General Agreement on Restricted

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

0285.1.00.Pdf

the great awakening Before you start to read this book, take this moment to think about making a donation to punctum books, an independent non-profit press, @ https://punctumbooks.com/support/ If you’re reading the e-book, you can click on the image below to go directly to our donations site. Any amount, no matter the size, is appreciated and will help us to keep our ship of fools afloat. Contri- butions from dedicated readers will also help us to keep our commons open and to cultivate new work that can’t find a welcoming port elsewhere. Our ad- venture is not possible without your support. Vive la Open Access. Fig. 1. Hieronymus Bosch, Ship of Fools (1490–1500) the great awakening: New Modes of Life amidst Capitalist Ruins. Copy- right © 2020 by the editors and authors. This work carries a Creative Commons BY-NC-SA 4.0 International license, which means that you are free to copy and redistribute the material in any medium or format, and you may also remix, transform and build upon the material, as long as you clearly attribute the work to the authors (but not in a way that suggests the authors or punctum books en- dorses you and your work), you do not use this work for commercial gain in any form whatsoever, and that for any remixing and transformation, you distribute your rebuild under the same license. http://creativecommons.org/licenses/by- nc-sa/4.0/ First published in 2020 by punctum books, Earth, Milky Way. https://punctumbooks.com ISBN-13: 978-1-953035-08-0 (print) ISBN-13: 978-1-953035-09-7 (ePDF) doi: 10.21983/P3.0285.1.00 lccn: 2020945724 Library of Congress Cataloging Data is available from the Library of Congress Copy Editing: Lucy Barnes Book Design: Vincent W.J. -

19064 Leggglobal SAR 0805

Western Asset Legg Mason U.S. Money Market Fund Western Asset Global Funds Plc U.S. Core Bond Fund Western Asset Euro Core Bond Fund Semi-Annual Report (Unaudited) Western Asset Diversified Strategic Income Bond For the period ended August 31, 2005 Fund Western Asset Global Multi Strategy Fund Western Asset U.S. High Yield Bond Fund Western Asset Emerging Markets Bond Fund Brandywine Global Opportunities Bond Fund Legg Mason Growth Fund Legg Mason Value Fund Royce U.S. Small Cap Equity Fund Royce 100 Equity Fund Batterymarch European Equity Fund Batterymarch Pacific Equity Fund Legg Mason Global Funds Plc Semi-Annual Report August 31, 2005 Table of Contents Introduction – Legg Mason Global Funds Plc 2 Market Commentary & Fund Reviews 4 Portfolio of Investments – Western Asset U.S. Money Market Fund 9 Portfolio of Investments – Western Asset U.S. Core Bond Fund 11 Portfolio of Investments – Western Asset Euro Core Bond Fund 16 Portfolio of Investments – Western Asset Diversified Strategic Income Bond Fund 19 Portfolio of Investments – Western Asset Global Multi Strategy Fund 23 Portfolio of Investments – Western Asset U.S. High Yield Bond Fund 31 Portfolio of Investments – Western Asset Emerging Markets Bond Fund 35 Portfolio of Investments – Brandywine Global Opportunities Bond Fund 37 Portfolio of Investments – Legg Mason Growth Fund 38 Portfolio of Investments – Legg Mason Value Fund 39 Portfolio of Investments – Royce U.S. Small Cap Equity Fund 40 Portfolio of Investments – Royce 100 Equity Fund 44 Portfolio of Investments – Batterymarch European Equity Fund 46 Portfolio of Investments – Batterymarch Pacific Equity Fund 47 Statement of Assets and Liabilities – Legg Mason Global Funds Plc 50 Statement of Operations – Legg Mason Global Funds Plc 54 Statement of Changes in Net Assets Attributable to Holders of Redeemable Participating Shares – Legg Mason Global Funds Plc 56 Notes to Financial Statements – Legg Mason Global Funds Plc 62 Financial Information – Legg Mason Global Funds Plc 82 Statement of Major Portfolio Changes – Western Asset U.S. -

LN.2-F Sfrkz

42>f<> t 0 -LN.2-f SfrKz TheWofld Bnk aM OM.CAL USE ONL' Public Disclosure Authorized MICROFICHE COPY bpwt No. P-5666-PE Report No. P- 5666-PE Type: (PR) SHEPHERD, / X31912 / I7 051/ LAlCO REPORTAND RECOMMNATION OF THE PR-SIDENT OF THE Public Disclosure Authorized INTERNATIONALBANK FOR RECONSTRUCTIONAND DEVELOPMENT TO THE EXECUTIVEDIf 4- TORS ,'. ON A PROPOSEEDT1OADE POLICY REFORMLOAN IN AN AMOUNTEQUIVALENT TO US$300 MILLION TO THE Public Disclosure Authorized REPUBLICOF PERU JANUARY10, 1992 Public Disclosure Authorized Thisdocnett has a resrictddbutio and may be and by recip onlyin thLeperfomance of thei:oficia s, ItsntetsmaY Mt otherw be disrelsedwithout Worl n thoriati MEN,CY EQUIVALENTS (As of December30, 1991) CurrencyUnit NuevoSol (SI.)V US$1.00 - S/.0.9S SI.1.00 = US$1.05 GOVERNMENTS FISCAL XEAR January 1 - December31 ABBREVIATIONS ALADI - Asociacid6nLatino-Ametica de Inttegract6n (Latin Ameria IntegrationAsociation) CERTEX Certiricado de Reinte TnbutWat a ta Exportacl4n(Export Tax Reimbutement Certificate) CIF Cost, Insurance and Freight D.L - DecMo Lcgslatvo (Lgisatie Decree) D.S. - Decreto Supremo (Supreme Decree) ECASA - Empresa de Comercializacidndel Arroz SA (Rice Marketing Company) ENCI - Empresa Naciontl de Comercializaa6nde Insumos(National Inputs Marketing Company) FENT - Fondo de ExportaonOs No Tradiconales (Fund for Non-Taditional Exports) F.AR - Fondo latinoeicno de Reservas (latin America Reserve Fund) FONCODES - Fondo Nacional de Compensaci6oy De ollo Soial (National Fund for Socal Compensationand Development) GATT -

La Nature Sociale De La Monnaie. Enjeux Théoriques Et Portée Institutionnelle the Social Nature of Money

Revue Interventions économiques Papers in Political Economy 59 | 2018 La nature sociale de la monnaie. Enjeux théoriques et portée institutionnelle The Social Nature of Money. Theoretical Challenges and Institutional Issues Adrien Faudot, Jonathan Massonnet et Jean-François Ponsot (dir.) Édition électronique URL : http://journals.openedition.org/interventionseconomiques/3613 DOI : 10.4000/interventionseconomiques.3613 ISBN : 1710-7377 ISSN : 1710-7377 Éditeur Association d’Économie Politique Référence électronique Adrien Faudot, Jonathan Massonnet et Jean-François Ponsot (dir.), Revue Interventions économiques, 59 | 2018, « La nature sociale de la monnaie. Enjeux théoriques et portée institutionnelle » [En ligne], mis en ligne le 01 janvier 2018, consulté le 24 septembre 2020. URL : http://journals.openedition.org/ interventionseconomiques/3613 ; DOI : https://doi.org/10.4000/interventionseconomiques.3613 Les contenus de la revue Interventions économiques sont mis à disposition selon les termes de la Licence Creative Commons Attribution 4.0 International. Revue Interventions économiques Papers in Political Economy 59 | 2017 La nature sociale de la monnaie. Enjeux théoriques et portée institutionnelle The Social Nature of Money. Theoretical Challenges and Institutional Issues Adrien Faudot, Jonathan Massonnet et Jean-François Ponsot (dir.) Édition électronique URL : http://journals.openedition.org/interventionseconomiques/3613 ISSN : 1710-7377 Éditeur Association d’Économie Politique Référence électronique Adrien Faudot, Jonathan Massonnet et Jean-François Ponsot (dir.), Revue Interventions économiques, 59 | 2017, « La nature sociale de la monnaie. Enjeux théoriques et portée institutionnelle » [En ligne], mis en ligne le 20 décembre 2017, consulté le 09 janvier 2018. URL : http://journals.openedition.org/ interventionseconomiques/3613 Ce document a été généré automatiquement le 9 janvier 2018. Les contenus de la revue Interventions économiques sont mis à disposition selon les termes de la Licence Creative Commons Attribution 4.0 International. -

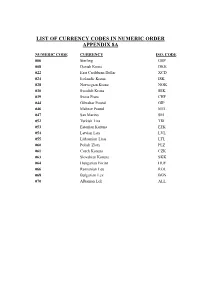

List of Currency Codes in Numeric Order Appendix 8A

LIST OF CURRENCY CODES IN NUMERIC ORDER APPENDIX 8A NUMERIC CODE CURRENCY ISO. CODE 006 Sterling GBP 008 Danish Krone DKK 022 East Caribbean Dollar XCD 024 Icelandic Krona ISK 028 Norwegian Krone NOK 030 Swedish Krona SEK 039 Swiss Franc CHF 044 Gibraltar Pound GIP 046 Maltese Pound MTL 047 San Marino SM 052 Turkish Lira TRL 053 Estonian Koruna EEK 054 Latvian Lats LVL 055 Lithuanian Litas LTL 060 Polish Zloty PLZ 061 Czech Koruna CZK 063 Slovakian Koruna SKK 064 Hungarian Forint HUF 066 Romanian Leu ROL 068 Bulgarian Lev BGN 070 Albanian Lek ALL NUMERIC CODE CURRENCY ISO. CODE 075 Russian Rouble RUR 083 Kyrgyzstan Som KGS 091 Slovenian Tolar SIT 092 Croatian Dinar HRD 094 Serbian + Monteneg. Dinar YUN 096 Macedonian MKD 204 Moroccan Dirham MAD 208 Algerian Dinar DZD 212 Tunisian Dinar TND 216 Libyan Dinar LYD 220 Egyptian Pound EGP 224 Sudanese Pound SDP 228 Mauritanian Ouguiya MRO 247 Cape Verde Escudo CVE 252 Gambian Dalasi GMD 257 Guinea-Bissau Peso GWP 260 Guinea Franc GNS 264 Sierra Leone SLL 268 Liberian Dollar LRD 276 Ghana Cedi GHC 288 Nigerian Naira NGN 310 Guinea Ekwele GQE 311 Sao Tome Dobra STD 322 Zaire ZRZ 324 Rwanda Franc RWF 328 Burundi Franc BIF 329 St. Helena Pound SHP 330 Angolan Kwanza AOK 334 Ethiopian Birr ETB 338 Djibouti Franc DJF 342 Somalia Shilling SOS 346 Kenyan Shilling KES 350 Uganda Shilling UGS 352 Tanzanian Shilling TZS NUMERIC CODE CURRENCY ISO. CODE 355 Seychelles Rupee SCR 366 Mozambique Metical MZM 370 Madagascar Franc MGF 373 Mauritius Rupee MUR 375 Comorian Franc KMF 378 Zambian Kwacha ZMK 382 Zimbabwe -

Bluepay XML Post

BluePay – XML Internet Payment Gateway TECHNICAL DOCUMENTATION XML INTERNET PAYMENT GATEWAY Version 4.8 Application Programming Interface Distributed By: BluePay, Inc. 184 Shuman Blvd Ste 350 Naperville, IL 60563 Last Updated: Phone: 866-739-8324 Fax: 866-422-9385 December 24, 2020 URL: www.bluepay.com ________________________________________________________________________________________________________ Page 1 BluePay – XML Internet Payment Gateway IMPORTANT NOTICE! The information contained in this publication is considered to be proprietary and confidential. It is intended solely for the use of BluePay partners, clients and employees. The contents of this document and the ideas contained herein may not be disclosed, reproduced or transmitted in any form or distributed, in whole or in part, without the prior written consent of BluePay, Inc. ________________________________________________________________________________________________________ Page 2 BluePay – XML Internet Payment Gateway TABLE OF CONTENTS INTENDED USE ...............................................................................................................................................................................3 INTEGRATION CONSIDERATIONS ...........................................................................................................................................3 USE OF INTERNET STANDARDS ................................................................................................................................................4 INPUT -

Minihistoria Monetari: Del Roma Ancian Al Globalisation

Minihistoria monetari: del Roma ancian al globalisation Per Cláudio Rinaldi [email protected] Indice 1. Le saga del denario. 2. Le nascentia del libra. 3. Le dollar del Medievo. 4. Nationalismo monetari. 5. Le prime immigrante latino. 6. Le standard auree e le symbolo inconfundibile 7. Le monetas transnational. 8. Technologia, abstraction e le moneta universal. 9. Le pecunia del futuro. 1. Le saga del denario Denario roman del 1e centennio ante Christo. Durante le 5e e le 4e centennios ante Christo, circulava in Italia central monetas nominate aes grave, o sia „bronzo pesante‟. Le parola latin aes designava le metallos minus nobile como le cupro, le bronzo e le laton. Le moneta basic e tamben de plus alte valor se nominava as o „unitate‟. Illo portava un littera I inscripte a un latere e le effigie del deo Jano (Ianus in latino) al altere. Un pecia con le medietate de su valor se appellava semis e portava un S e le deo Saturno. Le pecias minor contineva differente quantitates de bollettas: quatro bollettas habeva le triens, tres le quadrans, duo le sextans e un le uncia, iste ultime con peso e valor equivalente a un duodecimo del as. Malgrado le irregularitate de iste pecias rudimentari, illos representava un avantiamento in comparation al lingotos de bronzo dicte aes rude que habeva circulate como medio de excambio usque tunc. Circa 280 a.C., le romanos organisava un systema monetari complete, con plus monetas divisionari – le minor esseva le semuncia o „medie uncia‟, valente un vinti-quarto del as – e tamben multiplos como le dupondius, con valor de duo asses. -

Executive Intelligence Review, Volume 15, Number 37, September

SPETSNAZ WHAT THE PENTAGON WON'T TELL YOU... Two EIR Special Reports will. �PtqAL RtK>RT SPETSNAZ In the Pentagon's "authoritative" report on the Soviet military threat, Soviet MilitaryPower 1988, the word spets naz never even appears. But spetsnaz are Russian "green berets." Infiltrated into Western Europe, spetsnaz have new weapons that can wipe out NATO'S mobility, fire power, and depth of defense, before Marshal Nikolai Ogarkov launches his general assault. ELECTROMAGNETIC PULSE WEAPONS At least the Pentagon report mentions them-but only their "defensive" applications. In fact, they can be trans ported by spetsnaz, finely tuned to kill, paralyze, or di sorient masses of people, or to destroy electronics and communications. With EMP, as strategic weaponry or in the hands of spetsnaz, the Russians won't need to fire a single nuclear missile to take Europe. Global Showdown Escalates, 525 pages, $250 Electromagnetic-Effect Weapons, 100 pages, $150 Order from: EIR, P.O. Box 17390, " Washington, D.C. 20041-0390. In Europe: EIR, Nachrichtenagentur SPECIAL REPORT GmbH, Dotzheimer Str. 166, 0-6200 Wiesbaden, FRG, Phone (06121) 884-0. Founder and Contributing Editor: Lyndon H. LaRouche, Jr. Editor: Nora Hamerman From the Editor Managing Editors: Yin Berg and Susan Welsh Editoral Board: Warren Hamerman, Melvin Klenetsky, Antony Papert, Uwe Parpart Henke, Gerald Rose, Alan Salisbury, Edward Spannaus, Nancy Spannaus, Webster Tarpley, William Wertz, Carol White, Christopher White Science and Technology: Carol White Special Services: Richard Freeman Rarely has EIR been able to offer readers so broad an array of our Book Editor: Janine Benton Advertising Director: Marsha Freeman unique, independent news coverage as in the present edition. -

Crspsift 4.3.21 User Guide | Chapter 2: Installation and Setup PAGE 7 License Agreement

R CENTER FOR RESEARCH IN SECURITY PRICES, LLC An Affiliate of the University of Chicago Booth School of Business CRSPSift USER GUIDE Version 4.3.21 Updated May 7, 2021 R CENTER FOR RESEARCH IN SECURITY PRICES, LLC An Affiliate of the University of Chicago Booth School of Business 105 West Adams, Suite 1700 Chicago, IL 60603 Tel: 312.263.6400 Fax: 312.263.6430 Email: [email protected] Table of Contents Chapter 1: Introduction ...................................................................................5 Chapter 2: Installation and Setup ......................................................................6 Chapter 3: TsQuery: Time Series Access ...........................................................10 Entities ................................................................................................................................. 10 Data Items ............................................................................................................................. 15 Date ...................................................................................................................................... 20 Layout ................................................................................................................................... 21 Direct Edit .............................................................................................................................. 25 Executing a Query .................................................................................................................. -

Executive Intelligence Review, Volume 14, Number 18, May 1, 1987

ilillQuarterly Economic Report REAL/IT CATCHES UPW/TH THE MYTH- MAKERS • "One-third of a nation," to use FOR's famous phrase, "is ill-clothed, ill-housed, and ill-fed" again today, as in the 1930s. The good news about the "Reagan recovery" is that the official unemployment rate is way down. The bad news is that the figures are faked, and represent displacement of the workforce into low-pay, low-benefit jobs, or involuntary part-time jobs. It represents personal credit-card debt, jobless workers without unemployment benefits, hungry persons without food stamps, underemployed or unemployed workers seeking food charity, homeless persons, and rapidly growing poverty. • One year ago, EIR warned that the U.S. physical economy would begin a 15- 25% annual rate of decline sometime in 1986. We argued that such a decline could be slowed, by available political means, but even if slowed, would not be held back beyond the last quarter of the year. In June, the first evidence came in confirming our prediction. In December, again, we were right on the button. • The political climate in which the administration has been able to peddle the · lies that underpinned the recovery myth has itself changed. November's mid-term elections were a crushing defeat for candidates, especially Republican Party sen atatorial candidates, who were identified by the electorate as supporters of the administration's economic policies. Contents I. Introduction: reality catches up with the myth-makers and their frauds II. Poverty spreads as the 'safety net' collapses III. The collapse of basic industry IV. How defense and space programs drive economic growth V. -

Format Notes (PDF)

Revenue Online Services EU Savings Schema Notes Revenue Online Services Schema Notes EU Savings Last Updated 14th January 2014 Status Final Document Version 1.4 Page 1 of 32 Revenue Online Services EU Savings Schema Notes Contents 0 Document Information .................................................................................................................................................... 3 0.1 Synopsis..................................................................................................................................................................... 3 0.2 Change History .......................................................................................................................................................... 3 1 File Extensions ............................................................................................................................................................... 6 1.1 Notes On File Extensions ........................................................................................................................................... 6 2 Elements ........................................................................................................................................................................ 7 2.1 Notes on Elements ..................................................................................................................................................... 7 2.2 Definition of Table Columns ...................................................................................................................................... -

Oracle Financial Data Manager Data Dictionary, Release 4.5

Oracle Financial Data Manager Data Dictionary Release 4.5 July 2000 Part No. A82946-01 Oracle Financial Data Manager Data Dictionary, Release 4.5 Part No. A82946-01 Copyright © 1997, 2000, Oracle Corporation. All rights reserved. Contributing Authors: Greg Hall and Steven Roepke Reviewers: Kevin Courtney, Claudia Hawkins, Rondi Mertes, and David Todd The programs are not intended for use in any nuclear, aviation, mass transit, medical, or other inherently dangerous applications. It shall be the licensee’s responsibility to take all appropriate fail-safe, backup, redundancy, and other measures to ensure the safe use of such applications if the programs are used for such purposes, and Oracle Corporation disclaims liability for any damages caused by such use of the programs. The programs (which include both the software and documentation) contain proprietary information of Oracle Corporation; they are provided under a license agreement containing restrictions on use and disclosure and are also protected by copyright, patent, and other intellectual and industrial property laws. Reverse engineering, disassembly, or decompilation of the programs is prohibited. The information contained in this document is subject to change without notice. If you find any problems in the documentation, please report them to us in writing. Oracle Corporation does not warrant that this document is error free. Except as may be expressly permitted in your license agreement for these programs, no part of these programs may be reproduced or transmitted in any form or by any means, electronic or mechanical, for any purpose, without the express written permission of Oracle Corporation. Program Documentation is licensed for use solely to support the deployment of the Program and not for any other purpose.