Public Version

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TELCO: I Maggiori Gruppi Italiani, Europei (2018 E Primi 6 Mesi 2019) E Internazionali (Cenni)

TELCO: I maggiori gruppi italiani, europei (2018 e primi 6 mesi 2019) e internazionali (cenni) Milano, 6 novembre 2019 HIGHLIGHTS EUROPA In termini di fatturato gli Usa rappresentano il mercato più ampio (con 294 €mld), seguito da Europa (215 mld) e Cina (189 mld); a quest’ultimo paese la crescita più ampia tra il 2015 e il 2019E (+21%) Con l’acquisizione di Time Warner, AT&T consolida la 1° posizione a livello internazionale con un fatturato 2018 di circa € 149mld. Nelle prime 16 posizioni ci sono 6 gruppi europei (con TIM 16esima per fatturato) e 6 asiatici. Verizon Comm con i margini industriali più elevati (mon al 23% del fatturato), seguita dalla giapponese KDDI (20%) e da TIM (17,5%) L’Italia è il 4° mercato nella telefonia in Europa, (ricavi per 31,8 mld di euro; -2,6% sul 2014), dopo Germania (57,4 mld, +1,2%), Uk (37,8 mld)1, Francia (35,6 mld; -3,5%) e prima della Spagna (30,2 mld), l’unica in forte crescita (+11,3%) L’Italia migliora nella connettività e nei servizi pubblici digitali, con la copertura a banda larga veloce e il suo utilizzo in crescita (anche se quest’ultima sotto la media EU) ma con progressi più lenti nella connettività superveloce Nel benchmarking europeo, sul podio 2018 per Mon sul fatturato: Telenor al 23%, Swisscom al 17,6% e TIM al 17,5%; tre operatori in perdita (Altice E., TIM e Vodafone) appesantite da oneri una-tantum Considerando i player con ricavi >10 mld, nel benchmarking europeo sul podio 2018 per Mon sul fatturato: Telenor al 23%, Swisscom al 17,6% e TIM al 17,5%; tre operatori in perdita (Altice E., TIM e Vodafone) appesantite da oneri una-tantum Con l’acquisizione delle attività tedesche e dell’Europa dell’est di Liberty Group (in completamento), Vodafone diventerà il maggior proprietario di reti di nuova generazione (NGN) in Europa con 54 milioni di abitazioni raggiunte via cavo e via fibra Vodafone ha la struttura finanziaria più solida (debiti finanziari sul P.N. -

L'offerta Può Essere Soggetta a Limitazioni Tecniche Di Velocità

L’OFFERTA PUÒ ESSERE SOGGETTA A LIMITAZIONI TECNICHE DI VELOCITÀ E GEOGRAFICHE. VERIFICA PRIMA SU www.tim.it/verifica-copertura. TIM SUPER FIBRA/MEGA/ADSL Le offerte TIM SUPER FIBRA/MEGA/ADSL per clienti Del 46/17 sono valide per i clienti che richiedono un Nuovo Impianto, che passano a TIM Fisso da altro Operatore o per i già clienti con Linea Fissa TIM per atti- vazioni entro il 22/09/2019. Ogni offerta viene attivata secondo la migliore tecnologia e velocità disponibile per il cliente, con priorità su FTTH, poi FTTC/E, infine ADSL. In particolare, se il cliente è in copertura FTTH, si attiverà l’offerta TIM SUPER FIBRA con connessione Fibra fino a 1 GIGA in download /100 Mbps in upload, se in copertura FTTC si attiverà l’offerta TIM SUPER MEGA con Internet fino a 200/20 Mbps o fino a 100/20 Mbps in copertura FTTE; in caso di sola copertura ADSL si attiverà l’offerta TIM SUPER ADSL con Internet fino a 20/1 Mbps. Qualora l’attivazione della migliore tecnologia individuata su base copertura del cliente non fosse possibile per motivi tecnici, verrà proposta la migliore tecnologia alternativa disponibile. Qualora non andasse a buon fine anche l’attivazione della tecnologia ADSL, sulla linea di casa verrà attivata l’offerta Tutto Voce al prezzo di 36,90€/mese, maggiori dettagli su https://www.tim.it/offerte/fisso/solo-voce/linea-telefo- nica/tutto-voce) dalla quale si potrà recedere in qualsiasi momento. Offerta con domiciliazione delle bollette. In alternativa è previsto il pagamento di una cauzione di 100€ (vd paragrafo CAUZIONE). -

The Group Has Applied IFRS 16, Leases, Since January 1, 2019 Using the Retrospective Approach, Without Restating Comparative Prior Periods

Société anonyme. Share capital: €13,109,880 Registered office: 16, rue de la Ville l’Evêque – 75008 Paris, France Registered in Paris under no. 342 376 332 The Group has applied IFRS 16, Leases, since January 1, 2019 using the retrospective approach, without restating comparative prior periods. The income statement, balance sheet and segment information have been adjusted accordingly. Further to the application of IFRS 16, the Group amended its key profitability indicator to EBITDAaL (EBITDA after Leases) with effect from January 1, 2019. ANALYSIS OF THE GROUP’S BUSINESS AND RESULTS KEY CONSOLIDATED FINANCIAL DATA In € millions 2019 2018 INCOME STATEMENT Total revenues 5,332 4,891 Services revenues 5,115 4,692 EBITDAaL 1,654 1,755 Profit from ordinary activities 444 690 Profit for the period 1,726 330 Profit for the period attributable to owners of the Company 1,719 323 BALANCE SHEET Non-current assets 13,384 9,960 Current assets 4,209 1,277 Of which cash and cash equivalents 1,593 181 Assets held for sale 563 15 Total assets 18,156 11,252 Total equity 5,231 3,606 Non-current liabilities 7,315 4,974 Current liabilities 5,610 2,672 Liabilities held for sale - - Total equity and liabilities 18,156 11,252 CASH FLOWS Cash flows from operations 2,186 1,693 Right-of-use assets and interest expense on lease liabilities – IFRS 16 impact (585) - Capital expenditure – France (1,607) (1,555) Capital expenditure – Italy (369) (261) Capital expenditure – frequencies1 (252) (605) Net change in cash and cash equivalents – Group (excluding change in net 430 (1,444) debt and dividends) Dividends (59) (40) Net debt 3,609 3,983 1Including €225 million in 2019 and €61 million in 2018 for Italy. -

Financial Results Results for the Half Year to 30 September 2019 BT Group Plc 31 October 2019

Financial results Results for the half year to 30 September 2019 BT Group plc 31 October 2019 BT Group plc (BT.L) today announced its results for the half year to 30 September 2019. Key strategic developments: • Launched a host of new products for consumer and business segments, including the new Halo converged product plans and BT Mobile 5G • Introduced a range of new service initiatives including bringing the BT brand to the high street in over 600 EE/BT dual- branded stores, and to answer 100% of customer calls in the UK & Ireland from January 2020 • Continued to make progress on the BT modernisation agenda, including delivering over £1.1bn transformation benefits, announcing the first locations in our Better Workplace Programme, and disposal of BT Fleet Solutions • Outlined our Skills for Tomorrow programme to provide digital skills training for 10m UK children, families and businesses Operational: • 5G network live in over 20 cities and large towns; 5G smartphone plans now available on both EE and BT brands • Openreach announced the launch of new FTTP 1Gbps and 550Mbps products. FTTP rollout at c.23k premises passed per week; 4.2m ultrafast (FTTP and Gfast) premises passed to date; currently announced plans to build FTTP in 103 locations • Consumer fixed ARPC £38.5, broadly flat year on year; postpaid mobile ARPC £20.8, down 5.5% year on year due to impact of regulation and continued trend towards SIM-only; RGUs per address up to 2.38 • Postpaid mobile churn remains low at 1.2% in Q2 despite impact of auto switching; fixed churn at -

The Dominance and Monopolies Review, Fifth Edition

Dominance and Monopolies Review Fifth Edition Editors Maurits Dolmans and Henry Mostyn lawreviews the Dominance and Monopolies Review The Dominance and Monopolies Review Reproduced with permission from Law Business Research Ltd. This article was first published in The Dominance and Monopolies Review, - Edition 5 (published in July 2017 – editors Maurits Dolmans and Henry Mostyn) For further information please email [email protected] Dominance and Monopolies Review Fifth Edition Editors Maurits Dolmans and Henry Mostyn lawreviews PUBLISHER Gideon Roberton SENIOR BUSINESS DEVELOPMENT MANAGER Nick Barette BUSINESS DEVELOPMENT MANAGERS Thomas Lee, Joel Woods ACCOUNT MANAGERS Pere Aspinall, Sophie Emberson, Laura Lynas, Jack Bagnall MARKETING AND READERSHIP COORDINATOR Rebecca Mogridge RESEARCHER Arthur Hunter EDITORIAL COORDINATOR Gavin Jordan HEAD OF PRODUCTION Adam Myers PRODUCTION EDITOR Martin Roach SUBEDITOR Janina Godowska CHIEF EXECUTIVE OFFICER Paul Howarth Published in the United Kingdom by Law Business Research Ltd, London 87 Lancaster Road, London, W11 1QQ, UK © 2017 Law Business Research Ltd www.TheLawReviews.co.uk No photocopying: copyright licences do not apply. The information provided in this publication is general and may not apply in a specific situation, nor does it necessarily represent the views of authors’ firms or their clients. Legal advice should always be sought before taking any legal action based on the information provided. The publishers accept no responsibility for any acts or omissions contained -

TIM Comunica Entry - Termini E Condizioni

TIM ComUnica Entry - Termini e Condizioni 1 CARATTERISTICHE DEL SERVIZIO L’offerta TIM ComUnica Entry, è rivolto alle piccole e medie aziende e prevede la fornitura di una soluzione “Full VoIP” ad alta qualità che include servizi dati, voce e servizi innovativi di centralino. TIM ComUnica Entry (di seguito anche “Offerta”) è attivabile su Clienti mono sede oppure su clienti pluri sede attivando più offerte TIM Comunica Entry indipendenti tra loro; e può essere attivato solo in caso di disponibilità o contestuale attivazione di un accesso internet tra quelli elencati nel presente Profilo Commerciale. Laddove sia necessaria una soluzione con più sedi tra loro comunicanti, l’offerta di riferimento è la TIM ComUnica. Il Cliente potrà richiedere l’attivazione dell’Offerta sottoscrivendo la Proposta di Attivazione – Sezione TIM ComUnica Entry. L’Offerta comprende: • chiamate illimitate verso i numeri fissi nazionali e verso i principali numeri mobili nazionali1; • la possibilità di effettuare contemporaneamente da due a sei conversazioni telefoniche (canali voce). Per ciascun canale voce è possibile associare fino a 4 Utenti; • un accesso ad Internet con navigazione illimitata secondo le modalità proprie della tecnologia di accesso scelta dal Cliente (come specificato nel Paragrafo 3); • servizi e funzionalità di centralino indicati nel Paragrafo 7. Sono inoltre inclusi 1 Risponditore Automatico, oltre a 3 servizi di Fax Messaging (fax to email); • fornitura in noleggio di un Router TIR Standard per trasmissione dati/voce; l’ammontare del canone -

Comodo Threat Intelligence

Comodo Threat Intelligence Lab SPECIAL REPORT: AUGUST 2017 – IKARUSdilapidated Locky Part II: 2nd Wave of Ransomware Attacks Uses Your Scanner/Printer, Post Office Billing Inquiry THREAT RESEARCH LABS Locky Ransomware August 2017 Special Report Part II A second wave of new but related IKARUSdilapidated Locky ransomware attacks has occurred, building on the attacks discovered by the Comodo Threat Intelligence Lab (part of Comodo Threat Research Labs) earlier in the month of August 2017. This late August campaign also uses a botnet of “zombie computers” to coordinate a phishing attack which sends emails appearing to be from your organization’s scanner/printer (or other legitimate source) and ultimately encrypts the victims’ computers and demands a bitcoin ransom. SPECIAL REPORT 2 THREAT RESEARCH LABS The larger of the two attacks in this wave presents as a scanned image emailed to you from your organization’s scanner/printer. As many employees today scan original documents at the company scanner/printer and email them to themselves and others, this malware-laden email will look very innocent. The sophistication here includes even matching the scanner/printer model number to make it look more common as the Sharp MX2600N is one of the most popular models of business scanner/printers in the market. This second wave August 2017 phishing campaign carrying IKARUSdilapidated Locky ransomware is, in fact, two different campaigns launched 3 days apart. The first (featuring the subject “Scanned image from MX-2600N”) was discovered by the Lab to have commenced primarily over 17 hours on August 18th and the second (a French language email purportedly from the French post office featuring a subject including “FACTURE”) was executed over a 15-hour period on August 21st, 2017. -

ELENCO TELEFONIA FISSA E MOBILE Con PEC Per Internet

MINISTERO DELLO SVILUPPO ECONOMICO COMUNICAZIONI Direzione Generale per i Servizi di Comunicazione Elettronica, di Radiodiffusione e Postali Viale America, 201 – 00144 ROMA Elenco delle autorizzazioni generali di cui al decreto legislativo 1 agosto 2003 n. 259 per il servizio di installazione e fornitura di reti pubbliche di comunicazione elettronica e per l’espletamento del servizio telefonico accessibile al pubblico (ex licenze individuali d.m. 25 novembre 1997) 03/07/2018 Sig la Num Rete - Im ero Provi Voce - Società Indirizzo Cap Città Regione Tipo di provvedimento Data Partita Iva PEC pie d’ord ncia Mobil gat ine e o 10993 S.r.l. Via Pontaccio, 20121 Milano (MI) Lombardia Autorizzazione generale per servizio 13/06/2008 14 telefonico accessibile al pubblico. G 350 13212040151 [email protected] AREA DI COPERTURA: Regione Lombardia. Voce 12H AG Hardturmstrasse 08005 Zurich Svizz Lombardia Autorizzazione generale per 10/01/2017 , 201 era l'installazione e fornitura di una rete G 588 pubblica di comunicazione [email protected] elettronica. AREA DI COPERTURA: Settimo Milanese. Rete 2 S.r.l. Loc. Ponte alla 52100 Arezzo (AR) Toscana Autorizzazione generale per servizio 05/08/2013 Chiassa, 330 telefonico accessibile al pubblico. AREA DI COPERTURA: Comune di DIGITALMEDIAITALIAS Z 437 01986800512 Arezzo, Monte Savino, Castiglion [email protected] Fiorentino, Cortona, San Giovanni Valdarno, Montevarchi Voce 2BITE S.r.l. Via Saragat, 24 67100 L'Aquila (AQ) Abruzzo Autorizzazione generale per servizio 14/03/2016 di installazione e fornitura di una rete pubblica di comunicazione M 551 01610050666 [email protected] elettronica. AREA DI COPERTURA: Abruzzo, Marche, Lazio, Molise Rete 3P SYSTEM Via Matteotti, 3 30032 Fiesso (VE) Veneto Autorizzazione generale per servizio 17/05/2016 S.r.l. -

British Telecommunications Plc Annual Report

wholly-owned subsidiary of BT Group plc, British Telecommunications plc meets the conditions set forth in General set the conditions plc meets Telecommunications plc, British Group subsidiary wholly-owned of BT a As Form 20-F with filing this 20-F and is therefore reports on Form 10-K as applied to of Form Instruction (I) (1)(a) and (b) format. disclosure the reduced 2018 Form 20-F Form Report & Report Annual BRITISH TELECOMMUNICATIONS plc BRITISH TELECOMMUNICATIONS BRITISH TELECOMMUNICATIONS plc 2018 THE StratEGIC REPOrt GOVERNANCE FINANCIAL statEMENts ADDITIONAL INFORMatION Contents The Strategic Report Our strategy Our strategy in a nutshell How we’re doing – Delivering great customer experience 3 – Investing for growth 4 – Transforming our costs 5 Key performance indicators 6 Our non-financial performance 8 Our evolving strategy 10 Our business model Our business model 12 What we do 14 Our resources and culture Financial strength 16 Our networks and physical assets 16 Properties 17 Research and development 17 Brand and reputation 19 Our culture / The BT Way 20 Respecting human rights 21 Our stakeholders Our people 22 Customers 25 Communities and society 25 Lenders 26 Pension schemes 26 Suppliers 27 HM Government 27 Regulators 28 The environment 31 Our risks Our approach to risk management 33 Our principal risks and uncertainties 34 Operating review BT Consumer 48 EE 55 Business and Public Sector 59 Global Services 64 Wholesale and Ventures 69 Openreach 73 Technology, Service and Operations 79 Group performance Group performance 82 Governance 89 Financial statements 95 Additional information 208 Overview British Telecommunications plc (‘the group’ or ‘the company’ ) is the principal operating subsidiary of BT Group plc. -

BT Group Plc Results Release Q4 2020/21

Financial results Results for the full year to 31 March 2021 BT Group plc 13 May 2021 Philip Jansen, Chief Executive, commenting on the results, said “BT comes out of this challenging year as a stronger business with an even greater sense of purpose. Our fantastic colleagues have shown the true colours of BT – delivering resilient connectivity, supporting families and businesses and helping to underpin the heroism of the NHS. A number of uncertainties have now been removed. The Wholesale Fixed Telecoms Market Review, 5G spectrum auction and the Government's tax super-deduction give us the green light to build the UK’s next generation digital infrastructure even faster; today we are increasing and accelerating our FTTP target from 20m to 25m homes and businesses by December 2026 to deliver further value to our shareholders and support the Government’s full fibre ambitions. The conclusion of our triennial pension valuation today provides further clarity for shareholders. After a number of years of tough work, and as we look to build back better from the pandemic, we’re now pivoting to consistent and predictable growth. We are building a better BT for our customers, for the country, for our shareholders and for those who work for this great company – now and in the future.” BT Group plc (BT.L) today announced its results for the full year to 31 March 2021. Key strategic developments: • Ofcom's WFTMR1, outcome of recent spectrum auction and Government’s tax super-deduction allows us to increase and accelerate our FTTP build from 20m to 25m premises by December 2026; BT to explore potential joint venture for additional 5m build - see separate press release • Agreed triennial pension deficit of £7.98bn and deficit recovery plan comprising: asset-backed funding over 13 years (£180m p.a.) secured against the EE business; and further payments over 10 years (£900m p.a. -

Mobile Terminating Numbers

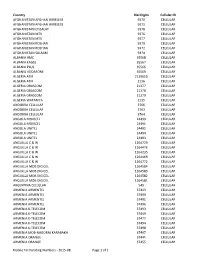

Country Dial Digits Cellular ID AFGHANISTAN AFGHAN WIRELESS 9370 CELLULAR AFGHANISTAN AFGHAN WIRELESS 9371 CELLULAR AFGHANISTAN ETISALAT 9378 CELLULAR AFGHANISTAN MTN 9376 CELLULAR AFGHANISTAN MTN 9377 CELLULAR AFGHANISTAN ROSHAN 9379 CELLULAR AFGHANISTAN ROSHAN 9372 CELLULAR AFGHANISTAN SALAAM 9374 CELLULAR ALBANIA AMC 35568 CELLULAR ALBANIA EAGLE 35567 CELLULAR ALBANIA PLUS 35566 CELLULAR ALBANIA VODAFONE 35569 CELLULAR ALGERIA ATM 2139619 CELLULAR ALGERIA ATM 2136 CELLULAR ALGERIA ORASCOM 21377 CELLULAR ALGERIA ORASCOM 21378 CELLULAR ALGERIA ORASCOM 21379 CELLULAR ALGERIA WATANIYA 2135 CELLULAR ANDORRA CELLULAR 3766 CELLULAR ANDORRA CELLULAR 3763 CELLULAR ANDORRA CELLULAR 3764 CELLULAR ANGOLA MOVICEL 24499 CELLULAR ANGOLA MOVICEL 24491 CELLULAR ANGOLA UNITEL 24492 CELLULAR ANGOLA UNITEL 24494 CELLULAR ANGOLA UNITEL 24493 CELLULAR ANGUILLA C & W 1264729 CELLULAR ANGUILLA C & W 1264476 CELLULAR ANGUILLA C & W 1264235 CELLULAR ANGUILLA C & W 1264469 CELLULAR ANGUILLA C & W 1264772 CELLULAR ANGUILLA MOB DIGICEL 1264584 CELLULAR ANGUILLA MOB DIGICEL 1264583 CELLULAR ANGUILLA MOB DIGICEL 1264582 CELLULAR ANGUILLA MOB DIGICEL 1264581 CELLULAR ARGENTINA CELLULAR 549 CELLULAR ARMENIA ARMENTEL 37443 CELLULAR ARMENIA ARMENTEL 37499 CELLULAR ARMENIA ARMENTEL 37491 CELLULAR ARMENIA ARMENTEL 37496 CELLULAR ARMENIA K-TELECOM 37493 CELLULAR ARMENIA K-TELECOM 37449 CELLULAR ARMENIA K-TELECOM 37477 CELLULAR ARMENIA K-TELECOM 37494 CELLULAR ARMENIA K-TELECOM 37498 CELLULAR ARMENIA MOB-NAGORNI KARABAKH 37497 CELLULAR ARMENIA ORANGE 37441 CELLULAR ARMENIA -

BT Group Plc Annual Report 2020 BT Group Plc Annual Report 2020 Strategic Report 1

BT Group plc Group BT Annual Report 2020 Beyond Limits BT Group plc Annual Report 2020 BT Group plc Annual Report 2020 Strategic report 1 New BT Halo. ... of new products and services Contents Combining the We launched BT Halo, We’re best of 4G, 5G our best ever converged Strategic report connectivity package. and fibre. ... of flexible TV A message from our Chairman 2 A message from our Chief Executive 4 packages About BT 6 investing Our range of new flexible TV Executive Committee 8 packages aims to disrupt the Customers and markets 10 UK’s pay TV market and keep Regulatory update 12 pace with the rising tide of in the streamers. Our business model 14 Our strategy 16 Strategic progress 18 ... of next generation Our stakeholders 24 future... fibre broadband Culture and colleagues 30 We expect to invest around Introducing the Colleague Board 32 £12bn to connect 20m Section 172 statement 34 premises by mid-to-late-20s Non-financial information statement 35 if the conditions are right. Digital impact and sustainability 36 Our key performance indicators 40 Our performance as a sustainable and responsible business 42 ... of our Group performance 43 A letter from the Chair of Openreach 51 best-in-class How we manage risk 52 network ... to keep us all Our principal risks and uncertainties 53 5G makes a measurable connected Viability statement 64 difference to everyday During the pandemic, experiences and opens we’re helping those who up even more exciting need us the most. Corporate governance report 65 new experiences. Financial statements 117 ..