-28 Dezimalerweiterung

Contract Specifications for Futures Contracts and Eurex14 Options Contracts at Eurex Deutschland and Stand March 278, 2008 Eurex Zürich Seite 1 [….] Annex A in relation to subsection 1.6 of the contract specifications: Futures on Shares of Produkt- Group Cash Contract Minimum Price Currency ID ID** Market- Size Change* ID** AEGON N.V. AENF NL01 XAMS 100 0.00010.01 EUR Koninklijke Ahold N.V. AHOG NL01 XAMS 100 0.00010.01 EUR Akzo Nobel N.V. AKUF NL01 XAMS 100 0.00010.01 EUR ASML Holding N.V. ASMG NL01 XAMS 100 0.00010.01 EUR Koninklijke BAM Groep N.V. BGPF NL01 XAMS 100 0.00010.01 EUR Corporate Express N.V. BUHF NL01 XAMS 100 0.00010.01 EUR Corio N.V. CL6F NL01 XAMS 50 0.0010.01 EUR CSM N.V. CSMF NL01 XAMS 50 0.0010.01 EUR Koninklijke BAM Groep N.V. DSMF NL01 XAMS 100 0.00010.01 EUR Reed Elsevier ELVF NL01 XAMS 100 0.0010.01 EUR Reed Elsevier N.V. ELVG NL01 XAMS 100 0.00010.01 EUR Fortis N.V. FO4G NL01 XAMS 100 0.00010.01 EUR Fugro N.V. FUGF NL01 XAMS 100 0.0010.01 EUR Heineken Holding N.V. HEHF NL01 XAMS 100 0.00010.01 EUR Hagemeyer N.V. HMYF NL01 XAMS 100 0.00010.01 EUR Heineken N.V. HNKF NL01 XAMS 100 0.00010.01 EUR SBM Offshore N.V. IHCG NL01 XAMS 100 0.00010.01 EUR ING Groep N.V. INNF NL01 XAMS 100 0.00010.01 EUR Koninklijke KPN N.V. -

August 2017 Turbulence in the Grocery Aisles William Drake

August 2017 Turbulence in the Grocery Aisles William Drake Dyson School of Applied Economics and Management, Cornell University In an unexpected, blockbuster announcement on June 16, Amazon Inc., the nation’s largest online retailer declared its intention to acquire Whole Foods Market Inc. in a friendly deal valued at $13.7 billion. Rapidly growing Amazon, which in 2016 accounted for 43% of all online sales in the U.S.,1 has made significant inroads in the retailing of books, music, electronics, clothing, baby goods and shoes but has to date been less successful in penetrating the $800 billion U.S. grocery segment. Whole Foods, the 9th largest supermarket retailer in the U.S. with 460+ stores and annual sales of $16.5 billion,2 will be Amazon’s largest acquisition to date and will give the company scale and a national “brick and mortar” footprint in the intensely competitive grocery segment. While business media, Wall Street analysts and industry watchers are offering perspectives and speculation on the typically secretive Amazon’s motives and future plans, one need look no further than food retailer market caps in the days following the announcement to gauge the potential impact on both food manufacturers and retailers.3 1 Digital Commerce 360, 2/17. 2 Company annual report, Progressive Grocer magazine, 5/17. 3 Fortune.com, 6/23/17. Change in Stock Price between June 15 and 16 Closes 4 2.4 2 0 -2 -1.7 -2.4 -4 -2.9 Percent -6 -4.7 -5.1 -8 -10 -9.2 -12 Amazon Kelloggs Kraft Heinz General Mills Walmart Target Kroger Fortune.com, June 23, 2017 The post-acquisition path forward for Amazon is replete with strategic possibilities. -

Contracts and Eurex14e Options Contracts at Eurex Deutschland and Eurex Zürich As of 22.01.2018 Page 1

Contract Specifications for Futures Contracts and Eurex14e Options Contracts at Eurex Deutschland and Eurex Zürich As of 22.01.2018 Page 1 ********************************************************************************** AMENDMENTS ARE MARKED AS FOLLOWS: INSERTIONS ARE UNDERLINED DELETIONS ARE CROSSED OUT ********************************************************************************** 1. Part: Contract Specifications for Futures Contracts […] 2. Subpart: Contract Specifications for Index Options […] 2.6.11 Price Gradations The price of a stock option or LEPO will generally be quoted with three or four decimal place. The smallest price change (Tick) shall be EUR 0.0005, EUR 0.001, EUR 0.01 or CHF 0.01 or GBX* 0.5, GBX 0.25 or USD 0.01. For stock options with group ID NL11, NL12 and NL13, the tick size will increase to EUR 0.05 for contracts with a premium above a predefined threshold stipulated in Annex B (Premium Threshold). The Management Boards of the Eurex Exchanges shall determine the relevant decimal place and the smallest price change (Tick) and shall notify all Exchange participation of any such decision. 3. Part: Contracts Off-Book […] Contract Specifications for Futures Contracts and Eurex14e Options Contracts at Eurex Deutschland and Eurex Zürich As of 22.01.2018 Page 2 3.3.4.2 Annex B: in relation to Subsection 2.6 of the Contract Specifications: […] Options on shares of Product-ID Group ID Minimum price Premium Minimum price change below Threshold change above threshold threshold Aalberts Industries N.V. AAI NL12 0.01 0.5 0.05 ABN AMRO Group AAR NL11 0.01 5 0.05 AEGON N.V. AEN NL11 0.01 5 0.05 Koninklijke Ahold NL11 Delhaize N.V. -

Benelux 20 : the 5 Most Represented Sectors

V.E (Vigeo Eiris)’s indices are composed of the highest-ranking listed companies as evaluated by the agency in terms of their performance in corporate responsibility. This range of indices: Euronext Vigeo World 120, Euronext Vigeo Europe 120, Euronext Vigeo Eurozone 120, Euronext Vigeo US 50, Euronext Vigeo France 20, Euronext Vigeo United Kingdom 20 and Euronext Vigeo Benelux 20, will be updated every six months. Constituent selection is based on data from the Equitics® methodology, developed by Vigeo. Selected companies have achieved the highest ratings in their reference universe. INDEX FEATURES Number of Constituents 20 Index Type Price Index Eligible Stock All the companies included in the related Vigeo Euronext Universe The weighting of each component at the review date reflects the Equitics® score of the company Weighting divided by the total sum of the scores of all components Review Semi-Annually (June and December) New constituents – May 2021 Benelux 20 : the 5 most represented N/A N/A sectors Beverage 10.0% 5.0% Business Support Services Chemicals 45.0% Diversified Banks 20.0% Financial Services - Real Estate Others 15.0% 5.0% Lowest global score Highest global score Average overall score 52/100 67/100 59/100 BENELUX 20 Index constituents – May 2021 Sector Issuer ISIN Diversified Banks ABN AMRO Bank N.V. NL0011540547 Insurance Aegon NL0000303709 Chemicals Akzo Nobel NL0013267909 Mining & Metals ArcelorMittal LU1598757687 Technology-Hardware ASML Holding NL0010273215 Insurance ASR Nederland NL0011872643 Financial Services - -

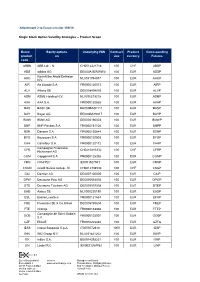

Attachment 2 to Eurex Circular 100/19 Single Stock Option Volatility

Attachment 2 to Eurex circular 100/19 Single Stock Option Volatility Strategies – Product Scope Eurex Equity options Underlying ISIN Contract Product Corresponding product on size currency Futures code ABBN ABB Ltd. - N. CH0012221716 100 CHF ABBP ADS adidas AG DE000A1EWWW0 100 EUR ADSP Koninklijke Ahold Delhaize AHO NL0011794037 100 EUR AHOP N.V. AIR Air Liquide S.A. FR0000120073 100 EUR AIRP ALV Allianz SE DE0008404005 100 EUR ALVP ASM ASML Holding N.V. NL0010273215 100 EUR ASMP AXA AXA S.A. FR0000120628 100 EUR AXAP BAS BASF SE DE000BASF111 100 EUR BASP BAY Bayer AG DE000BAY0017 100 EUR BAYP BMW BMW AG DE0005190003 100 EUR BMWP BNP BNP Paribas S.A. FR0000131104 100 EUR BNPP BSN Danone S.A. FR0000120644 100 EUR BSNP BYG Bouygues S.A. FR0000120503 100 EUR BYGP CAR Carrefour S.A. FR0000120172 100 EUR CARP Compagnie Financière CFR CH0210483332 100 CHF CFRP Richemont AG CGM Capgemini S.A. FR0000125338 100 EUR CGMP CRG CRH PLC IE0001827041 100 EUR CRGP CSGN Credit Suisse Group - N. CH0012138530 100 CHF CSGP DAI Daimler AG DE0007100000 100 EUR DAIP DPW Deutsche Post AG DE0005552004 100 EUR DPWP DTE Deutsche Telekom AG DE0005557508 100 EUR DTEP EAD Airbus SE NL0000235190 100 EUR EADP ESL EssilorLuxottica FR0000121667 100 EUR EFXP FRE Fresenius SE & Co.KGaA DE0005785604 100 EUR FREP FTE Orange FR0000133308 100 EUR FTEP Compagnie de Saint-Gobain GOB FR0000125007 100 EUR GOBP S.A. GZF ENGIE FR0010208488 100 EUR GZFQ IES5 Intesa Sanpaolo S.p.A. IT0000072618 1000 EUR IESP INN ING Groep N.V. NL0011821202 100 EUR INNP ITK InBev S.A. -

Ahold Delhaize Annual Report 2016 01

betterAnnual Reporttogether 2016 Ahold Delhaize Annual Report 2016 01 Introduction Welcome to our first Annual Report as a merged company, Ahold Delhaize. In 2016, we brought two successful businesses together to In 2016, we brought two create one of the world’s largest retail groups, able to deliver even more for the customers of our great local brands. This is reflected in the theme of our report: Better together. It is also successful businesses together the name of our strategy, which you will find out more about as you read our report. We believe that our long-term financial to create one of the world’s success is directly tied to how well we manage our financial, natural, and human resources. For that reason, we have decided to publish one report that provides an integrated view largest retail groups, able of our sustainability performance as part of our overall company performance. Please read on to find out more about our to deliver even more for year and the good momentum we achieved following the merger. Our report outlines the progress our great local brands made on all the customers of our great our strategic priorities, including making our fresh offering even fresher, providing healthier choices for our customers, reducing waste, supporting our communities, expanding our local brands. online offering, making it easier to shop, and much more. Ahold Delhaize Annual Report 2016 02 In this year’s report Overview Business review Governance Financials Investors 01 Introduction 20 Our Better Together strategy 73 Our Management Board -

Annual Report and Accounts 2020 and Is an Exact Copy of the Printed Document Provided to Unilever’S Shareholders

Disclaimer This is a PDF version of the Unilever Annual Report and Accounts 2020 and is an exact copy of the printed document provided to Unilever’s shareholders. Certain sections of the Unilever Annual Report and Accounts 2020 have been audited. These are on pages 112 to 167, and those parts noted as audited within the Directors’ Remuneration Report on pages 90 to 99. The maintenance and integrity of the Unilever website is the responsibility of the Directors; the work carried out by the auditors does not involve consideration of these matters. Accordingly, the auditors accept no responsibility for any changes that may have occurred to the financial statements since they were initially placed on the website. Legislation in the United Kingdom and the Netherlands governing the preparation and dissemination of financial statements may differ from legislation in other jurisdictions. Except where you are a shareholder, this material is provided for information purposes only and is not, in particular, intended to confer any legal rights on you. This Annual Report and Accounts does not constitute an invitation to invest in Unilever shares. Any decisions you make in reliance on this information are solely your responsibility. The information is given as of the dates specified, is not updated, and any forward-looking statements are made subject to the reservations specified in the cautionary statement on the inside back cover of this PDF. Unilever accepts no responsibility for any information on other websites that may be accessed from this site -

Full 2019 AGM Presentation Including Voting Results

ING Annual General Meeting 2020 28 April 2020 Amsterdam Agenda items Agenda item 1 Agenda item 6 Opening remarks and announcements. Remuneration policy of the Supervisory Board (voting item). Agenda item 2 Agenda item 7 A. Report of the Executive Board for 2019 (discussion item). Amendment of the Articles of Association (voting item). B. Sustainability (discussion item). Agenda item 8 C. Report of the Supervisory Board for 2019 (discussion item). Composition of the Supervisory Board: D. Remuneration report (advisory voting item). A. Appointment of Juan Colombás (voting item). E. Annual Accounts for 2019 (voting item). B. Appointment of Herman Hulst (voting item). Agenda item 3 C. Appointment of Harold Naus (voting item). A. Profit retention and distribution policy (discussion item). Agenda item 9 B. Dividend for 2019 (voting item) Withdrawn, no voting. A. Authorisation to issue ordinary shares (voting item). Agenda item 4 B. Authorisation to issue ordinary shares, with or without pre- A. Discharge of the members and former members of the emptive rights of existing shareholders (voting item). Executive Board in respect of their duties performed during the year 2019 (voting item). Agenda item 10 B. Discharge of the members and former members of the Authorisation to acquire ordinary shares in the Company’s own Supervisory Board in respect of their duties performed during capital (voting item). the year 2019 (voting item). Agenda item 5 Remuneration policy of the Executive Board (voting item). 2 Agenda item 1 Opening remarks and announcements 3 ING Annual General Meeting 2020 On the record date (end of day), 31 March 2020, the issued capital of the company consisted of: 3,900,494,550 issued ordinary shares No votes can be cast on 1,315,663 ordinary shares as these shares were held by ING on the record date A total of 3,899,178,887 votes can be cast 4 Agenda items 2A and 2B - discussion items Report of the Executive Board for 2019 and Sustainability See pages 3 to 91 of the 2019 Annual Report for the Report of the Executive Board for 2019. -

Amazon and Whole Foods: Grocery's Continued Evolution

www.inlandinstitutional.com Amazon and Whole Foods: Grocery’s Continued Evolution Amazon.com Inc.’s (“Amazon”) online retail strategy appears to be evolving with its recent announcement on June 16th to acquire Whole Foods Market, Inc. (Whole Foods). Though it is too early to know what the full impact will be on the super- market business, Amazon’s decision to enter the brick-and- mortar retail landscape may help energize the $800 billion grocery industry and in the long run make the business an even more central part of people’s shopping habits.1 One clear message from this action by Amazon is that the future of grocery retailing will be critically dependent on hav- ing physical stores in close proximity to the consumers’ resi- dence. Well located grocery stores will be key to the omni- channel future of retailing for groceries as well as many other categories of goods. Far from threatening the long term value of grocery anchored retail properties, by their actions Amazon has just told the market that they are key strategic assets. Whole Foods Strategic Footprint After struggling for a decade to find a successful prototype for entering the grocery business, Amazon has offered to pay $13.7 billion for Whole Foods. Many in grocery and real estate circles had predicted that the company would ultimately have to buy an established grocer if they were to have any chance to “get big fast.” Assuming the acquisition closes, Amazon will gain access to Whole Foods’ customers who spent approximately $16 billion in the last fiscal year at over 460 stores.