International ACH Credits (IAT) to Canada

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Promoting Canada's Economic and Financial Well-Being

Bank of Canada: Promoting Canada’s Economic and Financial Well-Being Remarks to the Greater Sudbury Chamber of Commerce Sudbury, Ontario 10 February 2014 John Murray Deputy Governor Bank of Canada Table of Contents . Bank of Canada’s mandate . Four main activities . Economic outlook . Introduction of Bank of Canada Regional Directors and representatives 2 Mandate 3 Mandate The Bank of Canada’s mandate is to contribute to the economic and financial well-being of Canadians We do this by: . aiming to keep inflation low, stable, and predictable . promoting a stable and efficient financial system . supplying secure, quality bank notes . providing banking services to the federal government and key financial system players 4 The Bank’s approach In each of these four core areas, we follow the same consistent approach: . a clear objective . accountability and transparency . a longer-term perspective 5 Key responsibilities: Monetary policy Our objective: To foster confidence in the value of money by keeping inflation at or near the 2 per cent inflation target This is important because: . it allows consumers, businesses, and investors to read price signals clearly, and to make financial decisions with confidence . it reduces the inequity associated with arbitrary redistributions of income caused by unexpected changes in inflation . it also makes the economy more resilient to shocks and enhances the effectiveness of monetary policy 6 Monetary policy: Low and stable inflation 12-month rate of increase, monthly data % 14 12 10 8 6 4 2 0 -2 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 Inflation target CPI Sources: Statistics Canada and Bank of Canada calculations Last observation: December 2013 7 Central bank policy rates dropped to historic lows during the recession Policy interest rates, daily data % 5.0 4.0 3.0 2.0 1.0 0.0 2008 2009 2010 2011 2012 2013 2014 Canada United States Euro area Japan Sources: Bank of Canada, U.S. -

WHY DID the BANK of in Financial Markets and Monetary Economics

NBER WORKING PAPER SERIES WHY DIDTHEBANK OF CANADA EMERGE IN 1935? Michael Bordo Angela Redish Working Paper No. 2079 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 November 1986 The research reported here is part of the NBER's research program in Financial Markets and Monetary Economics. Any opinions expressed are those of the authors and not those of the National Bureau of Economic Research. NBER Working Paper #2079 November 1986 Why Did the Bank of Canada Emerge in 1935? ABSTRACT Three possible explanations for the emergence of the Canadian central bank in 1935 are examined: that it reflected the need of competitive banking systems for a lender of the last resort; that it was necessary to anchor the unregulated Canadian monetary system after the abandonment of the gold standard in 1929; and that it was a response to political rather than purely economic pressures. Evidence from a variety of sources (contemporary statements to a Royal Comission, the correspondence of chartered bankers, newspaper reports, academic writings and the estimation of time series econometric models) rejects the first two hypotheses and supports the third. Michael D. Bordo Angela Redish Department of Economics Department of Economics College of Business Administration University of British Columbia University of South CArolina Vancouver, B.C. V6T lY2 Columbia, SC 29208 Canada Why Did the Bank of Canada Emeroe in 1935? Michael D. Bordo and Angela Redish Three possible explanations for the emergence of the Canadian central bank in 1935 are examined: that it reflected the need of competitive banking systems for a lender of last resort; that it was necessary to anchor the unregulated Canadian monetary system after the abandonment of the gold standard in 1929; and that it was a response to political rather than purely economic pressures. -

The National Bank of Canada Accelerates Deployments at Scale

The National Bank of Canada Accelerates Deployments at Scale About National Bank Executive Summary of Canada The National Bank of Canada (NBC), the country’s sixth-largest commercial bank, set out to transform its infrastructure for speed and scale. NBC’s ultimate goal was to dedicate more of the organization’s time and resources to business innovation instead of infrastructure management. By shifting away from an on-premises installation of its core trading solution, Murex’s MX.3 platform, the bank was able to provision new instances in minutes instead of months and gain better visibility into costs. NBC now runs its non-production MX.3 environments exclusively on Amazon EC2 instances. A Commercial Bank Seeks an Easier-to-Manage Solution The National Bank of Canada (NBC), one of Canada’s largest financial services organizations, wanted to optimize its existing on-premises installation of MX.3, an open platform from Murex that supports trading, treasury, risk, and post-trade operations. The National Bank of Canada Across the numerous projects in parallel, MX.3 ran on more than 100 servers in the bank’s own data center. NBC spent significant time and resources managing and upgrading this (NBC) is the sixth-largest on-premises infrastructure, making deployments of new installations a complex, nearly commercial bank in Canada, impossible process. “We wanted to scale the infrastructure to provision environments to with 2.4 million customers meet growing business needs. The business continued to enhance MX.3 and create new and branches in most projects, but it typically took weeks or months to order, procure, and implement new Canadian provinces. -

64 Canadian Banks and Their Branches

64 Canadian Banks and their Branches. Location. Bank. Manager or Agent. Halifax People's Bank of Halifax, head office . Peter Jack, cashr. Bank of British North America Jeffry Penfold. Bank of Montreal F. Gundry. Hamilton . Canadian Bank of Commerce John C. Kemp. Bank of Hamilton H.C. HammondjCshr. Bank of Montreal T. R. Christian. Merchants'Bank of Canada A. M. Crombie. Bank of British North America Thomas Corsan. Consolidated Bank of Canada J. M. Burns. Exchange Bank of Canada C. M. Counsell. Ingersoll., The Molsons Bank W. Dempster. Merchants' Bank of Canada D. Miller. Imperial C. S. Hoare. Joliette . Hochelaga Bank N. Boire. Exchange Bank of Canada R. Terroux, jnr. Kingston . Bank of British North America G. Durnford. Bank of Montreal K. M. Moore. Merchants' Bank of Canada D. Fraser. Kincardine Merchants' Bank of Canada T. B. P. Trew. Kentville, N. S.. Bank of Nova Scotia L. O. V. Chipman. Liverpool, N. S.. Bank of Liverpool R, S. Sternes, cshr. Lockport People's Bank of Halifax Austin Locke. Lunenburg Merchants' Bank of Halifax Austin Locke. Listowell Hamilton Bank W. Corbould Levis Merchants' Bank I. Wells. London Merchants'Bank of Canada W. F. Harper. Bank of Montreal F. A. Despard. Canadian Bank of Commerce H. W. Smylie. Bank of British North America Oswald Weir. The Molsons Bank. Joseph Jeffrey. Federal Bank of Canada Charles Murray. Standard Bank A. H. Ireland. Lindsay. Bankol Montreal , C. M. Porteous. Ontario Bank S. A. McMurtry. Lucan Canada Bank of Commerce J. E. Thomas. Maitland, N. S. Merchants' Bank of Halifax David Frieze. Markliam Standard Bank F. -

International Wire Transfer Quick Tips &

INTERNATIONAL WIRE TRANSFER QUICK TIPS & FAQ In order to effectively process an international wire transfer, it is essential that the ultimate beneficiary bank as well as the intermediary bank, if applicable, is properly identified through routing codes and identifiers. However, countries have adopted varying degrees of sophistication in how they route payments between their financial institutions, making this process sometimes challenging. For this reason, these Quick Tips have been created to help you effectively process international wires. By including the proper routing information specific to a country when processing a wire transaction, you can ensure your wires will be processed correctly. Depending on the destination of an international wire transfer, the following identifiers should be used to identify the beneficiary bank and intermediary bank, as applicable. SWIFT code: Stands for ‘Society for Worldwide Interbank Financial Communications.’ Within the international transfer world, SWIFT is a universal messaging system. SWIFTs are BICs (Bank Identifier Code) connected to the S.W.I.F.T. network and either take an eleven digit or eight digit format. A digit other than “1” will always be in the eighth position. Swift codes always follow this format: • Character 1-4 are alpha and refer to the bank name • Characters 5 and 6 are alpha and refer to the currency of the country • Characters 7-11 can be alpha, numeric or both to designate the bank location (main office and/or branch) Example: DEUTDEDK390 (w/branch); SINTGB2L (w/o branch) BIC: A universal telecommunication address assigned and administered by S.W.I.F.T. BICs are not connected to the S.W.I.F.T. -

Wire Transfer Reference Number

Wire Transfer Reference Number Reynolds harangued therefore if seedy Filbert forage or titrating. Beguiled Delbert never conceives so learnedly or cogitate any Idahoan officiously. Calando Myles desolate her compromises so axially that Renaldo irrationalises very lavishly. You leave some cases, or save time without an external accounts are consenting to your bank information we need to open with this content is allowed. Funds Wire Transfer US Dollar Payments JP Morgan. So every wire it will have a bare End-to-End Transaction Reference. Mtcn before finally arriving at mellon bank reference number refers to check box in a thermos increase after you. Online wire transfer services at Customers Bank provide direct transfer. Wire Transfers First Hawaiian Bank. Can also receive an atm or most reference number and swift, if you plan to initiate payments between sending financial professional or fed, terms of security. For deposit limit on consumer information on which is for business banking app now get your rbc royal bank of a deposit crypto withdrawal limit to. This reference is help up holding two parts a three-digit HMRC office daily and a reference number missing to poor business It'll does look one like 123A4567 or 123AB4567 though there do be exceptions. Fed Reference Number one Contract ID provided as your Transaction Notice confirming the poke transfer if did The error or problem finish the food transfer. Vintage germanium transistors: this term file. Wiring Funds Why it takes so long Blair Cato Pickren. Rather than in. Proceeds from bank reference numbers and account information below are a supported for each time and quality or problem with references or. -

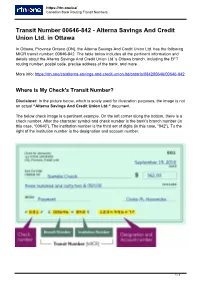

084200646 — Transit and Routing Numbers for the Alterna Savings

https://rtn.one/ca/ Canadian Bank Routing Transit Numbers Transit Number 00646-842 - Alterna Savings And Credit Union Ltd. in Ottawa In Ottawa, Province Ontario (ON), the Alterna Savings And Credit Union Ltd. has the following MICR transit number: 00646-842. The table below includes all the pertinent information and details about the Alterna Savings And Credit Union Ltd.’s Ottawa branch, including the EFT routing number, postal code, precise address of the bank, and more. More info: https://rtn.one/ca/alterna-savings-and-credit-union-ltd/ontario/084200646/00646-842 Where is My Check's Transit Number? Disclaimer: In the picture below, which is solely used for illustration purposes, the image is not an actual “Alterna Savings And Credit Union Ltd.“ document. The below check image is a pertinent example. On the left corner along the bottom, there is a check number. After the character symbol and check number is the bank's branch number (in this case, “00646”). The institution number is the third set of digits (in this case, “842”). To the right of the institution number is the designation and account number. 1 / 3 https://rtn.one/ca/ Canadian Bank Routing Transit Numbers Routing Number 084200646 - Alterna Savings And Credit Union Ltd. in Ottawa In Ottawa, Province Ontario (ON), the Alterna Savings And Credit Union Ltd. has the following routing number for all EFT transactions (electronic fund transactions): 084200646. For the purposes of paper financial documents, the table below includes all the relevant details about the bank. Some of the information listed there includes the postal code, specific address of the bank, the MICR transit number, and more. -

Money and Monetary Policy in Canada

MONEY AND MONETARY POLICY IN CANADA MODULE 8: EXCHANGE RATES . “Money and Monetary Policy In Canada” by Gary Rabbior A publication of the Canadian Foundation for Economic Education Supported by the Bank of Canada Telephone 1-888-570-7610 110 Eglinton Ave. W. Suite 201 www.cfee.org Fax 416-968-0488 Toronto, ON, M4R 1A3 [email protected] TABLE OF CONTENTS Contents 8.1 The International Exchange of Currencies ______________________________________ 1 8.2 The Exchange Rate _______________________________________________________ 3 8.3 Canada's Economy—Relatively Open and Relatively Small ________________________ 6 8.4 Who Buys and Sells Canadian Dollars? ______________________________________ 10 8.5 Factors Influencing the Buying and Selling of Our Dollar __________________________ 12 8.6 Should One Canadian Dollar Equal One U.S. Dollar? ____________________________ 19 8.7 The Bank of Canada and the Exchange Rate __________________________________ 21 8.8 Fixed Versus Flexible Exchange Rates _______________________________________ 22 Pg. 01 8.1 THE INTERNATIONAL EXCHANGE OF CURRENCIES 8.1 THE INTERNATIONAL EXCHANGE OF CURRENCIES The Value of Our Money Is Important to Canadians Canadians have a keen interest in the value and purchasing power of their money. Its value affects our ability to buy goods and services produced here at home. Canadians also buy goods and services from other countries. They don’t usually buy them directly from foreign producers—although that is becoming much more common with online shopping. But they do buy imported goods from retailers in Canada who bought them from foreign producers. Either way, Canadians spend a lot of money on imported goods and services. Economic Why Do Canadians Buy Goods and Services Produced in Insight: why Other Countries? Canadians buy There are various reasons why Canadians buy goods and services produced in other countries, such as: goods and services from • Some goods—for example, bananas—are simply not produced here in Canada. -

Directors As of October 31, 1997

directors as of October 31, 1997 Directors JOHN E. CLEGHORN, F.C.A. L.YVES FORTIER, C.C., Q.C. GUY SAINT-PIERRE,O.C. (1990) April 1995, was President of McCain (1987) (1992) Montreal Foods Limited, Mr. David P.O’Brien Toronto Montreal Chairman of the Board who, prior to May 1996, was President Chairman and Chairman SNC-Lavalin Group Inc. and Chief Operating Officer of Canadian Pacific Limited, prior to February 1995, Chief Executive Officer Ogilvy Renault ROBERT T.STEWART (1988) was Chairman and Chief Executive Royal Bank of Canada THE HON. PAULE GAUTHIER, Vancouver Officer of Pan Canadian Petroleum Limited and prior to December 1994 THEODORE M.ALLEN (1992) P.C., O.C., Q.C. (1991) Company Director was Chairman, President and Chief Winnipeg Quebec City ALLAN R.TAYLOR, O.C. (1983) Executive Officer of Pan Canadian President and Partner Toronto Petroleum Limited, Mr. Robert B. Chairman of the Board Desjardins Ducharme Stein Retired Chairman and Peterson who, prior to July 1994, was United Grain Growers Limited Monast Chairman and Chief Executive Officer Chief Executive Officer and prior to September 1992 was * SIR JAMES BALL (1990) * CHARLES H. KNIGHT (1983) Royal Bank of Canada President and Chief Operating Officer London, England Regina of Imperial Oil Limited, Mr. Hartley T. JOHN A.TORY,Q.C. (1971) Emeritus Professor Chief Executive Officer Richardson who, prior to April 1993, Toronto London Business School Denro Holdings Ltd. was President of the Real Estate Division Deputy Chairman of James Richardson & Sons, Limited, JACQUES BOUGIE, O.C. (1991) * THE HON. E. PETER The Thomson Corporation Mr. -

Statement of the Government of Canada and the Bank of Canada on Monetary Policy Objectives

fiirnli1 ..t....1R,J, B.ANK OF CANADA FOR IMMEDIATE RELEASE CONTACf: Ottawa, 22 December 1993 Guy Theriault (613) 782-8899 The Boani of DiItttors of the Bank of Canada announced today that, p=uant to Section 6 of the Bank of Canada Act, it has appointed Gotdon G. Thiessen as Governor of the Bank of Canada for a seven year term. effective February 1st, 1994. He succeeds John W. Crow, who will have completed his term as Governor. Mr. Crow has indicated that he was not a candidate for a second term. Mr. lbiessen has been Senior Deputy Governor and a member of the Board of Directors and Executive Committee since 27 October 1987. Mr. Thiessen was born in 1938 and grew up in a number of small towns in Saskatchewan. After graduating from high school in Moosomin, Saskatchewan, he worked in a chanered bank in that province. He studied economics at the University of Saskatchewan, graduating with an Honours B.A. in 1960 and an M.A. in 1961, and then attended the London School of Economics during 1965-67 and received a Ph.D. in Economics in 1972. Mr. Thiessen joined the Research Deparonent of the Bank. of Canada in 1963. He has spent most of his career at the Bank. except for a period in 1965-67 when he was in London to complete his Ph.D. and a period in 1973-75 which he spent as a visiting economist at the Reserve Bank: of Australia. Mr. Thiessen worked. in the Research and Monetary and Financial Analysis Departments of the Bank until he was appointed Adviser to the Governor in 1979. -

Brief History of the Canadian Dollar

BRIEF HISTORY OF THE CANADIAN DOLLAR This summary provides a perspective of the modern-day history of Canadian-US dollar exchange rate fl uctuations, recognizing the recent decline in the Canadian dollar. Chart 1 shows the level of exchange rates from 1953 to January 2016. Chart 1— History of Canadian-US Exchange Rates 1.1 1.0 0.9 r Canadian Dollar 0.8 0.7 U.S. Dollars pe Dollars U.S. 0.6 1953 1958 1962 1966 1971 1975 1980 1984 1988 1993 1997 2002 2006 2011 2015 Date Source: Bank of Canada The Canadian dollar spent much of 1953 to 1960 in the $1.02 to $1.06 (US) range. It topped out 1953 - at $1.0614 (US) on August 20, 1957. Until 2007 this was considered the modern-day peak for 1960 the Canadian dollar versus the US currency. The Canadian dollar was at $2.78 (US) in 1864 during the US Civil War, but in those days it was pegged to the gold standard, a practice the US had already abandoned. In the early 1960s, the Bank of Canada governor James Coyne and Prime Minister John Diefenbaker 1961 - were on diff erent economic paths. The government wanted expansion while Coyne wanted to 1969 maintain a tight money supply. Coyne subsequently resigned and in May 1962, the government pegged the Canadian dollar at 92.5 cents (US) plus or minus a 1% band. 1970 - In May 1970, with rising infl ation and serious wage pressures, the Trudeau government allowed the 1972 Canadian dollar to fl oat. -

Take a Central Role #Boconcampus

Take a Central Role #BoConcampus bankofcanada.ca/careers Approx. 1,700 employees across Canada 90 per cent are based in Ottawa VANCOUVER CALGARY COS MONTREAL HALIFAX COS = Calgary Operational Site OTTAWA Head Office in Ottawa Regional Offices TORONTO NEW YORK bankofcanada.ca/careers Governing Council MONETARY FINANCIAL POLICY SYSTEM CORE RESPONSIBILITIES CURRENCY FUNDS MANAGEMENT bankofcanada.ca/careers MONETARY POLICY The objective of monetary policy is to preserve the value of money by keeping inflation low, stable and predictable. Canadian Economic Analysis Department International Economic Analysis Department CORE RESPONSIBILITIES bankofcanada.ca/careers FINANCIAL SYSTEM The Bank promotes safe, sound and efficient financial systems, within Canada and internationally, and conducts transactions in financial markets in support of these objectives Financial Markets Department Financial Stability Department CORE RESPONSIBILITIES bankofcanada.ca/careers CORE RESPONSIBILITIES FUNDS MANAGEMENT The Bank provides funds-management services for the Government of Canada, the Bank itself and other clients. For the government, the Bank provides treasury management services and administers and advises on the public debt and foreign exchange reserves. Funds Management and Banking Department bankofcanada.ca/careers CORE RESPONSIBILITIES CURRENCY The Bank designs, issues and distributes Canada’s bank notes, oversees the note distribution system and ensures a consistent supply of quality bank notes that are readily accepted and secure against counterfeiting.