Return of Private Foundation 0. C

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

990-PF Or Section 4947(A)(1) Trust Treated As Private Foundation | Do Not Enter Social Security Numbers on This Form As It May Be Made Public

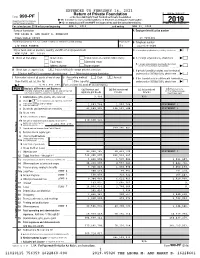

EXTENDED TO FEBRUARY 16, 2021 Return of Private Foundation OMB No. 1545-0047 Form 990-PF or Section 4947(a)(1) Trust Treated as Private Foundation | Do not enter social security numbers on this form as it may be made public. Department of the Treasury 2019 Internal Revenue Service | Go to www.irs.gov/Form990PF for instructions and the latest information. Open to Public Inspection For calendar year 2019 or tax year beginning APR 1, 2019 , and ending MAR 31, 2020 Name of foundation A Employer identification number THE LEONA M. AND HARRY B. HELMSLEY CHARITABLE TRUST 13-7184401 Number and street (or P.O. box number if mail is not delivered to street address) Room/suite B Telephone number 230 PARK AVENUE 659 212-679-3600 City or town, state or province, country, and ZIP or foreign postal code C If exemption application is pending, check here ~ | NEW YORK, NY 10169 G Check all that apply: Initial return Initial return of a former public charity D 1. Foreign organizations, check here ~~ | Final return Amended return 2. Foreign organizations meeting the 85% test, Address change Name change check here and attach computation ~~~~ | X H Check type of organization: Section 501(c)(3) exempt private foundation E If private foundation status was terminated Section 4947(a)(1) nonexempt charitable trust Other taxable private foundation under section 507(b)(1)(A), check here ~ | X I Fair market value of all assets at end of year J Accounting method: Cash Accrual F If the foundation is in a 60-month termination (from Part II, col. -

The Jewish Observer L DR

CHESHVAN, 5738 I OCTOBER 1977 VOLUME XII, NUMBER 8 fHE EWISH SEVENTY FIVE CENTS "Holocaust" - a leading Rosh Yeshiva examines the term and the tragic epoch it is meant to denote, offering the penetrating insights of a Daas Torah perspective on an era usually clouded with emo tion and misconception. "Holocaust Literature" - a noted Torah educator cuts a path through ever-mounting stacks of popular and scholarly works on "Churban Europe," highlighting the lessons to be learned and the pitfalls to be avoided. THE JEWISH BSERVER in this issue "Holocaust" - A Study of the Term, and the Epoch it is Meant to Describe, from a discourse by Rabbi Yitzchok Hutner K"t:l•7w. translated by Chaim Feuerman and Yaakov Feitman ......... .3 Dealing With "Ch urban Europa", THE JEWISH OB.SERVER is publi$ed a review article by Joseph Elias .................................................... 10 monthly, excePt July and August, by the Agudath Israel of America, 5 Beekman St., New York, N.Y. Thumb Prints, Simcha Bunem Unsdorfer r, .. , ................................ 19 10038. Second class postage paid at New York, N.Y. Subscription: Torah Ambassadors at large $7.50 per year; Two years, $13.00; Three years, $18.00; outside of the I. Bringing Torah to the Valley, Moshe Turk ....................... 22 United States $8.50 per year. II. The Mexico City Junket, Single copy seventy~five cents. Printed in the U.S.A. Suri Rosenberg and Rochel Zucker ........................ 25 Letters to the Editor ............................................................................ 30 RABBI N1ssoN WotrJN Editor Subscribe ------Clip.andsave------- Editorial Board The Jewish Observer l DR. ERNST L. BODENHEIMER Chairman Renew 5 Beekman Street/ New York, N.Y. -

Return of Private Foundation

l efile GRAPHIC p rint - DO NOT PROCESS As Filed Data - DLN: 93491015004014 Return of Private Foundation OMB No 1545-0052 Form 990 -PF or Section 4947( a)(1) Nonexempt Charitable Trust Treated as a Private Foundation Department of the Treasury 2012 Note . The foundation may be able to use a copy of this return to satisfy state reporting requirements Internal Revenue Service • . For calendar year 2012 , or tax year beginning 06 - 01-2012 , and ending 05-31-2013 Name of foundation A Employer identification number CENTURY 21 ASSOCIATES FOUNDATION INC 22-2412138 O/o RAYMOND GINDI ieiepnone number (see instructions) Number and street (or P 0 box number if mail is not delivered to street address) Room/suite U 22 CORTLANDT STREET Suite City or town, state, and ZIP code C If exemption application is pending, check here F NEW YORK, NY 10007 G Check all that apply r'Initial return r'Initial return of a former public charity D 1. Foreign organizations, check here (- r-Final return r'Amended return 2. Foreign organizations meeting the 85% test, r Address change r'Name change check here and attach computation H Check type of organization FSection 501(c)(3) exempt private foundation r'Section 4947(a)(1) nonexempt charitable trust r'Other taxable private foundation J Accounting method F Cash F Accrual E If private foundation status was terminated I Fair market value of all assets at end und er section 507 ( b )( 1 )( A ), c hec k here F of y e a r (from Part 77, col. (c), Other (specify) _ F If the foundation is in a 60-month termination line 16)x$ 4,783,143 -

When Unity Reigned: Yom Ha-Azma’Ut 1954

51 When Unity Reigned: Yom ha-Azma’ut 1954 By: ELAZAR MUSKIN A number of years ago while I rummaged through a box of old pa- pers and memorabilia that belonged to my late father, Rabbi Jacob Muskin z”l, of Cleveland, Ohio, a stained yellow mimeographed paper fell on my lap. As I picked it up, I began to realize that I was holding an historic document. The paper was folded in half and on the front cover it read, “Sixth Anniversary Celebration Israel Independence Day, Sunday May 9, 1954, Iyar 6, 5714.” The front cover also indicated the loca- tion of the celebration, The Taylor Road Synagogue Auditorium in Cleveland Heights, Ohio and noted that the event was sponsored by an organization called “The Orthodox Jewish Association of Cleveland.”1 1 In my letter to Rabbi Shubert Spero dated 2 July, 1997 I asked him a number of questions including: What was this sponsoring organization “The Orthodox Jewish Association”? How long did it exist? Who was Dr. David Magid, its President? In his letter dated 19 August, 1997 Rabbi Spero responded: “Shortly after my arrival in Cleveland I was called to a meeting with Rabbis E.M. Bloch and C.M. Katz z”l (who were very close to my late uncles, H.I. and B.E. Spero z”l, who were instrumental in bringing the Yeshiva to Cleveland) who told me that the Roshei Yeshiva did not wish to isolate themselves from the ‘city’ but rather saw themselves as a part of the general commu- nity and, given the sad state of Orthodoxy, felt a religious obligation to work for the ideals of Torah. -

Roster of Religious Personnel Page 1 Compiled by Earl Pruce

4/25/2019 Roster of Religious Personnel Page 1 Compiled by Earl Pruce Name Title Position Congregation / Organization Location Date Death Date Abelow, Peter (Dr.) Principal Beth Tfiloh Congregation High School --1989 Abramowitz, Abraham Rabbi Anshe Neisen Congregation Nov. 15, 1926 Abramowitz, Abraham Rabbi Tifereth Israel Congregation of Forest Park Forest Park Nov. 15, 1926 Abrams, Mendel L., Dr. Rabbi Beth Torah Congregation Hyattsville 1989, 1996, 1997 Abramson, Barry Ephraim Rabbi Shochet 1999- Abramson, Mordechai Rabbi Shochet 1989 Ackerman, Everett S. Rabbi Moses Montefiore Emunath Israel Woodmoor Hebrew Congregation 1978-1998? Ackerson, Mitchell S. Rabbi Chaplain Sinai Hospital 1993-- Adashek, Steven Mohel M.D. Mohel, 2004 Adler, Abraham Rabbi Anshe Sphard Congregation Feb. 17, 1920 Adler, Elan Rabbi Associate Rabbi Beth Tfiloh Congregation July 1993--Jan 2001 Adler, Elan Rabbi "Rabbi Designate" Moses Montefiore Anshe Emunah, Liberty Jewish Center Jan 2001 Adler, Joseph Cantor Har Zion Congregation 1928?-1933 Adler, L. Rabbi Beth Hamedrosh Hagodol Congregation Adler, Leon Rabbi Temple Emanuel Kensington 1953-1988 1988 Aftel, Jeffrey Rabbi Hebrew Day School Montgomery County 2001 Agus, Jacob B. Rabbi Beth El Congregation 1950-1980 Sept. 26, 1986 Albrecht, Avraham (Avi) Cantor Beth Tfiloh Congregation 1996- Alpern, Ian Cantor Beth Israel Congregation 1969-- Alter,Joel Rabbi Shoshana S Cardin Community H S Baltimore 2002 Altman, Solomon B. Cantor Har Zion Congregation 1934-5, 1941 Altmeyer, ? Cantor Temple Oheb Shalom 1853? Altshul, William Rabbi Hebrew Academy of Greater Washington Silver Spring 1996, 1997,2004 Amerling, Suzanne (Dr.) Baltimore Hebrew Congregation Religious School 1989, 1990 Anemer, Gedaliah Rabbi Yeshiva Boys School Silver Spring 1989 Anemer, Gedaliah Rabbi Young Israel Shomrai Emunah Congregation Silver Spring 1989-92, 1996, 1997 Ansell (Anshel), Rev. -

T S Form, 990-PF Return of Private Foundation

t s Form, 990-PF Return of Private Foundation OMB No 1545-0052 or Section 4947(a)(1) Nonexempt Charitable Trust Department of the Treasury Treated as a Private Foundation Internal Revenue service Note. The foundation may be able to use a copy of this return to satisfy state report! 2006 For calendar year 2006, or tax year beginning , and ending G Check all that a Initial return 0 Final return Amended return Name of identification Use the IRS foundation Employer number label. Otherwise , HE DENNIS BERMAN FAMILY FOUNDATION INC 31-1684732 print Number and street (or P O box number if mail is not delivered to street address) Room/suite Telephone number or type . 5410 EDSON LANE 220 301-816-1555 See Specific City or town, and ZIP code C If exemption application is pending , check here l_l Instructions . state, ► OCKVILLE , MD 20852-3195 D 1. Foreign organizations, check here Foreign organizations meeting 2. the 85% test, ► H Check type of organization MX Section 501(c)(3) exempt private foundation check here and attach computation = Section 4947(a)(1) nonexempt chartable trust 0 Other taxable private foundation E If private foundation status was terminated I Fair market value of all assets at end of year J Accounting method 0 Cash Accrual under section 507(b)(1)(A), check here (from Part ll, col (c), line 16) 0 Other (specify) F If the foundation is in a 60-month termination $ 5 010 7 3 9 . (Part 1, column (d) must be on cash basis) under section 507 (b)( 1 ► )( B ) , check here ► ad 1 Analysis of Revenue and Expenses ( a) Revenue and ( b) Net investment (c) Adjusted net ( d) Disbursements (The total of amounts in columns (b), (c), and (d) may not for chartable purposes necessary equal the amounts in column (a)) expenses per books income income (cash basis only) 1 Contributions , gifts, grants , etc , received 850,000 . -

Shalom Le Kulam, Hallo Alle Zusammen, Seit Mehr Als Drei Monaten Lebe Ich Nun in Israel Und Es Wird Zeit, Ihnen Und Euch Von Meinen Erfahrungen Hier Zu Berichten

Shalom le kulam, hallo alle zusammen, seit mehr als drei Monaten lebe ich nun in Israel und es wird Zeit, Ihnen und euch von meinen Erfahrungen hier zu berichten. Die Einsatzstelle: ALEH Negev – Nahalat Eran Das Dorf ALEH Negev ist eine Einrichtung für Menschen mit schweren und komplexen Beeinträchtigungen im Norden der israelischen Negevwüste. Neben Wohneinheiten für insgesamt 140 Residents befinden sich auf dem Gelände ein Krankenhausflügel für die, die eine medizinische Rundumbetreuung benötigen, ein integrativer Kindergarten, ein Hydrotherapiepool, eine Schule für die wenigen Kinder von ALEH Negev und viele auswärtige Schüler*innen, ein Streichelzoo und ein Reitzentrum sowie die Gebäude der Ta'asuka, also des Arbeitsplatzes der Bewohner*innen. Hinzu kommen Verwaltungsgebäude und die Räume für ambulante Therapien. Die meisten dieser Gebäude gruppieren sich um eine große Garten- oder Parkanlage. Die Residents erhalten in ALEH Negev die intensive Betreuung, die sie benötigen. Sie werden in ihrem Tagesablauf von Caregivern, israelischen und ausländischen Freiwilligen sowie Nurses und Therapeut*innen begleitet. Meine Arbeit Wie die meisten Freiwilligen bin ich in einem der Wohnhäuser eingesetzt. Davon gibt es fünf, zwei Männer- und zwei Frauenhäuser sowie ein gemischtes Haus, in dem auch ein paar Kinder leben. „Mein“ Haus, Beit Shachar, ist ein Männerhaus, dort leben dreiundzwanzig Männer im Alter von etwa zwanzig bis sechzig Jahren. Sie alle sind sowohl körperliche als auch geistige eingeschränkt, weswegen sie auf intensive Pflege und Betreuung angewiesen sind. Die Häuser sind in zwei Hälften unterteilt, in der jeweils zwei Gruppen von bis zu sechs Personen leben. Je zwei Residents teilen sich ein Schlafzimmer und zwei Schlafzimmer ein Badezimmer. -

The Lithuanian Jewish Community of Telšiai

The Lithuanian Jewish Community of Telšiai By Philip S. Shapiro1 Introduction This work had its genesis in an initiative of the “Alka” Samogitian Museum, which has undertaken projects to recover for Lithuanians the true history of the Jews who lived side-by-side with their ancestors. Several years ago, the Museum received a copy of the 500-plus-page “yizkor” (memorial) book for the Jewish community of Telšiai,2 which was printed in 1984.3 The yizkor book is a collection of facts and personal memories of those who had lived in Telšiai before or at the beginning of the Second World War. Most of the articles are written in Hebrew or Yiddish, but the Museum was determined to unlock the information that the book contained. Without any external prompting, the Museum embarked upon an ambitious project to create a Lithuanian version of The Telshe Book. As part of that project, the Museum organized this conference to discuss The Telshe Book and the Jewish community of Telšiai. This project is of great importance to Lithuania. Since Jews constituted about half of the population of most towns in provincial Lithuania in the 19th Century, a Lithuanian translation of the book will not only give Lithuanian readers a view of Jewish life in Telšiai but also a better knowledge of the town’s history, which is our common heritage. The first part of this article discusses my grandfather, Dov Ber Shapiro, who was born in 1883 in Kamajai, in the Rokiškis region, and attended the Telshe Yeshiva before emigrating in 1903 to the United States, where he was known as “Benjamin” Shapiro. -

The Corona Ushpizin

אושפיזי קורונה THE CORONA USHPIZIN Rabbi Jonathan Schwartz PsyD Congregation Adath Israel of the JEC Elizabeth/Hillside, NJ סוכות תשפא Corona Ushpizin Rabbi Dr Jonathan Schwartz 12 Tishrei 5781 September 30, 2020 משה תקן להם לישראל שיהו שואלים ודורשים בענינו של יום הלכות פסח בפסח הלכות עצרת בעצרת הלכות חג בחג Dear Friends: The Talmud (Megillah 32b) notes that Moshe Rabbeinu established a learning schedule that included both Halachic and Aggadic lessons for each holiday on the holiday itself. Indeed, it is not only the experience of the ceremonies of the Chag that make them exciting. Rather, when we analyze, consider and discuss why we do what we do when we do it, we become more aware of the purposes of the Mitzvos and the holiday and become closer to Hashem in the process. In the days of old, the public shiurim of Yom Tov were a major part of the celebration. The give and take the part of the day for Hashem, it set a tone – חצי לה' enhanced not only the part of the day identified as the half of the day set aside for celebration in eating and enjoyment of a חצי לכם for the other half, the different nature. Meals could be enjoyed where conversation would surround “what the Rabbi spoke about” and expansion on those ideas would be shared and discussed with everyone present, each at his or her own level. Unfortunately, with the difficulties presented by the current COVID-19 pandemic, many might not be able to make it to Shul, many Rabbis might not be able to present the same Derashos and Shiurim to all the different minyanim under their auspices. -

Shabbos Shacharis Zmanim-Minyan by the Minute

Shabbos Shacharis Zmanim‐Minyan By The Minute Vasikin Yeshivas Brisk 9:00 Adas Bnei Israel 7:00 Anshe Motele Adas Yeshurun 7:15 Kehilath Jacob Beth Samuel BAY Shul 7:25 Adas Yeshurun Beth Sholom Ahavas Achim Ezras Israel Mechitzah Minyon Heritage Russian Jewish Cong. 7:30 Kehilat Chovevei Tzion Kehilat Chovevei Tzion (Ashkenaz) K.I.N.S. of West Rogers Park Kehilath Jacob Beth Samuel Sha'arei Tzedek Mishkan Yair K.I.N.S. of West Rogers Park 8:00 Chicago Community Kollel Lubavitch Chabad of Skokie Kollel Ateres Ami (Russian) Or Torah Kollel Zichron Eliyahu Park Plaza Synagogue Or Torah Poalei Tzedek Telshe Yeshiva Yehuda Moshe 8:15 Bais Medrash Torah Utfillah Young Israel of Chicago Hebrew Theological College Young Israel of Northbrook Ohel Shalom Torah Center Young Israel of Skokie 8:20 Adas Yeshurun Young Israel of WRP 8:30 Agudath Israel Bikur Cholim 9:10 Khal Ohr Yisocher Chodorov Agudath Israel of West Rogers Park Shevet Achim/Buckingham Pavilion Bais Chaim Dovid 9:15 Ezras Israel Mechitzah Minyon Bais Yitzchok Darchei Noam of Glenbrook CCTC‐Chesed L'Avrohom Or Menorah Or Torah Yavneh‐ Newberger Hillel Center Sephardic Congregation Yisraelink Skokie Community Kollel 9:30 Anshei Lubavitch Yeshivas Brisk Bais Menachem Nusach Ari 8:40 Persian (Iran) Hebrew Bnei Reuven 8:45 Adas Yeshurun Chabad of Bucktown Anshe Motele Chabad of Wilmette‐ Kesser Maariv Lubavitch Chabad of Northbrook Bais Hamedrash Mikor Hachaim Lubavitch Chabad of the Gold Coast Bnei Reuven Mishna Ugemora Sha'arei Tzedek Mishkan Yair Or Simcha Nusach Ashkenaz Shearith -

Throughout the World, Chai Lifeline Is There Forthe Children and Families Who Are Stricken with Serious Illnesses

Throughout the world, Chai Lifeline is there forthe children and families who are stricken with serious illnesses. hen a child is sick with a ing. Serious illness has a complex effect serious illness the whole on every family member involved. Chai WJewish community feels the Lifeline offers advice, solutions and a pain. And Chai Lifeline gives every Jew whole lot more. In New York, Miami, the opportunity to care and actually The Midwest, London and Israel, Chai make a difference in the lives of these Lifeline reaches out and literally saves children and their families around the world. lives through its extensive programs of support. Through a variety of necessary, effective and creative Without Chai Lifeline, a Jewish child with a serious programs, Chai illness would be left alone to suffer. With Chai Lifeline holds the Lifeline that child and his family has the support of hands of thousands of the entire Jewish community. suffering children and their families and gives Help make the lives of thousands of suffering them the hope and children and their families a lot easier. Give to courage they need to Chai Lifeline and give each and every seriously survive. A hope that ill child the courage and the only the Jewish community can give. hope needed to survive. The children need tutors. The parents need advice and support. The siblings need understand- Programs-----------------------------·· Camp Simcha-in Memory of Dr. Samuel Abraham • Camp Simcha Israel • H.E.L.P-Homebound Educational Learning Program • Jacquelyn Wigs Fund • H.E.A.R.T.-Hebrew Enrichment & Remedial Tutoring • 6x Chai Volunteer Prag. -

Pinchas July 10, 2020

continued on back back on continued the host should make the guest feel as as feel guest the make should host the renewal of the relationship between between relationship the of renewal this approach toward treating a guest; guest; a treating toward approach this Sukkos is the celebration of the the of celebration the is Sukkos However, there is another way to view view to way another is there However, the first insight of the Vilna Gaon; Gaon; Vilna the of insight first the conduct. conduct. what the Torah wishes to teach us. us. teach to wishes Torah the what Sukkos. This comment dovetails with with dovetails comment This Sukkos. upon their faces and through their their through and faces their upon the guest. This, of course, is not not is course, of This, guest. the Vilna Gaon, refers to the holiday of of holiday the to refers Gaon, Vilna whose spiritual greatness is visible visible is greatness spiritual whose host displays a lack of interest toward toward interest of lack a displays host “Found us pleasing,” explains the the explains pleasing,” us “Found Jewish People have merited leaders leaders merited have People Jewish away at what the guest is offered, the the offered, is guest the what at away loved us, and found us pleasing. pleasing. us found and us, loved history, and even in our times, the the times, our in even and history, first approach is that by whittling whittling by that is approach first that Hashem chose the Jewish People, People, Jewish the chose Hashem that shone like the moon.