Rd5 Web Holdings.Indd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

In the United States District Court for the District of Delaware

IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF DELAWARE SEMCON TECH, LLC, Plaintiff, v. C.A. No. _________ APPLIED MATERIALS, INC., APPLIED MATERIALS SOUTH EAST ASIA PTE. JURY TRIAL DEMANDED LTD., APPLIED MATERIALS TAIWAN, LTD., APPLIED MATERIALS CHINA, APPLIED MATERIALS FRANCE S.A.R.L., AND APPLIED MATERIALS ITALIA SRL, Defendants. COMPLAINT FOR PATENT INFRINGEMENT This is an action for patent infringement arising under the Patent Laws of the United States of America, 35 U.S.C. § 1 et seq. in which Plaintiff Semcon Tech, LLC makes the following allegations against Defendants Applied Materials, Inc., Applied Materials South East Asia Pte. Ltd., Applied Materials Taiwan, Ltd., Applied Materials China, Applied Materials France S.A.R.L., and Applied Materials Italia Srl (collectively, “AMAT” or “Defendants”). PARTIES 1. Plaintiff Semcon Tech, LLC (“Semcon”) is a Delaware limited liability company. 2. On information and belief, Defendant Applied Materials, Inc. (“AMAT- US”) is a Delaware corporation with its principal place of business at 3050 Bowers Avenue, Santa Clara, California. On information and belief, AMAT can be served through its registered agent, The Corporation Trust Company, Corporation Trust Center, 1 1209 Orange Street, Wilmington, Delaware 19801. 3. On information and belief, Defendant Applied Materials South East Asia Pte. Ltd. (“AMAT-SG”) is a corporation organized under the laws of Singapore with its principal place of business at 8 Upper Changi Road North, Singapore 506906. 4. On information and belief, Defendant Applied Materials Taiwan, Ltd. (“AMAT-TW”) is a corporation organized under the laws of Taiwan with its principal place of business at No. -

GS40 0.11-Μm CMOS Standard Cell/Gate Array

GS40 0.11-µm CMOS Standard Cell/Gate Array Version 1.0 January 29, 2001 Copyright Texas Instruments Incorporated, 2001 The information and/or drawings set forth in this document and all rights in and to inventions disclosed herein and patents which might be granted thereon disclosing or employing the materials, methods, techniques, or apparatus described herein are the exclusive property of Texas Instruments. No disclosure of information or drawings shall be made to any other person or organization without the prior consent of Texas Instruments. IMPORTANT NOTICE Texas Instruments and its subsidiaries (TI) reserve the right to make changes to their products or to discontinue any product or service without notice, and advise customers to obtain the latest version of relevant information to verify, before placing orders, that information being relied on is current and complete. All products are sold subject to the terms and conditions of sale supplied at the time of order acknowledgement, including those pertaining to warranty, patent infringement, and limitation of liability. TI warrants performance of its semiconductor products to the specifications applicable at the time of sale in accordance with TI’s standard warranty. Testing and other quality control techniques are utilized to the extent TI deems necessary to support this war- ranty. Specific testing of all parameters of each device is not necessarily performed, except those mandated by government requirements. Certain applications using semiconductor products may involve potential risks of death, personal injury, or severe property or environmental damage (“Critical Applications”). TI SEMICONDUCTOR PRODUCTS ARE NOT DESIGNED, AUTHORIZED, OR WAR- RANTED TO BE SUITABLE FOR USE IN LIFE-SUPPORT DEVICES OR SYSTEMS OR OTHER CRITICAL APPLICATIONS. -

Sponsors Announced for Taiwan and China Semiconductor Industry Outlook 2003

Taiwan and China Semiconductor Industry Outlook – 2003 September 15-16, 2003 San Jose, California www.taiwan-china-outlook.com FOR IMMEDIATE RELEASE September 10, 2003 San Jose, Calif. SPONSORS ANNOUNCED FOR TAIWAN AND CHINA SEMICONDUCTOR INDUSTRY OUTLOOK 2003 The US-Taiwan Business Council, in conjunction with the Fabless Semiconductor Association, today announced the sponsors for Taiwan and China Semiconductor Industry Outlook 2003. Platinum sponsor - Agilent Technologies Gold sponsors - Applied Materials, Intel, NVIDIA, Synopsys, Teradyne, and Taiwan Semiconductor Manufacturing Company, Ltd. (TSMC) This event, focusing on the challenges and opportunities presented by the increasing economic integration of the United States, Taiwan and China semiconductor industries, will be held from September 15-16, 2003 in San Jose, Calif. Conference presentations, panels and Q&A sessions will cover economic integration; investment; export controls and dual-use technologies; intellectual property rights; business partnerships; market potential and acquiring market share. Keynote speeches will be given by Dr. Morris Chang, chairman, CEO and founder of TSMC, Kenneth Juster, under secretary of commerce for the Bureau of Industry and Security and Lisa Bronson, deputy under secretary of defense for Technology Security Policy & Counterproliferation. Additional speakers, updates to the conference agenda and registration information are available at www.taiwan-china-outlook.com. About the Conference Sponsors: Agilent Technologies (http://www.agilent.com) -

2019 Annual Report

Toppan Merrill - Flex LTD Annual Report Combo Book - FYE 3.31.19 ED | 105212 | 09-Jul-19 16:19 | 19-11297-1.aa | Sequence: 1 CHKSUM Content: 45264 Layout: 60155 Graphics: 0 CLEAN Our Shareholders, Employees, Customers and Partners: In 1969, Joe and Barbara Ann McKenzie started a family business hand soldering electronic parts onto printed circuit boards to help Silicon Valley startups meet their dynamic capacity needs. These “board stuffers,” as they were known back then, decided to name their small company Flextronics. The McKenzies dreamed of revolutionizing the way electronic products were manufactured, not only in Silicon Valley, but all around the world. Fifty years later, we may have shortened the company name from Flextronics to Flex, but our list of achievements and milestones over the past five decades is nothing short of remarkable. Today, we have a broad portfolio of diverse customers, including some of the best-known global brands such as Cisco, Ford, IBM, Johnson & Johnson and Microsoft. From manufacturing early networking equipment and mobile devices for companies like Motorola, Nokia, Juniper and Ericsson to making Palm Pilots, Xboxes, Blackberrys, and HP printers, Flex led the transition from contract manufacturing to value-added Electronic Manufacturing Services (EMS). Our top customers come from more than a dozen different industries, providing us with a unique perspective on many of the fastest growing companies, by industry and by geography. Flex was one of the first American service manufacturers to go offshore by setting up a manufacturing facility in Singapore. The company was one of the first to innovate with full service industrial parks across Asia and eventually other geographies, to bring suppliers closer to the manufacturing line, and to support emerging “just in time” supply chain needs. -

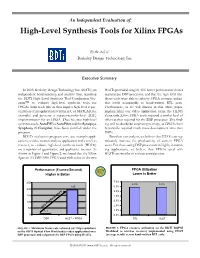

High-Level Synthesis Tools for Xilinx Fpgas

An Independent Evaluation of: High-Level Synthesis Tools for Xilinx FPGAs By the staff of Berkeley Design Technology, Inc. Executive Summary In 2009, Berkeley Design Technology Inc. (BDTI), an HLSTs provided roughly 40X better performance than a independent benchmarking and analysis firm, launched mainstream DSP processor, and that the high-level syn- the BDTI High-Level Synthesis Tool Certification Pro- thesis tools were able to achieve FPGA resource utiliza- gram™ to evaluate high-level synthesis tools for tion levels comparable to hand-written RTL code. FPGAs. Such tools take as their input a high-level repre- Furthermore, as we will discuss in this white paper, sentation of an application (written in C or MATLAB, for implementing our video application using the HLSTs example) and generate a register-transfer-level (RTL) along with Xilinx FPGA tools required a similar level of implementation for an FPGA. Thus far, two high-level effort as that required for the DSP processor. This find- synthesis tools, AutoESL’s AutoPilot and the Synopsys ing will no doubt be surprising to many, as FPGAs have Synphony C Compiler, have been certified under the historically required much more development time than program. DSPs. BDTI’s evaluation program uses two example appli- Based on our analysis, we believe that HLSTs can sig- cations, a video motion analysis application and a wireless nificantly increase the productivity of current FPGA receiver, to evaluate high-level synthesis tools (HLSTs) users. For those using DSP processors in highly demand- on a number of quantitative and qualitative metrics. As ing applications, we believe that FPGAs used with shown in Figure 1 and Figure 2, we found that the Xilinx HLSTs are worthy of serious consideration. -

United States District Court for the Western District of Texas Waco Division

Case 6:20-cv-01211 Document 1 Filed 12/31/20 Page 1 of 83 UNITED STATES DISTRICT COURT FOR THE WESTERN DISTRICT OF TEXAS WACO DIVISION Ocean Semiconductor LLC, Civil Action No.: 6:20-cv-1211 Plaintiff JURY TRIAL DEMANDED v. PATENT CASE NVIDIA Corporation (“NVIDIA”), Defendant. COMPLAINT FOR PATENT INFRINGEMENT Plaintiff Ocean Semiconductor LLC (“Ocean Semiconductor” or “Plaintiff”) files this Complaint against NVIDIA Corporation (“NVIDIA” or “Defendant”), seeking damages and other relief for patent infringement, and alleges with knowledge to its own acts, and on information and belief as to other matters, as follows: NATURE OF THE ACTION 1. This is an action for patent infringement arising under the Patent Laws of the United States, 35 U.S.C. § 1 et seq. THE PARTIES 2. Plaintiff Ocean Semiconductor is a limited liability company organized and existing under the laws of the State of Delaware, and its registered agent for service of process in Delaware is Rita Carnevale, 717 N. Union Street, Wilmington, DE 19805. Case 6:20-cv-01211 Document 1 Filed 12/31/20 Page 2 of 83 3. On information and belief, Defendant NVIDIA is a corporation organized and existing under the laws of Delaware, with its principal place of business at 2701 San Tomas Expressway, Santa Clara, CA 95050. NVIDIA is registered with the State of Texas and may be served with process through its registered agent, Corporation Service Company d/b/a CSC- Lawyers Incorporating Service Company, 211 E. 7th St., Suite 620, Austin, TX 78701. On information and belief, NVIDIA has a regional office in this District, including at least at 11001 Lakeline Blvd., Building 2, Suite 100, Austin, TX 78717. -

A Report on Semiconductor Foundry Access by US Academics (Discussion Held at a Meeting Virtually Held at the National Science Foundation on Dec 16, 2020)

A Report on Semiconductor Foundry Access by US Academics (Discussion held at a meeting virtually held at the National Science Foundation on Dec 16, 2020) Organizers: Sankar Basu1, Erik Brunvand2, Subhasish Mitra3, H.-S. Philip Wong4 Scribes: Sayeef Salahuddin5, Shimeng Yu6 1 NSF, [email protected] 2 NSF, [email protected] 3 Stanford University, [email protected] 4 Stanford University, [email protected] 5 University of California, Berkeley, [email protected] 6 Georgia Institute of Technology, [email protected] 2 Executive Summary Semiconductor technology and microelectronics7 is a foundational technology that without its continued advancement, the promises of artificial intelligence (AI), 5G/6G communication, and quantum computing will never be realized in practice. Our nation’s economic competitiveness, technology leadership, and national security, depend on our staying at the forefront of microelectronics. We must accelerate the pace of innovation and broaden the pool of researchers who possess research capability in circuit design and device technologies, and provide a pathway to translate these innovations to industry. This meeting has brought to the fore the urgent need for access to semiconductor foundry and design ecosystem to achieve these goals. Microelectronics is a field that requires sustained and rapid innovations, especially as the historical rate of progress following a predictable path, is no longer guaranteed as it had been in the past. Yet, there are many plausible paths to move forward, and the potential for further advances is immense. There is a future in system integration of heterogeneous technologies that requires end-to-end co-design and innovation. Isolated push along silos, such as miniaturization of components, will be inadequate. -

Lam Research Corporate Social Responsibility Report for 2015 Lam Research | Corporate Social Responsibility Report for 2015

Lam Research Corporate Social Responsibility Report for 2015 Lam Research | Corporate Social Responsibility Report for 2015 Further information on the material topics prioritized in this About This Report report are found in the Company Overview section. Lam Research Corporation (Lam Research, Lam, or the company) has developed this Corporate Social Boundaries Responsibility (CSR) Report to provide an overview of the company’s facilities and operations relating to Data reported in this document are for Lam Research. This environmental, social, and economic performance. This information covers subsidiaries, except for a few places report covers calendar year 2015. where we are still harmonizing our global systems to incorporate all of our data worldwide. Other exceptions and limitations are noted throughout the report. Content Our report is informed by the Global Reporting Initiative Company Data (GRI) G4 Guidelines, which provide a globally relevant framework for a standardized approach to reporting Lam Research is headquartered in Fremont, California, environmental, social, and economic performance. We and maintains a network of facilities throughout Asia, have included a GRI G4 Guideline Index to show our Europe, and the United States to meet the needs of our alignment with GRI reporting elements and to document global customer base. Our research and development our progress at integrating sustainability into our business. (R&D) facilities are located in Fremont and San Jose, As we continue to refine our reporting process, we are California; Tualatin, Oregon; and Villach, Austria. We have working to further align our report with the GRI framework. manufacturing facilities in the U.S. (California and Oregon), Austria, and Korea. -

We Need Net Neutrality As Evidenced by This Article to Prevent Corporate

We need Net Neutrality as evidenced by this article to prevent corporate censorship of individual free speech online, whether its AOL censoring DearAOL.com emails protesting their proposed email fee for prioritized email delivery that evades spam filters, AT&T censoring Pearl Jam which this article is about, or Verizon Wireless censoring text messages from NARAL Pro Choice America. If the FCC won't reclassify broadband under Title II the FTC should regulate Net Neutrality, also the DOJ should investigate corporations engaging in such corporate censorship and if they are violating competition laws break them up. Pearl Jam came out in favor of net neutrality after AT&T censored a broadcast a performance they did in Chicago last Sunday. I guess AT&T didn?t like Pearl Jam?s anti-Bush message. I don?t know if Pearl Jam?s sudden embrace of net neutrality is out of ignorance, or if it?s retaliation. It doesn?t really matter because it should help bring some more awareness to the issue. Here?s the issue with net neutrality, in a nutshell. AT&T wants to charge companies like Amazon, eBay, and Google when people like you and me access their web pages. And if the companies don?t pay, AT&T will make the web sites slower. The idea is that if one company doesn?t pay the fees but a competitor does, AT&T customers will probably opt to use the faster services. IT"S WORTH NOTING: Without content, an Internet connection has no value. Proponents say AT&T built the infrastructure, so they have the right to charge whoever uses it. -

WHITE PAPER Encrypted Traffic Management January 2016

FRAUNHOFER INSTITUTE FOR COMMUNICATION, INFORMATION PROCESSIN G AND ERGONOMICS FKI E WHITE PAPER ENCRYPTED TRAFFIC MANAGEMENT WHITE PAPER Encrypted Traffic Management January 2016 Raphael Ernst Martin Lambertz Fraunhofer Institute for Communication, Information Processing and Ergonomics FKIE in Wachtberg and Bonn. Project number: 108146 Project partner: Blue Coat Systems Inc. Fraunhofer FKIE White paper Encrypted Traffic Management 3 | 33 Contents 1 Introduction .......................................................................................... 5 2 The spread of SSL ................................................................................. 6 3 Safety issues in previous versions of SSL ............................................... 8 4 Malware and SSL ................................................................................... 9 5 Encrypted Traffic Management .............................................................. 11 5.1 Privacy ...................................................................................................................... 12 5.1.1 Requirements ............................................................................................................ 12 5.2 Compatibility ............................................................................................................ 12 5.2.1 Requirements ............................................................................................................ 12 5.3 Performance ............................................................................................................ -

TJR-1197 Goodbye.Pdf

CYPRESS SEMICONDUCTOR CORPORATION Internal Correspondence Date: August 19, 2016 WW: 3316 To: All Cypress Employees Author: T.J. Rodgers Author File#: TJR#1197 Subject: Goodbye cc: BoD, Jim Collins, Larry Sonsini It’s 2:30 in the afternoon on August 17, my last official day at Cypress. After packing my stuff, I realized there were goodbyes to write. So, this won’t be a typical “TJ memo,” revised 10 times, logical and filled with fact-checked data; it will be more stream-of-consciousness in style. In a way, writing this memo is like talking to your wife of 34 years, while she’s on her deathbed. What do you say? I’ve enjoyed being with you? We’ve done a lot of good things together? There are really no appropriate words. But, perhaps there are. In the 1970 movie Patton, as the General leaves his command, he says, “Gentlemen, all good things must come to an end. And the best thing that has happened to me in my life has been the honor and privilege of commanding the 3rd Army. Goodbye, and God bless you.” This is the way I feel about Cypress. We have a lot to be proud of. Cypress was founded in December 1982, when there were 59 publically traded American chip companies. Today, only 15 of them are left—and we are one of the 15. That statement applies to every Cypress employee, whether you came from old Cypress, Spansion, Fujitsu, Broadcom or Ramtron. Each of us has made it in the industry for a long time; we all now fight together under one flag; and we’re all still around because we’ve earned the right to be. -

Download Gtx 970 Driver Download Gtx 970 Driver

download gtx 970 driver Download gtx 970 driver. Completing the CAPTCHA proves you are a human and gives you temporary access to the web property. What can I do to prevent this in the future? If you are on a personal connection, like at home, you can run an anti-virus scan on your device to make sure it is not infected with malware. If you are at an office or shared network, you can ask the network administrator to run a scan across the network looking for misconfigured or infected devices. Another way to prevent getting this page in the future is to use Privacy Pass. You may need to download version 2.0 now from the Chrome Web Store. Cloudflare Ray ID: 67a229f54fd4c3c5 • Your IP : 188.246.226.140 • Performance & security by Cloudflare. GeForce Windows 10 Driver. NVIDIA has been working closely with Microsoft on the development of Windows 10 and DirectX 12. Coinciding with the arrival of Windows 10, this Game Ready driver includes the latest tweaks, bug fixes, and optimizations to ensure you have the best possible gaming experience. Game Ready Best gaming experience for Windows 10. GeForce GTX TITAN X, GeForce GTX TITAN, GeForce GTX TITAN Black, GeForce GTX TITAN Z. GeForce 900 Series: GeForce GTX 980 Ti, GeForce GTX 980, GeForce GTX 970, GeForce GTX 960. GeForce 700 Series: GeForce GTX 780 Ti, GeForce GTX 780, GeForce GTX 770, GeForce GTX 760, GeForce GTX 760 Ti (OEM), GeForce GTX 750 Ti, GeForce GTX 750, GeForce GTX 745, GeForce GT 740, GeForce GT 730, GeForce GT 720, GeForce GT 710, GeForce GT 705.