World Bank Document

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Real 007 Used Fake News to Get the U.S. Into World War II About:Reader?Url=

The Real 007 Used Fake News to Get the U.S. into World War II about:reader?url=http://www.thedailybeast.com/articles/2017/01/29/the-r... thedailybeast.com Marc Wortman01.28.17 10:00 PM ET Photo Illustration by Elizabeth Brockway/The Daily Beast CLOAK & DAGGER The British ran a massive and illegal propaganda operation on American soil during World War II—and the White House helped. In the spring of 1940, British Prime Minister Winston S. Churchill was certain of one thing for his nation caught up in a fight to the death with Nazi Germany: Without American support his 1 of 11 3/20/2017 4:45 PM The Real 007 Used Fake News to Get the U.S. into World War II about:reader?url=http://www.thedailybeast.com/articles/2017/01/29/the-r... nation might not survive. But the vast majority of Americans—better than 80 percent by some polls—opposed joining the fight to stop Hitler. Many were even against sending any munitions, ships or weapons to the United Kingdom at all. To save his country, Churchill had not only to battle the Nazis in Europe, he had to win the war for public opinion among Americans. He knew just the man for the job. In May 1940, as defeated British forces were being pushed off the European continent at Dunkirk, Churchill dispatched a soft-spoken, forty-three-year-old Canadian multimillionaire entrepreneur to the United States. William Stephenson traveled under false diplomatic passport. MI6—the British secret intelligence service—directed Stephenson to establish himself as a liaison to American intelligence. -

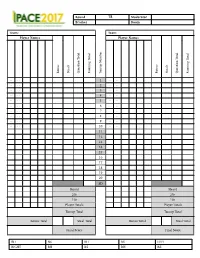

Round Moderator Bracket Room Team

Round 18 Moderator Bracket Room Team: Team: Player Names Player Names Steals Bonus Steals Question Total Running Total Bonus Running Total Tossup Number Question Total .. .. 1 .. .. .. .. 2 .. .. .. .. 3 .. .. .. .. 4 .. .. .. .. 5 .. .. .. .. 6 .. .. .. .. 7 .. .. .. .. 8 .. .. .. .. 9 .. .. .. .. 10 .. .. 11 12 13 14 15 16 17 18 19 20 SD Heard Heard 20s 20s 10s 10s Player Totals Player Totals Tossup Total Tossup Total Bonus Total Steal Total Bonus Total Steal Total Final Score Final Score RH RS BH BS LEFT RIGHT BH BS RH RS PACE NSC 2017 - Round 18 - Tossups 1. A small sculpture by this man depicts a winged putto with a faun's tail wearing what look like chaps, exposing his rear end and genitals. Padua's Piazza del Santo is home to a sculpture by this man in which one figure rests a hoof on a small sphere representing the world. His Atys is currently held in the Bargello along with his depiction of St. George, which like his St. Mark was originally sculpted for a niche of the (*) Orsanmichele. The equestrian statue of Marcus Aurelius inspired this man's depiction of Erasmo da Narni. The central figure holds a large sword and rests his foot on a helmeted head in a sculpture by this artist that was the first freestanding male nude produced since antiquity. For 10 points, name this Florentine sculptor of Gattamelata and that bronze David. ANSWER: Donatello [or Donatello Niccolò di Betto Bardi] <Carson> 2. Minnesota Congressman John T. Bernard cast the only dissenting vote against a law banning US intervention in this conflict. Torkild Rieber of Texaco supplied massive quantities of oil to the winning side in this war. -

The Treason of Rockefeller Standard Oil (Exxon) During World War II

The Treason Of Rockefeller Standard Oil (Exxon) During World War II By The American Chronicle February 4, 2012 We have reported on Wall Street’s financing of Hitler and Nazi programs prior to World War 2 but we have not given as much attention to its treasonous acts during the war. The depths to which these men of fabled wealth sent Americans to their deaths is one of the great untold stories of the war. John Rockefeller, Jr. appointed William Farish chairman of Standard Oil of New Jersey which was later rechristened Exxon. Farish lead a close partnership with his company and I. G. Farben, the German pharmaceutical giant whose primary raison d'etre was to occlude ownership of assets and financial transactions between the two companies, especially in the event of war between the companies' respective nations. This combine opened the Auschwitz prison camp on June 14, 1940 to produce artificial rubber and gasoline from coal using proprietary patents rights granted by Standard. Standard Oil and I. G. Farben provided the capital and technology while Hitler supplied the labor consisting of political enemies and Jews. Standard withheld these patents from US military and industry but supplied them freely to the Nazis. Farish plead “no contest” to criminal conspiracy with the Nazis. A term of the plea stipulated that Standard would provide the US government the patent rights to produce artificial rubber from Standard technology while Farish paid a nominal 5,000 USD fine Frank Howard, a vice president at Standard Oil NJ, wrote Farish shortly after war broke out in Europe that he had renewed the business relationship described above with Farben using Royal Dutch Shell mediation top provide an additional layer of opacity. -

Cómo Citar El Artículo Número Completo Más Información Del

Revista de Economía Institucional ISSN: 0124-5996 Universidad Externado de Colombia Braden, Spruille EL EMBAJADOR SPRUILLE BRADEN EN COLOMBIA, 1939-1941 Revista de Economía Institucional, vol. 19, núm. 37, 2017, Julio-Diciembre, pp. 265-313 Universidad Externado de Colombia DOI: https://doi.org/10.18601/01245996.v19n37.13 Disponible en: https://www.redalyc.org/articulo.oa?id=41956426013 Cómo citar el artículo Número completo Sistema de Información Científica Redalyc Más información del artículo Red de Revistas Científicas de América Latina y el Caribe, España y Portugal Página de la revista en redalyc.org Proyecto académico sin fines de lucro, desarrollado bajo la iniciativa de acceso abierto EL EMBAJADOR SPRUILLE BRADEN EN COLOMBIA, 1939-1941 Spruille Braden* * * * pruille Braden (1894-1978) fue embajador en Colombia entre 1939 y 1942, durante la presidencia de Eduardo Santos. Aprendió el español desdeS niño y conocía bien la cultura latinoamericana. Nació en Elkhor, Montana, pero pasó su infancia en una mina de cobre chilena, de pro- piedad de su padre, ingeniero de grandes dotes empresariales. Regresó a Estados Unidos para cursar su enseñanza secundaria. Estudió en la Universidad de Yale donde, siguiendo el ejemplo paterno, se graduó como ingeniero de minas. Regresó a Chile, trabajó con su padre en proyectos mineros y se casó con una chilena de clase alta. Durante su estadía sura- mericana no descuidó los vínculos políticos con Washington. Participó en la Conferencia de Paz del Chaco, realizada en Buenos Aires (1935-1936), y pasó al mundo de la diplomacia estadounidense, con embajadas en Colombia y en Cuba (1942-1945), donde estrechó lazos con el dictador Fulgencio Batista. -

Wall Street and the Rise of Hitler

TABLE OF CONTENTS Preface Introduction Unexplored Facets of Naziism PART ONE: Wall Street Builds Nazi Industry Chapter One Wall Street Paves the Way for Hitler 1924: The Dawes Plan 1928: The Young Plan B.I.S. — The Apex of Control Building the German Cartels Chapter Two The Empire of I.G. Farben The Economic Power of I.G. Farben Polishing I.G. Farben's Image The American I.G. Farben Chapter Three General Electric Funds Hitler General Electric in Weimar, Germany General Electric & the Financing of Hitler Technical Cooperation with Krupp A.E.G. Avoids the Bombs in World War II Chapter Four Standard Oil Duels World War II Ethyl Lead for the Wehrmacht Standard Oil and Synthetic Rubber The Deutsche-Amerikanische Petroleum A.G. Chapter Five I.T.T. Works Both Sides of the War Baron Kurt von Schröder and I.T.T. Westrick, Texaco, and I.T.T. I.T.T. in Wartime Germany PART TWO: Wall Street and Funds for Hitler Chapter Six Henry Ford and the Nazis Henry Ford: Hitler's First Foreign Banker Henry Ford Receives a Nazi Medal Ford Assists the German War Effort Chapter Seven Who Financed Adolf Hitler? Some Early Hitler Backers Fritz Thyssen and W.A. Harriman Company Financing Hitler in the March 1933 Elections The 1933 Political Contributions Chapter Eight Putzi: Friend of Hitler and Roosevelt Putzi's Role in the Reichstag Fire Roosevelt's New Deal and Hitler's New Order Chapter Nine Wall Street and the Nazi Inner Circle The S.S. Circle of Friends I.G. Farben and the Keppler Circle Wall Street and the S.S. -

Wall Street Funding of the Rise of Hitler

WALL STREET FUNDING OF THE RISE OF HITLER Antony Suttons’ Investigation Of Wall Street Funding Of World War II FOR RESEARCH PURPOSES ONLY FROM THE LIBRARY OF DR. MICHAEL SUNSTAR 2007 SUNSTAR COMMENTARY ON THE WALL STREET FUNDING OF HITLER BY ANTONY SUTTON: A question that has been on the minds of lots of researchers on the rise of Hitler is: 1. How did Hitler obtain such advanced technology? 2. Although Hitler seized the German military system, who funded him and how did he come up with so many different types of armor, equipment and machinery? 3. Were there any American corporations involved with Nazi manufacturing and corporate financing and if so, which ones? 4. Was the devil truly in the details, and if so, which of his companies assisted Hitler? 5. From fighter planes in the air, to submarines under the ocean, to tanks, armory, weaponry, and sophisticated chemical warfare, just how did Hitler obtain so much access to so much technology in such a short period of time? 6. Why did the U.S. Government take so much time in responding to Hitler’s takeover of European nations? 7. Was there a Project Paperclip already in effect in Nazi Germany, before PROJECT PAPERCLIP was reported to be recruited in the United States after World War II? 8. Why was Hitler so angry against the Jewish people? Was it because of his discovery of the Protocols of the Learned Elders of Zion and was it because he found out about a plot among Masonic Jews to take over the world? Could he have been angry as he looked around Germany and saw the Jewish people prosperous & successful, while the German workers were suffering poverty? Was Hitler truly the bastard son of a Rothschild, as his mother worked for a Rothschild who fancied young women? 9. -

Antony C. Sutton – Wall Street and the Rise of Hitler

PREFACE This is the third and final volume of a trilogy describing the role of the American corporate socialists, otherwise known as the Wall Street financial elite or the Eastern Liberal Establishment, in three significant twentieth-century historical events: the 1917 Lenin- Trotsky Revolution in Russia, the 1933 election of Franklin D. Roosevelt in the United States, and the 1933 seizure of power by Adolf Hitler in Germany. Each of these events introduced some variant of socialism into a major country — i.e., Bolshevik socialism in Russia, New Deal socialism in the United States, and National socialism in Germany. Contemporary academic histories, with perhaps the sole exception of Carroll Quigley's Tragedy And Hope, ignore this evidence. On the other hand, it is understandable that universities and research organizations, dependent on financial aid from foundations that are controlled by this same New York financial elite, would hardly want to support and to publish research on these aspects of international politics. The bravest of trustees is unlikely to bite the hand that feeds his organization. It is also eminently clear from the evidence in this trilogy that "public-spirited businessmen" do not journey to Washington as lobbyists and administrators in order to serve the United States. They are in Washington to serve their own profit-maximizing interests. Their purpose is not to further a competitive, free-market economy, but to manipulate a politicized regime, call it what you will, to their own advantage. It is business manipulation of Hitler's accession to power in March 1933 that is the topic of Wall Street and the Rise of Hitler. -

Maral Book Final .Indd

Cover Page The handle http://hdl.handle.net/1887/58772 holds various files of this Leiden University dissertation Author: Jefroudi, M. Title: “If I deserve it, it should be paid to me”: a social history of labour in the Iranian oil industry 1951-1973 Issue Date: 2017-10-11 “If I deserve it, it should be paid to me”: A Social History of Labour in the Iranian Oil Industry (1951-1973) Proefschrift ter verkrijging van de graad van Doctor aan de Universiteit Leiden, op gezag van Rector Magnificus prof. mr. C.J.J.M. Stolker, volgens besluit van het College voor Promoties te verdedigen op woensdag 11 oktober 2017 klokke 13:45 uur door Maral Jefroudi Geboren te Tehran 1982 Promotor: Prof. dr. T. Atabaki (Universiteit Leiden) Copromotor: Prof. dr. M.M. van der Linden (Universiteit van Amsterdam) Promotiecommissie: Prof. dr. K. Hofmeester (Universiteit Antwerpen) Prof. dr. L.A.C.I. Lucassen (Universitiet Leiden) Prof. dr. M. Vahabi (University Paris 8) Maral Jefroudi Leiden 2017 To oil workers, who make their own history Table of Contents List of Tables 10 Note on Transliteration 11 Aknowledgements 12 Introduction: A Social history of labour in the oil industry 15 The actors, objects and location of this history 22 Sources 27 Historiographical concerns: Periodisation, Embeddedness, Social and Global History 33 The Political and the Economic: State, Company, Workers 43 Chapter One Nationalisation: The Legal, the Tallied, and the Imagined 49 The D’Arcy Regime: The Beginning of British Control over Iranian Oil 54 Centralisation and Changing Terms -

Bridging the Atlantic

~\M.eh(q~ \1~StYQ . ~ llusi y-~ to! __________Advancing Frontiers \YuJ ( It{ 8' 1 ' . I • Bridging the Atlantic by Richard K. Schrader Thday millions of passengers fly betnreen the United States and Europe via the world's busiest ocean air corridor. It all started fifty years ago with Pan American's luxurious "Clippers." 34 " r.Oi()GAAf'to1 Of' ntr OOf, r~G 1' : v ...... Jo..ll C, IP£>'(Fl cov~t[Sv C' p.\ 'j ·'V[FI!II.-" ' , .·.·OFlLD :, U; ,:,', S HE PAN AMERICAN AIRWAYS nying boat Yankee jump to Marseilles, France-completing a 3,650-mile Clipper taxied from alongside its Port Washing journey and inaugurating scheduled airmail service T ton pier onto the open water of Long Island's across the North Atlantic. Manhasset Bay and turned into the wind. Then, as the Flown twelve years to the day after Charles A. Lind thunder of its four 1,500-horsepower engines echoed bergh's epic solo night from New York to Paris in the from the shoreside hangars, the gleaming, forty-one-ton Spirit of St. Louis, the Pan American crossing likewise airliner accelerated across the inlet, lifted off, and was an unprecedented achievement. Pan American Air banked eastward toward the Atlantic. With Captain Ar ways had not even existed at the time of Lindbergh's thur E. La Porte at the controls and fifteen other Pan epic feat. '" Its first commercial night, five months later American employees aboard as crew and observers, the on October 19, 1927, had been a I IO-mile hop from Key Yankee Clipper was bound for Europe with a cargo of West, Florida to Havana, Cuba with a borrowed single 112,574 pieces of mail and four dozen California engine floatplane carrying 251 pounds of mail. -

Open Thesis Mcculloch FINAL PDF

THE PENNSYLVANIA STATE UNIVERSITY SCHREYER HONORS COLLEGE DEPARTMENT OF SPANISH, ITALIAN AND PORUGUESE FRANCISCO FRANCO AND TEXACO: PROVIDING FUEL FOR BOTH THE WAR AND PROPAGANDA SHANNON MCCULLOCH Spring 2018 A thesis submitted in partial fulfillment of the requirements for baccalaureate degrees in Spanish and International Politics with honors in Spanish Reviewed and approved* by the following: Ross Pifer Clinical Professor of Law Thesis Supervisor John Lipski Edwin Erle Sparks Professor of Spanish and Linguistics Honors Adviser * Signatures are on file in the Schreyer Honors College. i ABSTRACT This thesis seeks to uncover exactly how the war relief aid, particularly through Texaco oil and oil stocks, contributed to Franco’s regime. Throughout history, we see a constant influence of regime type on media outlets, especially in Franco’s Spain. Further, it will verify a clear parallel between regime types and permissible media publications within each regime, respectively. By means of this paper, I hope to be able to contribute to the larger discussion on the political profile of Francisco Franco’s regime and the United States’ role in expanding its influence in Europe in the aftermath of World War II. This thesis will also question Texaco Oil and Franco’s Spain with respect to various trades, deals, and overall add to global conversations. How crucial really was the oil question to the Franco regime in the 1940’s and 50’s after the Civil War to fuel the economy and kick off the reconstruction process. ii TABLE OF CONTENTS LIST OF FIGURES ..................................................................................................... iii LIST OF TABLES ....................................................................................................... iv ACKNOWLEDGEMENTS ......................................................................................... v Chapter 1 Introduction ................................................................................................ -

How the Allied Multinationals Supplied Nazi Germany Throughout World War II

How the Allied multinationals supplied Nazi Germany throughout World War II The following excerpts thoroughly document how capitalists really acted during the Second World War. Behind the patriotic propaganda that encouraged the working class to slaughter each other in the interests of competing national interests, international capital quietly kept the commodity circuits flowing and profits growing across all borders. Trading with the Enemy - war means business as usual for international capital. Excerpts from "Trading With the Enemy: An Exposé of The Nazi-American Money-Plot 1933-1949" by Charles Higham; & "The Coca Cola Company under the Nazis" by Eleanor Jones and Florian Ritzmann Charles Higham is the son of a former UK MP and Cabinet member. We begin with some excerpts from "Trading With the Enemy: An Exposé of The Nazi- American Money-Plot 1933-1949" by Charles Higham; Hale, London, 1983. This is followed by "The Coca Cola Company under the Nazis" by Eleanor Jones and Florian Ritzmann; From the "Coca Cola Goes to War" website; http://xroads.virginia.edu/%7ECLASS/coke/coke.html ===================== From the "Trading With the Enemy" cover blurb; "Here is the extraordinary true story of the American businessmen and government officials who dealt with the Nazis for profit or through conviction throughout the Second World War: Ford. Standard Oil, Chase Bank and members of the State Department were among those who shared in the spoils. Meticulously documented and dispassionately told, this is an alarming story. At its centre is 'The Fraternity', an influential international group associated with the Rockefeller or Morgan banks and linked by the ideology of Business as Usual. -

Spain in Our Hearts Americans in the Spanish Civil War, 1936-1939 1St Edition Pdf, Epub, Ebook

SPAIN IN OUR HEARTS AMERICANS IN THE SPANISH CIVIL WAR, 1936-1939 1ST EDITION PDF, EPUB, EBOOK Adam Hochschild | 9780547973180 | | | | | Spain in Our Hearts Americans in the Spanish Civil War, 1936-1939 1st edition PDF Book The USSR was the Republic's most reliable supporter, and Stalinist commissars held key positions, enacting their own purges against Republican fighters deemed insufficiently loyal to the party line. Pages : Hochschild's book is not so much a history of the war although you will come away with a pretty good idea of its dimensions , but of the people mostly Americans, but some Canadians and Brits, too whose idealism led them take part. Texico comes off very badly for supplying Franco with tons of free oil. The Book Report Network. Spain in Our Hearts is a primer, a meditation, and a story of American adventure abroad. The fir Spain in Our Hearts by Adam Hochschild deals with much more than the Americans who volunteered to serve the Republican cause in the Spanish Civil war The title of the book is from a quote by Albert Camus: "Men of my generation have had Spain in our hearts. I found the stories of these starry-eyed volunteers most interesting. Merriman serves as the central figure and the book begins with his disappearance during battle in April We are introduced to a number of key members of the Lincoln Brigade, as well as the bad guys. The book's final chapter details Merriman's death, with quotes from his widow's letters, and ends with an American woman travelling in to an old battleground site to honor her uncle's death in It's a shame because it sounds amazing: "mansions confiscated from the wealthy had been converted into housing for the homeless; factor Less than a year of Spain "ruled" hehe by anarchists is inspiring enough to keep trudging through the descriptions of battles in this book.