Teesside Pension Fund Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Working for Outwood Grange Academies Trust

Working for Outwood Grange Academies Trust Welcome, Thank you for choosing to apply to Outwood. If you are successful, we hope that you will have an enjoyable and fulfi lling career with us and that together, we continue to have a positive impact on the life-chances of thousands of young people. While this pack will provide you with all the details you’ll need as you progress with your application, and hopefully your career with us, I wanted to introduce myself as the Chief Executive and Accounting Offi cer of Outwood Grange Academies Trust and introduce the Outwood vision to you. Quite simply, we want to be known for putting Students First, raising standards and transforming lives. It’s a bold vision, we know, but every day our colleagues strive to put it in place, whether that be in the classroom or in one of our business services roles, and we make sure we support every Outwood colleague in doing so. Whether you’re joining us as a support staff member, an NQT, teacher or in a leadership position, and everything in between, we will invest in you and your development throughout your career. By all working together, supporting and motivating each other, we believe we can raise current standards, and transform the lives of our students. We fully understand that as a Trust if we support and care for you to help you reach your potential, then in turn we can help ensure all the children in your charge will also reach theirs. With all but one of our inspected academies now rated as a Good or Outstanding school, even though almost all of them joined the Trust when they were inadequate or requiring improvement, now is an exciting time to join us. -

Use of Contextual Data at the University of Warwick Please Use

Use of contextual data at the University of Warwick Please use the table below to check whether your school meets the eligibility criteria for a contextual offer. For more information about our contextual offer please visit our website or contact the Undergraduate Admissions Team. School Name School Postcode School Performance Free School Meals 'Y' indicates a school which meets the 'Y' indicates a school which meets the Free School Meal criteria. Schools are listed in alphabetical order. school performance citeria. 'N/A' indicates a school for which the data is not available. 6th Form at Swakeleys UB10 0EJ N Y Abbey College, Ramsey PE26 1DG Y N Abbey Court Community Special School ME2 3SP N Y Abbey Grange Church of England Academy LS16 5EA Y N Abbey Hill School and Performing Arts College ST2 8LG Y Y Abbey Hill School and Technology College, Stockton TS19 8BU Y Y Abbey School, Faversham ME13 8RZ Y Y Abbeyfield School, Northampton NN4 8BU Y Y Abbeywood Community School BS34 8SF Y N Abbot Beyne School and Arts College, Burton Upon Trent DE15 0JL Y Y Abbot's Lea School, Liverpool L25 6EE Y Y Abbotsfield School UB10 0EX Y N Abbotsfield School, Uxbridge UB10 0EX Y N School Name School Postcode School Performance Free School Meals Abbs Cross School and Arts College RM12 4YQ Y N Abbs Cross School, Hornchurch RM12 4YB Y N Abingdon And Witney College OX14 1GG Y NA Abraham Darby Academy TF7 5HX Y Y Abraham Guest Academy WN5 0DQ Y Y Abraham Moss High School, Manchester M8 5UF Y Y Academy 360 SR4 9BA Y Y Accrington Academy BB5 4FF Y Y Acklam Grange -

Is Your School

URN DFE School Name Does your Does your Is your Number school school meet our school our attainment eligible? Ever6FSM criteria? 137377 8734603 Abbey College, Ramsey Ncriteria? N N 137083 3835400 Abbey Grange Church of England Academy N N N 131969 8654000 Abbeyfield School N N N 138858 9284069 Abbeyfield School N Y Y 139067 8034113 Abbeywood Community School N Y Y 124449 8604500 Abbot Beyne School N Y Y 102449 3125409 Abbotsfield School N Y Y 136663 3115401 Abbs Cross Academy and Arts College N N N 135582 8946906 Abraham Darby Academy Y Y Y 137210 3594001 Abraham Guest Academy N Y Y 105560 3524271 Abraham Moss Community School Y Y Y 135622 3946905 Academy 360 Y Y Y 139290 8884140 Academy@Worden N Y Y 135649 8886905 Accrington Academy N Y Y 137421 8884630 Accrington St Christopher's Church of England High School N N N 111751 8064136 Acklam Grange School A Specialist Technology College for Maths and Computing N Y Y 100053 2024285 Acland Burghley School Y Y Y 138758 9265405 Acle Academy N N Y 101932 3074035 Acton High School Y Y Y 137446 8945400 Adams' Grammar School N N N 100748 2094600 Addey and Stanhope School Y Y Y 139074 3064042 Addington High School Y Y Y 117512 9194029 Adeyfield School N Y Y 140697 8514320 Admiral Lord Nelson School N N N 136613 3844026 Airedale Academy N Y Y 121691 8154208 Aireville School N N Y 138544 8884403 Albany Academy N N N 137172 9374240 Alcester Academy N N N 136622 9375407 Alcester Grammar School N N N 124819 9354059 Alde Valley School N N Y 134283 3574006 Alder Community High School N Y Y 119722 8884030 -

Royal Air Force Visits to Schools

Location Location Name Description Date Location Address/Venue Town/City Postcode NE1 - AFCO Newcas Ferryhill Business and tle Ferryhill Business and Enterprise College Science of our lives. Organised by DEBP 14/07/2016 (RAF) Enterprise College Durham NE1 - AFCO Newcas Dene Community tle School Presentations to Year 10 26/04/2016 (RAF) Dene Community School Peterlee NE1 - AFCO Newcas tle St Benet Biscop School ‘Futures Evening’ aimed at Year 11 and Sixth Form 04/07/2016 (RAF) St Benet Biscop School Bedlington LS1 - Area Hemsworth Arts and Office Community Academy Careers Fair 30/06/2016 Leeds Hemsworth Academy Pontefract LS1 - Area Office Gateways School Activity Day - PDT 17/06/2016 Leeds Gateways School Leeds LS1 - Area Grammar School at Office The Grammar School at Leeds PDT with CCF 09/05/2016 Leeds Leeds Leeds LS1 - Area Queen Ethelburgas Office College Careers Fair 18/04/2016 Leeds Queen Ethelburgas College York NE1 - AFCO Newcas City of Sunderland tle Sunderland College Bede College Careers Fair 20/04/2016 (RAF) Campus Sunderland LS1 - Area Office King James's School PDT 17/06/2016 Leeds King James's School Knareborough LS1 - Area Wickersley School And Office Sports College Careers Fair 27/04/2016 Leeds Wickersley School Rotherham LS1 - Area Office York High School Speed dating events for Year 10 organised by NYBEP 21/07/2016 Leeds York High School York LS1 - Area Caedmon College Office Whitby 4 x Presentation and possible PDT 22/04/2016 Leeds Caedmon College Whitby Whitby LS1 - Area Ermysted's Grammar Office School 2 x Operation -

Whole Day Download the Hansard

Tuesday Volume 660 21 May 2019 No. 304 HOUSE OF COMMONS OFFICIAL REPORT PARLIAMENTARY DEBATES (HANSARD) Tuesday 21 May 2019 © Parliamentary Copyright House of Commons 2019 This publication may be reproduced under the terms of the Open Parliament licence, which is published at www.parliament.uk/site-information/copyright/. 593 21 MAY 2019 594 to be put in place retrospectively. In the light of all the House of Commons evidence, I am concerned about the wellbeing of those constituents who say that they may face financial ruin. Surely the only responsible thing to do is to pause and Tuesday 21 May 2019 announce a delay and an independent review, given that we know that people have already lost their lives. The House met at half-past Eleven o’clock Mel Stride: The loan charge is not retrospective. There has never been a time in the history of our country when the arrangements that I described a moment PRAYERS ago were ever compliant with our tax code. Of course, the loans,which there is no intention of ever repaying—they are simply there to avoid national insurance and income [MR SPEAKER in the Chair] tax—persist into the present. Generous “time to pay” arrangements are available with HMRC; I urge anybody who is involved in avoidance of this kind to talk to Oral Answers to Questions HMRC and come to sensible arrangements. Mr Lewis: Is the Minister not aware that the people TREASURY affected by this charge are strivers and people who are just about managing? They are the people who are The Chancellor of the Exchequer was asked— suffering as a consequence of this decision. -

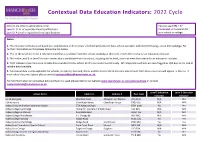

Education Indicators: 2022 Cycle

Contextual Data Education Indicators: 2022 Cycle Schools are listed in alphabetical order. You can use CTRL + F/ Level 2: GCSE or equivalent level qualifications Command + F to search for Level 3: A Level or equivalent level qualifications your school or college. Notes: 1. The education indicators are based on a combination of three years' of school performance data, where available, and combined using z-score methodology. For further information on this please follow the link below. 2. 'Yes' in the Level 2 or Level 3 column means that a candidate from this school, studying at this level, meets the criteria for an education indicator. 3. 'No' in the Level 2 or Level 3 column means that a candidate from this school, studying at this level, does not meet the criteria for an education indicator. 4. 'N/A' indicates that there is no reliable data available for this school for this particular level of study. All independent schools are also flagged as N/A due to the lack of reliable data available. 5. Contextual data is only applicable for schools in England, Scotland, Wales and Northern Ireland meaning only schools from these countries will appear in this list. If your school does not appear please contact [email protected]. For full information on contextual data and how it is used please refer to our website www.manchester.ac.uk/contextualdata or contact [email protected]. Level 2 Education Level 3 Education School Name Address 1 Address 2 Post Code Indicator Indicator 16-19 Abingdon Wootton Road Abingdon-on-Thames -

Redcar and Cleveland Education Improvement Partnership

Redcar and Cleveland Education Improvement Partnership Everything you need to know about living and working in education in Redcar & Cleveland Redcar and Cleveland EIP Collectively Ambitious...to develop outstanding young people . Your Guide Whether you are new to Redcar & Cleveland or have lived here all of your life, this guide will give you a summary of what you need to know about working in education in the local area. This guide should accompany other recruitment information, to show you the benefits of living and working in Redcar & Cleveland from the people who know it best - our staff and students. Providing you with a personal insight into life here and how it could be for you. We wish you luck in your application and look forward to welcoming you to our partnership. Why Redcar & Cleveland could be the place for you… Redcar and Cleveland Education Improvement Partnership (EIP).................. 3 - 6 Collectively ambitious, a partnership made up of a number of schools and colleges working together and supporting each other, to develop outstanding young people. Living in Redcar & Cleveland............................................................................ 7 - 8 With a beautiful coastline and soaring countryside on your doorstep; there are lots of leisure activities to take part in, places to visit, heritage to explore and places to eat. Transport Links.............................................................................................. 9 - 10 Road, bus, rail, air… Redcar & Cleveland have an excellent network of transport options to suit your needs. Help us give our Teaching and Training Opportunities........................................................... 11 - 12 There are a number of local organisations and associations, to give you all of the support you need in your career, helping you to advance. -

Secondary Education in Redcar & Cleveland 2019-2020

A Guide for Parents Redcar & Cleveland Children and Families Secondary Education in Redcar & Cleveland 2019-2020 www.redcar-cleveland.gov.uk/admissions this is Redcar & Cleveland 1 APPLY ONLINE From 13 August to 31 October 2018, you can apply for a secondary school place online for pupils starting secondary school year 7 in September 2019 • It is quick and easy to do • It is safe and secure • It is available 24 hours a day 7 days a week until the closing date, 31 October 2018 • You can amend your application right up to the closing date • We will confirm that we have received your application www.redcar-cleveland.gov.uk Go to the main Redcar and Cleveland website using the above address. Click on the blue tile entitled Secondary School Admissions and you will be taken to the online application site. Secondary Education, Redcar & Cleveland 2019-2020 This booklet gives important details about your child’s transfer to secondary school and other information which you may find helpful. It applies to parents / carers of pupils whose date of birth lies between 1 September 2007 and 31 August 2008. The transfer from primary to secondary school is an important milestone in a child’s education. It can be a time of anxiety as well as anticipation and excitement for those concerned. Staff in the Children and Families Department and in schools are committed to making the transition as smooth as they can and, wherever possible, trying to meet your preference for a secondary school. This booklet is divided into three parts: Part 1 Admission Arrangements This will be of particular interest to those parents whose children transfer to secondary education in September 2019. -

Draft Statement of Accounts for 2020-2021

Middlesbrough Council - Draft Statement of Accounts 2020/21 Covid Vaccination Bus – Central Middlesbrough Contents 1. 2. 3. 4. 5. 6. 7. NARRATIVE CORE NOTES TO COLLECTION TEESSIDE ANNUAL GLOSSARY REPORT AND FINANCIAL THE FUND PENSION GOVERNANCE OF TERMS WRITTEN STATEMENTS ACCOUNTS FUND STATEMENT STATEMENTS Narrative Movement in Detailed Income and Pension Report Reserves Notes to Expenditure Fund Statement the Account Statement Accounts of Accounts Independent Comprehensive Notes to the Notes to Auditors report Income and Collection the – Expenditure Fund Pension Middlesbrough Statement Fund Council Independent Balance Sheet Auditors report – Teesside Pension Fund Statement of Cash Flow Responsibilities Statement Middlesbrough Council Statement of Responsibilities – Teesside Pension Fund Page 02 Page 30 Page 36 Page 102 Page 106 Page 145 Page 169 The Statement of Accounts for Middlesbrough Council provides an overview of the Council’s financial position at 31 March 2021 and a summary of its income and expenditure during the 2020/21 financial year. The accounts are, in parts, technical and complex as they have been prepared to comply with the requirements of the Chartered Institute of Public Finance and Accountancy (CIPFA) as prescribed by the Code of Practice on Local Authority Accounting in the United Kingdom, and International Financial Reporting Standards. The accounts are available on the Council’s website: www.middlesbrough.gov.uk under Statement of Accounts. The Council’s Corporate Affairs and Audit Committee will consider the draft Accounts for information on 22 July 2021 under its governance and external financial reporting remit. The External Auditor’s audit results report to the Committee at the end of September will confirm whether the accounts provide a true and fair view of the Council’s financial position and transactions and any issues or amendments made as part of the audit process. -

Open Days for 2019 Entry

REDCAR & CLEVELAND EDUCATION IMPROVEMENT PARTNERSHIP IS PLEASED TO ANNOUNCE DETAILS OF OPEN DAYS FOR 2019 ENTRY Laurence Jackson School Huntcliff School Headteacher: Mrs C Juckes We invite you to attend our We invite Year 6 students, Outwood Academy Bydales parents and carers to our Coast Road, Marske-by-the-Sea, Redcar TS11 6AR We warmly welcome you to our Open Evening Tel: (01642) 474000 for prospective learners, parents & carers Email: [email protected] Open Evening Principal: Andrew Wappat Open Evening Thursday 27 September 2018 in our wonderful school “Students first: raising standards and transforming lives” 6.00 pm – 8.00 pm 6.00 pm – 8.00 pm Thursday 20 September 2018 Martyn Oliver, CEO Outwood Grange Academies Trust Tuesday 18 September 2018 Presentations at 6.00 pm and 7.00 pm 5.30 pm – 8.00 pm Open Day (Commencing with a presentation at 6.00 pm) Principal: Mrs Rachel Prentice MARSKE MILL LANE, SALTBURN, CLEVELAND, TS12 1HJ Presentations at 5.30 pm and 6.15 pm Monday 10 September 2018 Tel: (01287) 621010 Fax: (01287) 621011 prompt followed by a tour of the school 9.00 am – 10.30 am and 1.00 pm – 2.00 pm Linden Road, Brotton, Saltburn-by-the-Sea, TS12 2SJ E-Mail: [email protected] Tel: 01287 676305 Fax: 01287 677814 Website: www.saltburnlearningcampus.co.uk Open Evening Twitter: @SaltburnLCampus Church Lane, Guisborough, TS14 6R 6.00 pm – 8.00 pm Email: [email protected] Facebook: Saltburn Learning Campus Tel: 01287 636361 Website: www.tltrust.org/freebrough-academy Executive Headteacher: Mr P Eyre -

Applicant Information Pack Contents

Applicant Information Pack Contents Welcome Letter Outwood Grange Academies Trust Vision Child Safeguarding Policy Explanatory Notes How to Apply Welcome Dear applicant Thank you for your interest in working within the Outwood Grange Family of Schools. Outwood Grange Academies Trust is an education charity that has a proven track record of revolutionary school improvement and transforming the lives of children and young people. You will be joining a highly innovative, inspirational and ambitious organisation, so we are seeking an outstanding candidate who can realise the highest possible quality of services to support our educational vision, strong leadership and effective support to colleagues, to enable the organisation to achieve the best possible outcomes for students. This is an exciting and very rewarding role and we look forward to receiving your application. Yours faithfully Sir Michael Wilkins Chief Executive and Academy Principal Ethos and Vision “The whole point of schools is that children come first and everything we do must reflect this single goal.’’ Sir Michael Wilkins - Academy Principal & Chief Executive Outwood Grange Academies Trust Vision Academies within the Trust That Trust places students at the centre of everything The OGAT Multi-Academy Trust (MAT) currently it does, with a focus on creating a culture of success, comprises the following academy schools: a positive climate for learning, and increased student Outwood Grange Academy, Wakefield attainment, achievement and social and emotional Outwood Academy Acklam, -

Eligible If Taken A-Levels at This School (Y/N)

Eligible if taken GCSEs Eligible if taken A-levels School Postcode at this School (Y/N) at this School (Y/N) 16-19 Abingdon 9314127 N/A Yes 3 Dimensions TA20 3AJ No N/A Abacus College OX3 9AX No No Abbey College Cambridge CB1 2JB No No Abbey College in Malvern WR14 4JF No No Abbey College Manchester M2 4WG No No Abbey College, Ramsey PE26 1DG No Yes Abbey Court Foundation Special School ME2 3SP No N/A Abbey Gate College CH3 6EN No No Abbey Grange Church of England Academy LS16 5EA No No Abbey Hill Academy TS19 8BU Yes N/A Abbey Hill School and Performing Arts College ST3 5PR Yes N/A Abbey Park School SN25 2ND Yes N/A Abbey School S61 2RA Yes N/A Abbeyfield School SN15 3XB No Yes Abbeyfield School NN4 8BU Yes Yes Abbeywood Community School BS34 8SF Yes Yes Abbot Beyne School DE15 0JL Yes Yes Abbots Bromley School WS15 3BW No No Abbot's Hill School HP3 8RP No N/A Abbot's Lea School L25 6EE Yes N/A Abbotsfield School UB10 0EX Yes Yes Abbotsholme School ST14 5BS No No Abbs Cross Academy and Arts College RM12 4YB No N/A Abingdon and Witney College OX14 1GG N/A Yes Abingdon School OX14 1DE No No Abraham Darby Academy TF7 5HX Yes Yes Abraham Guest Academy WN5 0DQ Yes N/A Abraham Moss Community School M8 5UF Yes N/A Abrar Academy PR1 1NA No No Abu Bakr Boys School WS2 7AN No N/A Abu Bakr Girls School WS1 4JJ No N/A Academy 360 SR4 9BA Yes N/A Academy@Worden PR25 1QX Yes N/A Access School SY4 3EW No N/A Accrington Academy BB5 4FF Yes Yes Accrington and Rossendale College BB5 2AW N/A Yes Accrington St Christopher's Church of England High School