IVP WEB Printsummary 03012

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

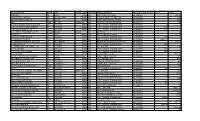

NASDAQ Stock Market

Nasdaq Stock Market Friday, December 28, 2018 Name Symbol Close 1st Constitution Bancorp FCCY 19.75 1st Source SRCE 40.25 2U TWOU 48.31 21st Century Fox Cl A FOXA 47.97 21st Century Fox Cl B FOX 47.62 21Vianet Group ADR VNET 8.63 51job ADR JOBS 61.7 111 ADR YI 6.05 360 Finance ADR QFIN 15.74 1347 Property Insurance Holdings PIH 4.05 1-800-FLOWERS.COM Cl A FLWS 11.92 AAON AAON 34.85 Abiomed ABMD 318.17 Acacia Communications ACIA 37.69 Acacia Research - Acacia ACTG 3 Technologies Acadia Healthcare ACHC 25.56 ACADIA Pharmaceuticals ACAD 15.65 Acceleron Pharma XLRN 44.13 Access National ANCX 21.31 Accuray ARAY 3.45 AcelRx Pharmaceuticals ACRX 2.34 Aceto ACET 0.82 Achaogen AKAO 1.31 Achillion Pharmaceuticals ACHN 1.48 AC Immune ACIU 9.78 ACI Worldwide ACIW 27.25 Aclaris Therapeutics ACRS 7.31 ACM Research Cl A ACMR 10.47 Acorda Therapeutics ACOR 14.98 Activision Blizzard ATVI 46.8 Adamas Pharmaceuticals ADMS 8.45 Adaptimmune Therapeutics ADR ADAP 5.15 Addus HomeCare ADUS 67.27 ADDvantage Technologies Group AEY 1.43 Adobe ADBE 223.13 Adtran ADTN 10.82 Aduro Biotech ADRO 2.65 Advanced Emissions Solutions ADES 10.07 Advanced Energy Industries AEIS 42.71 Advanced Micro Devices AMD 17.82 Advaxis ADXS 0.19 Adverum Biotechnologies ADVM 3.2 Aegion AEGN 16.24 Aeglea BioTherapeutics AGLE 7.67 Aemetis AMTX 0.57 Aerie Pharmaceuticals AERI 35.52 AeroVironment AVAV 67.57 Aevi Genomic Medicine GNMX 0.67 Affimed AFMD 3.11 Agile Therapeutics AGRX 0.61 Agilysys AGYS 14.59 Agios Pharmaceuticals AGIO 45.3 AGNC Investment AGNC 17.73 AgroFresh Solutions AGFS 3.85 -

Notice of 2013 Annual Meeting of Shareholders and Proxy Statement

Notice of 2013 Annual Meeting of Shareholders and Proxy Statement THE TIMKEN COMPANY Canton, Ohio U.S.A. 1300100_1_64sc.pdf 2 3/14/13 5:01 PM TABLE OF CONTENTS PAGE Chairman’s Letter ……………………………………………………………………………….… 2 Notice of Annual Meeting ………………………………………………………………………... 3 Proxy Statement ………………………………………………………………………………….. 5 Election of Directors ………………………………………………………………………… 5 Election of Directors (Item No. 1) ………………………………………..……………. 5 Nominees ………………………………………………………………………………… 6 Director Compensation ………………………………….………………………………….. 11 2012 Director Compensation Table………………………………………………………… 12 Board Leadership Structure ………………………………………………………………... 13 Risk Oversight ……………………………………………………………………………….. 13 Audit Committee ……………………………………………………………………………... 14 Audit Committee Report ………………………………………………………………..…… 14 Compensation Committee ………………………………………………………………….. 14 Compensation Committee Report ……………………………………………………….… 15 Nominating and Corporate Governance Committee ………………………………….…. 16 Beneficial Ownership of Common Stock ………………………………………………….. 17 Compensation Discussion and Analysis ……………………………………….……….… 20 Executive Compensation …………………………………………………………….…..…. 32 Ratification of Appointment of Independent Auditors (Item No. 2) ……………………... 44 Auditors ……………………………………………………………………………………….. 45 Shareholder Advisory Vote on Named Executive Officer Compensation (Item No. 3).. 45 Amendments to the Company’s Amended Articles of Incorporation to Reduce Certain Shareholder Voting Requirements (Item No. 4)……………………………….… 46 Amendments to the Company’s Amended -

The Information Age Was Born In

INDUSTRY CLUSTERS NUMBERNumber OF HIGH of TECHAdvanced INDUSTRY Services BUSINESSES Businesses HIGH TECH THE INFORMATION AGE WAS BORN IN DFW 75 In 1958, Dallas led the nation into the new 1 17 88 35E 1 60 760 121 era of information and communication TOP SEMICONDUCTOR & SEMICONDUCTOR TOP COMPUTER SYSTEMS & SOFTWARE MACHINERY MANUFACTURERS WITH COMPANIES WITH OPERATIONS IN DFW technologies with Nobel Laureate Jack 35W OPERATIONS IN DFW Kilby’s invention of the microchip at Texas Accenture [Irving] Creation Technologies [Plano] Instruments. This invention allowed Capgemini [Dallas] Maxim Integrated Products [Dallas] Cognizant [Irving] the development of laptop computers, Texas Instruments [Dallas, Plano, Richardson] Computer Sciences Corp [Irving] smartphones, and space travel. | Qorvo [Richardson] HP Enterprise Services [Plano] 190 The DFW technology industry IBM [Dallas] HIGH TECHHIGH encompasses four general categories: Infosys [Plano] manufacturing, information services, TOP FABLESS SEMICONDUCTOR COMPANIES WITH OPERATIONS IN DFW L-3 Communications [Rockwall] professional technical services, and bio-life Diodes Inc. [Plano] Microsoft [Irving] sciences. The region’s activity in key emerging Micron Technology [Allen] NTT Data [Plano] technologies such as next generation wireless Qorvo [Richardson] Oracle [Dallas] 30 and broadband communications, artifi cial STMicroelectronics [Coppell] Raytheon [Garland, McKinney] 635 intelligence, and virtual reality as well as RealPage [Richardson] 820 183 medical, bio, and life sciences, is gaining SAP AG [Irving] TOP TELECOM COMPANIES Siemens PLM Software [Plano] increasing national recognition. WITH OPERATIONS IN DFW 360 AT&T [Dallas] TEKsystems [Irving] 30 BT Global Services [Dallas] Trend Micro NA [Irving] Xerox [Dallas] 12 TH Cisco Systems [Richardson] 20 THE 7 LARGEST CONCENTRATION OF Ericsson [Plano] HIGHTECH JOBS IN THE U.S. -

Docket No. 16-0066 Dex Media, Inc. Exhibit 1

Docket No. 16-0066 Dex Media, Inc. Exhibit 1 CORRECTED TESTIMONY OF JERONIMOS “MIKE” KONIDARIS DEX MEDIA, INC. IN THE MATTER OF DEX MEDIA, INC., as agent for ILLINOIS BELL TELEPHONE CO., and as agent for FRONTIER NORTH, INC., FRONTIER COMMUNICATIONS OF THE CAROLINAS, LLC, CITIZENS TELECOMMUNICATIONS COMPANY OF ILLINOIS D/B/A FRONTIER CITIZENS COMMUNICATIONS OF ILLINOIS, FRONTIER COMMUNICATIONS – MIDLAND, INC., FRONTIER COMMUNICATIONS – PRAIRIE, INC., FRONTIER COMMUNICATIONS – SCHUYLER, INC., FRONTIER COMMUNICATIONS OF DEPUE, INC., FRONTIER COMMUNICATIONS OF ILLINOIS, INC., FRONTIER COMMUNICATIONS OF LAKESIDE, INC., FRONTIER COMMUNICATIONS OF MT. PULASKI, INC., and FRONTIER COMMUNICATIONS OF ORION, INC. PETITION FOR WAIVERS OF SECTIONS 732.50(a) and (c), 735.180(a)(1), 735.180(d), and 735.180(1), and Section 756.110 of Title 83 of the Administrative Code. Docket No. 16-0066 February 8, 2016 Docket No. 16-0066 Dex Media, Inc. Exhibit 1 1 Witness Information & Introduction 2 Q: Please state your full name and business address. 3 A: Jeronimos (“Mike”) Konidaris 4 2200 West Airfield Drive 5 P.O. Box 619810 6 DFW Airport, TX 75261 7 Q: By whom are you employed and in what capacity? 8 A: I am the Director of Telco Relations, Listing Acquisition and Print Services of Dex 9 Media, Inc., the successor to Dex One Corporation. 10 Q: Describe Dex Media’s involvement in the business of publishing telephone 11 directories. 12 A: Dex Media and its predecessors and affiliates have been in the business of publishing 13 telephone directories since 1886. Dex Media and affiliate companies are successors to the 14 publishing arms of a number of local exchange carriers (“LECs”), including AT&T 15 Illinois and Frontier in Illinois. -

Altegris /AACA Opportunistic Real Estate Fund

Altegris /AACA Opportunistic Real Estate Fund PORTFOLIO OF INVESTMENTS (Unaudited) September 30, 2020 Shares Value COMMON STOCK - 36.1 % ASSET MANAGEMENT - 0.4 % 32,801 Brookfield Infrastructure Corp. $ 1,816,854 ELECTRIC UTILITIES - 0.9 % 77,975 Brookfield Renewable Corporation 4,569,320 LEISURE TIME - 12.5 % 484,238 Caesars Entertainment, Inc. * 27,146,382 3,344,000 Drive Shack, Inc. * 3,745,280 98,756 Las Vegas Sands Corp. 4,607,955 1,054,511 MGM Resorts International 22,935,614 60,393 Wynn Resorts Ltd. 4,336,821 62,772,052 REAL ESTATE - 3.0 % 890,864 IQHQ *^(a)(b) 14,887,852 TECHNOLOGY SERVICES - 5.1 % 30,069 CoStar Group, Inc. * 25,513,847 TELECOMMUNICATIONS - 14.2 % 449,324 GDS Holdings Ltd. - ADR *+ 36,768,183 2,215,783 Switch, Inc. 34,588,373 71,356,556 TOTAL COMMON STOCK (Cost - $144,134,832) 180,916,481 PARTNERSHIP SHARES -13.9 % ELECTRIC UTILITIES - 5.7 % 250,509 Brookfield Infrastructure Partners LP 11,929,239 311,899 Brookfield Renewable Partners LP 16,390,292 28,319,531 SPECIALTY FINANCE - 8.2 % 2,399,241 Fortress Transportation & Infrastructure Investors LLC 41,098,998 TOTAL PARTNERSHIP SHARES (Cost - $47,859,371) 69,418,529 REITS - 62.6 % REITS - 62.1 % 181,610 Alexandria Real Estate Equities, Inc. + 29,057,600 144,893 American Tower Corp. + 35,024,985 240,140 Americold Realty Trust 8,585,005 217,330 Crown Castle International Corp. + 36,185,445 232,737 CyrusOne, Inc. 16,298,572 25,447 Equinix, Inc. 19,343,028 234,215 Equity Lifestyle Properties, Inc. -

Top Investors Dallas Regional Chamber

DALLAS REGIONAL CHAMBER | TOP INVESTORS DALLAS REGIONAL CHAMBER REGIONAL DALLAS JBJ Management Norton Rose Fulbright Silicon Valley Bank The Fairmont Hotel Top Investors JE Dunn Construction NTT DATA Inc. Simmons Bank The Kroger Co. Jim Ross Law Group PC Omni Dallas Hotel Slalom The University of The Dallas Regional Chamber (DRC) recognizes the following companies and organizations for their membership investment at JLL Omniplan, Inc. Smoothie King Texas at Arlington one of our top levels. Companies in bold print are represented on the DRC Board of Directors. For more information about the Jones Day Omnitracs, LLC SMU - Southern Methodist Thompson & Knight LLP University benefits of membership at these levels call (214) 746-6600. JPMorgan Chase & Co. Oncor Thompson Coburn Southern Dock Products Katten Muchin Rosenman LLP On-Target Supplies Thomson Reuters Southern Glazer’s Wine and KDC Real Estate Development & & Logistics Ltd TIAA Spirits 1820 Productions Bell Nunnally Crowe LLP Google Investments Options Clearing Corporation T-Mobile | Southwest Airlines 4Front Engineered Solutions BGSF CSRS goPuff TOP INVESTORS Ketchum Public Relations Origin Bank Tom Thumb - Albertsons 7-Eleven, Inc. Billingsley Company CyrusOne Granite Properties Southwest Office Systems, Inc. Kilpatrick Townsend ORIX Corporation USA Town of Addison A G Hill Partners LLC BKD LLP Dallas Baptist University Grant Thornton LLP & Stockton LLP Spacee Inc. OYO Hotels and Homes Toyota Motor North America ABC Home & Commercial bkm Total Office of Texas Dallas College Green Brick Partners Kimberly-Clark Corporation Spectra Pacific Builders Transworld Business Advisors - Services Kimley-Horn and Associates Spencer Fane LLP Blackmon Mooring & BMS CAT Dallas Cowboys Football Club Greenberg Traurig Pape-Dawson Downtown Dallas Accenture Ltd. -

Mlslistings Inc. Joins Zillow Partnership Platform

June 30, 2014 MLSListings Inc. Joins Zillow Partnership Platform Program enables MLS to send real-time listings directly to Zillow on behalf of participating brokerages SEATTLE, June 30, 2014 /PRNewswire/ -- Zillow, Inc. (NASDAQ: Z), the leading real estate information marketplace, today announced that MLSListings Inc. of Northern California has joined the Zillow® Partnership Platform, which sends MLS data directly to Zillow as often as every 15 minutes, ensuring that current, active listings are up to date, correct and in sync with the MLS data. "We are excited to welcome MLSListings to the Zillow Partnership Platform," said Errol Samuelson, Zillow chief industry development officer. "This partnership platform enables us to offer home shoppers in the intensely competitive housing market access to the most comprehensive inventory of homes with the most up-to-date information. We welcome the opportunity to expand our relationship with MLSListings and its subscribers." MLSListings' 16,000 subscribers can now easily ensure their listings are up to date and seen across the Yahoo!®-Zillow Real Estate Network, the largest real estate network on the webi, as well as on Zillow's popular suite of mobile apps and Zillow partners AOL® Real Estate and HGTV®'s FrontDoor®. MLSListings operates in northern California, specializing in Monterey, San Benito, San Mateo, Santa Clara and Santa Cruz counties. "We are pleased to participate in this partnership platform with Zillow to ensure our subscribers' listings have the benefit of both worlds; the immediacy and industry standards of the MLS coupled with the broadest marketing ability possible with Zillow," said James Harrison, president and CEO of MLSListings. -

Supplier Name State City Postal Code Country

SUPPLIER NAME STATE CITY POSTAL CODE COUNTRY STREET ADDRESS 1 TAX ID # or D&B Number Spend CHECK 158 NORTH IL JOLIET 60432 USA 158 N CHICAGO STREET 20-3110126 280.55 22ND CENTURY MEDIA IL ORLAND PARK 60467 USA 11516 W. 183RD ST. UNIT SW 20-1981583 2704 24/7 SECURED BOARD-UP IL JOLIET 60435 USA 2364 ESSINGTON RD, STE 264 27-0384206 2450 3M MN ST PAUL 55133-3225 USA 3M CENTER BLDG. 225-58-08 41-0417775 100 7/10 THE NEWS JOURNAL CREDIT R IL CHICAGO 60603 USA 115 S. LASALLE 12TH FLR WEST 13-4941092 20 7/12 US1.00 HO INTERNT CREDIT IL CHICAGO 60603 USA 115 S. LASALLE 12TH FLR WEST 13-4941092 -0.07 7/16 ERROR CORRECTION IL CHICAGO 60603 USA 115 S. LASALLE 12TH FLR WEST 13-4941092 0.07 9-1-1 PUBLIC EDUCATOR'S OF TX (blank) (blank) (blank) USA OF TEXAS 75-6049012 30 A BEEP, LLC IL JOLIET 60432 USA 452 N. CHICAGO STREET 36-4087404 847.95 A BETTER LIMOUSINE SER IL CHICAGO 60603 USA 115 S. LASALLE 12TH FLR WEST 13-4941092 252 A CORPORATE PRINTIN IL CHICAGO 60603 USA 115 S. LASALLE 12TH FLR WEST 13-4941092 10833.69 A CORPORATE PRINTING SRVCE INC IL WOODRIDGE 60517 USA 6808 HOBSON VALLEY DR UNIT 101 36-3749546 7104.7 A EAGLE OUTFTR IL CHICAGO 60603 USA 115 S. LASALLE 12TH FLR WEST 13-4941092 335 A FOLDING MACHINE SERVICE, INC IL GILBERTS 60136 USA P.O. BOX 194 36-3775093 232.85 A KIDS KITCHEN IL CHICAGO 60603 USA 115 S. -

Service Schedule for BT Web Conferencing Service Powered by Microsoft Live Meeting

Service Schedule for BT Web Conferencing Service powered by Microsoft Live Meeting 1. INTERPRETATION “Account” means an identifier that BT gives to the Customer. This identifier is used on all records. “BT Conferencing” means the business unit of BT that provides conferencing services. “Live Meeting” means the web conferencing service provided under this Contract and is the BT Web Conferencing Service powered by Microsoft Office Live Meeting service. “Microsoft” means PlaceWare Inc a wholly owned subsidiary of Microsoft Corporation. “Organiser” means the person whose account the meeting is booked under. “Presenter” means the person presenting the visual information to the audience. “Participant” means a person or persons connected to the Service. “BT Conference Coordinator” means the individual who will assist during the conference. “Minimum Period” means the initial term as stated in the order form. “Third Party Information” means data, information, video, graphics, sound, music, photographs, software and any other materials (in whatever form) not owned or generated by or on behalf of the Customer, published or otherwise made available by the Customer using Live Meeting 2007. Reference in this Contract to a month shall be deemed to mean a calendar month unless the context requires otherwise. Version 1.1 Page 1 of 6 August 2008 BT1006ee 2. SERVICE DESCRIPTION 2.1 Live Meeting Office Live Meeting provides the ability to share a PC desktop with a group of individuals for the purposes of collaborative working and presentations. Live Meeting uses advanced secure sockets layer encryption as standard. Table of included service features Service Features Number of participants Total number of participants that can join 1250* each meeting. -

Baron Mid Cap Growth Strategy

Baron Mid Cap Growth Strategy March 31, 2017 Dear Investor: almost 12% in the quarter. Tower operator SBA Communications Corp., Performance which was reclassified into this sector during the quarter, and Equinix, Inc., which owns and operates data centers, both gained on good operating During the quarter ended March 31, 2017, U.S. stocks continued their post- results. election rally. However, the markets witnessed a reversal of the so-called Industrials sector investments were the only detractors from relative results, “Trump Trade.” Many of the companies and sectors that performed best in mainly as a result of the underperformance of Verisk Analytics, Inc., which the immediate aftermath of the surprise election results trailed the broader provides information about risk to the insurance, financial services, and market. Investors presumably remained optimistic that the likely policies of energy industries, and Westinghouse Air Brake Technologies the Trump administration would foster accelerated economic growth. But Corporation, which provides components to the global rail industry. In investors were forced to temper their excitement about a near-term addition, as discussed below, several investments detracted from the increase in infrastructure spending and a sweeping replacement of the Strategy’s results after reporting quarterly results that did not fully meet Affordable Care Act. Against this backdrop, Baron Mid Cap Growth Strategy investor expectations. These included the online real estate service Zillow performed well. The Strategy gained 10.15%. The Russell Midcap Growth Group, Inc. and automotive aftermarket parts retailer Advance Auto Parts, Index (the “Index”) gained 6.89%, and the S&P 500 Index gained 6.07%. -

Complaints by Practice, Business, and Year Based on Complaint by Practice

Complaints By Practice, Business, and Year Based on Complaint By Practice OpenedYear PracticeName 2013 Abandonment of MH 2020 Abandonment of MH 2021 Abandonment of MH 2014 Abandonment of MH 2013 Abandonment of MH 2014 Abandonment of MH 2013 Abandonment of MH 2021 Abandonment of MH 2015 Abandonment of MH 2018 ADA (Americans w/Disabilities Act) 2019 ADA (Americans w/Disabilities Act) 2020 ADA (Americans w/Disabilities Act) 2021 ADA (Americans w/Disabilities Act) 2019 ADA (Americans w/Disabilities Act) 2020 ADA (Americans w/Disabilities Act) 2021 ADA (Americans w/Disabilities Act) 2018 ADA (Americans w/Disabilities Act) 2020 ADA (Americans w/Disabilities Act) 2020 ADA (Americans w/Disabilities Act) 2020 ADA (Americans w/Disabilities Act) Page 1 of 480 09/25/2021 Complaints By Practice, Business, and Year Based on Complaint By Practice BusinessName id 3 1 1 Comcast 1 Easy Acres Mobile Home Park 1 Leisure Estates 1 Pinecroft Mobile Home Park 1 T-Mobile 1 1 3 1 6 2 Baths Only fka Nathan Construction 1 Clallam Bay Corrections Center 1 Disability Rights Washington 1 Fidelity Investments 1 Fred Meyer 1 JAMS Mediation Arbitration and ADR Services 1 King County Metro 1 Page 2 of 480 09/25/2021 Complaints By Practice, Business, and Year Based on Complaint By Practice 2019 ADA (Americans w/Disabilities Act) 2020 ADA (Americans w/Disabilities Act) 2021 ADA (Americans w/Disabilities Act) 2019 ADA (Americans w/Disabilities Act) 2020 ADA (Americans w/Disabilities Act) 2019 ADA (Americans w/Disabilities Act) 2019 ADA (Americans w/Disabilities Act) 2021 -

Virtual Workplaces When Metaphors Breakdown

Virtual Workplaces When Metaphors Breakdown by Thomas W. I. Gallemore B.Arch, Carnegie Mellon, 1991 Submitted to the Department of Architecture in partial fulfillment of the requirements for the degree of Master of Science in Architecture Studies in Design Technology at the Massachusetts Institute of Technology June 1998 @ 1998 Massachusetts Institute of Technology. All rights reserved. Signature of the Author Thomas W. I. Gallemore Department of Architecture May 8,1998 , N 1 Certified By William L. Porter Norman B. and Muriel Leventhal Professor of Architecture and Planning Thesis ervisor Accepted by Roy Strickland Associate Professor of Architecture Chairman, Departmental Committee on Graduate Students J1 71998 Virtual Workplaces When Metaphors Breakdown by Thomas W. Gallemore Submitted to the Department of Architecture on May 8, 1998 in partial fulfillment of the requirements for the degree of Master of Science in Architecture Studies Abstract Our model of work is shaped by the places we choose to work and the tools we choose to work with. As we introduce new technologies and build new environments our model is changing. Today's virtual workplaces are grounded in models of work that have been reformed from our experiences using current technology in physical workspace. However we are discovering opportunities and possibilities for work in collaborative, virtual environments that question physical models. Emerging patterns of distributed collaboration in persistent virtual environments are changing the way we work in time and space, recasting our notion of workplace. Virtual workplaces are interpreted and experienced through metaphors that describe a space of potential for work occurrences. Through the lens of metaphors, this research focuses on breakdowns between collaborative work and the environment in which work occurs.