2. Q4 2020 AFI Report Signed.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Foreign Investments

Foreign Investments Fourth Quarter 2012 Republic of the Philippines PAMBANSANG LUPON SA UGNAYANG PANG-ISTADISTIKA (NATIONAL STATISTICAL COORDINATION BOARD) http://www.nscb.gov.ph The Foreign Investments in the Philippines is a quarterly publication prepared by the Economic Indicators and Satellite Accounts Division of the NATIONAL STATISTICAL COORDINATION BOARD (NSCB). For technical inquiries, please contact us at: (632) 895-5002 or email us at [email protected]. TERMS OF USE OF NSCB PUBLICATIONS The NSCB reserves its exclusive right to reproduce all its publications in whatever form. Any part of this publication should not be reproduced, recopied, lend or repackaged for other parties for any commercial purposes without written permission from the NSCB. Any part of this publication may only be reproduced for internal use of the recipient/customer company. Should any portion of the data in this publication are to be included in a report/article, the title of the publication and the NSCB as publisher should be cited as the source of the data Any information derived from the processing of data contained in this publication will not be the responsibility of NSCB. ISSN 1655-8928 Published by the National Statistical Coordination Board Midland Buendia Building 403 Sen. Gil Puyat Avenue Makati City 1200 Philippines. 2 April 2013 The Foreign Investments in the Philippines is available in printed and electronic formats (Excel/Word/PDF in CDRom). Back issues of this publication are available for purchase. For details, please contact us at (632) -

Doing Business in the Philippines

Doing Business in the Philippines International Investments Promotion Service Board of Investments As of April 2021 THE PHILIPPINE BOARD OF INVESTMENTS Your Window to Infinite Opportunities in the Philippines Due diligence assistance • Information support • Visit program development & investment briefing • Business matching Business registration facilitation • Networking with IPUs and other government agencies on pre-operational business requirements • Fast tracking with registration procedures • Assistance with local government requirements Aftercare service • Presence of government network to quickly respond to concerns • Regular supervision & monitoring 1. Demographic Sweet Sport and Rich Talent Pool 2. Competitive Salary and Steady Wage Increase THE PHILIPPINE 3. Low Labor Attrition/Turnover Rates 4. Industrial Peace ADVANTAGE 5. Access to Key Markets 6. Predictable Trading Environment 7. Unrestricted Movement of Critical Products and People Filipinos are younger compared PH in Demographic Sweet Spot to the rest of the world The median age in the Philippines is 25.7 and Rich Talent Pool years old. This is equivalent to the age of someone who recently graduated from college. 110M Population Japan 48.4 We produced over 790,000 college EU-28 42.5 graduates in AY 2018-2019 across Thailand 40.1 a wide range of disciplines including engineering an technology China 38.4 Our workforce is: USA 38.3 • Highly educated and English Proficient Australia 37.9 • Strongly customer-oriented • Multi-skilled UAE 32.6 • Highly trainable with fast learning -

Download Investment Incentives in the Philippines

www.pwc.com/ph More value for your business Investment incentives in the Philippines A primer on investment incentives under Philippine laws 2015 Isla Lipana & Co. Our offices Main Metro Manila Address 29th Floor Philamlife Tower 8767 Paseo de Roxas 1226, Makati City Telephone +63 (2) 845 2728 Facsimile +63 (2) 845 2806 Mail address P.O. Box 2288 Manila E-mail address [email protected] Branch Cebu City Address Keppel Center, Unit 1001-B Samar Loop corner Cardinal Rosales Avenue Cebu Business Park 6000 Cebu City Telephone +63 (32) 231 6464; 233 5020 Facsimile +63 (32) 233 9615 About the image Philippine Gems — Biri Island Rock Formation The Biri Island rock formation is composed of four small, rocky islands located in that perilous area where the San Bernardino Strait meets the Pacific Ocean. The incredible strength of these natural forces has caused the islands to take on distinct and interesting shapes. Geologists from the University of the Philippines state that the rocks date back from the Early Miocene Period, and their ages range from five to 23 million years old. Visit http://www.pwc.com/ph/gems for more information. (Photo by Dennis P. Bautista) © 2015 Isla Lipana & Co. All rights reserved. PwC refers to the Philippines member firm, and may sometimes refer to the PwC network. Each member firm is a separate legal entity. Please see www.pwc.com/structure for further details. PwC Philippines helps organizations and individuals create the value they’re looking for. We’re a network of firms in 157 countries with more than 195,000 people who are committed to delivering quality in assurance, tax and advisory services. -

ENVIRONMENTAL REPORT 2020 Mission/Vision

DUNLOP INTERNATIONAL (PHILIPPINES), INC. ENVIRONMENTAL REPORT 2020 Mission/Vision 2020 ENVIRONMENTAL REPORT Values 2020 ENVIRONMENTAL REPORT 2 Table of Contents TOPIC PAGE I. Company Profile ……………………………………… 4 II. Environmental Policy ……………………………………… 5 III. Programs and Activities ……………………………………… 6 IV. Environmental Manual ……………………………………… 7 V. Zero Landfill ……………………………………… 8 VI. Reduction of Carbon Dioxide footprint ……………………………………… 13 VII. Eliminate/reduce the use of VOC ……………………………………… 16 VIII. Carbon Capture ……………………………………… 17 IX. Clean Up Drives ………………………………………. 19 2020 ENVIRONMENTAL REPORT I. Company Profile Date of Incorporation 09 May 1977 (Dunlop Sport Company) Factory History 1996 acquisition of BTR (British Tyre & Rubber) 2017 became affiliate of SRI Change of Company Name 25 September 2017 (Securities and Exchange Commission) Registered Address 10th Avenue, Freeport Area of Bataan, Mariveles, Bataan Class Tennis and Squash Balls Manufacture (for export) Brands Dunlop Factory Area Information Land Area 24, 700 m2 Floor Area 15, 000 m2 Production Area 10, 500 m2 Employees 524 as of the end of 2019 Working Days 282 days (2 shifts) 2020 ENVIRONMENTAL REPORT 44 II. Environmental Policy Dunlop International (Philippines), Inc., in the manufacture of tennis and squash balls, is determined to preserve and protect the environment to achieve happiness for everyone. We commit to the continual improvement of our processes with the aim of reducing the impact to the environment. We commit to the prevention of pollution of our surroundings. We commit to comply with all legal and other requirements related to our environmental aspects. We commit to set up plans, which are consistent with this policy, to achieve objectives and targets related to improving our impact on the environment. -

REGIONAL PROFILE Region 3 Or Central Luzon Covers the Provinces of Bulacan, Pampanga, Tarlac, Nueva Ecija, Bataan, Zambales

REGIONAL PROFILE Region 3 or Central Luzon covers the provinces of Bulacan, Pampanga, Tarlac, Nueva Ecija, Bataan, Zambales and Aurora. It has a total land area of 2,215,752 hectares. The region is endowed with a balanced mix of environmental assets to value, maintain, develop and manage accordingly. It is composed of 494,533 hectares of forestland, 251,518 hectares of protected areas composed of watersheds and forest reserves, national parks, games refuge, bird sanctuary and wildlife area covering 13.8% of the region’s land area. Forty one percent of its land area is composed of agricultural plains with rice as its main crop. Long coastlines rich with fishing grounds border it. Mineral resources may be extracted in Bulacan and Zambales Central Luzon is traditionally known as the Rice Bowl of the Philippines due to its vast rice lands that produces most of the nation’s staple food products as well as a wide variety of other crops. With the opening of various investment opportunities in Economic Zones in Clarkfield and Subic Bay Area, Region III is now termed as the W-Growth Corridor due to the industrialization of many areas in the region. The W-Growth Corridor covers areas with rapid growth potentials for the industrial, tourism and agricultural sectors of Central Luzon, making Region III one of the most critical regions in terms of environmental concerns primarily due to the rapid sprawl of industries/establishments and human settlements while the necessary land use and environmental planning are not yet effectively being carved. [As such, the EMB, together with Local Government Units (LGUs) and other entities are trying to lessen the impact of infrastructure development and industrialization on the environment. -

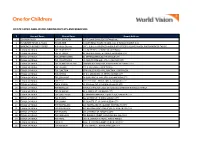

List of Ecpay Cash-In Or Loading Outlets and Branches

LIST OF ECPAY CASH-IN OR LOADING OUTLETS AND BRANCHES # Account Name Branch Name Branch Address 1 ECPAY-IBM PLAZA ECPAY- IBM PLAZA 11TH FLOOR IBM PLAZA EASTWOOD QC 2 TRAVELTIME TRAVEL & TOURS TRAVELTIME #812 EMERALD TOWER JP RIZAL COR. P.TUAZON PROJECT 4 QC 3 ABONIFACIO BUSINESS CENTER A Bonifacio Stopover LOT 1-BLK 61 A. BONIFACIO AVENUE AFP OFFICERS VILLAGE PHASE4, FORT BONIFACIO TAGUIG 4 TIWALA SA PADALA TSP_HEAD OFFICE 170 SALCEDO ST. LEGASPI VILLAGE MAKATI 5 TIWALA SA PADALA TSP_BF HOMES 43 PRESIDENTS AVE. BF HOMES, PARANAQUE CITY 6 TIWALA SA PADALA TSP_BETTER LIVING 82 BETTERLIVING SUBD.PARANAQUE CITY 7 TIWALA SA PADALA TSP_COUNTRYSIDE 19 COUNTRYSIDE AVE., STA. LUCIA PASIG CITY 8 TIWALA SA PADALA TSP_GUADALUPE NUEVO TANHOCK BUILDING COR. EDSA GUADALUPE MAKATI CITY 9 TIWALA SA PADALA TSP_HERRAN 111 P. GIL STREET, PACO MANILA 10 TIWALA SA PADALA TSP_JUNCTION STAR VALLEY PLAZA MALL JUNCTION, CAINTA RIZAL 11 TIWALA SA PADALA TSP_RETIRO 27 N.S. AMORANTO ST. RETIRO QUEZON CITY 12 TIWALA SA PADALA TSP_SUMULONG 24 SUMULONG HI-WAY, STO. NINO MARIKINA CITY 13 TIWALA SA PADALA TSP 10TH 245- B 1TH AVE. BRGY.6 ZONE 6, CALOOCAN CITY 14 TIWALA SA PADALA TSP B. BARRIO 35 MALOLOS AVE, B. BARRIO CALOOCAN CITY 15 TIWALA SA PADALA TSP BUSTILLOS TIWALA SA PADALA L2522- 28 ROAD 216, EARNSHAW BUSTILLOS MANILA 16 TIWALA SA PADALA TSP CALOOCAN 43 A. MABINI ST. CALOOCAN CITY 17 TIWALA SA PADALA TSP CONCEPCION 19 BAYAN-BAYANAN AVE. CONCEPCION, MARIKINA CITY 18 TIWALA SA PADALA TSP JP RIZAL 529 OLYMPIA ST. JP RIZAL QUEZON CITY 19 TIWALA SA PADALA TSP LALOMA 67 CALAVITE ST. -

Analysis of the Performance of Private Economic Zones in Philippines

International Journal of Development and Sustainability ISSN: 2186-8662 – www.isdsnet.com/ijds Volume 7 Number 2 (2018): Pages 502-517 ISDS Article ID: IJDS17111502 Analysis of the performance of private economic zones in Philippines Arianne Dumayas * Faculty of Economics, Chuo University, Higashi-nakano 742-1, Hachioji-shi, Tokyo, Japan Abstract The establishment of special economic zones has been a popular development policy tool for many developing economies like the Philippines. Special economic zones in the Philippines started as solely government-led and managed zones but eventually, the participation of private sector was allowed in 1995. As of 2016, majority of 348 active special economic zones are developed and managed by the private sector. Given the two decades of private sector participation, it is apt to analyze the economic contribution of these private special economic zones, particularly in comparison with public economic zones. This paper evaluates the performance of private and public economic zones using indicators on investments, exports, and employment. The increasing number of private economic zones are instrumental in driving the growth in investments, exports, and employment from 1995-2015. The analysis at zone level shows that while private economic zones deliver significant outcomes, public economic zones continue to play a major role. However, these findings are based on descriptive analysis. Further study using more sophisticated estimation techniques is required to assess the effectiveness of economic zones. Keywords: Special Economic Zones; Investments; Exports; Employment Published by ISDS LLC, Japan | Copyright © 2018 by the Author(s) | This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. -

Updates on the Implementation of Laws

Republic of the Philippines Senate Pasay City UPDATES ON THE IMPLEMENTATION OF LAWS (as of May 31, 2013) Fourteenth & Fifteenth Congress 1 PREFACE A law that successfully hurdles the legislative mill is a great achievement. But for all the tedious work that goes into the act of legislation, a law passed by Congress is rendered meaningless if it remains nothing more than a signed document on paper. In other words, if the law is not implemented, it becomes a “dead letter law.” There is therefore a need to continuously monitor and review the implementation of laws. It is in the interest of the citizens to check whether concerned agencies of the government have complied with the requirements, and if the corresponding Implementing Rules and Regulations have been issued. This is to ensure that stakeholders are able to maximize the benefits that these laws were originally designed to provide. This handbook contains a report on the implementation of laws passed during the Fourteenth and Fifteenth Congress. It aims to provide reference materials for Senators, Senate officials and other interested parties about the laws being implemented by different government departments, including their instrumentalities and agencies. It seeks to shed light on the reasons why some laws are not being fully carried out, as well as the problems encountered by the government agencies concerned in their implementation. We sincerely hope that this humble report would serve as a useful guide to everyone who may have the opportunity to use it. Atty. Crisante J. del Mundo Executive-Legislative Liaison Service Office of the External Affairs & Relations 2 TABLE OF CONTENTS Fourteenth Congress I. -

Style Guide for the Government Gabay Sa Estilo Para Sa Gobyerno

STYLE GUIDE FOR THE GOVERNMENT GABAY SA ESTILO PARA SA GOBYERNO PRESIDENTIAL COMMUNICATION DEVELOPMENT PRESIDENTIALAND STRATEGIC COMMUNICATIONS PLANNING OFFICEDEVELOPMENT AND STRATEGIC PLANNING OFFICE RESIDENTIAL C OMMUNIC AT I ON DEVEL OPMENT AND ST RA TEGIC PLANNING OFFI C 1 STYLE GUIDE FOR THE GOVERNMENT GABAY SA ESTILO PARA SA GOBYERNO PRESIDENTIAL COMMUNICATIONS DEVELOPMENT AND STRATEGIC PLANNING OFFICE 2 STYLE GUIDE FOR THE GOVERNMENT Presidential Communications Development and Strategic Planning Office ISBN 978-621-95495-0-9 All rights reserved. The content of this publication may be copied, adapted, and redistributed, in whole in part, provided that the material is not used for commercial purposes and that proper attribution be made. No written permission from the publisher is necessary. Some of the images used in this publication may be protected by restrictions from their original copyright owners; please review our bibliography for references used. Published exclusively by The Presidential Communications Developmentand Strategic Planning Office Office of the President of the Philippines 3/F New Executive Building, Malacañan Palace, San Miguel, Manila Website: http://www.pcdspo.gov.ph Email: [email protected] Book design by the Presidential Communications Development and Strategic Planning Office Published in the Philippines. 3 4 THE REPUBLIC OF THE PHILIPPINES BENIGNO S. AQUINO III President of the Philippines PRESIDENTIAL COMMUNICATIONS DEVELOPMENT AND STRATEGIC PLANNING OFFICE MANUEL L. QUEZON III Undersecretary of Presidential Communications Development and Strategic Planning Officer-in-Charge JAN MIKAEL dL. CO Assistant Executive Secretary Senior Presidential Speechwriter and Head of Correspondence Office JUAN POCHOLO MARTIN B. GOITIA Assistant Secretary Managing Editor, Official Gazette GINO ALPHONSUS A. -

Manufacturing Philippine Projects

Manufacturing Philippine Projects INDUSTRIAL ESTATE DEVELOPMENT IN REDONDO PENINSULA Description Redondo Peninsula covers over 2,000 hectares of land. However, only a portion of this can be developed for heavy industry. Currently, a shipbuilding firm with 300-hectare shipyard is operating in this district. The available lots in Redondo Peninsula are the 20 hectares located at Sitio Nagbayukan and the 86 hectares at the tip. In order to maximize the economic value of Redondo Peninsula as the Freeport’s strategic industrial estate, an industrial park for heavy industries can be developed in the said area like ship repair, shipbuilding, steel fabrication for offshore platform and other related industries. Type of investors/locators sought Industrial estate developer Available support service/s and facilities Strategic Location o Access by Land –two (2) to three (3) hour drive from Metro Manila; Access by Air – SBF is accessible to three (3) international airports, namely, the Ninoy Aquino International Airport (NAI) in Manila, Clark International Airport in Clark Freeport, and its very own international airport, the Subic Bay International Airport; Access by Sea – with 15 operational piers and wharves that can support a wide range of businesses and cargos. Incentives – SBMA is granting fiscal and non-fiscal incentives to its qualified locators. World Class Infrastructure o 15 operational piers and wharves; Subic Bay International Airport (SBIA), which is compliant with International Civil Aviation Organization (ICAO) standards for Category -

Fifth Edition

Fifth Edition CONTENTS 2 LIST OF PPP PROJECTS 4 THE PPP IN PH 5 PROJECTS UNDER PROCUREMENT 13 INVESTMENT OPPORTUNITIES 24 PROJECTS WITH ON-GOING STUDIES 43 AWARDED PROJECTS 52 THE PPP CENTER 53 POLICY INITIATIVES 54 DOING BUSINESS IN PH 55 THE PDMF 56 DIRECTORY 57 ACKNOWLEDGEMENTS PIPELINE AWARDED PROJECTS • Daang Hari - SLEX Link Road Project OF PUBLIC- • PPP for School Infrastructure Project (PSIP) Phase I • NAIA Expressway (Phase II) Project PRIVATE • PPP for School Infrastructure Project (PSIP) Phase II • Modernization of the Philippine Orthopedic Center PARTNERSHIP • Automatic Fare Collection System • Mactan-Cebu International Airport Passenger PROJECTS Terminal Building • LRT Line 1 Cavite Extension and O&M (as of December 05, 2014) PROJECTS UNDER PROCUREMENT Various projects can be financed and • Integrated Transport System - Southwest Terminal implemented via PPPs - from traditional • Bulacan Bulk Water Supply Project infrastructure projects such as toll roads, • Integrated Transport System - South Terminal airports, and transport systems; to • Laguna Lakeshore Expressway Dike Project non-traditional infrastructure such as • Operation & Maintenance of LRT Line 2 ICT systems and facilities, and social • New Centennial Water Source - Kaliwa Dam infrastructure like education and health. Project • Cavite-Laguna Expressway PROJECTS TO BE ROLLED-OUT FOR PROCUREMENT OF CONSULTANTS TO CONDUCT • Development, Operations and Maintenance of the New Bohol (Panglao) Airport PRE-INVESTMENT STUDIES • Development, Operations and Maintenance of -

Enhanced SEP 2014-2015

Preface The Socio-Economic Profile of Bataan before only contained plain tables and data without further description and analysis of the content, trend and impact of information that were deemed to be useful for the people particularly the Bataeños to know more of the province. For this year, the information usually gathered for SEP have been described. Available data with 5-year trend have also been presented. Moreover, graphical representations and write-ups are included. It is in this sense that the term “enhanced” has been intertwined in the SEP of the province- this initial effort aims to elevate the usual method of doing SEP so as to guide and help the users, researchers, investors, and decision-makers for easier understanding of data that describe the present sectoral characteristics of the province. This is only the start of systematic innovation of the province’s databank so as to transform this into a more useful reference, the Data Analytics Project. It is hoped that this document will be of help to all those concerned. Acknowledgement We would like to recognize all the LGUs, departments, offices and individuals who contributed to the preparation of this document, the Enhanced Socio-Economic Profile 2015. Table of Contents Page No. I. General Information 1 Area 1 Population 1 Political Figures 2016 1 Demography 2 Population Characteristics 2 Size and Population 2 Growth Rate per Municipality 4 Bataan Population Projection 5 Population Density 6 2. Economic Sector 7 A. Agriculture 7 A.1 Crops 7 A.2 Land Distribution 9 A.3 Livestock 11 Livestock Population 11 Poultry Production 12 B.