Market Analysis for Zero Energy Modular in Colorado February 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Concentrated Photovoltaic

Concentrated Photovoltaic (CPV) - Global Installation Size, Cost Analysis, Efficiencies and Competitive Analysis to 2020 Reference Code: GDAE1043MAR Publication Date: April 2011 The US, Germany and Japan are Key Countries for the CPV–The Emerging Solar Technology Industry CPV is an upcoming renewable market which promises to In 2010 Spain dominated the global CPV market with around provide cost-effective power generation at high levels of XX MW of cumulative installed capacity. Spain accounts for efficiency. Presently, the global CPV cumulative installed XX% of the global CPV installed base. Most parts of the country capacity is XX MW. The technology is still developing and so experience high DNI which attracts CPV installers for most CPV projects are in the pilot or prototype stage. Guascor investments in Spain. The US follows Spain with a cumulative Foton’s Navarre power plant and Murcia power plant are the installed capacity of around XX MW; thereby accounting for largest CPV plants with installed capacities of XX MW and XX XX% of the global CPV installed capacity. Greece and Australia MW respectively. Globally, Spain has the largest market for have also attracted CPV system installers due to a high DNI CPV installations. In the US, the major emerging companies are concentration. These countries account for approximately XX% SolFocus, Amonix, EMCORE and Skyline Solar. European and XX% of the global CPV cumulative installed capacity companies such as Concentrix, Abengoa Solar and ArimaEco respectively. have also started making progress in the CPV market. Global Cumulative Installations to Reach XX GW by 2020 Concentrated PV Market, Global, Cumulative Installed Capacity by Country, %, 2010 The CPV market is expected to grow dramatically over the next three years. -

Permitted/Approved Renewable Energy Facilities NORTHERN NEVADA SOUTHERN NEVADA 1150 E

Permitted/Approved Renewable Energy Facilities NORTHERN NEVADA SOUTHERN NEVADA 1150 E. William Street 9075 W. Diablo Dr., Ste. 250 Carson City, NV 89701 Las Vegas, NV 89148 Phone: (775) 684-6101 Phone: (702) 486-7210 Fax: (775) 684-6110 Fax: (702) 486-7206 Consumer Complaints: (775) 684-6100 Consumer Complaints: (702) 486-2600 Pursuant to Nevada Revised Statute 704.865, the PUCN approves Utility Environmental Protection Act (UEPA) permits for all privately- owned conventional (natural gas, oil, coal, nuclear) utility facilities constructed in Nevada. The PUCN also approves the construction of renewable energy projects with an output greater than 70 megawatts, and transmission for renewable energy greater than 200 kilovolts. Additionally, the PUCN approves purchase power agreements (PPAs) between NV Energy and conventional utility and renewable energy facilities. See the table below for a comprehensive list of renewable energy projects in Nevada with a PUCN- approved UEPA permit and/or PPA. Projects Within Nevada that Received PUCN PUCN Approval Project Details Approval MW Exporting/Internal Project UEPA¹ PPA² COD³ Notes⁶ Nameplate⁴ Generation⁵ Biogas 1 Truckee Meadows Water Reclamation Facility X 2005 0.80 Internal 2004 Geothermal 2 Beowawe X 2006 17.70 Internal 05-5010 3 Buffalo/Jersey Valley X N/A 24.00 N/A 06-10021 4 Brady X 1992 24.00 Internal 1990 5 Carson Lake X N/A 31.50 N/A 06-10021 6 Carson Lake Basin Project X N/A 62.00 N/A 07-07013 7 Clayton Valley 1 X N/A 53.50 N/A 10-03022 8 Coyote Canyon X N/A 70.00 Exporting 11-06014 9 -

Boulder Solar Power JUN 3 2016 MBR App.Pdf

20160603-5296 FERC PDF (Unofficial) 6/3/2016 12:51:20 PM UNITED STATES OF AMERICA BEFORE THE FEDERAL ENERGY REGULATORY COMMISSION Boulder Solar Power, LLC ) Docket No. ER16-_____-000 APPLICATION FOR MARKET-BASED RATE AUTHORIZATION, REQUEST FOR DETERMINATION OF CATEGORY 1 SELLER STATUS, REQUEST FOR WAIVERS AND BLANKET AUTHORIZATIONS, AND REQUEST FOR WAIVER OF PRIOR NOTICE REQUIREMENT Pursuant to Section 205 of the Federal Power Act (“FPA”),1 Section 35.12 of the regulations of the Federal Energy Regulatory Commission (“FERC” or the “Commission”),2 Rules 204 and 205 of the Commission’s Rules of Practice and Procedure,3 and FERC Order Nos. 697, et al.4 and Order No. 816,5 Boulder Solar Power, LLC (“Applicant”) hereby requests that the Commission: (1) accept Applicant’s proposed baseline market-based rate tariff (“MBR Tariff”) for filing; (2) authorize Applicant to sell electric energy, capacity, and certain ancillary services at market-based rates; (3) designate Applicant as a Category 1 Seller in all regions; and (4) grant Applicant such waivers and blanket authorizations as the Commission has granted to other sellers with market-based rate authorization. Applicant requests that the Commission waive its 60-day prior notice requirement6 to allow Applicant’s MBR Tariff to become effective as of July 1, 2016. In support of this Application, Applicant states as follows: 1 16 U.S.C. § 824d (2012). 2 18 C.F.R. § 35.12 (2016). 3 Id. §§ 385.204 and 385.205. 4 Mkt.-Based Rates for Wholesale Sales of Elec. Energy, Capacity & Ancillary Servs. by Pub. Utils., Order No. -

Energy Infrastructure Update for December 2016

Office of Energy Projects Energy Infrastructure Update For December 2016 Natural Gas Highlights • Natural received authorization to place into service its 2012 Storage Optimization Project which will provide 100 MMcf/d of capacity on its Gulf Coast Mainline from the Loudon Storage Field located near St. Emo in Fayette County, IL to a point of termination at Natural’s Compressor Station No. 113 near Joliet in Will County, IL. • Algonquin received authorization to place into service the Stony Point to Yorktown Take-up and Relay facilities as part of its Algonquin Incremental Market Project. These facilities will provide the remaining 97 MMcf/d of capacity out of the authorized 342 MMcf/d of capacity. • UGI Sunbury received authorization to place into service its Sunbury Pipeline Project which will provide 200 MMcf/d of capacity to serve markets in central PA, including a proposed electric generation facility in Snyder County, PA. • Tennessee received authorization to construct and operate its Southwest Louisiana Supply Project which will provide 295 MMcf/d of capacity on its existing 800 Line System in LA to serve the Cameron LNG export facility in Cameron Parish, LA. • Texas Eastern received authorization to construct and operate three projects, the Access South, the Adair Southwest, and the Lebanon Extension Projects, which will provide a total of 622 MMcf/d of capacity on its mainline from a receipt point in Uniontown, PA to Midwest and Southeastern markets. • Tennessee received authorization to construct and operate its Triad Expansion Project which will provide 180 MMcf/d of west-to-east capacity on its existing Line 300 system to serve a proposed electric generating plant in Lackawanna County, PA. -

Understanding Solar Lease Revenues

LIVE WORK PLAY RETIRE TURNING LAND INTO REVENUES: UNDERSTANDING SOLAR LEASE REVENUES Reprint Date: August 25, 2020 Mayor Kiernan McManus Council Member Council Member Council Member Council Member Mayor pro tem Claudia Bridges Tracy Folda Judith A. Hoskins James Howard Adams City Manager Finance Director Alfonso Noyola, ICMA-CM Diane Pelletier, CPA Boulder City Revenue Overview Table of Contents Unlike most other municipalities and counties in Nevada, the revenue stream for Boulder City does not include the lucrative Some History . gaming tax. Prior to the recession of 2007 - 2009, the City’s • 4 • revenue stream did not have a sizable amount of monies from land leases. With the recent focus by California and more Charter/Ordinance Requirements recently at the national level on renewable energy development, • 4 • the City was in a key position to take advantage of its unique Land Lease Process position for solar development by leasing city-owned land for • 6 • energy production. Because of those prudent actions, today the Energy Lease Revenue History solar lease revenues equate to roughly 28% to 34% of the City’s • 7 • overall revenue stream to support vital governmental functions. Energy Lease Revenue Projections • • But is Land Lease Revenue Stable? 9 A common question posed to our City Council surrounds the Energy Lease Revenue Potential stability of land lease revenues. Traditional commercial or • 9 • residential land leases have many risks, as the tenants are Overall Energy Lease Revenue subject to market conditions or changes in employment. And History and Projections with recessions, these types of leases are common casualties • 10 • of a downturn in the economy. -

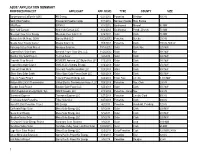

Ab307 Application Summary Proposed Project Applicant App

AB307 APPLICATION SUMMARY PROPOSED PROJECT APPLICANT APP. RCVD. TYPE COUNTY SIZE Bordertown to California 120kV NV Energy 6/27/2012 Powerline Washoe 120 kV North Elko Pipeline Prospector Pipeline Comp. 7/11/2012 Nat Gas Pipeline Elko, Eureka Wild Rose ORNI 47 7/17/2012 Geothermal Mineral 30 MW New York Canyon New York Canyon LLC 8/14/2012 Geothermal Persh., Church. 70 MW Mountain View Solar Energy Mountain View Solar LLC 9/24/2012 Solar Clark 20 MW Mahacek to Mt. Hope 230kV Eureka Moly LLC 10/23/2012 Powerline Eureka 230 kV Moapa Solar Energy Center Moapa Solar LLC 11/5/2012 Powerline Clark 230 kV, 500 kV Pahrump Valley Solar Project Abengoa Solar Inc. 11/14/2012 Solar Clark, Nye 225 MW Copper Rays Solar Farm Element Power Solar Dev. LLC 11/26/2012 Solar Nye 180 MW Boulder City Solar Project Techren Solar 1/2/2013 Solar Clark 300 MW Townsite Solar Project KOWEPO America LLC/Skylar Res. LP 1/15/2013 Solar Clark 180 MW Copper Mountain Solar 3 CMS-3 LLC (Sempra Energy) 1/16/2013 Solar Clark 250 MW Crescent Peak Wind Crescent Peak Renewables LLC 1/23/2013 Wind Clark 500 MW Silver State Solar South Silver State Solar Power South LLC 1/23/2013 Solar Clark 350 MW Toquop Power Project Toquop Power Holdings LLC 1/23/2013 Fossil Fuel Lincoln 1,100 MW Hidden Hills 230kV Transmission Valley Electric Transmission Assoc. LLC 1/28/2013 Powerline Nye, Clark 230 kV Boulder Solar Project Boulder Solar Power LLC 1/25/2013 Solar Clark 350 MW ARES Regulation Energy Mgmt. -

Nevada Energy Markets and Planning (E-MAP) Baseline Assessment

Nevada Energy Markets and Planning (E-MAP) Baseline Assessment Overview: ....................................................................................................................................................... 1 State Energy Landscape (Electric Sector)................................................................................................... 1 A. Electric Utility Providers .................................................................................................................. 2 B. Delivery Systems ................................................................................................................................ 5 C. Generation (in-state, out of state, and imports) ............................................................................ 13 D. Markets ............................................................................................................................................ 25 E. Existing Policies (Laws/Regulations) ............................................................................................. 27 F. Challenges ........................................................................................................................................ 36 G. Trends ............................................................................................................................................... 41 Governor Sandoval’s Energy Policy Goals ............................................................................................... 44 A. Executive Order.............................................................................................................................. -

Sunpower Corporation 2016 Annual Report

SUNPOWER 2016 ANNUAL REPORT ANNUAL 2016 SUNPOWER Corporate Headquarters SunPower Corporation 77 Rio Robles San Jose, California 95134 408.240.5500 sunpower.com Annual Report 2016 ©2017 SunPower Corporation. All Rights Reserved. SUNPOWER, the SUNPOWER logo, and all other trademarks cited herein are the property of SunPower Corporation in the U.S. and other countries as well. Executive Officers Thomas H. Werner President, CEO and Chairman of the Board Changing the Way Our World is Powered Charles D. Boynton With more than 30 years of proven experience, Executive Vice President SunPower is a global leader in solar innovation and and Chief Financial Officer sustainability. Our unique approach emphasizes Ken Mahaffey the seamless integration of advanced SunPower Executive Vice President technologies, delivering The Power of OneTM and General Counsel complete solar solutions and lasting customer Dr. Bill Mulligan value. SunPower delivers outstanding service Executive Vice President and impressive electricity cost savings for Global Operations residential, commercial and Douglas J. Richards power plant customers. Executive Vice President Administration At SunPower, we are passionately committed to changing the way our Board of Directors world is powered. And as Thomas H. Werner we continue shaping the Chairman of the Board future of Smart Energy, we are guided by our legacy Helle Kristoffersen Director of innovation, optimism, perseverance and integrity. Daniel Lauré Director Headquartered in Silicon Valley, Catherine Lesjak SunPower has about 7,000 dedicated, Director customer-focused employees in Africa, Asia, Australia, Europe, North America and South Thomas R. McDaniel Director America. Since 2011, we’ve been majority-owned by Total, the fourth largest* publicly-listed energy Ladislas Paszkiewicz company in the world. -

NV Energy North

Annual Progress Report for Planning Coordination NV Energy 2021 Annual Progress Report February 16, 2021 To: The WECC, Studies Subcommittee In accordance with WECC Progress Report Policies and Procedures, NV Energy is submitting 2021 Annual Progress Report, as presented below. NV Energy North Bordertown to California Sub 120 kV Project This project is comprised of a new 345/120 kV 280 MVA transformer at NVE’s Bordertown Substation and a 120 kV, 11-mile line from Bordertown to California substation. This project is expected to be in service by end of 2025. Multiple studies on the project have been performed by NVE indicating that no significant regional impact from these internal transmission facilities can be expected. West Tracy 345/120 kV Transformer This project is driven by expected load growth in the Reno/Tracy area. The project includes the construction of a new 120 kV switchyard and a new 345/120 kV 280 MVA transformer at the existing West Tracy substation. This project is planned to be in service in 2022. Multiple studies on the project have been performed by NVE indicating that no significant regional impact from this internal transmission facility can be expected. Dodge Flat Solar Energy Center NextEra Dodge Flat Solar PV project: Interconnection of 200 MW Solar PV generation and 50MW battery storage at Olinghouse 345 kV switching station folded into the 345kV Valmy – Tracy kV line #1. The proposed ISD is 12/2021. This was PUCN approved project in 2018. No regional effects or affected systems that are associated with this project have been identified by NVE. -

Operation Construction Development

Major Solar Projects in the United States Operating, Under Construction, or Under Development Updated March 7, 2016 Overview This list is for informational purposes only, reflecting projects and completed milestones in the public domain. The information in this list was gathered from public announcements of solar projects in the form of company press releases, news releases, and, in some cases, conversations with individual developers. It is not a comprehensive list of all major solar projects under development. This list may be missing smaller projects that are not publicly announced. Particularly, many smaller projects located outside of California that are built on a short time-scale may be underrepresented on this list. Also, SEIA does not guarantee that every identified project will be built. Like any other industry, market conditions may impact project economics and timelines. SEIA will remove a project if it is publicly announced that it has been cancelled. SEIA actively promotes public policy that minimizes regulatory uncertainty and encourages the accelerated deployment of utility-scale solar power. This list includes ground-mounted solar power plants 1 MW and larger. Example Projects Nevada Solar One Sierra SunTower Nellis Air Force Base DeSoto Next Generation Solar Energy Center Developer: Acciona Developer: eSolar Developer: MMA Renewable Ventures Developer: Florida Power & Light Co. Electricity Purchaser: NV Energy Electricity Purchaser: Southern Electricity Purchaser: Nellis AFB Electricity Purchaser: Florida Power & California -

February 2018 Monthly Update

Sustainable Technology and Infrastructure Monthly Market Update February 2018 Performance of Key Market Indices 35% 25% 25% 20% 19% 15% 15% 5% (5%) Feb-17 Apr-17 Jun-17 Aug-17 Oct-17 Dec-17 Feb-18 NASDAQ Clean Edge Green Energy Dow Jones Industrial Average NASDAQ Composite S&P 500 Index Performance February Ending Versus First Day of the February YTD CY 2017 52 Wk High 52 Wk Low Dow Jones Industrial Average (4.4%) 1.3% 25.1% (6.0%) 22.7% NASDAQ Composite (1.5%) 5.4% 28.2% (3.1%) 25.5% S&P 500 (3.8%) 1.5% 19.4% (5.5%) 16.5% NASDAQ Clean Edge Green Energy (3.8%) (2.3%) 30.8% (8.0%) 22.0% Notable Recent Transactions & Capital Raises Acquirer Target Transaction Description Corporate Transactions Acquired a leading water management, construction and drilling company for $565m Launched a tender offer to purchase 100% of the outstanding shares for $1.2bn Acquired its renewable O&M and development Corporate M&A and platform Asset Transactions Acquired the yieldco created by rival solar companies FirstSolar and SunPower for $1.7bn Asset Transactions Acquired five solar thermal plants in Spain with a total capacity of 250 MW for $1.4bn Acquired a 206 MW portfolio of renewable energy assets in Japan including solar and wind facilities for $326mm Company Description Aurora Innovation, a Palo Alto-based self-driving vehicle startup, has raised $90mm from Greylock Partners and Index Ventures Capital Raises Ionic Materials, a Massachusetts-based battery-material developer, has raised $65mm Note: M&A transaction values are in enterprise value, unless indicated otherwise. -

REVISED 2020 Power Source Disclosure Filing

DOCKETED Docket Number: 21-PSDP-01 Project Title: Power Source Disclosure Program - 2020 TN #: 238715 Document Title: REVISED 2020 Power Source Disclosure Filing Public Redacted version of the 2020 Power Source Disclosure Description: Annual Filing of Direct Energy Business, LLC Filer: Barbara Farmer Organization: Direct Energy Business, LLC Submitter Role: Applicant Submission Date: 7/7/2021 1:51:24 PM Docketed Date: 7/7/2021 Version: April 2021 2020 POWER SOURCE DISCLOSURE ANNUAL REPORT For the Year Ending December 31, 2020 Retail suppliers are required to use the posted template and are not allowed to make edits to this format. Please complete all requested information. GENERAL INSTRUCTIONS RETAIL SUPPLIER NAME Direct Energy Business, LLC ELECTRICITY PORTFOLIO NAME CONTACT INFORMATION NAME Barbara Farmer TITLE Reulatory Reporting Analyst MAILING ADDRESS 12 Greenway Plaza, Suite 250 CITY, STATE, ZIP Houston, TX 77046 PHONE (281)731-5027 EMAIL [email protected] WEBSITE URL FOR https://business.directenergy.com/privacy-and-legal PCL POSTING Submit the Annual Report and signed Attestation in PDF format with the Excel version of the Annual Report to [email protected]. Remember to complete the Retail Supplier Name, Electricity Portfolio Name, and contact information above, and submit separate reports and attestations for each additional portfolio if multiple were offered in the previous year. NOTE: Information submitted in this report is not automatically held confidential. If your company wishes the information submitted to be considered confidential an authorized representative must submit an application for confidential designation (CEC-13), which can be found on the California Energy Commissions's website at https://www.energy.ca.gov/about/divisions-and-offices/chief-counsels-office.