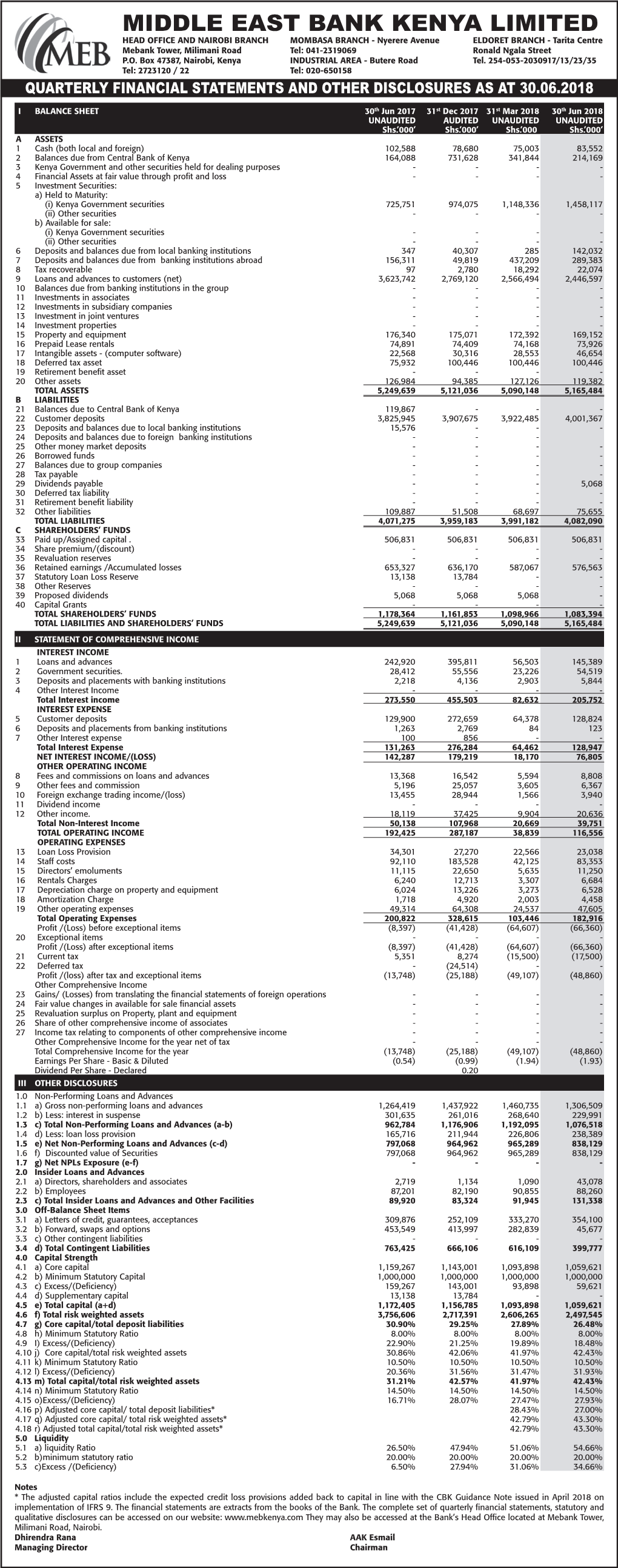

MIDDLE EAST 33X3 28-08.Indd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bank Code Finder

No Institution City Heading Branch Name Swift Code 1 AFRICAN BANKING CORPORATION LTD NAIROBI ABCLKENAXXX 2 BANK OF AFRICA KENYA LTD MOMBASA (MOMBASA BRANCH) AFRIKENX002 3 BANK OF AFRICA KENYA LTD NAIROBI AFRIKENXXXX 4 BANK OF BARODA (KENYA) LTD NAIROBI BARBKENAXXX 5 BANK OF INDIA NAIROBI BKIDKENAXXX 6 BARCLAYS BANK OF KENYA, LTD. ELDORET (ELDORET BRANCH) BARCKENXELD 7 BARCLAYS BANK OF KENYA, LTD. MOMBASA (DIGO ROAD MOMBASA) BARCKENXMDR 8 BARCLAYS BANK OF KENYA, LTD. MOMBASA (NKRUMAH ROAD BRANCH) BARCKENXMNR 9 BARCLAYS BANK OF KENYA, LTD. NAIROBI (BACK OFFICE PROCESSING CENTRE, BANK HOUSE) BARCKENXOCB 10 BARCLAYS BANK OF KENYA, LTD. NAIROBI (BARCLAYTRUST) BARCKENXBIS 11 BARCLAYS BANK OF KENYA, LTD. NAIROBI (CARD CENTRE NAIROBI) BARCKENXNCC 12 BARCLAYS BANK OF KENYA, LTD. NAIROBI (DEALERS DEPARTMENT H/O) BARCKENXDLR 13 BARCLAYS BANK OF KENYA, LTD. NAIROBI (NAIROBI DISTRIBUTION CENTRE) BARCKENXNDC 14 BARCLAYS BANK OF KENYA, LTD. NAIROBI (PAYMENTS AND INTERNATIONAL SERVICES) BARCKENXPIS 15 BARCLAYS BANK OF KENYA, LTD. NAIROBI (PLAZA BUSINESS CENTRE) BARCKENXNPB 16 BARCLAYS BANK OF KENYA, LTD. NAIROBI (TRADE PROCESSING CENTRE) BARCKENXTPC 17 BARCLAYS BANK OF KENYA, LTD. NAIROBI (VOUCHER PROCESSING CENTRE) BARCKENXVPC 18 BARCLAYS BANK OF KENYA, LTD. NAIROBI BARCKENXXXX 19 CENTRAL BANK OF KENYA NAIROBI (BANKING DIVISION) CBKEKENXBKG 20 CENTRAL BANK OF KENYA NAIROBI (CURRENCY DIVISION) CBKEKENXCNY 21 CENTRAL BANK OF KENYA NAIROBI (NATIONAL DEBT DIVISION) CBKEKENXNDO 22 CENTRAL BANK OF KENYA NAIROBI CBKEKENXXXX 23 CFC STANBIC BANK LIMITED NAIROBI (STRUCTURED PAYMENTS) SBICKENXSSP 24 CFC STANBIC BANK LIMITED NAIROBI SBICKENXXXX 25 CHARTERHOUSE BANK LIMITED NAIROBI CHBLKENXXXX 26 CHASE BANK (KENYA) LIMITED NAIROBI CKENKENAXXX 27 CITIBANK N.A. NAIROBI NAIROBI (TRADE SERVICES DEPARTMENT) CITIKENATRD 28 CITIBANK N.A. -

The Only Virtual Gathering Focused on Esg and Sustainable Finance Solutions for the African Market

REGISTER YOUR PLACE TODAY www.BondsLoans.com/events/esgafrica THE ONLY VIRTUAL GATHERING FOCUSED ON ESG AND SUSTAINABLE FINANCE SOLUTIONS FOR THE AFRICAN MARKET 400+ 30+ 170+ 150+ 3,000+ SENIOR EXPERT BORROWERS INVESTORS, LENDERS & ONLINE MEETINGS ATTENDEES SPEAKERS & ISSUERS ARRANGERS ARRANGED In a matter of weeks I have been able to reach dozens of institutions operating in the field of sustainable finance across a variety of countries. While our industry copes with an economic and health crisis, forums such as the ESG & Capital Markets Africa Virtual series are setting the stage for digital sharing of what responsible investment practices should look like: transparent, accessible and trustworthy. Alessia Falsarone, Managing Director, Head of Sustainable Investing, PineBridge Investments Silver Sponsors: AFD Ce fichier est un document Logo PROPARCO d’exécution créé sur Illustrator Bronze Sponsors: RVB Investorversion CC. Partner: YD 30-34 Rue du Chemin Vert 75011 Paris +33 (0)1 85 56 97 00 www.carrenoir.com Date : 22/02/2021 RÉFÉRENCES COULEURS TECHNIQUE ÉCHELLE 1/1 R0 V0 R225 V0 0 1 2 B145 B15 CUTTER www.BondsLoans.com/events/esgafrica BRINGING GLOBAL SUSTAINABLE FINANCE LEADERS TOGETHER WITH THE AFRICAN CAPITAL MARKETS COMMUNITY Meet senior decision-makers from African sovereigns, corporates and banks; share knowledge; debate; network; and move your business forward in the current economic climate without having to travel. 400+ 30+ 170+ 150+ SENIOR WORLD CLASS SOVEREIGN, CORPORATE INVESTORS, LENDERS ATTENDEES SPEAKERS & FI BORROWERS & ARRANGERS Access top market practitioners from across Industry leading speakers will share Hear first-hand how key local and Leverage our concierge the globe who are active in the African “on-the-ground” market intelligence and international market representatives are meeting service markets, including: senior borrowers, investors, updates on Africa’s economic backdrop. -

Annual Report 2017

ANNUAL REPORT 2017 CONTENTS CHAIRMAN AND CHIEF EXECUTIVE OFFICER’S REPORT 9 BOARD OF DIRECTORS AND COMMITTEES 13 SENIOR MANAGEMENT AND COMMITTEES 17 CORPORATE STRUCTURE 21 CORPORATE GOVERNANCE REPORT 23 CONSOLIDATED FINANCIAL STATEMENTS 37 3 BOARD OF DIRECTORS SENIOR MANAGEMENT 1 2 1 2 3 3 4 5 4 5 6 6 7 8 7 8 9 1. Mr. Wilson S. Benjamin Chairman 1. Mr. Korhan Alev Chief Executive Officer 2. Mr. Murat Solak Vice Chairman (appointed to the Board on 26 April 2017) 2. Mr. Gaurav Baid Chief Financial Officer 3. Mr. Ebrahim A. S. Bu Hendi Director 3. Mr. Abdulla Dawood AGM – Treasury & Financial Institutions 4. Mr. Raza Shah Kakakhail Head of Operations 4. Prof. Awadh Kh. Al-Enezi Director 5. Mr. Hamad Al Hiddi Head of Risk Management 5. Mr. Karunaker Nampalli Director 6. Mr. Philip Morley Head of Information Technology 6. Mr. Jawad Naser Jawad Jaafar Director 7. Mr. Mohamed Alhusaini Head of Compliance & MLRO 7. Mr. Yohannan Abraham Director 8. Ms. Sulagna Ghosh Head of Internal Audit 8. Mr. Govindan Swaminathan Director (appointed to the Board on 22 October 2017) 9. Mr. Mohammed Al Shaikh Head of Human Resources 4 BOARD OF DIRECTORS SENIOR MANAGEMENT 1 2 1 2 3 3 4 5 4 5 6 6 7 8 7 8 9 1. Mr. Wilson S. Benjamin Chairman 1. Mr. Korhan Alev Chief Executive Officer 2. Mr. Murat Solak Vice Chairman (appointed to the Board on 26 April 2017) 2. Mr. Gaurav Baid Chief Financial Officer 3. Mr. Ebrahim A. S. Bu Hendi Director 3. -

Social Capital and Internationalization of Commercial Banks in Kenya

ISSN 2519-8564 (рrint), ISSN 2523-451X (online). European Journal of Management Issues. – 2020. – 28 (1-2) European Journal of Management Issues Volume 28(1-2), 2020, pp.41-51 DOI: 10.15421/192005 Received: 12 February2020; 08 April 2020 Revised: 27 March 2020; 13 May 2020 Accepted: 03 June 2020 Published: 25 June 2020 UDC classification: 336 JEL Classification: M19 Social capital and internationalization of commercial banks in Kenya P. P. Omondi‡, J. W. Ndegwa‡‡, ‡‡‡ T. C. Okech Purpose – tо study sought to delve into social capital and commercial banks' internationalization in Kenya Drawing on the internationalization concept. Design/Method/Approach. The research adopted a positivist philosophical approach and used a descriptive cross-sectional research design targeting top and middle-level managers in Kenya's commercial banks. Data was collected using a structured questionnaire and analyzed using SPSS version 22.0 for both descriptive and inferential statistics. Structural Equation Modelling was used to establish the influence of social capital on commercial banks' internationalization in Kenya. Findings. The findings established a significant and positive relationship between the components of social capital: inter-cultural empathy, inter- personal impact and diplomacy, and commercial banks' internationalization. Practical implications. The results have significant consequences: Firstly, social capital has a positive and statistically significant ‡Philip Peters Omondi, relationship with commercial banks' internationalization. Head of Trade Finance, NCBA Bank, Secondly, all dimensions of social capital affect the acquisition of Nairobi, Kenya, foreign market knowledge and financial resources. Thirdly, the use e-mail: [email protected], https://orcid.org/0000-0001-5213-7269 of individuals' social capital often changes during internationalization. -

Annual Report

In the Name of God Annual Report For the Year Ended March 20, 2017 Financial Highlights IRR million 20171 20162 20153 20144 20135 Outstanding Loans 53,625,316 28,097,787 21,474,088 13,057,539 2,575,223 Deposits 62,781,801 34,416,163 24,914,454 14,422,913 1,141,668 Total Assets 74,544,249 41,377,823 30,717,191 21,252,583 5,590,608 Net Profit 2,023,812 1,355,526 848,516 820,029 408,081 Basic EPS 506 339 212 205 102 Guarantees 21,543,141 16,750,179 11,779,733 3,892,820 510,868 Letters of Credit 2,975,041 2,507,746 670,033 756,603 - Capital Adequacy Ratio, Basel-III Foundation-IRB (Percent) 12.6 12.8 13.8 - - Capital Adequacy Ratio, Basel-III Standardized Approach (Percent) 11.7 12.5 13.5 26.1 - 1. Year ended March 20, 2017 2. Year ended March 19, 2016 3. Year ended March 20, 2015 4. Year ended March 20, 2014 5. Year ended March 20, 2013. Middle East Bank had only five months of operation in that year The Exchange Rate of the Iranian Rial On March 20, 2017, the official exchange rate of the US dollar was: USD1 = IRR32,420. A Note on the Iranian Calendar Iran’s official calendar is a solar calendar that starts on the first day of spring and ends on the last day of winter. The government of Iran as well as Iranian banks have adopted the calendar year as their fiscal year. -

This Report, Sansar Capital Holds an Interest in Bank of Baghdad on Behalf of an Advisory Client

May/June 2013 A Closer Look at the Iraqi Banking Sector 16 RAFFLES QUAY #40-02A HONG LEONG BUILDING SINGAPORE 048581 TEL: +65 6372 7580 http://www.sansarcapital.com To request additional information, please contact: [email protected] Sansar Capital Management, LLC, 2013, Copyright © All Rights Reserved 1 Table of Contents Executive Summary 3 Methodology 4 Iraq: A Quick Glance 5 Banking Sector Overview 6 The State Owned Banks 8 How Iraqi Banks Make Money 10 Risk Analysis: CAMEL 16 ROE: Adjusting the reported numbers 19 Capital Issuance: What comes next? 22 Valuation: The Traditional Approach 24 Laws and Regulations 26 Company Overview: North Bank (BNOR) 27 Bank of Baghdad (BBOB) 34 Iraqi Middle East Bank Investment Bank (BIME) 41 Kurdistan International Bank (BKUI) 50 Dar Es Salaam Investment Bank (BDSI) 55 Important Disclosures: 60 Sources: 62 Sansar Capital Management, LLC, 2013, Copyright © All Rights Reserved 2 Executive Summary The Iraqi banking sector is poised for significant earnings and asset growth over the next decade driven by a strong macro environment, increasing credit penetration and an improving security situation. The IMF forecasts Iraqi GDP to grow at a rate of 9.0% in 2013 on the back of 8.4% growth in 2012 placing Iraq solidly in the category of one of the fastest growing economies in the world.1 The IEA in its World Energy Outlook report stated that Iraq is expected to contribute 45% of the global incremental oil supply over this decade.2 As a result, the IEA central scenario forecast predicts Iraq GDP to grow 151% between 2011 to 2020.2 Rising credit penetration is likely to further fuel banking sector growth. -

Middle East Bank Shares Score World-Leading Growth

www.retailbankerinternational.com Issue 758 / febuary 2019 THROUGH THE ROOF MIDDLE EAST BANK SHARES SCORE WORLD-LEADING GROWTH INNOVATION DISTRIBUTION FEATURE How Yapı Kredi is 86 400 will soon give US regional bank BB&T has revamping the Turkish Australians an alternative the potential to weather an banking industry to the dominant Big Four economic downturn RBI 758 February 2019.indd 1 14/01/2019 14:48:21 contents this month COVER STORY NEWS 06 05 / EDITOR’S LETTER 18 / DIGEST • Italy issues decree to stabilise struggling Banca Carige • RBS acquires 25% stake in millennial- focused fintech Loot • Linedata acquires French fintech Loansquare • BMO Financial Crimes Unit announced • Starling looks to France and Germany • ProBank austin launches financial compliance training • Ghana completes banking industry consolidation • ConnectOne completes Greater Hudson Bank merger • China reduces reserve requirement ratio • National Bank of Kuwait launches SWIFT gpi services THE MIDDLE EAST 19 Editor: Group Editorial Director: Head of Subscriptions: Douglas Blakey Ana Gyorkos Alex Aubrey +44 (0)20 7406 6523 +44 (0)20 7406 6707 +44 (0)20 3096 2603 [email protected] [email protected] [email protected] Senior Reporter: Sub-editor: Director of Events: Patrick Brusnahan Nick Midgley Ray Giddings +44 (0)20 7406 6526 +44 (0)161 359 5829 +44 (0)20 3096 2585 [email protected] [email protected] [email protected] Junior Reporter: Publishing Assistant: Briony Richter Mishelle Thurai +44 (0)20 7406 6701 +44 (0)20 7406 8633 [email protected] [email protected] Customer Services: +44 (0)20 3096 2603 or +44 (0)20 3096 2636, [email protected] Financial News Publishing, 2012. -

Relationship Between Operational Efficiency and Growth of Commercial Banks in Kenya

RELATIONSHIP BETWEEN OPERATIONAL EFFICIENCY AND GROWTH OF COMMERCIAL BANKS IN KENYA BY ERIC KANG’ETHE RESEARCH PROJECT SUBMITTED IN PARTIAL FULFILMENT OF THE REQUIREMENT FOR THE AWARD OF THE DEGREE OF MASTERS OF BUSINESS ADMINISTRATION, SCHOOL OF BUSINESS, UNIVERSITY OF NAIROBI OCTOBER, 2009 DECLARATION This research project report is my original work and has not been submitted for a degree in any other University. Signed ERIC KANG'ETHE D61/P/8463/04 This management research project has been submitted for examination with my approval as University NAME: MOHAMED N. MWACHITI LECTURER, DEPARTMENT OF FINANCE AND ACCOUNTING UNIVERSITY OF NAIROBI i DEDICATION To all of you who made me what I am today ii ACKNOWLEDGEMENT I thank the Almighty God for the life. Thank you for being with me all through. I acknowledge my family for being beside me all the way. Your support and encouragement has seen me this far. I also acknowledge my supervisor, Mr. Mohamed Mwachiti, who guided me throughout the research period. I also acknowledge the entire staff and management of Central Bank of Kenya and Capital Markets Authority and for allowing me to gather information concerning organisations surveyed. Your contribution to this research cannot be underestimated. iii TABLE OF CONTENTS DECLARATION............................................................................................................................................................................................i DEDICATIO N............................................................................................................................................................................................. -

ABIS 2019 Post Event Report

NAIROBI, KENYA | 19-20 FEBRUARY 2019 | WWW.AFRICABFSI.COM POST EVENT REPORT DIRECTOR’S NOTE Dear Participant, On behalf of Tradepass, I take immense pleasure in welcoming you to the inaugural edition of Africa BFSI Innovation Summit 2019. Being the inaugural edition, ABIS 2019 has attracted 350+ participants from the BFSI and technology industries, making it the largest Banking, Financial Services and Insurance summit in East Africa. The participation of leading local and international speakers representing some of the top banks, insurance and ȴQDQFLDOVHUYLFHFRPSDQLHVZLOOEULQJWRWKHIRUHQHZLQIRUPDWLRQDQGEXVLQHVVGHYHORSPHQWRSSRUWXQLWLHV 2YHUWKHFRXUVHRIWKHVHWZRGD\VWKHVXPPLWZLOOFRYHUFXWWLQJHGJHWRSLFVVXFKDV'LJLWDO%DQNLQJ&XVWRPHU([SHULHQFH0LFURȴQDQFH5LVNDQG &\EHUVHFXULW\'LJLWDO.<&&RUH%DQNLQJ3D\PHQWVDQG5HWDLO%DQNLQJDPRQJVWPDQ\RWKHUV$VSDUWRIWKHFXUUHQWHGLWLRQRIWKHFRQIHUHQFHDJHQGDD VHOHFWLRQRIRYHUSUHVHQWDWLRQVZLOOEHIHDWXUHGDORQJZLWKSDQHOGLVFXVVLRQVDQGȴUHVLGHFKDWVWKDWZLOOWKURZOLJKWRQVRPHRIWKHODWHVW technologies and innovations which play a key role in the evolving BFSI landscape.A series of interactive panel discussions and an array of networking sessions represent an exclusive opportunity to exchange ideas on trends in the BFSI sector & global best practices. The summit itself remains as an excellent platform to meet the industry thought leaders and key decision makers. I take this opportunity to specially thank our line-up of distinguished speakers for sparing their time to be here with us today. I would also like to extend a warm welcome to all -

Schedules to the KEPSS Rules and Regulations

Schedules to the KEPSS Rules and Regulations Schedule B SWIFT Bank Identifier Codes (BIC)s for KEPSS Participants for RMA as at September 2013 SWIFT TEST & SWIFT BIC CODE TRAINING (T&T) PARTICIPANT LIVE BIC CODE 1. AFRICAN BANKING CORPORATION ABCLKENA ABCLKEN0 2. BANK OF AFRICA AFRIKENX AFRIKEN0 3. BANK OF BARODA BARBKENA BARBKEN0 4. BANK OF INDIA BKIDKENA BKIDKEN0 5. BARCLAYS BANK OF KENYA BARCKENX BARCKEN0 6. CENTRAL BANK OF KENYA CBKEKENX CBKEKEN0 7. CFC STANBIC BANK KENYA LTD SBICKENX SBICKEN0 8. CHASE BANK LTD CKENKENA CKENKEN0 9. CITIBANK N.A. CITIKENA CITIKEN0 10.COMMERCIAL BANK OF AFRICA CBAFKENX CBAFKEN0 11.CONSOLIDATED BANK OF KENYA CONKKENA CONKKEN0 12.CO -OPERATIVE BANK OF KENYA LTD KCOOKENA KCOOKEN0 13.CREDIT BANK LTD CRBTKENA CRBTKEN0 14.DEVELOPMENT BANK OF KENYA LTD DEVKKENA DEVKKEN0 15.DIAMOND TRUST BANK KENYA LTD DTKEKENA DTKEKEN0 16.DUBAI BANK DUKNKENA DUKNKEN0 17.ECOBANK ECOCKENA ECOCKEN0 18.EQUATORIAL COMMERCIAL BANK EQUAKENA EQUAKEN0 19.EQUITY BANK EQBLKENA EQBLKEN0 20.FAMILY BANK LIMITED FABLKENA FABLKEN0 21.FIDELITY COMMERCIAL BANK FCBLKENA FCBLKEN0 22.FINA BANK LIMITED FBAKKENA FBAKKEN0 23.FIRST COMMUNITY BANK LIMITED IFCBKENA IFCBKEN0 24.GIRO BANK LTD GIROKENX GIROKEN0 25.GUARDIAN BANK LTD GUARKENA GUARKEN0 26.GULF AFRICAN BANK GAFRKENA GAFRKEN0 27.HABIB A.G. ZURICH HBZUKENA HBZUKEN0 28.HABIB BANK LTD HABBKENX HABBKEN0 29.HOUSING FINANCE COMPANY OF KENYA HFCOKENA HFCOKEN0 30.IMPERIAL BANK LTD IMPLKENA IMPLKEN0 SWIFT TEST & SWIFT BIC CODE TRAINING (T&T) PARTICIPANT LIVE BIC CODE 31.INVESTMENTS & MORTGAGES IMBLKENA -

Euroclear Bank Participants List

Euroclear Bank Participants List Participant Name BIC Code Participant Code AARGAUISCHE KANTONALBANK KBAGCH22XXX 92304 AB SVENSK EXPORTKREDIT SEKXSESSXXX 97147 ABAXBANK SPA ICBBITMMXXX 27431 ABBEY NATIONAL TREASURY SERVICES PL ANTSGB2LXXX 21391 ABBEY NATIONAL TREASURY SERVICES PL ANTSGB2LXXX 24587 ABBEY NATIONAL TREASURY SERVICES PL ANTSGB2LXXX 90281 ABLV BANK AS AIZKLV22XXX 18576 ABN AMRO BANK (SWITZERLAND) AG UBPGCHZ8XXX 12180 ABN AMRO BANK N.V. (FORMERLY FBN) FTSBNL2RXXX 12826 ABN AMRO BANK N.V. (FORMERLY FBN) FTSBNL2RXXX 12827 ABN AMRO BANK NV ABNAJESHXXX 13030 ABN AMRO BANK NV ABNANL2AXXX 90105 ABN AMRO BANK NV, RODERVELTLAAN ABNABE2AIPCXXX 93170 ABN AMRO GLOBAL CUSTODY NV n.a. 21900 ABN AMRO GLOBAL CUSTODY NV n.a. 24936 ABN AMRO GLOBAL CUSTODY SERVICES N. FTSBNL2RXXX 10937 ABN AMRO GLOBAL CUSTODY SERVICES N. FTSBNL2RXXX 11963 ABN AMRO GLOBAL CUSTODY SERVICES N. FTSBNL2RXXX 14447 ABN AMRO GLOBAL CUSTODY SERVICES N. FTSBNL2RXXX 14448 ABN AMRO GLOBAL CUSTODY SERVICES N. FTSBNL2RXXX 94763 ABN AMRO GLOBAL CUSTODY SERVICES N. FTSBNL2RXXX 97465 ABSA BANK LTD ABSAZAJJXXX 18440 ABU DHABI COMMERCIAL BANK PJSC ADCBAEAATRYXXX 15438 ABU DHABI INVESTMENT COMPANY ADICAEAAXXX 93301 ADAM & COMPANY PLC ADAGGB2SXXX 13446 ADAM & COMPANY PLC ADAGGB2SXXX 13458 ADAM & COMPANY PLC ADAGGB2SXXX 13460 1 ADAM & COMPANY PLC ADAGGB2SXXX 13504 ADAM & COMPANY PLC ADAGGB2SXXX 13576 ADAM & COMPANY PLC ADAGGB2SXXX 13638 ADAM & COMPANY PLC ADAGGB2SXXX 13641 ADAM & COMPANY PLC ADAGGB2SXXX 13646 ADM INVESTOR SERVICES INTERNATIONAL n.a. 10123 AFRICAN DEVELOPMENT BANK -

National Bank of Kuwait a Bank for the Next Generation

Volume XXX Autumn 2019 £5.95 The Global Magazine of the Arab Bankers Association (ABA) NATIONAL BANK OF KUWAIT A BANK FOR THE NEXT GENERATION H.E. MANSOUR BTEISH LEBANON’S ECONOMIC PRIORITIES BANK ABC PUTTING DIGITAL AT THE HEART OF THE BANK GCC BANK MERGERS REFORMING IRAQ’S BANKING SYSTEM EGYPT’S STRENGTHENING ECONOMY INTERPRETING LIBYA EIGHT YEARS AFTER THE FALL OF QADHAFI MANAGING SANCTIONS COMPLIANCE IN THE AGE OF BREXIT AND GDPR AUTUMN 2019 CONTENTS 3 Volume XXX, Autumn 2019 Contents Volume XXX Autumn 2019 £5.95 The Global Magazine of the Arab Bankers Association (ABA) › Letter from the Chief Executive Officer 6 › Letter from the Editor 7 NATIONAL BANK OF KUWAIT A BANK FOR THE NEXT GENERATION H.E. MANSOUR BTEISH LEBANON’S ECONOMIC PRIORITIES › BANK ABC People and news 8 PUTTING DIGITAL AT THE HEART OF THE BANK GCC BANK MERGERS REFORMING IRAQ’S BANKING SYSTEM EGYPT’S STRENGTHENING ECONOMY › INTERPRETING LIBYA EIGHT YEARS COVER STORY AFTER THE FALL OF QADHAFI MANAGING SANCTIONS COMPLIANCE IN THE AGE OF BREXIT AND GDPR National Bank of Kuwait: a bank for the next generation 12 Cover photo: Mada’in Saleh, a Nabatean archaeological site in the north-west of › Saudi Arabia Profile of Isam al-Sager, Group CEO of National Bank of Kuwait 16 › COVER STORY ARAB BANKERS ASSOCIATION H.E. Mansour Bteish, Lebanon’s Minister Chief Executive Officer of Economy and Trade, outlines George Kanaan Lebanon’s economic programme 18 Board of Directors Chairman Abdulaziz al-Khereiji, Riyad Bank › Tareq al-Sadhan, CEO of Riyad Bank, describes his Vice Chairman