Corporate Governance Case Studies Volume 7

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FITTING-OUT MANUAL for Commercial Occupiers

FITTING-OUT MANUAL for Commercial Occupiers SMRT PROPERTIES SMRT Investments Pte Ltd 251 North Bridge Road Singapore 179102 Tel : 65 6331 1000 Fax : 65 6337 5110 www.smrt.com.sg While every reasonable care has been taken to provide the information in this Fitting-Out Manual, we make no representation whatsoever on the accuracy of the information contained which is subject to change without prior notice. We reserve the right to make amendments to this Fitting-Out Manual from time to time as necessary. We accept no responsibility and/or liability whatsoever for any reliance on the information herein and/or damage howsoever occasioned. 09/2013 (Ver 3.9) Fitting Out Manual SMRT Properties To our Valued Customer, a warm welcome to you! This Fitting-Out Manual is specially prepared for you, our Valued Customer, to provide general guidelines for you, your appointed consultants and contractors when fitting-out your premises at any of our Mass Rapid Transit (MRT) or Light Rail Transit (LRT) stations. This Fitting-Out Manual serves as a guide only. Your proposed plans and works will be subjected to the approval of SMRT and the relevant authorities. We strongly encourage you to read this document before you plan your fitting-out works. Do share this document with your consultants and contractors. While reasonable care has been taken to prepare this Fitting-Out Manual, we reserve the right to amend its contents from time to time without prior notice. If you have any questions, please feel free to approach any of our Management staff. We will be pleased to assist you. -

Merdeka Generation Package $100 Top-Up Benefit

Merdeka Generation Package $100 Top-Up Benefit The Merdeka Generation (MG) One-Time $100 Top-Up will be available from 01 July 2019 onwards. Apart from the top-up locations at the MRT stations and bus interchanges, temporary top-up booths at selected Community Clubs/ Centres will be set up to provide even greater convenience to our MGs with their top ups. a) TransitLink Ticket Offices Operating Hours TransitLink Ticket Offices Public Location Weekdays Saturdays Sundays Holidays 1 Aljunied MRT Station * 1200 - 1930 Closed 2 Ang Mo Kio MRT Station 0800 - 2100 3 Bayfront MRT Station (CCL)* Closed 1200 - 2000 4 Bedok Bus Interchange 1000 - 2000 1000 - 1700 Closed 5 Bedok MRT Station * 1200 - 2000 6 Bishan MRT Station * 1200 - 1930 Closed 7 Boon Lay Bus Interchange 0800 - 2100 8 Bugis MRT Station 1000 - 2100 9 Bukit Batok MRT Station * 1200 - 1930 10 Bukit Merah Bus Interchange * 1200 - 1930 11 Changi Airport MRT Station ~ 0800 - 2100 12 Chinatown MRT Station ~@ 0800 - 2100 13 City Hall MRT Station 0900 - 2100 14 Clementi MRT Station 0800 - 2100 15 Eunos MRT Station * 1200 - 1930 1200 - 1800 Closed 16 Farrer Park MRT Station * 1200 - 1930 17 HarbourFront MRT Station ~ 0800 - 2100 Updated as of 2 July 2019 Operating Hours TransitLink Ticket Offices Public Location Weekdays Saturdays Sundays Holidays 18 Hougang MRT Station * 1200 - 1930 19 Jurong East MRT Station * 1200 - 1930 20 Kranji MRT Station * 1230 - 1930 # 1230 - 1930 ## Closed## 21 Lakeside MRT Station * 1200 - 1930 22 Lavender MRT Station * 1200 - 1930 Closed 23 Novena MRT Station -

Yamato Transport Branch Postal Code Address TA-Q-BIN Lockers

Yamato Transport Branch Postal Code Address TA-Q-BIN Lockers Location Postal Code Cheers Store Address Opening Hours Headquarters 119936 61 Alexandra Terrace #05-08 Harbour Link Complex Cheers @ AMK Hub 569933 No. 53 Ang Mo Kio Ave 3 #01-37, AMK Hub 24 hours TA-Q-BIN Branch Close on Fri and Sat Night 119937 63 Alexandra Terrace #04-01 Harbour Link Complex Cheers @ CPF Building 068897 79 Robinson Road CPF Building #01-02 (Parcel Collection) from 11pm to 7am TA-Q-BIN Call Centre 119936 61 Alexandra Terrace #05-08 Harbour Link Complex Cheers @ Toa Payoh Lorong 1 310109 Block 109 #01-310 Toa Payoh Lorong 1 24 hours Takashimaya Shopping Centre,391 Orchard Rd, #B2-201/8B Fairpricexpress Satellite Office 238873 Operation Hour: 10.00am - 9.30pm every day 228149 1 Sophia Road #01-18, Peace Centre 24 hours @ Peace Centre (Subject to Takashimaya operating hours) Cheers @ Seng Kang Air Freight Office 819834 7 Airline Rd #01-14/15, Cargo Agent Building E 546673 211 Punggol Road 24 hours ESSO Station Fairpricexpress Sea Freight Office 099447 Blk 511 Kampong Bahru Rd #02-05, Keppel Distripark @ Toa Payoh Lorong 2 ESSO 319640 399 Toa Payoh Lorong 2 24 hours Station Fairpricexpress @ Woodlands Logistics & Warehouse 119937 63 Alexandra Terrace #04-01 Harbour Link Complex 739066 50 Woodlands Avenue 1 24 hours Ave 1 ESSO Station Removal Office 119937 63 Alexandra Terrace #04-01 Harbour Link Complex Cheers @ Concourse Skyline 199600 302 Beach Road #01-01 Concourse Skyline 24 hours Cheers @ 810 Hougang Central 530810 BLK 810 Hougang Central #01-214 24 hours -

Press R Elease

PRESS RELEASE NEW APPOINTMENTS TO THE BOARDS OF SPRING, JTC and EMA The Minister for Trade and Industry has appointed new members to the Boards of SPRING Singapore (SPRING), JTC Corporation (JTC) and Energy Market Authority (EMA). In addition, there were re-appointments at SPRING, EMA and Sentosa Development Corporation (SDC). These appointments took effect on 1 April 2010. SPRING Board 2. New Appointments Mr Roger Chia – Founder, Chairman and Managing Director, Rotary Engineering Limited COL Lai Chung Han – Director (Policy), Ministry of Defence Mr Viswa Sadasivan – Chief Executive Officer, Strategic Moves Pte Ltd Mr Tan Choon Shian – Deputy Managing Director, Economic Development Board Re-appointments Ms Chong Siak Ching – President and Chief Executive Officer, Ascendas Pte Ltd Mr Thomas Chua – Chairman and Managing Director, Teckwah Industrial Corporation Ltd Mr Lim Boon Wee – Deputy Secretary (Land and Corporate), Ministry of Transport Ms Janet Young – Managing Director, Regional Head MNC Asia, Bank of America (Singapore) 100 High Street, #09-01, The Treasury, Singapore 179434 T (65) 6225 9911 F (65) 6332 7260 www.mti.gov.sg PRESS RELEASE 3. Five members have stepped down from the SPRING Board: BG Ng Chee Meng – Chief of Air Force, Republic of Singapore Air Force Mr Manohar Khiatani – Chief Executive Officer, JTC Corporation Dr Jitendra Singh – Saul P Steinberg Professor of Management, The Wharton School, University of Pennsylvania Mr Robert Tsao – Chairman Emeritus, United Microelectronics Corporation Mr Zagy Mohamad – Sales Director, Datacraft Singapore JTC Board 4. New Appointments Major- General Neo Kian Hong – Chief of Defence Force, Ministry of Defence Mr Ong Ye Kung – Assistant Secretary-General, National Trades Union Congress 5. -

Financial Results Results for the Half Year to 30 September 2019 BT Group Plc 31 October 2019

Financial results Results for the half year to 30 September 2019 BT Group plc 31 October 2019 BT Group plc (BT.L) today announced its results for the half year to 30 September 2019. Key strategic developments: • Launched a host of new products for consumer and business segments, including the new Halo converged product plans and BT Mobile 5G • Introduced a range of new service initiatives including bringing the BT brand to the high street in over 600 EE/BT dual- branded stores, and to answer 100% of customer calls in the UK & Ireland from January 2020 • Continued to make progress on the BT modernisation agenda, including delivering over £1.1bn transformation benefits, announcing the first locations in our Better Workplace Programme, and disposal of BT Fleet Solutions • Outlined our Skills for Tomorrow programme to provide digital skills training for 10m UK children, families and businesses Operational: • 5G network live in over 20 cities and large towns; 5G smartphone plans now available on both EE and BT brands • Openreach announced the launch of new FTTP 1Gbps and 550Mbps products. FTTP rollout at c.23k premises passed per week; 4.2m ultrafast (FTTP and Gfast) premises passed to date; currently announced plans to build FTTP in 103 locations • Consumer fixed ARPC £38.5, broadly flat year on year; postpaid mobile ARPC £20.8, down 5.5% year on year due to impact of regulation and continued trend towards SIM-only; RGUs per address up to 2.38 • Postpaid mobile churn remains low at 1.2% in Q2 despite impact of auto switching; fixed churn at -

The Dominance and Monopolies Review, Fifth Edition

Dominance and Monopolies Review Fifth Edition Editors Maurits Dolmans and Henry Mostyn lawreviews the Dominance and Monopolies Review The Dominance and Monopolies Review Reproduced with permission from Law Business Research Ltd. This article was first published in The Dominance and Monopolies Review, - Edition 5 (published in July 2017 – editors Maurits Dolmans and Henry Mostyn) For further information please email [email protected] Dominance and Monopolies Review Fifth Edition Editors Maurits Dolmans and Henry Mostyn lawreviews PUBLISHER Gideon Roberton SENIOR BUSINESS DEVELOPMENT MANAGER Nick Barette BUSINESS DEVELOPMENT MANAGERS Thomas Lee, Joel Woods ACCOUNT MANAGERS Pere Aspinall, Sophie Emberson, Laura Lynas, Jack Bagnall MARKETING AND READERSHIP COORDINATOR Rebecca Mogridge RESEARCHER Arthur Hunter EDITORIAL COORDINATOR Gavin Jordan HEAD OF PRODUCTION Adam Myers PRODUCTION EDITOR Martin Roach SUBEDITOR Janina Godowska CHIEF EXECUTIVE OFFICER Paul Howarth Published in the United Kingdom by Law Business Research Ltd, London 87 Lancaster Road, London, W11 1QQ, UK © 2017 Law Business Research Ltd www.TheLawReviews.co.uk No photocopying: copyright licences do not apply. The information provided in this publication is general and may not apply in a specific situation, nor does it necessarily represent the views of authors’ firms or their clients. Legal advice should always be sought before taking any legal action based on the information provided. The publishers accept no responsibility for any acts or omissions contained -

News Release for Immediate Release

News Release For Immediate Release Celebrate and Discover with Media Fiesta 2010 Sophomore edition promises to take the festivities across Singapore Singapore, 24 February 2010 – Media Fiesta, a month-long festival offering interactive media activities, experiential games and showcasing local talent, will return for its second edition in March 2010. Themed “Celebrate and Discover Media”, this year’s programme line-up will bring Singaporeans on an exploratory journey into the world of media. Continuing their partnership from 2009, Media Fiesta 2010 is hosted by the Media Development Authority (MDA) and organised by Pico Art International. The focus for this year is to provide an inspirational platform for audiences to experiment and engage with various forms of media – including traditional, new and future media. Through its various activities, Media Fiesta offers participants a glimpse into the future by demonstrating the convergence of media and info communications, thereby exciting Singaporeans about the new possibilities brought about by this transformation. It also aims to create greater awareness of and appreciation for Singapore-made media content, services and applications. The inaugural event in 2009 featured a four-day main event and fringe events across the island, focusing on public education activities. In 2010, the outreach strategy has been fine-tuned to bring Media Fiesta to a larger audience. Media Fiesta 2010 will feature a ‘Media Transformer ’, a mobile display that showcases interactive media exhibits such as the Future Media Showcase, a Download Café, Media in Creation, Media Trivia and Know your Film Ratings. Page 1 of 25 The Media Transformer will make its stops at four anchor events 1, with one happening on each weekend of the month. -

Link to PDF Version

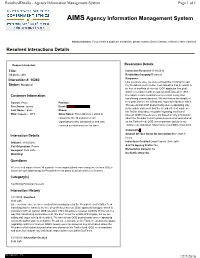

ResolvedDetails - Agency Information Management System Page 1 of 1 AIMS Agency Information Management System Announcement: If you create a duplicate interaction, please contact Gwen Cannon-Jenkins to have it deleted Resolved Interactions Details Reopen Interaction Resolution Details Title: Interaction Resolved:11/30/2016 34 press calls Resolution Category:Resolved Interaction #: 10260 Response: Like everyone else, we were excited this morning to read Status: Resolved the President-elect’s twitter feed indicating that he wants to be free of conflicts of interest. OGE applauds that goal, which is consistent with an opinion OGE issued in 1983. Customer Information Divestiture resolves conflicts of interest in a way that transferring control does not. We don’t know the details of Source: Press Position: their plan, but we are willing and eager to help them with it. The tweets that OGE posted today were responding only First Name: James Email: (b)(6) ' to the public statement that the President-elect made on Last Name: Lipton Phone: his Twitter feed about his plans regarding conflicts of Title: Reporter - NYT Other Notes: This contact is a stand-in interest. OGE’s tweets were not based on any information contact for the 34 separate news about the President-elect’s plans beyond what was shared organizations who contacted us and who on his Twitter feed. OGE is non-partisan and does not received our statement on the issue. endorse any individual. https://twitter.com/OfficeGovEthics Complexity( Amount Of Time Spent On Interaction:More than 8 Interaction Details hours Initiated: 11/30/2016 Individuals Credited:Leigh Francis, Seth Jaffe Call Origination: Phone Add To Agency Profile: No Assigned: Seth Jaffe Memorialize Content: No Watching: Do Not Destroy: No Questions We received inquires from 34 separate news organizations concerning tweets from OGE's twitter account addressing the President-elect's plans to avoid conflicts of interest. -

Dimensional Investment Group

SECURITIES AND EXCHANGE COMMISSION FORM N-Q Quarterly schedule of portfolio holdings of registered management investment company filed on Form N-Q Filing Date: 2008-04-29 | Period of Report: 2008-02-29 SEC Accession No. 0001104659-08-027772 (HTML Version on secdatabase.com) FILER DIMENSIONAL INVESTMENT GROUP INC/ Business Address 1299 OCEAN AVE CIK:861929| IRS No.: 000000000 | State of Incorp.:MD | Fiscal Year End: 1130 11TH FLOOR Type: N-Q | Act: 40 | File No.: 811-06067 | Film No.: 08784216 SANTA MONICA CA 90401 2133958005 Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-Q QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT INVESTMENT COMPANY Investment Company Act file number 811-6067 DIMENSIONAL INVESTMENT GROUP INC. (Exact name of registrant as specified in charter) 1299 Ocean Avenue, Santa Monica, CA 90401 (Address of principal executive offices) (Zip code) Catherine L. Newell, Esquire, Vice President and Secretary Dimensional Investment Group Inc., 1299 Ocean Avenue, Santa Monica, CA 90401 (Name and address of agent for service) Registrant's telephone number, including area code: 310-395-8005 Date of fiscal year end: November 30 Date of reporting period: February 29, 2008 ITEM 1. SCHEDULE OF INVESTMENTS. Dimensional Investment Group Inc. Form N-Q February 29, 2008 (Unaudited) Table of Contents Definitions of Abbreviations and Footnotes Schedules of Investments U.S. Large Cap Value Portfolio II U.S. Large Cap Value Portfolio III LWAS/DFA U.S. High Book to Market Portfolio DFA International Value Portfolio Copyright © 2012 www.secdatabase.com. -

Comodo Threat Intelligence

Comodo Threat Intelligence Lab SPECIAL REPORT: AUGUST 2017 – IKARUSdilapidated Locky Part II: 2nd Wave of Ransomware Attacks Uses Your Scanner/Printer, Post Office Billing Inquiry THREAT RESEARCH LABS Locky Ransomware August 2017 Special Report Part II A second wave of new but related IKARUSdilapidated Locky ransomware attacks has occurred, building on the attacks discovered by the Comodo Threat Intelligence Lab (part of Comodo Threat Research Labs) earlier in the month of August 2017. This late August campaign also uses a botnet of “zombie computers” to coordinate a phishing attack which sends emails appearing to be from your organization’s scanner/printer (or other legitimate source) and ultimately encrypts the victims’ computers and demands a bitcoin ransom. SPECIAL REPORT 2 THREAT RESEARCH LABS The larger of the two attacks in this wave presents as a scanned image emailed to you from your organization’s scanner/printer. As many employees today scan original documents at the company scanner/printer and email them to themselves and others, this malware-laden email will look very innocent. The sophistication here includes even matching the scanner/printer model number to make it look more common as the Sharp MX2600N is one of the most popular models of business scanner/printers in the market. This second wave August 2017 phishing campaign carrying IKARUSdilapidated Locky ransomware is, in fact, two different campaigns launched 3 days apart. The first (featuring the subject “Scanned image from MX-2600N”) was discovered by the Lab to have commenced primarily over 17 hours on August 18th and the second (a French language email purportedly from the French post office featuring a subject including “FACTURE”) was executed over a 15-hour period on August 21st, 2017. -

Speech by Chief of Defence Force Major-General Neo Kian Hong at the Chief of Defence Force Change of Command Parade

Speech by Chief of Defence Force Major-General Neo Kian Hong at the Chief of Defence Force Change of Command Parade 01 Apr 2010 Deputy Prime Minister and Minister for Defence, Mr Teo Chee Hean; Minister for Education and Second Minister for Defence, Dr Ng Eng Hen; Permanent Secretaries; Distinguished Guests, Men and Women of the SAF, Good evening, and thank you for your presence. The mission of the Singapore Armed Forces is to deter threats to Singapore's peace and security, and should it fail, to secure a swift and decisive victory over the aggressor. To remain true to our mission, we need a strong and credible SAF to allow us to pursue our national interests and provide space for Singapore to continue to prosper and grow. The key building blocks of the 3rd Generation SAF are already in place. Firstly, the SAF has acquired cutting-edge equipment and formed new units to transform the SAF into an advanced networked force that can seamlessly tap each Service's capabilities. The Sikorsky S-70B naval helicopters, for example, help enhance the frigates' ability to undertake anti- surface and anti-submarine warfare missions at longer ranges. The frigate's Command, Control and Communications suite also allows it to network with a variety of land-based and airborne SAF assets. Similarly, the Army's Terrex combat vehicles are equipped with the Battlefield Management System which allows each vehicle to call on the fire power of an array of air and land platforms, such as the Apache helicopters. Secondly, to deal with an expanded spectrum of operations both at home and overseas, the SAF has been re-organised into new operational commands. -

Lockdown but Not Shutdown

SBS TRANSIT LTD LOCKDOWN BUT NOT NOT BUT SHUTDOWN ANNUAL REPORT 2020 We’ve been busy this entire time ANNUAL REPORT 2020 In a pandemic,“ the health and safety of our commuters and staff takes on new significance. We stepped up the cleaning and disinfection of our buses and trains, bus interchanges and Mass Rapid Transit (MRT) stations“ as well as our depots and offices. LIM JIT POH CHAIRMAN, SBS TRANSIT LTD PG 1 SBS TRANSIT LTD OUR VISION Moving people in a safe, reliable and affordable way. OUR MISSION To achieve excellence for our customers, employees, shareholders and community. To this end, we are committed to delivering safe and reliable services at affordable prices, being an employer of choice, creating significant shareholder value and becoming a socially responsible corporate role model. OUR CORE BELIEFS To achieve our Vision and Mission, we are guided by the following beliefs: We will: • Be driven by our customers’ needs • Strive for excellence in everything we do • Act with integrity at all times • Treat people with fairness and respect • Maintain safety as a top priority • Collaborate with our partners for a win-win outcome • Give our shareholders a reasonable return PG 2 ANNUAL REPORT 2020 CONTENTS 4 Chairman’s Statement 14 Group Financial Highlights 16 The Impact of COVID-19 36 Bits & Bytes 53 Corporate Information 54 Board of Directors 60 Key Management 65 Operations Review 74 Sustainability Report 84 Corporate Governance 104 Directors’ Particulars 108 Risk Management 112 Financial Calendar 113 Financial Statements 114