Heading East: Eurasian Rail Freight Opportunities

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Preliminary Impact Assessment of the New Transport Infrastructure Project on Trans-Baikal Territory Geosystems, Russia

! Journal(of(Materials(and(( J. Mater. Environ. Sci., 2018, Volume 9, Issue 8, Page 2213-2224 Environmental(Sciences( ! ISSN(:(2028;2508( CODEN(:(JMESCN( http://www.jmaterenvironsci.com! Copyright(©(2018,((((((((((((((((((((((((((((( University(of(Mohammed(Premier(((((( (Oujda(Morocco( Preliminary impact assessment of the new transport infrastructure project on Trans-Baikal Territory geosystems, Russia N. Pomazkova 1*, L. Faleychik 1, A. Faleychik 2 1Institute of Natural Resources, Ecology and Cryology, Russian Academy of Sciences, Siberian Branch, Nedorezov street Chita, Russia. 2Transbaikal State University, Alexandro-Zavodskaya street, Chita, Russia. Received 04 Dec 2017, Abstract Revised 05 Feb 2018, Transbaikalia is in the interest area of the largest foreign policy initiative of China – the Accepted 10 Feb 2018 project “Silk Road Economic Belt”. The creation of the infrastructure linking member states (China, Russia, Mongolia) is one of the priority directions of this cooperation. First of all, the possibility of constructing a high-speed railway (HSR) is discussed. It is Keywords known that HSRs exert an overall positive effect on the development of regional !!environmental impact economies, especially on such brunches as tourism and regional cooperation. However assessment, this initiative carries risks for the natural ecosystems of the region such as: land take, !!Trans-Baikal Territory biodiversity loss, degradation and fragmentation of habitats, increasing pollution, barrier !!high-speed railway, effects, noise, land use impacts. This paper is focusing on the potential impacts of under !!spatial analysis, project on the geosystems. The spatial analysis results show that the project is likely to !!geographic information endanger 43 out of 122 natural geosystems located on the Trans-Baikal Territory. Along system (GIS), them there are 5 types of rare landscapes and 6 landscape types which are not presented !!nature protected areas. -

Belt and Road Transport Corridors: Barriers and Investments

Munich Personal RePEc Archive Belt and Road Transport Corridors: Barriers and Investments Lobyrev, Vitaly and Tikhomirov, Andrey and Tsukarev, Taras and Vinokurov, Evgeny Eurasian Development Bank, Institute of Economy and Transport Development 10 May 2018 Online at https://mpra.ub.uni-muenchen.de/86705/ MPRA Paper No. 86705, posted 18 May 2018 16:33 UTC BELT AND ROAD TRANSPORT CORRIDORS: BARRIERS AND INVESTMENTS Authors: Vitaly Lobyrev; Andrey Tikhomirov (Institute of Economy and Transport Development); Taras Tsukarev, PhD (Econ); Evgeny Vinokurov, PhD (Econ) (EDB Centre for Integration Studies). This report presents the results of an analysis of the impact that international freight traffic barriers have on logistics, transit potential, and development of transport corridors traversing EAEU member states. The authors of EDB Centre for Integration Studies Report No. 49 maintain that, if current railway freight rates and Chinese railway subsidies remain in place, by 2020 container traffic along the China-EAEU-EU axis may reach 250,000 FEU. At the same time, long-term freight traffic growth is restricted by a number of internal and external factors. The question is: What can be done to fully realise the existing trans-Eurasian transit potential? Removal of non-tariff and technical barriers is one of the key target areas. Restrictions discussed in this report include infrastructural (transport and logistical infrastructure), border/customs-related, and administrative/legal restrictions. The findings of a survey conducted among European consignors is a valuable source of information on these subjects. The authors present their recommendations regarding what can be done to remove the barriers that hamper international freight traffic along the China-EAEU-EU axis. -

Trans-Baykal (Rusya) Bölgesi'nin Coğrafyasi

International Journal of Geography and Geography Education (IGGE) To Cite This Article: Can, R. R. (2021). Geography of the Trans-Baykal (Russia) region. International Journal of Geography and Geography Education (IGGE), 43, 365-385. Submitted: October 07, 2020 Revised: November 01, 2020 Accepted: November 16, 2020 GEOGRAPHY OF THE TRANS-BAYKAL (RUSSIA) REGION Trans-Baykal (Rusya) Bölgesi’nin Coğrafyası Reyhan Rafet CAN1 Öz Zabaykalskiy Kray (Bölge) olarak isimlendirilen saha adını Rus kâşiflerin ilk kez 1640’ta karşılaştıkları Daur halkından alır. Rusçada Zabaykalye, Balkal Gölü’nün doğusu anlamına gelir. Trans-Baykal Bölgesi, Sibirya'nın en güneydoğusunda, doğu Trans-Baykal'ın neredeyse tüm bölgesini işgal eder. Bölge şiddetli iklim koşulları; birçok mineral ve hammadde kaynağı; ormanların ve tarım arazilerinin varlığı ile karakterize edilir. Rusya Federasyonu'nun Uzakdoğu Federal Bölgesi’nin bir parçası olan on bir kurucu kuruluşu arasında bölge, alan açısından altıncı, nüfus açısından dördüncü, bölgesel ürün üretimi açısından (GRP) altıncı sıradadır. Bölge topraklarından geçen Trans-Sibirya Demiryolu yalnızca Uzak Doğu ile Rusya'nın batı bölgeleri arasında bir ulaşım bağlantısı değil, aynı zamanda Avrasya geçişini sağlayan küresel altyapının da bir parçasıdır. Bölgenin üretim yapısında sanayi, tarım ve ulaşım yüksek bir paya sahiptir. Bu çalışmada Trans-Baykal Bölgesi’nin fiziki, beşeri ve ekonomik coğrafya özellikleri ele alınmıştır. Trans-Baykal Bölgesinin coğrafi özelliklerinin yanı sıra, ekonomik ve kültürel yapısını incelenmiştir. Bu kapsamda konu ile ilgili kurumsal raporlardan ve alan araştırmalarından yararlanılmıştır. Bu çalışma sonucunda 350 yıldan beri Rus gelenek, kültür ve yaşam tarzının devam ettiği, farklı etnik grupların toplumsal birliği sağladığı, yer altı kaynaklarının bölge ekonomisi için yüzyıllardır olduğu gibi günümüzde de önem arz ettiği, coğrafyasının halkın yaşam şeklini belirdiği sonucuna varılmıştır. -

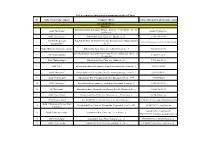

List of Exporters Interested in Supplying Grain to China

List of exporters interested in supplying grain to China № Name of exporting company Company address Contact Infromation (phone num. / email) Zabaykalsky Krai Rapeseed Zabaykalsky Krai, Kalgansky District, Bura 1st , Vitaly Kozlov str., 25 1 OOO ''Burinskoe'' [email protected]. building A 2 OOO ''Zelenyi List'' Zabaykalsky Krai, Chita city, Butina str., 93 8-914-469-64-44 AO "Breeding factory Zabaikalskiy Krai, Chernyshevskiy area, Komsomolskoe village, Oktober 3 [email protected] Тел.:89243788800 "Komsomolets" str. 30 4 OOO «Bukachachinsky Izvestyank» Zabaykalsky Krai, Chita city, Verkholenskaya str., 4 8(3022) 23-21-54 Zabaykalsky Krai, Alexandrovo-Zavodsky district,. Mankechur village, ul. 5 SZ "Mankechursky" 8(30240)4-62-41 Tsentralnaya 6 OOO "Zabaykalagro" Zabaykalsky Krai, Chita city, Gaidar str., 13 8-914-120-29-18 7 PSK ''Pole'' Zabaykalsky Krai, Priargunsky region, Novotsuruhaytuy, Lazo str., 1 8(30243)30111 8 OOO "Mysovaya" Zabaykalsky Krai, Priargunsky District, Novotsuruhaytuy, Lazo str., 1 8(30243)30111 9 OOO "Urulyungui" Zabaykalsky Krai, Priargunsky District, Dosatuy,Lenin str., 19 B 89245108820 10 OOO "Xin Jiang" Zabaykalsky Krai,Urban-type settlement Priargunsk, Lenin str., 2 8-914-504-53-38 11 PK "Baygulsky" Zabaykalsky Krai, Chernyshevsky District, Baygul, Shkolnaya str., 6 8(3026) 56-51-35 12 ООО "ForceExport" Zabaykalsky Krai, Chita city, Polzunova str. , 30 building, 7 8-924-388-67-74 13 ООО "Eсospectrum" Zabaykalsky Krai, Aginsky district, str. 30 let Pobedi, 11 8-914-461-28-74 [email protected] OOO "Chitinskaya -

Current Distribution of the Striped Field Mouse (Apodemus Agrarius Pallas, 1771) in Eastern Transbaikalia: New Findings in the Disjunction Area Yu

ISSN 20751117, Russian Journal of Biological Invasions, 2015, Vol. 6, No. 1, pp. 1–5. © Pleiades Publishing, Ltd., 2015. Original Russian Text © Yu.A. Bazhenov, M.V. Pavlenko, V.P. Korablev, A.I. Kardash, 2014, published in Rossiiskii Zhurnal Biologicheskikh Invasii, 2014, No. 4, pp. 2–9. Current Distribution of the Striped Field Mouse (Apodemus agrarius Pallas, 1771) in Eastern Transbaikalia: New Findings in the Disjunction Area Yu. A. Bazhenova, b, M. V. Pavlenkoc, V. P. Korablevc, †, and A. I. Kardashd aDaursky State Nature Biosphere Reserve, ul. Komsomol’skaya 76, Nizhny Tsasuchey, Zabaikalsky krai, 674480 Russia bInstitute of Natural Resources, Ecology, and Cryology, Siberian Branch, Russian Academy of Sciences, ul. Nedorezova 16A, Chita, 672014 Russia email: [email protected] cInstitute of Biology and Soil Science, Far Eastern Branch, Russian Academy of Sciences, pr. 100letiya Vladivostoka 159, Vladivostok, 690022 Russia email: [email protected] dChita Plague Control Station, ul. Biologicheskaya 1, Chita, 672014 Russia Received November 12, 2013 Abstract—Materials on the new findings of the striped field mouse (Apodemus agrarius) in Transbaikalia, within an earlier disjunction area in the habitat of this species (in the basins of the Onon and Ingoda rivers), are presented. Possible causes of the expansion of the species range are discussed. It is most probable that the species was introduced from the basin of the Argun River with a cargo of agricultural products to the lower reaches of the Onon River or the upper reaches of the Shilka River. Currently, the striped field mouse is a com mon species inhabiting a floodplain shrub biotope in the lower reaches of the Ingoda and Onon rivers. -

Intermodal Logisticslogistics Unlockingunlocking Vvaluealue

IntermodalIntermodal LogisticsLogistics UnlockingUnlocking VValuealue Asian Institute of Transport Development E-5, Qutab Hotel, Shaheed Jeet Singh Marg, New Delhi 110 016, India Tel: (91-11) 26856117 Telefax: (91-11) 26856113 Email: [email protected] ASIAN INSTITUTE OF TRANSPORT DEVELOPMENT Intermodal Logistics: Unlocking Value © Asian Institute of Transport Development, New Delhi First published 2007 All rights reserved Published by Asian Institute of Transport Development E-5, Qutab Hotel Shaheed Jeet Singh Marg New Delhi-110 016 INDIA Phones: +91-11-26856117, 26856113 Fax: +91-11-26856113 Email: [email protected], [email protected] Intermodal Logistics Unlocking Value ASIAN INSTITUTE OF TRANSPORT DEVELOPMENT CONTENTS Preface i Abbreviations iii Contextual Information vii Chapter 1: Globalisation and Logistics: The Container Revolution 1 Section I : Maritime Transport Logistics Chapter 2: Maritime Transport Networks and Container Shipping Development 27 Chapter 3: A New Ports Structure: Asia Moves Ahead 45 Section II: Land Transport Logistics Chapter 4: Land Transport Networks: Regional and Subregional 85 Chapter 5: Dry Ports: Sharing Benefits 153 Section III: Facilitation of Multimodal Transport Logistics Chapter 6: Institutional Framework: Cross-border Impediments 167 Section IV: The Way Ahead 193 Annexures 199 References 205 Preface For about 25 years now, national barriers to trade and investment have been dismantled at an unprecedented pace, leading to a degree of integration of product and financial markets that is reminiscent of the pre- twentieth century global economic arrangements. One of the consequences of this has been the spread of production facilities across national borders. Thus, what was started by US multinational firms in the 1960s in Europe has now become a global trend. -

Chapter 3 Current Status of the Multimodal Transport Via Ferry in the GTR

EVALUATION STUDY ON THE SEA-LAND ROUTES IN NORTHEAST ASIA 2014 Greater Tumen Initiative (GTI) Secretariat Tayuan Diplomatic Compound 1-1-142 No. 1 Xindong Lu, Chaoyang District Beijing, 100600, China www.tumenprogramme.org Tel: +86-10-6532-5543 Fax: +86-10-6532-6465 [email protected] The views expressed in this paper are those of the author and do not necessarily reflect the views and policies of the Greater Tumen Initiative (GTI) or members of its Consultative Commission and Transport Board or the governments they represent. GTI does not guarantee the accuracy of the data included in this publication and accepts no responsibility for any consequence of their use. By making any designation of or reference to a particular territory or geographic area, or by using the term “country” in this document, GTI does not intend to make any judgments as to the legal or other status of any territory or area. “Evaluation Study on the Sea-Land Routes in Northeast Asia” was financed and carried out by Korea Maritime Institute, Dr. Lee Sung-woo, Dr. Kim Geun-sub and Dr. Kim Eun-woo. The Study aimed at assessment of the problems and impediments for ferry services in East/Japan Sea. The Study results and conclusions serve to facilitate the intermodal transportation services in the Greater Tumen Region through the promotion of the land-sea shipping lines. FOREWORD Northeast Asia is one of the fastest growing economic blocks in the world. It carries large clout in the global economy and trade due remarkable growth it has posted so far. -

BR IFIC N° 2939 Index/Indice

BR IFIC N° 2939 Index/Indice International Frequency Information Circular (Terrestrial Services) ITU - Radiocommunication Bureau Circular Internacional de Información sobre Frecuencias (Servicios Terrenales) UIT - Oficina de Radiocomunicaciones Circulaire Internationale d'Information sur les Fréquences (Services de Terre) UIT - Bureau des Radiocommunications Part 1 / Partie 1 / Parte 1 Date/Fecha 09.02.2021 Description of Columns Description des colonnes Descripción de columnas No. Sequential number Numéro séquenciel Número sequencial BR Id. BR identification number Numéro d'identification du BR Número de identificación de la BR Adm Notifying Administration Administration notificatrice Administración notificante 1A [MHz] Assigned frequency [MHz] Fréquence assignée [MHz] Frecuencia asignada [MHz] Name of the location of Nom de l'emplacement de Nombre del emplazamiento de 4A/5A transmitting / receiving station la station d'émission / réception estación transmisora / receptora 4B/5B Geographical area Zone géographique Zona geográfica 4C/5C Geographical coordinates Coordonnées géographiques Coordenadas geográficas 6A Class of station Classe de station Clase de estación Purpose of the notification: Objet de la notification: Propósito de la notificación: Intent ADD-addition MOD-modify ADD-ajouter MOD-modifier ADD-añadir MOD-modificar SUP-suppress W/D-withdraw SUP-supprimer W/D-retirer SUP-suprimir W/D-retirar No. BR Id Adm 1A [MHz] 4A/5A 4B/5B 4C/5C 6A Part Intent 1 121000526 BEL 1520.7500 SANKT VITH RODT BRF BEL 6°E03'55'' 50°N17'51'' FX 1 -

Lebedev Trade Paper for Conference Only

CHINA AND FOREST TRADE IN THE ASIA-PACIFIC REGION: IMPLICATIONS FOR FORESTS AND LIVELIHOODS SIBERIAN AND RUSSIAN FAR EAST TIMBER FOR CHINA LEGAL AND ILLEGAL PATHWAYS, PLAYERS, AND TRENDS ANATOLY LEBEDEV COLLABORATING INSTITUTIONS Forest Trends (http://www.forest -trends.org): Forest Trends is a non-profit organization that advances sustainable forestry and forestry’s contribution to community livelihoods worldwide. It aims to expand the focus of forestry beyond timber and promotes markets for ecosystem services provided by forests such as watershed protection, biodiversity and carbon storage. Forest Trends analyzes strategic market and policy issues, catalyzes connections between forward-looking producers, communities, and investors and develops new financial tools to help markets work for conservation and people. It was created in 1999 by an international group of leaders from forest industry, environmental NGOs and investment institutions. Center for In ternational Forestry Research (http://www.cifor.cgiar.org): The Center for International Forestry Research (CIFOR), based in Bogor, Indonesia, was established in 1993 as a part of the Consultative Group on International Agricultural Research (CGIAR) in response to global concerns about the social, environmental, and economic consequences of forest loss and degradation. CIFOR research produces knowledge and methods needed to improve the wellbeing of forest-dependent people and to help tropical countries manage their forests wisely for sustained benefits. This research is conducted in more -

Surviving IS-4 Heavy Tanks Last Update: February 20, 2015

Surviving IS-4 Heavy Tanks Last update: February 20, 2015 Listed here are the IS-4 heavy tanks that still exist today. Борис Фаворов , 2010 - http://fotki.yandex.ru/search/%D0%98%D0%A1- 4/users/favorovby/view/244383?page=6&how=week&type=image IS-4 – Kubinka Tank Museum (Russia) "vololo" - http://fotki.yandex.ru/users/vololo/view/215772?page=0 IS-4 – Exhibition in park ODORA SibVo, Chita, Chita Oblast (Russia) ‘’vitalk’’ - http://www.reibert.info/forum/showthread.php?t=44207&page=12 IS-4 – Zabaykalsk, Zabaykalsky Krai (Russia) "Kursant" - http://fotki.yandex.ru/search/%D0%98%D0%A1-4/users/vordringen/view/281913?page=6&how=week&type=image IS-4 – Unknown location (Russia) "vatryk" - http://fotki.yandex.ru/users/vatryk/tags/wreck%20technics/view/288751?page=15 IS-4 – Unknown location (Russia) "Александр Васильевич " - http://rcforum.ru/showthread.php?t=1398&page=83 IS-4 – Unknown location near Kazakhstan-China border (Kazakhstan) "Александр Васильевич " - http://rcforum.ru/showthread.php?t=1398&page=83 IS-4 – Unknown location near Kazakhstan-China border (Kazakhstan) "usov" - http://forum.worldoftanks.ru/index.php?/topic/143288-%-%D0%B8%D1%81-4-%D0% Four IS-4 wrecks – Unknown location (Russia) "usov" - http://forum.worldoftanks.ru/index.php?/topic/143288-%D IS-4 wreck – Unknown location (Russia) "FotosergS ", 2012 - http://fotki.yandex.ru/users/fotosergs/view/439106/?page=4#preview IS-4 turret – Museum "Sestroretsk Boundary" at industrial complex-1 "Elephant", Beloostrov, near St. Petersburg (Russia) http://terijoki.spb.ru/trk_terra.php?item=22&p=2 -

The Arctic in World Affairs

The Arctic in World Affairs: A North Pacific Dialogue on Arctic Marine Issues 2012 North Pacific Arctic Conference Proceedings KMI/EWC SERIES ON THE FUTURE OF THE MARINE ARCTIC The Korea Maritime Institute (KMI) is a government-affiliated research organization under the umbrella of the National Research Council for Economics, Humanities and Social Science (NRCS) in the Republic of Korea. Since its establishment in 1984, KMI has been a major think-tank in the development of national maritime and fisheries policies including shipping and logistics, port development, coastal and ocean management, maritime safety and security, and fisheries affairs. Currently, KMI is building research capacity on the new ocean industries, the so-called Blue Economy, for sustainable coastal and ocean resources development. KMI’s interna- tional research network covers not only the Asian region but also other regions such as Africa, the Pacific islands, the Americas, Europe and the polar areas. The East-West Center promotes better relations and understanding among the people and nations of the United States, Asia, and the Pacific through cooperative study, research, and dialogue. Established by the US Congress in 1960, the Center serves as a resource for information and analysis on critical issues of common concern, bringing people together to exchange views, build expertise, and develop policy options. The Center’s 21-acre Honolulu campus, adjacent to the University of Hawai‘i at Mānoa, is located midway between Asia and the US mainland and features research, residential, and international conference facilities. The Center’s Washington, DC, office focuses on preparing the United States for an era of growing Asia Pacific prominence. -

Renewable Energy Prospects for the Russian Federation, a Remap

REMAP 2030 RENEWABLE ENERGY PROSPECTS FOR THE RUSSIAN FEDERATION RENEWABLE ENERGY PROSPECTS FOR THE RUSSIAN FEDERATION REMAP 2030 APRIL 2017 WORKING PAPER Copyright © IRENA 2017 Unless otherwise stated, material in this publication may be freely used, shared, copied, reproduced, printed and/or stored, provided that appropriate acknowledgement is given of IRENA as the source and copyright holder. Material in this publication that is attributed to third parties may be subject to separate terms of use and restrictions, and appropriate permissions from these third parties may need to be secured before any use of such material. ISBN 978-92-9260-021-1 (Print) ISBN 978-92-9260-022-8 (PDF) AboutIRENA The International Renewable Energy Agency (IRENA) is an intergovernmental organisation that supports countries in their transition to a sustainable energy future and serves as the principal platform for international co-operation, a centre of excellence, and a repository of policy, technology, resource and fi nancial knowledge on renewable energy. IRENA promotes the widespread adoption and sustainable use of all forms of renewable energy, including bioenergy, geothermal, hydropower, ocean, solar and wind energy, in the pursuit of sustainable development, energy access, energy security and low-carbon economic growth and prosperity. This report and other supporting material are available for download through wwwirenaorgremap Acknowledgements This publication has benefi ted from valuable comments and guidance provided by the Ministry of Energy of the Russian Federation (Alexey Texler, Natalia Nozdrina, Artem Nedaikhlib and Yulia Gorlova). It was reviewed at three meetings that took place in Moscow, on 26 October 2015, 27 April 2016 and 12 October 2017, and benefi ted from the input of the REmap Russia working group.