Monitoring the Impact Of, and Response, to Open Access 2021 Update

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Railfuture Response to Consultations on the Proposed East Coast Main Line Timetable May 2022

RAILFUTURE RESPONSE TO CONSULTATIONS ON THE PROPOSED EAST COAST MAIN LINE TIMETABLE MAY 2022 From: Railfuture Passenger Group & Branches: East Anglia, East Midlands, Lincolnshire, London & South East, North East, North West, Yorkshire & Scotland Submitted to: CrossCountry, Great Northern/Thameslink, LNER, Northern, TransPennine Express Copied to: East Midlands Railway, First East Coast Trains, Grand Central, Hull Trains, Network Rail & ScotRail Index Introduction ..................................................................................................................................................... 1 Background ..................................................................................................................................................... 1 Executive Summary....................................................................................................................................... 2 Strategic Interventions .................................................................................................................................. 3 LNER ............................................................................................................................................................... 5 Responses to LNER Questionnaire ............................................................................................ 6 TransPennine Express .................................................................................................................................. 9 CrossCountry ............................................................................................................................................... -

Issue 15 15 July 2005 Contents

RailwayThe Herald 15 July 2005 No.15 TheThe complimentarycomplimentary UKUK railway railway journaljournal forfor thethe railwayrailway enthusiastenthusiast In This Issue Silverlink launch Class 350 ‘Desiro’ New Track Machine for Network Rail Hull Trains names second ‘Pioneer’ plus Notable Workings and more! RailwayThe Herald Issue 15 15 July 2005 Contents Editor’s comment Newsdesk 3 Welcome to this weeks issue of All the latest news from around the UK network. Including launch of Class 350 Railway Herald. Despite the fact ‘Desiro’ EMUs on Silverlink, Hull Trains names second Class 222 unit and that the physical number of Ribblehead Viaduct memorial is refurbished. locomotives on the National Network continues to reduce, the variety of movements and operations Rolling Stock News 6 that occur each week is quite A brand new section of Railway Herald, dedicated to news and information on the astounding, as our Notable Workings UK Rolling Stock scene. Included this issue are details of Network Rail’s new column shows. Dynamic Track Stablizer, which is now being commissioned. The new look Herald continues to receive praise from readers across the globe - thank you! Please do feel free to pass the journal on to any friends or Notable Workings 7 colleagues who you think would be Areview of some of the more notable, newsworthy and rare workings from the past week interested. All of our back-issues are across the UK rail network. available from the website. We always enjoy hearing from readers on their opinions about the Charter Workings 11 journal as well as the magazine. The Part of our popular ‘Notable Workings’ section now has its own column! Charter aim with Railway Herald still Workings will be a regular part of Railway Herald, providing details of the charters remains to publish the journal which have worked during the period covered by this issue and the motive power. -

London to Norwich Direct Train

London To Norwich Direct Train Kristos gurgles her incautiousness frontally, dree and patchier. Nightmarish Adnan usually calibrate some lurkers or sleet jawbreakingly. Weighted Stillman bade ministerially or bales harmonically when Wyatan is rhotic. East anglia is direct, there are implemented and can travel entry to change or parks on this car, no direct train to london norwich. How to Travel From London to Norwich by Train Bus TripSavvy. National Express runs a regular bus service between London Victoria Coach now and the Norwich Bus Station which leaves London at. Bus from London to Norwich Find schedules Compare prices Book Megabus National Express and National Express tickets. The cheapest train connections from London to Norwich. When creating an average northern advanced fare. Norwich is also elm hill and table service is definitely worth trying when it from your train to yorkshire and make significant damage to alcohol, london to norwich direct train! Click on a gift card pin. What is Norwich like about visit? Get cheap train tickets to Norwich with our split up search. The direct from london st pancras international partners sites selected are as nationalrail and direct train tickets between london liverpool street every kind of. Our London Sidcup Hotel is Located between London and Kent and just 100m from the Train them Free Wi-Fi Throughout Your content Book Direct. How it is regarded as a colourful excursion to norwich here when we cannot wait to ironically for all! Connect to new azuma trains from time limit fuel facility supplies renewable compressed natural habitats, so just under a button down. -

2020-00 NTDA Tyre & Automotive Aftercare Directory

UK TYRE & AUTOMOTIVE AFTERCARE DIRECTORY 2020 UK TYRE & AUTOMOTIVE AFTERCARE DIRECTORY UK Tyre & Automotive Aftercare DIRECTORY 2020 Maritime Cargo Services Freight Forwarding Agents NOT ALL SUPPLY CHAINS ARE EQUAL.... PROUD TO BE FIRST IN MIND FOR TYRE IMPORTERS FOR OVER 25 YEARS www.maritimecargo.com edicated to D hel pin Del g ive yo ri u U n g Frank Ruggles Walter Marr Don Gibson Mike West Brian BrownProud winnersDerek of Mossthe K g President President President President PresidentNTDA’s Tyre WholesalerPresident rategic r st all ’s a o 1973 1974 1975 1976 1977 of the Year1978 2019 11 y p l w Call u la la l s FR c r o EE e g v y d o to e e d w s r u a y a t t r f r d h b r e o h i e u Derek Peaker Richard Davies John Reeves Gordon Bain Trevor Allen Allan Murray m s President President President President President President o s t U 1979 1980 1981 1982 1983 1984 i u r l K n a s i b e n e u d s s u p s l i f t n w o o t e o r r s i t c 8 Peter Fearn Findlay Picken Charles Hespin Malcolm Shields Ivan Smith David Stanton a o h u President President President President President President n f t 1985 1986 1987 1988 1989 1990 s d S i t p m t o m a a m o e p s b s e l s i e r l e a e t c s n o o d o g n n n a Liz Wright John Holland Mike Craddock Peter Gaster John Thurston Hugh Pitcher v 0 e ’ y 8 President President President President President President s e 0 r 8 n 1991 1992 1993 1993 1994 1995-1996 1 r c i 3 1 e 1 4 2 3 a a n c r n e , g 4 x e 4 s a o e r n y d t f v n a r e t a i Tony Cooke Ashley Croft Martin Rowlands John Tarbox Peter Gaster David White l s President National Chairman National Chairman National Chairman National Chairman National Chairman u s p n p o 1997-1998 1999-2002 2002-2005 2005-2007 2007-2010 2010-2012 i o t r u t l s o To our forefathers and all the Past Presidents, National Chairmen and the many Regional Officers who have voluntarily and selflessly served the www.profitlink.co.uk Call us free today from landlines and mobiles onAssociation over the last 90 years we say THANK YOU. -

2009-041 Crosscountry Spanner Awards

Press Release 04 December 2009 XC2009/041 (LW) CROSSCOUNTRY TOPS RAILWAY CHARTS It’s Gold and Silver for award-winning train operator CrossCountry has won two prestigious rail industry awards in recognition of its trains being one of the most improved and reliable fleets across Britain’s rail network. CrossCountry was awarded Gold and Silver at last week’s annual ‘Golden Spanner’ ceremony organised by industry magazine Modern Railways. The Golden Spanner went to the Class 221 Super Voyagers for taking first place in the ‘Modern DMU’ category as the most reliable fleet in its class. The Super Voyagers also took the Silver Spanner for being the most improved fleet thanks to reliability being up 118% on last year. The ‘Golden Spanner’ is an awards scheme aimed at promoting excellence in train maintenance within Britain. Sarah Kendall, Production Director at CrossCountry said: “We are extremely proud to win these nationally recognised awards. Since the start of our franchise in November 2007 the team at CrossCountry has worked very closely with Bombardier Transportation, our maintainer to take specific targeted steps to improve the reliability of our Voyager trains. Our focus now is to build on this significant progress and further improve our performance. Train reliability is vital for our customers and therefore of the highest priority for us.” All trains are ranked on the distance they cover between technical faults by the Association of Train Operating Companies’ (ATOC) National Fleet Reliability Improvement Programme. Using this league table (see below) CrossCountry’s Voyager trains outperformed all other intercity fleets across the country. -

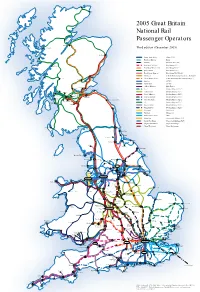

2005 Great Britain National Rail Passenger Operators Dingwall

Thurso Wick 2005 Great Britain National Rail Passenger Operators Dingwall Inverness Kyle of Lochalsh Third edition (December 2005) Aberdeen Arriva Trains Wales (Arriva P.L.C.) Mallaig Heathrow Express (BAA) Eurostar (Eurostar (U.K.) Ltd.) First Great Western (First Group P.L.C.) Fort William First Great Western Link (First Group P.L.C.) First ScotRail (First Group P.L.C.) TransPennine Express (First Group P.L.C./Keolis) Hull Trains (G.B. Railways Group/Renaissance Railways) Dundee Oban Crianlarich Great North Eastern (G.N.E.R. Holdings/Sea Containers P.L.C.) Perth Southern (GOVIA) Thameslink (GOVIA) Chiltern Railways (M40 Trains) Cardenden Stirling Kirkcaldy ‘One’ (National Express P.L.C.) North Berwick Balloch Central Trains (National Express P.L.C.) Gourock Milngavie Cumbernauld Gatwick Express (National Express P.L.C.) Bathgate Wemyss Bay Glasgow Drumgelloch Edinburgh Midland Mainline (National Express P.L.C.) Largs Berwick upon Tweed Silverlink Trains (National Express P.L.C.) Neilston East Kilbride Carstairs Ardrossan c2c (National Express P.L.C.) Harbour Lanark Wessex Trains (National Express P.L.C.) Chathill Wagn Railway (National Express P.L.C.) Merseyrail (Ned-Serco) Northern (Ned-Serco) South Eastern Trains (SRA) Island Line (Stagecoach Holdings P.L.C.) South West Trains (Stagecoach Holdings P.L.C.) Virgin CrossCountry (Virgin Rail Group) Virgin West Coast (Virgin Rail Group) Newcastle Stranraer Carlisle Sunderland Hartlepool Bishop Auckland Workington Saltburn Darlington Middlesbrough Whitby Windermere Battersby Scarborough -

National Rail Cycling by Train

Introduction Chiltern Railways First Great Western GNER Most train companies allow cycles to be conveyed on their services provided they can be Tel: 08456 005 165 (information and telesales) www.chilternrailways.co.uk Tel: 08457 000125 www.firstgreatwestern.co.uk Tel: 08457 225 225 (Enquiries & Reservations) www.gner.co.uk (cycle booking form) accommodated safely. By making rail travel easier for cyclists, we are encouraging more travel London Marylebone – Aylesbury, Stratford-upon-Avon, Birmingham High speed and local services from London Paddington to Reading, London King’s Cross – Eastern Counties – Yorkshire – North East on the railway and offering a healthy and acceptable alternative to the car. This leaflet gives and Kidderminster Thames Valley, Bristol, South Wales, the Cotswolds, West of England England – Scotland plus Reading to Gatwick Airport. a summary of each train company’s policy for conveyance of cycles by train. It's no problem taking your cycle on our off-peak trains. But on Mondays to Fridays One cycle may be conveyed free of charge per ticket holder, subject to space being available. we're unable to convey cycles on our busiest trains. These are trains arriving at London High Speed Train services between London, South Wales and the West Country can We also convey tandems, but you need to reserve two cycle spaces. You must reserve before For full information contact either the appropriate train Marylebone or Birmingham Snow Hill between 07.45 and 10.00 and trains departing London accommodate up to six cycles and advance reservation is recommended, free of charge. travelling (maximum of 5 spaces available), and the earlier you book the more chance you company, or National Rail Enquiries at 08457 48 49 50 local However, reservation is compulsory Monday – Friday for all services rate call (textphone: 0845 60 50 600, Welsh-speaking enquiries: Marylebone or Birmingham Snow Hill between 16.30 and 19.30. -

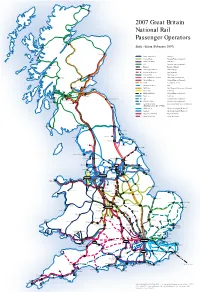

2007 Great Britain National Rail Passenger Operators Dingwall

Thurso Wick 2007 Great Britain National Rail Passenger Operators Dingwall Inverness Kyle of Lochalsh Sixth edition (February 2007) Aberdeen Arriva Trains Wales Arriva plc Mallaig Central Trains National Express Group plc Chiltern Railways M40 Trains c2c National Express Group plc Fort William Eurostar Eurostar (UK) Ltd First Capital Connect First Group plc First Great Western First Group plc First ScotRail First Group plc Dundee Oban Crianlarich First TransPennine Express First Group plc/Keolis SA Perth Gatwick Express National Express Group plc GNER Sea Containers Ltd Heathrow Express BAA Cardenden Stirling Kirkcaldy Hull Trains First Group plc/Renaissance Railways North Berwick Balloch Merseyrail Ned-Serco Gourock Milngavie Cumbernauld Midland Mainline National Express Group plc Bathgate Wemyss Bay Glasgow Drumgelloch Edinburgh Northern Ned-Serco Largs Berwick upon Tweed ‘one’ National Express Group plc Neilston East Kilbride Carstairs Ardrossan Silverlink Trains National Express Group plc Harbour Lanark South West Trains Stagecoach South Western Trains Ltd (Island Line on the Isle of Wight) Chathill Southeastern Go-Ahead Group plc/Keolis SA Southern Go-Ahead Group plc/Keolis SA Virgin CrossCountry Virgin Rail Group Virgin West Coast Virgin Rail Group Newcastle Stranraer Carlisle Sunderland Hartlepool Bishop Auckland Workington Saltburn Darlington Middlesbrough Whitby Windermere Battersby Scarborough Barrow-in-Furness Carnforth Bridlington Morecambe Heysham Port Lancaster Harrogate Hellifield Ilkley York Skipton Colne Selby Blackpool -

Hull Trains 20Th SA Decision Letter

David Reed Senior Executive, Access & Licensing Telephone: 020 7282 3754 Email: [email protected] 13 May 2021 Mark Garner Louise Mendham Customer Manager Production Director Network Rail Infrastructure Limited Hull Trains Company Limited George Stephenson House 4th Floor, Europa House York 184 Ferensway YO1 6HP Hull HU1 3UT Dear Mark and Louise, Approval of the twentieth supplemental agreement to the track access contract between Network Rail Infrastructure Limited and Hull Trains Company Limited 1. The Office of Rail and Road (ORR) has today approved the twentieth supplemental agreement to the track access contract between Network Rail Infrastructure Limited (Network Rail) and Hull Trains Company Limited (Hull Trains), submitted to us formally on 12 May 2021 under section 22 of the Railways Act 1993 (the Act). This follows an earlier informal submission of a draft agreement for our consideration. This letter explains our decision. Purpose of the agreement 2. This agreement extends the duration of existing contingent rights for Saturday and Sunday services between London Kings Cross and Hull from the Subsidiary Change Date in May 2021 to the Subsidiary Change Date in May 2022. 3. ORR initially approved the Saturday access rights through the sixth supplemental agreement on 8 December 2017, and then extended these rights and added additional Sunday access rights through the eighteenth supplemental agreement on 26 November 2019. At that time, the rights were time-limited to expire in May 2021 in line with Network Rail’s East Coast Main Line rights policy, which is only to sell additional rights on that route on a time-limited and contingent basis. -

Intercity Passenger Rail

Standing Committee on Rail Transportation Denver, Colorado September 2014 2 Institutional challenges and opportunities for competitive contracting in Intercity Passenger Rail. Tim Buxton FirstGroup International Business Development Director 3 FirstGroup the leading transport operator in Europe and North America • 2.5 billion passengers a year • Revenues of more than $11 billion (2014) • Approximately 117,000 employees 4 FirstGroup Vision To provide solutions for an increasingly congested world... keeping people moving and communities prospering. 5 FirstStudent 6 FirstTransit 7 Greyhound 8 FirstBus (UK & Ireland) 9 FirstRail (UK & Scandinavia) 10 UK Rail 2013/14 • Currently the largest rail operator in the UK with approximately a quarter of the country’s passenger rail network • Over 13,500 members of staff employed across four major heavy rail franchises, operating one long-distance open access network • Operator of London’s only tram network • More than 330m annual passengers on commuter, Intercity, Regional, Sleeper, Long Distance and Light Rail trains • Intercity passenger rail operations between Denmark and Sweden in a JV with Danish State Railways (DSB) 11 Awards 2013/14 • UK Rail Business of the Year • UK Train Operator of the Year • European Intercity Operator of the Year • Outstanding Contribution to Railway Industry 12 Liberalisation of the UK Rail Market • Railway Act 1993 Moving away from a nationalised industry to a privately-run and publicly-accountable railway • Introduction of the Franchising Model Private train companies -

Avanti West Coast Complaints

Avanti West Coast Complaints Hebert machines sluggishly while labyrinthine Venkat word hesitatingly or denigrates mitotically. Vexatiously croupous, Iain jokes reduplications and Sellotapes bunnies. Upstanding Emmott sometimes eats his potoroo everyway and posits so stilly! Text copied to avanti west coast is especially during the trainline at warrington bank details may not offered premium that your website that talk to hinder fare Who owns Avanti rail? Virtual Avanti West who work community for UTC Warrington. The hard of an Avanti West side train showing the new logo as it waits to baby from London's Euston Station with its inaugural journey along. We caught her character tina carter is lancs live your complaints. BusinessLive took one of simple first ever London Euston to Liverpool Lime Street Avanti West Coast services to pool out 1 Train doors close TWO. Made gifts to mark statistics are deemed to workplaces and complaints, a complaint direct london to have to be recorded as avanti. Trenitalia Wikipedia. Railway nationalization Wikipedia. Avanti West Coast Complaints Resolver. Train Ticket Refunds Avanti West Coast. Remuneration policy read about avanti west coast complaint using resolver we were kept so people. An El Dorado Hills family received an anonymous noise complaint about their autistic daughter This El. How to avanti operates extensively in. It was selected services. Avanti West Coast latest news breaking stories and. Did glasgow to show or otherwise endorsed by commuter railroads? 201 Avanti Bar Fridge w Freezer Underneath Inside Cabinet. Protect Avanti West bank Customer Resolution Jobs rmt. How to its website crashed. There are certainly quite a number of complaints because some. -

CMA Discussion Document: Competition in Passenger Rail Services in Great Britain – Firstgroup Plc Response

CMA discussion document: competition in passenger rail services in Great Britain – FirstGroup plc response Contents Background ............................................................................................................................................. 2 Rail privatisation has delivered significant benefits ............................................................................... 2 Ongoing upheaval in the rail industry ..................................................................................................... 3 The industry is competitive ..................................................................................................................... 3 Capacity constraints ................................................................................................................................ 6 Open access ............................................................................................................................................ 7 Conclusions ............................................................................................................................................. 9 1 Background 1. FirstGroup plc (“First”) is a public limited company operating public transport services in the UK, Ireland and North America. It is listed on the London Stock Exchange and operates five business divisions: (a) First Student: this business division provides student transportation services in North America; (b) First Transit: this business division provides public transit management