216002 Temple Bar Cover(E)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Click Here to Download the 2013 Winners Book

The prestigious Construction Marketing Awards are highly regarded as a measure of excellence in construction marketing and business development. Now in its 13th year the awards, organised by The Chartered Institute of Marketing Construction Industry Group (CIMCIG), are an invaluable opportunity for recognition; a way to showcase creativity, innovation and effectiveness in your company’s marketing and/or business development strategy. The CMAs raise the profile of marketing professionals and their achievements. Being shortlisted is a statement of your organisations achievement. Winner or Highly Commended is evidence of your achievement via the display of an award logo and award trophy. The winners are outlined in the following pages and our congratulations go to the teams involved. “Last year’s Construction Marketing Awards were possibly the best that we had seen in their 12 year history and set a benchmark for this year that would be very hard to match, let along beat. It is with this in mind that I am proud to say that the, number, range and quality of entries in the 2013 Construction Marketing Awards achieved that and made the judging process particularly difficult, whilst enjoyable. Our winners have demonstrated that clear objective setting, diligent planning and relevant execution delivers results. So yet again we have been presented with some excellent work and some fantastic case studies where companies within our industry are using the profession of marketing to lead the business to more profitable times. In so doing, the Construction Marketing Awards 2013 have raised the bar even higher for 2014. CIMCIG is proud to run these Awards and delighted to present this summary of the winning campaigns. -

2019 Annual Report Annual 2019

a force for good. 2019 ANNUAL REPORT ANNUAL 2019 1, cours Ferdinand de Lesseps 92851 Rueil Malmaison Cedex – France Tel.: +33 1 47 16 35 00 Fax: +33 1 47 51 91 02 www.vinci.com VINCI.Group 2019 ANNUAL REPORT VINCI @VINCI CONTENTS 1 P r o l e 2 Album 10 Interview with the Chairman and CEO 12 Corporate governance 14 Direction and strategy 18 Stock market and shareholder base 22 Sustainable development 32 CONCESSIONS 34 VINCI Autoroutes 48 VINCI Airports 62 Other concessions 64 – VINCI Highways 68 – VINCI Railways 70 – VINCI Stadium 72 CONTRACTING 74 VINCI Energies 88 Eurovia 102 VINCI Construction 118 VINCI Immobilier 121 GENERAL & FINANCIAL ELEMENTS 122 Report of the Board of Directors 270 Report of the Lead Director and the Vice-Chairman of the Board of Directors 272 Consolidated nancial statements This universal registration document was filed on 2 March 2020 with the Autorité des Marchés Financiers (AMF, the French securities regulator), as competent authority 349 Parent company nancial statements under Regulation (EU) 2017/1129, without prior approval pursuant to Article 9 of the 367 Special report of the Statutory Auditors on said regulation. The universal registration document may be used for the purposes of an offer to the regulated agreements public of securities or the admission of securities to trading on a regulated market if accompanied by a prospectus or securities note as well as a summary of all 368 Persons responsible for the universal registration document amendments, if any, made to the universal registration document. The set of documents thus formed is approved by the AMF in accordance with Regulation (EU) 2017/1129. -

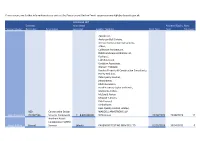

Suppliers £500 2020-21

Mansfield District Council Supplier Spend +/-£500 2020/21 Body Name Body Supplier Ref Supplier Name Transaction ID Net AmountGL Code Payment Date Expenditure Category Service Category Revenue/Capital Mansfield District Council 37UF 0000200 PPG Architectural Coatings EMEA 0010144585 2123.102164000186 16/04/2020Redecoration Grants Repairs/Voids Revenue Mansfield District Council 37UF 0000200 PPG Architectural Coatings EMEA 0010146425 1581.912165000320 25/06/2020Materials Stores VR Depot Stock Revenue Mansfield District Council 37UF 0000200 PPG Architectural Coatings EMEA 0010146599 511.092165000320 09/07/2020Materials Stores VR Depot Stock Revenue Mansfield District Council 37UF 0000200 PPG Architectural Coatings EMEA 0010147698 582.782165000320 13/08/2020Materials Stores VR Depot Stock Revenue Mansfield District Council 37UF 0000200 PPG Architectural Coatings EMEA 0010148816 1089.082165000320 24/09/2020Materials Stores VR Depot Stock Revenue Mansfield District Council 37UF 0000200 PPG Architectural Coatings EMEA 0010150236 1,250.622165000320 29/10/2020Materials Stores VR Depot Stock Revenue Mansfield District Council 37UF 0000200 PPG Architectural Coatings EMEA 0010151859 993.182165000320 10/12/2020Materials Stores VR Depot Stock Revenue Mansfield District Council 37UF 0000200 PPG Architectural Coatings EMEA 0010152795 594.452165000320 14/01/2021Materials Stores VR Depot Stock Revenue Mansfield District Council 37UF 0000200 PPG Architectural Coatings EMEA 0010153814 662.272165000320 04/02/2021Materials Stores VR Depot Stock Revenue Mansfield -

Highland Council Current Contracts Register, PDF 1004.23 KB

If you require any further information please contact the Procurement Unit on Email: [email protected] Estimated NET Contract value (local Assumed Expiry Max. Contract Owner Reference Description currency) Supplier Name(s) Start Date Date Extension Aecom Ltd, Anderson Bell Christie, Armour Construction Consultants, Atkins, Collective Architecture, DWA Landscape Architects Ltd, Fairhurst, Faithful+Gould, Goodson Associates, Graham + Sibbald, Hardies Property & Construction Consultants, Harley Haddow, IMG Quality Control, jmarchitects, Kiloh Associates, mackie ramsay taylor architects, MacLeod+Jordan, McCue & Porter, McLeod + Aitken, Pick Everard, rankinfraser, Ross Quality Control Limited, 000- Construction Design WARDELL ARMSTRONG LLP, Aberdeenshire FNRW2596 Services Framework £ 8,000,000.00 WYG Group 24/08/2020 23/08/2023 12 Northern Roads Collaboration SCRIM Argyll & Bute (blank) Surveys (blank) PAVEMENT TESTING SERVICES LTD 01/05/2019 30/04/2022 0 New Primary School, Highland Ness Castle, Council CAL18042 Inverness £ 12,502,424.00 Kier Regional Ltd 13/04/2021 13/09/2022 0 Raigmore Primary CAL18047 School - ELC Works £ 871,521.00 MORRISON CONSTRUCTION LTD 24/03/2021 24/10/2021 0 Duncan Forbes Primary School, Culloden - Nursery CAL18071 Expansion £ 1,400,775.00 Morgan Sindall 16/11/2021 16/05/2022 0 Hilton Primary School, Inverness - CAL18073 ELC Expansion £ 2,681,648.00 MORGAN SINDALL PLC 07/06/2021 07/06/2022 0 Ben Wyvis Primary School - Nursery Extension and Internal Alteration CAL19012 Works £ 2,684,396.00 Morrison -

Kkaleidoscope

K KALEIDOSCOPE 2017 EDItIOn ADDED vALuE gOSSIP! COmPAny rOunD uPS AnD mOrE! K Brian Manning Chief Executive CONTENTS company Round ups WELCOmE tO 4-16 carbon coach KALEIDOSCOPE 17 awards a difficult 2016 but looking eu funding and this needs to be resolved. 18-19 forward to 2017 meanwhile in our developments side we are still transiting between our dunelm 2016 did not work out as we forecast or Homes operation to esh Homes and this Project gateway planned. it has proved to be a very difficult will continue in 2017. We should not forget year and that is mainly down to events our specialist businesses who are strong 20-21 outside the north east region. performers in 2016 and making significant contributions. our main problems in 2016 was in the esh safe awards yorkshire region hopefully these are now the other main area of focus is our “Project behind us and we will be focusing on 2017 gateway” which has started well but is now 22-23 with a new structure to our yorkshire moving into a critical period of installation operations now taking shape. in 2017 which will be so important to the group. our new it platform (Business esh added value the north east has again produced a transformation) can massively help us avoid strong performance and that will allow us 24-29 some of the problems we have faced in to present a respectable year end result managing our business during its expansion albeit disappointing. over the last 5-10 years. gossip the main point is that we are a very strong i just want thank everyone for their hard business that is able to manage the types of 30-31 work in 2016 and stress that the directors problems that come along in the construction and shareholders see a positive outlook industry, we aim to be open and honest, learn going forward. -

Building Reinstatement

MARKETING REVIEW In Respect Of Bridge Road Bleadon Weston-super-Mare BS24 0AT Prepared by Tim Beare Lambert Smith Hampton Whiteladies House 51/55 Whiteladies Road Clifton Bristol, BS8 2LY Tel: 0117 926 6666 Fax: 0117 925 0527 Date: January 2013 CONTENTS INTRODUCTION 1. EXECUTIVE SUMMARY 2 THE PROPERTY 2.1. Location 2.2. Description 2.3. Accommodation 2.4 Business Rates 2.5 Tenure 2.6 Planning 2.7 Utilities 3. MARKET COMMENTARY 3.1. Introduction 3.2 General 3.3 Local Market 3.4 Summary 4. MARKETING STRATEGY 4.1. Brochure & mailing 4.2. Adverting 4.3. Websites 4.4. Quoting terms 4.5. Results 5. SUMMARY OF FINDINGS 6. PERSONNEL 6.1 Lambert Smith Hampton 6.2 Adair Paxton Appendices Appendix 1 Property Brochure Appendix 2 Mailing List – Large occupiers Appendix 3 Mailing List – open storage occupiers Appendix 4 Screen shot – Invest West website Appendix 5 Advert for Estates Gazette Appendix 6 Screenshot – LSH, EGi & Focus Property websites Appendix 7 Schedule of Enquiries Appendix 8 Letter from Adair Paxton 2 Bleadon Works, Bridge Road, Bleadon January 2013 INTRODUCTION Lambert Smith Hampton was requested to market the Marshalls site in the village of Bleadon and, following instructions, commenced the marketing campaign in November 2011. The intention at the outset was to seek a new owner-occupier for the site and it was on this basis that the site was initially marketed. This report on set outs the process of marketing that has been undertaken in the twelve months that the site was on the market and provides findings for the exercise. -

EBU Master Point Ranking Lists 2009 Top Scorers for 2009 2

EBU Master Point Ranking Lists 2009 Top Scorers for 2009 2 Pos Name County Local Green Total Rank 1 Mr W J Holland Manchester 9201 21666 30867 Premier Grand Master 2 Mr RR Davis Bedfordshire 15633 14017 29650 Grand Master 3 Mr FR Springett North East 21520 6245 27765 Life Master 4 Mr CF Owen North East 9098 16668 25766 Premier Grand Master 5 Mrs J Springett North East 18470 6045 24515 5 Star Premier Regional Master 6 Miss M Brunner Manchester 6739 17666 24405 Premier Grand Master 7 Mr E Scerri Berks. & Bucks. 9546 10617 23158 Grand Master 8 Mr I H Pagan Middlesex 2481 18438 22740 Premier Grand Master 9 Mr J Dhondy Middlesex 7569 14559 22128 Premier Grand Master 10 Mrs J Davies Herts 11691 9003 20694 Premier Life Master 11 Mrs R Goldenfield Manchester 9678 10845 20523 Premier Grand Master 12 Mr J R Willans Kent 8337 11704 20041 Grand Master 13 Mr D Bakhshi London 1556 18067 19623 Grand Master 14 Mr TR Rees Berks. & Bucks. 3124 16097 19221 Premier Grand Master 15 Mr P N Rosen Middlesex 6108 12775 18883 Premier Grand Master 16 Mr B N Goldenfield Manchester 8095 10520 18615 Premier Grand Master 17 Mr R Palmer Berks. & Bucks. 5383 13175 18558 Grand Master 18 Mr C N Jagger Cambs & Hunts 2127 16063 18190 Premier Grand Master 19 Mr D Oram Herts 7318 10720 18038 Premier Grand Master 20 Mr P D Hackett Staffs & Shropshire 3535 13850 17385 Premier Grand Master 21 Mr J A Sansom Worcester 9407 7860 17267 Grand Master 22 Mr D A Gold London 2276 14863 17139 Life Master 23 Mrs L Solomon Devon 7591 9421 17012 Grand Master 24 Mrs C Oram Herts 7223 9695 -

Setting a New Standard

CHECKLIST: ENVIRONMENTALLY AND SOCIALLY RESPONSIBLE TIMBER USE You have decided to use FSC certified OSB or plywood. Have you taken all the necessary steps to ensure the process is watertight? This list will help you check each stage of the process. s Specify environmentally and socially responsible materials. Write a tight specification making it clear to your contractors and sub-contractors that you want FSC certified OSB and plywood. s Explain the requirements of the specification and make sure the contractor understands its importance. Do this early enough to allow the contractor enough time to research, source and buy FSC certified materials. s Make sure contractor understands what paperwork they will need to provide at the end of the project. Ask for delivery notes and invoices stating that materials are FSC certified and carry the supplier’s Alternatives to unsustainable chain of custody number. plywood in the UK s Monitor compliance with the specification. construction industry This means checking all delivery notes and invoices of materials arriving on site. s Keep the paper work. This allows you to prove that the specification was met. SETTING A NEW STANDARD: s Consider getting your own FSC certification or using FSC project certification, allowing you to Greenpeace is dedicated to protecting the world’s remaining ancient forests and the plants, advertise your use of FSC materials.. animals and peoples that depend on them. We promote real solutions such as products certified by the Forest Stewardship Council (FSC), which ensures that timber comes from environmentally responsible and socially just forest management. We investigate and expose the trade in illegal and destructively logged timber. -

REPORT to CABINET 13Th December 2016

REPORT TO CABINET 13th December 2016 TITLE OF REPORT: Tenders for the Supply of Goods and Services REPORT OF: Mike Barker, Strategic Director Corporate Services and Governance Purpose of the Report 1. The purpose of this report is to ask Cabinet to consider the tenders received for; i) the Supply of a Library Management System. ii) the Supply of Construction & Building Materials. iii) the Supply of Construction Small Plant & Tools. 2. The background to these contracts is contained in the attached appendices. Proposal 3. Cabinet is asked to agree and note the recommendations below. Recommendations 4. It is recommended Cabinet agree: i) the tender from Capita Business Services Ltd, Birmingham be accepted for the contract for the Supply of a Library Management System on the terms set out in appendix 1 to the report. ii) the tenders from (Lot 1 Trade Kits): - R. Dinning, Wolseley, Jewson, CMT Group, Grafton Merchanting GB Limited, (Lot 2 General Kits):- Arco Limited, Arnold Laver, Brammer, Bunzl Catering Supplies, CMT Group, Crossling Ltd, Crown Paints Ltd, Edmundson Electrical Limited, Edmundson Electrical Limited, Eurocell Profiles, Eyre & Elliston Ltd, Flame Heating Spares, Glenwood Paint Supplies Ltd, Grafton Merchanting GB Ltd, J & P Hardware Ltd, J T Dove, James A Jobling & Co.t/a Jobling Purser, Jewson Limited, Marshalls Mono Ltd, Newey & Eyre, Pilkington Building Products UK, PPG Architectural Coatings, R. Dinning, Snapfast, Sovereign Chemicals Limited, Specialist Building Products Limited t/a Swish Building Products, Stax Trade Centres Ltd, The Beck Company Limited, Travis Perkins, Wolseley UK Ltd, 1 of 9 be accepted for the contract for the Supply of Construction & Building Materials on the terms set out in appendix 2 to the report. -

Company / Organisation Who Qualifies

Company / Organisation Who qualifies Adecco Group Employees Adient Seating Ltd Employees Airbus Employees Aldi Employees Allianz Group Employees Alstom Employees AM Trust UK (previously Car Care Plan Ltd) Employees Anglian Water Services Ltd Employees ASCO Members Asda Stores Ltd Employees Association of Accounting Technicians (AAT) Members Avon Employees B&Q Employees Babcock International Employees BAE Employess Balfour Beatty PLC Employees BCA Employees BI Worldwide Employees Blue Light Card (BLC) Members Bombardier Inc. Employees Bosch Group Employees Brake Bros Ltd Employees British Airways (BA) Employees and Pensioners British Association of Dental Nurses (BADN) Members British Heart Foundation (BHF) Employees British Medical Association (BMA) Employees BT Employees and Pensioners CAD CAM Automotive Employees Calsonic Kansei UK Employees CAMRA Members Capita Employees Centrica Employees Charlton Athletic Employees and Members Chartered Institute of Public Finance and Members Accountancy (CIPFA) Chartered Insurance Institute (CII) Members Chartered Society of Physiotherapy (CSP) Members Civica Employees Civil Service Employees Coca Cola Enterprises Ltd Employees Communication Workers Union (CWU) Members Compass Group UK & Ireland Employees Connells Residential Employees Co-Operative Group Limited Employees Costco Members Countrywide Employees Crown Paints Employees Defence Discount Service (DDS) Members DHL International Employees Driving Instructors Association (DIA) Members Dunlop Systems and Components Ltd Employees Easyjet Employees -

Material Gains in Sustainability the Business Case for the Construction Products Sector

Material gains in sustainability The business case for the construction products sector This is a joint report with Acknowldgements PwC and the Construction Products Association would like to express their thanks to all those who completed the survey and particularly the organisations prepared to contribute further views during follow-up discussions. PwC would also like to recognise the contribution made by Anne-Audley Issler, Summer Intern. 2 PwC Contents Foreword 2 Executive summary 3 Key messages 5 1 Sustainability as a strategic asset 6 2 New regulation and organisational change must stick 8 3 Beyond carbon reductions – factors to consider 14 4 Sustainability has strong growth prospects 18 5 Quantifying impacts and commercial implications 22 6 Investment is needed but there are barriers to 26 overcome: inertia, cost and initiative overload Conclusions 32 Recommendations 33 Contacts 36 Material gains in sustainability 1 Foreword Much of the industry sees sustainable construction as an opportunity, according to the evidence from this survey which was completed at the depths of the recent downturn. We identified many examples of innovation and initiative and a clear readiness on the part of the sector’s leading businesses to research, develop and bring to market the products that will contribute to a low carbon outcome. We also saw uncertainty; over how best to measure and communicate sustainability; and the willingness of end-users to invest and re-train to the extent necessary to bring about a significant change in the application of sustainable building materials. The construction sector needs to work more closely with the Government in order to gain their guidance to deliver the improvements in energy, resource and carbon efficiency. -

Building-Performance---Futurebuild

ecobuild The future of the built environment is here 06-08 March 2018 / ExCeL, London Building Performance ecobuild The future of the built environment is here Presenting the futurebuild districts… Timber Concrete Offsite Energy & HVAC Building Performance will look far beyond the construction and design of buildings and Infrastructure Green & Blue will consider the wellbeing 25,400 Infrastructure agenda across new build, overall visitors refurb and retrofit projects. Building Performance, part of the futurebuild Building District Energy districts, will present the latest construction 9,000+ Performance materials, products and technologies, building performance showcasing leading brands responsible for the “envelope of the building” from windows, professionals* doors, roofing, cladding, insulation, surfaces, BIM and more. It will also include the UK’s *From Architects, Local largest gathering of international pavilions. Authorities, Installers, BIM Managers, Quantity and Building Surveyors, Designers, Research & Development, Engineers and Planners and Developers Building Performance Our visitors want to source the latest building performance Visitors from products and are interested in: 2017 included: 38%38% Building MaterialsMaterials A2Dominion Interserve 29%29% Building SySystemsstems Adam Architecture Jewson 25%25% Finishing PrProductsoducts & MaterialsMaterials ADP Keepmoat ARUP Kier 24%24% IntInteriorerior DesignDesign Atkins Laing O’Rourke 21%21% BIM B&Q London Borough Balfour Beatty of Camden, Ealing, 16%16% Fittings Hillingdon,