Boulder Solar Power JUN 3 2016 MBR App.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Concentrated Photovoltaic

Concentrated Photovoltaic (CPV) - Global Installation Size, Cost Analysis, Efficiencies and Competitive Analysis to 2020 Reference Code: GDAE1043MAR Publication Date: April 2011 The US, Germany and Japan are Key Countries for the CPV–The Emerging Solar Technology Industry CPV is an upcoming renewable market which promises to In 2010 Spain dominated the global CPV market with around provide cost-effective power generation at high levels of XX MW of cumulative installed capacity. Spain accounts for efficiency. Presently, the global CPV cumulative installed XX% of the global CPV installed base. Most parts of the country capacity is XX MW. The technology is still developing and so experience high DNI which attracts CPV installers for most CPV projects are in the pilot or prototype stage. Guascor investments in Spain. The US follows Spain with a cumulative Foton’s Navarre power plant and Murcia power plant are the installed capacity of around XX MW; thereby accounting for largest CPV plants with installed capacities of XX MW and XX XX% of the global CPV installed capacity. Greece and Australia MW respectively. Globally, Spain has the largest market for have also attracted CPV system installers due to a high DNI CPV installations. In the US, the major emerging companies are concentration. These countries account for approximately XX% SolFocus, Amonix, EMCORE and Skyline Solar. European and XX% of the global CPV cumulative installed capacity companies such as Concentrix, Abengoa Solar and ArimaEco respectively. have also started making progress in the CPV market. Global Cumulative Installations to Reach XX GW by 2020 Concentrated PV Market, Global, Cumulative Installed Capacity by Country, %, 2010 The CPV market is expected to grow dramatically over the next three years. -

Permitted/Approved Renewable Energy Facilities NORTHERN NEVADA SOUTHERN NEVADA 1150 E

Permitted/Approved Renewable Energy Facilities NORTHERN NEVADA SOUTHERN NEVADA 1150 E. William Street 9075 W. Diablo Dr., Ste. 250 Carson City, NV 89701 Las Vegas, NV 89148 Phone: (775) 684-6101 Phone: (702) 486-7210 Fax: (775) 684-6110 Fax: (702) 486-7206 Consumer Complaints: (775) 684-6100 Consumer Complaints: (702) 486-2600 Pursuant to Nevada Revised Statute 704.865, the PUCN approves Utility Environmental Protection Act (UEPA) permits for all privately- owned conventional (natural gas, oil, coal, nuclear) utility facilities constructed in Nevada. The PUCN also approves the construction of renewable energy projects with an output greater than 70 megawatts, and transmission for renewable energy greater than 200 kilovolts. Additionally, the PUCN approves purchase power agreements (PPAs) between NV Energy and conventional utility and renewable energy facilities. See the table below for a comprehensive list of renewable energy projects in Nevada with a PUCN- approved UEPA permit and/or PPA. Projects Within Nevada that Received PUCN PUCN Approval Project Details Approval MW Exporting/Internal Project UEPA¹ PPA² COD³ Notes⁶ Nameplate⁴ Generation⁵ Biogas 1 Truckee Meadows Water Reclamation Facility X 2005 0.80 Internal 2004 Geothermal 2 Beowawe X 2006 17.70 Internal 05-5010 3 Buffalo/Jersey Valley X N/A 24.00 N/A 06-10021 4 Brady X 1992 24.00 Internal 1990 5 Carson Lake X N/A 31.50 N/A 06-10021 6 Carson Lake Basin Project X N/A 62.00 N/A 07-07013 7 Clayton Valley 1 X N/A 53.50 N/A 10-03022 8 Coyote Canyon X N/A 70.00 Exporting 11-06014 9 -

Fire Fighter Safety and Emergency Response for Solar Power Systems

Fire Fighter Safety and Emergency Response for Solar Power Systems Final Report A DHS/Assistance to Firefighter Grants (AFG) Funded Study Prepared by: Casey C. Grant, P.E. Fire Protection Research Foundation The Fire Protection Research Foundation One Batterymarch Park Quincy, MA, USA 02169-7471 Email: [email protected] http://www.nfpa.org/foundation © Copyright Fire Protection Research Foundation May 2010 Revised: October, 2013 (This page left intentionally blank) FOREWORD Today's emergency responders face unexpected challenges as new uses of alternative energy increase. These renewable power sources save on the use of conventional fuels such as petroleum and other fossil fuels, but they also introduce unfamiliar hazards that require new fire fighting strategies and procedures. Among these alternative energy uses are buildings equipped with solar power systems, which can present a variety of significant hazards should a fire occur. This study focuses on structural fire fighting in buildings and structures involving solar power systems utilizing solar panels that generate thermal and/or electrical energy, with a particular focus on solar photovoltaic panels used for electric power generation. The safety of fire fighters and other emergency first responder personnel depends on understanding and properly handling these hazards through adequate training and preparation. The goal of this project has been to assemble and widely disseminate core principle and best practice information for fire fighters, fire ground incident commanders, and other emergency first responders to assist in their decision making process at emergencies involving solar power systems on buildings. Methods used include collecting information and data from a wide range of credible sources, along with a one-day workshop of applicable subject matter experts that have provided their review and evaluation on the topic. -

Environmental and Economic Benefits of Building Solar in California Quality Careers — Cleaner Lives

Environmental and Economic Benefits of Building Solar in California Quality Careers — Cleaner Lives DONALD VIAL CENTER ON EMPLOYMENT IN THE GREEN ECONOMY Institute for Research on Labor and Employment University of California, Berkeley November 10, 2014 By Peter Philips, Ph.D. Professor of Economics, University of Utah Visiting Scholar, University of California, Berkeley, Institute for Research on Labor and Employment Peter Philips | Donald Vial Center on Employment in the Green Economy | November 2014 1 2 Environmental and Economic Benefits of Building Solar in California: Quality Careers—Cleaner Lives Environmental and Economic Benefits of Building Solar in California Quality Careers — Cleaner Lives DONALD VIAL CENTER ON EMPLOYMENT IN THE GREEN ECONOMY Institute for Research on Labor and Employment University of California, Berkeley November 10, 2014 By Peter Philips, Ph.D. Professor of Economics, University of Utah Visiting Scholar, University of California, Berkeley, Institute for Research on Labor and Employment Peter Philips | Donald Vial Center on Employment in the Green Economy | November 2014 3 About the Author Peter Philips (B.A. Pomona College, M.A., Ph.D. Stanford University) is a Professor of Economics and former Chair of the Economics Department at the University of Utah. Philips is a leading economic expert on the U.S. construction labor market. He has published widely on the topic and has testified as an expert in the U.S. Court of Federal Claims, served as an expert for the U.S. Justice Department in litigation concerning the Davis-Bacon Act (the federal prevailing wage law), and presented testimony to state legislative committees in Ohio, Indiana, Kansas, Oklahoma, New Mexico, Utah, Kentucky, Connecticut, and California regarding the regulations of construction labor markets. -

Energy Infrastructure Update for December 2016

Office of Energy Projects Energy Infrastructure Update For December 2016 Natural Gas Highlights • Natural received authorization to place into service its 2012 Storage Optimization Project which will provide 100 MMcf/d of capacity on its Gulf Coast Mainline from the Loudon Storage Field located near St. Emo in Fayette County, IL to a point of termination at Natural’s Compressor Station No. 113 near Joliet in Will County, IL. • Algonquin received authorization to place into service the Stony Point to Yorktown Take-up and Relay facilities as part of its Algonquin Incremental Market Project. These facilities will provide the remaining 97 MMcf/d of capacity out of the authorized 342 MMcf/d of capacity. • UGI Sunbury received authorization to place into service its Sunbury Pipeline Project which will provide 200 MMcf/d of capacity to serve markets in central PA, including a proposed electric generation facility in Snyder County, PA. • Tennessee received authorization to construct and operate its Southwest Louisiana Supply Project which will provide 295 MMcf/d of capacity on its existing 800 Line System in LA to serve the Cameron LNG export facility in Cameron Parish, LA. • Texas Eastern received authorization to construct and operate three projects, the Access South, the Adair Southwest, and the Lebanon Extension Projects, which will provide a total of 622 MMcf/d of capacity on its mainline from a receipt point in Uniontown, PA to Midwest and Southeastern markets. • Tennessee received authorization to construct and operate its Triad Expansion Project which will provide 180 MMcf/d of west-to-east capacity on its existing Line 300 system to serve a proposed electric generating plant in Lackawanna County, PA. -

Understanding Solar Lease Revenues

LIVE WORK PLAY RETIRE TURNING LAND INTO REVENUES: UNDERSTANDING SOLAR LEASE REVENUES Reprint Date: August 25, 2020 Mayor Kiernan McManus Council Member Council Member Council Member Council Member Mayor pro tem Claudia Bridges Tracy Folda Judith A. Hoskins James Howard Adams City Manager Finance Director Alfonso Noyola, ICMA-CM Diane Pelletier, CPA Boulder City Revenue Overview Table of Contents Unlike most other municipalities and counties in Nevada, the revenue stream for Boulder City does not include the lucrative Some History . gaming tax. Prior to the recession of 2007 - 2009, the City’s • 4 • revenue stream did not have a sizable amount of monies from land leases. With the recent focus by California and more Charter/Ordinance Requirements recently at the national level on renewable energy development, • 4 • the City was in a key position to take advantage of its unique Land Lease Process position for solar development by leasing city-owned land for • 6 • energy production. Because of those prudent actions, today the Energy Lease Revenue History solar lease revenues equate to roughly 28% to 34% of the City’s • 7 • overall revenue stream to support vital governmental functions. Energy Lease Revenue Projections • • But is Land Lease Revenue Stable? 9 A common question posed to our City Council surrounds the Energy Lease Revenue Potential stability of land lease revenues. Traditional commercial or • 9 • residential land leases have many risks, as the tenants are Overall Energy Lease Revenue subject to market conditions or changes in employment. And History and Projections with recessions, these types of leases are common casualties • 10 • of a downturn in the economy. -

2020 ANNUAL REPORT Table of CONTENTS EDITOR’S COMMENTS

2020 ANNUAL REPORT table of CONTENTS EDITOR’S COMMENTS ...................................................................................................... 3 ENERGY SITES OF NORTH DAKOTA ................................................................................... 4 A VIEW FROM ABOVE ....................................................................................................... 4 NORTH DAKOTA GENERATION .......................................................................................... 5 GENERATION ................................................................................................................... 6 Mining ..................................................................................................................... 6 Reclamation ............................................................................................................. 7 Coal-Based ................................................................................................................. 8 Peaking Plants ............................................................................................................. 9 Wind .........................................................................................................................10 Hydroelectric ..............................................................................................................14 Geothermal ................................................................................................................15 Solar .........................................................................................................................16 -

Solar Ready II FINAL REPORT May 2016

Solar Ready II FINAL REPORT May 2016 Solar Ready II MID-AMERICA REGIONAL COUNCIL Solar Ready II | Final Report Solar Ready II participants Northwestern Indiana Regional Planning Commission (NIRPC) Population of engaged jurisdictions: 515,384 Central New York Regional Ohio-Kentucky-Indiana Regional Planning and Development Metropolitan Washington Council of Governments Council of Governments (OKI) Board (CNYRPDB) (MWCOG) Population of engaged Population of engaged Population of engaged jurisdictions: 4.2 million jurisdictions: 411,760 jurisdictions: 1.9 million Delaware Valley Regional Southwest Florida Regional Mid-American Regional Council Planning Council (SWFRPC) Planning Commission (DVRPC) (MARC) Population of engaged Population of engaged jurisdictions: 1.44 million Population of engaged jurisdictions: 2.2 million jurisdictions: 1.6 million Maricopa Association North Central Texas Council of Tampa Bay Regional Planning of Governments (MAG) Governments (NCTCOG) Council (TBRPC) Population of engaged Population of engaged Population of engaged jurisdictions: 3.56 million jurisdictions: 4.64 million jurisdictions: 2.4 million Contents Executive Summary....................3 Detailed Narrative .......................8 Major Findings ............................13 SRII Partner Reports ..................15 Conclusion ..................................28 Appendix.....................................30 page 2 | Solar Ready II | Final Report Executive Summary Solar Ready II by the numbers... 2.5 Years 277 Jurisdictions 408 Events, 34 Webinars 13,444 Participants 626 Solar Contracts 4.91 MW Solar The major objective of the Solar Ready II (SRII) project was to expand the proven collaborative approach of the Solar Ready KC initiative — a DOE Rooftop Solar Challenge project launched in the Kansas City metropolitan region in 2011 — to a national scale, using established relationships among regional planning councils and their member local governments. -

US Solar Industry Year in Review 2009

US Solar Industry Year in Review 2009 Thursday, April 15, 2010 575 7th Street NW Suite 400 Washington DC 20004 | www.seia.org Executive Summary U.S. Cumulative Solar Capacity Growth Despite the Great Recession of 2009, the U.S. solar energy 2,500 25,000 23,835 industry grew— both in new installations and 2,000 20,000 employment. Total U.S. solar electric capacity from 15,870 2,108 photovoltaic (PV) and concentrating solar power (CSP) 1,500 15,000 technologies climbed past 2,000 MW, enough to serve -th MW more than 350,000 homes. Total U.S. solar thermal 1,000 10,000 MW 1 capacity approached 24,000 MWth. Solar industry 494 revenues also surged despite the economy, climbing 500 5,000 36 percent in 2009. - - A doubling in size of the residential PV market and three new CSP plants helped lift the U.S. solar electric market 37 percent in annual installations over 2008 from 351 MW in 2008 to 481 MW in 2009. Solar water heating (SWH) Electricity Capacity (MW) Thermal Capacity (MW-Th) installations managed 10 percent year-over-year growth, while the solar pool heating (SPH) market suffered along Annual U.S. Solar Energy Capacity Growth with the broader construction industry, dropping 10 1,200 1,099 percent. 1,036 1,000 918 894 928 Another sign of continued optimism in solar energy: 865 -th 725 758 742 venture capitalists invested more in solar technologies than 800 542 any other clean technology in 2009. In total, $1.4 billion in 600 481 2 351 venture capital flowed to solar companies in 2009. -

Wild Springs Solar Project Draft Environmental Assessment Pennington County, South Dakota

Wild Springs Solar Project Draft Environmental Assessment Pennington County, South Dakota DOE/EA-2068 April 2021 Table of Contents Introduction and Background ................................................................................... 1 Purpose and Need for WAPA’s Federal Action ...................................................................... 1 Wild Springs Solar’s Purpose and Need .................................................................................. 1 Proposed Action and Alternatives ............................................................................ 2 No Action Alternative .............................................................................................................. 2 Alternatives Considered but Eliminated from Further Study .................................................. 2 Proposed Action ....................................................................................................................... 2 Solar Panels and Racking ................................................................................................3 Electrical Collection System ...........................................................................................4 Inverter/Transformer Skids .............................................................................................4 Access Roads ..................................................................................................................5 Fencing & Cameras .........................................................................................................5 -

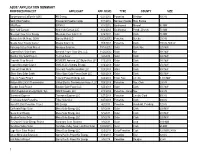

Ab307 Application Summary Proposed Project Applicant App

AB307 APPLICATION SUMMARY PROPOSED PROJECT APPLICANT APP. RCVD. TYPE COUNTY SIZE Bordertown to California 120kV NV Energy 6/27/2012 Powerline Washoe 120 kV North Elko Pipeline Prospector Pipeline Comp. 7/11/2012 Nat Gas Pipeline Elko, Eureka Wild Rose ORNI 47 7/17/2012 Geothermal Mineral 30 MW New York Canyon New York Canyon LLC 8/14/2012 Geothermal Persh., Church. 70 MW Mountain View Solar Energy Mountain View Solar LLC 9/24/2012 Solar Clark 20 MW Mahacek to Mt. Hope 230kV Eureka Moly LLC 10/23/2012 Powerline Eureka 230 kV Moapa Solar Energy Center Moapa Solar LLC 11/5/2012 Powerline Clark 230 kV, 500 kV Pahrump Valley Solar Project Abengoa Solar Inc. 11/14/2012 Solar Clark, Nye 225 MW Copper Rays Solar Farm Element Power Solar Dev. LLC 11/26/2012 Solar Nye 180 MW Boulder City Solar Project Techren Solar 1/2/2013 Solar Clark 300 MW Townsite Solar Project KOWEPO America LLC/Skylar Res. LP 1/15/2013 Solar Clark 180 MW Copper Mountain Solar 3 CMS-3 LLC (Sempra Energy) 1/16/2013 Solar Clark 250 MW Crescent Peak Wind Crescent Peak Renewables LLC 1/23/2013 Wind Clark 500 MW Silver State Solar South Silver State Solar Power South LLC 1/23/2013 Solar Clark 350 MW Toquop Power Project Toquop Power Holdings LLC 1/23/2013 Fossil Fuel Lincoln 1,100 MW Hidden Hills 230kV Transmission Valley Electric Transmission Assoc. LLC 1/28/2013 Powerline Nye, Clark 230 kV Boulder Solar Project Boulder Solar Power LLC 1/25/2013 Solar Clark 350 MW ARES Regulation Energy Mgmt. -

Nevada Energy Markets and Planning (E-MAP) Baseline Assessment

Nevada Energy Markets and Planning (E-MAP) Baseline Assessment Overview: ....................................................................................................................................................... 1 State Energy Landscape (Electric Sector)................................................................................................... 1 A. Electric Utility Providers .................................................................................................................. 2 B. Delivery Systems ................................................................................................................................ 5 C. Generation (in-state, out of state, and imports) ............................................................................ 13 D. Markets ............................................................................................................................................ 25 E. Existing Policies (Laws/Regulations) ............................................................................................. 27 F. Challenges ........................................................................................................................................ 36 G. Trends ............................................................................................................................................... 41 Governor Sandoval’s Energy Policy Goals ............................................................................................... 44 A. Executive Order..............................................................................................................................