Future of Mobility the Technologies and Trends Driving Innovation in the Emerging Mobility Ecosystem

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Banma Connecting China

D2D Group Briefing 1 March 2019 BANMA CONNECTING CHINA Passion for People and Technology The announcement BMW Group and Daimler AG are combining to create a new global organisation providing urban mobility solutions, reflects an increasing importance, and urgency traditional OEMs are placing upon developing platforms to retain customers within their in-car connected service eco-systems.1 This pooling of talent, technology and investment is designed to counter competition and disruption from the tech sector, in the provision of localised connected solutions better reflecting end user lifestyle needs. Alibaba is one such organisation that via its partnership with SAIC, one of China’s most successful domestic OEMs, created Banma. Banma an infotainment platform, based upon the AliOS operating system, enables collaboration between developers and car manufacturers in research and development. Builing upon its initial activity with Roewe and MG cars, Banma plans to connect 6 million vehicles by 2023.2 Banma Network Technology The Banma infotainment platform is based upon Alibaba‘s AliOS, a forked but incompatible version of the open-source Android operating system. AliOS is designed for smart devices, such as televisions, smart phones, and most recently connected vehicles. The latest Banma system, version 2.0, was Source: Banma released in Dec 2017 and requires a minimum of 8 minutes for its over-the-air upgrades, with over 400k car owners having now upgraded.2 Banma’s user experience is based upon its map service, where map is designed to be the desktop of its operating system. Banma provides a number of features, most popular of which are Navigation, USB video play, WiFi share (vehicle to phone and vice versa, two-way connectivity), fleet management and real-time CarChat. -

Houc Nu.Ml>Erfour

houc nu.ml>erfour .-- 4 Work 1- edited by Yedda Morrison & David Buuck W inter 2000-0 I contents Editors' Note.s Laura Elrick lripwirc:: a journal of poetics TOWto MOUTH Jeff Derksen issue -4 - Work - Winu:r 2000..01 Global Shoes, Local Things, Rc:lations of Production Masks, and Architect Enemies edited by Yedda Morrison & David Buuck Eileen Myles ISSN: 1099-2170 Work Lcm:rs 15 All rights revert to authors upon publication. BobbicWcst $8 one issue .. Work?!• 22 $15 rwo issues (oUisidt of US please add $2 per issue) Stephen Callis, Leslie Ernn, & Rubtn Ortiz. Torres from Murtkr in my Suite I Bimwnidos a/ Hotel California 25 Printed at lnkworks, a worker-owned prirushop in Berkeley, CA. Cover design by Amanda Hughen. Steven Fanner Spcctadcr 37 Thanks to Stephen Callis & Deirdre Kovac for design & software: hdp. Thanks also to Justin Paulson of www.C'.t.ln.org, John Cn.wford of West Catherine Daly End Prcss, & Hclen Gilbcrt of Rcd Lcucr Prcss. Word Processing 42 Alan Gilbert Subscriptions, submissions, & inquiries to: "How Soon is Now?": The New Independents 44 uipwirc do Yedda Morrison & David Buuck ~ Banbou P.O. Box 420936 WongOI, tn.nslated by Boadiba & Jack Hirschman 66 San Fn.ncisco, CA 941-42-0936 [email protected] Bibiana Padilla Maltos www.dur.uionprcss.com/tripwirc Two collages 68 Distributed by: Rodrigo lOscano 70 Small Press Distribution Two poems I notes 800-869-7553 www.spdbooks.org France T hiorct from Laurenu, translated by Gail Scott 78 Camille Roy from Craqu": an may on clan struggle 83 Karen Brodine Editors' Notes from \%man Sitti11g at tht Machint, ThinJring 92 tripwire 4: Work Zapatista Army of National Liberation (EZLN) Zcdillo's Last Moments! (The Political Class) 98 Material vs. -

A Comparative Law Perspective on Intermediaries' Direct Liability in Cloud Computing Context -- a Proposal for China

Maurer School of Law: Indiana University Digital Repository @ Maurer Law Theses and Dissertations Student Scholarship 10-2016 A Comparative Law Perspective on Intermediaries' Direct Liability in Cloud Computing Context -- A Proposal for China Shi Xu Indiana University Maurer School of Law, [email protected] Follow this and additional works at: https://www.repository.law.indiana.edu/etd Part of the Comparative and Foreign Law Commons, and the Intellectual Property Law Commons Recommended Citation Xu, Shi, "A Comparative Law Perspective on Intermediaries' Direct Liability in Cloud Computing Context -- A Proposal for China" (2016). Theses and Dissertations. 32. https://www.repository.law.indiana.edu/etd/32 This Dissertation is brought to you for free and open access by the Student Scholarship at Digital Repository @ Maurer Law. It has been accepted for inclusion in Theses and Dissertations by an authorized administrator of Digital Repository @ Maurer Law. For more information, please contact [email protected]. A COMPARATIVE LAW PERSPECTIVE ON INTERMEDIARIES’ DIRECT LIABILITY IN CLOUD COMPUTING CONTEXT—A PROPOSAL FOR CHINA SHI XU Submitted to the faculty of Indiana University Maurer School of Law in partial fulfillment of the requirements for the degree Doctor of Juridical Science OCTOBER 2016 ii DEDICATION To my beloved Dad and Mom, Mr. Xu Wenguang and Mrs. Liu Li. I love you deeply in my heart. iii ACKNOWLEDGEMENT I want to express my sincere gratitude to my advisor, Prof. Leaffer. I want to thank him for his valuable guidance, consultation, supports and patience. I also want to thank my dissertation committee members, Prof. Mark Janis and Prof. Michael Mattioli, for their valuable guidance and comments on my dissertation. -

亿欧智库 Copyright Reserved to EO Intelligence, October 2020 前言 前言

万物互联时代的操作系统 研究报告 亿欧智库 https://www.iyiou.com/research Copyright reserved to EO Intelligence, October 2020 前言 前言 研究背景与目的 物联网因其宏大主题,以及巨大的应用想象空间而备受政府和企业的关注。国际电信联盟 (ITU) 对物联网的定义:“物联网主要解决物品到 物品 (Thing to Thing,T2T),人到物品(Human to Thing,H2T),人到人 (Human to Human,H2H) 之间的互联。”因此物联网也被视为是 继计算机、互联网之后的第三次技术革命。但由于物联网包含的软硬件技术太多,既牵涉到硬件端如传感器、通讯模组、异构芯片,也涉及 到软件层如操作系统和应用软件,行业发展遇到不少困境,行业整体呈波段式前进。 AIoT+云计算+5G的发展,使得万物互联正在逐渐成为现实,整个ICT产业可能有一次重塑的机会。数据的连接节点、传输速度、时延、处理 的规模和速度得到不断的提升,“万物互联”的AIoT将会在智能家居、智慧工厂、智慧城市等场景下均有较大表现。 亿欧智库一直关注于物联网产业的发展,自2018年发布《2018中国物联网应用研究报告》以来,后续又推出了深入探讨物联网技术发展及 应用的报告。《 2019年中国智慧城市发展研究报告》、《 2020中国车联网商业模式分析报告》、《 2020智能物流产业研究报告》、 《2020巨头企业物联网业务布局研究》等已发布报告从不同角度探讨物联网技术的发展。 我们也越来越关注底层技术在物联网产业发展中起到的推动力。操作系统作为重要底层软件技术之一,上承应用开发,下接海量的硬件终端, 正在吸引巨头提前布局。我们观察到国内外科技巨头都在操作系统层面有所布局,比如谷歌的Android Things和Fuchsia、阿里的AliOS和 AliOS Things、华为的LiteOS和鸿蒙OS、ARM的MbedOS等。 但市场中对于面向万物互联时代的操作系统还未有充分的讨论,我们希望借助这份报告来实现对物联网操作系统(IoT OS)的定义与梳理, 提供给物联网从业人士和其他对物联网产业感兴趣的人士一些有用见解。 EO Intelligence 2 前言 前言 主要研究发现 ⚫ 物联网终端海量碎片化的特征,很可能使得物联网的操作系统并不像PC或手机系统具有个别企业垄断市场的局面; 桌面端:Windows系列 88.23% + Mac系列 8.9% = 97.13% 海量碎片的物联网端:分业务、分场景、分生态 移动端:Android 74% + iOS 25%=99% ⚫ 云计算厂商和终端硬件设备厂商有充分的动力去推动自研物联网操作系统,“云+端”是物联网操作系统的主要竞争场;云计算厂商做 IoT OS的代表有阿里云、谷歌云、AWS、Azure等,硬件相关厂商做IoT OS的代表有华为、ARM、苹果等。技术积累和资源禀赋决定 了不同厂商的入局点不同。 ⚫ 当前阶段应用的物联网操作系统往往呈现出轻量级系统和通用级系统并存的情况,轻量级满足低计算资源(RAM及ROM资源最小以KB 计)场景,通用级适用于计算资源较好( RAM及ROM资源在MB以上,甚至达到GB)的物联网场景,是否会出现一种统一的IoT OS, 还是多套系统的配合实现功能,目前而言下定论还为时尚早。巨头尝试去打破操作系统这种异构状态,但前景不明朗。新老操作系统 的交替会持续相当一段时间。 ⚫ 嵌入式操作系统几乎每10年会发生一次重大模态进化,目前的时间节点下来比较,很类似于2005-2008年移动操作系统的爆发前夜,当 时无论是微软、惠普&Palm、诺基亚、谷歌、三星、黑莓,还是苹果公司都在积极探索面向下一代的便携式个人计算机新形态,并最 -

Software-Defined Vehicles a Forthcoming Industrial Evolution

Software-Defined Vehicles A Forthcoming Industrial Evolution 3 w Software-Defined Vehicles—A Forthcoming Industrial Evolution | Contents Contents Introduction 1 1. Understanding "software-defined vehicles" 2 2. Driving forces of software-defined vehicles 3 2.1 Industrial development requirements 3 2.2 Consumer expectations 3 2.3 Value chain transfer 4 3. Gap between the Present and the Future 6 3.1 The automotive hardware and software architecture does not suit the software-defined vehicles 6 3.2 The traditional waterfall software development model has major limitations 11 3.3 Organizational structure and talent supply are major shortcomings of software-oriented automotive transformation 13 3.4 Obstacles from the supply chain system 14 4. What are the new opportunities 16 4.1 Industry value chain under the "software-defined vehicle" trend 16 4.2 Prominent position of software platforms 17 4.3 From Tier-2 to Tier-0.5 19 5. How should different enterprises respond 21 5.1 OEMs transform based on rational assessment and their capabilities 21 5.2 With "oppression from both ends", parts enterprises should seek self-transformation 23 5.3 Facing both opportunities and challenges, automotive software companies shall create value based on flexible positioning 25 Conclusion 26 Contact us 27 w Software-Defined Vehicles—A Forthcoming Industrial Evolution | Introduction Introduction Over the past few years, standardized hardware of smartphones and computers gradually reached physical limits, pushing industrial transformation from hardware upgrades to software development. The automotive industry is different from the smartphone and computer industries in terms of hardware standardization and technology. Thus, the automotive industry is not ready to replicate the exact development pattern of the smartphone or computer. -

Proceedings of the ACL 2016 Student Research Workshop

ACL 2016 The 54th Annual Meeting of the Association for Computational Linguistics Proceedings of the Student Research Workshop August 7-12, 2016 Berlin, Germany c 2016 The Association for Computational Linguistics Order copies of this and other ACL proceedings from: Association for Computational Linguistics (ACL) 209 N. Eighth Street Stroudsburg, PA 18360 USA Tel: +1-570-476-8006 Fax: +1-570-476-0860 [email protected] ISBN 978-1-945626-02-9 ii Introduction Welcome to the ACL 2016 Student Research Workshop! Following the tradition of the previous years’ workshops, we have two tracks: research papers and thesis proposals. The research papers track is as a venue for Ph.D. students, masters students, and advanced undergraduates to describe completed work or work-in-progress along with preliminary results. The thesis proposal track is offered for advanced Ph.D. students who have decided on a thesis topic and are interested in feedback about their proposal and ideas about future directions for their work. We received in total 60 submissions: 14 thesis proposals and 46 research papers, more than twice as many as were submitted last year. Of these, we accepted 4 thesis proposals and 18 research papers, giving an acceptance rate of 36% overall. This year, all of the accepted papers will be presented as posters alongside the main conference short paper posters on the second day of the conference. Mentoring programs are a central part of the SRW. This year, students had the opportunity to participate in a pre-submission mentoring program prior to the submission deadline. The mentoring offers students a chance to receive comments from an experienced researcher in the field, in order to improve the quality of the writing and presentation before making their final submission. -

Xiaomi Corp 01810 (XHKG)

Morningstar Equity Analyst Report | Report as of 27 Aug 2020 04:38, UTC | Page 1 of 14 Xiaomi Corp 01810 (XHKG) Morningstar Rating Last Price Fair Value Estimate Price/Fair Value Trailing Dividend Yield % Forward Dividend Yield % Market Cap (Bil) Industry Stewardship QQ 21.35 HKD 12.50 HKD 1.71 — 0.00 514.01 Consumer Electronics Standard 27 Aug 2020 27 Aug 2020 27 Aug 2020 27 Aug 2020 27 Aug 2020 27 Aug 2020 16:22, UTC 06:04, UTC Morningstar Pillars Analyst Quantitative Important Disclosure: Economic Moat None None The conduct of Morningstar’s analysts is governed by Code of Ethics/Code of Conduct Policy, Personal Security Trading Policy (or an equivalent of), Valuation QQ Overvalued and Investment Research Policy. For information regarding conflicts of interest, please visit http://global.morningstar.com/equitydisclosures Uncertainty Very High High Financial Health — Strong Xiaomi’s Q2 Below Estimates, but Fair Value Estimate Increased to HKD Source: Morningstar Equity Research 12.50 on Likely Huawei Gains Quantitative Valuation 01810 Business Strategy and Outlook decline of 40%. The profit decline was driven by cost aCYM Dan Baker, Analyst, 27 August 2020 increases across the board with selling & marketing Undervalued Fairly Valued Overvalued Investors in Xiaomi will be hoping the company can expenses up 40%, administrative expenses up 16%, and leverage its proven ability to manufacture and market research and development costs up 26%. The impact of Current 5-Yr Avg Sector Country the pandemic in key markets such as India was a driver of Price/Quant Fair Value 1.44 — 0.77 0.78 good value-for-money smartphone hardware into a sticky Price/Earnings 41.7 — 21.4 12.9 software ecosystem that will allow the company to the lower-than-expected results but heavy promotional Forward P/E 38.6 — 15.9 11.9 increase its margins and returns. -

M Em Ories O F Vietnam

IN THIS ISSUE SPORTS BAYSHORE H e a l t h C o m i n g & t h r o u g h a t F i t n e s s SERVING ABERDEEN, HAZLET, c o u n t y ’s KEYPORT AND MATAWAN Page 25 Page 42 MAY 15,1996 40 CENTS VOLUME 26, NUMBER 20 M iddletow n is going h ig h tech BY CINDY HERRSCHAFT ship must be kept for the life of the struc ture. For a municipality that’s more than Staff Writer 300 years old and has more than 23,000 I n the next few months, Middletown will buildings, that adds up to “a lot” of paper be taking a ride on the information work, said Bennett. superhighway that could save countless All those pieces of paper are kept in hun trees. dreds of boxes at various locations around Local officials are purchasing new com the township, including the basements of the puter equipment that will allow town main library on New Monmouth Road and records to be stored on compact discs the Lincroft branch. instead of millions of pieces of paper. Since the building department generates “It eliminates the need for a lot of the majority of the documents, it will be the paper,” explained Township Administrator first one to begin using the new system, Joseph P. Leo, who said the state laws gov which is expected to cost about $80,000, erning record-keeping are “crazy.” officials said. Limiting the need for storage space is One of the biggest expenses is pur paramount for Middletown right now, since chasing a scanner large enough to copy the officials are running out of places to keep all three-foot blueprints developers submit to the records. -

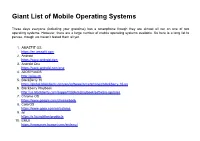

Giant List of Mobile Operating Systems

Giant List of Mobile Operating Systems These days everyone (including your grandma) has a smartphone though they are almost all run on one of two operating systems. However, there are a large number of mobile operating systems available. So here is a long list to peruse, though we haven’t tested them all yet. 1. AMAZFIT OS https://en.amazfit.com 2. Android https://www.android.com 3. Android One https://www.android.com/one 4. AliOS/YunOS http://alios.cn 5. BlackBerry 10 https://global.blackberry.com/en/software/smartphones/blackberry-10-os 6. Blackberry Playbook http://us.blackberry.com/support/tablets/playbook/software-updates 7. Chrome OS https://www.google.com/chromebook 8. ColorOS https://www.oppo.com/en/coloros 9. /e/ https://e.foundation/products 10. EMUI https://consumer.huawei.com/en/emui 11. Fire Operating System https://developer.amazon.com/sdk-download 12. Flyme OS http://www.flymeos.com/firmware.html 13. Fuchsia https://fuchsia.dev 14. Funtouch OS https://www.vivo.com/en/funtouchos 15. GridOS https://github.com/GridOS 16. HTC Sense https://www.htc.com/us/phone-features/htc-sense-os 17. Indus OS http://www.indusos.com 18. iOS https://www.apple.com/ios 19. iPodLinux http://www.ipodlinux.org 20. Kai OS https://www.kaiostech.com 21. LG UX https://www.lg.com/us/mobile-phones/g7-thinq/specs 22. LineageOS https://lineageos.org 23. LiteOS https://www.huawei.com/minisite/liteos 24. Lune Operating System https://webos-ports.org 25. Maruos https://maruos.com 26. Maemo OS http://maemo.org 27. -

Global Tech Biweekly Vol.9 Oct 4, 2019 in This Issue

Friday AMTD Global Tech Biweekly vol.9 4 October 2019 Adobe – the benchmark of cloud transition (SaaS) Figure 1: Major financial metrics (TTM revenue, TTM operating income, and TTM FCF growth, YoY) to trace the changes of Adobe’s cloud transition 80% TTM Revenue TTM Operating income - Non GAAP TTM FCF 60% 40% 20% 0% 4QFY08 2QFY10 4QFY11 2QFY13 4QFY14 2QFY16 4QFY17 2QFY19 -20% -40% -60% before transition during transition after transition Source: Company data, AMTD Research In this issue, we will discuss the changes that cloud transition brought to traditional software company from a financial and valuation perspective. AMTD views: different from cloud native company, traditional software company normally adopts perpetual licensing model, under which the revenue is vulnerable to the fluctuation of economy and the change of major customers. Thus, more and more software companies are moving their business to cloud based subscription model (SaaS) to reduce business risks and improve operating efficiency. Today, Adobe, the benchmark of cloud transition, had recovered from falling profit in the transition, and has now achieved a quite stable revenue growth with the help of stronger cash flow. AMTD Research AMTD Research Brian Li Michelle Li +852 3163-3384 +852 3163-3383 [email protected] [email protected] Cloud/SaaS Adobe – the benchmark of cloud transition Adobe is one of the world largest software companies. It has historically focused upon the creation of multimedia and creativity software products. From PostScript to PDF, Illustrator to Photoshop, Adobe has developed industry standard for editing software from graphic and photos to web and videos. -

Durham E-Theses

Durham E-Theses Airy Children of Our Brain: Emotion, Science and the Legacy of Eighteenth-Century Philosophy in the Shelley Circle, 1812-1821 SHIH, TERENCE,H,W How to cite: SHIH, TERENCE,H,W (2011) Airy Children of Our Brain: Emotion, Science and the Legacy of Eighteenth-Century Philosophy in the Shelley Circle, 1812-1821 , Durham theses, Durham University. Available at Durham E-Theses Online: http://etheses.dur.ac.uk/877/ Use policy The full-text may be used and/or reproduced, and given to third parties in any format or medium, without prior permission or charge, for personal research or study, educational, or not-for-prot purposes provided that: • a full bibliographic reference is made to the original source • a link is made to the metadata record in Durham E-Theses • the full-text is not changed in any way The full-text must not be sold in any format or medium without the formal permission of the copyright holders. Please consult the full Durham E-Theses policy for further details. Academic Support Oce, Durham University, University Oce, Old Elvet, Durham DH1 3HP e-mail: [email protected] Tel: +44 0191 334 6107 http://etheses.dur.ac.uk 2 ‘Airy Children of Our Brain’: Emotion, Science and the Legacy of Eighteenth-Century Philosophy in the Shelley Circle, 1812-1821 Terence H. W. Shih Submitted for the degree of Doctor of Philosophy Department of English Studies Durham University 2011 ABSTRACT This thesis examines the physical effects of human emotion and the mind through selected texts written by the Shelley circle, including P. -

New OS Technology to Break OS Slavery and Unbundle Embedded Software Development

New OS technology to break OS slavery and unbundle embedded software development eerF new computer Operating system Nikolay ILYIN, CEO & co-founder to disrupt digital mobility Software is eating the World and a Vehicle A vehicle is a Data Center on wheels (hundreds/thousands CPU/GPU cores), that consumes a lot of power; Its various components require different Operating Systems (specialized features, multi-task scheduling logic, multiple HW architectures) for example some needs real-time OSes; Becomes an IoT connectivity hub for V2X, Edge clouds, Internet, internal sensors / systems and driver’s portable devices, seamlessly using multiple wireless technologies and protocols. Modern vehicle software has more than 100 million lines of code, and this number grows fast! Software Industry’ problems ➢ There were no significant and disruptive innovations in OS for 30 years! Developers are forced to fork and customize Linux, design own or study custom OSes, characterized by low compatibility and code reuse with high development and maintenance cost. New emerging products and solutions (5G, Industry 4.0, Robotics, IoT, Smart transportation, Edge computing) require more efficient OS architectures and software toolsets; ➢ Absence of flexible professional developer tools. Each CPU vendor offers its specialized limited tooling, such as compiler; ➢ Most OS don’t enable access to full hardware capabilities and limit it with restricted set of system library’ APIs. Even available APIs are often don’t obey standards and embrace them into proprietary form; ➢ OS development roadmaps are unclear to apps developers and can be inappropriate or even contradict (e.g. some API are deprecated). Your business can be ruined at any moment by OS vendor or treated as 2nd class citizens.